Académique Documents

Professionnel Documents

Culture Documents

NC Business License

Transféré par

personal1492Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NC Business License

Transféré par

personal1492Droits d'auteur :

Formats disponibles

Y

OF RALE

I City of Raleigh

GH

CI

ES

TAB

LISHED 1

79

2

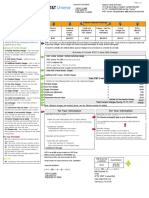

Business License Application

Revenue Services - 03

P.O. Box 590 | Raleigh, NC 27602

(919) 890-3200

INSTRUCTIONS

1) Who Must Pay Tax - Any person who conducts business within the city, either by maintaining a business

location within the City limits or, either personally or through agents, solicits business within the city, or picks up

and/or delivers goods or services within the City limits, is liable for the City’s Business License fees unless

specifically exempted by State law or local ordinance. If a company or individual is engaged in more than one

type of business activity within the city, a separate license may be required for each type of business activity. A

separate license is required for each business location in the City limits.

2) License Tax Due Date - The Business License tax must be paid before a business begins operating in the

Raleigh City Limits. LICENSES EXPIRE ON JUNE 30. Renewal notices are mailed to licensed businesses

each year. If you do not receive a renewal notice by June 1, please contact Revenue Services at (919) 890-3200.

3) To apply for a Business License - Complete all questions on the attached application. Zoning approval may be

required before a license is issued.

4) Determine Amount of Tax Due – Use the tax schedules to determine the license codes that apply to your

business activities. Multiple license codes may apply. Businesses operating within the Raleigh city limits without

a business license are subject to police citation.

5) Payment - Mail completed application and payment to: City of Raleigh, Revenue Services – 03/PO BOX

590/Raleigh, NC 27602. Make check or money order payable to “City of Raleigh.”

6) Display of License - Your license will be processed and mailed to you within 3-5 business days. Upon receipt,

please post the license at your business location.

7) No abatement of tax - If a licensee discontinues a business before the end of the period for which the license

was issued, the license tax shall not be abated nor shall a refund of any part of the license tax be made.

8) Collection of unpaid tax - Any person who begins or continues to engage in a business taxed under this article

without payment of such fees is liable for an additional tax of five percent (5%) of the tax due for each month or

portion thereof that the tax is delinquent, up to the maximum of 25%

9) Change in place of business - To receive renewal notices and other correspondence in a timely manner,

PLEASE NOTIFY REVENUE SERVICES IF BUSINESS LOCATION OR MAILING ADDRESS CHANGES. Home

based businesses must get zoning approval before license modification can be processed.

10) Regulatory Licenses - The following types of businesses are regulated by the City and must obtain special

approval before beginning operation. If you intend to operate any of these types of businesses, please contact

Revenue Services at (919) 890-3200 for instruction on how to apply.

Establishments with amplified entertainment Beer/Wine

Massage Businesses Rooming House

Massagists Pawnbrokers

11) Disclaimer - The issuance of a business license does not constitute acceptance or approval of the use of the

above named location as having complied with existing building codes, fire prevention code, zoning code, city

ordinance, or state law. A licensee shall remain fully liable and responsible for bringing the premises in

conformity with all applicable City and State Codes.

Business License Application rev 4/2007

For Office Use Only

BUSINESS START DATE: / / Account __________________________

Each business must have a principal location. A business is considered to be Home Based if the principal location of the business is a residence. This

includes businesses of a mobile nature such as construction companies, mobile car repair, power washing, repair services, peddlers, etc.

If the answer to both questions below is yes, our policies require that you obtain a Home Occupation Use Permit from the Zoning Division of

the Inspections Department before applying for a Business License

Is Your Business Located in the Raleigh City Limits? Yes No Is the Business Home Based? Yes No

Businesses engaging in the following business activities must obtain Zoning approval BEFORE applying for a Business License. Contact

the Zoning Division at (919) 516-2500.

Peddlers by foot, vehicle, pushcart, or without a retail location Outdoor Storage Facilities

Outdoor temporary businesses (Christmas Tree Lots, Fireworks, Adult Establishments

Pumpkin Lots, Produce Stands, etc). Plant Nursery

Kennels Fayetteville Street/Downtown District Business Activities (Mail Drop

Daycare Boxes, News Racks, Outdoor Dining, Outdoor Merchandise)

Automobile Dealer Bed and Breakfast Inn

Junk Yard Valet Parking (Contact the Transportation Division at (919) 890-3430).

If you are a Pawnbroker, Massagist, or operate a Massage Business, , then you must fill out the Massagist, Massage Business, or

Pawnbroker application instead of the Business License application.

1. / ( )

Business Name Business Location Phone Number

2. / / / /

Business Location Address. (Physical Address, not PO BOX) Suite/Apt City State Zip Code

3. Type of Business Ownership: Corporation Sole Proprietor Partnership

4. Describe business. Include all activities:

5. / / / /

Business Mailing Address if different from above (all mail will be sent to this address) Suite/Apt City State Zip Code

6. / /

Applicant Name Last or Corporate First MI

7. / / / /

Applicant Address Suite/Apt City State Zip Code

8. Does your business sell intoxicating beverages? No Yes (If yes, must also complete a City of Raleigh Beer/Wine License Application.)

9. Does your business provide amplified entertainment? No Yes (If yes, must also complete a City of Raleigh Amplified Entertainment Permit Application.)

TAX SCHEDULES

Schedule I. Business License Tax Exemptions:

The following business activities are exempt from licensing. However, businesses engaging in other non-exempt business activities (see Schedules II, III, and

IV) ARE subject to licensing of non-exempt activities under Sections II, III, and IV. Example: The sale of computer hardware is exempt, but software sales are

subject to licensing under gross receipts in Section III below.

EX - Exempt

Accountants Auctioneers Computer Hardware Insurance Companies Oculists Photographers Surgeons

Active Military Banks Retail Sales Land Surveyors Office Equipment Physicians Telecommunications

Alarm Dealers Blind Persons Computer Hardware Rental Landscape Architects Retail Sales Private Detectives Telephone Companies

Alarm Monitoring Bondsmen Dentists Morticians Office Equipment Rental Railway Companies Trucking Companies

Appliance Retail Sales Breweries Embalmers Motor Fuel Whsle Opticians Real Estate Agents Veterinarians

Appliance Rental Bus Companies Engineers Distributor Optometrists Real Estate Appraisers Wineries

Architects Chiropodists Flea Market Vendors Natural Gas (Piped) Osteopaths Real Estate Rentals

Attorneys Chiropractors Healers Non-Profit Pest Control Applicators Savings & Loan Assoc

Business License Application rev 4/2007

Schedule II. Business License Tax Based on Business Activity:

Businesses engaging in the business activities listed below are subject to the license tax shown for each activity conducted. Indicate clearly which activities apply

to your business by checking the appropriate box(es). Other nonexempt business activities are subject to licensing in Section III. Example: A retail store selling

ice cream would be licensed for ice cream under this schedule and licensed for other retail sales under Schedule III based on gross receipts excluding ice cream

sales.

CODE BUSINESS ACTIVITY TAX RATE BT Employment Agency $100.00

AF Admission Fee Entertainment/Pinball Machines/Riding Devices $25.00 BY Funeral Home or Retail Coffin Sales $50.00

AA Advertising-on Motor Vehicles $5.00 BW Heating/Lubricating/Illuminating Oil Distributor $50.00

Hotels/Motels (per Room, Minimum( fee $25.00)

AB Advertising-on Movie Screens $75.00 CE

# of Rooms: __________ X $1.00

AC Advertising-Outdoor or By Public Announcement $35.00

CF Ice Cream $2.50

Armored Car Service (per Armored Car)

AG Ice Manufacturer

# of Armored Cars _________ X $15.00

(25-50 Tons Daily) $100.00

AI Automatic Sprinklers or Elevators $100.00 CH

(51-75 Tons Daily) $150.00

AK Auto/Truck/Trailer Dealers $25.00 (76 + Tons Daily) $200.00

AL Auto/Truck/Trailer Whsle Parts & Accessories $37.50 CR Insulation Service $50.00

AM Auto/Truck/Trailer Service, Retail Parts & Accessories $12.50 Juke Boxes (per Juke Box)

CS

Barber/Beauty Shop/Nail Salon (per Operator) # of Juke Boxes: ___________ X $5.00

AN

# of Operators __________ X $2.50 EB Laundry or Linen Supply $50.00

AP Bicycles & Accessories $25.00 CO Loan Agency or Check-Cashing $100.00

Bowling Alley (per Lane)

AV CX Merchant/Peddler- By Foot $10.00

# of Lanes ____________ X $10.00

CY Merchant/Peddler- By Vehicle or Pushcart $25.00

SC Branch/Chain Store- Retail/Whsle (exclude 1st Location) $50.00

CJ Merchant/Peddler- No Retail Store or < 6 months $100.00

GB Café/Cafeteria/Restaurant AR Motorcycles and Accessories $12.50

(0-4 Seats) $25.00 Movie Theaters (per Screen)

(5 or more Seats) $42.50 DM

# of Screens: __________ X $200.00

DS Campground $12.50

DB Pool Tables $25.00

BG Collection Agency $50.00

DW Produce- Wholesale $100.00

BH Contractor- Construction $25.00

DY Soft Drinks/Sandwiches/Tobacco or Vending Machines (<5) $4.00

BQ Contractor- Electrical, Heating/Mechanical, Plumbing $50.00

CT TV/Radio/Music Players/Pianos- Sale or Repair $5.00

Dance Studio or Kindergarten

BO Utility- Electric Company $2,000.00

BK (1-3 Instructors) $10.00

VR Video Rental/Sale $25.00

(4 or More Instructors) $50.00

DU Weapons- Firearms $50.00

BC Dry Cleaners $50.00

Electronic Video Games (per Machine) EA Weapons- Knives, Daggers, or Similar Weapon $200.00

EV

# of Machines: __________ X $5.00

SCHEDULE II TAX ______________

IF APPLYING BETWEEN FEB 1 AND JUNE 30, DIVIDE BY TWO ______________

Schedule III. Business License Tax Based on Gross Receipts:

Businesses generating receipts from business activities (such as retail, wholesale, manufacturing, or services) not listed in Schedules I and II above are required

to license those activities based on gross receipts for a 12 month period as reported on their most recently completed income tax return. Exclude gross receipts

from business activities listed in Schedules I and II above.

Fill in gross receipts amount in box below, then check the applicable tax rate box; if gross receipts are greater than $100,000, use the equation to find

total Schedule III Tax Due. Note: Maximum tax on Gross Receipts is $20,000

GR Gross Receipts Tax Table

Gross Receipts License Tax GROSS RECEIPTS ______________

$ 1 - $ 50,000 $ 50.00

$ 50,001 - $ 75,000 $ 75.00

$ 75,001 - $100,000 $ 100.00

$100,000 + Use equation: __________________ - $100,000.00 = _________________ x .0006 = ______________ + $100.00 = _________________

GROSS RECEIPTS TOTAL SCH. III LICENSE TAX

MAX. TAX $20,000

SCHEDULE III TAX ______________

Business License Application rev 4/2007

Schedule IV. Business License Tax Based on Number of Employees (No Gross Receipts/No Other Tax Schedules Apply):

Businesses conducting business activities which are not exempt per Schedule I, are not subject to business license tax per Schedule II, and for which no gross

receipts are generated at that business location (for example, a company headquarters or research/development facility) are taxed based on number of employees

per the schedule below.

MI No Gross Receipts/No Other Tax Schedules Apply

1-5 Employees $ 667.00

6-10 Employees $1,334.00

11 + Employees $2,000.00

SCHEDULE IV TAX ______________

IF APPLYING BETWEEN FEB 1 AND JUNE 30, DIVIDE BY TWO ______________

Instructions: Fill in the boxes below with the appropriate amount from schedules II, III, and IV. If a schedule does

not apply to your business, leave blank. Calculate the total Business License tax by adding the amounts from each

schedule and fill in the appropriate box.

SCHEDULE II TAX ______________

SCHEDULE III TAX ______________

SCHEDULE IV TAX ______________

+

TOTAL BUSINESS LICENSE TAX _______________

Signature of Applicant Date / /

VALIDATION

(For Office Use Only)

Business License Application rev 4/2007

Vous aimerez peut-être aussi

- Santa Clara Business LicenseDocument2 pagesSanta Clara Business LicenseTom Reynolds100% (1)

- Pine Ridge Apartment Welcome LetterDocument2 pagesPine Ridge Apartment Welcome LetterKamil KowalskiPas encore d'évaluation

- Rent Receipt: Check No. - Cash Money OrderDocument5 pagesRent Receipt: Check No. - Cash Money OrderSharjeel Ahmad KhanPas encore d'évaluation

- News From Comcast: Pin-Chen ThyDocument3 pagesNews From Comcast: Pin-Chen ThyDũng XêCôPas encore d'évaluation

- NNNNNDocument4 pagesNNNNNeprovePas encore d'évaluation

- CPS EnergyDocument2 pagesCPS EnergyFGPas encore d'évaluation

- Suresh Rent Ledger 2018-19 PDFDocument1 pageSuresh Rent Ledger 2018-19 PDFGokul KuwarPas encore d'évaluation

- Disconnect Notice: Total Past Due $364.55Document8 pagesDisconnect Notice: Total Past Due $364.55Aut BeatPas encore d'évaluation

- Washington Business License ApplicationDocument4 pagesWashington Business License ApplicationGreenpoint Insurance ColoradoPas encore d'évaluation

- Rent Ledger PDFDocument1 pageRent Ledger PDFJahziel KwonPas encore d'évaluation

- 001nov262019 PDFDocument2 pages001nov262019 PDFsarahPas encore d'évaluation

- Display ViewDocument6 pagesDisplay ViewSindy Delgado0% (3)

- 4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EDocument1 page4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EA Random GamerPas encore d'évaluation

- Harvey Metabank Jan22Document1 pageHarvey Metabank Jan22Mark Dewey0% (1)

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocument1 pageCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnPas encore d'évaluation

- Illinois ComEd BillDocument2 pagesIllinois ComEd BillbenPas encore d'évaluation

- COLLINS N OKONKWO Paystub Feb 12 2024Document1 pageCOLLINS N OKONKWO Paystub Feb 12 2024ellamaekitchensPas encore d'évaluation

- TX Utility BillDocument4 pagesTX Utility Billfehijan689Pas encore d'évaluation

- PolicyconfirmationDocument1 pagePolicyconfirmationTascie CookPas encore d'évaluation

- Bill2022 2Document1 pageBill2022 2Carla Bermudez RamirezPas encore d'évaluation

- Arizona Phonix UtilityDocument2 pagesArizona Phonix Utilitykelley gregoryPas encore d'évaluation

- Bill 1.1Document2 pagesBill 1.1Александр ТимофеевPas encore d'évaluation

- USA TD Bank StatementDocument1 pageUSA TD Bank StatementjessiPas encore d'évaluation

- Pay StubDocument1 pagePay StubLulu HuttonPas encore d'évaluation

- Utility Bill Template 02Document5 pagesUtility Bill Template 02Ooo SssPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument6 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterBobbyPas encore d'évaluation

- 941 1st QTR 2010Document2 pages941 1st QTR 2010Larry BartonPas encore d'évaluation

- You're Enrolled in Auto Pay:: Shop AccessoriesDocument4 pagesYou're Enrolled in Auto Pay:: Shop AccessoriesRaez RodilladoPas encore d'évaluation

- Visit: Your Payment Is Due Your Total Due How To Contact UsDocument2 pagesVisit: Your Payment Is Due Your Total Due How To Contact UsMirtha Gonzalez100% (1)

- Verizon Bill 03 16 2019Document1 pageVerizon Bill 03 16 2019duttasurajit50% (2)

- Electric UTILITY BILLDocument1 pageElectric UTILITY BILLcathy clarkPas encore d'évaluation

- Mortgage Statement DummyDocument1 pageMortgage Statement DummyAjha Dortch100% (1)

- Rent Ledger 2021Document1 pageRent Ledger 2021LazaroSantiagoPas encore d'évaluation

- Your Electricity BillDocument3 pagesYour Electricity BillDannyPas encore d'évaluation

- View DocumentDocument2 pagesView Documentltasha24100% (1)

- Disconnect Notice: Nipuna Indula 13035 Windfern RD Apt 219 Houston, TX 770643028Document3 pagesDisconnect Notice: Nipuna Indula 13035 Windfern RD Apt 219 Houston, TX 770643028Steven Andrew100% (1)

- BinderDocument2 pagesBinderJordan ChaconPas encore d'évaluation

- Chase Bank Financial StatementDocument3 pagesChase Bank Financial StatementGo DumpPas encore d'évaluation

- Rent Receipt: (Signature)Document1 pageRent Receipt: (Signature)Akhil RaviPas encore d'évaluation

- Suncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingDocument3 pagesSuncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingolaPas encore d'évaluation

- UL PayStub 2019.01.15Document1 pageUL PayStub 2019.01.15Marcus GreenPas encore d'évaluation

- Utility BilDocument4 pagesUtility BilGarth BrooksPas encore d'évaluation

- Explanation of Amount Due: Click Here To Pay OnlineDocument2 pagesExplanation of Amount Due: Click Here To Pay OnlinePhillipPas encore d'évaluation

- CODE - 00491630201020000022: Declaration of Insurance PolicyDocument2 pagesCODE - 00491630201020000022: Declaration of Insurance PolicyKeller Brown Jnr100% (1)

- Sunrun Statement: Power Purchase Agreement: Account Number (S) AmountDocument1 pageSunrun Statement: Power Purchase Agreement: Account Number (S) AmountDalePas encore d'évaluation

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochPas encore d'évaluation

- Quick Bill Summary: Manage Your Account Account Number Date DueDocument50 pagesQuick Bill Summary: Manage Your Account Account Number Date Dueanon-870812Pas encore d'évaluation

- Rossi Construction Inc: Single Tammy Jo Gentile 302 Vermont Way Lehigh Acres, FL 33936 02/12/2022Document1 pageRossi Construction Inc: Single Tammy Jo Gentile 302 Vermont Way Lehigh Acres, FL 33936 02/12/2022olaPas encore d'évaluation

- Georgia Power BillDocument2 pagesGeorgia Power BillAlex NeziPas encore d'évaluation

- CA Residential Lease Agreement 05112011Document5 pagesCA Residential Lease Agreement 05112011got2bsurePas encore d'évaluation

- 11-2-15 BillDocument2 pages11-2-15 Billapi-224572596100% (1)

- Statement 0102 0502Document1 pageStatement 0102 0502Anonymous pmsSgfPas encore d'évaluation

- Cosmic Ascent Jewelry 1423 S Thurston ST TACOMA, WA 98408-3548 Tax Registration - ActiveDocument2 pagesCosmic Ascent Jewelry 1423 S Thurston ST TACOMA, WA 98408-3548 Tax Registration - ActiveCosmic Ascent100% (1)

- First Citizens Checking: Important Account InformationDocument3 pagesFirst Citizens Checking: Important Account InformationAbhishek VPas encore d'évaluation

- Personal Articles Application / Binder-ReceiptDocument2 pagesPersonal Articles Application / Binder-ReceiptRachel PiperPas encore d'évaluation

- Service AddressDocument1 pageService Addresskeogh takakoPas encore d'évaluation

- Past BillsDocument39 pagesPast BillsTollPas encore d'évaluation

- Business Application Form 2020 Revised 2022 1Document2 pagesBusiness Application Form 2020 Revised 2022 1Jan Cyrelle AbrazadoPas encore d'évaluation

- TCTDocument2 pagesTCTRene Jane RosendoPas encore d'évaluation

- Nevada Business Registration Form InstructionsDocument3 pagesNevada Business Registration Form InstructionstibymiaPas encore d'évaluation

- Banana Oil LabDocument5 pagesBanana Oil LabjbernayPas encore d'évaluation

- Intensive Care Fundamentals: František Duška Mo Al-Haddad Maurizio Cecconi EditorsDocument278 pagesIntensive Care Fundamentals: František Duška Mo Al-Haddad Maurizio Cecconi EditorsthegridfanPas encore d'évaluation

- Resonant Excitation of Coherent Cerenkov Radiation in Dielectric Lined WaveguidesDocument3 pagesResonant Excitation of Coherent Cerenkov Radiation in Dielectric Lined WaveguidesParticle Beam Physics LabPas encore d'évaluation

- KNOLL and HIERY, The German Colonial Experience - IntroDocument6 pagesKNOLL and HIERY, The German Colonial Experience - IntroGloria MUPas encore d'évaluation

- Triple Net Lease Research Report by The Boulder GroupDocument2 pagesTriple Net Lease Research Report by The Boulder GroupnetleasePas encore d'évaluation

- Proiect La EnglezăDocument5 pagesProiect La EnglezăAlexandraPas encore d'évaluation

- Hard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Document330 pagesHard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Adriel senciaPas encore d'évaluation

- Similarities and Differences Between Theravada and Mahayana BuddhismDocument10 pagesSimilarities and Differences Between Theravada and Mahayana BuddhismANKUR BARUA89% (9)

- Areopagitica - John MiltonDocument1 pageAreopagitica - John MiltonwehanPas encore d'évaluation

- @PAKET A - TPM BAHASA INGGRIS KuDocument37 pages@PAKET A - TPM BAHASA INGGRIS KuRamona DessiatriPas encore d'évaluation

- "Written Statement": Tanushka Shukla B.A. LL.B. (2169)Document3 pages"Written Statement": Tanushka Shukla B.A. LL.B. (2169)Tanushka shuklaPas encore d'évaluation

- Transform Your Appraisal Management Process: Time-Saving. User-Friendly. Process ImprovementDocument10 pagesTransform Your Appraisal Management Process: Time-Saving. User-Friendly. Process ImprovementColby EvansPas encore d'évaluation

- DAA R19 - All UnitsDocument219 pagesDAA R19 - All Unitspujitha akumallaPas encore d'évaluation

- EY Global Hospitality Insights 2016Document24 pagesEY Global Hospitality Insights 2016Anonymous BkmsKXzwyKPas encore d'évaluation

- 01.performing Hexadecimal ConversionsDocument11 pages01.performing Hexadecimal ConversionsasegunloluPas encore d'évaluation

- Disruptive Strategy Final Paper Company ProfilesDocument2 pagesDisruptive Strategy Final Paper Company ProfilesHumberto Jose Arias BarrosPas encore d'évaluation

- Essay On Stamp CollectionDocument5 pagesEssay On Stamp Collectionezmt6r5c100% (2)

- Pegasus W200Document56 pagesPegasus W200Aleixandre GomezPas encore d'évaluation

- Micro Fibra Sintetica at 06-MapeiDocument2 pagesMicro Fibra Sintetica at 06-MapeiSergio GonzalezPas encore d'évaluation

- Six Sigma PDFDocument62 pagesSix Sigma PDFssno1Pas encore d'évaluation

- Sample CVDocument3 pagesSample CVsam_mad00Pas encore d'évaluation

- CWTS Narrative ReportDocument10 pagesCWTS Narrative ReportJa Rich100% (1)

- Hibike Euphonium - Crescent Moon DanceDocument22 pagesHibike Euphonium - Crescent Moon Dancelezhi zhangPas encore d'évaluation

- Frugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiDocument9 pagesFrugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiGisselle RomeroPas encore d'évaluation

- Week 4Document5 pagesWeek 4عبدالرحمن الحربيPas encore d'évaluation

- Playing Djembe PDFDocument63 pagesPlaying Djembe PDFpbanerjeePas encore d'évaluation

- KGTE February 2011 ResultDocument60 pagesKGTE February 2011 ResultSupriya NairPas encore d'évaluation

- Form A HypothesisDocument2 pagesForm A Hypothesismrshong5bPas encore d'évaluation

- Services Marketing-Unit-Ii-ModifiedDocument48 pagesServices Marketing-Unit-Ii-Modifiedshiva12mayPas encore d'évaluation

- Rehabilitation Major Repair of Permanent Bridges Bariis Br.Document2 pagesRehabilitation Major Repair of Permanent Bridges Bariis Br.John Rheynor MayoPas encore d'évaluation