Académique Documents

Professionnel Documents

Culture Documents

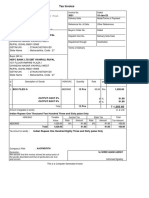

BIR Tax

Transféré par

Lovely L. ChuaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BIR Tax

Transféré par

Lovely L. ChuaDroits d'auteur :

Formats disponibles

A.

Professionals and Other Supplier of Services Hired under a Contract for Service or Job

Order deriving gross receipts of P250,000.00 and below in 12-month period from a LONE

PAYOR and with no other source of income

Registration Requirements

1. Registration with the Bureau using BIR Form No. 1901 for Taxpayer Idenfication Number

(TIN) issuance with taxpayer type of ‘Professional’ or ‘Professional – In General’ with the

following documentary requirements:

a. Copy of service contract showing the amount of income payment;

b. Any idenfication issued by an authorized government body (e.g. Bith Certificate,

passport, driver’s license, Community Tax Certificate, etc.) that shows the name,

address and birthdate of the applicant; and

The Registration Officer shall add the words “Job Order” in the business name field,

e.g. “Juan Dela Cruz – Job Order”.

2. Payment of Annual Registration Fee (ARF);

3. Tax Type Income Tax; Percentage Tax; Registration Fee (RF);

4. Exemption from the issuance of Certificate of Registration (COR);

Bookkeeping and Invoicing Requirements

5. Exemption from compliance with the issuance of registered receipts/invoices;

6. Exemption from the requirement of maintenance of Books of Accounts;

Tax Compliance Requirements

7. Filing of Annual Income Tax Return (BIR Form No. 1701);

8. Exemption from filing of Quarterly Income Tax Return (BIR) Form No. 1701Q);

9. Not subject to creditable withholding tax rates; and

10. Filing and payment of Percentage Tax using Quarterly Percentage Tax Return (BIR Form

No. 2551Q):

a. If opted to avail of the Graduated Income Tax Rates under Section 24(A)(2)(a) of the

Tax Code, as amended – Subject to withholding of three percent (3%) percentage tax

under Section 5.116(A)(1) of Revenue Regulations (RR) No. 2-98, as amended;

b. Exempted from filing and payment of percentage tax and/or withholding of percentage

tax if qualified and opted to avail of the 8% income tax rate and submits an Income

Payee’s Sworn Declaration of his/her gross receipts/sales (Annex “A1”) to the lone

income payor/withholding agent, together with a copy of duly received BIR Form No.

1901 or copy of BIR Form No. 0605 – Annual Registration Fee payment, in lieu of the

COR (not required to attach COR)

Avail of the Eight Percent (8%) Income Tax Rate Option

Professionals and Other Supplier of Service hired under a Contract for Service or

Job Order deriving gross receipts of P250,000.00 and below in any 12-month period

from lone payor and with no other source of Income, shall signify the intention to elect

the 8% income tax rate in filing of BIR Form No. 1905 (Application for Registration

Information Update) or filing of 1st Quarterly Percentage Tax Return.

B. Professionals and Other Supplier of Services Hired under a Contract of Service or Job

Order deriving gross receipts ABOVE P250,000 and NOT EXCEEDING P3,000.000 in

any 12 – month period from LONE PAYOR and with no other source of income

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 3051 Revised DateDocument1 page3051 Revised DateElla and MiraPas encore d'évaluation

- BIR RULING (DA - (C-077) 259-09) : AedhstDocument4 pagesBIR RULING (DA - (C-077) 259-09) : AedhstTaxation LawPas encore d'évaluation

- Melanie S. Samsona Business Tax Chapter 7 ExercisesDocument3 pagesMelanie S. Samsona Business Tax Chapter 7 ExercisesMelanie SamsonaPas encore d'évaluation

- Revenue DetailsDocument1 pageRevenue Detailsviratkant143Pas encore d'évaluation

- Decentralization in the Philippines: A Review of Fiscal, Political and Service Delivery AspectsDocument13 pagesDecentralization in the Philippines: A Review of Fiscal, Political and Service Delivery AspectsDaniel Paulo MangampatPas encore d'évaluation

- Solved Jim Received A Six Month Extension To October 15 2014 ToDocument1 pageSolved Jim Received A Six Month Extension To October 15 2014 ToAnbu jaromiaPas encore d'évaluation

- FYCE BM1804 - Income Taxation HandoutDocument17 pagesFYCE BM1804 - Income Taxation HandoutLisanna DragneelPas encore d'évaluation

- US Internal Revenue Service: Iw2 - 1999Document12 pagesUS Internal Revenue Service: Iw2 - 1999IRSPas encore d'évaluation

- Assignment No. 1 - The Budget ProcessDocument4 pagesAssignment No. 1 - The Budget ProcessCindy Faye CrusantePas encore d'évaluation

- 709 Form 2005 SampleDocument4 pages709 Form 2005 Sample123pratus91% (11)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAyanna Sellers100% (5)

- Vol 1Document254 pagesVol 1BhawnaBishtPas encore d'évaluation

- Processing For The Issuance of Professional Tax ReceiptDocument2 pagesProcessing For The Issuance of Professional Tax ReceiptRhea Mae A. SibalaPas encore d'évaluation

- 2020 Tax ReturnDocument16 pages2020 Tax ReturnTbahajBayan100% (1)

- Receipt Voucher: Xiaomi Technology India Private LimtiedDocument1 pageReceipt Voucher: Xiaomi Technology India Private Limtiedsaroj2058Pas encore d'évaluation

- IESCO Online Consumer BillDocument1 pageIESCO Online Consumer Billdestiner_187144% (9)

- CBE 5 Module 5 TrueDocument8 pagesCBE 5 Module 5 TrueChristian John Resabal BiolPas encore d'évaluation

- Kavita 2Document2 pagesKavita 2api-3721187Pas encore d'évaluation

- No 14 - The Late Lino Gutierrez V Collector of Internal RevenueDocument2 pagesNo 14 - The Late Lino Gutierrez V Collector of Internal RevenueA Paula Cruz FranciscoPas encore d'évaluation

- Financial Reporting 3rd Edition - (CHAPTER 12 Income Taxes)Document52 pagesFinancial Reporting 3rd Edition - (CHAPTER 12 Income Taxes)gvfx48zc7xPas encore d'évaluation

- IT Exercise 1Document23 pagesIT Exercise 1Acua RioPas encore d'évaluation

- 6 Basic Employee Benefits in The PhilippinesDocument7 pages6 Basic Employee Benefits in The PhilippinesgeLO36Pas encore d'évaluation

- RMC 70-2010 Use of Reappraised Value As Basis For Computing Depreciation of PPE Is Not Allowed For Tax Purposes.Document2 pagesRMC 70-2010 Use of Reappraised Value As Basis For Computing Depreciation of PPE Is Not Allowed For Tax Purposes.zooeyPas encore d'évaluation

- Polish Financial LawDocument138 pagesPolish Financial LawPilar Alemany100% (1)

- ACC - Chapter 11Document29 pagesACC - Chapter 11Le Pham Khanh Ha (K17 HCM)Pas encore d'évaluation

- Holiday and Wage Record SpreadsheetDocument2 pagesHoliday and Wage Record SpreadsheetpasangbhpPas encore d'évaluation

- Netaji Subhas Open University: Learning ObjectivesDocument48 pagesNetaji Subhas Open University: Learning ObjectivesMr. Tanmoy Pal ChowdhuryPas encore d'évaluation

- TaxOptimizer© From TaxSpannerDocument14 pagesTaxOptimizer© From TaxSpanneryeswanthPas encore d'évaluation

- HPCL Visakhapatnam price listDocument1 pageHPCL Visakhapatnam price listmc3lawrinPas encore d'évaluation

- Service TaxDocument7 pagesService TaxmurusaPas encore d'évaluation