Académique Documents

Professionnel Documents

Culture Documents

12 Accountancy Comp Delhi2017 1

Transféré par

harshit agrawalTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

12 Accountancy Comp Delhi2017 1

Transféré par

harshit agrawalDroits d'auteur :

Formats disponibles

CBSE

Class 12 Accountancy

Question Paper Comp. Delhi 2017 (set 1)

General Instructions :

This question paper contains two parts A and B.

Part A is compulsory for all.

Part B has two options : Option – I Analysis of Financial Statements and Option – II

Computerized Accounting.

Attempt only one option of Part B.

All parts of a question should be attempted at one place.

PART – A

(Accounting for Partnership Firms and Companies)

1. Why should a new partner contribute towards goodwill on his admission? (1)

Ans. A new partner should contribute towards the goodwill so as to compensate the

existing partners for the sacrifice they make in favour of the new partner.

2. X, Y and Z were partners sharing profits and losses in the ratio of 3 : 2 : 2. Z retired

and the amount due to him was ₹ 85,000. He was paid ₹ 5,000 immediately. The

balance was payable in three equal annual installments carrying interest @ 6% p.a.

Pass necessary journal entry for recording the same on the date of Z’s retirement.

(1)

Ans.

Books of the X,Y,Z

Journal

Date Particulars LF Dr (₹) Cr (₹)

Z’s Capital A/c .........................................Dr. 85,000

To Cash / Bank A/c 5,000

To Z’s Loan A/c

[Amount due to Z on his retirement transferred to his loan A/c 80,000

Material downloaded from myCBSEguide.com. 1 / 28

after payment of Rs. 5,000]

3. State any one occasion for the dissolution of the firm on court’s orders. (1)

Ans. The court may order a partnership firm to be dissolved on any of the following

grounds: (any one of the following)

a. When a partner becomes insane;

b. When a partner becomes permanently incapable of performing his duties as a

partner;

c. When a partner is guilty of misconduct which is likely to adversely affect the business

of the firm;

d. When a partner persistently commits breach of partnership agreement;

e. When a partner has transferred the whole of his interest in the firm to a third party;

f. When the business of the firm cannot be carried on except at a loss; or

g. When, on any ground, the court regards dissolution to be just and equitable.

4. Change in Profit Sharing Ratio amounts to dissolution of partnership or partnership

firm? Give reason in support of your answer. (1)

Ans. Change in Profit Sharing Ratio amounts to Dissolution of partnership and not

dissolution of firm as the existing agreement comes to an end and the firm continues

under the new agreement.

5. In which ratio do the remaining partners acquire the share of profit of the retiring

partner? (1)

Ans. Remaining partners acquire the share of profit of the retiring partner in Gaining

ratio.

6. What is meant by ‘Employee Stock Option Plan’? (1)

Ans. Employee Stock Option Plan means option granted by the company to its employees

and employee directors to subscribe the shares of the company at a price that is lower

than the market price. But it is not an obligation on the employee to subscribe for it.

7. The total capital of the firm of Sakshi, Mehak and Megha is ₹ 1,00,000 and the

market rate of interest is 15%. The net profits for the last 3 years were ₹ 30,000; ₹

36,000 and ₹ 42,000. Goodwill is to be valued at 2 years purchase of the last 3 years’

super profits. Calculate the goodwill of the firm. (3)

Ans. Goodwill = Super Profits × No. of years’ purchase;

Super Profits = Average Profits – Normal Profits;

Material downloaded from myCBSEguide.com. 2 / 28

Normal Profits = Capital employed

i.e. 1,00,000 × 15/100 = 15,000

Average Profits = = 36,000

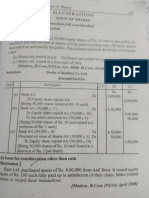

8. Madhur Ltd. took over the assets of ₹ 3,90,000 and Liabilities of ₹ 40,000 of Rasova

Ltd. for a consideration of ₹ 4,00,000. 20% was paid by a cheque and the balance by

issue of fully paid equity shares of ₹ 100 each at a premium of 60%. Show necessary

journal entries for these transactions in the books of Madhur Ltd. (3)

Ans.

Books of the Madhur Ltd.

Journal

Dr. Cr.

Date Particulars L.F. Amt. Amt.

(Rs.) (Rs.)

(i) Assets A/c Dr. 3,90,000

Goodwill A/c Dr. 50,000

To Liabilities A/c 40,000

To Rasova A/c 40,000

[Assets and Liabilities of Rasova Ltd. taken over]

(ii) Rasova Ltd. Dr. 4,00,000

To Bank a/c 80,000

To Equity share Capital A/c 2,00,000

To Securities premium Reserve A/c 1,20,000

[20% Payment made to Rasova Ltd. by cheque and balance

and balance settled by issue of equity shares at a premium

of 60%]

OR

Rasova Ltd. Dr. 80,000

Material downloaded from myCBSEguide.com. 3 / 28

To bank A/c 80,000

(20% Payment made of Rasova Ltd. by cheque)

Rasova Ltd. Dr. 3,20,000

To Equity share Capital A/c 2,00,000

To Secuities Premium Reserve A/c 1,20,000

(Balance due to Rasova Ltd. Settled by issue of equity

shares at a premium of 60%)

9. Xansa Ltd. offered 22,000 equity shares of ₹ 100 each to the public at a premium of ₹

20 per share. The amount per share was payable as ₹ 30 on application; ₹ 50

(including premium) on allotment; and the balance on first and final call. 20,000

shares were subscribed by the public. All calls were made. A shareholder holding

1,000 shares failed to pay the first and final call money. His shares were forfeited.

Show ‘Share Capital’ in the Balance Sheet of Xansa Ltd. Also, prepare ‘Notes to

Accounts’. (3)

Ans.

Balance Sheet of Xansa Ltd. As at ............. (As per revised schedule VI)

Particulars Note No. Amount ₹ Current year Amount ₹ Previous year

EQUITY & LIABILITIES

I Shareholder’s funds : 1 19,60,000 -‐-‐-‐-‐-‐-‐-‐-‐

a) Share Capital

Notes to Accounts :

Particular (Rs.)

(1) Share Capital

Authorised Capital: xxxxxxxxx

…….. equity shares of Rs. 100 each

Issued Capital

Material downloaded from myCBSEguide.com. 4 / 28

22,000 equity shares of Rs. 100 each 22,00,000

Subscribed capital

Subscribed and fully paid

19,000 shares of Rs. 100 each 19,00,000

Add: Forfeited shares A/c 60,000

19,60,000

10. Anuj, Manoj and Disha were partners in a firm sharing profits and losses in the ratio

of 2 : 2 : 1. On 1st April, 2016, the capitals of the partners were : ₹ 3,00,000; ₹ 2,00,000

and ₹ 1,00,000 respectively. The firm closes its books on 31stMarch every year. Disha

died on 1st July, 2016.

a. On Disha’s death the goodwill of the firm was valued at ₹ 30,000.

b. Disha’s share of profit till the date of her death was calculated at ₹ 12,000.

Pass necessary journal entries in the books of the firm for the above on Disha’s

Death. (3)

Ans.

Books of Anuj, Manoj and Disha Journal

Dr. Cr.

Date Particulars L.F

(Rs.) (Rs.)

2016

(a) Anuj’s Capital A/c Dr. 3,000

July 1

Manoj’s Capital A/c Dr. 3,000

To Disha’s Capital A/c 6,000

[Disha’s Share of Goodwill adjusted to Anuj and manoj in

their gaining ratio]

July 1 (b) Profit & Loss Suspense A/c Dr. 12,000

To Disha’s Capital A/c 12,000

[Disha’s Share of Profits till her death credited to her A/c]

Material downloaded from myCBSEguide.com. 5 / 28

July 1 (c) Disha’s Capital A/c Dr. 1,18,000

To Disha’s Executors’ A/c 1,18,000

[Balance of Disha’s capital A/c transferred to her

executors’ A/c]

11. Books of the Tvisha and DivyaTvisha and Divya were partners in a firm carrying on

a tiffin service in Hyderabad. Divya noticed that a lot of food is left at the end of the

day. To avoid wastage, she suggested that the same may be distributed among the

needy. Tvisha wanted it to be mixed with the food to be served the next day.

Tvisha then gave a proposal that if her share in the profit is increased, she will not

mind free distribution of left over food. Divya happily agreed. So, they decided to

change their profit sharing ratio to 3 : 2 with immediate effect. On the date of

change in the profit-sharing ratio, the goodwill of the firm was valued at ₹ 50,000.

a. Pass the necessary adjustment entry for the treatment of goodwill.

b. State any two values highlighted in the behavior of Tvisha and Divya. (4)

Ans.

a.

Journal

Dr. Cr.

Date Particulars L.F

(Rs.) (Rs.)

2016 Apr

Divya’s Capital A/c Dr. 5,000

1

To Tvisha’s Capital A/c 5,000

[Treatment of goodwill on change in Profit sharing

ratio]

a. Values (Any two):

Compassion,

Sensitivity towards underprivileged,

Optimum utilisation of resources,

Material downloaded from myCBSEguide.com. 6 / 28

Concern for society

(Or any other suitable value)

12. Prayuj Ltd. forfeited 2,000 shares of ₹ 10 each, fully called up, on which they had

received only ₹ 14,000. 50 of the forfeited shares were reissued for ₹ 9 per share

fully paid up. Pass necessary journal entries for forfeiture and re-issue of shares.

Also prepare share forfeited account. (4)

Ans.

Books of the Prayuj Ltd.

Journal

Dr. Cr.

Date Particulars L.F

(Rs.) (Rs.)

(i) Share Capital A/c Dr. 20,000

To Forfeited Shares A/c 14,000

To Calls in arrear A/c 6,000

[2,000 shares of Rs. 10 each forfeited for non payment of Rs.

6,000]

(ii) Bank A/c Dr. 450

Forfeited shares A/c Dr. 50

To Share capital A/c 500

[50 of the forfeited shares reissued for Rs. 9 per share]

(iii) Forfeited shares A/c Dr. 300

To Capital Reserve A/c 300

[Gain on reissue of shares transferred to Capital reserve A/c]

Forfeited Shares A/c

Dr. Cr.

Particular Particular

Material downloaded from myCBSEguide.com. 7 / 28

Amt (₹) Amt (₹)

To Equity Share Capital A/c 50

To Capital Reserve A/c 300 By Equity Share Capital A/c 14,000

To Balance c/d 13,650

14,000 14,000

13. a. Journalise the following transaction at the time of issue of 12% debentures;

Nandan Ltd. issued ₹ 90,000, 12% debentures of ₹ 100 each at a discount of 5%

redeemable at 110%.

b. Journalise the following transactions on redemption of debentures :

i. Kipter Ltd. redeemed ₹ 1,90,000, 14% debentures of ₹ 100 each issued at par

by converting them into equity shares of ₹ 10 each issued at a premium of

25%.

ii. Rabtec Ltd. purchased its own 3,000, 12% Debentures of ₹ 100 each at ₹ 96 per

debenture for immediate cancellation. Ignore entries for Debenture

Redemption Reserve, Debenture Redemption Investments and Interest. (6)

Ans.

a.

Books of Nandan Ltd.

Journal

Dr. Cr.

Date Particulars L.F.

(Rs.) (Rs.)

Bank A/c 85,500

To 12% Debentures Application % Allotment A/c 85,000

[Application received for Rs. 90,000, 12 % debentures issued at

5% discount]

12% Debentures Application & Allotment A/c Dr. 85,500

Loss on Issue of Debentures of Debentures A/c 13,500

To 12% Debentures A/c 90,000

Material downloaded from myCBSEguide.com. 8 / 28

To Premium on Redemption of Debentures A/c 9,000

[Allotment of 900 12% debentures at 5% Discount redeemable

at 10% premium]

OR

12% Discount Application & Allotment A/c Dr. 85,500

Discount on issue of Debentures A/c Dr. 4,500

Loss on Issue of Debentures A/c Dr. 9,000

To 12% Debentures A/c 90,000

To Premium on Redemption of Debentures A/c 9,000

[Allotment of 900, 12% Debentures at 5% Discount redeemable

at 10% premium]

b. i.

Books of Kipter Ltd.

ournal

Date Particulars L.F Dr. (Rs.) Cr. (Rs.)

14% Debentures A/c Dr. 1,90,000

To Debentures holder’s A/c 1,90,000

[Amount payable to Debentures holders on Conversion]

Debentures holder’s A/c Dr. 1,90,000

To Equity Share Capital A/c 1,52,000

To Securities Premium Reserve A/c 38,000

[Equity shares issued at 25% Premium to 14% Debentures

holders’ A/c]

ii.

Books of Rabtec Ltd.

Material downloaded from myCBSEguide.com. 9 / 28

Journal

Date Particulars L.F. Dr. (Rs.) Cr. (Rs.)

Own Debentures A/c Dr. 2,88,000

To Bank A/c 2,88,000

[3,000 own Debentures purchased for cancellation]

12% Debentures A/c Dr. 3,00,000

To own Debentures A/c 2,88,000

To profit on Cancellation of own Debentures A/c 12,000

[Cancellation of own Debentures]

Profit on Cancellation of Own Debentures A/c Dr. 12,000

To Capital Reserve A/c 12,000

[Profit on cancellation of own Debentures transferred to

capital reserve A/c]

14. Give the necessary journal entries for the following transactions on dissolution of

the firm of Aman and Rajat on 31st March, 2016, after the transfer of various assets

(other than cash) and the third party liabilities to Realisation Account. They shared

profits and losses in the ratio of 2 : 1. (6)

a. There was a bill of exchange of ₹ 10,000 under discount. The bill was received

from Derek who became insolvent.

b. Bills payable of ₹ 30,000 falling due on 30th April, 2016 were discharged at ₹

29,550.

c. Creditors of ₹ 30,000 took over stock of ₹ 10,000 at 10% discount and the balance

was paid to them in cash.

d. There was an old typewriter which had been written off completely. It was

estimated to realize ₹ 600. It was taken away by Rajat at 25% less than the

estimated price.

e. Aman agreed to take over the responsibility of completing dissolution at an

agreed remuneration of ₹ 1,000 and to bear all realization expenses. Actual

Material downloaded from myCBSEguide.com. 10 / 28

realisation expenses ₹ 800 were paid by the firm.

f. Loss on realization was ₹ 54,000.

Ans.

Books of the Aman and Rajat Journal

Dr. Cr.

Date Particulars L.F.

(Rs.) (Rs.)

(a) Realisation A/c Dr. 10,000

To Bank A/c 10,000

[Payment of a Dishonoured B/R under discount]

(b) Realisation A/c Dr. 29,550

To Bank A/c 29,550

[Bills payable discharged]

(c) Realisation A/c Dr. 21,000

To Bank A/c 21,000

[Creditors took over stock & balance paid in cash]

(d) Rajat’s Capital A/c Dr. 450

To Realisation A/c 450

[Unrecorded old typewriter taken over By Rajat]

(e) [i] Realisation A/c Dr. 1,000

To Aman’s Capital A/c 1,000

[Remuneration given to Aman for completing dissolution

work]

[ii] Aman’s Capital A/c 800

To bank A/c 800

[Expenses paid by the firm but borne by Aman]

Material downloaded from myCBSEguide.com. 11 / 28

(f) Aman’s Capital A/c Dr. 36,000

Rajat’s Capital A/c Dr. 18,000

To Realisation A/c 54,000

[Loss on Realisation]

15. Piya and Bina are partners in a firm sharing profits and losses in the ratio of 3 : 2.

Following was the Balance Sheet of the firm as on 31-3-2016. (6)

Liabilities Amount (₹) Assets Amount (₹)

Capitals : Piya 80,000 Sundry Assets 1,20,000

Bina 40,000 1,20,000

1,20,000 1,20,000

The profits ₹ 30,000 for the year ended 31-3-2016 were divided between the partners

without allowing interest on capital @ 12% p.a. and salary to Piya @ ₹ 1,000 per month.

During the year Piya withdrew ₹ 8,000 and Bina withdrew ₹ 4,000. Showing your

working notes clearly, pass the necessary rectifying entry.

Ans. Books of the Piya and Bina

Journal

Date Particulars L.F. Dr. (Rs.) Cr. (Rs.)

2016 Apr 1 Bina’s Capital A/c Dr. 5,856

To Piya’s Capital A/c 5,856

[Rectifying entry for omission of IOC and Piya’s salary]

Working Notes:

1. Calculation of Opening Capital”

PIYA BINA

Closing Capital 80,000 40,000

Material downloaded from myCBSEguide.com. 12 / 28

Add: Drawings 8,000 4,000

88,000 44,000

Less: Profits 18,000 12,000

Opening Capital 70,000 32,000

IOC @ 12% 8,400 3,840

2.

Past Adjustment Table

Particulars Piya Bina Total

Omission of IOC 8,400 (Cr.) 3,840 (Cr.) 12,240 (Dr.)

omission of Piya’ salary 12,000 (Cr.) ………….. 12,000 (Dr.)

20,400 (Cr.) 3,840 (Cr.) 24,240 (Dr.)

Dr. Total divided in PSR 14,544 (Dr.) 9,696 (Dr.) 24,240 (Cr.)

Net Effect 5856 (Cr.) 5,856 (Dr.) 00000

16. Nitro Paints Ltd. invited application for issuing 1,60,000 equity shares of ₹ 10 each at

a premium of ₹ 3 per share. The amount was payable as follows :

On application – ₹ 6 per share (including premium ₹ 1)

On allotment – ₹ 3 per share (including premium ₹ 1) and the balance – on first and

final call.

Application for 1,80,000 shares were received. Applications for 10,000 shares were

rejected and pro-rata allotment was made to the remaining applicants. Over

payment received on application was adjusted towards sums due on allotment. All

calls were made and were duly received except allotment and final call from Aditya

who was allotted 3,200 shares. His shares were forfeited. Half of the forfeited shares

were reissued for ₹ 43,000 as fully paid up.

Pass necessary journal entries for the above transactions in the books of Nitro

Paints Ltd. (8)

OR

Material downloaded from myCBSEguide.com. 13 / 28

Midee Ltd. invited applications for issuing 27,000 shares of ₹ 100 each payable as

follows :

₹ 50 – per share on application

₹ 10 – per share on allotment

Balance – on first and final call.

Applications were received for 40,000 shares. Full allotment was made to the

applicants of 7,000 shares. The remaining applicants were allotted 20,000 shares on

pro-rata basis. Excess money received on application was adjusted towards

allotment and call.

Asha, holding 600 shares was belonged to the category of applicants to whom full

allotment was made, paid the call money at the time of allotment. Ankur, who

belonged to the category of applicants to whom shares were allotted on pro-rata

basis did not pay anything after application on his 200 shares. Ankur’s shares were

forfeited after the first and final call. These shares were later reissued at ₹ 105 per

share as fully paid up. Pass necessary journal entries in the books of Midee Ltd. for

the above transactions, by opening calls in arrears and calls in advance accounts

wherever necessary.

Ans.

Books of Nitro Paints Ltd. Journal

Date Particulars L.F. Dr. (Rs.) Cr. (Rs.)

(i) Bank A/c Dr. 10,80,000

To Equity share Application A/c 10,80,000

[Application money received on 1,80,000 Shares]

(ii) Equity share application A/c Dr. 10,80,000

To Equity Share Capital A/c 8,00,000

To Securities Premium Reserve A/c 1,60,000

To Equity Share Allotment A/c 60,000

Material downloaded from myCBSEguide.com. 14 / 28

To Bank A/c 60,000

[Application money transferred to Share capital A/c,

Securities Premium A/c, share Allotment A/c & surplus

refunded]

(iii) Equity Share Allotment A/c Dr. 4,80,000

To Equity Share Capital A/c 3,20,000

To Securities Premium Reserve A/c 1,60,000

[Allotment money due on 1,60,000 Shares]

(iv) Bank A/c Dr. 4,11,600

To Equity Share Allotment A/c 4,11,600

[Amount Received on allotment except on 3,200 Shares]

OR

Bank A/c Dr. 4,11,600

Calls – in – arrear A/c Dr. 8,400 4,20,000

To Equity share Allotment A/c

[Amount received on Allotment except on 3,200 Shares]

(v) Equity Share first & Final Call A/c Dr. 6,40,000

To Equity Share Capital A/c 4,80,000

To Securities Premium Reserve A/c 1,60,000

[First & Final call Money due on 1,60,000 Shares]

(vi) Bank A/c Dr. 6,27,200

To Equity Share First & Final Call A/c 6,27,200

[First & Final call money received except on 3,200 Shares]

OR

Bank A/c Dr. 6,27,200

Calls – in – arrear A/c Dr. 12,800

Material downloaded from myCBSEguide.com. 15 / 28

To Equity share First & Final Call A/c 6,40,000

[First and Final call Money Received except on 3,200

share]

(vii) Equity Share Capital A/c Dr. 32,000

Securities Premium Reserve A/c Dr. 6,400

To Forfeited Shares A/c 17,200

To Equity Share Allotment A/c 8,400

To Equity Share First & final call A/c 12,800

[Forfeiture of 3,200 Shares for non payment of Allotment

and call money]

OR

Equity Share Capital A/c Dr. 32,000

Securities Premium Reserve A/c Dr. 6,400

To Forfeited Shares A/c 17,200

To call – in – Arrear A/c 21,800

[Forfeiture of 3,200 Shares for non Payment of allotment

and call money

(viii) Bank A/c Dr. 43,000

To Equity Share Capital A/c 16,000

To Securities Premium Reserve A/c Dr. 27,000

[1,600 of the forfeited shares reissued as fully paid up]

(ix) Forfeited Shares A/c Dr. 8,600

To Capital Reserve A/c 8,600

[Gain on 1,600 Reissued shares transferred to capital

reserve A/c]

Material downloaded from myCBSEguide.com. 16 / 28

OR

Date Particulars L.F. Dr. (Rs.) Cr. (Rs.)

(i) Bank A/c Dr. 20,00,000

To Equity share Application A/c 20,00,000

[Application Monet Received on 40,000 shares]

(ii) Equity Share Application A/c Dr. 20,00,000

To Equity Share Capital A/c 13,50,000

To Equity Share Allotment A/c 2,00,000

To Calls in advance A/c 4,50,000

[application money transferred to share capital A/c and

excess transferred to share allotment and calls in advance

A/c]

(iii) Equity share Allotment A/c Dr. 2,70,000

To Equity share capital A/c 2,70,000

[Allotment money due to 27,000 shares]

(iv) Bank A/c Dr. 94,000

To Equity Share Allotment A/c 70,000

To Calls in Advance A/c 24,000

[Allotment money Received on 27,000 shares and calls in

Advance on 600 shares]

(v) Equity share First & Final Call A/c Dr. 10,80,000

To Equity Share Capital A/c 10,80,00

[First & Final Call money due on 27,000 shares]

(vi) Bank A/c Dr. 10,52,500

Calls – in – arrear A/c Dr. 3,500

Material downloaded from myCBSEguide.com. 17 / 28

Calls – in advance A/c 24,000

To Equity Shares first & Final call A/c 10,80,000

[First & Final Call Money Received except on 200 Shares

calls in advance adjusted]

(vii) Equity Share Capital A/c Dr. 20,000

To Forfeited Shares A/c 16,500

To Calls – in – arrear A/c 3,500

[Forfeiture of 200 shares for non payment of call money]

(viii) Bank A/c Dr. 21,000

To Equity Share Capital A/c 20,000

To Securities Premium Reserve A/c 1,000

[200 forfeited shares reissued as fully paid up]

(ix) Forfeited Shares A/c Dr. 16,500

To Capital Reserve A/c 16,500

[Gain on Reissued Shares Transferred to Capital reserve

A/c]

17. The Balance Sheet of Madhu and Vidhi who are sharing profits in the ratio of 2 : 3 as

at 31st March, 2016 is given below : (8)

Liabilities Amount (₹) Assets Amount (₹)

Madhu’s Capital 5,20,000 Land & Building 3,00,000

Vidhi’s Capital 3,00,000 Machinery 2,80,000

General Reserve 30,000 Stock 80,000

Debtors 3,00,000

Bills payable 1,50,000 2,90,000

Less : Provision 10,000

Bank 50,000

Material downloaded from myCBSEguide.com. 18 / 28

10,00,000 10,00,000

Madhu and Vidhi decided to admit Gayatri as a new partner from 1st April, 2016 and

their new profit sharing ratio will be 2 : 3 : 5. Gayatri brought ₹ 4,00,000 as her capital

and her share of goodwill premium in cash.

a. Goodwill of the firm was valued at ₹ 3,00,000.

b. Land and Building was found undervalued by ₹ 26,000.

c. Provision for doubtful debts was to be made equal to 5% of the debtors.

d. There was a claim of ₹ 6,000 on account of workmen compensation.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of

the reconstituted firm.

OR

Ativ, Meha and Nupur were partners sharing profits and losses in the ratio of 5 : 3 :

2. On 31-3-2016, their Balance Sheet was as under :

Liabilities Amount (₹) Assets Amount (₹)

Trade creditors 26,500 Bank 25,000

Employees’ Provident Fund 23,500 Debtors 30,000

Ativ’s capital 1,00,000 Stock 55,000

Meha’s capital 50,000 Fixed assets 1,20,000

Nupur’s capital 40,000 Advertisement expenditure 10,000

2,40,000 2,40,000

Ativ retired on 1-4-2016. For this purpose, the following adjustments were agreed

upon :

(a) Goodwill of the firm was to be valued at 2 years’ purchase of the average profits

of 3 completed years preceding the date of retirement. The profits for previous

years were : 2013-14 ₹ 55,000; 2014-15 ₹ 65,000; 2015-16 ₹ 60,000.

(b) Fixed assets were to be increased by ₹ 25,000.

(c) Stock was overvalued by ₹ 5,000.

Material downloaded from myCBSEguide.com. 19 / 28

(d) ₹ 20,000 were immediately paid to Ativ and the balance was transferred to his

loan account.

Prepare Revaluation account, Partners Capital Accounts and the Balance Sheet of

the reconstituted firm.

Ans.

Revaluation A/c

Particulars Amt(Rs.) Particulars Amt(Rs.)

To Claim for Workmen Compensation 6,000 By Land & Building 26,000

To Provision for Bed debts 5,000

To Partner’s Capital

Accounts (Gain)

Madhu – 6,000

Vidhi – 9,000 15,000

26,000 26,000

Partners’ Capital A/c

Particulars Madhu Vidhi Gayatri Particulars Madhu Vidhi Gayatri

To balance

5,98,000 4,17,000 4,00,000 By balance b/d 5,20,000 3,00,000

c/d

By General

12,000 18,000

Reserve A/c

By Revaluation A/c 6,000 9,000

By Cash A/c 4,00,000

By Premium for 60,000 90,000

goodwill A/c

5,98,000 4,17,000 4,00,000 5,98,000 4,17,000 4,00,000

Material downloaded from myCBSEguide.com. 20 / 28

Balance Sheet of as at 31st March 2016

Liabilities Amt (Rs.) Assets Amt (Rs.)

Partner’s Capital A/c Land & Building 3,26,000

Madhu 5,98,000 Machinery 2,80,000

Vidhi 4,17,000 Stock 80,000

Gayatri 4,00,000 14,15,000 Debtors 3,00,000

Claim for Workmen Less: Provision 15,000 2,85,000

Compensation 6,000 Bank 6,00,000

Bills Payable A/c 1,50,000

15,71,000 15,71,000

Working Bank A/C

Particulars Amt (Rs.) Particulars Amt (Rs.)

To Balance b/d 50,000 By Balance c/d 6,00,000

To Gayatri’s Capital A/c 4,00,000

To Premium for Goodwill A/c 1,50,000

6,00,000 6,00,000

OR Revaluation A/C

Particulars Amt (Rs.) Particulars Amt (Rs.)

To Stock 5,000 By Fixed Assets 25,000

To Partner’s Capital A/cs (Profit)

Ativ 10,000

Mehra 6,000

Nupur 4,000 20,000

Material downloaded from myCBSEguide.com. 21 / 28

25,000 25,000

Partners’ Capital A/c

Dr. Cr.

Particulars Ativ Meha Nupur Particulars Ativ Meha Nupur

To Advertisement By Balance

5,000 3,000 2,000 1,00,000 50,000 40,000

Expenditure A/c b/d

By

To Ativ’s Capital A/c 36,000 24,000 Revaluation 10,000 6,000 4,000

A/c

By Meha’s

To Bank A/c 20,000 36,000

Capital A/c

By Nupur’s

To Ativ’s Loan A/c 1,45,000 24,000

Capital A/c

To Balance c/d 17,000 18,000

1,70,000 56,000 44,000 1,70,000 56,000 44,000

Balance Sheet of Meha & Nupur as at 31st March 2016

Liabilities Amt (Rs.) Assets Amt (Rs.)

Partner’s Capital A/c: Fixed Assets 1,45,000

Mehra 17,000 Stock 50,000

Nupur 18,000 35,000 Debtors 30,000

Ativ’s Loan A/c 1,45,000 Bank 5,000

Employee’s Provident Fund 23,500

Trade Creditors 26,500

2,30,000 2,30,000

Working:

Material downloaded from myCBSEguide.com. 22 / 28

Goodwill = = 1,20,000

PART – B Option – I (Analysis of Financial Statements)

18. Cash Flow Statement shows inflows and outflows of ‘Cash’ and ‘Cash Equivalents’

from various activities of an enterprise during a particular period. Give the

meaning of ‘cash’ for the purpose of preparing Cash Flow Statement. (1)

Ans. For the purpose of preparing Cash Flow Statement, Cash comprises cash in hand

and demand deposits with bank.

19. Give an example of an activity, which is a financing activity for every type of

enterprise. (1)

Ans. Following are the activities which are financing activity for any enterprise (any

one)

Dividends paid

Issue of Shares

Redemption of Preference shares

Buy Back of shares

Issue of Debentures

Redemption of Debentures

Obtaining Long Term Loans

Repayment of long term loans

20. a. Classify the following items under Major Head and Sub-Head (if any) in the

Balance Sheet of a company as per Schedule III of the Companies Act, 2013. (4)

i. Capital Work in progress; and

ii. Provision for warranties.

b. State any two objectives of ‘Analysis of Financial Statements’.

Ans.

a.

Items Heads Sub-heads

Capital Work in progress Non current Assets Fixed Assets

Provision for warranties Non Current Liability Long Term provisions

b. Objectives of ‘Analysis of Financial Statements’ are: (any two)

Material downloaded from myCBSEguide.com. 23 / 28

To assess the current profitability and operational efficiency of the firm as a whole

as well as of its different departments.

To ascertain the relative importance of different components of financial position

of the firm.

To identify the reasons for change in profitability/financial position of the firm.

To judge the ability of the firm to repay its debts i.e. to know its solvency position.

To assess liquidity position of the business.

To facilitate inter-‐firm and intra-‐firm comparisons.

To know the managerial efficiency & to facilitate preparation of budgets.

21. a. Net profit after interest and tax ₹ 1,00,000; Current assets ₹ 4,00,000; Current

liabilities ₹ 2,00,000; Tax rate 20%; Fixed assets ₹ 6,00,000; 10% Long term debt ₹

4,00,000. Calculate Return on Investment.

b. Rate of Gross profit on cost of a company is 25%. Its Gross profit is ₹ 5,00,000. Its

shareholders’ Funds are ₹ 12,00,000; Current liabilities are ₹ 3,00,000 and

Current Assets are ₹ 10,00,000. Calculate its Working Capital Turnover ratio. (4)

Ans. Profit before interest and tax = 1,00,000+ 25,000+40,000= 1,65,000

Return on Investment

= 20.625%

(b) Revenue From Operations = 25,00,000

Cost of Revenue From Operations= 25,00,000 ‐ 5,00,000 = 20,00,000

Working Capital = 10,00,000 - 3,00,000 = 7,00,000

Working Capital Turnover Ratio=

= 2.86 times

OR

Working Capital Turnover Ratio=

Material downloaded from myCBSEguide.com. 24 / 28

= 3.57 time

22. From the following statement of Profit and Loss of Star Ltd., for the years ended 31st

March, 2015 and 2016, prepare a common size statement. (4)

Particulars Note No. 2015-16 (₹) 2014-15 (₹)

Revenue from operations 25,00,000 20,00,000

Employee benefit expenses 10,00,000 7,00,000

Other expenses

2,00,000 3,00,000

Tax rate 40%

Ans. Common Size Statement For the year ending 31st March 2015 and 2016

Note % of Revenue From

Particulars Absolute Amounts

No. Operations

2014-15 2015-16

2014-15

(Rs.) (Rs.)

Revenue from 20,00,000 25,00,000 100% 100%

Operations

Add other income -‐-‐-‐-‐-‐ -‐-‐-‐-‐-‐-‐ -‐-‐-‐-‐-‐ -‐-‐-‐-‐-‐

Total Revenue 20,00,000 25,00,000 100% 100%

Less: Expenses

Employee Benefit 7,00,000 10,00,000 35% 40%

Expenses 3,00,000 2,00,000 15% 8%

Other Expenses

Total Expenses 10,00,000 12,00,000 50% 48%

Profit before Tax 10,00,000 13,00,000 5,00,000 52%

Less: Tax @ 40% 4,00,000 5,20,000 2,50,000 20.8%

Profit after tax 6,00,000 7,80,000 2,50,000 31.2%

Material downloaded from myCBSEguide.com. 25 / 28

23. Calculate Cash Flows from Investing Activities from the following information: (6)

Particulars 31st March, 2015 (₹) 31st March, 2014 (₹)

Investments in Land 16,00,000 6,00,000

10% Long term Investments 2,50,000 4,00,000

Plant and Machinery 3,00,000 2,00,000

Goodwill 80,000 15,000

Additional Information :

A machine costing ₹ 40,000 (depreciation provided thereon ₹ 12,000) was sold for ₹

35,000. Depreciation charged during the year was ₹ 60,000.

Ans.

Cash flows From Investing Activities

Particulars Details (Rs.) Amount (Rs.)

B. Cash flows from investing Activities :

Purchase of Land (10,00,000)

Sale of Long Term Investments 1,50,000

Interest on Long term Investment 40,000

Purchase of Plant and Machinery (1,88,000)

Sales of Plant and Machinery 35,000

Purchase of Good will (65,000)

Net Cash Used in investment Activities (10,28,000)

Notes: Plant and Machinery A/c

Particulars Rs. Particulars Rs.

Material downloaded from myCBSEguide.com. 26 / 28

To Balance b/d 2,00,000 By Cash A/c 35,000

To Statement of P/L 7,000 By Depreciation A/c 60,000

To Cash A/c (Bal figure) 3,46,000 By Balance c/d 3,00,000

(Purchase)

3,95,000 3,95,0000

PART – B Option – II (Computerized Accounting)

18. Name any two software tools for organizing, processing and querying data in

flexible manner. (1)

Ans. Database tools are (any two)

i. Access.

ii. Oracle.

iii. SQL server.

19. What is meant by ‘Database’? (1)

Ans. A database is a shared collection of interrelated data tables, files or structures which

are designed to meet the varied informational needs of an organization. It has the

property of being integrated and being shared.

20. What is meant by a “Form”? How ‘Split Form’ is different from ‘Simple Form’? (4)

Ans. Form: Access provides a user friendly interface, which allows users to enter

information in a graphical way. It is known as ‘Form ‘This information transparently

passes to the underlying database.

Split Form: This presentation shows underlying database in one half of the section and

form in other half for entering information in the record selected in the data sheet. The

two views in the form are synchronized so that scrolling in one view causes scrolling of

the other view to same location of the record.

21. Name and explain the type of software which meets the requirements of large

business organizations with multi-users and scattered locations. (4)

Ans. Name of the software is “Tailored Accounting Software” as they are designed to

meet the requirements of large business organizations with multi users who are scattered

on different geographical locations. They require special training to run and use. They

are important part of the organizational MIS. The secrecy and authenticity checks are

robust in such software and they provide high flexibility in terms of number of users as

Material downloaded from myCBSEguide.com. 27 / 28

well.

22. Explain any four advantages of computerized accounting software. (4)

Ans. Following are the advantages of computerized accounting system (any four):

1. Timely generation of reports and information in desired format.

2. Efficient record keeping.

3. Ensures effective control over the system.

4. Economy in the processing of accounting data.

5. Conditionality of data is maintained.

23. Explain the following formatting tools with example : (6)

i. Number formatting

ii. Currency

iii. Percentage

iv. Dates

Ans. Formatting of spreadsheet makes easier to read and understand important

information.

Currency: excel is equipped to incorporate various currency sighs in pictorial form

for dollar it uses $ similarly for other currencies also. If the user instructs the use of

the format it will assign a currency format along with entry. (Example)

Percentage: If we enter a value representing a percentage as a whole number

followed by the percentage sign without any decimal places, Excel assigns to the cell

the percentage format that follows the pattern along with the entry. (Example)

Date: If we enter a date (dates are values, too) that follows one of the built in excel

formats, such as 16-04-2017 or 16 Apr-2017the program assigns a date format that

follows the pattern of the date. (Example)

Material downloaded from myCBSEguide.com. 28 / 28

Vous aimerez peut-être aussi

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- Cor Acc Unit 01Document19 pagesCor Acc Unit 01vignesh iyerPas encore d'évaluation

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirPas encore d'évaluation

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KPas encore d'évaluation

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaPas encore d'évaluation

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedPas encore d'évaluation

- 12 Accountancy Lyp 2014 Delhi Set2Document11 pages12 Accountancy Lyp 2014 Delhi Set2Ashish GangwalPas encore d'évaluation

- Marking Scheme PRE-BOARD (2009-10) : Part ADocument9 pagesMarking Scheme PRE-BOARD (2009-10) : Part AIsha KembhaviPas encore d'évaluation

- Admission Test No. 2Document5 pagesAdmission Test No. 2Mitesh Sethi0% (1)

- 19013comp Sugans Pe2 Accounting Cp8 5Document12 pages19013comp Sugans Pe2 Accounting Cp8 5Ubaidulla MachingalPas encore d'évaluation

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaPas encore d'évaluation

- MS - Accountancy - 12-Practice Paper-1Document7 pagesMS - Accountancy - 12-Practice Paper-1Arun kumarPas encore d'évaluation

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalPas encore d'évaluation

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhPas encore d'évaluation

- Problem - No.1 Amalgamation in The Nature of Purchase - Net Asset Method Without Statutory Reserve)Document6 pagesProblem - No.1 Amalgamation in The Nature of Purchase - Net Asset Method Without Statutory Reserve)Siva SankariPas encore d'évaluation

- 12 Accounts CBSE Sample Papers 2019 Marking SchemeDocument16 pages12 Accounts CBSE Sample Papers 2019 Marking SchemeSalokya KhandelwalPas encore d'évaluation

- AccoutancyRoundTest1 Sample Class 12Document3 pagesAccoutancyRoundTest1 Sample Class 12Samyuktha nairPas encore d'évaluation

- Corporate AccountingDocument25 pagesCorporate Accountingrakshithaparimala100Pas encore d'évaluation

- CBSE Class XII 2024 Commerce Accountancy Sample Paper SolDocument11 pagesCBSE Class XII 2024 Commerce Accountancy Sample Paper Solrajputudbhav2429Pas encore d'évaluation

- Cbse Question Bank Admission of PartnersDocument6 pagesCbse Question Bank Admission of Partnersvsy9926Pas encore d'évaluation

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyPas encore d'évaluation

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKPas encore d'évaluation

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- Advanced Accounts Revision Notes by Jai Chawla Sir PDFDocument100 pagesAdvanced Accounts Revision Notes by Jai Chawla Sir PDFRaghavendra PrasadPas encore d'évaluation

- Accounts CH 6 Cash FlowDocument11 pagesAccounts CH 6 Cash Flowapsonline8585Pas encore d'évaluation

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Document8 pagesSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuPas encore d'évaluation

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickPas encore d'évaluation

- Vineet FileDocument8 pagesVineet FileVineet KumarPas encore d'évaluation

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993Pas encore d'évaluation

- III - 5th Sem - AmalgamationDocument34 pagesIII - 5th Sem - AmalgamationAysha RiyaPas encore d'évaluation

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyPas encore d'évaluation

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethPas encore d'évaluation

- Isc-Xii Debk Model Test PapersDocument160 pagesIsc-Xii Debk Model Test PapersRahul PareekPas encore d'évaluation

- 3 AdmissionDocument14 pages3 AdmissionAman KakkarPas encore d'évaluation

- TESTDocument3 pagesTESTjoker mcPas encore d'évaluation

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789Pas encore d'évaluation

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYAPas encore d'évaluation

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadPas encore d'évaluation

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MitharePas encore d'évaluation

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddinePas encore d'évaluation

- Business Combination Answers (Manav)Document58 pagesBusiness Combination Answers (Manav)Harshit ChauhanPas encore d'évaluation

- 1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033Document21 pages1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033jiya.mehra.2306Pas encore d'évaluation

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraPas encore d'évaluation

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaPas encore d'évaluation

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaPas encore d'évaluation

- Amalgamation Dec 2020Document46 pagesAmalgamation Dec 2020binu100% (2)

- Fa - 6 Amalgamation & LLPDocument10 pagesFa - 6 Amalgamation & LLPalokchowdhury111Pas encore d'évaluation

- Ts Grewal Class 12 Accountancy Chapter 7 PDFDocument11 pagesTs Grewal Class 12 Accountancy Chapter 7 PDFmonikaPas encore d'évaluation

- 41 33 AccountsDocument18 pages41 33 AccountsMayur PalPas encore d'évaluation

- REVISION TEST Admission of A PartnerDocument2 pagesREVISION TEST Admission of A PartnerOshvi ShrivastavaPas encore d'évaluation

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaPas encore d'évaluation

- Partnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Shreyash JhaPas encore d'évaluation

- Corporate Practice QPDocument10 pagesCorporate Practice QPr quePas encore d'évaluation

- Additional Illustrations 8Document16 pagesAdditional Illustrations 8Thulsi JayadevPas encore d'évaluation

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaPas encore d'évaluation

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaPas encore d'évaluation

- 12 Accountancy Lyp 2017 Outside Delhi Set3Document42 pages12 Accountancy Lyp 2017 Outside Delhi Set3Ramprasad Sarkar100% (1)

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUPas encore d'évaluation

- Paper2 Set2 SolutionDocument7 pagesPaper2 Set2 Solutionadityatiwari122006Pas encore d'évaluation

- 12 Accountancy Lyp 2006 Delhi Set1Document8 pages12 Accountancy Lyp 2006 Delhi Set1harshit agrawalPas encore d'évaluation

- 12 Accountancy Lyp 2005 Delhi Set1Document7 pages12 Accountancy Lyp 2005 Delhi Set1harshit agrawalPas encore d'évaluation

- 12 Accountancy Lyp 2005 Delhi Set2Document8 pages12 Accountancy Lyp 2005 Delhi Set2harshit agrawalPas encore d'évaluation

- Read MeDocument1 pageRead Meharshit agrawalPas encore d'évaluation

- GUI Programming-A ReviewDocument15 pagesGUI Programming-A Reviewbhavye bhatiaPas encore d'évaluation

- Study Material XII IPDocument111 pagesStudy Material XII IPitxpertsPas encore d'évaluation

- April 2006Document8 pagesApril 2006Mohd HafizPas encore d'évaluation

- Berkshire Hathaway 2014Document15 pagesBerkshire Hathaway 2014Vik SinghPas encore d'évaluation

- Fin544 TUTORIAL and FormulaDocument9 pagesFin544 TUTORIAL and FormulaYumi MayPas encore d'évaluation

- AerCap - Q220 - 6-KDocument59 pagesAerCap - Q220 - 6-Khero111983Pas encore d'évaluation

- ACC101 Su20 HuyenDTT GroupAssignment Group3Document40 pagesACC101 Su20 HuyenDTT GroupAssignment Group3An Hoài ThuPas encore d'évaluation

- Osdl - GistDocument7 pagesOsdl - Gistsandeep raj (RA1861001010024)Pas encore d'évaluation

- Final Exam - Fall 2007Document9 pagesFinal Exam - Fall 2007jhouvanPas encore d'évaluation

- Acca f7 Int Revision Mock Questions - Version 2 Final 7th NovDocument10 pagesAcca f7 Int Revision Mock Questions - Version 2 Final 7th NovsunilmourPas encore d'évaluation

- Financial Audit AOL 2Document4 pagesFinancial Audit AOL 2Natasha HerlianaPas encore d'évaluation

- Look Before You LeverageDocument14 pagesLook Before You LeverageIrfan Mohd100% (3)

- Victoria Care Indonesia Billingual 31 Des 2020Document118 pagesVictoria Care Indonesia Billingual 31 Des 2020Sugiarto ChasPas encore d'évaluation

- Cir 45-1Document4 pagesCir 45-1Polo OaracilPas encore d'évaluation

- Project Report: Title of The ProjectDocument31 pagesProject Report: Title of The Projectsharanya mukherjeePas encore d'évaluation

- Withholding VAT Guideline (2017-18)Document29 pagesWithholding VAT Guideline (2017-18)banglauserPas encore d'évaluation

- Chapter 1 - LiabilitiesDocument3 pagesChapter 1 - LiabilitiesPatrick Jayson VillademosaPas encore d'évaluation

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )johanes ongoPas encore d'évaluation

- Financial Statement Analysis MCQs With AnswerDocument5 pagesFinancial Statement Analysis MCQs With AnswerHamza Khan Yousafzai100% (1)

- CHAPTER II Credit in The CompanyDocument8 pagesCHAPTER II Credit in The CompanyReiner GGayPas encore d'évaluation

- Dissertation Project of FinanceDocument7 pagesDissertation Project of FinanceWriteMyBiologyPaperGlendale100% (1)

- CRDB Bank Q3 2020 Financial Statement PDFDocument1 pageCRDB Bank Q3 2020 Financial Statement PDFPatric CletusPas encore d'évaluation

- Auditing and Assurance: Specialized Industries: M12 Group WorkDocument4 pagesAuditing and Assurance: Specialized Industries: M12 Group WorkEleonor ClaveriaPas encore d'évaluation

- M&A - Valuation - Expanded - BV - SS EQUIPODocument3 pagesM&A - Valuation - Expanded - BV - SS EQUIPOGianina Mendoza NestaresPas encore d'évaluation

- Presented By:: Shubham Bhutada Aurangabad (MH)Document30 pagesPresented By:: Shubham Bhutada Aurangabad (MH)1986anu100% (1)

- Tutorial 9 - Dividend and Dividend PolicyDocument2 pagesTutorial 9 - Dividend and Dividend PolicyAmy LimnaPas encore d'évaluation

- Chrissworld Ipo ProsDocument71 pagesChrissworld Ipo ProsjdPas encore d'évaluation

- Stock Analysis Excel Revised March 2017Document26 pagesStock Analysis Excel Revised March 2017Sangram Panda100% (1)

- Cash BudgetDocument8 pagesCash BudgetKei CambaPas encore d'évaluation

- Finc361 - Lecture - 10 - Project Cost of Capital PDFDocument36 pagesFinc361 - Lecture - 10 - Project Cost of Capital PDFLondonFencer2012Pas encore d'évaluation

- Finc301 15s2 OutlineDocument8 pagesFinc301 15s2 OutlineMarilyn WooPas encore d'évaluation

- Unit-5. Introduction To Option ValuationDocument21 pagesUnit-5. Introduction To Option ValuationNikita DakiPas encore d'évaluation