Académique Documents

Professionnel Documents

Culture Documents

MAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer Pricing

Transféré par

AlliahDataTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer Pricing

Transféré par

AlliahDataDroits d'auteur :

Formats disponibles

PAMANTASAN NG LUNGSOD NG VALENZUELA

STRATEGIC BUSINESS ANALYSIS

LECTURE: RESPONSIBILITY ACCOUNTING

SEGMENT EVALUATION

TRANSFER PRICING

RESPONSIBILITY ACCOUNTING – a system of accounting wherein costs and revenues are accumulated and

reported by levels of responsibility or by responsibility centers within the organization.

Responsibility center (also called accountability center)

- A clearly identified part or segment of an organization that is accountable for a specified function or set of

activities.

- Any part of the organization that a particular manager is responsible for

TYPES OF RESPONSIBILITY CENTERS:

a. Cost Center (or expense center) – a segment of an organization in which managers are held responsible for the

costs or expenses incurred in the segment.

b. Revenue Center – where management is responsible primarily for revenues.

c. Profit Center – a segment of the organization in which the manager is held responsible for both revenues and

costs.

d. Investment Center – a segment of the organization where the manager controls revenues, costs and

investments. The center’s performance is measured in terms of the use of the assets as well as the revenues

earned and the costs incurred.

CLASSIFICATION OF COSTS IN RESPONSIBILITY ACCOUNTING

a. By responsibility center

b. By cost type, as to controllability

c. By specific cost items or cost elements within each classification in (1) and (2).

RESPONSIBILITY vs. ACCOUNTABILITY

Responsibility has two facets, (1) the obligation to secure results, and (2) the obligation to report back the results

achieved to higher authority.

Accountability denotes the obligation to report results achieved to higher authority.

THE CONCEPT OF DECENTRALIZATION

Decentralization refers to the separation or division of the organization into more manageable units wherein each

unit is managed by an individual who is given decision authority and held accountable for his decisions.

Goal congruence – all members of an organization have incentives to perform for a common interest.

Sub-optimization – occurs when one segment of a company takes action that is in its own best interests, but

is detrimental to the firm as a whole.

BENEFITS OF DECENTRALIZATION

1. Better access to local information

2. Cognitive limitations

3. More timely response

4. Focusing of central management

5. Training and evaluation

6. Motivation

7. Enhanced competition

COSTS OF DECENTRALIZATION

1. Some decisions made in one sub-unit may bring about negative effect to the other sub-units or the organization

as a whole.

2. Decentralization necessitates a more elaborate reporting system hence, the costs of gathering and reporting data

increase.

3. Job duplication or overlapping of functions is usually encountered in a decentralized set-up.

MAC3: Lecture 01 jvacpa Page 1 of 4

MEASURING THE PERFORMANCE OF INVESTMENT CENTERS

Performance measures for investments usually attempt to assess how well managers are utilizing invested assets of the

division to produce profits by relating operating profits to assets.

Return on Investment (ROI) is the most common measure of performance for investment centers.

ROI can be defined as follows:

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒

𝑅𝑂𝐼 =

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐴𝑠𝑠𝑒𝑡𝑠

Operating income refers to earnings before interest and taxes. Operating assets include all assets acquired to generate

operating income, including cash, receivables, inventories, land, buildings and equipment.

The ROI formula can also be broken down into the product of margin and turnover. Margin is the ratio of operating

income to sales. Turnover is defined as sales divided by average operating assets.

𝑅𝑂𝐼 = 𝑀𝑎𝑟𝑔𝑖𝑛 × 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟

or

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 𝑆𝑎𝑙𝑒𝑠

𝑅𝑂𝐼 = ×

𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐴𝑠𝑠𝑒𝑡𝑠

Three advantages of using ROI to evaluate the performance of investment centers:

1. It encourages managers to pay careful attention to the relationships among sales, expenses and investment, as

should be the case for a manager of an investment center.

2. It encourages cost efficiency.

3. It discourages excessive investment in operating assets.

Two disadvantages of using ROI are:

1. It discourages managers from investing in projects that would decrease the divisional ROI but would increase

the profitability of the company as a whole. (Generally, projects with an ROI less than a division’s current ROI

would be rejected.)

2. It can encourage myopic behavior, in that managers may focus on the short run at the expense of the long-run.

Residual Income (RI) – the difference between operating income and the minimum peso return required on a

company’s operating assets. The equation for RI can be expressed as follows:

𝑅𝐼 = 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 − (𝑀𝑖𝑛𝑖𝑚𝑢𝑚 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑅𝑒𝑡𝑢𝑟𝑛 × 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐴𝑠𝑠𝑒𝑡𝑠)

Economic Value Added (EVA) – a more specific version of residual income. It represents the segment’s true

economic profit because it measures the benefits obtained by using resources in a particular way.

After-tax operating income [EBIT x (1 – Tax Rate)] xx

Less: Desired income

[After-tax WACC x (Total Assets – Non-interest bearing current liabilities] xx

Economic Value Added (EVA) xx

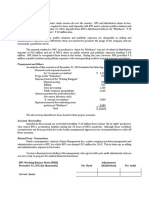

PROBLEM 1: Best Workplace (BW), a division of Modular Office Corporation, buys and installs modular office

components. For the most recent year, the division had the following performance targets:

Asset turnover 2.5

Profit margin 6.0 %

Target rate of return on investments for RI 13.0 %

Cost of capital 10.0 %

Income tax rate 40.0 %

Actual information concerning the company’s performance for last year follows:

Total assets at beginning of year P 3,600,000

Total assets at end of year 5,300,000

Total invested capital (annual average) 8,000,000

MAC3: Lecture 01 jvacpa Page 2 of 4

Sales 9,000,000

Variable operating costs 3,650,000

Direct fixed costs 4,770,000

Allocated fixed costs 675,000

Required:

a. For BW, compute the segment margin and the average assets for the year.

b. Based on segment margin and average assets, compute the profit margin, asset turnover and ROI.

c. Evaluate the ROI performance of BW.

d. Using your answers from part b, compute the residual income of BW.

PROBLEM 2: The Sporty Company produces a wide variety of sports equipment. Its newest division, Golf Pro,

manufactures and sells a single product, AccuClub, a golf club that uses global positioning satellite technology to

improve the accuracy of golfer’s shots. The demand for AccuClub is relatively intensive to price changes. The

following data are available for Golf Pro, which is an investment center for Sporty:

Total annual fixed costs P 30,000,000

Variable cost per AccuClub P 500

Number of AccuClub sold each year 150,000 units

Average operating assets invested in the division. P 48,000,000

Required:

1. Compute Golf Pro’s ROI if the selling price of AccuClub is P720 per club.

2. If management requires ROI of at least 25% from the division, what is the minimum selling price that the Golf Pro

Division should charge per AccuClub?

3. Assume Sporty judges the performance of its investment centers on basis of RI rather than ROI. What is the

minimum selling price that Golf Pro should charge per AccuClub if the company’s required rate of return is 20%?

PROBLEM 3: Adan Inc. reported these data at year-end:

Pre-tax operating income P 5,000,000

Current assets 8,000,000

Long-term assets 22,000,000

Current liabilities 3,000,000

Long-term liabilities 5,000,000

Weighted average cost of capital 10 %

Income tax rate 30 %

Required: Calculate the Economic Value Added EVA).

TRANSFER PRICING – the monetary value or the price charged by one segment of a firm for the goods and services

it supplies to another segment of the same firm.

Objectives of Transfer Pricing

1. To facilitate optimal decision-making.

2. To provide a basis in measuring divisional performance.

3. To motivate the different department heads in improving their performance and that of their departments.

Approaches for Determining Transfer Price:

1. Negotiated transfer price

2. Cost-based transfer price

3. Market-based transfer price

General rules in Choosing a Transfer Price:

MAC3: Lecture 01 jvacpa Page 3 of 4

The maximum price should be no greater than the lowest market price at which the buying segment can

acquire the goods or services externally.

The minimum price should be no less than the selling segment’s incremental costs associated with the

goods or services plus the opportunity cost of the facilities used.

A good should be transferred internally whenever the minimum transfer price (set by the selling division)

is less than the maximum transfer price (set by the buying division). By using this rule, total profits of the

firm are not decreased by an internal transfer.

PROBLEM 1: Electric Division of Engineered Products Co. has developed a wind generator that requires a special

“S” ball bearing. The Ball Bearing Division of Engineered Products Co has the capability to produce such a ball

bearing.

Unfortunately, the Ball Bearing Division is operating at capacity and will need to reduce production of another existing

product, “T” bearing, by 1,000 units per month to provide the 600 “S” bearings needed each month by the Electric

Division. The “T“ bearing currently sells for P50 per unit. Variable costs incurred to produce the “T” bearing are P30

per unit; variable costs to produce the new “S” bearing would be P60 per unit.

Electric Division has found an external supplier that would furnish the needed “S” bearings at P100 per unit. Assume

that both Electric Division and Ball Bearing Division are independent, autonomous investment centers.

Required:

1. What is the maximum price per unit that Electric Division would be willing to pay the Ball Bearing Division for

the “S” bearing?

2. What is the minimum price that Ball Bearing Division would consider to produce the “S” bearing?

3. How would your answer to question “b” be different if Ball Bearing did not need to forfeit any of its existing sales

to produce the “S” bearing?

PROBLEM 2: GreenThumb, Inc., is a nursery products firm. It has three divisions that grow and sell plants: the

Western Division, the Southern Division and the Central Division.

Recently, the Southern Division of GreenThumb acquired a plastics factory that manufactures green plastics pots.

These pots can be sold both externally and internally. Company policy permits each manager to decide whether to buy

or sell internally. Each divisional manager is evaluated on the basis of return on investment and EVA.

The Western Division had bought its plastic pots in lots of 100 from a variety of vendors. The average price paid was

P75 pre box of 100 pots. However, the acquisition made Nay Sy, manager of Western Division, wonder whether a

more favorable price could be arranged. She decided to approach Flint, manager of Southern Division, to see if he

wanted to offer a better price for an internal transfer. She suggested a transfer of 3,500 boxes at P70 per box.

Flint gathered the following information regarding the cost of a box of 100 pots:

Direct materials , P 35; Direct labor, P8; Variable overhead, P10; Fixed overhead*, P10; Selling price, P75

Production capacity, 20,000boxes

*Fixed overhead is based on P200,000/20,000boxes.

Required:

1. Suppose that the plastics factory is producing at capacity and can sell all that it produces to outside customers. How

should Flint respond to Nay’s request for a lower transfer price?

2. Now assume that the plastics factory is currently selling 16,000 boxes. What are the minimum and maximum

transfer prices? Should Flint consider the transfer at P70 per box?

3. Suppose that GreenWorld’s policy is that all transfer prices be set at full cost plus 20%. Would the transfer take

place? Why or why not?

MAC3: Lecture 01 jvacpa Page 4 of 4

Vous aimerez peut-être aussi

- 8a. Responsibility and Segment Accounting CRDocument20 pages8a. Responsibility and Segment Accounting CRAngelica Gaspay EstalillaPas encore d'évaluation

- MAS1Document46 pagesMAS1Frances Bernadette BaylosisPas encore d'évaluation

- Stock Edited PDFDocument29 pagesStock Edited PDFCzarina PanganibanPas encore d'évaluation

- Week 2 Tutorial Questions Chp#1-With AnswersDocument5 pagesWeek 2 Tutorial Questions Chp#1-With AnswersBowen Chen100% (1)

- Ho Abc0abmDocument5 pagesHo Abc0abmAngel Alejo AcobaPas encore d'évaluation

- MASDocument7 pagesMASHelen IlaganPas encore d'évaluation

- Chapter10.Standard Costing Operational Performance Measures and The Balanced Scorecard PDFDocument36 pagesChapter10.Standard Costing Operational Performance Measures and The Balanced Scorecard PDFJudy Anne SalucopPas encore d'évaluation

- AssignDocument13 pagesAssignvnp100% (1)

- 25 Profit-Performance Measurements & Intracompany Transfer PricingDocument13 pages25 Profit-Performance Measurements & Intracompany Transfer PricingLaurenz Simon ManaliliPas encore d'évaluation

- Mas Ho No. 2 Relevant CostingDocument7 pagesMas Ho No. 2 Relevant CostingRenz Francis LimPas encore d'évaluation

- Financial Management - FSADocument6 pagesFinancial Management - FSAAbby EsculturaPas encore d'évaluation

- PRTC Olympiad Reg 12Document14 pagesPRTC Olympiad Reg 12Vincent Larrie MoldezPas encore d'évaluation

- COS 103 - Variable Costing ExercisesDocument2 pagesCOS 103 - Variable Costing ExercisesAivie Pangilinan100% (1)

- P 1Document27 pagesP 1Mark Lorenz SarionPas encore d'évaluation

- OPT QuizDocument5 pagesOPT QuizAngeline VergaraPas encore d'évaluation

- Direct and Absorption Costing 2014Document15 pagesDirect and Absorption Costing 2014Aj de CastroPas encore d'évaluation

- Public Accountancy PracticeDocument69 pagesPublic Accountancy Practicelov3m3100% (2)

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesPas encore d'évaluation

- Abc 3Document13 pagesAbc 3Lhorene Hope DueñasPas encore d'évaluation

- PFS: Financial Aspect - Investment CostsDocument11 pagesPFS: Financial Aspect - Investment CostsSheena Cadiz FortinPas encore d'évaluation

- Chapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingDocument39 pagesChapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingAnggari SaputraPas encore d'évaluation

- Q Manacc1 Bep 2019Document5 pagesQ Manacc1 Bep 2019Deniece RonquilloPas encore d'évaluation

- Responsibility Accounting and Transfer PricingDocument68 pagesResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaPas encore d'évaluation

- p1 IaDocument1 pagep1 IaLeika Gay Soriano OlartePas encore d'évaluation

- Q - Add or Drop A SegmentDocument1 pageQ - Add or Drop A SegmentIrahq Yarte TorrejosPas encore d'évaluation

- Reconciliation: Responsibility Accounting and Transfer Pricing (C. Variable Costing & Segmented Reporting)Document2 pagesReconciliation: Responsibility Accounting and Transfer Pricing (C. Variable Costing & Segmented Reporting)LaraPas encore d'évaluation

- 2018 - 2019 MAS 01 70mcqDocument30 pages2018 - 2019 MAS 01 70mcqMarc Allen Anthony GanPas encore d'évaluation

- Basic MA's 2Document9 pagesBasic MA's 2Lycka Bernadette MarceloPas encore d'évaluation

- Chapter 13 - Resp-Acctg PT 6Document9 pagesChapter 13 - Resp-Acctg PT 6Hiraya ManawariPas encore d'évaluation

- CA 04 - Job Order CostingDocument17 pagesCA 04 - Job Order CostingJoshua UmaliPas encore d'évaluation

- Quantitative TechniquesDocument4 pagesQuantitative Techniquesshamel marohom100% (2)

- CH2 QuizkeyDocument5 pagesCH2 QuizkeyiamacrusaderPas encore d'évaluation

- Ac4 CbaDocument1 pageAc4 CbaRobelyn Lacorte100% (1)

- Responsibility Acctg Transfer Pricing GP Analysis 1Document21 pagesResponsibility Acctg Transfer Pricing GP Analysis 1John Bryan100% (1)

- MASDocument46 pagesMASKyll Marcos0% (1)

- QUIZ REVIEW Homework Tutorial Chapter 5Document5 pagesQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoPas encore d'évaluation

- 10 X08 BudgetingDocument13 pages10 X08 Budgetingjenna hannahPas encore d'évaluation

- Bsa 2202 SCM PrelimDocument17 pagesBsa 2202 SCM PrelimKezia SantosidadPas encore d'évaluation

- Chapter 14 (Business Combination)Document6 pagesChapter 14 (Business Combination)Kerr John GuilaranPas encore d'évaluation

- AC78.6.2 Final Examinations Questions and Answers 1Document15 pagesAC78.6.2 Final Examinations Questions and Answers 1rheaPas encore d'évaluation

- Chapter 1 - MAS IntroductionDocument9 pagesChapter 1 - MAS Introductionchelsea kayle licomes fuentesPas encore d'évaluation

- NU - Correction of Errors Single Entry Cash To AccrualDocument8 pagesNU - Correction of Errors Single Entry Cash To AccrualJem ValmontePas encore d'évaluation

- Q - Process Further Scarce ResourceDocument2 pagesQ - Process Further Scarce ResourceIrahq Yarte TorrejosPas encore d'évaluation

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarPas encore d'évaluation

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199Pas encore d'évaluation

- Required: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToDocument2 pagesRequired: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToErica AbegoniaPas encore d'évaluation

- Intermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementDocument15 pagesIntermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementMJ Legaspi0% (1)

- Managerial AccountingMid Term Examination (1) - CONSULTADocument7 pagesManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- Intacc Review Questions Micha 1Document3 pagesIntacc Review Questions Micha 1Christian ContadorPas encore d'évaluation

- 04 CVP AnswerDocument36 pages04 CVP AnswerjoyjoyjoyPas encore d'évaluation

- Exam 7Document15 pagesExam 7mohit verrmaPas encore d'évaluation

- Law 12Document1 pageLaw 12Cyrille Keith FranciscoPas encore d'évaluation

- MGMT 134 CA KeyDocument4 pagesMGMT 134 CA KeyAnand KL100% (1)

- Financial Management MDocument3 pagesFinancial Management MYaj CruzadaPas encore d'évaluation

- Probs Rel CostingDocument15 pagesProbs Rel Costingcoleen paraynoPas encore d'évaluation

- D15Document12 pagesD15neo14Pas encore d'évaluation

- Assign. 2 Module 2Document9 pagesAssign. 2 Module 2Kristine VertucioPas encore d'évaluation

- MAS Responsibility Acctg.Document6 pagesMAS Responsibility Acctg.Rosalie Solomon BocalaPas encore d'évaluation

- ACC51112 Responsibility Accounting WITH ANSWERSDocument8 pagesACC51112 Responsibility Accounting WITH ANSWERSjasPas encore d'évaluation

- Set 1 2 3 Possible Questions Uring The Oral DefenseDocument13 pagesSet 1 2 3 Possible Questions Uring The Oral DefenseAlliahDataPas encore d'évaluation

- The Problem and Its BackgroundDocument25 pagesThe Problem and Its BackgroundAlliahDataPas encore d'évaluation

- MAC Other Valuation TechniquesDocument35 pagesMAC Other Valuation TechniquesAlliahDataPas encore d'évaluation

- Op Aud Quizzes 9 Files MergedDocument166 pagesOp Aud Quizzes 9 Files MergedAlliahDataPas encore d'évaluation

- MAC Other Valuation TechniquesDocument35 pagesMAC Other Valuation TechniquesAlliahDataPas encore d'évaluation

- Blah BlahDocument4 pagesBlah BlahAlliahDataPas encore d'évaluation

- Case Study 2 Frankie and Rudy Two Different WorldsDocument2 pagesCase Study 2 Frankie and Rudy Two Different WorldsAlliahDataPas encore d'évaluation

- Strama ModuleDocument93 pagesStrama ModuleAlliahDataPas encore d'évaluation

- GROUP 4 Thesis ProposalDocument8 pagesGROUP 4 Thesis ProposalAlliahDataPas encore d'évaluation

- Shareholders Equity Part 1Document57 pagesShareholders Equity Part 1AlliahDataPas encore d'évaluation

- What Is Audit Sampling?: Prepared By: Alex Almodiel, CPA, MBADocument31 pagesWhat Is Audit Sampling?: Prepared By: Alex Almodiel, CPA, MBAAlliahDataPas encore d'évaluation

- Pamantasan NG Lungsod NG ValenzuelaDocument5 pagesPamantasan NG Lungsod NG ValenzuelaAlliahDataPas encore d'évaluation

- Business Plan Outline: "Choco Musa"Document16 pagesBusiness Plan Outline: "Choco Musa"AlliahDataPas encore d'évaluation

- Presentation GROUP4Document19 pagesPresentation GROUP4AlliahDataPas encore d'évaluation

- Laws On Other Business Transactions: Philippine Deposit Insurance Corporation (PDIC) LawDocument15 pagesLaws On Other Business Transactions: Philippine Deposit Insurance Corporation (PDIC) LawAlliahDataPas encore d'évaluation

- STS ReviewerDocument5 pagesSTS ReviewerAlliahDataPas encore d'évaluation

- Part B-Professional Accountant in Public PracticeDocument58 pagesPart B-Professional Accountant in Public PracticeAlliahDataPas encore d'évaluation

- Informed Consent Form-Detoxicare PDFDocument2 pagesInformed Consent Form-Detoxicare PDFAlliahDataPas encore d'évaluation

- Income Tax Reviewer Edward ArribaDocument26 pagesIncome Tax Reviewer Edward ArribaOdarbil BasogPas encore d'évaluation

- Commerce Assignment SheetDocument8 pagesCommerce Assignment SheetDean PhamPas encore d'évaluation

- PPP in Delhi Gurgaon Expressway - Group 3Document5 pagesPPP in Delhi Gurgaon Expressway - Group 3Nikhil SainiPas encore d'évaluation

- Kho Wah Wah Form BK-2Document4 pagesKho Wah Wah Form BK-2Steph SaavedraPas encore d'évaluation

- Ib Business Management - Answers To 1.2c Activity - Types of OrganisationDocument6 pagesIb Business Management - Answers To 1.2c Activity - Types of Organisationroberto100% (1)

- Raymundo A. Antolino and Nelia A. AntolinoDocument5 pagesRaymundo A. Antolino and Nelia A. AntolinoMark AntolinoPas encore d'évaluation

- What Are The Sources of Revenue For The Local Government UnitDocument3 pagesWhat Are The Sources of Revenue For The Local Government UnitKris UngsonPas encore d'évaluation

- Chapter 9 PowerPointDocument101 pagesChapter 9 PowerPointcheuleee100% (2)

- MCQs On Taxation LawDocument18 pagesMCQs On Taxation LawAli Asghar RindPas encore d'évaluation

- Portfolio Management 1Document139 pagesPortfolio Management 1thuyvuPas encore d'évaluation

- ACC 430 Chapter 9Document13 pagesACC 430 Chapter 9vikkiPas encore d'évaluation

- TM ACC ABCandABM1Document7 pagesTM ACC ABCandABM1anamikarblPas encore d'évaluation

- Working Capital Tools and TechniquesDocument60 pagesWorking Capital Tools and TechniquesMaria Bernadita RiveraPas encore d'évaluation

- Tantoco Vs Municipal CouncilDocument4 pagesTantoco Vs Municipal CouncilWilliam Christian Dela CruzPas encore d'évaluation

- Voluntary Assessment Payment ProgramDocument2 pagesVoluntary Assessment Payment ProgramNepean Philippines IncPas encore d'évaluation

- Ch03 Tool Kit 2017-09-11Document20 pagesCh03 Tool Kit 2017-09-11Roy HemenwayPas encore d'évaluation

- A - Examination Remuneration Bill - 01042015Document2 pagesA - Examination Remuneration Bill - 01042015patel_346879839Pas encore d'évaluation

- IPO Prospectus Eng (Astarta)Document177 pagesIPO Prospectus Eng (Astarta)lawman7767Pas encore d'évaluation

- Chapter 17 Flashcards - QuizletDocument34 pagesChapter 17 Flashcards - QuizletAlucard77777Pas encore d'évaluation

- Ceiling 6.000.00 Ceiling 10,0000 Ceiling 5,000.00: Basic Salary Pera de Minimis BenefitsDocument6 pagesCeiling 6.000.00 Ceiling 10,0000 Ceiling 5,000.00: Basic Salary Pera de Minimis Benefitsjohn frits gerard mombayPas encore d'évaluation

- Ratio Analysis of Beximco Pharmaceuticals LimitedDocument12 pagesRatio Analysis of Beximco Pharmaceuticals Limitedapi-3707335100% (4)

- Cities Annual Report FY 2001-02Document688 pagesCities Annual Report FY 2001-02L. A. PatersonPas encore d'évaluation

- Business Cycle: Is The Economy Getting Better or Worse?Document22 pagesBusiness Cycle: Is The Economy Getting Better or Worse?Earl Russell S PaulicanPas encore d'évaluation

- Kellog 2016Document70 pagesKellog 2016JadPas encore d'évaluation

- Accounting For Non AccountantsDocument66 pagesAccounting For Non AccountantsPrinceAndre100% (2)

- Bayer Annual Report 2005Document113 pagesBayer Annual Report 2005api-3805289100% (1)

- Jose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpDocument8 pagesJose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpAngelica CastilloPas encore d'évaluation

- Examples TransferpricingDocument15 pagesExamples Transferpricingpam7779Pas encore d'évaluation

- Leases Slides - FinalDocument34 pagesLeases Slides - FinalAnonymous n3n1Ae100% (1)

- Guidelines To Completing Form CR 1Document5 pagesGuidelines To Completing Form CR 1Charles MainaPas encore d'évaluation