Académique Documents

Professionnel Documents

Culture Documents

47 Louh v. BPI

Transféré par

Lawdemhar CabatosCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

47 Louh v. BPI

Transféré par

Lawdemhar CabatosDroits d'auteur :

Formats disponibles

CASE DIGEST

LOUH v. BPI

Law 101 ObliCon – Usurious Transactions

Court Supreme Court Third Division

Citation G.R. No. 225562

Date08 March 2017

Petitioners William C. Louh, Jr. and Irene L. Louh

Respondent Bank of the Philippine Islands

Ponente Reyes, J.

Relevant Stipulations on interest rates that are excessive and unconscionable are void for being

topiccontrary to morals, if not against the law. Being void, it is as if there was no express

contract thereon Hence, the courts may reduce the interest rate as reason and equity

demand.

Prepared by Lawdemhar Cabatos

FACTS:

Respondent BPI issued a credit card in William’s name, with Iren as the extension card holder. Pursuant

to the terms and conditions of the cards’ issuance, 3.5% finance charge and 6% late payment charge

shall be imposed monthly upon unpaid credit availments.

Spouses Louh were remiss in their obligations starting 14 October 2009 and subsequently received

demand letters from BPI. Upon failure to pay, BPI filed before the RTC of Makati City a complaint for

Collection of a Sum of Money.

The RTC declared Spouses Louh in default for failing to file an Answer despite being given granted an

extension, and upon rendering a decision, ordered Spouses Louh to solidarily pay BPI P533,836.71 plus

12% finance and 12% late payment annual charges, finding the 3.5% monthly finance charge and 6%

monthly late payment charges iniquitous and unconscionable, and 25% of the amount due as attorney’s

fees.

The CA affirmed the RTC decision in toto, explaining that the Spouses Louh were properly declared in

default, and that BPI offered ample evidence.

ISSUE– HELD – RATIO:

ISSUE HELD

WoN the CA erred in sustaining BPI’s compliant. NO

BPI had offered as evidence, among others, delivery receipts pertaining to the credit cards and the terms and

conditions governing the use thereof, computer-generated authentic copies of the SOAs, and demand letters

sent by BPI, which Spouses Louh received. The Spouses Louh slept on their rights to refute BPI’s evidence,

including the receipt of the SOAs and demand letters. BPI cannot be made to pay for the Spouses Louh’s

negligence, omission, or belated actions.

Citing the ruling in Macalinao v. BPI, the Court held that the 3.5% monthly finance charge and 6% monthly

late payment charge were excessive and unconscionable, and thus void. Accordingly, the courts may reduce

the interest rate as reason and equity demand, and the penalty charges pursuant to Article 1229 of the Civil

Code. In MCMP Construction Corp. v. Monark Equipment Corp., the Court also held that the 25% of the total

amount due as attorney’s fees was exorbitant and unconscionable, and reduced the same to 5%.

RULING:

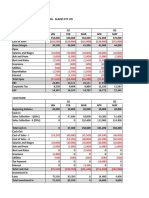

WHEREFORE, the Decision of the CA finding the Spouses Louh liable for the payment of credit availments,

plus finance and late payment charges of 12% each per annum are AFFIRMED. The principal amount due,

reckoning period of the computation and late payment charges, and attorney’s fees are MODIFIED as follows:

(1) The principal amount due is P113,756.83 as indicated in the SOA dated October 14, 2009;

(2) Finance and late payment charges of 12% each per annum shall be computed from October 14, 2009

until full payment; and

(3) five percent (5%) of the total amount due is to be paid as attorney's fees.

SO ORDERED.

Page 1 of 1

Vous aimerez peut-être aussi

- Louh v. Bank of The Philippine IslandsDocument3 pagesLouh v. Bank of The Philippine IslandsKim B.Pas encore d'évaluation

- Louh vs. BPIDocument1 pageLouh vs. BPIRobPas encore d'évaluation

- Obligations and Contracts Case Digests Remedies in Case of Breach and Subsidiary Remedies of CreditorDocument3 pagesObligations and Contracts Case Digests Remedies in Case of Breach and Subsidiary Remedies of Creditormaccy adalidPas encore d'évaluation

- Papa V ValenciaDocument3 pagesPapa V ValenciaGabe Ruaro100% (1)

- UP Vs Delos Angeles DigestDocument2 pagesUP Vs Delos Angeles DigestdenPas encore d'évaluation

- CABANTING Vs BPI FAMILY SAVINGS BANK, INC.Document2 pagesCABANTING Vs BPI FAMILY SAVINGS BANK, INC.Mac SorianoPas encore d'évaluation

- Visayan Saw Mill vs. CA and RJ TradingDocument1 pageVisayan Saw Mill vs. CA and RJ Tradingpowerplus jPas encore d'évaluation

- De Guzman V. CADocument1 pageDe Guzman V. CAPaolo Sison GoPas encore d'évaluation

- Valid Tender of Payment Extinguishes Obligation Despite RefusalDocument3 pagesValid Tender of Payment Extinguishes Obligation Despite RefusalLiaa AquinoPas encore d'évaluation

- 317 Siguan v. Lim, 318 SCRA 725Document1 page317 Siguan v. Lim, 318 SCRA 725Ralph VelosoPas encore d'évaluation

- Gonzales Vs The Heirs of Thomas and Paula CruzDocument1 pageGonzales Vs The Heirs of Thomas and Paula Cruzmcris101100% (1)

- Borbon II vs. Servicewide Specialists, IncDocument3 pagesBorbon II vs. Servicewide Specialists, IncMaria Angela GasparPas encore d'évaluation

- Padilla Breaches Land Sale ContractDocument2 pagesPadilla Breaches Land Sale ContractMichael MartinPas encore d'évaluation

- Visayan Sawmill CompanyDocument2 pagesVisayan Sawmill CompanyRA CumigadPas encore d'évaluation

- DeGuzman To Soco - ObliconDocument5 pagesDeGuzman To Soco - ObliconTom Louis HerreraPas encore d'évaluation

- RTC ruling on nullity of mortgage contracts due to alleged duressDocument2 pagesRTC ruling on nullity of mortgage contracts due to alleged duressMaica MagbitangPas encore d'évaluation

- PNB Vs Sapphire Shipping DIGESTDocument3 pagesPNB Vs Sapphire Shipping DIGESTLiaa Aquino100% (2)

- Court rules on credit card disputeDocument3 pagesCourt rules on credit card disputeAlyssa Alee Angeles JacintoPas encore d'évaluation

- Mendoza V CADocument2 pagesMendoza V CArapgracelimPas encore d'évaluation

- Quinto v. PeopleDocument2 pagesQuinto v. PeopleamberspanktowerPas encore d'évaluation

- Tengco V CaDocument2 pagesTengco V CaGale Charm SeñerezPas encore d'évaluation

- Digest-MWSS v. DawayDocument2 pagesDigest-MWSS v. DawayNamiel Maverick D. BalinaPas encore d'évaluation

- GONZALES VS CRUZ HEIRS LAND CONTRACT DISPUTEDocument1 pageGONZALES VS CRUZ HEIRS LAND CONTRACT DISPUTELaura R. Prado-Lopez100% (1)

- Montecillo V. ReynesDocument2 pagesMontecillo V. ReynesJolo CoronelPas encore d'évaluation

- Construction firms dispute over defective dump truckDocument2 pagesConstruction firms dispute over defective dump truckPriscilla DawnPas encore d'évaluation

- Ko Vs PNBDocument5 pagesKo Vs PNBley092Pas encore d'évaluation

- Liguez vs. CADocument2 pagesLiguez vs. CAJames Erwin VelascoPas encore d'évaluation

- Yam Vs CADocument2 pagesYam Vs CATenet ManzanoPas encore d'évaluation

- De Leon Vs Syjuco DigestDocument3 pagesDe Leon Vs Syjuco DigestRomeo Obias Jr.100% (3)

- Yek Tong Lin Fire Versus YusingcoDocument1 pageYek Tong Lin Fire Versus YusingcoRogelio Rubellano IIIPas encore d'évaluation

- Marquez Vs ElisanDocument2 pagesMarquez Vs ElisanHarold EstacioPas encore d'évaluation

- GAN TION V CADocument2 pagesGAN TION V CANaiza Mae R. Binayao100% (1)

- Filinvest v. Philippine AcetyleneDocument4 pagesFilinvest v. Philippine AcetyleneEmir MendozaPas encore d'évaluation

- Slc-Law: Persons and Family RelationsDocument1 pageSlc-Law: Persons and Family RelationsJomar TenezaPas encore d'évaluation

- Solar Harvest Inc. v. Davao Corrugated Carton Corp. & Andre T. Almocera v. Johnny OngDocument2 pagesSolar Harvest Inc. v. Davao Corrugated Carton Corp. & Andre T. Almocera v. Johnny OngMica Arce100% (1)

- Chan v. CA (1994)Document4 pagesChan v. CA (1994)Fides DamascoPas encore d'évaluation

- Abella v. FranciscoDocument1 pageAbella v. FranciscoSJ San JuanPas encore d'évaluation

- Topic: NATURE OF THE CASE: Petition For Review On Certiorari Under Rule 45 of The 1997 Revised RulesDocument2 pagesTopic: NATURE OF THE CASE: Petition For Review On Certiorari Under Rule 45 of The 1997 Revised Rulesrgtan3100% (6)

- Digest - Gan Tion V CADocument1 pageDigest - Gan Tion V CALiaa AquinoPas encore d'évaluation

- Gallardo Vs IACDocument2 pagesGallardo Vs IACMaica MagbitangPas encore d'évaluation

- CRUZ vs. SUZARADocument4 pagesCRUZ vs. SUZARAmark anthony mansuetoPas encore d'évaluation

- Manuel Ubas, Sr. vs. Wilson ChanDocument7 pagesManuel Ubas, Sr. vs. Wilson ChanArvy VelasquezPas encore d'évaluation

- Food Vs SiapnoDocument8 pagesFood Vs SiapnoMargie Rose PulidoPas encore d'évaluation

- Spouses Velarde v. CADocument2 pagesSpouses Velarde v. CADianne Rosales100% (1)

- Art. 1416 TMBC Vs SilverioDocument4 pagesArt. 1416 TMBC Vs SilverioBam BathanPas encore d'évaluation

- Arroyo V Berwin Digest, DKC Holdings Corp v. CA, Gutierrez Hermanos (Firm) v. Orense, Florentino Et Al v. EncarnacionDocument4 pagesArroyo V Berwin Digest, DKC Holdings Corp v. CA, Gutierrez Hermanos (Firm) v. Orense, Florentino Et Al v. EncarnacionJoaquin Niccolo FernandezPas encore d'évaluation

- MBTC Vs ChiokDocument3 pagesMBTC Vs ChiokNath AntonioPas encore d'évaluation

- Highpoint vs. Republic (Full Text, Word Version)Document9 pagesHighpoint vs. Republic (Full Text, Word Version)Emir MendozaPas encore d'évaluation

- Pabugais v. SahijwaniDocument3 pagesPabugais v. SahijwaniEmir MendozaPas encore d'évaluation

- Santos vs. Ventura Foundation, Inc.Document2 pagesSantos vs. Ventura Foundation, Inc.Jm SantosPas encore d'évaluation

- Hermanos Vs SaldanaDocument4 pagesHermanos Vs SaldanaLee SomarPas encore d'évaluation

- Rural Bank of Paranaque v. CADocument1 pageRural Bank of Paranaque v. CAIvan LuzuriagaPas encore d'évaluation

- San Miguel Prop. v. BF HomesDocument4 pagesSan Miguel Prop. v. BF HomesJustinePas encore d'évaluation

- CONSTRUCTIVE FULFILLMENTDocument15 pagesCONSTRUCTIVE FULFILLMENTDennis Aran Tupaz Abril100% (1)

- TLG International v. Hon. Delfin Flores withdraw deposit dismissal caseDocument1 pageTLG International v. Hon. Delfin Flores withdraw deposit dismissal casegelatin528Pas encore d'évaluation

- Philippine Savings Bank vs Spouses Castillo | Interest Rate ChangesDocument3 pagesPhilippine Savings Bank vs Spouses Castillo | Interest Rate ChangesPre AvanzPas encore d'évaluation

- OBLICON Legal Compensation To Novation Case DigestsDocument22 pagesOBLICON Legal Compensation To Novation Case DigestsRascille Laranas67% (3)

- Interest or Mutuum - Part 2Document3 pagesInterest or Mutuum - Part 2Maria Anny YanongPas encore d'évaluation

- Court reduces debt and legal fees in credit card collection caseDocument8 pagesCourt reduces debt and legal fees in credit card collection caseRuby TorresPas encore d'évaluation

- Louh vs. BpiDocument1 pageLouh vs. BpiRhei BarbaPas encore d'évaluation

- McDonald v. National City Bank of New YorkDocument2 pagesMcDonald v. National City Bank of New YorkLawdemhar Cabatos0% (1)

- Laguna Transportation Co. v. SSS: Change in Business Form Does Not Exempt CoverageDocument2 pagesLaguna Transportation Co. v. SSS: Change in Business Form Does Not Exempt CoverageLawdemhar CabatosPas encore d'évaluation

- Tuason Vs BolañosDocument1 pageTuason Vs BolañosLawdemhar CabatosPas encore d'évaluation

- Bachrach vs. La ProtectoraDocument2 pagesBachrach vs. La ProtectoraLawdemhar Cabatos100% (1)

- Cui V CuiDocument3 pagesCui V CuiLawdemhar CabatosPas encore d'évaluation

- 43 in Re Petition of SycipDocument3 pages43 in Re Petition of SycipLawdemhar CabatosPas encore d'évaluation

- 43 in Re Petition of SycipDocument3 pages43 in Re Petition of SycipLawdemhar CabatosPas encore d'évaluation

- 44 Nebreja v. ReonalDocument2 pages44 Nebreja v. ReonalLawdemhar Cabatos100% (1)

- 16 in Re GutierrezDocument2 pages16 in Re GutierrezLawdemhar CabatosPas encore d'évaluation

- 148 Marcos v. MarcosDocument2 pages148 Marcos v. MarcosLawdemhar CabatosPas encore d'évaluation

- 110 People v. MangulabnanDocument2 pages110 People v. MangulabnanLawdemhar CabatosPas encore d'évaluation

- 56 Siquian v. PeopleDocument2 pages56 Siquian v. PeopleLawdemhar Cabatos100% (1)

- 46 Macalinao v. BPIDocument2 pages46 Macalinao v. BPILawdemhar CabatosPas encore d'évaluation

- 148 Marcos v. MarcosDocument2 pages148 Marcos v. MarcosLawdemhar CabatosPas encore d'évaluation

- Ang Nars Partylist vs. Executive Secretary (Summary)Document7 pagesAng Nars Partylist vs. Executive Secretary (Summary)Lawdemhar Cabatos33% (3)

- 182 Asiavest v. CADocument2 pages182 Asiavest v. CALawdemhar CabatosPas encore d'évaluation

- 154 in Re de VillaDocument4 pages154 in Re de VillaLawdemhar CabatosPas encore d'évaluation

- Special Power of Attorney - SampleDocument2 pagesSpecial Power of Attorney - SampleLawdemhar CabatosPas encore d'évaluation

- (Case Digest) de Jesus v. Syquia (G.R. No. L-39110. November 28, 1933.)Document2 pages(Case Digest) de Jesus v. Syquia (G.R. No. L-39110. November 28, 1933.)Lawdemhar CabatosPas encore d'évaluation

- Supreme Court Acquits Appellant Due to Insufficient EvidenceDocument2 pagesSupreme Court Acquits Appellant Due to Insufficient EvidenceLawdemhar Cabatos40% (5)

- Cantabil Retail India Limited Private Equity ReportDocument15 pagesCantabil Retail India Limited Private Equity ReportMayank GugnaniPas encore d'évaluation

- Steven - Perkins DRUNK TRADERDocument19 pagesSteven - Perkins DRUNK TRADERjigarchhatrolaPas encore d'évaluation

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Document15 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Kyrie IrvingPas encore d'évaluation

- VC, PE, Angel investors and startup ecosystem parties in IndonesiaDocument82 pagesVC, PE, Angel investors and startup ecosystem parties in IndonesiaGita SwastiPas encore d'évaluation

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaPas encore d'évaluation

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariPas encore d'évaluation

- How George Soros Made $8 BillionDocument2 pagesHow George Soros Made $8 BillionAnanda rizky syifa nabilahPas encore d'évaluation

- Basic Method For Making Economy Study NotesDocument3 pagesBasic Method For Making Economy Study NotesMichael DantogPas encore d'évaluation

- ST 2 PDFDocument2 pagesST 2 PDFEbenezer SamedwinPas encore d'évaluation

- Case - FMC - 02Document5 pagesCase - FMC - 02serigalagurunPas encore d'évaluation

- Salient Features of The Companies Act, 2013Document6 pagesSalient Features of The Companies Act, 2013SuduPas encore d'évaluation

- Fabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Document19 pagesFabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Janna Gunio0% (1)

- Aavas FinanciersDocument8 pagesAavas FinanciersSirish GopalanPas encore d'évaluation

- Cash Flow and Financial PlanningDocument64 pagesCash Flow and Financial PlanningKARL PASCUAPas encore d'évaluation

- Personal Finance PowerPointDocument15 pagesPersonal Finance PowerPointKishan KPas encore d'évaluation

- Enterprise Risk Management - Beyond TheoryDocument34 pagesEnterprise Risk Management - Beyond Theoryjcl_da_costa6894100% (4)

- Toa Consolidated Sample QuestionsDocument60 pagesToa Consolidated Sample QuestionsBabi Dimaano NavarezPas encore d'évaluation

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahPas encore d'évaluation

- Simple Annuity Activity (Math of Investment)Document1 pageSimple Annuity Activity (Math of Investment)RCPas encore d'évaluation

- Monthly One Liners - April 2021Document29 pagesMonthly One Liners - April 2021ramPas encore d'évaluation

- Acquisition Analysis and RecommendationsDocument49 pagesAcquisition Analysis and RecommendationsAnkitSawhneyPas encore d'évaluation

- Eco 411 Problem Set 1: InstructionsDocument4 pagesEco 411 Problem Set 1: InstructionsUtkarsh BarsaiyanPas encore d'évaluation

- Ali Mousa and Sons ContractingDocument1 pageAli Mousa and Sons ContractingMohsin aliPas encore d'évaluation

- The Journal of Performance Measurement Table of ContentsDocument12 pagesThe Journal of Performance Measurement Table of ContentsEttore TruccoPas encore d'évaluation

- Research Proposal On Challenges of Local GovernmentDocument26 pagesResearch Proposal On Challenges of Local GovernmentNegash LelisaPas encore d'évaluation

- The MBA DecisionDocument7 pagesThe MBA DecisionFiry YuanditaPas encore d'évaluation

- MAS Annual Report 2010 - 2011Document119 pagesMAS Annual Report 2010 - 2011Ayako S. WatanabePas encore d'évaluation

- Pimentel v. Aguirre, Et. Al. - G.R. No. 132988Document15 pagesPimentel v. Aguirre, Et. Al. - G.R. No. 132988sejinmaPas encore d'évaluation

- T3-Sample Answers-Consideration PDFDocument10 pagesT3-Sample Answers-Consideration PDF--bolabolaPas encore d'évaluation

- Consistent Compounders: An Investment Strategy by Marcellus Investment ManagersDocument27 pagesConsistent Compounders: An Investment Strategy by Marcellus Investment Managersvra_pPas encore d'évaluation