Académique Documents

Professionnel Documents

Culture Documents

PBL

Transféré par

ovifinTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PBL

Transféré par

ovifinDroits d'auteur :

Formats disponibles

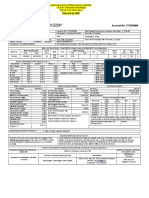

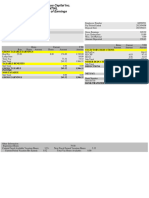

TOTAL FACILITY / SECURITY:

Fig. in million BDT.

Summary of exposure Security Value

Existing Limit O/S Overdue Proposed Total

A/C: Amber Group

Funded 1,878.12 1,295.54 224.77 1,878.12 i. Cash Collateral 0

Non-Funded 1,863.46 86.85 1,863.46 (sub ii. Other Collateral 319.16

(sub : 530) : 530)

Total: 3,211.58 1,382.39 224.77 3,211.58 Total 319.16

A/C: Partex Group

Funded 1,651.76 1,652.00 380.42 +50.00 1,701.76 i. Cash Collateral 21.70

(FDR)

Non-Funded 726.97 138.66 726.97 ii. Other Collateral 0

(sub : 390) (sub : 390)

Total: 1,988.73 1,790.66 380.42 +50.00 2,038.73 Total 21.70

Grand- 3,529.88 2,952.04 606.98 +50.00 3,579.88 i. Cash Collateral 21.70

Funded (FDR)

Grand Non- 2,590.43 225.51 2,590.43 ii. Other Collateral 319.16

Funded

Total: 5,200.31 3,173.05 605.19 +50.00 5,250.31 Total 340.86

Brief of Collateral:

A/C: Amber Denim Ltd. Value

1) 1st ranking pari-passu charge on registered mortgage of 1457.93 decimal project lands along with 01 single storied DBL portion:

factory building measuring 291,128 sft.; 01 single storied warehouse building measuring 101,560.00 sft; 01 single 280.65 (30.87% of

storied ETP building measuring 9,777.00 sft.; 01 single storied Chemical Warehouse Building measuring 40,535.00 lending stake)

sft. and other structures totaling 443,000 sft. among working capital lenders i.e. Dhaka bank Ltd., Shahajalal Islami

Bank Ltd. and Social Islami Bank Ltd. The property stands in the name of Partex Denim Limited.

A/C: Amber Denim Mills Ltd. Value

2) 1st ranking pari-passu charge with RJSC among DBL and other lenders by way of Registered Mortgage of 40.09 DBL portion:

bigha (or 1323.05 decimal) project land along with 01 single storied factory building (space: 243,390 sft.) and 01 114.89 (15% of

single storied warehouse (space: 47,621 sft.) and Chemical Warehouse Building (Space: 47,524 sft.) at lending stake)

Jangaliapara, Banglabazar, Bhoual, Mirzapur, Gazipur, standing in the name of Partex Denim Mills Ltd.

TOTAL Tk.395.54 million

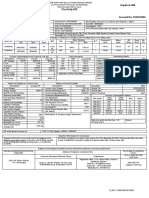

Liability with other Banks/ NBFI: Fig in Million BDT

A/C: Partex Beverage Ltd.

SL NO BANK Branch Nature of Loan Sanction Limit O/S as on 31.12.2018

1 Janata Bank Ltd. Motijheel Corporate Term Loan 357.40 0.00

LTR/LIM 150.00 0.00

CC (Hypo) 80.00 80.60

CC (Pled) 120.00 115.90

Sub-Total 707.40 196.50

2 Meghna Bank Ltd. Principal OD 80.00 82.90

LTR 250.00 235.36

Term loan 107.90 166.74

Sub-Total 437.90 485.00

3 Trust Bank Ltd. Dhanmondi TL 961.83 738.20

OD/Bai-m 40.00 0.00

LTR/Murabaha 228.00 0.00

Sub-Total 1,229.83 738.20

5 United Leasing HO Lease 20.20 -

6 United Leasing HO Lease 79.00 -

7 Lanka Bangla (PBL) HO Lease 50.00 -

8 Lanka Bangla (PBL) HO TL 130.00 -

9 National Finance Ltd HO Lease 45.00 -

10 Islami Finance HO Lease 60.00 -

11 Islami Finance HO Lease 200.00 169.10

12 Jamuna Bank STL 56.30 -

13 Premier Leasing HO TL 60.00 30.97

14 Eastern Bank Ltd. OD 650.00 550.00

15 AB Bank Ltd. Kawran Bazar Br. Time Loan 700.00 -

Grand Total 5585.62 3085.10

SL NO BANK Branch Nature of Loan Sanction Limit Closing as

on

31.10.2019

1.00 Janata Bank Motijheel Corporate Term Loan 357.40 -

LTR/LIM 150.00 -

CC (Hypo) 80.00 83.14

CC (Pled) 120.00 71.61

Sub-Total 707.40 154.75

2.00 Dhaka Bank PBL LO TL 400.00 213.60

STL 300.00 -

LTR 150.00 387.56

OD 120.00 122.50

Sub-Total 970.00 723.66

3.00 Dhaka Bank PPL LO LTR 100.00 -

OD 90.00 93.10

Sub-Total 190.00 93.10

4.00 Meghna Bank Principal OD 80.00 79.99

LTR 250.00 280.54

S/TL 107.89 70.84

Sub-Total 437.89 431.37

5.00 Trust Bank Dhanmondi TL 961.83 670.59

OD/Bai-m 40.00 39.82

LTR/Murabaha 228.00 164.76

Sub-Total 1,229.83 875.17

6.00 Islami Finance PO Lease 200.00 170.00

7.00 Premier Leasing HO TL 60.00 30.97

8.00 Eastern Bank Ltd Gulshan OD 650.00 562.25

Term Loan 2,087.12 1,156.00

Working Capital 2,358.00 1,885.27

Total 4,445.12 3,041.26

Business Performance:

(BDT in million)

Year Sales Import Export Net Account Turnover Highest Dr. Lowest Dr.

Profit with DBL [Cr. Sum] balance balance

A/C: Partex Beverage Ltd.

31.12.2014 2506.39 269.82 - 378.85 1498.65 - -

30.09.2015 2535.72 153.87 336.56 1694.84 - -

30.06.2016 2,665.04 582.16 355.18 2179.60 115.08 7.79

30.06.2017 2,052.08 299.80 - 278.74 1925.60 129.99 77.23

(09 months)

30.06.2018 2,756.11 458.32 405.33 1830.65 95.21 100.34

2019 - 481.64 - - 753.52 122.88 110.63

Financial Ratio Analysis:

Ratio 30.06.18 (Score) Comment

A. Leverage:

1. Debt to Tangible Net worth (times) 0.20 1. Excellent: Tangible Net Worth is higher than Debt.

2. Debt to Total Asset (times) 0.16 2. Excellent: Debt is 16% against Total Asset.

B. Liquidity 1. Good: The client is capable to meet its short term obligations.

1. Current Ratio (times) 3.67 2. Unacceptable: Insufficient cash & easily marketable securities to pay

2. Cash Ratio (times) 0.04 short term debt.

C. Profitability

1. Net Profit Margin (%) 15.00 1. Excellent: Net Profit margin is excellent.

2. Return on Assets (%) 8.00 2. Marginal: Return on asset is marginal.

3. Operating Profit to Operating Assets (%) 10.00 3. Unacceptable: Operating Profit is low against operating asset.

D. Coverage 1. Excellent: High coverage to pay the interest.

1. Interest Coverage (times) 8.19 2. Excellent: Have sufficient strength against debt to be serviced.

2. Debt Service Coverage Ratio (Times) 8.19 3. Excellent: Have sufficient cash flow from operation against debt to be

3. Cash flow Coverage Ratio (times) 8.56 serviced.

E. Operating Efficiency

1. Inventory Turnover Days 274.45 1. Unacceptable: Inventory turnover is very high.

2. Accounts Receivables Collection Days 38.43 2. Excellent: Ac receivable collection is excellent.

3. Asset Turnover (%) 57.00 3. Marginal: Marginal asset turnover.

F. Earnings Quality

1. Operating Cash flow to Sales (%) 18.00 1. Excellent: Have sufficient Operating cash flow against their sales.

Limit Utilization (2017-19): (Revolving limits only)

Loan Type : BBLC LC LTR STL OD BG

A/C: Partex Beverage Ltd.

Limit : - 500.00 (250.00) (30.00) 120.00 30.00

299.80 (0.86X)

Volume of utilization (2017) - 249.35 (0.99X) 38.71 (1.29X) 1925.60 Nil

[limit: 350.00 ml]

Volume of utilization (2018) - 0.91 (1.31X) 393.05 (1.57X) Nil 1714.54 10.84

Volume of utilization (2019) - 0.96 (1.31X) 393.05 (1.57X) Nil 1714.54 10.84

Group (Partex & Amber) Summary: (Import)[Sight+DP+BBLC]

AMBER GROUP PARTEX GROUP

Year No. of LC Volume in million Year No. of LC Volume in million

2016 69 654.59 2016 65 622.93

2017 69 1057.25 2017 65 370.89

2018 157 1473.37 2018 91 654.96

2019 12 79.62 2019 10 54.40

Total 307 3264.83 231 1703.18

Net Income from the client/ group (Up to 31.12.2018): (Details at Page# 20-21)

(BDT in million)

Summary of Income: [Partex + Amber Group, With Local Office]

Year Interest Fees & Commission Exchange Gain Others Gross Income Net Income Yield

2014 152.50 44.322 0 0 196.822 100.98 16.77%

2015 167.02 41.17 0 0 208.19 123.98 14.95%

2016 162.35 26.55 0 0 188.90 108.00 12.79%

2017 150.31 18.84 0 0 169.15 101.52 11.25%

2018 303.09 12.36 0 0 315.45 194.21 13.01%

2019

TOTAL (2014-18) 935.27 143.24 0 0 1078.51 628.69

Vous aimerez peut-être aussi

- Account Status: Printed On: 26-Jul-2018 6:20:01PMDocument2 pagesAccount Status: Printed On: 26-Jul-2018 6:20:01PMTanzir HasanPas encore d'évaluation

- Portfolio 10113Document1 pagePortfolio 10113Shahid MahmudPas encore d'évaluation

- Marginable SecuritiesDocument4 pagesMarginable SecuritiesAbraham LinkonPas encore d'évaluation

- Working Capital AnalysisDocument9 pagesWorking Capital AnalysisDr Siddharth DarjiPas encore d'évaluation

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiPas encore d'évaluation

- MTBSL: MTB Securities LimitedDocument2 pagesMTBSL: MTB Securities LimitedMuhammad Ziaul HaquePas encore d'évaluation

- MTBSL: MTB Securities LimitedDocument2 pagesMTBSL: MTB Securities Limitedasdfghjkl007Pas encore d'évaluation

- LEGALDocument1 pageLEGALanon_764077379Pas encore d'évaluation

- Adani Green Energy Limited: PrintDocument3 pagesAdani Green Energy Limited: PrintBijal DanichaPas encore d'évaluation

- Portfolio RJ 3188Document1 pagePortfolio RJ 3188fahmidazerinsPas encore d'évaluation

- Portfolio 13103Document1 pagePortfolio 13103Shahid MahmudPas encore d'évaluation

- Member No.121, Dhaka Stock Exchange Ltd. Modhumita Bldg. (1st Floor), 160, Mothjheel C/A, Dhaka-1000Document1 pageMember No.121, Dhaka Stock Exchange Ltd. Modhumita Bldg. (1st Floor), 160, Mothjheel C/A, Dhaka-1000Md HarunPas encore d'évaluation

- Bagal Annexure II in Principle Format PDFDocument4 pagesBagal Annexure II in Principle Format PDFRamesh KulkarniPas encore d'évaluation

- Bagal Annexure II in Principle FormatDocument4 pagesBagal Annexure II in Principle FormatRamesh KulkarniPas encore d'évaluation

- CASH - DN3260 - Ataur Rahman - 28 - 05 - 2023Document1 pageCASH - DN3260 - Ataur Rahman - 28 - 05 - 2023Ataur RahmanPas encore d'évaluation

- Ar MisDocument35 pagesAr MisNARUTOPas encore d'évaluation

- RAJGHARANADocument20 pagesRAJGHARANAPriyanshu tripathiPas encore d'évaluation

- RA9HH Computation For 2354722 As of 2021-07-21Document1 pageRA9HH Computation For 2354722 As of 2021-07-21John Kendrick J. UmayamPas encore d'évaluation

- Financial Statement F.Y 19-20Document9 pagesFinancial Statement F.Y 19-20jmpnv007Pas encore d'évaluation

- MTB Securities Limited: TREC # 197, Dhaka Stock Exchange LTD., 68 Motijheel C/A, Dhaka-1000Document1 pageMTB Securities Limited: TREC # 197, Dhaka Stock Exchange LTD., 68 Motijheel C/A, Dhaka-1000Flora RokaiyaPas encore d'évaluation

- Buy/Sale Order Book Is Not Signed.: Sector Exposure in %Document1 pageBuy/Sale Order Book Is Not Signed.: Sector Exposure in %Sarwar GolamPas encore d'évaluation

- Introduction of DLF LimitedDocument15 pagesIntroduction of DLF LimitedArun Kumar SinghPas encore d'évaluation

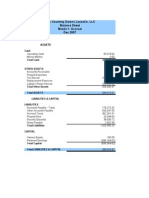

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Dec 2007Document58 pagesUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Dec 2007MarcyPas encore d'évaluation

- 732 ElectrcityDocument1 page732 ElectrcityHasan AliPas encore d'évaluation

- Reliance Power ShareholdingDocument2 pagesReliance Power Shareholdingvarun_bhuPas encore d'évaluation

- Dakshin Haryana Bijli Vitran NigamDocument3 pagesDakshin Haryana Bijli Vitran NigamRavinder YadavPas encore d'évaluation

- Sep 22Document1 pageSep 22krishna tiwari (OHRWA TM)Pas encore d'évaluation

- CASH - DN3260 - Ataur Rahman - 08 - 02 - 2023Document1 pageCASH - DN3260 - Ataur Rahman - 08 - 02 - 2023Ataur RahmanPas encore d'évaluation

- View BillDocument1 pageView BillPratham BhardwajPas encore d'évaluation

- COMPDocument2 pagesCOMPSairishi GhoshPas encore d'évaluation

- Electricity Bill: Account No: 7791830000Document1 pageElectricity Bill: Account No: 7791830000Jai Mata diPas encore d'évaluation

- Portfolio RAJ3398Document2 pagesPortfolio RAJ3398aabaki1983Pas encore d'évaluation

- Provisional Profit and Loss Accounts For The Period Un-Audited AuditedDocument4 pagesProvisional Profit and Loss Accounts For The Period Un-Audited AuditedAnonymous btsj64wRPas encore d'évaluation

- BillDocument1 pageBillSunil KumarPas encore d'évaluation

- CMP G 42000517953Document1 pageCMP G 42000517953VikasSainiPas encore d'évaluation

- Unicon Infra PVT LTD (2018) : 1-Jan-2020 To 31-Dec-2020 Particulars Closing Balance Credit DebitDocument3 pagesUnicon Infra PVT LTD (2018) : 1-Jan-2020 To 31-Dec-2020 Particulars Closing Balance Credit DebitOjhal RaiPas encore d'évaluation

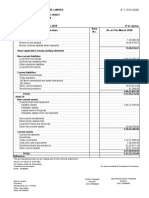

- Balance Sheet As at 31st March 2003Document9 pagesBalance Sheet As at 31st March 2003mpdharmadhikariPas encore d'évaluation

- NDDB AR 2016-17 Eng 0 Part44Document2 pagesNDDB AR 2016-17 Eng 0 Part44siva kumarPas encore d'évaluation

- Portfolio 11114Document1 pagePortfolio 11114Shahid MahmudPas encore d'évaluation

- Miln Devi. BillDocument1 pageMiln Devi. Billkuldeeptawar250Pas encore d'évaluation

- Bank Performance AnalysisDocument4 pagesBank Performance AnalysisSurbhî GuptaPas encore d'évaluation

- Pg1 3 MergedDocument10 pagesPg1 3 MergedAryan DhamechaPas encore d'évaluation

- TREC-041, Dhaka Stock Exchange LTD.: Portfolio StatementDocument1 pageTREC-041, Dhaka Stock Exchange LTD.: Portfolio StatementShahid MahmudPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- View Bill731Document1 pageView Bill731ah95550154Pas encore d'évaluation

- Cost To Complete As Per Site Requirements: Total Contract Value Profit NPR (%)Document1 pageCost To Complete As Per Site Requirements: Total Contract Value Profit NPR (%)Caguioa Mark Anthony G.Pas encore d'évaluation

- Premier Food BsDocument2 pagesPremier Food BsJames AshfieldPas encore d'évaluation

- MTB Securities Limited: TREC # 197, Dhaka Stock Exchange LTD., 68 Motijheel C/A, Dhaka-1000Document2 pagesMTB Securities Limited: TREC # 197, Dhaka Stock Exchange LTD., 68 Motijheel C/A, Dhaka-1000asdfghjkl007Pas encore d'évaluation

- Bati Devi Bijli BillDocument1 pageBati Devi Bijli Billravi40440457Pas encore d'évaluation

- Eicher Motors: PrintDocument3 pagesEicher Motors: PrintAryan BagdekarPas encore d'évaluation

- Accounts AssignmentDocument17 pagesAccounts AssignmentApoorvPas encore d'évaluation

- MTBSL: MTB Securities LimitedDocument2 pagesMTBSL: MTB Securities Limitedasdfghjkl007Pas encore d'évaluation

- Electricity Bill Duplicate Bill: Him SinghDocument1 pageElectricity Bill Duplicate Bill: Him SinghSûmìt KúmãrPas encore d'évaluation

- 22 Aug 2022Document1 page22 Aug 2022Sunil KumarPas encore d'évaluation

- Electricity Bill Duplicate BillDocument1 pageElectricity Bill Duplicate BillJatin kumarPas encore d'évaluation

- Jaduda JatDocument7 pagesJaduda JatAbhay TiwariPas encore d'évaluation

- June 2023Document1 pageJune 2023PAWAN SONIPas encore d'évaluation

- Brian Tai - Pay Slip 00002Document1 pageBrian Tai - Pay Slip 00002Brian TaiPas encore d'évaluation

- DB Renews Private Limited: Provisionalbalance Sheet As at 31stmarch, 2019Document8 pagesDB Renews Private Limited: Provisionalbalance Sheet As at 31stmarch, 2019Anonymous btsj64wRPas encore d'évaluation

- Credit Derivatives and Structured Credit: A Guide for InvestorsD'EverandCredit Derivatives and Structured Credit: A Guide for InvestorsPas encore d'évaluation

- Ggwuwe BQVWKB: C VWV CwiwpwzDocument25 pagesGgwuwe BQVWKB: C VWV CwiwpwzovifinPas encore d'évaluation

- MTB Yaqeen Hire Purchase Under Shirkatul Milk (HPSM) : (In The Name of Allah, The Merciful, The Compassionate)Document25 pagesMTB Yaqeen Hire Purchase Under Shirkatul Milk (HPSM) : (In The Name of Allah, The Merciful, The Compassionate)ovifinPas encore d'évaluation

- Yaqeen Product Brochure enDocument29 pagesYaqeen Product Brochure enovifinPas encore d'évaluation

- B Fabric Manufacturing Weaving Mill List 2019 c2 PDFDocument55 pagesB Fabric Manufacturing Weaving Mill List 2019 c2 PDFovifinPas encore d'évaluation

- Tassgps PDFDocument16 pagesTassgps PDFovifinPas encore d'évaluation

- UI Listed Fire Door Information in BDDocument2 pagesUI Listed Fire Door Information in BDovifinPas encore d'évaluation

- Boq-Furniture, FixtureDocument11 pagesBoq-Furniture, FixtureovifinPas encore d'évaluation

- Artho Rin AdalatDocument2 pagesArtho Rin AdalatovifinPas encore d'évaluation

- Letter of Undertaking: Information Regarding Ownership of Borrowing Individual/OrganisationDocument1 pageLetter of Undertaking: Information Regarding Ownership of Borrowing Individual/OrganisationovifinPas encore d'évaluation

- 30m Ferris WheelDocument2 pages30m Ferris WheelovifinPas encore d'évaluation

- RMG Factory ParticularsDocument1 pageRMG Factory ParticularsovifinPas encore d'évaluation

- Annexure-2: Table: 1-ECAI's Credit Rating Categories Mapped With BB Rating GradeDocument1 pageAnnexure-2: Table: 1-ECAI's Credit Rating Categories Mapped With BB Rating GradeovifinPas encore d'évaluation

- Finance CTDocument1 pageFinance CTovifinPas encore d'évaluation

- CIB Undertaking KaDocument1 pageCIB Undertaking Kaovifin0% (1)

- Car LoanDocument44 pagesCar LoanovifinPas encore d'évaluation

- CIB UndertakingDocument1 pageCIB UndertakingovifinPas encore d'évaluation

- LOAN DOCUMENTATION Letter For Inserting DateDocument1 pageLOAN DOCUMENTATION Letter For Inserting DateovifinPas encore d'évaluation

- Business Plan OutlineDocument2 pagesBusiness Plan OutlineovifinPas encore d'évaluation

- BCT DialogueDocument43 pagesBCT DialogueKevin FigueroaPas encore d'évaluation

- Open Letter To Mr. Anand Gopal Mahindra, Ex-Director of Kotak Mahindra Bank LimitedDocument12 pagesOpen Letter To Mr. Anand Gopal Mahindra, Ex-Director of Kotak Mahindra Bank LimitedLaw WhizPas encore d'évaluation

- Thruway LetterDocument3 pagesThruway LetterjspectorPas encore d'évaluation

- Revised Loyalty Card Application Form (HQP-PFF-108)Document2 pagesRevised Loyalty Card Application Form (HQP-PFF-108)louiegi001Pas encore d'évaluation

- PMR2019 Cbrewtw PDFDocument98 pagesPMR2019 Cbrewtw PDFTeddyPas encore d'évaluation

- Rental AgreementDocument3 pagesRental AgreementArun KumarPas encore d'évaluation

- Mythri Ojas Institute Tally Erp 9 Exam: Name of The Student: Batch TimeDocument12 pagesMythri Ojas Institute Tally Erp 9 Exam: Name of The Student: Batch TimeMk Siv SpPas encore d'évaluation

- Annual 2009Document28 pagesAnnual 2009communitypPas encore d'évaluation

- The Chattel Mortgage LawDocument12 pagesThe Chattel Mortgage LawBethyl PorrasPas encore d'évaluation

- Divorce - Marital Settlement Agreement - No ChildrenDocument9 pagesDivorce - Marital Settlement Agreement - No ChildrencyannaxavierPas encore d'évaluation

- Insurance Notes 1Document36 pagesInsurance Notes 1sheelaarul07Pas encore d'évaluation

- Education Loans by Commercial Banks in IndiaDocument164 pagesEducation Loans by Commercial Banks in IndiaAnand Sharma100% (1)

- Floating Rate Notes: Concepts and BuzzwordsDocument6 pagesFloating Rate Notes: Concepts and BuzzwordsMyagmarsuren SanaakhorolPas encore d'évaluation

- Banker's Secret To Creating Wealth!Document3 pagesBanker's Secret To Creating Wealth!pbowen22375% (4)

- Civil - Law - BarQA - 2009 2017 Pages 161 182,1 7usDocument29 pagesCivil - Law - BarQA - 2009 2017 Pages 161 182,1 7usKAREENA AMEENAH ACRAMAN BASMANPas encore d'évaluation

- Admin Salvage Law Report.Document8 pagesAdmin Salvage Law Report.Sittie Hainah F. Barabadan-MacabangonPas encore d'évaluation

- Loans Create DepositsDocument6 pagesLoans Create DepositsPeter OnyangoPas encore d'évaluation

- Test Bank For Bank Management and Financial Services 9th Edition by RoseDocument50 pagesTest Bank For Bank Management and Financial Services 9th Edition by RoseAzui VincentPas encore d'évaluation

- Internship Report On Loan and AdvanceDocument72 pagesInternship Report On Loan and AdvanceAsad KhanPas encore d'évaluation

- Principles of LendingDocument116 pagesPrinciples of Lendingrufinus ondiekiPas encore d'évaluation

- Home LoanidbiDocument2 pagesHome LoanidbivinodmcaPas encore d'évaluation

- Case Digest of Kasilag VsDocument1 pageCase Digest of Kasilag VsNikko SterlingPas encore d'évaluation

- Real Estate in IndiaDocument9 pagesReal Estate in IndiaVandan SapariaPas encore d'évaluation

- Sales Reviewer 1Document16 pagesSales Reviewer 1Christina AurePas encore d'évaluation

- Indian Overseas Bank PO 2009 Solved Question PaperDocument59 pagesIndian Overseas Bank PO 2009 Solved Question PaperVishesh AgrawalPas encore d'évaluation

- BOE Bonded TemplateDocument2 pagesBOE Bonded TemplateSuzanne Cristantiello100% (6)

- Indiabuls Final PresentationDocument39 pagesIndiabuls Final PresentationVanraj PandeyPas encore d'évaluation

- FMI7e ch17Document37 pagesFMI7e ch17lehoangthuchienPas encore d'évaluation

- EditionDocument28 pagesEditionSan Mateo Daily JournalPas encore d'évaluation

- NSE Equity Research Module 1 PDFDocument143 pagesNSE Equity Research Module 1 PDFBanePas encore d'évaluation