Académique Documents

Professionnel Documents

Culture Documents

Advances To Officers, Investment Property, Cash Surrender Value

Transféré par

Mary Joyce Yu0 évaluation0% ont trouvé ce document utile (0 vote)

86 vues2 pagesshort reviewer about advances to officers, investment property, and cash surrender value

Titre original

Advances to Officers, Investment Property, Cash Surrender Value

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentshort reviewer about advances to officers, investment property, and cash surrender value

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

86 vues2 pagesAdvances To Officers, Investment Property, Cash Surrender Value

Transféré par

Mary Joyce Yushort reviewer about advances to officers, investment property, and cash surrender value

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

ADVANCES TO OFFICERS price, which is called the Bargain Purchase

Option. If mahal, cannot be considered as finance

They are recorded at present value and recognize lease. Pag binenta nang hindi magbebenta and

interest income. tinaasan price, not classified as finance lease.

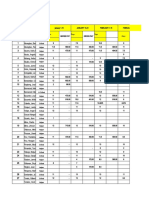

Amortization table for the amount advanced, Substance over form – form is that the lessee will

debit advances to officers, credit interest income.

only use the property for a period but in effect,

(Using the effective interest method)

there will be a transfer of ownership. Yung form

Prepaid compensation expense is amortized in a niya is nagrerent lang but in substance, kanya na

straight line basis. Just divide the amount by the yun.

term. As we amortize it, debit Compensation Lessor – for them, there are only two

Expense, credit Prepaid Compensation Expense. classifications of lease. The first is dealer. He

The Compensation Expense will contra the really sells but dahil sa sobrang mahal ng benta

Interest Income. niya, you cannot pay it ng buo, kaya installments

Alternative entry: debit Advances to Officers- na lang. So mukhang finance lease rin.

2M, ang contra niya para maging 1271000 If the finance lessee leases out to others,

Discount on Officer’s Advances. As we operating lease yung classification ng sublease

amortize, we debit Discount on Officer’s niya to others. It is qualified to be classified as

Advances and credit Interest Income. Investment Property because the ownership will

We may amortize every end of the accounting be transferred at the end of the term. But kung

period or if it is on installment basis, every operating lessee lang tayo and we lease out to

payment. others, it cannot be classified as Investment

INVESTMENT PROPERTY Property because we do not own the property.

How do we measure Investment Property? Just

If not main line of business, and we rent it out to like PPE, we can choose whether to use the Cost

earn additional income and we just don’t want the Model or the Fair Value Model.

land or space to be idle, it is an investment If we choose the Fair Value Model, all the

property. properties must be measured in this way.

If the space is divided into two, the half is being Fair Value Model – we compare the carrying

used by the owner for the company purpose and value and the fair value. Any difference will be

the other half is being rented out, the presentation the Gain on Fair Value Increase.

is divided. The part used is presented as PPE and The Gain on Fair Value Increase will be other

the part rented out is Investment Property. income.

If only ¼ is used by the company, or if the part If FV Model is used, any changes in value as a

used is not material, consider the whole property result of the market changes will be reported as

as Investment Property. part of the profit or loss.

If the part used by the business is bigger than Reclassification from Investment Property to

what is rented out, consider the property as PPE. PPE – if using the Cost Model, whatever the FV

If half talaga, hati ang presentation. becomes the cost. Debit PPE and credit

If nasa main line ng business, inventory. Investment Property. No depreciation yet.

If we bought it nang walang purpose, Investment Reclassification from Inventory to PPE – we

Property. value inventory at cost and fv less cost to sell,

Types of leases: operating and finance. whichever is lower. Debit Decline in Market

Operating lease – pay and pay but the ownership value for Inventory, credit Allowance for Decline

is and will not be transferred. in Market Value.

Finance lease – lease to own. It’s like buying in Reclassification from PPE to Assets Held for

installments. At the end of the term, there will be Sale – Update CV first. Debit Acc Dep, debit FV

an option for the buyer to purchase it for a small of PPE, credit CV of PPE. Any difference will be

debited to Loss on Reclassification or credited to debit Prepaid Insurance, credit Insurance

Gain on Reclassification. Before reclassification, Expense.

we must be sure that there is a market for it. If Kung magkano yung masisingil from the

reclassified, depreciation stops. insurance company, debit Receivable from the

If the Assets Held for Sale are not sold ibabalik Insurance Company.

sa PPE. FV becomes cost. Compute depreciation Close all related accounts. (the cash surrender

again. Any difference will be Gain or Loss. value of insurance)

If there is any difference, Gain or Loss on

CASH SURRENDER VALUE OF LIFE

Settlement of Insurance.

INSURANCE POLICY

Pag di namatay tapos natapos na yung 10 years,

Cash surrender value – the amount to be given makukuha natin yung cash if we want. But if di

back by the insurance company if nothing natin kinuha, it’s as if nakadeposit siya.

happens to the insured person. This will only

apply to officers na ang beneficiary is the

company. Ang pambayad sa premium came from

the company. So insurance expense ng company.

But if the company paid for the officer’s

insurance and the beneficiary is not the company,

say for example, the family is the beneficiary, it

is not an insurance expense. It is also an expense

but benefit na lang ng officer. You cannot debit

insurance expense if the company is not the

beneficiary.

Example. If the term of the insurance is 10 years,

tapos sa pangatlong taon, wala pa ring

nangyayari sa insured officer, the insurance

company will give a notice saying, “At this point,

the cash surrender value is Php 50, 000.” We will

record it as our asset. Debit Cash Surrender Value

of Life Insurance Policy, credit Insurance

Expense. To reduce the insurance expense.

If we pay for the insurance, debit Insurance

Expense, credit Cash. In apportioning to the

remaining accounting period, we record an

adjusting entry.

In another year, another cash surrender value

(increase). Irerecord yung dagdag lang, Debit

Cash Surrender Value of Life Insurance Policy,

credit Insurance Expense.

If the company issued dividends, it is not our

income. It becomes a deduction from Insurance

Expense. Debit Cash Surrender Value, credit

Insurance Expense.

If the 10 year period has not yet lapsed but the

insured officer died, update the insurance first. If

may natitira pa na di na mag-aapply in the future,

Vous aimerez peut-être aussi

- Investment Accounting As 13Document4 pagesInvestment Accounting As 13ALANKRIT TRIPATHIPas encore d'évaluation

- CFP NotesDocument19 pagesCFP Notesdaksh.aggarwal26Pas encore d'évaluation

- Features Equity DeptDocument4 pagesFeatures Equity DeptLoc Vo DinhPas encore d'évaluation

- Chapter Cost of CapitalDocument13 pagesChapter Cost of CapitalAbdul BasitPas encore d'évaluation

- NotesDocument44 pagesNotesMingru WangPas encore d'évaluation

- Accounting of DebenturesDocument24 pagesAccounting of Debenturesmanya singhPas encore d'évaluation

- Investment in Debt SecuritiesDocument10 pagesInvestment in Debt SecuritiesSUBA, Michagail D.Pas encore d'évaluation

- Class Participation Report Session-2: My ContributionDocument1 pageClass Participation Report Session-2: My ContributionSNEH SMRITIPas encore d'évaluation

- Asset VS LiabilitiesDocument10 pagesAsset VS LiabilitiesSuhas Salehittal100% (1)

- Accountancy Notes PDF Class 11 Chapter 7Document4 pagesAccountancy Notes PDF Class 11 Chapter 7UwuuuuPas encore d'évaluation

- Capital & RevenueDocument14 pagesCapital & RevenueNeha KumariPas encore d'évaluation

- Financial MGT NotesDocument42 pagesFinancial MGT Notes匿匿Pas encore d'évaluation

- 03 BIWS Equity Value Enterprise ValueDocument6 pages03 BIWS Equity Value Enterprise ValuecarminatPas encore d'évaluation

- FAR Handout Investment PropertyDocument4 pagesFAR Handout Investment PropertyPIOLA CAPINAPas encore d'évaluation

- Types of DebenturesDocument3 pagesTypes of DebenturesNidheesh TpPas encore d'évaluation

- Assessing Financial Viability of The Project: R I (R I)Document4 pagesAssessing Financial Viability of The Project: R I (R I)wolverineorigins02Pas encore d'évaluation

- Leases: Negotiating Costs EtcDocument5 pagesLeases: Negotiating Costs EtcMillie ShoniwaPas encore d'évaluation

- Cost of Capital 1Document7 pagesCost of Capital 1Tinatini BakashviliPas encore d'évaluation

- Basic Accounting Terminology: Tangible AssetsDocument4 pagesBasic Accounting Terminology: Tangible Assetskavya guptaPas encore d'évaluation

- Accounts Final PresentationDocument30 pagesAccounts Final PresentationRITIKAPas encore d'évaluation

- 14 Purchase of Business And, Profits Prior To Incorporation: O EctivesDocument20 pages14 Purchase of Business And, Profits Prior To Incorporation: O EctivesSandhiyaPas encore d'évaluation

- Real Estate Finance Interview QuestionsDocument3 pagesReal Estate Finance Interview QuestionsJack Jacinto100% (2)

- Topic 28: Financial Asset at Amortized CostDocument1 pageTopic 28: Financial Asset at Amortized Costemman neriPas encore d'évaluation

- F FM Coc 09.03.22Document19 pagesF FM Coc 09.03.22Yash PokernaPas encore d'évaluation

- Managing Financial Resources and Decisions of Finance Finance Essay (WEB)Document28 pagesManaging Financial Resources and Decisions of Finance Finance Essay (WEB)johnPas encore d'évaluation

- Treasury NotesDocument6 pagesTreasury NotesRobinson MojicaPas encore d'évaluation

- FinanceDocument3 pagesFinanceRahul RoyPas encore d'évaluation

- Treasury Finals ReviewerDocument5 pagesTreasury Finals ReviewerGodween CruzPas encore d'évaluation

- Basics of LeasingDocument10 pagesBasics of LeasingNeeraj PariharPas encore d'évaluation

- Capital Budgeting Decision Criteria: Payback, NPV, IRR, MIRR and Profitability IndexDocument7 pagesCapital Budgeting Decision Criteria: Payback, NPV, IRR, MIRR and Profitability Indexantonio morenoPas encore d'évaluation

- Deducting Expenses As An Employee: Self-Employment: Is It For You?Document11 pagesDeducting Expenses As An Employee: Self-Employment: Is It For You?The VaultPas encore d'évaluation

- Discuss The Impact of Depreciation Expense On The Cash Flow AnalysisDocument2 pagesDiscuss The Impact of Depreciation Expense On The Cash Flow AnalysisDjahan RanaPas encore d'évaluation

- Reporting and Analyzing Off-Balance Sheet FinancingDocument31 pagesReporting and Analyzing Off-Balance Sheet FinancingmanoranjanpatraPas encore d'évaluation

- Illustration RapDocument1 pageIllustration RapShub KumarPas encore d'évaluation

- Cost of CapitalDocument9 pagesCost of CapitalKunwer TaibaPas encore d'évaluation

- FinShiksha - Some Common Interview QuestionsDocument12 pagesFinShiksha - Some Common Interview QuestionskaranPas encore d'évaluation

- Accountancy 7Document65 pagesAccountancy 7Arif ShaikhPas encore d'évaluation

- 25 LeasingDocument9 pages25 Leasingddrechsler9Pas encore d'évaluation

- Accounting ConceptsDocument5 pagesAccounting ConceptsAhmed ZimamPas encore d'évaluation

- Partnership AccountsDocument4 pagesPartnership AccountsnathanrengaPas encore d'évaluation

- Reviewer in Business FinanceDocument3 pagesReviewer in Business FinancebaekhyunPas encore d'évaluation

- 03 Depreciation & LeaseDocument37 pages03 Depreciation & LeaseVarsha BhutraPas encore d'évaluation

- Gross Income: Definition Means All Gains, Profits, and IncomeDocument19 pagesGross Income: Definition Means All Gains, Profits, and IncomeKathPas encore d'évaluation

- FM Theory PDFDocument55 pagesFM Theory PDFJeevan JazzPas encore d'évaluation

- DCF Analysis: What Is Higher? Cost of Equity or The Cost of Debt and Why?Document4 pagesDCF Analysis: What Is Higher? Cost of Equity or The Cost of Debt and Why?Yash ModiPas encore d'évaluation

- Transactions Account Debited CreditedDocument8 pagesTransactions Account Debited CreditedH O P EPas encore d'évaluation

- FM 1 - CH 5 NoteDocument12 pagesFM 1 - CH 5 NoteEtsub SamuelPas encore d'évaluation

- FINANCE Time Value PvoaDocument24 pagesFINANCE Time Value PvoaJanzel SantillanPas encore d'évaluation

- Advanced Accounting NotesDocument8 pagesAdvanced Accounting Noteslove bangtanPas encore d'évaluation

- Chapter 9Document3 pagesChapter 9SharecePas encore d'évaluation

- Assignment Financial Institutes and Markets 24 11 2018Document7 pagesAssignment Financial Institutes and Markets 24 11 2018devang asherPas encore d'évaluation

- DCF Caveats in ValuationDocument23 pagesDCF Caveats in Valuationricoman1989Pas encore d'évaluation

- 07.2022 Real Estate Finance and Economics For Appraisers HandoutDocument23 pages07.2022 Real Estate Finance and Economics For Appraisers HandoutJohnny Castillo SerapionPas encore d'évaluation

- Debt and Value: Beyond Miller-Modigliani: Stern School of BusinessDocument68 pagesDebt and Value: Beyond Miller-Modigliani: Stern School of BusinessRoyLadiasanPas encore d'évaluation

- Ahmed Elsayad Finance Q + A's 2008 To August 2017Document20 pagesAhmed Elsayad Finance Q + A's 2008 To August 2017MoatasemMadianPas encore d'évaluation

- VU Lesson 5Document4 pagesVU Lesson 5ranawaseemPas encore d'évaluation

- INCLUSIONS (Gross Income For Individuals) 1. Compensation IncomeDocument4 pagesINCLUSIONS (Gross Income For Individuals) 1. Compensation IncomeJoAiza DiazPas encore d'évaluation

- Finance Management Notes MbaDocument12 pagesFinance Management Notes MbaSandeep Kumar SahaPas encore d'évaluation

- Tugas MK 1 (RETNO NOVIA MALLISA)Document5 pagesTugas MK 1 (RETNO NOVIA MALLISA)Vania OlivinePas encore d'évaluation

- Analytics RatiosDocument4 pagesAnalytics RatiosMary Joyce YuPas encore d'évaluation

- Jai-Alai Corporation of Philippines v. Bank of Philippine IslandsDocument6 pagesJai-Alai Corporation of Philippines v. Bank of Philippine IslandsMary Joyce YuPas encore d'évaluation

- Customs of The TagalogsDocument25 pagesCustoms of The TagalogsMary Joyce YuPas encore d'évaluation

- Implications of The On-Going Trade WarDocument6 pagesImplications of The On-Going Trade WarMary Joyce YuPas encore d'évaluation

- 20th Century Science and TechnologyDocument8 pages20th Century Science and TechnologyMary Joyce YuPas encore d'évaluation

- Mess Expense SheetDocument13 pagesMess Expense SheetMuhammad rehan baigPas encore d'évaluation

- Learning MaterialDocument254 pagesLearning MaterialujjmahaPas encore d'évaluation

- Restaurant Firms' IPO Motivations and post-IPO Performances: Staying Public, Being Delisted or Merged?Document19 pagesRestaurant Firms' IPO Motivations and post-IPO Performances: Staying Public, Being Delisted or Merged?Juliany HelenPas encore d'évaluation

- Retail Bicycle Shop Business PlanDocument31 pagesRetail Bicycle Shop Business PlanThomas LewaPas encore d'évaluation

- China Innovation Eco-SystemDocument47 pagesChina Innovation Eco-SystemDRAGON-STAR PlusPas encore d'évaluation

- Week 11 Module 11 TAX2 Business and Transfer Taxation PADAYHAGDocument13 pagesWeek 11 Module 11 TAX2 Business and Transfer Taxation PADAYHAGfernan opeliñaPas encore d'évaluation

- Subsidiary BooksDocument16 pagesSubsidiary BooksAnindya NandiPas encore d'évaluation

- December 2017 Hindu Leads PrintedDocument86 pagesDecember 2017 Hindu Leads PrintedlovehackinggalsPas encore d'évaluation

- Boi Form 501 - Economic and Low-Cost HousingDocument12 pagesBoi Form 501 - Economic and Low-Cost HousingRey SitjarPas encore d'évaluation

- Managerial Accounting Basics: Garrisson cp3Document66 pagesManagerial Accounting Basics: Garrisson cp3GlenPalmerPas encore d'évaluation

- Acc 109 p2 Quiz Statement of Comprehensive IncomeDocument11 pagesAcc 109 p2 Quiz Statement of Comprehensive IncomeRonel CastillonPas encore d'évaluation

- Module 4 - Problem 5Document1 pageModule 4 - Problem 5Lycksele RodulfaPas encore d'évaluation

- Chapter 2: Salaries.: Computation of Income Under The Head Income From "Salaries"Document8 pagesChapter 2: Salaries.: Computation of Income Under The Head Income From "Salaries"Varun AadarshPas encore d'évaluation

- Salaries and Wages Adjustments (2020-2021)Document38 pagesSalaries and Wages Adjustments (2020-2021)CarloCabanayanPas encore d'évaluation

- Chapter 2 Cost Concepts and ClassificationDocument40 pagesChapter 2 Cost Concepts and ClassificationJean Rae RemiasPas encore d'évaluation

- MCQ FR I - OnsolidatedDocument50 pagesMCQ FR I - OnsolidatedAman GuptaPas encore d'évaluation

- Chapter 11 - Tutorial QuestionDocument6 pagesChapter 11 - Tutorial QuestionFallen LeavesPas encore d'évaluation

- Business Plan For Plastic in Ethiopia DoDocument39 pagesBusiness Plan For Plastic in Ethiopia DoTesfaye Degefa100% (3)

- Payroll Mayor GaylordDocument127 pagesPayroll Mayor GaylordEz EkPas encore d'évaluation

- FA Mid Term Exam Dec 2022Document3 pagesFA Mid Term Exam Dec 2022ha90665Pas encore d'évaluation

- An Introduction To Consolidated Financial StatementsDocument22 pagesAn Introduction To Consolidated Financial Statementsratih meliniaPas encore d'évaluation

- Introduction To AccountingDocument5 pagesIntroduction To Accountingorda55555Pas encore d'évaluation

- Armes Tax ProcdecerDocument87 pagesArmes Tax ProcdecerMuddanaGowdaPas encore d'évaluation

- Index of Activities: Chartered Accountants Program Financial Accounting & ReportingDocument78 pagesIndex of Activities: Chartered Accountants Program Financial Accounting & ReportingJAGRUITI JAGRITIPas encore d'évaluation

- United States v. The McNally Pittsburg Manufacturing Corporation, a Kansas Corporation, and McNally Pittsburg Manufacturing Corporation, a Kansas Corporation, Successor to the McNally Pittsburg Manufacturing Corporation of Wellston, Ohio, a Delaware Corporation, Predecessor, 342 F.2d 198, 10th Cir. (1965)Document6 pagesUnited States v. The McNally Pittsburg Manufacturing Corporation, a Kansas Corporation, and McNally Pittsburg Manufacturing Corporation, a Kansas Corporation, Successor to the McNally Pittsburg Manufacturing Corporation of Wellston, Ohio, a Delaware Corporation, Predecessor, 342 F.2d 198, 10th Cir. (1965)Scribd Government DocsPas encore d'évaluation

- LPG Financial Assistance AgreementDocument0 pageLPG Financial Assistance AgreementsudheerPas encore d'évaluation

- Fabm2: Quarter 1 Week 4 Module 4Document13 pagesFabm2: Quarter 1 Week 4 Module 4Micah GPas encore d'évaluation

- Section 80DD, Section 80DDB, Section 80U - Tax Deduction For Disabled PersonsDocument19 pagesSection 80DD, Section 80DDB, Section 80U - Tax Deduction For Disabled Personsvvijayaraghava100% (1)

- Assumption College of Nabunturan: Nabunturan, Davao de Oro ProvinceDocument7 pagesAssumption College of Nabunturan: Nabunturan, Davao de Oro ProvinceJudithaPas encore d'évaluation

- Sap t030 ConfigDocument2 pagesSap t030 ConfigSubhas GuhaPas encore d'évaluation