Académique Documents

Professionnel Documents

Culture Documents

ASSET 2019 Mock Boards - AFAR

Transféré par

Kenneth Christian WilburDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ASSET 2019 Mock Boards - AFAR

Transféré par

Kenneth Christian WilburDroits d'auteur :

Formats disponibles

CONTROL NO.

MOCK BOARD EXAMINATIONS

November 10, 2019

ADVANCED FINANCIAL ACCOUNTING AND REPORTING

NOTE: Final answers must be indicated on the separate answer sheet provided. Intermediary work on

questionnaire and scratch paper will merit no points.

1. Which cost accumulation procedure is most applicable in continuous mass production

manufacturing environments?

A. standard C. process

B. actual D. job order

2. The installment method of recognizing profit for accounting purposes is acceptable if

A. collection in the year of sale do not exceed 30% of the total sales price

B. an unrealized profits account is credited

C. collection of the sales price is not reasonably assured

D. the method is consistently used for all sales of similar merchandise

1. If a company reports a receivable denominates in Euros (€) and the Philippine peso weakens vis-à-

vis the Euro:

A. The company will not report the change in the relative value of the receivable until the

receivable is collected.

B. The company will accrue the gain in its financial statements as of the statement date, even

before the receivable is collected.

C. The company will accrue the loss in its financial statements as of the statement date, even

before the receivable is collected.

D. The company will recognize the increase in the Philippine peso value of the receivable on its

balance shees as of the statement date, but the unrealized gain will not be recognized in its

income statement until the receivable is collected.

4. The term “control” means ownership, directly or indirectly through subsidiaries of

A. more than one-half of the outstanding voting stock of another company.

B. at least 20% of the voting stock of another company.

C. at least 50% of the voting stock of another company.

D. at least 10% of the voting stock of another company.

5. Under the cost recovery method of revenue recognition,

A. income is recognized on a proportionate basis as cash is received on the sale of the product.

B. income is recognized when the cash received from the sale of the product is greater than

the cost of the product.

C. income is recognized immediately.

D. none of these.

6. An example of a notional amount is

A. number of barrels of oil.

B. interest rates.

C. currency swaps.

D. stock prices.

7. A December 15, 2019 purchase of goods was denominated in a currency other than the entity’s

functional currency. The transaction resulted in a payable that was fixed in terms of the amount of

foreign currency, and was paid on the settlement date, January 20, 2020. The exchange rates

between the functional currency and the currency in which the transaction was denominated

changed between the transaction date and December 31, 2019, and again between December 31,

2019, and January 20, 2020. Both exchange rate changes resulted in gains. The amount of the gain

that should be included in the 2020 financial statements would be

A. the gain from December 31, 2019, to January 20, 2020

B. the gain from December 15, 2019, to January 20, 2020

C. the gain from December 15, 2019, to December 31, 2019

D. zero.

8. In a production cost report using process costing, transferred-in costs are similar to

A. direct materials added at a point during the process

B. conversion costs added during the process

C. costs transferred to the next process

D. costs included in beginning inventory

9. Partnership capital and drawings accounts are similar to the corporate

A. paid in capital, retained earnings, and dividends accounts.

B. retained earnings account.

C. paid in capital and retained earnings accounts.

D. preferred and common stock accounts.

10. If a new partner acquires a partnership interest directly from the partners rather than from the

partnership itself,

A. no entry is required.

B. the partnership assets should be revalued.

C. the existing partners’ capital accounts should be reduced, and the new partner’s account

increased.

D. the partnership has undergone a quasi-reorganization.

Advanced Financial Accounting and Reporting Page 2 of 8

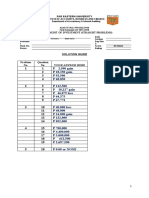

11. The following data pertains to Pelicans Co.’s construction jobs, which commenced during 2019:

Project 1 Project 2

Contract price P420,000 P300,000

Cost incurred during 2019 240,000 280,000

Estimated cost to complete 120,000 40,000

Billed to customers during 2019 150,000 270,000

Received from customers during 2019 90,000 250,000

If Pelicans used the percentage of completion method, what amount of gross profit (loss) would

Pelicans report in its 2019 income statement?

A. (20,000) C. 22,500

B. 20,000 D. 40,000

12. On January 1, 2019, SMV Corp. issued 200,000 additional shares of P10 par value common stock in

exchange for all of QM Corp’s common stock. Immediately before this business combination, SMV’s

stockholder’s equity was P8,000,000 and QM’s stockholder’s equity was P4,000,000. On January 1,

2019, fair market value of SMV’s common stock was P20 per share, and fair market value of QM’s

net assets was P4,000,000. SMV’s net income for the year ended December 31, 2019, exclusive of

any consideration of QM, was P1,250,000. QM’s net income for the year ended December 31, 2019,

was P300,000. During 2019, SMV paid dividends of P450,000. SMV had no business transactions

with QM in 2019. Assuming that purchase method was used in this business combination, how

much is the consolidated stockholder’s equity at December 31, 2019?

A. 8,800,000 C. 13,100,000

B. 9,100,000 D. 13,350,000

Advanced Financial Accounting and Reporting Page 3 of 8

For numbers 13 and 14:

On January 1, 2020, Owen Corp. purchased all of Sharp Corp.’s common stock for P1,200,000. On

that date, the fair values of Sharp’s assets and liabilities equaled their carrying amounts of

P1,320,000 and P320,000, respectively. During 2020, Sharp paid cash dividends of P20,000. Selected

information for the separate balance sheets and income statements of Owen and Sharp as of

December 31, 2020, and for the year ended follows:

Owen Sharp

Balance Sheet Accounts:

Investment in subsidiary 1,300,000

Retained earnings 1,240,000 560,000

Total stockholders’ equity 2,620,000 1,120,000

Income Statement Accounts:

Operating income 420,000 200,000

Equity in earnings of Sharp 120,000

Net income 400,000 140,000

13. In Owen’s 2020 consolidated income statement, what amount should be reported for amortization

of goodwill?

A. 0 C. 18,000

B. 12,000 D. 20,000

14. In Owen’s December 31, 2020 consolidated balance sheet, what amount should be reported as total

retained earnings?

A. 1,240,000 C. 1,380,000

B. 1,360,000 D. 1,800,000

15. The following information pertains to shipments of merchandise from Home Office to Branch

during 2020:

Home office’s cost of merchandise P160,000

Intracompany billings 200,000

Sales by branch 250,000

Unsold merchandise at branch, 12/31/20 20,000

In the combined income statement of Home Office and Branch for the year ended December 31,

2020, what amount of the above transactions should be included in sales?

A. 250,000 C. 200,000

B. 230,000 D. 180,000

Advanced Financial Accounting and Reporting Page 4 of 8

16. On September 1, 2020, Bain Corp. received an order for equipment from a foreign customer for

300,000 local currency units (LCU) when the peso equivalent was P96,000. Bain shipped the

equipment on October 15, 2020 and billed the customer for 300,000 LCU when the peso equivalent

was P100,000. Bain received the customer’s remittance in full on November 16, 2020 and sold the

300,000 LCU for P105,000. In its income statement for the year ended December 31, 2020, Bain

should report a foreign exchange transaction gain of:

A. 0 C. 5,000

B. 4,000 D. 9,000

For numbers 17 and 18:

The following condensed balance sheet is presented for the partnership of Alfa and Beda, who share

profits and losses in the ratio of 60:40, respectively:

Cash 45,000

Other assets 625,000

Beda, loan 30,000

700,000

Accounts payable, 120,000

Alfa, capital 348,000

Beda, capital 232,000

700,000

17. The assets and liabilities are fairly valued on the balance sheet. Alfa and Beda decide to admit Capp

as a new partner with a 20% interest. No goodwill or bonus is to be recorded. What amount should

Capp contribute in cash or other assets?

A. 110,000 C. 140,000

B. 116,000 D. 145,000

18. Instead of admitting a new partner, Alfa and Beda decide to liquidate the partnership. If the other

assets are sold for P500,000, what amount of the available cash should be distributed to Alfa?

A. 255,000 C. 327,000

B. 273,000 D. 348,000

19. The flexible budget for the month of May was for 9,000 units with direct materials at P15 per unit.

Direct labor was budgeted at 45 minutes per unit for a total of P81,000. Actual output for the month

was 8,500 units with P127,500 in direct materials and P77,775 in direct labor expense. The direct

labor standard of 45 minutes was maintained throughout the month. Variance analysis of the

performance for the month of May would show a (an)

A. 7,500 favorable materials usage variance.

B. 1,275 favorable direct labor efficiency variance.

C. 1,275 unfavorable direct labor efficiency variance.

D. 1,275 unfavorable direct labor price variance.

Advanced Financial Accounting and Reporting Page 5 of 8

20. The manufacturing firm planned to manufacture and sell 100,000 units of product during the year

at a variable cost per unit of P4.00 and a fixed cost per unit of P2.00. the firm fell short of its goal

and only manufactured 80,000 units at a total incurred cost of P515,000. The firm’s manufacturing

cost variance was

A. 85,000 favorable C. 5,000 favorable

B. 35,000 unfavorable D. 5,000 unfavorable

21. For the first semester of 2020, Public University assessed its students P4,000,000 (net of refunds),

covering tuition and fees for educational and general purposes. However, only P3,700,000 was

expected to be realized because tuition remissions of P80,000 were allowed to faculty members’

children attending Public University, and scholarship totaling P220,000 were granted to students.

What amount should Public University include in education and general current funds revenues

from student tuition and fees?

A. 4,000,000 C. 3,780,000

B. 3,920,000 D. 3,700,000

22. In April 2020, Alice Reed donated P100,000 cash to her church, with the stipulation that the income

generated from the gift is to be paid to Alice during her lifetime. The conditions of this donation are

that, after Alice dies, the principal can be used by the church for any purpose voted on by the church

elders. The church received interest of P8,000 on the P100,000 for the year ended March 31, 2021

and the interest was remitted to Alice. In the church’s March 31, 2021 financial statements

A. P8,000 should be reported under support and revenue in the activity statement.

B. P92,000 should be reported under support and revenue in the activity statement.

C. P100,000 should be reported as deferred support in the balance sheet.

D. The gift and its terms should be disclosed only in notes to the financial statements.

23. Queen Co. is a print shop, which produces jobs to customer specifications. During January, Job #123

was worked on and the following information is available:

Direct materials used P2,500

Direct labor hours worked 15

Machine time used 16

Direct labor rate per hour P7.00

Overhead application rate per machine hour P18.00

What was the total cost of Job #123 for January?

A. 3,025 C. 2,770

B. 2,812 D. 2,713

24. The Lotus Co. manufactures a specialty line of product using a job order costing system. During

May, the following costs were incurred in completing Job #03: direct materials, P13,700; direct labor,

P4,800; administrative, P1,400; and selling , P5,600. Factory overhead was applied at the rate of P25

per machine hour. Job #03 requires 800 machine hours. If Job #03 resulted in 7,000 good units,

what is the cost of goods sold per unit?

A. 6.50 C. 5.70

B. 6.30 D. 5.50

Advanced Financial Accounting and Reporting Page 6 of 8

25. The following information relates to Job No. 2468, which being carried out by Flexy Feet to meet a

customer’s order:

Dept. A Dept. B v

Direct materials consumed P5,000 P3,000

Direct labor rate per hour 4 5

Production overhead per direct labor hour 4 4

Direct labor hours employed 400 200

Administrative and other overhead cost 20% of full production cost

Profit markup 25% of selling price

What is the selling price to the customer of Job No. 2468?

A. 16,250 C. 19,800

B. 17,333 D. 20,800

26. The Backflushers Manufacturing Corp. uses a Raw and In Process inventory account and expenses

all conversion costs to the cost of goods sold account. At the end of each month, all inventories are

counted, their conversion cost components are estimated, and inventory account balances are

adjusted accordingly. Raw material cost is backflushed from RIP to finished goods. The following

information is for the month of May:

Raw and In Process inventory account, May 1, P5,000

including P500 of conversion cost

Raw materials received during May 100,000

(50% down, balance in four installments)

Raw and In Process inventory account, May 31, 5,250

including P650 of estimated conversion cost

What is the amount to be backflushed from RIP to finished goods?

A. 90,900 C. 104,500

B. 99,900 D. 109,100

27. Seco Corp. was forced into bankruptcy and is in the process of liquidating assets and paying claims.

Unsecured claims will be paid at the rate of P0.40 on the peso. Hale holds a P30,000 noninterest

bearing note receivable from Seco collateralized by an asset with a book value of P35,000 and a

liquidation value of P5,000.

The amount to be realized by Hale on this note is

A. 5,000 C. 15,000

B. 12,000 D. 17,000

Advanced Financial Accounting and Reporting Page 7 of 8

For numbers 28 and 29:

The following selected account balances were taken from the balance sheet of Quitting Corp. as of

December 31, 2020, immediately before the take-over of the trustee:

Marketable securities P300,000

Inventories 110,000

Land 150,000

Building 400,000

Additional information:

● Marketable securities have present market value of P320,000. These securities have been

pledged to secure notes payable of P280,000.

● The estimated worth of inventories is P70,000. However, inventories with book value of

P50,000 have been pledged to secure notes payable for P60,000. The realizable value of the

inventories pledged is estimated to be P40,000.

● Land and building are estimated to have a total realizable value of P450,000. This property

is pledged to secure the mortgage payable of P250,000.

28. What is the estimated amount available for preferred claims and unsecured creditors out of assets

pledged with fully secured creditors?

A. 840,000 C. 770,000

B. 810,000 D. 240,000

29. What is the total amount of net free assets?

A. 810,000 C. 270,000

B. 770,000 D. 240,000

30. Krebs Crabs, Inc. franchisor, entered into a franchise agreement with Liwayway Ligaya, franchisee,

on July 1, 2020. The total franchise fees agreed upon is P1,100,000, of which P100,000 is payable

upon signing and the balance payable in four equal annual installments. It was agreed that the down

payment is not refundable, notwithstanding lack of substantial performance of services by

franchisor. When Krebs prepares its financial statements on July 31, 2020, the unearned franchise

fees to be reported is:

A. 0 C. 1,000,000

B. 100,000 D. 1,100,000

Advanced Financial Accounting and Reporting Page 8 of 8

Vous aimerez peut-être aussi

- Acctg 11 Q1 - FinalsDocument8 pagesAcctg 11 Q1 - FinalsIvy SalisePas encore d'évaluation

- QUIZ1Document4 pagesQUIZ1alelliePas encore d'évaluation

- Chapter 12Document10 pagesChapter 12GloowwjPas encore d'évaluation

- AainvtyDocument4 pagesAainvtyRodolfo SayangPas encore d'évaluation

- Book 9Document2 pagesBook 9Actg SolmanPas encore d'évaluation

- Theory - Part 2 PDFDocument21 pagesTheory - Part 2 PDFBettina OsterfasticsPas encore d'évaluation

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopPas encore d'évaluation

- 3rd NCR Cup Junior Edition Quiz Bee KPMGDocument17 pages3rd NCR Cup Junior Edition Quiz Bee KPMGrcaa04100% (1)

- Home Office, Branches and AgenciesDocument5 pagesHome Office, Branches and AgenciesBryan ReyesPas encore d'évaluation

- Solution To Chapter 20Document46 pagesSolution To Chapter 20수지Pas encore d'évaluation

- Ch19 Consolidated Fs With Minority InterestsDocument5 pagesCh19 Consolidated Fs With Minority InterestsralphalonzoPas encore d'évaluation

- ACCY 303 - Midterm ExaminationDocument12 pagesACCY 303 - Midterm ExaminationCORNADO, MERIJOY G.Pas encore d'évaluation

- Activity 1 Home Office and Branch Accounting - General ProceduresDocument4 pagesActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaPas encore d'évaluation

- Spice Is Right ImportsDocument2 pagesSpice Is Right ImportsLaiza Grace FabrePas encore d'évaluation

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahPas encore d'évaluation

- Intercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupDocument60 pagesIntercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupPhil MO JoePas encore d'évaluation

- Mid PS3Document8 pagesMid PS3heyPas encore d'évaluation

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobPas encore d'évaluation

- Comprehensive Income & Discontinued Oper PDFDocument8 pagesComprehensive Income & Discontinued Oper PDFDarwin Competente Lagran0% (1)

- Module No. 1 - Week 1 Businessn CombinationDocument5 pagesModule No. 1 - Week 1 Businessn CombinationJayaAntolinAyustePas encore d'évaluation

- Module 13 Other Professional ServicesDocument18 pagesModule 13 Other Professional ServicesYeobo DarlingPas encore d'évaluation

- Afar 09Document14 pagesAfar 09RENZEL MAGBITANGPas encore d'évaluation

- Quiz in Business Combi, Conso and Corpo LiqDocument11 pagesQuiz in Business Combi, Conso and Corpo LiqExequielCamisaCrusperoPas encore d'évaluation

- CMPC131Document15 pagesCMPC131Nhel AlvaroPas encore d'évaluation

- Advanced Accounting Guerrero Peralta Volume 1 Solution ManualDocument190 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution ManualGrayl TalaidPas encore d'évaluation

- Home Office Branch and Agency Transaction Business Combination 1Document10 pagesHome Office Branch and Agency Transaction Business Combination 1PaupauPas encore d'évaluation

- AFAR ReviewDocument11 pagesAFAR ReviewPaupauPas encore d'évaluation

- Activity - Audit of InventoryDocument2 pagesActivity - Audit of InventoryRyan DueÑas GuevarraPas encore d'évaluation

- Chapter 3 Partnership Liquidation and IncorporationDocument73 pagesChapter 3 Partnership Liquidation and IncorporationHarry J Gartlan100% (1)

- Activity Task Business CombinationDocument7 pagesActivity Task Business CombinationCasper John Nanas MuñozPas encore d'évaluation

- Types of Joint ArrangementsDocument5 pagesTypes of Joint ArrangementsJean Ysrael Marquez100% (2)

- PRTC AFAR-1stPB 05.22Document12 pagesPRTC AFAR-1stPB 05.22Ciatto SpotifyPas encore d'évaluation

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaPas encore d'évaluation

- CHAPTER 6 Caselette Audit of InvestmentsDocument33 pagesCHAPTER 6 Caselette Audit of InvestmentsErica PortesPas encore d'évaluation

- P2Document18 pagesP2Robert Jayson UyPas encore d'évaluation

- AC 103 Midterm Exam PDFDocument28 pagesAC 103 Midterm Exam PDFXyriel RaePas encore d'évaluation

- Final Preboard May 08Document21 pagesFinal Preboard May 08Ray Allen PabiteroPas encore d'évaluation

- Taxation: Multiple ChoiceDocument16 pagesTaxation: Multiple ChoiceJomar VillenaPas encore d'évaluation

- AST MidtermsDocument12 pagesAST MidtermsRica Regoris100% (1)

- Chapter 6 ADVACC 2Document21 pagesChapter 6 ADVACC 2Angelic100% (1)

- Top 5 Accounting Firms in The PhilippinesDocument8 pagesTop 5 Accounting Firms in The PhilippinesRoselle Hernandez100% (3)

- Installment Sales QDocument5 pagesInstallment Sales QRed YuPas encore d'évaluation

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesPas encore d'évaluation

- ACC 142-PeriodicalDocument11 pagesACC 142-PeriodicalRiezel PepitoPas encore d'évaluation

- Foreign Currency Transactions2019Document6 pagesForeign Currency Transactions2019Jeann MuycoPas encore d'évaluation

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- 09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingDocument8 pages09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingJonailyn YR PeraltaPas encore d'évaluation

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezPas encore d'évaluation

- Afar NotesDocument6 pagesAfar NotesJane EstradaPas encore d'évaluation

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonPas encore d'évaluation

- LTCCDocument2 pagesLTCCN JoPas encore d'évaluation

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezPas encore d'évaluation

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinPas encore d'évaluation

- Insurance Contracts UploadDocument2 pagesInsurance Contracts UploadRafael BarbinPas encore d'évaluation

- Multiple Choic1Document4 pagesMultiple Choic1stillwinmsPas encore d'évaluation

- Partnerships Liquidation: Advanced Accounting, Fifth EditionDocument33 pagesPartnerships Liquidation: Advanced Accounting, Fifth Editionhasan jabrPas encore d'évaluation

- Advanced Accounting Home Office, Branch and Agency TransactionsDocument7 pagesAdvanced Accounting Home Office, Branch and Agency TransactionsMajoy Bantoc100% (1)

- ACT1205 - Module 3 - Audit of InvestmentsDocument6 pagesACT1205 - Module 3 - Audit of InvestmentsIo AyaPas encore d'évaluation

- ASSET 2019 Mock Boards - FARDocument7 pagesASSET 2019 Mock Boards - FARKenneth Christian WilburPas encore d'évaluation

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.Pas encore d'évaluation

- Aklan State Univeristy School of Management SchoolDocument4 pagesAklan State Univeristy School of Management SchoolKenneth Christian WilburPas encore d'évaluation

- LABORATORIES - It Is Defined As A Place Equipped For Experimental Study in ADocument1 pageLABORATORIES - It Is Defined As A Place Equipped For Experimental Study in AKenneth Christian WilburPas encore d'évaluation

- Controls TestDocument19 pagesControls TestKenneth Christian WilburPas encore d'évaluation

- Joint Products-By ProductsDocument19 pagesJoint Products-By ProductsKenneth Christian WilburPas encore d'évaluation

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburPas encore d'évaluation

- Theories: Far Eastern University - Manila Quiz No. 1Document6 pagesTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburPas encore d'évaluation

- Chapter-3 Homework CashDocument5 pagesChapter-3 Homework CashKenneth Christian WilburPas encore d'évaluation

- Q3 - Audit of Cash (S. Prob - KEY)Document7 pagesQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburPas encore d'évaluation

- Case DigestsDocument2 pagesCase DigestsKenneth Christian WilburPas encore d'évaluation

- Chapter-4 Homework ReceivablesDocument3 pagesChapter-4 Homework ReceivablesKenneth Christian WilburPas encore d'évaluation

- Q2 - Correction of Errors (S. Prob - KEY)Document7 pagesQ2 - Correction of Errors (S. Prob - KEY)Kenneth Christian WilburPas encore d'évaluation

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- Chapter-2 Homework MisstatementsDocument4 pagesChapter-2 Homework MisstatementsKenneth Christian WilburPas encore d'évaluation

- Quiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Document6 pagesQuiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Kenneth Christian WilburPas encore d'évaluation

- Q2 - Correction of Errors (S. Prob - KEY)Document7 pagesQ2 - Correction of Errors (S. Prob - KEY)Kenneth Christian WilburPas encore d'évaluation

- Quiz 9 - Subs Test - Audit of Inventory (KEY)Document4 pagesQuiz 9 - Subs Test - Audit of Inventory (KEY)Kenneth Christian WilburPas encore d'évaluation

- Quiz 8 - Audit of Inventory (Straight Prob - KEY)Document8 pagesQuiz 8 - Audit of Inventory (Straight Prob - KEY)Kenneth Christian Wilbur100% (1)

- Quiz 12 - Subs Test - Audit of Investment (Q)Document3 pagesQuiz 12 - Subs Test - Audit of Investment (Q)Kenneth Christian WilburPas encore d'évaluation

- Quiz 10 - Audit of Investment (BASIC PROB - KEY)Document5 pagesQuiz 10 - Audit of Investment (BASIC PROB - KEY)Kenneth Christian WilburPas encore d'évaluation

- Q3 - Audit of Cash (S. Prob - KEY)Document7 pagesQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburPas encore d'évaluation

- Q4 - Audit of Receivables (Prob - KEY)Document5 pagesQ4 - Audit of Receivables (Prob - KEY)Kenneth Christian Wilbur100% (1)

- Quiz 8 - Audit of Inventory (Straight Prob - KEY)Document8 pagesQuiz 8 - Audit of Inventory (Straight Prob - KEY)Kenneth Christian Wilbur100% (1)

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocument5 pagesThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburPas encore d'évaluation

- Final Exam - TaxDocument2 pagesFinal Exam - TaxKenneth Christian WilburPas encore d'évaluation

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Partnership ActivityDocument6 pagesPartnership ActivityKenneth Christian WilburPas encore d'évaluation

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburPas encore d'évaluation

- Analisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantoDocument12 pagesAnalisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantotresnaPas encore d'évaluation

- Tim Muller - Healthcare Deal Maker 2023Document3 pagesTim Muller - Healthcare Deal Maker 2023Timothee MullerPas encore d'évaluation

- Executive Summary CompleteDocument4 pagesExecutive Summary CompleteJepkemei MeliPas encore d'évaluation

- Course 2 Sample Exam Questions: y Units of BroccoliDocument47 pagesCourse 2 Sample Exam Questions: y Units of BroccoliEden ZapicoPas encore d'évaluation

- Test Bank For Strategic Management and Competitive Advantage 4th Edition BarneyDocument24 pagesTest Bank For Strategic Management and Competitive Advantage 4th Edition BarneyLindaEvansizgo100% (31)

- Depreciation Solution PDFDocument10 pagesDepreciation Solution PDFDivya PunjabiPas encore d'évaluation

- CV CFO Mario Perez Ago 22Document2 pagesCV CFO Mario Perez Ago 22alfredoPas encore d'évaluation

- The Influence of the Structure of Ownership and Dividend Policy of the Company (The Quality of the Earnings and Debt Policies are Intervening Variable): Empirical Study on Manufacturing Companies Listed on the Indonesia Stock ExchangeDocument22 pagesThe Influence of the Structure of Ownership and Dividend Policy of the Company (The Quality of the Earnings and Debt Policies are Intervening Variable): Empirical Study on Manufacturing Companies Listed on the Indonesia Stock ExchangeInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- International Financial Reporting StandardsDocument20 pagesInternational Financial Reporting StandardsMargareth SilvianaPas encore d'évaluation

- Basic Financial ManagementDocument12 pagesBasic Financial ManagementGama TamaPas encore d'évaluation

- Module4-FINANCIAL PLANNING AND FORECASTINGDocument11 pagesModule4-FINANCIAL PLANNING AND FORECASTINGRiza FarrePas encore d'évaluation

- Chapter 6 GitmanDocument14 pagesChapter 6 GitmanLee Shaykh86% (7)

- EconomyDocument5 pagesEconomyDranel BalacaPas encore d'évaluation

- Fin 425 Final NIKEDocument11 pagesFin 425 Final NIKEcuterahaPas encore d'évaluation

- Assurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonDocument21 pagesAssurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonmerantidownloaderPas encore d'évaluation

- Capital Market Contribution in An Economic Developing Country Like BangladeshDocument42 pagesCapital Market Contribution in An Economic Developing Country Like BangladeshRaihan WorldwidePas encore d'évaluation

- Fixed Income StrategyDocument29 pagesFixed Income StrategyBryan ComandiniPas encore d'évaluation

- CH 10Document9 pagesCH 10Antonios FahedPas encore d'évaluation

- CHAPTER 11 Dividend PolicyDocument56 pagesCHAPTER 11 Dividend PolicyMatessa AnnePas encore d'évaluation

- Chartier Et Al IndictmentDocument48 pagesChartier Et Al IndictmentNewsdayPas encore d'évaluation

- Outstanding Investor DigestDocument6 pagesOutstanding Investor DigestSudhanshuPas encore d'évaluation

- Finance ManagementDocument182 pagesFinance Managementuma3shinePas encore d'évaluation

- Q4 Financial Report PT Pyridam 2015 PDFDocument68 pagesQ4 Financial Report PT Pyridam 2015 PDFHyan IonaPas encore d'évaluation

- Amazon Stock Report $AMZNDocument7 pagesAmazon Stock Report $AMZNctringhamPas encore d'évaluation

- Green Mountain Coffee Roasters, IncDocument21 pagesGreen Mountain Coffee Roasters, IncaminoacidPas encore d'évaluation

- Stock 1Document5 pagesStock 1IrinaHaquePas encore d'évaluation

- Lesson 10 Stock and BondsDocument4 pagesLesson 10 Stock and BondsIrene FranciscoPas encore d'évaluation

- Productive Output MethodDocument36 pagesProductive Output MethodEcha NoviandiniPas encore d'évaluation

- Candidate Orientation L2 FinalDocument42 pagesCandidate Orientation L2 FinalelyPas encore d'évaluation

- 401k Cost Comparison WorksheetsDocument3 pages401k Cost Comparison Worksheetserichaaz0% (1)