Académique Documents

Professionnel Documents

Culture Documents

RCBC V Alfa

Transféré par

Jhoel VillafuerteTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

RCBC V Alfa

Transféré par

Jhoel VillafuerteDroits d'auteur :

Formats disponibles

RCBC v. Alfa RTW Manufacturing Corp., et al.

,

G.R. No. 133877

November 14, 2001

FACTS: Respondent applied for four Letters of Credit with petitioner to facilitate its purchase

of raw materials for its garments business. Upon said letters of credit, corresponding bill of

exchange of various amounts were drawn and charged to account of Alfa. Alfa had executed 4

Trust Receipts stipulating that it had received in trust for RCBC. When the obligations became

due, RCBC demanded payment citing 2 Comprehensive Surety Agreements allegedly executed

by the individual defendants. Under such surety agreement, it was essentially agreed that Alfa

and the signatory officers jointly guarantee the punctual payment of their obligation provided

that the liability of the individual defendants and Alfa shall not exceed the sum of P4 Million and

P7.5 Million and such interest as may accrue thereon and expenses as may be incurred by RCBC.

Upon default of payment, RCBC filed a civil case before RTC Makati for a sum of money

against Alfa and the individual defendants. The trial court ordered the defendants to pay RCBC

more than P18 Million inclusive of the interest and other legal fees. On appeal, CA affirmed the

decision of the trial court but modified the amount to only P3 Million inclusive of the stipulated

interest and other legal fees.

ISSUE: Whether or not the Court of Appeals erred in awarding to RCBC the minimal sum of P3

Million instead of P18 Million granted by the trial court

RULING: YES. The appellate court disregarded the parties’ stipulations in their contracts of

loan, specifically, those pertaining to the agreed interest rates, service charges and penalties in

case of any breach thereof. CA failed to apply the time-honored doctrine that which is agreed to

in a contract is the law between the parties. Thus, the obligations arising from contracts have the

force of law between the contracting parties and should be complied with in good faith. The

Court cannot vary the terms and conditions therein stipulated unless such stipulation is contrary

to law, morals, good customs, public order or public policy.

The present case involves an obligation arising from a letter of credit-trust receipt

transaction. Under this arrangement, a bank extends to a borrower a loan covered by the letter of

credit, with the trust receipt as security of the loan. In contracts contained in trust receipts, the

contracting parties may establish agreements, terms and conditions they may deem advisable,

provided they are not contrary to law, morals or public order. In the computation of interest, the

principal amount of loans corresponding to each trust receipt must earn an interest rate of 16%

per annum with the stipulated service charge of 2% per annum on the loan principal or the

outstanding balance thereof, from the date of execution until finality of court’s Decision. A

penalty of 6% per annum of the amount due and unpaid must also be imposed computed from

the date of demand until the finality of court’s Judgment. The interest of 16% per annum, as

long as unpaid, also earns interest which is computed from the date of filing of the complaint

until finality of the court’s decision. From such finality the total unpaid amount (principal +

interest + service charge + penalty + interest on the interest) computed shall earn interest of

12% per annum until satisfied.

Vous aimerez peut-être aussi

- Sia Vs CADocument1 pageSia Vs CAvaleryannsPas encore d'évaluation

- Bank of Commerce Vs Flores G.R. No. 174006 December 8, 2010Document1 pageBank of Commerce Vs Flores G.R. No. 174006 December 8, 2010Ebbe DyPas encore d'évaluation

- Central Bank of The Philippines vs. Dela Cruz and Rural BankDocument2 pagesCentral Bank of The Philippines vs. Dela Cruz and Rural BankMichelle Vale CruzPas encore d'évaluation

- Feati Bank vs. CADocument4 pagesFeati Bank vs. CAMulan DisneyPas encore d'évaluation

- Republic v. CA and ArquilloDocument1 pageRepublic v. CA and ArquilloJhoel VillafuertePas encore d'évaluation

- Republic v. CA and ArquilloDocument1 pageRepublic v. CA and ArquilloJhoel VillafuertePas encore d'évaluation

- Law in PracticeDocument307 pagesLaw in Practiceandyoch86Pas encore d'évaluation

- BBAA - Shareholders AgreementDocument43 pagesBBAA - Shareholders AgreementArvel DomingoPas encore d'évaluation

- Contract Terms - First Year StudentDocument15 pagesContract Terms - First Year StudentSahid S Kargbo100% (1)

- RCBC vs CA ruling on defective insurance policy endorsementsDocument4 pagesRCBC vs CA ruling on defective insurance policy endorsementsFncsixteen UstPas encore d'évaluation

- Cuyco v. Cuyco: Scope of Real Estate Mortgage and Imposition of Legal InterestDocument2 pagesCuyco v. Cuyco: Scope of Real Estate Mortgage and Imposition of Legal InterestClarisse Anne PeraltaPas encore d'évaluation

- MWSS V DawayDocument2 pagesMWSS V DawayPerry Rubio100% (1)

- RCBC v. Hi-Tri Development Corporation and Luz R. Bakunawa: Manager's Check Funds Not Subject to EscheatDocument1 pageRCBC v. Hi-Tri Development Corporation and Luz R. Bakunawa: Manager's Check Funds Not Subject to EscheatAiza OrdoñoPas encore d'évaluation

- SPOUSES SY v DE VERA-NAVARRO: Equitable mortgage vs legitimate contract of saleDocument1 pageSPOUSES SY v DE VERA-NAVARRO: Equitable mortgage vs legitimate contract of saleabbywinsterPas encore d'évaluation

- Digests 7Document10 pagesDigests 7KristineSherikaChyPas encore d'évaluation

- Metrobank vs. Go Case DigestDocument2 pagesMetrobank vs. Go Case DigestRyzer Rowan100% (1)

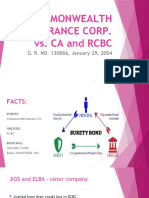

- Commonwealth v. RCBCDocument1 pageCommonwealth v. RCBCAna AltisoPas encore d'évaluation

- Spouses Silos v. PNBDocument2 pagesSpouses Silos v. PNBFrancisco Ashley AcedilloPas encore d'évaluation

- SPCL Case DigestsDocument191 pagesSPCL Case DigestsPaul Angelo TombocPas encore d'évaluation

- Metropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestDocument3 pagesMetropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestNullus cumunisPas encore d'évaluation

- Landl & Co. V. Metrobank G.R. No. 159622 July 30, 2004 FactsDocument3 pagesLandl & Co. V. Metrobank G.R. No. 159622 July 30, 2004 FactsJose MasaratePas encore d'évaluation

- PNB Vs FF CruzDocument4 pagesPNB Vs FF CruzSu Kings AbetoPas encore d'évaluation

- Lumantas v. CalapizDocument2 pagesLumantas v. CalapizAlleine TupazPas encore d'évaluation

- Court voids rental rate changes in rehabilitation planDocument2 pagesCourt voids rental rate changes in rehabilitation planRomPas encore d'évaluation

- Bank of America Vs CADocument2 pagesBank of America Vs CAVebsie D. Molavin100% (1)

- GR 147074 Paderes vs. CADocument3 pagesGR 147074 Paderes vs. CAJeremae Ann CeriacoPas encore d'évaluation

- BSB vs. Sally GoDocument4 pagesBSB vs. Sally GoJustinJalandoniPas encore d'évaluation

- BPI vs. de RenyDocument1 pageBPI vs. de RenyVanya Klarika NuquePas encore d'évaluation

- Arce v. Capital InsuranceDocument1 pageArce v. Capital InsuranceGerald SuarezPas encore d'évaluation

- Genuino Civil Law Digest. Republic Vs David To Vda de BuncioDocument16 pagesGenuino Civil Law Digest. Republic Vs David To Vda de BuncioJoyce GenuinoPas encore d'évaluation

- Gonzales v. PCIB (G.R. No. 180257)Document1 pageGonzales v. PCIB (G.R. No. 180257)Glenn Rey D. AninoPas encore d'évaluation

- Credit Transactions DigestDocument5 pagesCredit Transactions DigestMarcus J. ValdezPas encore d'évaluation

- People's Trans East v. Doctors of New MillenniumDocument3 pagesPeople's Trans East v. Doctors of New MillenniumJayson RacalPas encore d'évaluation

- G.R. No. 190043Document1 pageG.R. No. 190043anapot14Pas encore d'évaluation

- Estores v. SupanganDocument2 pagesEstores v. Supangan12234567890Pas encore d'évaluation

- Philippine National Bank vs Noah's Ark Sugar RefineryDocument2 pagesPhilippine National Bank vs Noah's Ark Sugar RefineryNica09_foreverPas encore d'évaluation

- PNB allowed to foreclose on mortgaged properties of company under liquidationDocument2 pagesPNB allowed to foreclose on mortgaged properties of company under liquidationHomer CervantesPas encore d'évaluation

- De La Paz Vs L & J DevelopmentDocument3 pagesDe La Paz Vs L & J DevelopmentMary Louisse RulonaPas encore d'évaluation

- 07 RCBC Savings Bank V OdradaDocument2 pages07 RCBC Savings Bank V OdradaAnonymous bOncqbp8yiPas encore d'évaluation

- Supreme Court Acquits Man of Child Abuse but Upholds Rape ConvictionDocument2 pagesSupreme Court Acquits Man of Child Abuse but Upholds Rape Convictionlim_daniellePas encore d'évaluation

- BDO Unibank, Inc. vs. Engr. Selwyn LaoDocument2 pagesBDO Unibank, Inc. vs. Engr. Selwyn Laolucky javellana100% (2)

- Bitanga Vs Pyramid ConstructionDocument1 pageBitanga Vs Pyramid ConstructionLaw StudentPas encore d'évaluation

- Letter of CreditDocument7 pagesLetter of Creditmeiji15Pas encore d'évaluation

- 73 Spouses Serfino v. Far East Bank and Trust Company (Now Bpi)Document1 page73 Spouses Serfino v. Far East Bank and Trust Company (Now Bpi)GSSPas encore d'évaluation

- MARFORI VS MAKING ENTERPRISES DISPUTE OVER MARSMAN BUILDINGDocument3 pagesMARFORI VS MAKING ENTERPRISES DISPUTE OVER MARSMAN BUILDINGTanya PimentelPas encore d'évaluation

- Hilario vs. MirandaDocument12 pagesHilario vs. MirandaNash LedesmaPas encore d'évaluation

- Prudential Bank Vs IacDocument3 pagesPrudential Bank Vs IacMon ChePas encore d'évaluation

- Equitable Pci Bank v. NG Sheung Ngor (2007)Document2 pagesEquitable Pci Bank v. NG Sheung Ngor (2007)Charmaine MejiaPas encore d'évaluation

- Soriano V. People G.R. NO. 162336 FEBRUARY 1, 2010 DoctrineDocument3 pagesSoriano V. People G.R. NO. 162336 FEBRUARY 1, 2010 DoctrineTricia CornelioPas encore d'évaluation

- Vintola V Insular Bank of Asia and America 150 Scra 140Document2 pagesVintola V Insular Bank of Asia and America 150 Scra 140MylesPas encore d'évaluation

- Producers Bank vs Excelsa Industries RulingDocument3 pagesProducers Bank vs Excelsa Industries Rulingangelsu04100% (1)

- SC Acquits Petitioners in Trust Receipts Case Due to Lack of Criminal IntentDocument2 pagesSC Acquits Petitioners in Trust Receipts Case Due to Lack of Criminal IntentHans Henly GomezPas encore d'évaluation

- Rule.68.Forem - Movido vs. RFCDocument1 pageRule.68.Forem - Movido vs. RFCapple_doctoleroPas encore d'évaluation

- Bank of the Philippine Islands Fails to Block Hotel's Rehabilitation PlanDocument3 pagesBank of the Philippine Islands Fails to Block Hotel's Rehabilitation PlanHannika SantosPas encore d'évaluation

- Po Pauco Vs Siguenza - G.R. No. 29295. October 22, 1928Document2 pagesPo Pauco Vs Siguenza - G.R. No. 29295. October 22, 1928Ebbe DyPas encore d'évaluation

- Philippine Supreme Court Upholds Hotel's Rehabilitation PlanDocument3 pagesPhilippine Supreme Court Upholds Hotel's Rehabilitation PlanJordan Tumayan100% (2)

- Union Bank Vs CADocument1 pageUnion Bank Vs CAJoben Del RosarioPas encore d'évaluation

- Transfield v. Luzon Hydro Corp DIGESTDocument3 pagesTransfield v. Luzon Hydro Corp DIGESTkathrynmaydeveza100% (5)

- Real Estate Development Center vs. Manila Banking CorporationDocument2 pagesReal Estate Development Center vs. Manila Banking CorporationSilver Anthony Juarez Patoc100% (1)

- Rizal Bank vs Alfa RTW Obligations and Interest RatesDocument2 pagesRizal Bank vs Alfa RTW Obligations and Interest RatesLyrehs SherylPas encore d'évaluation

- BPI vs. SPS Yu DigestDocument3 pagesBPI vs. SPS Yu DigestMary Louisse RulonaPas encore d'évaluation

- Polotan Vs CADocument3 pagesPolotan Vs CAMary Ann Isanan100% (1)

- MotumDocument2 pagesMotumDock AcePas encore d'évaluation

- COMMONWEALTH INSURANCE CORP vs. RCBCDocument14 pagesCOMMONWEALTH INSURANCE CORP vs. RCBCKê MilanPas encore d'évaluation

- BPI vs SPS YU - Truth in Lending Act Substantial ComplianceDocument4 pagesBPI vs SPS YU - Truth in Lending Act Substantial ComplianceNormzWabanPas encore d'évaluation

- Agency Trust and PartnershipDocument3 pagesAgency Trust and PartnershipJhoel VillafuertePas encore d'évaluation

- Zamoras V SU JRDocument1 pageZamoras V SU JRJhoel VillafuertePas encore d'évaluation

- Estate Liability for Guarantor's Obligations After DeathDocument10 pagesEstate Liability for Guarantor's Obligations After DeathJhoel VillafuertePas encore d'évaluation

- Agency Trust PartnershipDocument2 pagesAgency Trust PartnershipJhoel VillafuertePas encore d'évaluation

- Hilario V IACDocument1 pageHilario V IACJhoel VillafuertePas encore d'évaluation

- Borja v. BorjaDocument1 pageBorja v. BorjaJhoel VillafuertePas encore d'évaluation

- Silverio Vs RepublicDocument1 pageSilverio Vs RepublicJhoel VillafuertePas encore d'évaluation

- Borja v. BorjaDocument1 pageBorja v. BorjaJhoel VillafuertePas encore d'évaluation

- Godoy v. CA: Motion to Acquit Same as Demurrer to EvidenceDocument1 pageGodoy v. CA: Motion to Acquit Same as Demurrer to EvidenceJhoel VillafuertePas encore d'évaluation

- Criminal ProcedureDocument3 pagesCriminal ProcedureJhoel VillafuertePas encore d'évaluation

- Labor LawDocument2 pagesLabor LawJhoel VillafuertePas encore d'évaluation

- Agrarian Law and Social LegislationDocument14 pagesAgrarian Law and Social LegislationJhoel VillafuertePas encore d'évaluation

- Estolas V MabalotDocument2 pagesEstolas V MabalotJhoel Villafuerte100% (1)

- Buada V Cement CenterDocument3 pagesBuada V Cement CenterJhoel VillafuertePas encore d'évaluation

- Nisnisan V CADocument2 pagesNisnisan V CAJhoel VillafuertePas encore d'évaluation

- Go CincoDocument3 pagesGo CincoJhoel VillafuertePas encore d'évaluation

- Liability of HeirsDocument2 pagesLiability of HeirsJhoel VillafuertePas encore d'évaluation

- CPRDocument4 pagesCPRJhoel VillafuertePas encore d'évaluation

- Cornes V Leal RealtyDocument3 pagesCornes V Leal RealtyJhoel VillafuertePas encore d'évaluation

- LTDDocument1 pageLTDJhoel VillafuertePas encore d'évaluation

- Important LaborDocument1 pageImportant LaborJhoel VillafuertePas encore d'évaluation

- Digests PropertyDocument9 pagesDigests PropertyJhoel VillafuertePas encore d'évaluation

- Ladera v. HodgesDocument9 pagesLadera v. HodgesJhoel Villafuerte100% (1)

- TAOPA Vs PeopleDocument1 pageTAOPA Vs PeopleJhoel VillafuertePas encore d'évaluation

- BOC Jurisdiction Over Wood Product ImportationDocument1 pageBOC Jurisdiction Over Wood Product ImportationJhoel VillafuertePas encore d'évaluation

- Dela Cruz Vs MoyaDocument1 pageDela Cruz Vs MoyaJhoel VillafuertePas encore d'évaluation

- People Vs MarianoDocument1 pagePeople Vs MarianoJhoel VillafuertePas encore d'évaluation

- PPDM39 ModelDiagramsDocument198 pagesPPDM39 ModelDiagramsJosephine CapistranoPas encore d'évaluation

- Frustration (Notes and Cases)Document6 pagesFrustration (Notes and Cases)Shavi Walters-SkeelPas encore d'évaluation

- Annual General Meeting NoticeDocument210 pagesAnnual General Meeting NoticearunPas encore d'évaluation

- Letter of Intent - We Trade Corporation - Cannaray LTDDocument5 pagesLetter of Intent - We Trade Corporation - Cannaray LTDMaika Projects SupportPas encore d'évaluation

- THE ESSENTIAL ELEMENT OF THE PRINCIPAL-AGENT RELATIONSHIPDocument17 pagesTHE ESSENTIAL ELEMENT OF THE PRINCIPAL-AGENT RELATIONSHIPKingsley RajPas encore d'évaluation

- Data Sheet: High-Speed Switching DiodeDocument9 pagesData Sheet: High-Speed Switching Diode81968Pas encore d'évaluation

- Npcil - 2.2 GCC - Supply1Document67 pagesNpcil - 2.2 GCC - Supply1srama_narayanan100% (1)

- Contract/Agreemen T Procedures FOR Contract AdministrationDocument6 pagesContract/Agreemen T Procedures FOR Contract AdministrationDiana Alexandra ComaromiPas encore d'évaluation

- Procurement and TenderingDocument68 pagesProcurement and TenderingBUKENYA BEEE-2026Pas encore d'évaluation

- Reflective Optical Sensor GuideDocument7 pagesReflective Optical Sensor Guideluisemtz91Pas encore d'évaluation

- Takeover: Basic InformationDocument2 pagesTakeover: Basic InformationAbidi BéchirPas encore d'évaluation

- CONTRACTSDocument37 pagesCONTRACTSAaron ViloriaPas encore d'évaluation

- Suspension and TerminationDocument24 pagesSuspension and TerminationpremalanaiduPas encore d'évaluation

- Nature, Forms and Kinds of Agency Contract ExplainedDocument11 pagesNature, Forms and Kinds of Agency Contract Explainedmaricar_roca0% (1)

- San Miguel Corporation V NLRC Marc9Document4 pagesSan Miguel Corporation V NLRC Marc9Raymarc Elizer AsuncionPas encore d'évaluation

- Hyd Inc SwivelsDocument140 pagesHyd Inc SwivelsCentral HydraulicsPas encore d'évaluation

- GS What Lies Beneath PresentationDocument112 pagesGS What Lies Beneath PresentationBob MoncrieffPas encore d'évaluation

- Sale of Goods Implied CoditionDocument127 pagesSale of Goods Implied CoditionChaitanya PatilPas encore d'évaluation

- Pricebook 2014 InternationalDocument454 pagesPricebook 2014 InternationalALBERTO GONZALEZPas encore d'évaluation

- National Agricultural Cooperative Marketing Federation of India Ltd. (Nafed) NAFED House, Siddhartha Enclave Ashram Chowk, Ring Road New Delhi-110014Document32 pagesNational Agricultural Cooperative Marketing Federation of India Ltd. (Nafed) NAFED House, Siddhartha Enclave Ashram Chowk, Ring Road New Delhi-110014Rahul KumarPas encore d'évaluation

- Vodafone Cash Business Application FormDocument4 pagesVodafone Cash Business Application Formmichael AmponsahPas encore d'évaluation

- Mahila Pay and ParkDocument113 pagesMahila Pay and ParkSaurabh PednekarPas encore d'évaluation

- Davao Integrated Port Stevedoring Services Us. AbarquezDocument10 pagesDavao Integrated Port Stevedoring Services Us. Abarquez유니스Pas encore d'évaluation

- A. Express TermsDocument27 pagesA. Express TermscwangheichanPas encore d'évaluation

- Lawsuit SWDocument68 pagesLawsuit SWCBS 11 NewsPas encore d'évaluation

- 118184-2000-San Miguel Properties Phils. Inc. v. Spouses PDFDocument8 pages118184-2000-San Miguel Properties Phils. Inc. v. Spouses PDFGooglePas encore d'évaluation

- Terms of Contract SlidesDocument18 pagesTerms of Contract Slidessolar system100% (2)