Académique Documents

Professionnel Documents

Culture Documents

Impact of Fundamental Factors and Exchange Rate On The Stock Price of PT Garuda Indonesia (Persero) TBK Period of 2011-2018

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Impact of Fundamental Factors and Exchange Rate On The Stock Price of PT Garuda Indonesia (Persero) TBK Period of 2011-2018

Droits d'auteur :

Formats disponibles

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Impact of Fundamental Factors and Exchange

Rate on the Stock Price of Pt Garuda Indonesia

(Persero) Tbk Period of 2011-2018

Harum Wening Gayatri1

Hakiman Thamrin2

Pascasarjana, Universitas Mercubuana

Abstract:- This study aims to examine the fundamental to 2011. In 2013 Garuda again experienced a decline in

factors consisting of Current Ratio (CR), Operating share prices in the range of Rp.496 per share due to the

Profit Margin (OPM), Net Profit Margin (NPM), weakening of Garuda's performance.

Return On Assets (ROA), Return On Equity (ROE),

Debt to Equity Ratio (DER), Debt to Asset Ratio (DAR), In the following year, Garuda again experienced an

and Price to Earning Ratio (PER) and the exchange rate increase in share prices because it managed to close 2014 in

against the share price of Garuda Indonesia. The study the range of Rp. 555 per share. The increase in share price

uses secondary data taken from Garuda Indonesia's was allegedly caused by the resignation of Garuda

quarterly financial statements for the period 2011-2018. Indonesia's Managing Director, Emirsyah Satar. In

The analysis technique uses multiple linear regression addition, the change of Garuda Indonesia's board of

with SPSS version 20. The results showed the CR, directors has also made many investors optimistic about the

OPM, NPM, DAR and PER had no effect on stock new line of directors, thereby increasing Garuda's share

prices. ROA and ROE have a significant effect on the price. In 2015, it was known that Garuda had experienced

positive direction of stock prices. DER and exchange an increase in profit compared to 2014, however its share

rate have a significant effect with a negative direction price actually declined to Rp309 per share. The weakening

on stock prices. of the rupiah against the US dollar, which reached Rp

13,600 at the end of 2015, is thought to be the cause of the

Keywords:- Fundamental factor, Exchange rate dan decline. This also continued to occur in the following years

Stock price. until 2018 where Garuda closed its share price at Rp298 per

share.

I. INTRODUCTION

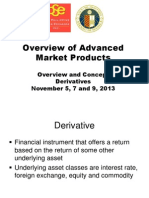

800

Garuda Indonesia is a state-owned company in the 750

700 730

field of transportation that has gone public. Through its IPO

dated 11 February 2011, Garuda Indonesia with the issuer 635

600

code GIAA officially issued its first share at a selling price 555

per share set by the Ministry of BUMN of Rp750. This 500 496

price is the lowest price offered, namely Rp750 to Rp1,100

400

by three underwriters, namely PT Mandiri Sekuritas, PT

338

Bahana Sekuritas, and PT Dana Reksa. But according to the 300 309 300298

Head of Research of PT e-Trading Securities, the initial

offering price of GIAA reflects 32.41 times the ratio of 200

share price compared to net profit per share and 2.21 times 100

the share price ratio compared to the book value so that it is

still relatively expensive when compared to Malaysia 0

Airlines, Singapore Airlines, or Cathay Pacific Airways. IPO Des Des Des Des Des Des Des Des

2011 2011 2012 2013 2014 2015 2016 2017 2018

Even though it is owned by the government, the Fig 1:- Development of Garuda Indonesia Stock Prices in

aviation industry which is currently in decline and many 2011-2018

airlines that have stopped operating due to bankruptcy also Source: Garuda Indonesia annual report, processed from

have a negative impact on the movement of GIAA stock www.idx.co.id 2019.

prices after officially taking the floor on the Indonesia

Stock Exchange. The failure of Garuda's shares caused the The decline in Garuda's share price in this study will

share price to decline and caused the three underwriters to be reviewed using a fundamental approach which according

experience a total loss of almost Rp690 billion (Lestari, to Ang (2017) basically talks about how investors conduct a

2014). In July 2012, Garuda's share price had increased historical analysis of the financial strength of a company,

because it almost reached its initial offering price of Rp730 where this process is often also referred to as company

per share. This increase was partly due to Garuda's ability analysis. In this research, fundamental factors such as

to reduce losses and increase revenue up to 100% compared

IJISRT20JAN566 www.ijisrt.com 1243

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Current Asset (CR), Operating Profit Margin (OPM), Net Formulation of the problem

Profit Margin (NPM), Return On Asset (ROA), Return On Based on the background that has been explained,

Equity (ROE), Debt to Equity Ratio (DER), Debt to Asset then the main problem in this study is to formulate how to

Ratio (DAR), and Price to Earning Ratio (PER). increase the price of Garuda Indonesia shares by seeking

changes in fundamental factors and anticipating changes in

Setyawan (2014) states that CR has a positive the exchange rate of the rupiah against the dollar (USD)

influence on stock prices. Anshari (2016) shows CR does which are further described in the following research

not affect stock prices. In Kandiman's research (2017), it questions:

shows that CR has a negative effect on stock prices. 1. Does CR affect the price of Garuda Indonesia shares?

2. Does OPM affect the price of Garuda Indonesia shares?

Nurlia's research (2016) found that OPM had a 3. Does NPM affect the price of Garuda Indonesia shares?

negative effect on stock prices, which was the opposite of 4. Does ROA affect the price of Garuda Indonesia shares?

Andrian's (2015) research because it found that OPM had a 5. Does ROE affect the price of Garuda Indonesia shares?

positive effect. Yanti (2013) actually states that OPM has 6. Does DER affect the price of Garuda Indonesia shares?

no effect on stock prices. 7. Does DAR affect the price of Garuda Indonesia shares?

8. Does PER affect the price of Garuda Indonesia shares?

Hutami (2012) concluded that NPM has a positive 9. Does the exchange rate affect the price of Garuda

effect on stock prices. Different results were shown by Indonesia shares?

Andrian (2015) and Nurlita (2018) who stated that NPM

had a negative and significant effect on stock prices. II. LITERATURE REVIEW

Hutapea et al (2017) found a different result that there was

no effect of NPM on stock prices. Capital Structure Theory

According to the trade-off theory revealed by Myers

Fathoni (2014) and Fauziah et al (2014) showed the (2011), "Companies will owe up to a certain level of debt,

fundamental factors of ROA were not proven to affect where the tax savings (tax shields) from additional debt

stock prices. While Mustofa (2016) shows ROA has a equals the cost of financial distress". Financial distress

significant positive effect on stock prices. Febrianti (2017) costs are bankruptcy costs or re-organization, and agency

shows ROA has a negative effect on stock prices. costs that increase as a result of the decline in the

credibility of a company. Trade-off theory in determining

Adi, et al (2012) who examined the effect of ROE on the optimal capital structure includes several factors

stock prices found a positive influence. In contrast to including taxes, agency costs and financial distress costs

Setyorini et al (2016) who found ROE to have a negative but still maintain the assumption of market efficiency and

effect on stock prices. While Sukmawati et al (2010) symmetric information as a balance and benefit of using

concluded ROE did not affect stock prices. debt. The optimal level of debt is reached when the tax

savings (tax shields) reach the maximum amount of the cost

The result of Mussalamah's research (2015) states that of financial distress.

DER has a negative effect on stock prices. Alipuddin's

research (2016) found the opposite, namely DER had a The pecking order theory explains why companies

significant positive effect on stock prices. Manoppo, et al that have higher levels of profit actually have smaller debt

(2017) said there was no influence between DER and stock levels. Specifically, companies have sequences of

prices. Puspitasari research results (2015) show that DAR preferences in the use of funds. In reality, there are

has a positive effect on changes in stock prices. Damayanti companies that use funds for their investment needs are not

and Valianti (2016) actually found the opposite of the appropriate as in the order (hierarchy) scenario mentioned

negative influence that DAR has on stock prices. in the pecking order theory. This is contrary to the pecking

order theory which states that the company will choose to

Stock prices and PER have a strong relationship issue debt first rather than issuing shares when it needs

supported by previous research by Ratih (2013). external funding.

Kartikasari's research (2012) found that PER had a negative

influence on stock prices. In contrast to research by Signaling Theory

Tresnawati (2017) who did not find the effect of PER on Signaling theory reveals that how a company should

stock prices. give signals to users of financial statements. This theory is

also supported by Herlina (2013) stating that information

Rachmadhanto and Raharja (2014) found the results from companies can be responded positively or negatively

that the exchange rate of the rupiah against foreign by investors, which can affect stock price volatility. Good

currencies had a positive influence on stock prices. Another quality companies will intentionally give a signal to the

study conducted by Wijaya (2012) found the opposite is market, thus the market is expected to be able to

that exchange rates have a negative effect on stock prices. differentiate between good and bad quality companies

The research result of Putri (2016) and Andriana (2015) (Sukirni, 2015). Share prices will rise when there is excess

results of her research showed that the exchange rate was demand and will fall if there is an oversupply (Madhavan

not significant to the stock price. and Richardson, 2017). Complete, accurate, relevant and

timely information is needed by investors in the capital

IJISRT20JAN566 www.ijisrt.com 1244

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

market as an analytical tool for making investment Tandelilin (2016) states that ROA illustrates the extent

decisions. of the ability of assets owned by the company can generate

profits. The higher ROA ratio indicates that the company is

Agency Approach more effective in utilizing assets to generate net income

According to this approach, capital structures are after tax, which also means that the company's performance

structured to reduce conflicts between various interest is more effective. Rising asset values will be accompanied

groups. The conflict between shareholders and managers is by rising share prices because ROA is a reflection of asset

the concept of free cash flow. There is a tendency for productivity so that assets are more productive in

managers to retain resources so that they have control over generating profit along with rising share prices. Signal

those resources. Debt can be considered as a way to reduce theory states that a high level of ROE will encourage

agency conflict with free cash flow. If the company uses managers to provide more detailed information, because

debt, then the manager will be forced to issue cash from the managers want to convince investors that the company is

company to pay interest. To do the right calculation of able to produce good profitability. The higher the value of

capital structure, companies need to use online accounting ROE, the higher the stock price, because the return or

software such as journals. Journals summarize all of your income obtained by the owner of the company will be

company's financial records into an accounting system that higher so that the company's stock price will increase.

can be used to produce financial reports according to the

needs of the company anytime and anywhere. With cloud Information on the increase in DER will be received

technology and a certified security system, Journals will by the market as a bad signal that will provide a negative

keep your financial data safe without fear of facing the risk entry for investors in making decision to buy shares. This

of loss. makes demand and share prices decline. At present a

company that has a small DER value is not necessarily

Purchasing Power Parity better than a company that has a larger DER, because

Purchasing Power Parity (PPP) is a theory that seeks basically the company cannot avoid debt. Every company

to see the relationship between inflation and the exchange needs working capital which sometimes cannot be funded

rate. According to purchasing power parity, the foreign by the profits obtained by the company.

exchange market is in a state of balance if all deposits /

savings deposits in various foreign currencies offer the According to Sartono (2014) the higher the DAR, the

same level of return (Madura, 2012). Regarding the greater the risk faced, and investors will ask for a higher

exchange rate in purchasing power parity, Ball, et al., level of profit, a high ratio indicates a low proportion of

(2014) stated that exchange rates between currencies of two own capital to finance assets. This will be responded

countries will be in balance if the prices of a group of negatively by investors in the capital market. The higher

goods and services in the two countries are the same. As the DAR of a company, the lower the company's stock

according to Madura (2012), the exchange rate is not price due to the greater debt costs can reduce the company's

permanent but will change to maintain purchasing power profitability. The decline in corporate profits will cause

parity. investor demand for the stock price is also reduced which

will then cause prices to decline. Thus the DAR is thought

Theoritical Framework to have a negative influence on stock prices.

A low CR will cause a decline in market prices of the

relevant stock price. On the other hand, a CR that is too PER is the relationship between prices on the stock

high is not necessarily good, because in certain conditions market and current earnings per share that are widely used

it shows that there are a lot of company funds that are by investors as a general guide to measuring the value of

unemployed (little activity) which can ultimately reduce the shares. PER shows the profit growth of the company, and

company's ability. The greater CR owned shows the investors will be interested in the profit growth so that in

company's ability to meet its operational needs, especially the end it will have an effect on stock prices. A high PER

working capital, which is very important to maintain the indicates that investors are willing to pay a premium share

company's performance, which in turn affects stock prices price for the company.

(Ratnasari, 2016).

Changes in the exchange rate of the rupiah against the

OPM describes what is usually called ‘pure profit dollar contribute to the movement of stock prices. The

received for each rupiah from sales made. The higher the weakening of the rupiah against the dollar can cause

OPM, the better the operations of a company. It can be company performance to decline because costs associated

concluded that the stock price depends on OPM, which in with export-import activities will increase so that it will

this case is predicted to have a positive relationship. While have an impact on decreasing stock returns due to sluggish

NPM is the acquisition of net profit after tax on sales. domestic and foreign investor interest to invest in

Suhardjono (2016) states if the greater the NPM, the companies (Farida and Darmawan, 2017).

company's performance will be more productive, so that it

will increase investor confidence to invest in the company. Penelitian Michael (2013) menyatakan nilai tukar

With NPM, investors can judge whether the company is rupiah berpengaruh negatif terhadap harga saham.

profitable or not. Penelitian Ouma dan Muriu (2014); Sholihah (2014);

Pujawati, et al., (2015); Saputra dan Dharmadiaksa (2016)

IJISRT20JAN566 www.ijisrt.com 1245

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

juga menyatakan nilai tukar berpengaruh negatif terhadap 7. DAR is this ratio measures the percentage of the

harga saham. Dengan demikian diduga bahwa nilai tukar amount of funds originating from debt both short and

yang tinggi akan membuat harga saham menjadi menurun long term (Fahmi, 2017). The DAR formula is as

sehingga arah hubungan yang dibangun adalah negatif. follows:

III. RESEARCH METHODOLOGY 𝒕𝒐𝒕𝒂𝒍 𝒖𝒕𝒂𝒏𝒈

𝑫𝑨𝑹 =

𝒕𝒐𝒕𝒂𝒍 𝒂𝒔𝒔𝒆𝒕

Operationalization of Variables

The variables in this study are operationalized as 8. PER is the market price of each share in the future

follows: (Jogiyanto, 2014). PER is formulated:

1. CR or current ratio is a ratio to measure the company's 𝒉𝒂𝒓𝒈𝒂 𝒑𝒆𝒓 𝒍𝒆𝒎𝒃𝒂𝒓 𝒔𝒂𝒉𝒂𝒎

ability to pay short-term liabilities or debt that are due 𝑷𝑬𝑹 =

𝒍𝒂𝒃𝒂 𝒃𝒆𝒓𝒔𝒊𝒉 𝒔𝒂𝒉𝒂𝒎

immediately when billed as a whole. The CR ratio

formula used is: 9. Exchange Rate is the price of one unit of US dollars

(USD) in Rupiah (Rp) (Simorangkir and Suseno, 2014).

𝒂𝒔𝒔𝒆𝒕 𝒍𝒂𝒏𝒄𝒂𝒓 In this study dollar exchange rate data was used during

𝑪𝑹 = the study period.

𝒖𝒕𝒂𝒏𝒈 𝒋𝒂𝒏𝒈𝒌𝒂 𝒑𝒆𝒏𝒅𝒆𝒌

2. OPM is a profitability ratio that shows how much 10. Share price is the price of a stock on the market that is

percentage of net income earned from each sale taking place on a stock exchange (Sunariyah, 2016). In

(Harahap, 2014). OPM can be calculated using the this study using the closing stock price (closing price).

formula:

Population and Sample

𝒍𝒂𝒃𝒂 𝒖𝒔𝒂𝒉𝒂 The population in this study is the quarterly financial

𝑶𝑷𝑴 = 𝒙 𝟏𝟎𝟎% statements of PT Garuda Indonesia Tbk. Samples were

𝒕𝒐𝒕𝒂𝒍 𝒑𝒆𝒏𝒋𝒖𝒂𝒍𝒂𝒏

taken with a saturated sampling technique where all

3. NPM according to Syamsuddin (2016) is the ratio members of the population were used as research samples.

between net income that is sales after deducting all In order to meet the requirements of the number of research

expenses including taxes compared to sales. The NPM samples, the research period taken was from 2011 to 2018

ratio is formulated: so that the sample size was obtained 32 samples of

financial statements.

𝒍𝒂𝒃𝒂 𝒔𝒆𝒕𝒆𝒍𝒂𝒉 𝒑𝒂𝒋𝒂𝒌

𝑵𝑷𝑴 = 𝒙 𝟏𝟎𝟎% Data Collection Method

𝒕𝒐𝒕𝒂𝒍 𝒑𝒆𝒏𝒋𝒖𝒂𝒍𝒂𝒏

The data collection method in this study uses the

documentation method because the data used are secondary

4. ROA is a comparison between net income after tax and

data. The quarterly financial statements of PT Garuda

assets to measure the level of total investment taking

Indonesia Tbk published during the period 2011-2018 are

(Tandelilin, 2016). ROA Ratio is formulated:

secondary data on the study.

𝒍𝒂𝒃𝒂 𝒔𝒆𝒕𝒆𝒍𝒂𝒉 𝒑𝒂𝒋𝒂𝒌

𝑹𝑶𝑨 = 𝒙 𝟏𝟎𝟎% Data Analysis Techniques

𝒕𝒐𝒕𝒂𝒍 𝒂𝒔𝒔𝒆𝒕 Data analysis techniques in this study used descriptive

statistical analysis and inferential statistics using multiple

5. ROE is a ratio that measures the ability of companies to

linear regression analysis with the SPSS program.

obtain profits available to shareholders of the company

(Darmadji and Fakhruddin, 2018). This ratio is

Y = a + β1 X1 + β2 X2 + β3 X3 + β4 X4 + β5 X5 + β6

formulated:

X6 + β7 X7 + β8 X8 + β9 X9 + e

𝒍𝒂𝒃𝒂 𝒔𝒆𝒕𝒆𝒍𝒂𝒉 𝒑𝒂𝒋𝒂𝒌

𝑹𝑶𝑬 = 𝒙 𝟏𝟎𝟎% Ket:

𝒕𝒐𝒕𝒂𝒍 𝒆𝒌𝒖𝒊𝒕𝒂𝒔 Y = Harga saham

β123, dst = Koefisien regresi

6. DER according to Syamsuddin (2016) is a ratio that can

X1 = CR

show the relationship between the number of long-term

X2 = OPM

loans provided by company owners. The DER formula

X3 = NPM

is:

𝒕𝒐𝒕𝒂𝒍 𝒖𝒕𝒂𝒏𝒈 X4 = ROA

𝑫𝑬𝑹 = X5 = ROE

𝒕𝒐𝒕𝒂𝒍 𝒎𝒐𝒅𝒂𝒍 X6 = DER

X7 = DAR

X8 = PER

X8 = Nilai tukar

e = standar eror

IJISRT20JAN566 www.ijisrt.com 1246

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

IV. RESEARCH RESULT Seen PER variable obtained a regression coefficient of

0.213 with a positive sign. This means that PER has a

Multiple Linear Regression Analysis positive relationship with stock prices. If Garuda Indonesia

Multiple linear regression is an analysis that is used is able to increase the Price Earning ratio, it will cause the

simultaneously to examine two or more variables with a stock price to increase by 21.3% (0.213 x 100%).

dependent variable (Ghozali, 2016). Based on the results of

data processing, the following multiple linear regression LNKURS variable regression coefficient obtained -

equation is obtained: 0.433 with a negative sign. These results indicate that the

exchange rate has a negative relationship with stock prices.

Y = -4,062 + 0,223 CR + 0,034 OPM – 0,021 NPM If the dollar exchange rate increases, the stock price will

+ 0,661 ROA + 0,393 ROE – 0,618 DER + 0,177 DAR + decrease by 43.3% (0.433 x 100%).

0,213 PER – 0,433 LNKURS + e

Goodnes of Fit Test Results

The constant value obtained is -4,062. The negative Goodness of fit test results aim to test the feasibility of

value in this constant shows that the price of Garuda the overall regression model. This is done with the

Indonesia shares tends to be at a low level during 2011 to significance test F and the coefficient of determination as

2018. follows:

The CR regression coefficient obtained 0.223 with a Model F Sig.

positive sign indicates that Garuda Indonesia has a fairly 1 Regression 25.318 .000a

good Current Ratio and has a positive relationship with Residual

stock prices. If Garuda Indonesia can increase the Current Total

Ratio then this will make the share price increase by 22.3% Table 1:- Significance Test Results F

(0.223 x 100%).

Based on the data shown the calculated F value of

OPM variable regression coefficient obtained 0.034 25.318 with sig 0,000. At df1 = 9 and df2 = 23 5%

with a positive sign. These results indicate that if Garuda significance obtained F table value of 2.32. This result thus

Indonesia experiences an increase in Operating Profit shows that all independent variables (CR, OPM, NPM,

Margin, the share price will increase by 3.4% (0.034 x ROA, ROE, DER, DAR, PER and exchange rate)

100%). simultaneously have a significant effect on Garuda

Indonesia stock prices because F count is 25.318> F table

It is known that NPM obtained a regression 2.32 and sig 0,000 <sig 0.05.

coefficient of -0,021 with a negative sign indicating a

negative influence of NPM on stock prices. If Garuda The determination coefficient test aims to determine

Indonesia experiences an increase in the Net Profit Margin the percentage of the effect of independent variables on the

side, the share price will decrease by 2.1% (0.021 x 100%). dependent variable (Ghozali, 2016). The coefficient of

determination test results are obtained as follows:

The ROA variable obtained a regression coefficient of

0.661 with a positive sign. This means that ROA has a Model R R Square Adjusted R Square

positive relationship with stock prices. If Garuda Indonesia 1 .955a .912 .876

is able to increase Return on Assets, the share price will Table 2:- Test Results for the Coefficient of Determination

increase by 66.1% (0.661 x 100%). Sumber : data diolah, 2019.

ROE variable regression coefficient obtained 0.393 The coefficient of determination is formulated R2 =

with a positive sign. These results indicate that if Garuda Adjusted R Square X 100%. From the table above shows

Indonesia experiences an increase in Return on Equity, the the determination coefficient value of 0.876 which means

share price will increase by 39.3% (0.393 x 100%). that all independent variables namely CR, OPM, NPM,

ROA, ROE, DER, DAR, PER and exchange rates have the

It is known that DER obtained a regression coefficient ability of 87.6% in explaining variations in stock prices.

of -0.618 with a negative sign indicating a negative While the remaining 12.4% is influenced by other variables

influence of DER on stock prices. If Garuda Indonesia not examined in this study.

experiences an increase in Debt to Equity Ratio, the share

price will decrease by 61.8% (0.618 x 100%). Hypothesis Test Results

1. Hypothesis 1 - The effect of CR on stock prices is

DAR regression coefficient obtained 0.177 with a shown by the regression coefficient of 0.223 t count

positive sign indicates that Garuda Indonesia has a Debt to 1.518 and sig 0.143 information rejected. These results

Asset Ratio that has a positive relationship with stock indicate that CR has no effect on stock prices because

prices. If Garuda Indonesia can increase its Debt to Asset the value of t value 1.518 <t table 2.042 at a

Ratio this will make the share price increase by 17.7% significance level of 5% two-party test.

(0.177 x 100%). 2. Hypothesis 2 - The influence of OPM on stock prices is

shown by the regression coefficient of 0.034 t count

IJISRT20JAN566 www.ijisrt.com 1247

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

0.079 and sig 0.938 information rejected. These results V. DISCUSSION

indicate that OPM has no effect on stock prices because

the t value is 0.079 <t table 2.042 at the 5% significance Effect of Current Ratio on Share Prices

level of the two-party test. Hypothesis 1 test results indicate rejected, meaning

3. Hypothesis 3 - The effect of NPM on stock prices that CR has no effect on stock prices. These results indicate

obtained a regression coefficient of -0.021 with a that the high and low CR values owned by Garuda

calculated value of -0.018 and sig of 0.985. At the 5% Indonesia do not become a benchmark for investors in

significance level of the two-party test the t value of determining the company's financial condition, so it does

table 2.042 was obtained. Thus these results indicate not affect the movement of stock prices in the capital

that NPM has no effect on stock prices because the market. The results of this study contradict the previous

value of t arithmetic is smaller than the value of t table research conducted by Saputri and Soekotjo (2016),

(-0.018 <2.042) at the significance level of 5%. Pratama and Erawati (2014), and Setiyawan and Pardiman

4. Hypothesis 4 - The effect of ROA on stock prices shows (2014) which have shown that the current ratio affects stock

the value of the ROA regression coefficient on stock prices. The results of this study are more in line with Ansari

prices is 0.661 with a t value of 1.980 and significance (2016), Antareka (2016), and Bagherzadeh et al (2013)

of 0.060. The t value in the table with a significance which states that CR has no effect on stock prices.

level of 10% for the two-party test was 1,697. Thus

these results indicate that ROA is proven to have a Effect of Operating Profit Margin on Share Prices

significant effect on stock prices because t value 1.980> The results showed that OPM was not proven to have

t table 1.697 and sig 0.060 <sig 0.10. The value of the an effect on stock prices, thus H2 was rejected. These

regression coefficient that is positive indicates the results indicate that the higher OPM does not necessarily

direction of influence given by ROA is positive, reflect the better operations of the company so that it does

meaning that if ROA has increased by 1% then it will not affect the determination of share prices on the capital

make the stock price also increased by 66.1%. market. The results of the study are in line with previous

5. Hypothesis 5 - The effect of ROE on stock prices shows research by Nugroho (2011) which states that OPM is not

that the ROE regression coefficient on stock prices is significant to stock prices.

0.393 with t count 1.871 and sig 0.075. These results

indicate that ROE has a positive and significant effect Effect of Net Profit Margin on Share Prices

on stock prices because the value of t value 1.871> t NPM is the net profit after tax on sales. The results

table 1.697 with sig 0.075 <sig 0.10. Thus it was shown showed that NPM did not significantly affect stock prices,

that the increase that occurred in ROE would be able to which means H3 was rejected. This indicates that the

increase share prices by 39.3%. company's achievement of net profit from sales is not able

6. Hypothesis 6 - The effect of DER on stock prices shows to attract investors to invest in the company so that it has no

the value of the DER regression coefficient on stock effect on the stock price. The results of this study are in line

prices is -0.618 and the t value is -2.556 with sig 0.018. with Hutapea et al (2017) and Sholihah (2018) which states

T table at the 5% significance level of the two-party test that NPM is not significant to the company's stock price.

obtained 2,042. These results indicate that DER has a This means that management has failed in terms of

significant negative effect on stock prices because - operations (sales) and this will result in reduced investor

2,556> -2,042 and sig 0,018 <sig 0,05. The increase in confidence in investing in the company. NPM measures the

DER will reduce the share price by 61.8%. company's ability to generate net profits from sales made

7. Hypothesis 7 - Effect of DAR on stock prices The by the company.

regression coefficient value is shown at 0.177 and t

arithmetic 1.601 sig 0.121. T count value of 1.601 <t NPM does not affect the stock price implies that when

table 2.042 shows that DAR does not significantly net profit rises, total sales will go up, this is due to the high

influence the stock price at the 5% significance level of costs incurred by the company.

the two-party test.

8. Hypothesis 8 - The effect of PER on stock prices shows Effect of Return on Assets on Share Prices

that PER is insignificant to stock prices because t values Hypothesis 4 test results show that ROA is proven to

obtained are 1.728 <t table 2.042 at the 5% significance have a significant effect on stock prices in a positive

level of the two-party test. direction. The results of the study are in line with several

9. Hypothesis 9 - The effect of the exchange rate on the studies including Ferdianto (2014) who concluded that

stock price is shown the LNKURS regression ROA affects the share price in the mining sector in 2011-

coefficient value of the stock price is -0.433 and the t 2013. Another study by Muksal (2014) showed that the

value is -2.335 with sig 0.028. T table at the 5% secondary market sector in the Jakarta Islamic Index (JII)

significance level of the two-party test obtained 2,042. ROA affected stock prices. Research by Rahmi et al. (2013)

These results indicate that the exchange rate has a who conducted research on the variable ROA, the results

significant negative effect on stock prices because - found were that the ROA variable had a positive effect on

2,351> -2,042 and sig 0,028 <sig 0,05. An increase in stock prices. The results of this study have the implication

the exchange rate will reduce share prices by 43.3%. that the company's ability to generate a return on assets

used, makes the company have the opportunity to increase

growth so that it can effectively generate profits which

IJISRT20JAN566 www.ijisrt.com 1248

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

ultimately becomes a positive signal that reflects the Novasari (2013), and Prasetyo (2012) which states that

company's financial prospects in the future. PER is not significant to stock prices. In this research PER

cannot be used to predict or predict high or low stock

Effect of Return on Equity on Share prices prices, or in other words stock prices are not influenced by

Hypothesis 5 test results indicate received in a PER. This is because investors usually look for shares

positive direction which means an increase in ROE will using other considerations such as Earning Per Share.

make the stock price also increased. This is in line with the

signal theory which states that high levels of ROE Effect of Exchange Rates on Share Prices

encourage managers to convince investors that the Hypothesis 9 test results show that the exchange rate

company is able to produce good profitability. Similar has a significant negative effect on stock prices. This

research results were conducted by Ratih (2013) who found indicates that the weakening of the rupiah against the dollar

that ROE has a positive and significant effect on stock can cause company performance to decline because costs

prices. In line with the opinion of Saleh (2015) Kohansal et associated with export-import activities will increase so that

al. (2013), Wang et al. (2013) who found Return on Equity it will have an impact on decreasing stock returns. The

(ROE) significant and positive effect on stock prices. This results of the study are in line with previous studies

research implies that the higher the value of ROE, the conducted by Anggoro (2011) and Wijaya (2012) who

higher the share price, because the return or income found that the exchange rate had a negative effect on stock

obtained by the company owner will be higher so that the prices. This research implies that the weakening

company's stock price will increase. With the ability of (decreasing) of the exchange rate of the rupiah against the

Garuda Indonesia to produce high rates of return on the value of foreign currencies (US dollars) has a negative

capital used, it is considered a positive thing, giving rise to impact on the equity market, causing the capital market to

a good perception in the eyes of investors. not attract investors, causing investors to turn to the money

market because it has greater profits.

Effect of Debt to Equity Ratio on Share Prices

DER can be used as a measurement of how far a VI. CONCLUSIONS

company is financed by the creditor. Hypothesis 6 test

results show that DER has a significant effect on stock From the results of the research described,

prices in a negative direction, which means an increase in conclusions can be drawn:

DER will make the stock price decrease and conversely a 1. CR has no effect on the share price of Garuda Indonesia

decline in DER will make the stock price increase. This in the 2011-2018 financial statement period. The

result is in line with the pecking order theory which states financial condition shown by CR does not become a

that an increase in DER will be accepted by the market benchmark for investors in evaluating the company's

shows that the company does not have sufficient retained performance so that it does not affect the stock offering.

earnings to finance the company's operations so that it must 2. OPM has no effect on the share price of Garuda

use external funds for expansion requirements that are Indonesia in the 2011-2018 financial statement period.

subject to bankruptcy risk. The results of this study are in OPM which is always changing is not a consideration of

line with previous studies by Ratih (2013), Safitri (2013), investors in determining their investment in the

and Raharjo (2013) because they have shown that DER has company.

a negative effect on stock prices. 3. NPM has no effect on the share price of Garuda

Indonesia in the 2011-2018 financial statement period.

Effect of Debt to Asset Ratio on Share Prices The high value of NPMs does not cause share prices to

If the company has a higher DAR value, the amount become higher in the capital market.

of loan capital from the company will also be high. The 4. ROA has a significant effect on the positive direction of

higher the DAR of a company, the lower the company's the share price of Garuda Indonesia in the 2011-2018

stock price due to the greater debt costs can reduce the financial statement period. The higher the company's

company's profitability. However, the results of the study achievements in net income from assets, showing better

showed different because the DAR in this study was not performance and attracting investors, thereby increasing

proven to affect the price of shares in the capital market. share prices.

Results are in line with previous research by Ponggohong 5. ROE has a significant effect on the positive direction of

(2016) which states that DAR is not significant to stock the share price of Garuda Indonesia in the 2011-2018

prices. financial statement period. High ROE is a good signal

to increase stock prices in the capital market.

Effect of Price to Earning Ratio on Share Prices 6. DER has a significant negative effect on the price of

Hypothesis 8 test results show that PER has no effect Garuda Indonesia stock prices in the 2011-2018

on stock prices. Thus this indicates that the profit growth of financial statement period. The composition of the debt

the company is not able to attract investors so that it will value that is too large can cause investors to see it as a

not have any effect on stock prices. The results of the study bad signal of the risk of bankruptcy faced by the

contradict Primayanti (2013) and Ademola et al. (2016) company, thereby reducing share prices.

Price Price Earning Ratio (PER) has a positive and 7. DAR has no effect on the share price of Garuda

significant effect on stock prices. The results of the study Indonesia in the 2011-2018 financial statement period.

are in line with previous research by Tresnawati (2017),

IJISRT20JAN566 www.ijisrt.com 1249

Volume 5, Issue 1, January – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

8. PER has no effect on the share price of Garuda [8]. Sugiyono. 2015. Metode Penelitian Kuantitatif R&D.

Indonesia in the 2011-2018 financial statement period. Bandung : Alfabeta.

The size of the uncertain PER does not affect investor [9]. Tandelilin, Eduardus. 2012. Analisis Investasi Dan

valuations on the company's stock price. Manajemen Portofolio. Yogyakarta: BPFE UGM.

9. The exchange rate has a significant negative effect on [10]. Weston dan Copeland. 2011. Manajemen Keuangan.

the price of Garuda Indonesia shares in the 2011-2018 Jilid I. Edisi ke 9. Jakarta : Binarupa Aksara.

financial statement period. The high dollar exchange

rate makes companies have to pay more for operations

whose raw materials are purchased imported so that

investors are worried about the poor financial

performance which will ultimately reduce the price of

shares.

From the research results that have been explained, it

can be given research suggestions as follows:

1. Garuda Indonesia can increase the net profit

achievement of the total assets owned so that it will

attract investors to invest in the company and ultimately

make the stock price increase because investors will be

interested in the condition of the company that has the

ability to manage earnings per asset well.

2. The company can also increase the efficiency of the use

of capital (shares) in order to generate high net income

so that it can be a good signal to be able to increase

share prices.

3. Garuda Indonesia can pay close attention to the use of

external debt more proportionally so as not to provide

speculation that the company is experiencing losses

which can ultimately maintain the stability of share

prices on the capital market.

4. Garuda Indonesia can make savings in such a way as to

cover operational costs and optimize various other

financial items so that operational costs can be covered

even though the exchange rate has increased.

5. It is recommended that further studies examine other

financial variables that are thought to be able to trigger

changes in Garuda Indonesia stock prices.

REFERENCES

[1]. Ang, Robert. 2017. Buku Pintar Modal Indonesia.

Jakarta : Media Soft Indonesia.

[2]. Brigham & Houston. 2013. Dasar-dasar Manajemen

Keuangan. Jakarta: Salemba Empat.

[3]. Fakhrudin. 2011. Pasar Modal Indonesia. Edisi

Ketiga. Jakarta : Salemba Empat

[4]. Ghozali, Imam. 2015. Aplikasi Analisis Multivariate

dengan program IBM SPSS 19: Semarang: Badan

penerbit UNDIP.

[5]. Husnan, Suad. 2012. Dasar-dasar Manajemen

Keuangan. Edisi Keenam. Cetakan Pertama.

Yogyakarta: STIM YKPN.

[6]. Iwan dan Ika. 2019. Pengaruh Current Ratio, Debt To

Equity Ratio dan Return On Assets Terhadap Price

Earning Ratio (Studi Kasus pada Sub Sektor

Konstruksi dan Bangunan yang Terdaftar di Bursa

Efek Indonesia Tahun 2012–2017). Jurnal Ilmiah

Manajemen Bisnis, Volume 5, No. 2 Universitas

Mercubuana

[7]. Sartono, Agus. 2014. Manajemen Keuangan Teori

dan Aplikasi. Edisi 4. Yogyakarta: BPFE.

IJISRT20JAN566 www.ijisrt.com 1250

Vous aimerez peut-être aussi

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Explorning the Role of Machine Learning in Enhancing Cloud SecurityDocument5 pagesExplorning the Role of Machine Learning in Enhancing Cloud SecurityInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- A Review: Pink Eye Outbreak in IndiaDocument3 pagesA Review: Pink Eye Outbreak in IndiaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- Studying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaDocument5 pagesStudying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Navigating Digitalization: AHP Insights for SMEs' Strategic TransformationDocument11 pagesNavigating Digitalization: AHP Insights for SMEs' Strategic TransformationInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Hepatic Portovenous Gas in a Young MaleDocument2 pagesHepatic Portovenous Gas in a Young MaleInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Review of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsDocument5 pagesReview of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Automatic Power Factor ControllerDocument4 pagesAutomatic Power Factor ControllerInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Formation of New Technology in Automated Highway System in Peripheral HighwayDocument6 pagesFormation of New Technology in Automated Highway System in Peripheral HighwayInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Drug Dosage Control System Using Reinforcement LearningDocument8 pagesDrug Dosage Control System Using Reinforcement LearningInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- The Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicDocument7 pagesThe Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Mobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaDocument2 pagesMobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Securing Document Exchange with Blockchain Technology: A New Paradigm for Information SharingDocument4 pagesSecuring Document Exchange with Blockchain Technology: A New Paradigm for Information SharingInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Perceived Impact of Active Pedagogy in Medical Students' Learning at the Faculty of Medicine and Pharmacy of CasablancaDocument5 pagesPerceived Impact of Active Pedagogy in Medical Students' Learning at the Faculty of Medicine and Pharmacy of CasablancaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Intelligent Engines: Revolutionizing Manufacturing and Supply Chains with AIDocument14 pagesIntelligent Engines: Revolutionizing Manufacturing and Supply Chains with AIInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Enhancing the Strength of Concrete by Using Human Hairs as a FiberDocument3 pagesEnhancing the Strength of Concrete by Using Human Hairs as a FiberInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Exploring the Clinical Characteristics, Chromosomal Analysis, and Emotional and Social Considerations in Parents of Children with Down SyndromeDocument8 pagesExploring the Clinical Characteristics, Chromosomal Analysis, and Emotional and Social Considerations in Parents of Children with Down SyndromeInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Supply Chain 5.0: A Comprehensive Literature Review on Implications, Applications and ChallengesDocument11 pagesSupply Chain 5.0: A Comprehensive Literature Review on Implications, Applications and ChallengesInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Teachers' Perceptions about Distributed Leadership Practices in South Asia: A Case Study on Academic Activities in Government Colleges of BangladeshDocument7 pagesTeachers' Perceptions about Distributed Leadership Practices in South Asia: A Case Study on Academic Activities in Government Colleges of BangladeshInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Advancing Opthalmic Diagnostics: U-Net for Retinal Blood Vessel SegmentationDocument8 pagesAdvancing Opthalmic Diagnostics: U-Net for Retinal Blood Vessel SegmentationInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- The Making of Self-Disposing Contactless Motion-Activated Trash Bin Using Ultrasonic SensorsDocument7 pagesThe Making of Self-Disposing Contactless Motion-Activated Trash Bin Using Ultrasonic SensorsInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Natural Peel-Off Mask Formulation and EvaluationDocument6 pagesNatural Peel-Off Mask Formulation and EvaluationInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Beyond Shelters: A Gendered Approach to Disaster Preparedness and Resilience in Urban CentersDocument6 pagesBeyond Shelters: A Gendered Approach to Disaster Preparedness and Resilience in Urban CentersInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Handling Disruptive Behaviors of Students in San Jose National High SchoolDocument5 pagesHandling Disruptive Behaviors of Students in San Jose National High SchoolInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- José Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1Document8 pagesJosé Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1karen hudes100% (1)

- A Study On People Perception Towards Stock Market PROJECT MANAGMENTDocument43 pagesA Study On People Perception Towards Stock Market PROJECT MANAGMENTChinmaya MohantyPas encore d'évaluation

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaPas encore d'évaluation

- Gross KlussmannDocument131 pagesGross KlussmannMotiram paudelPas encore d'évaluation

- Financial Analysis of DG Khan Cement Company LtdDocument19 pagesFinancial Analysis of DG Khan Cement Company LtdHissan AhmedPas encore d'évaluation

- Bank Strategic Planning and Budgeting ProcessDocument18 pagesBank Strategic Planning and Budgeting ProcessBaby KhorPas encore d'évaluation

- Overview of Advanced Derivatives MarketsDocument19 pagesOverview of Advanced Derivatives MarketsAllene Leyba Sayas-TanPas encore d'évaluation

- What is Market Profile in 40 CharactersDocument3 pagesWhat is Market Profile in 40 Charactersnakulyadav7Pas encore d'évaluation

- Capital Market in India ProjectDocument26 pagesCapital Market in India ProjectNamrataShahaniPas encore d'évaluation

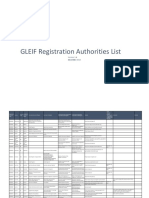

- GLEIF Registration Authorities List: 4 December 2018Document33 pagesGLEIF Registration Authorities List: 4 December 2018fhrjhaqobPas encore d'évaluation

- HKUST Canvas - Quiz 3 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionsDocument10 pagesHKUST Canvas - Quiz 3 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionslauyingsumPas encore d'évaluation

- Air Canada, WestJet Push Back Return of 737 MaxDocument1 pageAir Canada, WestJet Push Back Return of 737 MaxGeniePas encore d'évaluation

- HW4 Corporate Finance QuestionsDocument12 pagesHW4 Corporate Finance QuestionsDaniel ChiuPas encore d'évaluation

- PROFITMART - Franchisee-1Document17 pagesPROFITMART - Franchisee-1Suyash KhairnarPas encore d'évaluation

- BANKING ISSUESDocument17 pagesBANKING ISSUESbhavyaPas encore d'évaluation

- Xii Mcqs CH - 11 Redemption of DebenturesDocument4 pagesXii Mcqs CH - 11 Redemption of DebenturesJoanna GarciaPas encore d'évaluation

- GLIFDocument38 pagesGLIFTigmarashmi MahantaPas encore d'évaluation

- Private Commercial BanksDocument7 pagesPrivate Commercial Banksjakia sultanaPas encore d'évaluation

- Pricing Asian and Basket Options Via Taylor ExpansionDocument35 pagesPricing Asian and Basket Options Via Taylor ExpansionSorasit LimpipolpaibulPas encore d'évaluation

- Project Report: Submitted byDocument68 pagesProject Report: Submitted bySammy GaurPas encore d'évaluation

- Stock Broking Firms 2003Document41 pagesStock Broking Firms 2003sudipkudasPas encore d'évaluation

- Financial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Document2 pagesFinancial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Mahesh Shinde100% (1)

- Greater Rochester 40 Under 40 African American LeadersDocument48 pagesGreater Rochester 40 Under 40 African American LeadersMessenger Post MediaPas encore d'évaluation

- Panera Bread Business Plan FinalDocument19 pagesPanera Bread Business Plan FinalCarly NelsonPas encore d'évaluation

- Financial Statements-Schedule-III - Companies Act, 2013 PDFDocument13 pagesFinancial Statements-Schedule-III - Companies Act, 2013 PDFCA Ujjwal KumarPas encore d'évaluation

- Sample Questions:: Section I: Subjective QuestionsDocument8 pagesSample Questions:: Section I: Subjective Questionsnaved katuaPas encore d'évaluation

- 9.2更新-2022 ACE实习信息汇总Document228 pages9.2更新-2022 ACE实习信息汇总Zack ZhangPas encore d'évaluation

- MasDocument13 pagesMasHiroshi Wakato50% (2)

- Etf Guide PDFDocument2 pagesEtf Guide PDFFalconsPas encore d'évaluation