Académique Documents

Professionnel Documents

Culture Documents

Rouble Crisis, Again: Fiscal Balances

Transféré par

Sadia AliDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rouble Crisis, Again: Fiscal Balances

Transféré par

Sadia AliDroits d'auteur :

Formats disponibles

ROUBLE CRISIS, AGAIN

In May, the rouble came under more pressure than at any time since Black Tuesday in October 1994.

Since the introduction of the currency corridor in 1995, the strong rouble has served as a nominal an-

chor for the economy, helping bring down inflationary expectations and giving foreign investors the

confidence to lend to the Russian government, banks, and companies. Commitment to the rouble cor-

ridor limited the Central Bank’s ability to print money, and forced the government to finance its defi-

cits in non-inflationary ways – by borrowing on the domestic and international bond markets. Infla-

tion has been brought down from 200 percent per year in early 1995 to 8 percent today. The anchor is

now at risk, threatening to undermine Russia’s hard-earned stability. This report analyses what has

brought Russia’s currency to the brink of devaluation.

Fiscal balances

With a low initial stock of domestic debt, the bond market did not at first impose severe constraints

on government finances. But high interest rates and profligate borrowing, especially during the 1996

election season, caused the stock of GKO's to rise from 3.5% at the end of 1995 to 13.5% of GDP

two years later. Most of this debt was short-term, with an average maturity of under a year. In the

spring of 1997, the government began a gradual deficit reduction, assisted by falling interest rates. In

the first four months of 1998, the government brought the deficit down to 4.4% of GDP by running a

primary surplus (the deficit minus interest payments) of 0.5% of GDP.

Budget deficit (%, GDP)

1

-1

-2

-3

-4

-5

-6

-7

-8

-9

-10

1996 Q 1 1996 Q 2 1996 Q 3 1996 Q 4 1997 Q 1 1997 Q 2 1997 Q 3 1997 Q 4 1997 Q 1

Prim ary deficit Interestpaym ents

Source: Ministry of Finance

RUSSIAN ECONOMIC TRENDS, June 1998 1

The fiscal tightening is an important achievement, and has reduced the government’s need for new

financing. But even though it is currently not borrowing to finance its current spending, the govern-

ment must still raise an average of 8 billion roubles each week to roll over the existing domestic debt

as it matures. Each week, as the debt comes due, investors decide anew whether to keep their capital

in rouble assets. The government must therefore constantly work to retain confidence both in its own

creditworthiness and in the rouble’s on-going stability. When investors grow less willing to hold rou-

bles, the government must offer higher interest rates. These higher interest rates increase the govern-

ment’s debt burden and feed investor concerns about whether the government will be able to pay

them back.

Existing GKO/OFZ debt coming due for repayment during 1998 (R bln)

12

10

0

05.08

09.09

03.06

24.06

26.08

02.09

30.09

23.09

08.07

29.07

22.07

10.06

19.08

16.09

12.08

28.10

09.12

23.12

17.06

01.07

15.07

07.10

14.10

04.11

21.10

25.11

18.11

11.11

Principal due Interest payments

Source: CBR

The concern is not that the government will actually default on its debt obligations. Rather, investors

fear that if interest rates rise to punitively high levels – both for the government and for companies in

the real economy – the Central Bank will be tempted to loosen monetary policy in an attempt to

lower interest rates. In the process, the real value of the debt would fall, but the rouble would be sac-

rificed. During the recent crisis, yields on rouble-denominated debt have soared, while dollar-

denominated debt yields have hardly moved, evidence that investors are concerned about the cur-

rency rather than the government’s likelihood of default.

RUSSIAN ECONOMIC TRENDS, June 1998 2

Interest rates on dollar and rouble debt

60

50

40

30

20

10

0

30.09 14.10 28.10 12.11 26.11 10.12 25.12 14.01 28.01 11.02 25.02 12.03 26.03 09.04 23.04 08.05 25.05

Interest rate on Russian dollar MinFin debt Inflation adjusted interest rate on Russian rouble debt

Source: Moscow Times, Troika Dialog

GKO's, Rouble deposits and M0 (R bln)

400

350

300

250

200

150

100

50

0

12.95 03.96 06.96 09.96 12.96 03.97 06.97 09.97 12.97 03.98

M0 R ouble deposits G KO & O FZ (m arketvalue)

Source: CBR

RUSSIAN ECONOMIC TRENDS, June 1998 3

Demand for rouble assets

Russia’s domestic debt is not high by international standards. The trouble is that Russian households

and companies, for a variety of reasons, have been unwilling to keep their capital in roubles. The

stock of rouble-denominated government debt has grown larger than the total stock of rouble depos-

its in commercial banks.

With the slight economic recovery in 1997, the financial health of Russian companies improved, and

corporate rouble deposits grew. But households, who saw the real value of their deposits wiped out

during the 1992 inflation, remain unwilling to commit their savings to rouble assets. Russians are

also discouraged from holding roubles by inefficient banks offering low interest rates and few serv-

ices to depositors, and by ever-inquisitive tax inspectors. Instead, the preferred instrument both for

savings and for many transactions remains dollar cash. In the second half of 1997, household rouble

deposits increased by $1.2 bln, with time deposits actually falling by $0.9 bln, while Russians bought

a net $9.6 bln of foreign currency cash, perhaps driven by fears that the January 1 re-denomination

would be confiscatory. Household purchases of foreign cash in the last quarter of 1997 were $5.9 bln,

exactly matching the decline in Central Bank foreign exchange reserves over the same period.

Non-resident purchases of GKO's, resident purchases of foreign cash and changes in reserves,

1997 ($ bln)

10

-2

-4

-6

Q1 Q2 Q3 Q4

N et non-resident inflow s into G K O s N et purchases of foreign currency cash by residents Increase in foreign exchange reserves

Source: CBR

It is foreigners who have made up the difference. Their holdings of GKO's and OFZ's increased

sharply during the late 1996 and the first half of 1997, a period when emerging debt markets were

buoyant around the world. Foreigners’ share of the government rouble debt market increased to

roughly 30% in the summer of 1997. Then in July, Thailand devalued the Baht, setting off a chain of

events that was to lead to a sea change in market sentiment. Russia as a large emerging market bor-

rower was severely hit. Investors became much more cautious about taking on Russian risk, and de-

manded a higher interest rate to do so. Since the Russian debt markets are dependent on foreign par-

ticipation, the CBR had to let interest rates rise sufficiently to keep the foreign investors in the mar-

ket and thus to assure the stability of the rouble.

RUSSIAN ECONOMIC TRENDS, June 1998 4

Higher interest rates have turned out to be sufficient to stem the outflow of foreigners, who continue

to own almost a third of the market. Even in the last quarter of 1997, when the sell-off was particu-

larly severe, there was a net inflow of $0.2 bln into GKO's. Foreign investors have been price sensi-

tive, coming into and out of the market depending on the interest rate level and the perceived “fun-

damental” risk. The graph below shows that periods when the exchange rate was at the top of the

CBR’s daily intervention band (i.e. when the CBR was purchasing dollars and so replenishing re-

serves) coincided with periods of falling GKO interest rates, and vice-versa.

Interest rates and capital movements*

5 80

70

4

60

50

3

40

2

30

20

1

10

0 0

01.10 15.10 29.10 12.11 26.11 10.12 25.12 13.01 27.01 10.02 24.02 11.03 25.03 08.04 22.04 07.05 22.05

Daily exchange rate as a proportion of CBR 's daily intervention band (lhs) Six-month G KO interest rate (rhs)

* The lower line is the position of the MICEX daily rate inside the daily intervention band of the CBR. Peri-

ods when it is at the top of the band are those where the CBR is buying dollars and so building reserves. At

these times of capital inflows interest rates on GKO's are falling (the upper line). Periods when the exchange

rate is at the bottom of its daily band are those where the CBR is supporting the rouble by selling dollars for

roubles. At these time of capital outflows the interest rate on GKO's is increasing.

Source: CBR, Troika Dialog

In the euphoric investment climate of the first ten months of 1997, Russian banks took the opportu-

nity to borrow heavily in the syndicated loan and Eurobond markets. Foreign liabilities of the bank-

ing system increased from 11% of total liabilities at the beginning of 1997 to 17.5% at the end of the

year. The banks used these foreign funds to invest in Russian assets: treasury bills, regional and cor-

porate bonds, loans to the private sector, and equity. During the course of 1997, Russian banks saw

their foreign liabilities overtake their foreign assets. By the end of March 1998, foreign liabilities ex-

ceeded foreign assets by about $6.5 bln, not including off-balance sheet rouble forward exposure.

RUSSIAN ECONOMIC TRENDS, June 1998 5

Foreign assets and liabilities of commercial banks (R bln)

120

80

17.2%

40

11%

8.5%

0

01.96 03.96 05.96 07.96 09.96 11.96 01.97 03.97 05.97 07.97 09.97 11.97 01.98 03.98

Foreign liabilities Foreign assets

Note: percentages refer to the share of total bank liabilities. Liabilities do not include off-balance sheet items

such as rouble forwards.

Source: CBR

After the Asian crisis hit Russia in October 1997, the flow of foreign money came to a halt. None-

theless, Russian banks must continue to find foreign currency to service these loans, and may find

themselves needing to repay the principal as well if their creditors refuse to roll the loans over when

they come due. These rollovers have been thrown into doubt by the sharp decline in the value of

banks’ assets, which has made them much less attractive credit risks. Banks have been forced to sell

off assets at extremely low prices to meet their obligations. Fears about the solvency of Russian

banks have come to a head since the Central Bank placed Tokobank, one of the top twenty banks and

a heavy borrower from foreigners, into administration when it became clear that it would be unable

to make payments to its creditors.

The drop in Central Bank foreign exchange reserves – driven by the outflow of households and the

reduced inflow of foreign capital – led the monetary authorities to raise interest rates, causing an ac-

tual decline in base money. Without any new inflows of capital into the banking system, this has

made credit extremely tight and further driven down asset prices.

RUSSIAN ECONOMIC TRENDS, June 1998 6

Base money and Gross International Reserves of the CBR (R bln)

180

160

140

120

100

80

60

40

20

0

01.97 03.97 05.97 07.97 09.97 11.97 01.98 03.98

Base money G ross international reserves

Source: CBR

Outlook

Falling GKO yields late this week may mean that the worst of the current crisis has past. But points

of weakness remain. To avoid a renewed crisis, the government must take a number of steps. First,

the federal government must continue to cut its deficit, both by forging ahead with its plan to cut ex-

penditures and by drawing on other sources of revenue – most importantly, by recovering revenue

that has been lost to wasteful regional governments. Second, the government should consider con-

ducting a greater proportion of its borrowing in foreign currency at longer maturities. Third, Russians

must be convinced to hold more roubles. Currency stability is necessary but not sufficient. Russia

needs a more efficient, trustworthy banking system. International experience of banking reform show

that introducing foreign competition into the retail banking sector is the most direct way of improv-

ing bank efficiency and reducing dependence on volatile foreign capital flows.

In the short term, the need to maintain confidence in the rouble will impose a straightjacket on the

government’s behaviour. The need to roll over billions of roubles of GKO's each week puts eco-

nomic policy under constant scrutiny from foreign and domestic investors. Any sign of wavering

from the course of reform by the government would incur immediate punishment from the bond

market, and would put the rouble in jeopardy once again.

RUSSIAN ECONOMIC TRENDS, June 1998 7

ECONOMIC UPDATE

Output GDP and investment (1995=100, SA)

105

There is now GDP data for the first four months

of 1998. However, that data is likely to be re- 100

Real GDP

vised which makes comparisons with 1997 dif- 95

ficult to interpret. Revisions to 1998 data are

90

likely to imply a flat economy more or less. A

definite verdict has to await further work by Go- 85

skomstat. More generally, growth is likely to 80

falter this year due to repeated periods with

turmoil on Russian markets. High interest rates 75

Fixed investment

and lack of funding will again delay the long- 70

awaited recovery of the economy. 01.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98 04.98

Industrial production numbers show some

moderate growth. The January-April average Industry (1995=100, SA)

was about 0.8 % higher than the average for 105

Energy and fuels output

1997 as a whole. Agricultural production in- 100

creased by about the same amount. Indicators

of activity in the construction sectors were in- 95 Industrial production

conclusive. While, real construction works were 90

down by 0.8 % in January-April 1998 over the

85

full-year 1997 number, dwellings completed

were up by 2.7 %. Freigth transportation turn- 80

over went down by 1.4 %. 75

70

01.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98 04.98

Aggregate demand

The demand indicators suggest less gloom. Consumer expenditures and retail sales

Real wholesale trade was 1.4 % higher in (1995=100)

January-April than in the same period in 1997. 120 Consumer expenditures

Meanwhile, real retail sales went up by 3.2 %. 115 Retail sales

By contrast, real paid services went down by 110

0.7 %. Thus, demand seems to be increasing 105

although real incomes have been falling. In the 100

95

first four months of this year, real disposable

90

household income was down by 7.4 % over the

85

same period in 1997.

80

01.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98 04.98

RUSSIAN ECONOMIC TRENDS, June 1998 8

Wages

Real wages and wage arrears

The trend towards higher accrued wages has- 300 150

continued so far in 1998. In April, the average

monthly wage was 8.3 % higher than in April 260

Real wage arrears,

140

Dec-1995=100

last year. The increase between the first four (left scale)

months of 1997 to the first four months of 1998 220 130

Real monthly wage due,

was even higher at 9.5 %. However, this devel- 1995=100 (right scale)

opment has been matched by a further unwel- 180 120

come runup of wage arreas. Nominal wage ar-

rears amounted to R 50.1 bn at end-April com- 140 110

pared to R 39.7 bn at end-1997 and R 36.7 bn

at end-April 1997. 100 100

01.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98 04.98

Arrears

Arrears and Bank Credits & Loans, % of

March figures for non-payments were again

GDP*

disappointing, with all types of arrears, includ-

ing government wage debt, rising by 4- 5.5% 45.0

compared to the previous month. In an attempt 40.0

to collect some of the nearly hopeless tax 35.0

debts, the government issued a new resolution 30.0

To employees

on May 22. It aims at centralising all of state 25.0

To budget &

claims to the companies at the Federal Bank- 20.0 extra-budgetary

ruptcy Service and introduces a ‘quick bank- 15.0

ruptcy’ procedure which attempts to raise 10.0

To suppliers

money for creditors through a sale of an enter- 5.0

Bank loans & credits

prise as a going concern. This option may 0.0

01.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98

make bankruptcy more acceptable to local

*Data is for the four sectors of the economy (industry,

authorities, as it softens social implications of agriculture, transport & construction) prior to January

insolvency procedure. 1998 and for the whole of the economy from January

1998

Prices Inflation rates, % per year

Inflation has been declining steadily. The

twelve-month increase in the CPI amounted to 25

only 7.9 % in April, down from 15.3 % in April of

the year before. As before, service prices rose 20

particularly fast, increasing by 16.5 % as com-

pared to 6.5 % for food and beverages, and 15

Consumer

6.3 % for non-food goods. Producer price infla- price index

10

tion has decelerated even more rapidly and is

now running at only 3.9 %. This favorable trend

5

attests to the success of the authorities in tam- Producer price index

ing inflation. However, inflation is not likely to

0

fall much further, while it would rise again if the 01.97 03.97 05.97 07.97 09.97 11.97 01.98 03.98

rouble would weaken in a major way.

RUSSIAN ECONOMIC TRENDS, June 1998 9

Foreign Trade

The trade surplus showed the usual seasonal

improvement in March, reaching $ 2.3 bn in the Merchandise exports and imports ($ bn)

10

first quarter of 1998. Still, exports were 14% 9

lower than in March 1997. Price of Russian oil 8 Exports

continued to fall, with exporters trying to off-set 7

these effects by charging above-the-market 6

prices on exports to CIS countries, a reverse of 5

the situation that prevailed before 1998. Last 4

year’s balance of payments figures published 3

Imports

by the CBR showed 1997 current account sur- 2

plus shrinking to $3.3 bn, or 0.7% of GDP from 1

$12.1 bn in 1996 on the back of falling trade 0

01.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98

surplus and widening deficit in interest and divi-

dends payments. Foreign direct investment Source: Goskomstat

increased 2.5 times last year reaching $6.2 bn.

The budget

In the first four months of 1998, the federal

budget ran an IMF-definition deficit of 4.4% of

Federal budget deficit, % GDP

GDP, down from 8.5% in the first four months

6

of 1997. The primary budget, not including debt

4

service expenditures of 4.9% of GDP, ran a

2

surplus of 0.5% of GDP in the same period. 0

The primary surplus in the month of April was -2 Debt service

0.8% of GDP, meaning that the federal gov- -4

ernment has run primary surpluses for an un- -6

precedented third consecutive month. -8

Primary balance

-10

The deficit reduction was achieved by reducing -12

federal spending to 15.3% of GDP in the first -1401.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98 04.98

four months, down from 18.9% in the same pe-

riod of 1997. Major cuts have occurred in

spending on subsidies to industry and agricul-

ture and on aid to other CIS countries. Regional

governments have also begun to pay back the Federal revenues and expenditures, % GDP

loans they took from the federal government in 35

late 1997 to settle wage arrears to their em-

30 Federal expenditures

ployees.

25

Federal tax collection slipped in April to 9.2% of 20

GDP, down from 9.5% in March and 12% of 15

GDP in the same month of 1997. Revenue for

10

the first four months rose to 10.9% of GDP Federal revenues

between January and April, up from 10.4% in 5

the first four months of 1997, but remained be- 0

low the government’s budget target. Regional 01.96 04.96 07.96 10.96 01.97 04.97 07.97 10.97 01.98 04.98

and local revenues were a robust 11.8% of

GDP in the first quarter, slightly higher than the

same period of the previous year.

RUSSIAN ECONOMIC TRENDS, June 1998 10

Interest rates Interest rates and inflation, % per year

160

The CBR increased interest rates three times in

May. The final rise brought the Refinance rate 140

CBR

R efinance rate

and the Lombard rates to 150% on May 29. 120

This is the highest level since February 1996, a 100

time at which inflation in the preceeding 12 80

months had been 90%. In the year to April 60 6 month G KO

1998, the inflation rate was down to just about yield

40

8%. The level of the refinance rate reveals the

severity of the crisis that hit Russian markets in 20 CPI

May. 0

01.10.97 27.11.97 29.01.98 27.03.98 26.05.98

Source: Troika Dialog, CBR

Financial markets

Moscow Times $ Index 1997-1998

The Russian stock market suffered its worst 450

falls in May. It was down 40% in the month, hit- 400

ting lows at levels that occurred in between the

350

two rounds of the presidential elections in June

300

1996. Markets were very thin and sentiment

250

very bearish. One of the main futures exchange

200

collapsed. Rumours of bank and brokers losses

150

abounded. By the end of May, the Moscow

100

Times was 70% below its peak of the summer

of 1997. 50

0

12.96 03.97 05.97 07.97 09.97 10.97 12.97 03.98 05.98

Source: Moscow Times

The exchange rate

The rouble exchange rate and daily inter-

As discussed in the special section to this re-

vention band (R/$)*

port, at the center of the crisis was the stability 5.80

of the rouble. Though it fluctuated inside the

5.85

Central Bank’s daily intervention band over the

course of the month, the rate did not change 5.90

much more than normal. Indeed, in the month, 5.95

it fell by its usual average of 0.5% against the 6.00

dollar. However the pressure on it was severe, 6.05

with the CBR using about $1.5 bn of reserves

6.10

to defend its stability. This reduced reserves to

6.15

$14.6 bn at the beginning of June.

6.20

01.09 29.09 27.10 24.11 23.12 23.01 20.02 23.03 20.04 20.05

* MICEX exchange rate

Source: CBR

RUSSIAN ECONOMIC TRENDS, June 1998 11

Vous aimerez peut-être aussi

- Courage Is CallingDocument26 pagesCourage Is CallingAverage consumer50% (2)

- PlannersBundle 2023Document28 pagesPlannersBundle 2023grgrgrgr100% (1)

- Cleric Spell List D&D 5th EditionDocument9 pagesCleric Spell List D&D 5th EditionLeandros Mavrokefalos100% (2)

- Avatar Legends The Roleplaying Game 1 12Document12 pagesAvatar Legends The Roleplaying Game 1 12azeaze0% (1)

- A Financial History of The United States PDFDocument398 pagesA Financial History of The United States PDFiztok_ropotar6022Pas encore d'évaluation

- On Second Thought by Wray Herbert - ExcerptDocument23 pagesOn Second Thought by Wray Herbert - ExcerptCrown Publishing Group22% (9)

- Anecdotal Records For Piano Methods and Piano BooksDocument5 pagesAnecdotal Records For Piano Methods and Piano BooksCes Disini-PitogoPas encore d'évaluation

- Kierkegaard, S - Three Discourses On Imagined Occasions (Augsburg, 1941) PDFDocument129 pagesKierkegaard, S - Three Discourses On Imagined Occasions (Augsburg, 1941) PDFtsuphrawstyPas encore d'évaluation

- BattleRope Ebook FinalDocument38 pagesBattleRope Ebook FinalAnthony Dinicolantonio100% (1)

- Bonus Masters and InspiratorsDocument73 pagesBonus Masters and InspiratorsGrosseQueue100% (1)

- Case StudyDocument3 pagesCase StudyAnqi Liu50% (2)

- Hse Departmental Meeting Attendance SheetDocument1 pageHse Departmental Meeting Attendance SheetJunard Lu HapPas encore d'évaluation

- The Toyota Kata Practice Guide: Practicing Scientific Thinking Skills for Superior Results in 20 Minutes a DayD'EverandThe Toyota Kata Practice Guide: Practicing Scientific Thinking Skills for Superior Results in 20 Minutes a DayÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- Adam Grant - Given and TakeDocument62 pagesAdam Grant - Given and TakeDavi GomesPas encore d'évaluation

- EmTech TG Acad v5 112316Document87 pagesEmTech TG Acad v5 112316Arvin Barrientos Bernesto67% (3)

- The Fusion Marketing Bible: Fuse Traditional Media, Social Media, & Digital Media to Maximize MarketingD'EverandThe Fusion Marketing Bible: Fuse Traditional Media, Social Media, & Digital Media to Maximize MarketingÉvaluation : 5 sur 5 étoiles5/5 (2)

- Galactic CompassDocument7 pagesGalactic CompassPedro WinnerPas encore d'évaluation

- Local Situation Covid19 enDocument11 pagesLocal Situation Covid19 enHo AndyPas encore d'évaluation

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 enDEFPas encore d'évaluation

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 enHally TillsPas encore d'évaluation

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 engggAaaaPas encore d'évaluation

- HCMC Market Presentation Q3 2010 - enDocument42 pagesHCMC Market Presentation Q3 2010 - enmaykidPas encore d'évaluation

- Confidence and Self DoubtDocument10 pagesConfidence and Self DoubtAminkeng JoshuaPas encore d'évaluation

- Local Situation Covid19 enDocument8 pagesLocal Situation Covid19 enErik ChanPas encore d'évaluation

- Monthly Holidays Schedule: Father's DayDocument9 pagesMonthly Holidays Schedule: Father's DayFrancisco RamirezPas encore d'évaluation

- 7 16 10TheWrongDebateDocument3 pages7 16 10TheWrongDebaterichardck30Pas encore d'évaluation

- Excel Program of WorksDocument2 pagesExcel Program of WorksrichardPas encore d'évaluation

- Yearly Overview v2 LargeDocument2 pagesYearly Overview v2 LargeAshleyPas encore d'évaluation

- Irony and Satire English Quiz Presentation in Cream Modern Abstract StyleDocument20 pagesIrony and Satire English Quiz Presentation in Cream Modern Abstract StyleHy SomachariPas encore d'évaluation

- Copy of Копия Project Management Gantt Chart TemplateDocument1 pageCopy of Копия Project Management Gantt Chart TemplatemangeoPas encore d'évaluation

- P007 Abn CCC Ar SHD 2553 S01Document1 pageP007 Abn CCC Ar SHD 2553 S01Abdul basithPas encore d'évaluation

- Heritage Transport Museum: Village-Fatehpur District-MewatDocument1 pageHeritage Transport Museum: Village-Fatehpur District-MewatHarshita ParnamiPas encore d'évaluation

- P007 Abn CCC Ar SHD 2559 S01Document1 pageP007 Abn CCC Ar SHD 2559 S01Abdul basithPas encore d'évaluation

- Dräxlmaer B1Document1 pageDräxlmaer B1Anastasia GiscaPas encore d'évaluation

- TEORIAPDF2Document1 pageTEORIAPDF2Thalita RamanaPas encore d'évaluation

- Index Books of Shaykh-ul-Islam DR Muhammad Tahir-ul-QadriDocument9 pagesIndex Books of Shaykh-ul-Islam DR Muhammad Tahir-ul-QadriMinhajBooks50% (2)

- Mapa URI-SA 2017: Campo de Futebol Sete AreiaDocument1 pageMapa URI-SA 2017: Campo de Futebol Sete AreiaCleiton ReisdorferPas encore d'évaluation

- Jeffhadennet The Motivation Myth ExcerptDocument20 pagesJeffhadennet The Motivation Myth ExcerptAlex Fernando Trujillo BriosoPas encore d'évaluation

- Des-J-1360-001-01-0 (Mto - Sketch - Form)Document1 pageDes-J-1360-001-01-0 (Mto - Sketch - Form)Yawar AliPas encore d'évaluation

- 8 6 10similaritiesto2008Document2 pages8 6 10similaritiesto2008richardck50Pas encore d'évaluation

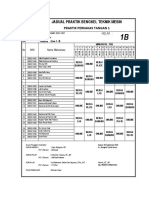

- Jadwal Praktek Bengkel 1B PDFDocument2 pagesJadwal Praktek Bengkel 1B PDFAdib RizqullohPas encore d'évaluation

- Jadwal Praktek Bengkel 1BDocument2 pagesJadwal Praktek Bengkel 1BAdib RizqullohPas encore d'évaluation

- Redemptor PapercraftDocument6 pagesRedemptor PapercraftReinaldo Vinicius de SouzaPas encore d'évaluation

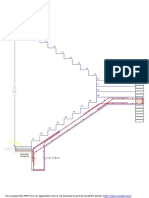

- 12 - Adega - Cortes - Vinhas Do Morro-ModelDocument1 page12 - Adega - Cortes - Vinhas Do Morro-ModelFlávia FreitasPas encore d'évaluation

- El Buen Lector Se Hace, No Nace - Reflexiones Sobre La Lectura y La Escritura - Felipe GarridoDocument1 pageEl Buen Lector Se Hace, No Nace - Reflexiones Sobre La Lectura y La Escritura - Felipe GarridoHarve Leyva SolanoPas encore d'évaluation

- Activitate OnlineDocument4 pagesActivitate OnlineRadu SoarePas encore d'évaluation

- MCC 3Document16 pagesMCC 3vinod kumarPas encore d'évaluation

- Process AutomationDocument1 pageProcess Automationpradeep1987coolPas encore d'évaluation

- Pormenores VÃOSDocument1 pagePormenores VÃOSIsmaelAmarchandePas encore d'évaluation

- You Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterDocument1 pageYou Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterSIOMARA MARIBEL JURADO GARCIAPas encore d'évaluation

- Donation SheetDocument1 pageDonation SheetCeleste ThompsonPas encore d'évaluation

- Dhoelra Marigold 548Document8 pagesDhoelra Marigold 548Nitish BhattacharjeePas encore d'évaluation

- Feb 08 - Work ProgrammeDocument13 pagesFeb 08 - Work ProgrammeChong Wee LinPas encore d'évaluation

- l2::l Satrufa 5/sunfa : M T W TDocument6 pagesl2::l Satrufa 5/sunfa : M T W THania MumtazPas encore d'évaluation

- 3 QTD MCO and Cumulative Outflow AnalysisDocument1 page3 QTD MCO and Cumulative Outflow AnalysisAlberto EstanesPas encore d'évaluation

- Miñoza Infiesto PlansDocument9 pagesMiñoza Infiesto PlansRodrigo MiñozaPas encore d'évaluation

- Plano Arquitectónico CASA OSWALDO 2Document1 pagePlano Arquitectónico CASA OSWALDO 2residencia generalPas encore d'évaluation

- Daily ReportDocument14 pagesDaily Reportricki 2909Pas encore d'évaluation

- Braking System-1Document16 pagesBraking System-1CASAQUI LVAPas encore d'évaluation

- Vol 25, Issue No 16, DataBankDocument32 pagesVol 25, Issue No 16, DataBankSenthil KumarPas encore d'évaluation

- The Wave - Muscat Main Brochure 2010Document21 pagesThe Wave - Muscat Main Brochure 2010ywa00Pas encore d'évaluation

- Edc Structure PDFDocument2 pagesEdc Structure PDFThai chheanghourtPas encore d'évaluation

- February 2020: MarchDocument8 pagesFebruary 2020: MarchHania MumtazPas encore d'évaluation

- Who Wants To Be A Millionaire HW4 - Phuong HaDocument8 pagesWho Wants To Be A Millionaire HW4 - Phuong HaPhuong HaPas encore d'évaluation

- P007 Abn CCC Ar SHD 2557 S01Document1 pageP007 Abn CCC Ar SHD 2557 S01Abdul basithPas encore d'évaluation

- JULIO PLANTA 1-Layout1-1Document1 pageJULIO PLANTA 1-Layout1-1Joule GonzalesPas encore d'évaluation

- Project Begin: Today: Range: Início Duração Início Duração % Activities Previsto Prevista Real Real ConclusãoDocument1 pageProject Begin: Today: Range: Início Duração Início Duração % Activities Previsto Prevista Real Real ConclusãoInfo. ContemporaniumPas encore d'évaluation

- A0 Vue en Plan Barracuda V1Document1 pageA0 Vue en Plan Barracuda V1karlPas encore d'évaluation

- D110 Motor MapDocument2 pagesD110 Motor MapBala SubramanianPas encore d'évaluation

- NursesExperiencesofGriefFollowing28 8 2017thepublishedDocument14 pagesNursesExperiencesofGriefFollowing28 8 2017thepublishedkathleen PerezPas encore d'évaluation

- CBSE Class11 Maths Notes 13 Limits and DerivativesDocument7 pagesCBSE Class11 Maths Notes 13 Limits and DerivativesRoy0% (1)

- SDLC Review ChecklistDocument4 pagesSDLC Review Checklistmayank govilPas encore d'évaluation

- Question No. 2: (Type Here)Document5 pagesQuestion No. 2: (Type Here)temestruc71Pas encore d'évaluation

- Mark Scheme Big Cat FactsDocument3 pagesMark Scheme Big Cat FactsHuyền MyPas encore d'évaluation

- Young Entrepreneurs of IndiaDocument13 pagesYoung Entrepreneurs of Indiamohit_jain_90Pas encore d'évaluation

- Normalization Techniques For Multi-Criteria Decision Making: Analytical Hierarchy Process Case StudyDocument11 pagesNormalization Techniques For Multi-Criteria Decision Making: Analytical Hierarchy Process Case StudyJohn GreenPas encore d'évaluation

- Full TextDocument143 pagesFull TextRANDYPas encore d'évaluation

- 1574 PDFDocument1 page1574 PDFAnonymous APW3d6gfd100% (1)

- Rules and IBA Suggestions On Disciplinary ProceedingsDocument16 pagesRules and IBA Suggestions On Disciplinary Proceedingshimadri_bhattacharje100% (1)

- Percussion Digital TWDocument26 pagesPercussion Digital TWAlberto GallardoPas encore d'évaluation

- Explicit and Implicit Grammar Teaching: Prepared By: Josephine Gesim & Jennifer MarcosDocument17 pagesExplicit and Implicit Grammar Teaching: Prepared By: Josephine Gesim & Jennifer MarcosJosephine GesimPas encore d'évaluation

- Cluster University of Jammu: Title: English Anthology and GrammarDocument2 pagesCluster University of Jammu: Title: English Anthology and GrammarDÁRK GAMINGPas encore d'évaluation

- Conflict Management Strategy ThesisDocument16 pagesConflict Management Strategy ThesisKrizna Dingding DotillosPas encore d'évaluation

- Dribssa Beyene Security Sector Reform Paradox Somalia PublishedDocument29 pagesDribssa Beyene Security Sector Reform Paradox Somalia PublishedNanny KebedePas encore d'évaluation

- Classroom Management PaperDocument7 pagesClassroom Management PaperdessyutamiPas encore d'évaluation

- U6 - S7 - Trabajo Individual 7 - Ficha de Aplicación INGLES 3Document2 pagesU6 - S7 - Trabajo Individual 7 - Ficha de Aplicación INGLES 3Antonio Andres Duffoo MarroquinPas encore d'évaluation

- Parallels of Stoicism and KalamDocument95 pagesParallels of Stoicism and KalamLDaggersonPas encore d'évaluation

- Network Firewall SecurityDocument133 pagesNetwork Firewall Securitysagar323Pas encore d'évaluation

- Presentation 1Document8 pagesPresentation 1chandrima das100% (1)

- Chapter 1Document6 pagesChapter 1Alyssa DuranoPas encore d'évaluation