Académique Documents

Professionnel Documents

Culture Documents

Im Not A Virus Ammar Master PDF

Transféré par

Areeb AbbasTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Im Not A Virus Ammar Master PDF

Transféré par

Areeb AbbasDroits d'auteur :

Formats disponibles

"I'm not a virus"

Ammar Master, Senior Manager,

Asia Pacific Vehicle Forecasts

“I’m not a virus, I’m a human. Eradicate the prejudice”, read the placard of a student from Wuhan,

who in early February stood on a busy pedestrian street in Florence and symbolically donned a

black blindfold and protective mask. His silent appeal was as stark as it was poignant, drawing an

extraordinary reaction from the public as they spontaneously hugged the masked stranger. Footage

of the event has since been shared widely on social media and serves as a moving reminder of the

repercussions of a virus outbreak on social mores and interaction.

On a less esoteric level, the repercussions of the coronavirus outbreak are being felt far and wide.

Supply chains across industries globally have been disrupted, not least the automotive industry in China

and beyond.

While the spread of COVID-19 in China appears to have been contained to some degree – for the

time being at least – the virus is now proliferating across the world, even to seemingly unconnected

countries. And we could be looking at a scenario where localised eruptions continue to occur

throughout 2020.

More importantly, the final toll on human life and the outbreak’s impact on global economies may not

be become fully apparent until 2020 comes to a close.

The Indian automotive industry, which is still reeling from the worst sales slump in more than 20 years,

also faced supply shortages of several components from China. This is likely to hit output in February

and March.

Not only that but automakers in India are having to tread a fine line by balancing their output of BS-

IV versus BS-VI models prior to the implementation of the stricter BS-VI regulations in April this year.

Given the unpredictability of the consumer response to the shift to BS-VI vehicles, Indian production

volumes could suffer over the coming months.

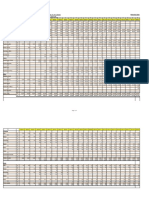

We currently expect Light Vehicle production in India to average 339,000 units per month for the

next six months. That said, there is a nominal downside risk if the virus outbreak in China deteriorates

significantly as this would lead to a greater shortage of components.

Other headwinds that could undermine sales (and production) this year include relatively weaker GDP

growth; financial sector stress; global uncertainty and its impact on exports, investments and the

economy; and brewing social tensions triggered by a new citizenship law, as so startlingly demonstrated

by the recent Hindu-Muslim clashes in Delhi that led to 47 fatalities.

On balance, however, the Indian market remains more susceptible to domestic rather than external

risks.

To read more from LMC Automotive, visit our blog

lmc-auto.com/news-and-insights

Vous aimerez peut-être aussi

- M P C Monetary Policy Statement: Tate Ank of AkistanDocument3 pagesM P C Monetary Policy Statement: Tate Ank of AkistanSaitama DekuPas encore d'évaluation

- Instructions For Official Internship Summer 2021Document2 pagesInstructions For Official Internship Summer 2021Areeb AbbasPas encore d'évaluation

- On-Campus Classes For Thursday, October 07, 2021 FinalDocument4 pagesOn-Campus Classes For Thursday, October 07, 2021 FinalAreeb AbbasPas encore d'évaluation

- MPS May 2021 CompendiumDocument31 pagesMPS May 2021 CompendiumAreeb AbbasPas encore d'évaluation

- Money Market by Muhammad Owais Atta SiddiquiDocument19 pagesMoney Market by Muhammad Owais Atta SiddiquimubiePas encore d'évaluation

- On-Campus Classes For Sunday October 10, 2021Document3 pagesOn-Campus Classes For Sunday October 10, 2021Areeb AbbasPas encore d'évaluation

- M P C Monetary Policy Statement: Tate Ank of AkistanDocument2 pagesM P C Monetary Policy Statement: Tate Ank of AkistanAreeb AbbasPas encore d'évaluation

- Introduction To DerivativesDocument28 pagesIntroduction To DerivativesAreeb AbbasPas encore d'évaluation

- Guidelines For Sinopharm Vaccine - 5705Document5 pagesGuidelines For Sinopharm Vaccine - 5705Wpress PressPas encore d'évaluation

- 1 Exercises - MM - enDocument14 pages1 Exercises - MM - enSyed Osama Ali ShahPas encore d'évaluation

- Be Prepared For The Uncleared Margin Rules (UMR) : ContactsDocument4 pagesBe Prepared For The Uncleared Margin Rules (UMR) : ContactsAreeb AbbasPas encore d'évaluation

- Course Rubrics and Grading CriteriaDocument5 pagesCourse Rubrics and Grading CriteriaAreeb AbbasPas encore d'évaluation

- Budget Brief 2021-22Document79 pagesBudget Brief 2021-22Arslan Shafique ChPas encore d'évaluation

- Week 5-Redbull Anti BrandDocument14 pagesWeek 5-Redbull Anti BrandAreeb AbbasPas encore d'évaluation

- Guidelines For Sinovac Vaccine - 6303Document6 pagesGuidelines For Sinovac Vaccine - 6303Wpress PressPas encore d'évaluation

- Introduction To DerivativesDocument28 pagesIntroduction To DerivativesAreeb AbbasPas encore d'évaluation

- 2 Strategic Management Shan Foods Private Limited PDFDocument43 pages2 Strategic Management Shan Foods Private Limited PDFFaisalPas encore d'évaluation

- Historical DataDocument4 pagesHistorical DataAreeb AbbasPas encore d'évaluation

- Examination AssignmentDocument2 pagesExamination AssignmentAreeb AbbasPas encore d'évaluation

- 1st AprilDocument5 pages1st AprilAreeb AbbasPas encore d'évaluation

- CH 9 Performance Review of The Insurance Sector PDFDocument12 pagesCH 9 Performance Review of The Insurance Sector PDFAreeb AbbasPas encore d'évaluation

- The Impact of Social Media Influencers On Purchase IntentionDocument18 pagesThe Impact of Social Media Influencers On Purchase IntentionBambi MrrPas encore d'évaluation

- @hassan2015 - Strategic Use of Social Media For Small Business Based On The AIDA Model PDFDocument8 pages@hassan2015 - Strategic Use of Social Media For Small Business Based On The AIDA Model PDFHeri SiswantoPas encore d'évaluation

- Budget 2020 21 Highlights Comments Deloittepk NoexpDocument98 pagesBudget 2020 21 Highlights Comments Deloittepk NoexpOwais WahidPas encore d'évaluation

- Attitudes Toward Sex-Roles: Traditional or Egalitarian?Document13 pagesAttitudes Toward Sex-Roles: Traditional or Egalitarian?Areeb AbbasPas encore d'évaluation

- ReportDocument67 pagesReportAurangzeb MarriPas encore d'évaluation

- Jubilee General InsuranceDocument9 pagesJubilee General InsuranceAreeb AbbasPas encore d'évaluation

- SKD Tractor Assembly ProcessDocument3 pagesSKD Tractor Assembly ProcessAreeb AbbasPas encore d'évaluation

- DocumentDocument2 pagesDocumentAreeb AbbasPas encore d'évaluation

- Journal of Retailing and Consumer Services 47 (2019) 150-156Document7 pagesJournal of Retailing and Consumer Services 47 (2019) 150-156Areeb AbbasPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Indwdhi 20230930Document4 pagesIndwdhi 20230930vwong8245Pas encore d'évaluation

- CIFFADocument300 pagesCIFFANagi Gabriel100% (2)

- Brief Industrial Profile of Amritsar District: Msme Development InstituteDocument13 pagesBrief Industrial Profile of Amritsar District: Msme Development InstituteUNISON Lawn EquipmentsPas encore d'évaluation

- GDTM hoàn chỉnhDocument70 pagesGDTM hoàn chỉnhNam NguyenPas encore d'évaluation

- Foundations of Financial Management 16th Edition Block Test Bank 1Document27 pagesFoundations of Financial Management 16th Edition Block Test Bank 1john100% (33)

- 6E-UR413T - MR Harish Kukreja - DED-GOI-28 JAN 23Document1 page6E-UR413T - MR Harish Kukreja - DED-GOI-28 JAN 23Jatin SalujaPas encore d'évaluation

- Forex Opening Range Breakout StrategyDocument4 pagesForex Opening Range Breakout StrategySIightly100% (1)

- E L F T: Xchange Isted Unds RustDocument25 pagesE L F T: Xchange Isted Unds RustFooyPas encore d'évaluation

- General insurance phone binding loan detailsDocument3 pagesGeneral insurance phone binding loan detailsKrishnaPas encore d'évaluation

- Assignment Cover Sheet: Accounting and Costing For BusinessDocument35 pagesAssignment Cover Sheet: Accounting and Costing For BusinessTharushi HettiarachchiPas encore d'évaluation

- CA Foundation PDFDocument34 pagesCA Foundation PDFShyam ShelkePas encore d'évaluation

- Moniepoint Document 2023-07-28T05 05.xlaDocument42 pagesMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyPas encore d'évaluation

- Partial Financial Statement and Analysis of San Miguel CorporationDocument3 pagesPartial Financial Statement and Analysis of San Miguel CorporationKaithleen Coreen EbaloPas encore d'évaluation

- SEC Memo Circ No. 06-05 - Consolidated Scale of FinesDocument17 pagesSEC Memo Circ No. 06-05 - Consolidated Scale of FinesHailin QuintosPas encore d'évaluation

- NCRMP Alibaug UGC Work Action PlanDocument14 pagesNCRMP Alibaug UGC Work Action PlanKULDEEP KUMAR50% (2)

- Perfectly Competitive Firm Decisions and EquilibriumDocument2 pagesPerfectly Competitive Firm Decisions and Equilibriumanon_954124867Pas encore d'évaluation

- Grammar and Vocabulary TestsDocument4 pagesGrammar and Vocabulary TestsNguyễn NguyênPas encore d'évaluation

- M Sand Note TamilDocument4 pagesM Sand Note Tamilkaru kPas encore d'évaluation

- Dirlist13 02400000 02700000Document301 pagesDirlist13 02400000 02700000Shomit0% (1)

- Lecture Notes: Theory of MarketsDocument24 pagesLecture Notes: Theory of MarketsAdruffPas encore d'évaluation

- Rupay Lounge ListDocument2 pagesRupay Lounge ListKorean kocchaPas encore d'évaluation

- BiptDocument1 pageBiptArputPas encore d'évaluation

- Taxation (Malawi) : Specimen Questions For June 2015Document10 pagesTaxation (Malawi) : Specimen Questions For June 2015angaPas encore d'évaluation

- Darya-Varia Interim Financial Statements for Q1 2020Document122 pagesDarya-Varia Interim Financial Statements for Q1 2020melissa santosoPas encore d'évaluation

- Eun8e Chapter06 TB AnswerkeyDocument28 pagesEun8e Chapter06 TB AnswerkeyshouqPas encore d'évaluation

- RIYADH OPEN FOR BUSINESS AS GLOBAL HUBDocument25 pagesRIYADH OPEN FOR BUSINESS AS GLOBAL HUBPriy SharmaPas encore d'évaluation

- Central Bank Functions ExplainedDocument7 pagesCentral Bank Functions ExplainedTilahun MikiasPas encore d'évaluation

- Lowy Institute 2023 Asia Power Index Key Findings ReportDocument36 pagesLowy Institute 2023 Asia Power Index Key Findings ReportDimitris VgPas encore d'évaluation

- Banking and Financial InstitutionDocument2 pagesBanking and Financial InstitutionMaricar TabadaPas encore d'évaluation

- Introduction To Food CostingDocument17 pagesIntroduction To Food CostingSunil YogiPas encore d'évaluation