Académique Documents

Professionnel Documents

Culture Documents

Circular - VAT Refund 60 Days

Transféré par

Balu Mahendra SusarlaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Circular - VAT Refund 60 Days

Transféré par

Balu Mahendra SusarlaDroits d'auteur :

Formats disponibles

GOVERNMENT OF ANDHRA PRADESH

COMMERCIAL TAXES DEPARTMENT

Office of the

Commissioner of Commercial Taxes,

Andhra Pradesh, Hyderabad.

CIRCULAR-3

CCT’s Ref.No. CCW/CS(1)/ 128 /2015 Dt: 19-06-2015

Sub: APVAT Act,2005- Refunds –Section 38 of the Act-- DIPP,GOI Action

Points on ease of Doing Business -Certain instructions - Reg.

Ref : 1. Secretary Industries &Commerce Dept Lr No Ind&Com(IP)

Dept/OSD-31/2015 dt 09-06-2015 on DIPP,GOI Action Points

on Ease of Doing Business

*****

It is to inform that as per section 38 of the APVAT Act,2005, any

excess tax paid by the dealer shall be refunded within a period of 90 days of the

claim made by the dealer.

Recently Government in the reference cited has communicated

certain action points to all the Government departments for ease of doing

business. These action points require our department to issue Refunds within

sixty (60) days from the date of claim.

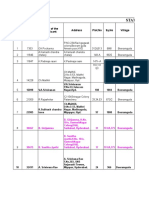

Therefore the Deputy Commissioner in the state are requested to

ensure that all the claims of Refunds are settled and issued within Sixty days

from the date of claim by the dealer.

The Deputy Commissioners are requested to issue necessary

instructions to the assessing authorities in this regard.

The above instructions shall be scrupulously followed.

SD/-J.SYAMALARAO

Commissioner of Commercial Taxes.

To

All Deputy Commissioner(CT)s of the Divisions

All Commercial Tax Officers in the state

All Registering Authorities in the state

Copy to Senior Officers in the office of Commissioner(CT)

//t.c.f.b.o//

SD/-T.RAMESHBABU

Joint Commissioner(Computers)

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- S O U T H C E N T R A L: List of LIC Offices For Servicing of PMJDY ClaimDocument23 pagesS O U T H C E N T R A L: List of LIC Offices For Servicing of PMJDY ClaimBalu Mahendra SusarlaPas encore d'évaluation

- CEA-Reimbursement-FormatDocument4 pagesCEA-Reimbursement-FormatBalu Mahendra SusarlaPas encore d'évaluation

- 685Document4 pages685Balu Mahendra SusarlaPas encore d'évaluation

- DA GoDocument6 pagesDA GoBalu Mahendra SusarlaPas encore d'évaluation

- iit 5th roundDocument26 pagesiit 5th roundBalu Mahendra SusarlaPas encore d'évaluation

- Limited On Their Being Allotted To Telangana Cadre.: K. Praveen Kumar Secretary To GovernmentDocument2 pagesLimited On Their Being Allotted To Telangana Cadre.: K. Praveen Kumar Secretary To GovernmentBalu Mahendra SusarlaPas encore d'évaluation

- DOCSs 25112020Document2 pagesDOCSs 25112020Balu Mahendra SusarlaPas encore d'évaluation

- Explanatory NoteDocument5 pagesExplanatory NoteBalu Mahendra SusarlaPas encore d'évaluation

- Évé) (Éjééå Béeé ºéæéêfé (Ié (Ééê®Sé É: Key To The Budget Documents 2021-2022Document18 pagesÉvé) (Éjééå Béeé ºéæéêfé (Ié (Ééê®Sé É: Key To The Budget Documents 2021-2022SidharthaPas encore d'évaluation

- CMRFDocument2 pagesCMRFBalu Mahendra SusarlaPas encore d'évaluation

- 2017rev MS111Document2 pages2017rev MS111Balu Mahendra SusarlaPas encore d'évaluation

- OutcomeBudgetE2020 2021Document285 pagesOutcomeBudgetE2020 2021Rohit MishraPas encore d'évaluation

- Budget at A GlanceDocument19 pagesBudget at A GlanceRohan PalPas encore d'évaluation

- 2017hou RT4Document1 page2017hou RT4Balu Mahendra SusarlaPas encore d'évaluation

- 2016hou RT131Document3 pages2016hou RT131Balu Mahendra SusarlaPas encore d'évaluation

- State District Zone: Divisional Grievance Redressal OfficersDocument9 pagesState District Zone: Divisional Grievance Redressal Officersdheerajnarula1991Pas encore d'évaluation

- SignedDocument1 pageSignedBalu Mahendra SusarlaPas encore d'évaluation

- 2019hou RT33Document2 pages2019hou RT33Balu Mahendra SusarlaPas encore d'évaluation

- Beeramguda (V) PatancheruDocument10 pagesBeeramguda (V) PatancheruvikramsimhareddyPas encore d'évaluation

- 2012rev RT1012Document1 page2012rev RT1012Balu Mahendra SusarlaPas encore d'évaluation

- BudgetDocument33 pagesBudgetRaghu RamPas encore d'évaluation

- 07 - Chapter 2 PDFDocument58 pages07 - Chapter 2 PDFBalu Mahendra SusarlaPas encore d'évaluation

- 2018PR RT58Document2 pages2018PR RT58Balu Mahendra SusarlaPas encore d'évaluation

- 2017se RT84Document1 page2017se RT84Balu Mahendra SusarlaPas encore d'évaluation

- 9.form For TTA Claim PDFDocument3 pages9.form For TTA Claim PDFBalu Mahendra SusarlaPas encore d'évaluation

- rps1999 PDFDocument429 pagesrps1999 PDFsyedPas encore d'évaluation

- TreasurycodeDocument59 pagesTreasurycodeBalu Mahendra SusarlaPas encore d'évaluation

- Volume VII 1 PDFDocument322 pagesVolume VII 1 PDFBalu Mahendra SusarlaPas encore d'évaluation

- TDS Under Section 194C: Press Releases Blog PostsDocument4 pagesTDS Under Section 194C: Press Releases Blog PostsBalu Mahendra SusarlaPas encore d'évaluation