Académique Documents

Professionnel Documents

Culture Documents

Company Formation Procedure

Transféré par

Vijay Chhabria0 évaluation0% ont trouvé ce document utile (0 vote)

67 vues5 pagesName of the company and Main Object -Four to six alternative names from the directors with the emphasis on the main objects of the company. DIN-Minimum 2 director 3. Digital SignatureMinimum 1 director with the filing fee of Rs 500 / 5. Name ApprovalForm 1A-with name of minimum 2 subscriber digitally signed by the director. 2. Names of the proposed directors a) Date of birth proof, identity proof, Addresses proof, occupation b) Consent of the director c

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentName of the company and Main Object -Four to six alternative names from the directors with the emphasis on the main objects of the company. DIN-Minimum 2 director 3. Digital SignatureMinimum 1 director with the filing fee of Rs 500 / 5. Name ApprovalForm 1A-with name of minimum 2 subscriber digitally signed by the director. 2. Names of the proposed directors a) Date of birth proof, identity proof, Addresses proof, occupation b) Consent of the director c

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

67 vues5 pagesCompany Formation Procedure

Transféré par

Vijay ChhabriaName of the company and Main Object -Four to six alternative names from the directors with the emphasis on the main objects of the company. DIN-Minimum 2 director 3. Digital SignatureMinimum 1 director with the filing fee of Rs 500 / 5. Name ApprovalForm 1A-with name of minimum 2 subscriber digitally signed by the director. 2. Names of the proposed directors a) Date of birth proof, identity proof, Addresses proof, occupation b) Consent of the director c

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 5

Process of Documentation for New Company incorporation & after That Procedure

1. Name of the company & Main Object -Four to six alternative names from the

directors with the emphasis on the main objects of the company and significance of

the names.

2. DIN-Minimum 2 Director

3. Digital Signature- Minimum 1Director

4. Name Approval- Form 1A-with name of minimum 2 subscriber digitally signed by

the director with the filing fee of Rs 500/-

5. After Name Approval

a. Prepare one copy of franked MOA,AOA and POA

b. Form-1-franked with Subscriber detail

c. Form-18-Change of Regd Office

d. Form-32-with Consent, Photo and identity proof of Director

e. Sign & Send for Approval of ROC

f. Hearing & after approval of Form Upload to Website & Paid Fees

g. After upload of the papers on the website deliver the above document with

acknowledgement copy papers to the Roc

List of documents required:

1. Names of the proposed directors.

a) Date of Birth Proof, Identity Proof, Addresses proof, occupation

b) Director Identification Number and Permanent Account Number (For All directors)

c) Consent of the director

2. Names of the proposed subscriber\promoter\shareholder.

a) Date of Birth Proof, Identity Proof, Addresses (Proof of Residence)

3. Proposed registered office Address of the company with Police Station jurisdiction

4. Object Clause of the company: Type & nature of business to be carried by the

proposed company.

5. Power of Attorney

6. Digital Signature Certificate (For at least 1 director)

6. After Incorporation

1. Opening of Bank Account.

2. Registration under Shop & Establishment Act.

3. PAN Registration. (Form 49A of UTI).

4. TAN Registration. (Form 49B of UTI).

5. Registration with Sales Tax Authority. (VAT TIN & CST TIN).

6. Registration with Excise Authority. (If Manufacturing Unit).

7. Registration with Custom. (If Exporting &/or Importing Unit).

8. Registration under Works Contract Act. (If undertakes Contracts).

9. Registration with PT Authority. (Registration & Enrolment Certificate).

10. Registration under Service Tax Act. (If provides Services).

11. Registration for EPF No., Gratuity Fund.

12. Registration under ESIC Act.

13. Registration under Contract Labour (Regulation & Abolition) Act

14. Registration under Maharashtra Labour Welfare Board

15. Meetings

a) First Meeting and four meeting in year

b) General Meeting annual and extraordinary if necessary

c) Minutes Books, Disclosure and Attendance Sheet

d) Compliance Certificate and Annual Filing-23AC, 23ACA, 20 B,66

PROCEDURE FOR REGISTRATION UNDER VARIOUS ACT

Sr. Name of Act Registration Procedure Documents Required

No. for

1. Companies Act, Registration of Please refer below

1956 Company mentioned steps in Note

(a)

2. Income Tax Act, Permanent Fill in Form 49A with the 1) Certificate of

1961 Account No. required details with UTI Incorporation 2) M/A &

(PAN) A/A 3) Proof of

Address i.e. Rent

Agreement.

3. Income Tax Act, Tax Deduction Fill in Form 49B with the 1) Certificate of

1961 Account No. required details with UTI Incorporation 2) M/A &

(TAN) A/A

4. Bombay Shops and Place of Form ‘A’ to be signed by 1) Name & address of

Establishments Act Business. Authorized Signatory. the authorized

1948 signatory of RISPL with

board resolution.2) List

of directors with

their residential

addresses, age, status,

occupations and date

from which in position.

3) No objection

certificate of the owner

of the premises for use

of the premises for the

business purpose. 4)

Business transaction

proof. 5) Prescribed

fee depend up on

employees strength.

5. Maharashtra Value VAT TIN No. 1) Application to be filled 1) Proof of address. 2)

Added Tax in Form 101 along with Letter of Authority. 3)

Annexure I 2) Rs.5000 cheque if it is

Application in Form 108 Voluntary Registration.

to be filled for TIN 4) Certificate of

Application. Incorporation 5) M/A &

A/A. 6) Blank cancelled

cheque.

6. Central Sales Tax CST TIN No. 1) Application to be filled 1) Proof of address. 2)

Act, in Form A duly signed & Letter of Authority. 3)

verified. 2) Application to Certificate of

be made within 30 days. Incorporation 4) M/A &

3) Court Fee Stamp of A/A.

Rs.25 to be annexed.

7. Central Excise Act, Excise 1) Application to be filled 1) Certificate of

1944 Registration in in A1 in Duplicate. Incorporation M/A &

case of A/A. 2) Ground plan of

Manufacturing the Factory. 3) List of

unit Various Factories/

Godown/ Warehouse.

4) Product list &

process detail 5) PAN

No. 6) List of Director/

Authorized person. 7)

Particulars of the

Company. 8) Copy of

Board Resolution.

8. Custom Act, 1962 Custom 1) Application to be filled 1) 2 Photograph of

Registration in in Aayat Niryat Form Signatory duly attested

case of import duly certified by the by bank. 2) List of

&/or export (IEC Bank (Photo & Signature Director 3) Bank

Code) Verification). Part I & Account Details 4)

Part II, (along with Sub Cover with affixed

section I) and Part IV. stamp of Rs.30/- 5)

DD of Rs.1000/- in

Favor of Joint DGFT

payable at Mumbai. 5)

PAN Card photocopy 6)

Bank Certificate on

Bank L/H. 7) M/A &

A/A certified copy.

9. The Employees’ Provident Fund 1) Letter addressed to 1) Name & addresses

Provident Funds & Registration Regional Provident Fund of the authorized

Miscellaneous Commissioner, duly signatories with board

Provisions Act, signed by Authorized resolution. 2) List of

1952 Signatory along with directors with

Questionnaire. 2) their residential

Applicable in case of no. addresses &

of employee exceed 20 occupations. 3)

during the year. Business transaction

proof. 4) Copy of

Bombay Shops &

Establishment.

License. 5) Certified

true copy of ownership

proof or Leave &

License agreement. 6)

List of Employees with

copy of attendance

muster & salary

register. 7) First month

PF challan for the PF

contribution paid. 8)

Bankers details.

10. Professional Tax PT Registration 1) Fill Form 2 for 1) Certificate of

Act, 1975 for Company Enrolment Certificate for Incorporation. 2) M/A

Company. 2) File the & A/A. 3) Proof of

Office – duly signed form with PT Address. 4) Details of

Registration Authority. 3) Fees as per Company. 5) Details of

Br., Vikrikar the slab rate applicable. Head office in case

Bhavan, 4) Application to be registering for Branch

Mazgaon. made within 30 days. office in Maharashtra.

Mumbai - 1 6) Certificate under

any other Act i.e.

MVAT & CST.

11. Professional Tax PT Registration 1) Fill Form 1 for 1) Certificate of

Act, 1975 for Employee Registration Certificate. Incorporation. 2) M/A

2) File the duly signed & A/A. 3) Company

form with PT Authority. details.

3) Application to be

made within 30 days.

12. Finance Act 1994 Service Tax 1) Apply for Registration 1) Proof of Address. 2)

Chapter V Registration in Form ST 1 (in PAN No. 3) List of

Duplicate) to the Branch office 4) Note

Superintendent of on Accounting System

Excise. 2) Mention the adopted 5) Series of

service under which Invoice maintain along

Company falls. 3) Need with sample copy. 6)

to apply only after Gross Last Year Balance

value exceeds Rs.3 Sheet along with T/B

Lakhs during the year. of Branches. 7) Detail

4) Service Tax payable of record of account

only after value exceeds maintained. 8) Bank

Rs.4 Lakhs. account no. of Branch

& Central Office.

13. Works Contract Person No need to Register

Tax Act, 1989 undertaking separately. Now required

contract need to to register under MVAT

apply. only.

14. Maharashtra Letter addressed to Dy. 1) Application Form

Labour Welfare Commissioner, duly A1-cum Return. 2)

Board signed by Authorized Memorandum & Article

Signatory for allotment of Association of

of Code No. RISPL. 3) Prescribed

fee depend up on

employees strength as

on date of

Registration.

15. Employee State Letter addressed to 1) Name & addresses

Insurance Regional Director E.S.I. of the authorized

Corporation Corporation , duly signed signatories with board

by Authorized Signatory resolution. 2) List of

along with Employers’ directors with

Registration Form their residential

addresses &

occupations. 3) Copy

of P.F code draft letter

of registration. 4)

Certified true copy of

ownership proof or

Leave & License

agreement. 5) List of

Employees with copy

of attendance muster

& salary register with

male & female details.

6) First month ESIC

chalan for the ESIC

contribution paid, if

employees drawing

less than Rs.7500/=

gross salary. 7)

Bankers’ details.

16. Contract Labour ( An application in

Regulation & prescribed form

Abolition) Act accompanied by

prescribed fees to the

registering officer.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Pesonet FaqsDocument4 pagesPesonet FaqsRey Razel CavePas encore d'évaluation

- Case 8 - Hanshin 2007Document3 pagesCase 8 - Hanshin 2007Kuyax Lopez100% (2)

- Act 624 Finance No.2 Act 2002Document23 pagesAct 624 Finance No.2 Act 2002Adam Haida & CoPas encore d'évaluation

- Factoring Project ReportDocument15 pagesFactoring Project ReportSiddharth Desai100% (3)

- 3 2018-12-05 PLTF Mem ISO PetitionDocument34 pages3 2018-12-05 PLTF Mem ISO Petitiondanielrestored100% (1)

- Real Options and Mergers Insights for M&A DealsDocument26 pagesReal Options and Mergers Insights for M&A DealsasmaPas encore d'évaluation

- causelistALL2022 08 25 2Document160 pagescauselistALL2022 08 25 2Akash TandonPas encore d'évaluation

- EWS #3 Valloire ResultsDocument4 pagesEWS #3 Valloire ResultsmkazimerPas encore d'évaluation

- SEC MC 28 FormDocument1 pageSEC MC 28 FormAngieLlantoCuriosoPas encore d'évaluation

- PNB Not Liable for Debts of Acquired CompanyDocument20 pagesPNB Not Liable for Debts of Acquired CompanyJana mariePas encore d'évaluation

- Insurance CodesDocument14 pagesInsurance CodesshetiakhuPas encore d'évaluation

- Hotel Invoice Sample 6Document1 pageHotel Invoice Sample 6naveed ansariPas encore d'évaluation

- IFRS 9 ProposalDocument12 pagesIFRS 9 ProposalMuhammad Shahbaz KhanPas encore d'évaluation

- High Fructose Corn Syrup Causes Mouth SoresDocument8 pagesHigh Fructose Corn Syrup Causes Mouth SoresA Ali Khan100% (1)

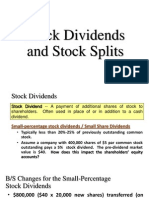

- Stock Dividends and Stock SplitsDocument18 pagesStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- Case Digest - Caltex Vs CA, G.R. No. 97753Document2 pagesCase Digest - Caltex Vs CA, G.R. No. 97753J Yasser Pascubillo100% (1)

- CHUMDHIDocument3 pagesCHUMDHINitesh MasihPas encore d'évaluation

- Primary DealersDocument3 pagesPrimary DealersJestin JosephPas encore d'évaluation

- Module 9: What Is A Brand?: Brand Next Manifesto by Wolff OlinsDocument4 pagesModule 9: What Is A Brand?: Brand Next Manifesto by Wolff OlinsRui ManuelPas encore d'évaluation

- Accounting Services ProposalDocument8 pagesAccounting Services ProposalMoireeG100% (1)

- 07ap ChallengesRA9266Document4 pages07ap ChallengesRA9266Ian Kenneth OrasaPas encore d'évaluation

- Strategy Formulation and Implementation OutlineDocument4 pagesStrategy Formulation and Implementation OutlineMariell Joy Cariño-TanPas encore d'évaluation

- Valuation White PaperDocument16 pagesValuation White Paperprateekbhatia13764Pas encore d'évaluation

- KLM baggage rules and allowancesDocument2 pagesKLM baggage rules and allowancesNavjotPas encore d'évaluation

- Upwork Email Test 081819Document5 pagesUpwork Email Test 081819markPas encore d'évaluation

- Financial Statement Analysis Chapter 14Document164 pagesFinancial Statement Analysis Chapter 14Alvina Baquiran100% (1)

- Corporations and Other Juridical EntitiesDocument6 pagesCorporations and Other Juridical EntitiesJanus MariPas encore d'évaluation

- Sue Reyer Joins Eva Garland Consulting As Director of Accounting and ComplianceDocument2 pagesSue Reyer Joins Eva Garland Consulting As Director of Accounting and CompliancePR.comPas encore d'évaluation