Académique Documents

Professionnel Documents

Culture Documents

50 Novurj-408 PDF

Transféré par

Riya JainTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

50 Novurj-408 PDF

Transféré par

Riya JainDroits d'auteur :

Formats disponibles

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/331486915

FINANCIAL PERFORMANCE OF STATE BANK OF INDIA

Article · November 2018

CITATIONS READS

0 3,725

2 authors:

Kanagavalli Ganesan Saroja Devi Rajendran

Alagappa University Karpagam Academy of Higher Education

36 PUBLICATIONS 6 CITATIONS 31 PUBLICATIONS 7 CITATIONS

SEE PROFILE SEE PROFILE

All content following this page was uploaded by Kanagavalli Ganesan on 14 November 2019.

The user has requested enhancement of the downloaded file.

Universal Review ISSN NO : 2277-2723

FINANCIAL PERFORMANCE OF STATE BANK OF INDIA

Dr.G. KANAGAVALLI,

Assistant Professor, Department of Commerce, School of Management,

Alagappa University, Karaikudi-04.

E-Mail Id: kanagarajesh25@gmail.com

R.SAROJA DEVI,

Ph.D (FT) Research Scholar, Department Commerce, School of Management,

Alagappa University, Karaikudi-04.

E-Mail Id:rajendransaro@gmail.Com

Abstract

This paper attempts to analyze the financial performance of State bank of India. It is major part

of total banking system in India. SBI is the India’s largest commercial bank in terms of assets,

deposits and employees. The study is based upon secondary data covering the period from 2013-

2018. For analyzing the performance Mean, Standard Deviation (SD), Coefficient of Variation

(CV), Multiple Regression, Two way ANOVA and spread are calculated.

INTRODUCTION

Banks are life blood and the nervous system of the Indian economy. Banking plays an

important role in the economic development of a country and forms the core of the money

market in an advanced country. In India, the money market is characterized by the existence of

both the organized and unorganized sectors. The organized sector includes Commercial banks,

Co-operative banks and Regional Rural banks while the unorganized sector includes indigenous

bankers and private money lenders. Among the banking institutions in the organized sector, the

commercial banks are the oldest institutions having a wide network of branches, commanding

utmost public confidence and having the lion’s share in the total banking operations. Initially,

Volume 7, Issue XI, NOVEMBER/2018 Page No:393

Universal Review ISSN NO : 2277-2723

they were established as corporate bodies with share-holdings by private individuals, but

subsequently there has been a drift towards State ownership and control.1

In Modern times banking is the kingpin of all business activity. It is an important

instrument of mobilizing the community’s resources through institutional framework. As a

matter of fact, economic and industrial development of a country depends, is the main, upon how

efficiently funds are managed by the banks. Hence, banking plays an important in the economic

development of the country. Adequacy of capital and competency of management are the two

pillars upon which the earnings of the banks depend. Sufficiency of capital instills depositor’s

confidence, which helps in mobilizing of deposits. Increase in deposits increases the lending

business and therefore enhances the possibilities of income generation for the bank. Moreover, a

bank with a sound capital base can take business opportunity more effectively and can

concentrate well on dealing with problem arising from unexpected loses. The success and

survival of a bank depends to a great extent upon the dedication and competence of its managers.

A smart bank manager can, not only help to mobilize resources and deploy them in profitable

channels, the manager can also reduce the amount of idle balances and help to earn more profits.

The banks now focus on integrated balance-sheet management where all the relevant factors

which effect an appropriate balance sheet composition deserve consideration. Therefore various

components of balance sheet are analyzed keeping in view the strengths of a bank. Analyzing

Asset and Liability behaviour means managing both assets and liabilities simultaneously for the

purpose of minimizing the adverse impact of interest rate movement, providing liquidity and

enhancing the market value of equity. A careful designing and management of Asset and

Liability behaviour is integral part of banking business particularly because over three forth of its

Volume 7, Issue XI, NOVEMBER/2018 Page No:394

Universal Review ISSN NO : 2277-2723

resources originate from the depositors. However, the banks do not have free hand in the making

of their behaviour on both sides (asset and liabilities).

STATEMENT OF THE PROBLEM

Liquidity is the ability of an organisation to meet its financial obligations during the

short-term and to maintain long-term debt-paying ability. The long-term survival depends on

satisfactory income earned by it. A sound liquidity leads to better profitability, and it turn

reduces the probability of default risk in the future. Further, risk and return are very important

aspects to be considered while making any decision regarding a company’s finances. Therefore,

a study of liquidity, profitability, leverage, turnover, market based and their association with risk,

assessing the financial position very much necessary to evaluate the financial strength of the

bank.

REVIEW OF LITERATURE

S. Subalakshmi1 , S. Grahalakshmi and M. Manikandan (2018)2 SBI is the India’s largest

commercial bank in terms of assets, deposits and employees. SBI is the preferred banker for

most of public sector corporations. It occupies a unique place in the Indian money market as it

commands more than one third of India’s bank resources. Public has enormous faith in State

bank of India because of its dedicated services. This study aims at analyzing the Financial Ratio

analysis of State Bank of India. The main objective for commercial bank is to maximize the

value of profit. To do so, banks concentrate on their financial performance analysis and attempt

to structure their portfolios in order to maximize their return. The most popular tool/technique

Volume 7, Issue XI, NOVEMBER/2018 Page No:395

Universal Review ISSN NO : 2277-2723

for analyzing the Financial Statement of Bank is Ratio Analysis. Ratio analysis enables the

management of banks to identify the causes of the changes in their advances, income, deposits,

expenditure, profits and profitability over the period of time and thus helps in pinpointing the

direction of action required for increasing the deposits, income, advances and reducing the

expenditure and for altering the profitability prospects of the banks in future. Therefore the study

was undertaken to analyze financial status of public sector bank especially to SBI (State Bank of

India).

SCOPE OF THE STUDY

The present study relates to the financial performance of the State Bank of India. It is

designed to analyze the financial performance of the State Bank of India. The study is based on

the annual reports of the company for the period of 5 years 2013-14 to 2017-18. It includes

liquidity, profitability, leverage, turnover and market based ratio performance of the State Bank

of India. The present study does not cover the human resource practices employee performance,

performance of mutual funds in the Indian stock market and the like.

OBJECTIVES OF THE STUDY

1. To analysis the liquidity, profitability performance of SBI.

2. To study the turnover and market based ratios performance of SBI.

HYPOTHESIS OF THE STUDY

Ho: There is no significant difference in the values of Profitability ratio of the selected State

Bank of India.

Volume 7, Issue XI, NOVEMBER/2018 Page No:396

Universal Review ISSN NO : 2277-2723

Ho: There is no significant difference in the values of turnover ratio of the selected State Bank of

India.

Ho: There is no significant difference in the values of market based ratio of the selected State

Bank of India.

STRUCTURE OF AN ANNUAL REPORT

The structure of the company’s annual report (Balance sheet) takes the following pattern and

reports the information under the contents like; Board of directors, Chairman’s review

Notice of Meetings, Reports of the Directors Sources of Application of Funds , Profit and Loss

Report, Particulars of employees, Accounts of subsidiary companies, , Shareholder information ,

Cash flow statement, Consolidated financial statement, Shareholder reference, Financial Ratios,

Dividend statistics, Capital Structure, financial graphs, diagrammatical and graphical

presentation of financial results etc.

RESEARCH METHODOLOGY

The present study is based on secondary data. The analysis is based on liquidity,

profitability, leverage, turnover ratio and market based ration which are calculated with the help

of data from financial statements of the State Bank of India. All the related to State Bank of India

Auditors reports, Internet, Books, Journals, Magazines and the like.

FRAME WORK OF ANALYSIS

The statistical techniques used for analyzing the data vary from descriptive to

multivariate. The details of the statistical tools are Descriptive statistics like mean, standard

deviation, Two- way ANOVA, Multiple Regression Analysis.

Volume 7, Issue XI, NOVEMBER/2018 Page No:397

Universal Review ISSN NO : 2277-2723

LIQUIDITY RATIO IN SBI

The following table -1 current ratio in state bank of India.

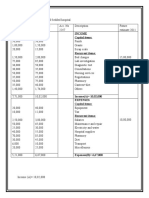

TABLE-1

CURRENT RATIO

(Rs.in Crore)

Year Current Assets Current Liabilities Ratio (in times)

2013 – 14 1740686.54 96412.96 18.05

2014 – 15 1969915.09 137698.05 14.30

2015 – 16 2108265.36 159875.57 13.18

2016 – 17 2509039.66 155235.19 16.16

2017 – 18 3187765.55 167138.08 19.07

Mean 2303134.44 143271.97 16.152

S.D 567962.5635 28351.47604 2.468799

C.V 24.66041728 19.78857137 15.28479

Source: Annual Reports of SBI.

Regression equation of Y on X1 and X2

Required equation model is 17.847 + 6.446E-6 X1 +0.00 X2

Where Y= Current Ratio; X1: Current Asset; X2: Current Liability

Result of regression analysis

Standard Adjusted

Variable Coefficients T Stat P-Value R Square

Error R Square

Constant

17.847 .769 23.200 .002

X1

6.446E-6 .000 16.090 .004

X2 .993 0.985

.000 .000 -14.386 .005

Source: Computed Data

Volume 7, Issue XI, NOVEMBER/2018 Page No:398

Universal Review ISSN NO : 2277-2723

Table 1 shows that current ratio of State Bank of India Ltd. The mean value was 16.15

times, the standard deviation was 2.46, and the co-efficient of variation was 15.28 times.

Regression equation model is depicted in table 1 from the equation model, it is taken

increase in current assets would increase in current ratio of State Bank of India was 6.466E6

times, when current liabilities remain constant. Similarly decrease in current liabilities would

increase in current ratio was 0.00 times, when current asset remain constant. It is found that both

liquidity position and growth in terms of the company have been good during the period of the

study. The results of regression analysis show that the current ratio contributes significantly to

the increase in the liquidity position of a company. The coefficient for current is highly

significant at the 5 per cent level.

PROFITABILITY RATIO IN SBI

Profitability means the ability of a company to earn profit. In analyzing profitability, the

profit making ability of an organization is measured in terms of the size of the investment therein

or its sales volume. Profitability ratios measure the overall performance and effectiveness of a

company. The following Table -2 shows that the profitability ratio in state bank of India.

TABLE -2

PROFITABILITY RATIO IN STATE BANK OF INDIA

Year/ Gross Net Operating Return Return on Return on

profit

Ratio Profit ratio Profit on Total Shareholders’ Investment

Ratio Ratio Assets Fund

2013 – 14 151.14 10.62 63.98 0.61 9.207781 2.73

Volume 7, Issue XI, NOVEMBER/2018 Page No:399

Universal Review ISSN NO : 2277-2723

2014 – 15 155.74 11.66 63.58 0.65 10.20068 2.64

2015 – 16 165.86 8.60 60.88 0.44 6.897029 2.08

2016 – 17 176.53 8.77 58.29 0.39 5.568176 1.36

2017 – 18 187.53 -4.63 58.09 -0.19 -2.98795 -0.65

Mean

167.36 7.004 60.964 0.38 5.777143 1.632

S.D

14.92716 6.628909 2.799862 0.337046 5.231195 1.387793

CV

8.919193 94.64461 4.592649 88.69631 90.54987 85.03635

Source: Computed

From the above table the mean value of gross profit ratio (167.36) followed by the operating

profit (60.964), net profit (7.004), Return on Shareholders’ Fund ratio (5.77), Return on

Investment (1.632) and Return on Total Assets (0.38). The best performance of Gross profit in

profitability ratio of state bank of India.

TEST OF SIGNIFICANT OF PROFITABILITY RATIO

Table 2.1 gives the relevant details whether the profitability ratio of the State Bank of India

different for the five years. Two ways ANOVA was used.

Table 2.1 ANOVA- Profitability Ratio

(Rs.in Crore)

Source of Sum of Degree of Mean

Variation Square freedom Square F-ratio P-value F crit

Rows

20.66789 4 5.166973 0.086451 0.985652 2.866081

Columns

109801.1 5 21960.23 367.4247 5.87E-19 2.71089

Error

1195.359 20 59.76796

Total

111017.2 29

Source: Computed

Volume 7, Issue XI, NOVEMBER/2018 Page No:400

Universal Review ISSN NO : 2277-2723

From the above table that the F-value is less than the F-critical value for the alpha level selected

(0.05). Therefore, we have evidence to accept the null hypothesis and say that at least one of the

three samples have significantly different means and thus belong to an entirely different

population.

TURNOVER RATIO IN SBI

There are few ratios that help measures turnover position. The turnover ratios are also known as

activity of efficiency ratios. They indicate the efficiency with which the capital employed is

routed at the business. The overall Profitability of the business depends on capital employed and

the turnover, i.e. the speed at which the capital employed in the business totals higher or rate of

ratios. The following Table -2 shows that the turnover ratio in state bank of India.

TABLE -3

TURNOVER RATIO IN STATE BANK OF INDIA

Year/ Ratio Fixed Assets Total Assets Working Capital Sales to Capital

Turnover Ratio Turnover Ratio Turnover Ratio Employed Ratio

2013 – 14 12.80705 0.057182

0.062328

0.060433

2014 – 15 12.04223 0.054853

0.061316

0.058807

2015 – 16 11.13321 0.051201

0.059365

0.0551

2016 – 17 2.784553 0.044165

0.050773

0.046853

2017 – 18 3.534764 0.040918

0.046799

0.042999

Mean

8.460361 0.049664 0.056116 0.052838

S.D

4.88221 0.006938 0.00692 0.0076

CV

57.70688 13.96981 12.33135 14.38397

Source: Computed

Volume 7, Issue XI, NOVEMBER/2018 Page No:401

Universal Review ISSN NO : 2277-2723

From the above table the mean value of Fixed Assets Turnover Ratio (8.46) followed by the

Working Capital Turnover Ratio (0.056), Sales to Capital Employed Ratio (0.052), Total Assets

Turnover Ratio (0.049).

TEST OF SIGNIFICANCE-TURNOVER RATIO

Table 3.1 gives the relevant details whether the turnover ratio of the State Bank of India different

for the five years. Two ways ANOVA was used.

Table -3.1

ANOVA – TURNOVER RATIO

Degrees

Source of Sum of of Mean

Variation Squares freedom Square F-ratio P-value F crit

Rows 4.7570

0.000422 3 0.000141 351.9538 3.94E-07 63

Columns 5.1432

9.21E-05 2 4.6E-05 115.2309 1.63E-05 53

Error

2.4E-06 6 3.99E-07

Total

0.000516 11

Source: Computed

From the above table that the F-value is highest than the F-critical value for the alpha level

selected (0.05). Therefore, we have evidence to reject the null hypothesis.

MARKET BASED RATIO IN SBI

Year/ EPS Cash Dividend Dividend Book Price (P/BV

Ratio Earnings Payout Yield Value Earnings Ratio)

per Ratio Ratio

Volume 7, Issue XI, NOVEMBER/2018 Page No:402

Universal Review ISSN NO : 2277-2723

Share

2013 – 14 0.0920 0.103355 14.28751 0.076438 0.066981

14.136 0.066

2014 – 15 0.1020 0.1107 145.714 14.86445 0.00901 0.074644 0.007

2015 – 16 0.0689 0.080755 155.4946 10.85994 0.00565 0.070878 0.004

2016 – 17 0.0556 0.067862 157.0037 8.929279 0.00631 0.099032 0.0056

-

2017 – 18

0.0298 -0.01656 0 0 0.004684 -0.13168 0.004

Mean 0.0577

4 0.069222 94.49996 9.757934 0.020418 0.035971 0.01732

S.D 0.0522

62 0.050938 80.02222 5.965784 0.031357 0.094551 0.027242

CV 90.511

84 73.58664 84.67963 61.13778 153.5728 262.8523 157.2848

TEST OF SIGNIFICANCE-MARKET BASED

Table 4 .1 gives the relevant details whether the market based ratio – different for the five

years. Two ways ANOVA was used.

Table 4.1

ANOVA- Market Based Ratio

(Rs.in Crore)

Source of Sum of Degree of Mean

Variation Square freedom Square F P-value F crit

3390.436 3 1130.145 1.185493 0.348593 3.287382

Rows

42651.75 5 8530.349 8.948116 0.000421 2.901295

Columns

14299.68 15 953.3123

Error

60341.87 23

Total

Source: Computed

Volume 7, Issue XI, NOVEMBER/2018 Page No:403

Universal Review ISSN NO : 2277-2723

From the above table that the F-value is less than the F-critical value for the alpha level selected

(0.05). Therefore, we have evidence to accept the null hypothesis and say that at least one of the

three samples have significantly different means and thus belong to an entirely different

population.

CONCLUSION

Liquidity ratio measure a company’s ability to cash to meet short term financial

commitments. The average mean of current ratio was16.15 times, the average mean of absolute

ratio was 0.42 times and the average mean of defensive –interval ratio was 0.390 times,

profitability ratio is best regarded as earnings generated in relation to the resources invested in

company activities. The average mean of gross profit ratio was 167.36 per cent, the average

mean of net profit ratio was 7.004 per cent, the average mean of operating profit ratio was 60.96

per cent, the average mean of return on total assets ratio was 0.38 per cent, the average mean of

return on shareholders’ fund ratio was 5.77 per cent, and the average mean of return on

investment ratio was 1.63 per cent.

Activity or turnover ratio measure the efficiency of a firm or company in generating

revenues by converting its production into cash or sales. The average mean of fixed assets ratio

was 8.4times, the average mean of total turnover ratio was 0.049 times, the average mean of

working capital turnover ratio was 0.05 times and the average mean of sales to capital employed

ratio was 0.052 times.

. According to the analysis, the SBI is maintaining the required standards and running

profitability. SBI overall performance has been analyzed in detail in terms of deposit

Volume 7, Issue XI, NOVEMBER/2018 Page No:404

Universal Review ISSN NO : 2277-2723

mobilization, loans and advances, investment position, non-performing assets, earnings and

profitability efficiency.

REFERENCES

1. Subalakshmi1 , S. Grahalakshmi and M. Manikandan (2018). “Financial Ratio Analysis

of SBI [2009 - 2016]”, ICTACT Journal on Management Studies, , Volume: 04, Issue: 01

ISSN: 2395-1664 (ONLINE), FEBRUARY 2018, DOI: 10.21917/ijms.2018.0095.

2. J.D. Agarwal, “Finance India”, Available at: http://www.india_financing.com, Accessed

on 2016.

3. SBI Annual Report 2014-15". State Bank of India. Retrieved 14 January 2016

4. "Annual Report [2016-17] of State Bank of India" (PDF)

WEBSITES

1. www.sbi.co.in

2. http://www.sbimauritius.com/new/files/about.php

3. http://www.sbicaps.com/index.php/about-us/at-a-glance/

Volume 7, Issue XI, NOVEMBER/2018 Page No:405

View publication stats

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Study On Factors Affecting Stock MarketDocument78 pagesA Study On Factors Affecting Stock MarketRiya JainPas encore d'évaluation

- A Study On Asset MGTDocument66 pagesA Study On Asset MGTRiya JainPas encore d'évaluation

- Project Report On Comparative StudyDocument108 pagesProject Report On Comparative Studyritesh palitPas encore d'évaluation

- Consumer Satisfaction in Iob BankDocument124 pagesConsumer Satisfaction in Iob BankRiya Jain100% (1)

- Vehicle Loan ProjectDocument99 pagesVehicle Loan ProjectAnkit Vardhan68% (37)

- Analyst Presentation 30062017finalv2 PDFDocument62 pagesAnalyst Presentation 30062017finalv2 PDFRiya JainPas encore d'évaluation

- Credit Appraisal System at Indian OverseDocument86 pagesCredit Appraisal System at Indian OverseYogi AnandPas encore d'évaluation

- MERGERSINBANKINGINDUSTRYOFINDIASOMEEMERGINGISSUESDocument10 pagesMERGERSINBANKINGINDUSTRYOFINDIASOMEEMERGINGISSUESAkshay PawarPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Income Capital ItemsDocument2 pagesIncome Capital ItemsDeepti KukretiPas encore d'évaluation

- ICCT Colleges Foundation, IncDocument2 pagesICCT Colleges Foundation, IncSheen Catayong100% (1)

- AOA FOrmat - Public Limited CompanyDocument10 pagesAOA FOrmat - Public Limited CompanyChethan VenkateshPas encore d'évaluation

- Retained Earnings: AssignmentDocument2 pagesRetained Earnings: Assignmentmaria evangelistaPas encore d'évaluation

- Higher.: Similar Assets I A Market That Is Not ActiveDocument2 pagesHigher.: Similar Assets I A Market That Is Not ActiveAia SmithPas encore d'évaluation

- Indiabulls Securities LimitedDocument1 pageIndiabulls Securities Limitedraj200224Pas encore d'évaluation

- State Profile (2016-17)Document197 pagesState Profile (2016-17)Niladri MandalPas encore d'évaluation

- Appendix F: Accounting For PartnershipsDocument17 pagesAppendix F: Accounting For PartnershipsDerian Wijaya100% (1)

- Form A Fund ManagementDocument88 pagesForm A Fund ManagementAh MhiPas encore d'évaluation

- CABARLE Microeconomics FLADocument6 pagesCABARLE Microeconomics FLAAdrian CabarlePas encore d'évaluation

- Unit-3: What Is Unit Costing?Document8 pagesUnit-3: What Is Unit Costing?bcomh01097 UJJWAL SINGHPas encore d'évaluation

- Review of Related Literature and StudiesDocument20 pagesReview of Related Literature and StudiesRed SecretarioPas encore d'évaluation

- Nike Presentation Intro of FinanceDocument11 pagesNike Presentation Intro of FinanceRashe FasiPas encore d'évaluation

- Hwhwwjwjwjwjwjwiwiwiwkke Cpa Review School of The Philippines Manila Corporations Dela Cruz / de Vera / Lopez / LlamadoDocument9 pagesHwhwwjwjwjwjwjwiwiwiwkke Cpa Review School of The Philippines Manila Corporations Dela Cruz / de Vera / Lopez / LlamadoSophia PerezPas encore d'évaluation

- Module 1 Financial Statement AnalysisDocument56 pagesModule 1 Financial Statement AnalysisBlueBladePas encore d'évaluation

- HDFC Life Click 2 InvestDocument7 pagesHDFC Life Click 2 InvestShaik BademiyaPas encore d'évaluation

- Ind - Ass.CF I ProblemsDocument3 pagesInd - Ass.CF I ProblemsNop SopheaPas encore d'évaluation

- Benevolent Funds Program 2011-09-21 ToolkitDocument22 pagesBenevolent Funds Program 2011-09-21 ToolkitNational Association of REALTORS®100% (1)

- Week 06 EntrepreneurshipDocument4 pagesWeek 06 EntrepreneurshipR TECHPas encore d'évaluation

- 1 Modul - Accounting IntermediateDocument30 pages1 Modul - Accounting IntermediatepastadishéPas encore d'évaluation

- Solutions Manual For Intermediate Accounting Volume 2 Canadian 7th Edition by Beechy IBSN 1259108023Document532 pagesSolutions Manual For Intermediate Accounting Volume 2 Canadian 7th Edition by Beechy IBSN 1259108023Brewer32% (28)

- Chapter 1 Exercises-Income TaxationDocument14 pagesChapter 1 Exercises-Income TaxationFaith Pumihic0% (1)

- Evaluating A Firm's Financial PerformanceDocument47 pagesEvaluating A Firm's Financial PerformanceErlanggaPas encore d'évaluation

- Chapter 1 Problem 3: Exercises: - Journal EntryDocument18 pagesChapter 1 Problem 3: Exercises: - Journal EntryAlarich CatayocPas encore d'évaluation

- Restaurant Revitalization Fund Program Guide As of 4.28.21-508 - 0Document22 pagesRestaurant Revitalization Fund Program Guide As of 4.28.21-508 - 0the kingfishPas encore d'évaluation

- Cambridge International Examinations: Accounting 9706/33 May/June 2017Document16 pagesCambridge International Examinations: Accounting 9706/33 May/June 2017Malik AliPas encore d'évaluation

- CA P. E. II Course PE II Exam Revision Test Papers NovembeDocument25 pagesCA P. E. II Course PE II Exam Revision Test Papers Novembeakash yadavPas encore d'évaluation

- 10 - 11 - 12 - Data Cruncher Plus InstructionDocument6 pages10 - 11 - 12 - Data Cruncher Plus InstructionatikasaPas encore d'évaluation

- 1 OA - No.170/00050/2017/CAT/Bangalore BenchDocument5 pages1 OA - No.170/00050/2017/CAT/Bangalore BenchRocky JaduPas encore d'évaluation

- Research Insight - 3Document6 pagesResearch Insight - 3Srinivas NandikantiPas encore d'évaluation