Académique Documents

Professionnel Documents

Culture Documents

Registration Form Amended 31.12.14 PDF

Transféré par

akhtarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Registration Form Amended 31.12.14 PDF

Transféré par

akhtarDroits d'auteur :

Formats disponibles

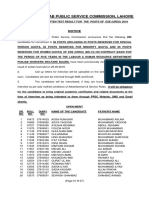

Canteen Stores Department

MINISTRY OF DEFENCE

REGISTRATION FORM

1. Type of Firm / Company (Public Ltd, Private Ltd, Partnership, Sole Proprietorship): ________________

2. Complete Name of Firm / Company: _____________________________________________________

3. Contact Details of Firm / Company:

Address ___________________________________________________________________________

PTCL No (with city code): ____________________________ Mobile: __________________________

Fax: ___________________________________ E-mail _____________________________________

4. Name and address of owner(s) / partners / proprietor:

Ser Full Name Residential Address CNIC No Contact No

5. Bank Details:

Account Title / Name: ________________________________________________________________

Name of Bank / Branch (with code no): ___________________________________________________

Account No: ________________________________________________________________________

6. Are you / your Firm registered with the Income / Sales Tax Department? If so, please quote following:

a. National Tax Number: _____________________________

b. Sales Tax Registration No: ______________________________

7. Seek Registration as:

a. Importer b. Trader c. Manufacturer d. Distributor e. Stockiest

(Tick the applicable. Please attach a letter confirming the status of applicant as an accredited agent of dealer in that particular

item which is being offered for sale to CSD).

8. If manufacturer, furnish details of manufacturing plants / facilities:

Ser Address Name of Person in charge PTCL / Mob No

9. Brand name of items / commodities proposed to be supplied to CSD:-

a. ________________________________ d. ______________________________

b. ________________________________ e. ______________________________

c. ________________________________ f. ______________________________

(Separate sheet may be attached where necessary)

10. Are you a regular supplier of any Govt/Semi Govt/Public sector organization? Quote name(s):

__________________________________________________________________________________

11. Details of Branches/Dealers/Agents:

Ser Name of Branch / Dealer / Agent City Tel / Mob No

12. Details regarding Pakistan Standards and Quality Control Authority (PSQCA) License(s)

Ser Category of Item Item Code License No Validity

13. Details of Membership of Trading / Manufacturers Association:

Ser Name of Trading / Manufacturing Association Member since

14. Person(s) authorized to sign correspondence with CSD:

Ser Name of Person Appointment / Mob No Specimen

Designation Signatures

15. Certified that the above information is correct in all respects. In case it is found incorrect subsequently,

my/our registration may be cancelled.

Signature: _______________________________

Office Stamp of

Name: __________________________________

the Firm

Appointment: _____________________________

N I C No: ________________________________

Address: ________________________________

Date: ___________________

Witness No.1 Signature: _____________________ Witness No. 2 Signature: __________________

Name: ___________________________________ Name: _________________________________

N I C No: _________________________________ N I C No: _______________________________

Address: _________________________________ Address: _______________________________

Date: ______________________ Date: ____________________

INSTRUCTIONS

1. In case firm is a Limited concern, name of the Managing Director must be shown in the Registration Form.

2. If case firm is a Limited concern incorporated in Pakistan, attach photocopy of Certificate of Incorporation.

3. In case firm is a Partnership concern, attach photocopy of Partnership Deed.

4. If you are an Importer, attach attested photocopies of recent Bill of Lading / Bill of Entries.

5. If you a manufacturer, attach a photocopy of the Registration Certificated under Factories Act.

6. If case you are a distributor, please attach an Authority Letter from the mother firm on its letter head with official stamp, indicating

their approval / authorization to your firm as their distributor.

7. Attach Original Bank Statement of the last one year showing credit/debit liabilities.

8. Attach attested photocopy of Income/Sales Tax Department letter, under which your firm has been allotted National Tax Number and

Sales Tax Registration Number.

9. In case firm is a stockiest except “Food Grain, Grocery items & stationery”, a Dealership Certificate will be provided under which

manufacturer has authorized to sell their products on their behalf.

10. Attach photocopies of CNIC of owner(s), official signing the registration form and the witnesses.

11. Attach copy of PSQCA license of each SKU, if applicable.

12. Bank Draft/Pay Order for Rs. 75,000/- on account of Initial Registration Fee (Non-Refundable) in favour of Head Office, CSD

Rawalpindi be attached with this form.

13. Bank Draft/Pay Order for Rs.15,000/- on account of annual renewal fee (Non-Refundable) in favour of Head Office, CSD will be

deposited between 1 July to 30 August every year. Otherwise, it would be deducted from the firm / company running bills.

14. Bank Draft/Pay Order for Rs.1,500/- per item will be paid as induction charges (category based induction incase of 50 plus items).

Head Office CSD: 265 Muhammad Hussain Road, Post Office Box No. 1039, Rawalpindi Cantt. Pakistan

Telephone:051-8771712, 051-8771724, 8771714, 8771715 Fax 051-8771721

Web:www.csd.gov.pk E-Mail: ddproc1@csd.gov.pk

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- TranslationDocument1 pageTranslationakhtarPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

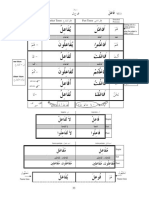

- Imperfect Tense Past Tense: He Was/is. (Document1 pageImperfect Tense Past Tense: He Was/is. (akhtarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Imperfect Tense Past Tense: Attached Pronouns Detached PronounsDocument1 pageImperfect Tense Past Tense: Attached Pronouns Detached PronounsakhtarPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Imperfect Tense Past Tense: He Taught.Document1 pageImperfect Tense Past Tense: He Taught.akhtarPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Imperfect Tense Past Tense: He Disbelieved.Document1 pageImperfect Tense Past Tense: He Disbelieved.akhtarPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Imperfect Tense Past Tense: He Called Out.Document1 pageImperfect Tense Past Tense: He Called Out.akhtarPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Feminine Gender: Imperfect Tense Past TenseDocument1 pageFeminine Gender: Imperfect Tense Past TenseakhtarPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Provided by Unisa Institutional RepositoryDocument190 pagesProvided by Unisa Institutional RepositoryakhtarPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- TranslationDocument1 pageTranslationakhtarPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Justice DeniedDocument58 pagesJustice DeniedakhtarPas encore d'évaluation

- Arabic ConjugationDocument55 pagesArabic ConjugationakhtarPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Antihyperglycemic and Antihyperlipidemic Effect ofDocument6 pagesAntihyperglycemic and Antihyperlipidemic Effect ofakhtarPas encore d'évaluation

- Entry Test 2020 Urdu PDFDocument3 pagesEntry Test 2020 Urdu PDFakhtarPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- 01 RegularDocument5 pages01 RegularakhtarPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Pakistan Under Siege - Extremism, Society, and The State On JSTOR PDFDocument1 pagePakistan Under Siege - Extremism, Society, and The State On JSTOR PDFakhtarPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Li 9780745335421Document17 pagesLi 9780745335421akhtarPas encore d'évaluation

- Sargodha Ramadan Timings 2019 Calendar, Iftar & Sehri Time ScheduleDocument4 pagesSargodha Ramadan Timings 2019 Calendar, Iftar & Sehri Time ScheduleakhtarPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Ese (Urdu) 7 J 2019Document7 pagesEse (Urdu) 7 J 2019akhtarPas encore d'évaluation

- Pakistan Under SiegeDocument2 pagesPakistan Under SiegeakhtarPas encore d'évaluation

- Engg 135 Design of Reinforced Concrete Structures: Bond and Bar Development Reading: Wight and Macgregor Chapter 8Document24 pagesEngg 135 Design of Reinforced Concrete Structures: Bond and Bar Development Reading: Wight and Macgregor Chapter 8Manuel MirandaPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Beginner Guide To Drawing AnimeDocument14 pagesBeginner Guide To Drawing AnimeCharles Lacuna75% (4)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)Document172 pages4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)gregory berlemontPas encore d'évaluation

- MANILA HOTEL CORP. vs. NLRCDocument5 pagesMANILA HOTEL CORP. vs. NLRCHilary MostajoPas encore d'évaluation

- 1 Reviewing Number Concepts: Coursebook Pages 1-21Document2 pages1 Reviewing Number Concepts: Coursebook Pages 1-21effa86Pas encore d'évaluation

- Digital Culture and The Practices of ArtDocument31 pagesDigital Culture and The Practices of ArtLívia NonatoPas encore d'évaluation

- The VerdictDocument15 pagesThe VerdictEbuka sixtusPas encore d'évaluation

- B Blunt Hair Color Shine With Blunt: Sunny Sanjeev Masih PGDM 1 Roll No.50 Final PresentationDocument12 pagesB Blunt Hair Color Shine With Blunt: Sunny Sanjeev Masih PGDM 1 Roll No.50 Final PresentationAnkit Kumar SinghPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Modern America Study Guide With Answers 2020 21Document2 pagesModern America Study Guide With Answers 2020 21maria smithPas encore d'évaluation

- I Wanted To Fly Like A ButterflyDocument12 pagesI Wanted To Fly Like A ButterflyJorge VazquezPas encore d'évaluation

- VDOVENKO 5 English TestDocument2 pagesVDOVENKO 5 English Testира осипчукPas encore d'évaluation

- Annex E - Part 1Document1 pageAnnex E - Part 1Khawar AliPas encore d'évaluation

- Test Bank For Biology 7th Edition Neil A CampbellDocument36 pagesTest Bank For Biology 7th Edition Neil A Campbellpoupetonlerneanoiv0ob100% (31)

- Drimaren - Dark - Blue HF-CDDocument17 pagesDrimaren - Dark - Blue HF-CDrajasajjad0% (1)

- 2017 Ecatalogue Howtim Exit SignDocument38 pages2017 Ecatalogue Howtim Exit SignSatish Phakade-PawarPas encore d'évaluation

- Answer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)Document4 pagesAnswer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)erijfPas encore d'évaluation

- Ingo Plag Et AlDocument7 pagesIngo Plag Et AlDinha GorgisPas encore d'évaluation

- Mapeh Reviewer For My LabidabsDocument3 pagesMapeh Reviewer For My LabidabsAshley Jovel De GuzmanPas encore d'évaluation

- Part 1: Hôm nay bạn mặc gì?Document5 pagesPart 1: Hôm nay bạn mặc gì?NamPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Infographic Group Output GROUP 2Document2 pagesInfographic Group Output GROUP 2Arlene Culagbang GuitguitinPas encore d'évaluation

- People Vs SantayaDocument3 pagesPeople Vs SantayaAbigail DeePas encore d'évaluation

- The List of Official United States National SymbolsDocument3 pagesThe List of Official United States National SymbolsВікторія АтаманюкPas encore d'évaluation

- 1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistDocument5 pages1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistNick RamboPas encore d'évaluation

- 34 The Aby Standard - CoatDocument5 pages34 The Aby Standard - CoatMustolih MusPas encore d'évaluation

- Tutorial Inteligencia Artificial by MegamugenteamDocument5 pagesTutorial Inteligencia Artificial by MegamugenteamVictor Octavio Sanchez CoriaPas encore d'évaluation

- Short StoriesDocument20 pagesShort StoriesPatrick Paul AlvaradoPas encore d'évaluation

- Study of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesDocument60 pagesStudy of Indian Wrist Watch Industry and Repositioning Strategy of Titan WatchesVinay SurendraPas encore d'évaluation

- Do 18-A and 18 SGV V de RaedtDocument15 pagesDo 18-A and 18 SGV V de RaedtThomas EdisonPas encore d'évaluation

- Kangar 1 31/12/21Document4 pagesKangar 1 31/12/21TENGKU IRSALINA SYAHIRAH BINTI TENGKU MUHAIRI KTNPas encore d'évaluation

- Project Presentation (142311004) FinalDocument60 pagesProject Presentation (142311004) FinalSaad AhammadPas encore d'évaluation