Académique Documents

Professionnel Documents

Culture Documents

2018

Transféré par

Jay ParekhCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2018

Transféré par

Jay ParekhDroits d'auteur :

Formats disponibles

Journal of Management (JOM)

Volume 5, Issue 3, May–June 2018, pp. 143–151, Article ID: JOM_05_03_018

Available online at

http://www.iaeme.com/jom/issues.asp?JType=JOM&VType=5&IType=3

Journal Impact Factor (2016): 2.4352 (Calculated by GISI) www.jifactor.com

ISSN Print: 2347-3940 and ISSN Online: 2347-3959

© IAEME Publication

PAYMENTS IN INDIA GOING DIGITAL: A

STUDY WITH REFERENCE TO CREDIT CARD

PAYMENTS

Dr. Subramanian.S

Professor of Finance, Dilla University, Ethiopia

ABSTRACT

Payment systems in any country are the most essential part of the economic system

of the country. Digital payment is a way of payment made through digital modes. Cards

are provided by banks to their account holders which remain the most used digital

payment mode till now. Many of us use cards for transferring funds and making digital

payments. Credit cards are innovative instruments in the area of financial services

offered by commercial banks. The movement from paper based payment system to

electronic means of payment facilitates quicker and safer transactions. The movement

can also be easily tracked. This also adds to the accountability of funds in an economy.

The high incidence of cash transactions has an undesirable effect of inability to track

transactions leading to loss of revenue in the form of tax evasion.

In cognizance with this background, the main objective of the study is to make an

attempt to find out whether the credit card is growing up for popularity of digital

payments mode. The study revealed that there is a relationship between volume of

transaction and value of payments. Hence, it is obvious if there is an increase in volume

of transaction; value of payments is also increased but not in outstanding cards

available. The study is based on secondary sources besides being analytical in nature.

The data for the years commencing from the financial year (FY) 2007-08 to 2017-18

have been used in the study. The tools used for analyses are trend, correlation,

percentage and multiple regressions analyzed by SPSS.

Key words: Credit Cards, E-Payments, E-Banking, Digital Payments, Digital Vision,

RBI.

Cite this Article: Dr. Subramanian.S, Payments In India Going Digital: A Study with

Reference To Credit Card Payments. Journal of Management, 5(3), 2018, pp. 143–151.

http://www.iaeme.com/jom/issues.asp?JType=JOM&VType=5&IType=3

1. INTRODUCTION

The banking system of India should not only be hassle free but also be able to meet new

challenges posed by technology and any other external and internal factors. Without a sound

banking system, India cannot have a healthy economy. During the past three decades Indian

banking system has several outstanding achievements to its credit, the most striking is its

http://www.iaeme.com/JOM/index.asp 143 editor@iaeme.com

Dr. Subramanian.S

extensive reach. It is no longer confined to metropolitans or cosmopolitans in India. In fact, it

has reached even the remote corners of the country. This is one of the main reasons for the

growth of Indian economy. In olden days, accepting of deposits and sanctioning loans and

advances to customers were the main functions of banks but to-day banks perform enormous

new functions such as agency function, financing of foreign trade, credit creation. For

performing all these functions efficiently, many new e- payments products such as credit card,

debit card, ATM are used by banks (Gupta, 2007). Indian digital payments industry is expected

to reach $700 billion by 2022 in terms of value of transactions. It is expected that more than 80

per cent of the urban population in India will adopt digital payments as a part of their routine

by 2022 and 70 per cent of the retail chains will adopt the same. (www.reuters.com). E-

payments will offer a transparent environment to compare the cost and quality of services

offered by a variety of financial institutions. As a result, the focus is going to shift from generic

banking service to customized banking services.

Today, banks offer various financial services like ‘internet banking’, ‘mobile-banking’,

‘payment of bills’ on credit cards, ATM withdrawals which have had major impact on the

economic growth besides leading to the reduction of transaction time and increased reach of

banking and financial sector to sections of people previously not exposed to banking and

financial services. A credit card is a monetary instrument that enables the cardholder to obtain

goods and service without actual payment at the time of purchase. It is also popularly known

as plastic money. It can be said that a credit card is basically “Buy Now” “Pay Later” card

provided to the customer. Now –a -days, in view of global business, the individual is not the

icing. This will take the customer and banks edging their way towards cyberspace with

innovative services taken to retain these customers. VISA has also estimated that electronic

payment networks, by increasing the efficiency and velocity of payments has the potential to

create cost savings of at least 1 percent of the GDP annually over paper based systems in any

given economy (www.corporate.visa.com). Bank net India has also revealed that debit cards

have become very popular in India. But, as of date, ATM/Debit cards have still their primary

usage for cash withdrawal from the ATM machines, while credit cards are more popular in

making payments online (www. banknetindia.com). The development of the credit card is one

of the most significant phenomena of the modern financial services scenario.

2. SIGNIFICANCE OF THE STUDY

The number of credit card holdings and usages has been increasing significantly in recent

decades across the globe. This trend is reaching popularity as a preferred mode of payment for

shopping and other various services viz. utility bill payments, online payment across the border

due to convenient method of payment in lieu of cash, checks, pay order or other way of payment

(Themba & Tumedi, 2012). The Indian Government is bringing positive policy framework such

as Goods and Services Tax (GST), financial inclusion, improving digital infrastructure,

launching payment systems such as Aadhar enabled payments, UPI, and others which are

supporting the digital payments industry. In 2016, Indian Government made a significant move

viz. demonetization, to curb black money circulation within the country and to increase digital

payment penetration. It is a phenomenal step made by India towards improving cashless

economy resulting in sharp increase of several digital payment channels in the country. The

changing customer behavior, increasing internet penetration rate, and government policies are

fueling the industry which is indirectly supported by the growing demand for P2P payments, e-

commerce platforms, utility bill payments, and others. The development of digital infrastructure

in India stands out by providing a strong technological ecosystem.

The credit card market in India is about 37.48 million with a value turnover around INR.

4689.65 Billion At the end of March 2018. There is a growth rate of outstanding cards 25.60

http://www.iaeme.com/JOM/index.asp 144 editor@iaeme.com

Payments In India Going Digital: A Study with Reference To Credit Card Payments

per cent from 21.75 per cent and in value of payments growth would be INR 4,589.65 Billion

from 3, 283.82 billion during the FY 2017-18 from 2016-17 respectively in cards available and

by value of payments. It is also reported that growth value of payments from 37.91 per cent to

39. 77 per cent. The market is expected to grow by 50 per cent p.a. The usage of credit cards

has also hit a record high growth in India (39.77%). This would still be a very low penetration

of a potential market of 60 million cardholders. The credit card business is a low-margin, high

volume business. Thus, given the low income per card and the high initial investments by the

bank, large volumes in terms of cards issued and the transactions financed are required to make

the operations profitable.

In March 2010, the value of payments was only INR. 618.24 billion to INR.4589.65 billion.

That shows a leap of 642 (%) per cent in eight years. Credit card payments or plastic money

offers a lot of convenience, it comes at a price. Although, it has become an inseparable part of

our lifestyle, it requires a serious thought. Using a credit card is safer than carrying cash. The

number of defaults has also been reduced in recent years. In this background, the researcher

makes an attempt to examine and analyses whether the credit card payments is growing up

popularity and test whether there is any relationship between outstanding cards, volume of

transaction and value of payments for achieving digital vision strategy is significant of the

study.

3. REVIEW OF LITERATURE

Many empirical studies have been conducted on the subject of ‘Plastic Money’ in India and

abroad. The major emphasis of research has been on various issues like frauds, security, usage

pattern, new method of e-payment, etc. From the review of literature, it was found that hardly

there was an important study which examined the perception of both users and traders on the

usage of plastic money and digital payments.

Dewri et al. (2016) investigated behavioral usage patterns of credit card users in the

emerging economics and how the external factors are influencing the credit card users to use

credit cards in their day-to-day life. The study found that there is a significant relationship

among – earnings and usage of credit limit; different age group has diverse tendency to use

credit card and repayment attitudes; profession and usage behavior of credit card; e-repayment

attitudes to pay bill by different age groups. Sriyalatha, Kumudini. (2016) showed that the most

influential variable on attitude towards credit card usage is card used intention followed by

perceived usefulness and availability of information.

Research evidence reflects that credit card related debt is rising significantly since last

recent decade due to substantial share of household spending across the globe (Arabzadeh et

al., 2015). Aparna Iyer (2013) reveals that safety and security are the new challenges as banks

go electronic even in the hinder land. As banks go more Hi-Tech, the regulator has to

necessarily stay a step ahead. Themba. G and Tumedi .B.G (2012) the study found that credit

card ownership and usage in Botswana are relatively high and that these appear to be influenced

by consumer demographics and in particular income, age, education, gender and marital status

as well as attitude towards debt. Thomas et al. (2010) noted that on average an American carries

4.4 cards in his/her wallet. By contrast the credit card market in India is reported to be low due

to the fact that 40 per cent of the populations do not own a bank account (Khare et al. 2011).

Linda Eagle (2010) report unfolds that as more bank customers begin to use electronic

banking solutions, hackers and money launderers are becoming more creative in their fraud

tactics over the past period. Subramanaian.S (2010), the outcome of the result depends upon

the awareness level of cardholders; they look more satisfied on the awareness level of the card

being issued by the banks. The issuers should take necessary steps to improve their cardholders’

awareness for perennial satisfaction of the cardholders. Subramanian.S and Swaminathan.M

http://www.iaeme.com/JOM/index.asp 145 editor@iaeme.com

Dr. Subramanian.S

(2010) revealed that customers prefer electronic mode of transaction than paper based

instruments which are healthy practices for Indian economic growth. The electronic payments

(EP) options also allow the companies to track the receipts in a more transparent manner and

manage payments and liquidity more efficiently.

Sumanjeet. S (2009) concludes that despite the existence of variety of e-commerce payment

systems, credit cards are the most dominant payment system. Subramanian.S and Swaminathan.

M (2009) revealed that the consumers have now preferred the use of payment cards for these

are safer to carry and provide credit facilities. The growth trend, to some extent, will be

impacted by the current financial turmoil and credit squeeze. Bankers will also become a little

more conscious while doing risk evaluation of credit card applicants. But the overall trend will

remain positive. Gan et.al., (2008) in this study report that the number of credit cards was found

to be significantly influenced by income and gender as well as perceptions that include “credit

cards leads to over spending”, “Saving as payment source”, “unreasonable interest rates”,

“credit card as status symbol.”

Murugesan.S (2007) found that the credit card gives ample scope for the expansion and

growth of business besides recommending more innovative and user-friendly schemes should

be introduced to make more number of people to have credit cards. Parimala .J (2007)

highlighted the marketing environment of credit cards in Trichirappalli. Her major findings

reveal that there is no sufficient merchant establishment to honour credit cards; cardholders

were not aware of all services offered by the issuers and lack of sufficient advertisement and

publicity. Her suggestions to overcome these and reduce charges for penalty, interest, annual

charges are a much scope for growth and expansions of credit cards market. Swarnalatha. N

(2007) analyzed the results of the credit card services. The study was based on the perception

of selected credit cardholders of various issuing banks in Chennai city. This research revealed

that single cardholders are less satisfied than multiple cardholders.

4. METHODOLOGY

The study covers the secondary sources of information collected through reference from books,

IBA journal, RBI Bulletin, Published Articles and related banks Websites. The study covers the

period during the financial year (FY) ending 31st March 2007-08 to 20017-18. The tools used

for analyses are trend, correlation, percentage and multiple regression analysis.

5. RESULTS AND DISCUSSIONS

The following tables and analyses reveal the digital payments through credit cards in India:

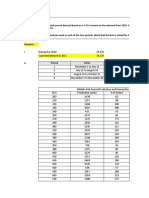

Table1 Trend of Outstanding Credit card during the Period from 2007-08 to 2017-18

Outstanding**

Growth rate

*FY Cardholders Trend value

(%)

(In. Millions)

2007-08 27.55 - 19.07

2008-09 24.70 -10.34 19.94

2009-10 18.33 -25.79 20.82

2010-11 18.04 -1.58 21.70

2011-12 17.65 -2.16 22.57

2012-13 19.55 10.76 23.45

2013-14 19.18 -1.89 24.33

2014-15 21.11 10.06 25.20

2015-16 24.51 16.11 26.08

2016-17 29.84 21.75 26.96

2017-18 37.48 25.60 27.83

Source: Compiled from RBI monthly Bulletin, Money and Banking up to May 2018

http://www.iaeme.com/JOM/index.asp 146 editor@iaeme.com

Payments In India Going Digital: A Study with Reference To Credit Card Payments

*FY-12 months commencing from 1st April to 31st March every year.

** Cards outstanding issued by banks (excluding those withdrawn/blocked).

From the table 1, it is found that the number of outstanding cards issued for the various

banks during the financial year ending 2007-08 to 2017-18. This data clearly indicate that

numbers of outstanding cards are growing at phenomenal rate. It has been grown up from 27.55

million to 37.48 million during 2007-08 to 2017-18. During the period 2008-09 to 2009-10, the

outstanding cards are declining from 24.70 million to 18.33(-25.79%) million the reason behind

the impact of global financial turmoil and crisis, the card issuing banks have blocked or

withdrawn for inactive cards (cf: RBI). This impact has continued upto the FY ending of 2011-

12. After revamping and normal course of the banking business, there were sharp rise to 21.11

million from 17.65 million cards circulated during the FY 2014-15 from 2011-12. Due to the

cross selling of product and other banking strategy the issuers /banks has taken steps to

encourage and improve the outstanding number of cards has jumped from 21.11million to 37.48

million (+77.55%) during the period of 2014-15 to 2017-1. It is important to note that current

FY, outstanding cards were the highest growth rate of 25.60 per cent. It reveals that bankers are

very much interested to sell his cards and also customers may be more aware about the usage

of digital money than paper based payment mode.

Table 2 Trend volume of card transaction during the period of 2007-08 to 2017-18

Volume Growth rate

*FY Trend value

(In. Millions) (%)

2007-08 228.20 - 21.51

2008-09 259.56 13.74 128.23

2009-10 234.24 -9.75 234.94

2010-11 265.14 13.19 341.65

2011-12 319.96 20.68 448.37

2012-13 396.61 23.96 555.08

2013-14 509.08 28.36 661.80

2014-15 615.12 20.83 768.51

2015-16 785.73 27.74 875.23

2016-17 1087.13 38.36 981.94

2017-18 1405.16 29.25 1088.66

Table 3 Trend Value of card payments during the periods of 2007-08 to 2017-18

Value Growth rate

*FY Trend value

(INR. in Billions) (%)

2007-08 579.85 - -78.56

2008-09 653.56 12.71 273.44

2009-10 618.24 -5.40 625.45

2010-11 755.16 22.15 977.45

2011-12 966.13 27.94 1329.46

2012-13 1229.51 27.26 1681.47

2013-14 1539.85 25.24 2033.47

2014-15 1899.16 23.33 2385.48

2015-16 2381.20 25.38 2737.48

2016-17 3283.82 37.91 3089.49

2017-18 4589.65 39.77 3441.50

Source: Compiled from RBI monthly Bulletin, Money and Banking up to May 2018

The tables 2 and 3 capture throughout credit cards payment channels during FY ending of

2007-08 to 2016-17 both in terms of value and volume. This data clearly indicate that card

http://www.iaeme.com/JOM/index.asp 147 editor@iaeme.com

Dr. Subramanian.S

payments transactions are growing at phenomenal rate in volume and value. The number of

card users has jumped from 21.11 to 37.48 million during 2014-15 to 2017-18. This number

was merely 17.65 million in 2011-12 (see table 1). The number of card transactions has surged

dramatically as a result. There were 509.08 million transactions as a result of the sharp rise in

card users in 2013-14. At the same time the volume of transactions, which had more than

doubled in FY2013-14 to 509.08 million, grew at a relatively higher growth rate of 28.36 per

cent among the previous years. In the three year-ago, the number of transactions was only

234.24 million due to blocked inactive card for global financial crisis.

Due to the technological development, the proportion of card payment both in terms of

volume and value of payment has increased sharply. This means more people are increasingly

relying on card payment transactions. The value of card transactions jumped into around three

times (INR. 579.85 billion to 1539.85 billion INR) in five year of 2007-08 to 2013-14. Cards

users have found convenience in the use of card payments for transaction. They transfer

payments through cards than ever before. The card banking has been reflecting a growing trend

is increasing by 20.68 per cent (319.96 million from 265.14 million) by volume and 27.94 per

cent (INR.966.13 billion from INR.755.16 billion) by value during the same period of 2010-11

to 2011-12.

In the year 2012-13 and 2013-14, the number of card transaction continuously grows up

from 396.61million to 509.08 million and by value INR1229.51 billion to INR.1539.85 billion.

During the financial years (FY) 2014-15, the total volume of card transaction is further growing

upward trend from 615.12 million to 785.73 million transactions which indicate the growth rate

of 20.83 per cent to 27.74 per cent and the value of transaction from INR 1899.16 billion to

2381.20 billion (+25.38%) which indicates fast growing upwards trends than the previous years.

During 2007-08 to 2014-15, the numbers /volume of card banking transacted from 228.20

million to 615.12 million and in value INR. 579.85 billion to 1899.16 billion of payments

through this mode. It is clearly indicated that the total growth of card transaction around three

times by volume and in value. The FY 2016-17 to 2017-18, volume of transaction is increasing

further to 1405.16 million (+ 29.25%) from 1087.13 million and by values of INR.4589.65

(+39.77%) billion from INR. 3283.82 billion. This implies that the existing card users are

gaining confidence to transact payments frequently through the card mode. It is further

important to reveals that more number of customers preferred card payments which indicate

that the existing users transact larger amount through card banking. It was also found that the

relationship between volume of transactions and value of card payments is high and positive

(0.999) meaning that if there is an increase in number of transaction simultaneously value of

payments also increased.

The card payment in India seems to be catching on. Over the past years, it has grown rapidly.

India has a large number of cards users, the potential is still untapped. The study shows that

further push to promote a less-cash economy, the government has asked the banks to provide

more facility to the customers and also drive to push digital payments in a time bound manner.

It is also indentified that there is an indication of further growth of card payments for the digital

vision and financial inclusion perspectives. So, the bankers should motivate customers by

offering subsidy/incentive to promote further card usage. It observed that the government

needed to increase further infrastructural development for digital payments. The main vision of

Digital India initiative is to ‘transform India into a digitally empowered society and knowledge

economy’ (www.indiacelebrating.com). It is convinced beyond doubt that card banking is a

great digital way in the effort to financially include the unbanked and semi banked societies in

the countries where there is low access to finance. Hence, it is evident that the expedition of

digital vision via card banking is inevitable.

http://www.iaeme.com/JOM/index.asp 148 editor@iaeme.com

Payments In India Going Digital: A Study with Reference To Credit Card Payments

6. MULTIPLE REGRESSIONS EQUATION FOR THE VALUE OF CARD

PAYMENTS

Dependent variable: Growth value of credit card payments (Y)

Independent variables:

1. Number of cardholders/outstanding cards (X1)

2. Number/volume of Transaction (X2)

Dependent variable: Growth value of credit card payments (Y)

Multiple R value = 0.998

R square value = 0.997

F value =1319.625

P value = 0.000**

Table 5 Multiple regressions equation for the growth value of card payments

Unstandardized

Variable(s) SE of B ‘t’ value P value

co-efficient (B)

X1 -2.758 6.547 -0.421 0.685

X2 3.323 0.104 31.951 0.000**

Constant 98.463 116.181 0.847 0.421

** P value denote significant at 1% level

The multiple correlation coefficient R = 0.998 measures the degree of relationship between

the actual values and the predicted values of the order of value for card payment. Because the

predicted values are obtained as a linear combination of Number of Outstanding

Cards/cardholders (X1), Number of card Transactions (X2), the coefficient value of 0.998

indicates that the relationship between growth value of credit card payments and two

independent variables is quite moderate and positive.

The coefficient of determination, R-square measures the goodness-of-fit of the estimated

value of R2 = 0.997 shows about 99.70 per cent of the variation. This information is quite useful

in assessing the overall accuracy of the model and significant at 1% level, since p value is less

than 0.01.

The Multiple regression equation is

Y=98.463 -2.758X1+3.323X2

The constant a = 98.463 has no interpretable meaning because the average level of

dependable variable could not be negatively employed. Nonetheless, this value should not be

discarded. It plays an important role when using the estimated regression line/equation for

prediction. b1 = -2.758 represents the outstanding number of credit cards (X1) dimension of

holding other variable are constant. The estimated negative sign implies that such effect is

negative and implies that value would decrease by -2.758 for every unit of increases as

outstanding number cards. b1 = 3.323 represents the volume /number of transaction (X2) of

holding other variable are constant. The estimated positive sign implies that such effect is

positive and implies that value of card payments would increase by 3.323 for every unit of an

increase as volume or number of card transactions and usage.

It is concluded that the rating order of growth value of card payments for every one unit

increases of variable the number of transaction increased but not with regard to outstanding

number of cards possess. Further, the variables of increasing volume of transaction is highly

significant than outstanding number of cards issued by the banks which indicates that card

http://www.iaeme.com/JOM/index.asp 149 editor@iaeme.com

Dr. Subramanian.S

issuing banks should restrict to issue cards/ blocked inactive cards for minimizing maintenance

costs and default risk. It reveals that increasing volume or number of transaction is highly

significant to increase the value of payments. The card issuing division of banks should adopt

right marketing strategy such as waiver of bank charges and commission, tax benefits etc., to

motivate merchant for acceptability of card payments and cash back offers, discount facility

and other incentives/subsidy for increasing cardholder’s usage.

7. CONCLUDING REMARKS AND SUGGESSTIONS

To conclude that there is a relationship between volumes transaction and the value of payments

but not in outstanding cards possess. This means that increasing number of transaction

simultaneously the values of payments are also increases. The study suggests and recommends

the card issuers to increases the number of transaction for popularity of digital card payment in

value. The government is also supporting digital payments a lot. It has reduced some taxes and

announced incentives for digital payments. It has launched Lucky Grahak Yojna for customers

and Digi Dhan Vyapar Yojna for shopkeepers. The future of digital payments is very bright.

Recently, the Finance Minister doubles the allocation to the Digital India programme to INR

3,073 crore in 2018-19 (www. tamil.oneindia.com). These will also an important milestone to

achieve our economic objectives of digital payments vision.

Despite a sharp jump in the number of credit cards, value and its use, complaints regarding

credit cards have dropped significantly. According to data released by the Reserve Bank of

India (RBI, 2017), credit card-related complaints dropped over 5 per cent despite a 27 per cent

jump in customer complaints in the overall banking sector. The number of complaints has

dropped because of digitalization and government policies or measures to promote electronic

bill payments. Securities and safety measures are also improved. All these factors point to the

immediate need of promoting an important electronic payment product of credit cards for

achieving digital vision of India. It is also possible to create paperless eco- free cashless society

which can improve economic development of the country at large.

8. SCOPE FOR FURTHER RESEARCH

There is a need for nationwide study of credit card ownership and usage behaviour in India.

Such a study could also illuminate further on credit card ownership and usage patterns amongst

rural and urban consumers. There is also a need for further investigation into the nature and

strength of association between credit card ownership and usage and demographic variables of

interest and satisfaction. These may be the scope of the future study.

REFERENCES

[1] Abdul-Muhmin, Alhassan G., & Umar, Yakubu A. (2007). Credit card ownership and usage

behaviour in Saudi Arabia: The impact of demographics and attitudes towards debt. Journal of

Financial Services Marketing, 12(3), 219-235.

[2] .Arabzadeh, E., & Aghaeian, S. (2015). The relationship of usages and Management of credit

cards on lifestyles and purchasing behaviours of Cardholders. International Journal of

Management Research and Business Strategy, 4(3), 245-256. Available from:

https://www.researchgate.net/publication/299492921.

[3] Aparna Iyer (2013) The new“Face book of Indian banking”, The Financial Express, March,P6

[4] Banknet India’. Bank Customer Survey Research Report on Payment Systems was released at

Banknet’s Fourth International Conference on Payment Systems held on January 16, 2008 at

Mumbai: Taj Lands End http://www.banknetindia.com/books/pssurvey.html.

[5] Dewri. L .V , Md. Rashidul Islam & Netai Kumar Saha (2016), Behavioral Analysis of Credit

Card Users in a Developing Country: A Case of Bangladesh, International Journal of Business

http://www.iaeme.com/JOM/index.asp 150 editor@iaeme.com

Payments In India Going Digital: A Study with Reference To Credit Card Payments

and Management; Vol. 11, No. 4; 2016, ISSN 1833-3850 E-ISSN 1833-8119(accessed on 2nd

April 2018).

[6] Gan, L. L., Maysami, R. R. C., & Koh, H. C. (2008). Singapore credit cardholders: ownership

usage patterns and perceptions. Journal of Services Marketing, 22(4), 267-279.

http://dx.doi.org/10.1108/08876040810881678.

[7] Gupta.V, (2007). E-banking: Animator from Udaipur: An Evaluation from Marketing

Perspective. http://animatorfromudaipurindia. blogspot.com/2007/10/e-banking.html.

[8] Gurusamy. S, (2007). Merchant Banking and Financial Services. Chennai: Vijay Nicole

Imprints Private Limited, p.344.

[9] Khare, A., Khare, A., & Singh, S. (2011). Factors affecting credit card use in India. Asia Pacific

Journal of Marketing and Logistics, 24(2), 236-256.

http://dx.doi.org/10.1108/13555851211218048

[10] Linda Eagle,(2010) Preventing EFT Fraud with Training Reducing Risk to Financial Institutions

and Their Customers, Banker’s Academy, Briefings, May, 17, pp3.

[11] Murugesan. S (2007), “A study of bank credit card culture in Chennai city.” Unpublished Ph.D.

Thesis. Tiruchirappalli: Bharathidasan University, India, pp.259.

[12] Parimala. J (2007). “A study of bank services with special reference to the credit cards in

Trichirappalli, Tamilnadu.” Unpublished Ph.D. Thesis, Tiruchirappalli, India: Bharathidasan

University, pp.214.

[13] Reserve Bank of India (2017) Money and Banking, Monthly Bulletin, Oct, RBI report on

payment and settlement system, vision 2012-15.

[14] Sriyalatha, Kumudini. (2016). Determinants of Customers’ Attitude towards Credit Card Usage:

Lessons Learned From Academics in Sri Lanka. Case Studies in Business and Management. 3.

19. 10.5296/csbm.v3i2.9664.

[15] Swarnalatha. N (2002), “‘Credit cards services’: A study based on the perception of selected

credit cardholders of various issuing banks in Chennai city.” Unpublished Ph.D. Thesis,

Chennai: University of Madras, India pp.282.

[16] Subramanian.S (2010), “ A study on marketing of e-banking of products with reference to credit

cards in Thanjavur,Tamil Nadu”.Unpublished Ph.D Thesis, Tiruchirappalli, Bharathidasan

University, India, Pp.276.

[17] Subramanian .S &Swaminathan. M (2010) Payments in India going ‘e-way’ -an analytical study,

International Journal of research in commerce and management, Vol.1 (5) Pp54-62.

[18] Subramanian.S and Swaminathan(2009). M, “A Critical Analysis of Indian Payment card

market – With special reference to Credit Card”. Impact of Economic Crisis in Global Business

Scenario. Third International Conference held on September 24-25 at Sri Sai Ram Institute of

Management Studies, Chennai, India.

[19] Sumanjeet .S (2009) “Emergence of payment Systems in the Age of Electronic Commerce”:

The state of Act” Global Journal of International Business Research, vol. 2(2) pp.17-36.

[20] Themba, G., & Tumedi, C. B. (2012). Credit Card Ownership and Usage Behaviour in

Botswana. International Journal of Business Administration, 3(6), 60-71.

[21] Thomas, F., Maloles III. C., & Swoboda, B. (2010). Debit and credit card usage and satisfaction:

Who uses which and why-evidence from Austria. International Journal of Bank Marketing,

28(2), 150-165. http://dx.doi.org/10.1108/02652321011018332.

[22] http://www.indiacelebrating.com/government/digital-india/

[23] www.rbi.org.in.

[24] http://www.banknetindia.com/banking/5113.htm17.

[25] https://www.reuters.com/brandfeatures/venture-capital/article?id=12775

[26] http://www.corporate.visa.com.

[27] https://tamil.oneindia.com/news/india/arun-jaitley-will-present-budget-on-today-310039.html.

http://www.iaeme.com/JOM/index.asp 151 editor@iaeme.com

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Robber Bridegroom Script 1 PDFDocument110 pagesRobber Bridegroom Script 1 PDFRicardo GarciaPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Yamaha TW 125 Service Manual - 1999Document275 pagesYamaha TW 125 Service Manual - 1999slawkomax100% (11)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Athletic KnitDocument31 pagesAthletic KnitNish A0% (1)

- Brochure of El Cimarron by HenzeDocument2 pagesBrochure of El Cimarron by HenzeLuigi AttademoPas encore d'évaluation

- Malware Reverse Engineering HandbookDocument56 pagesMalware Reverse Engineering HandbookAJGMFAJPas encore d'évaluation

- Grade 4 Fsa Warm-UpsDocument32 pagesGrade 4 Fsa Warm-Upsapi-290541111100% (3)

- U.S. Individual Income Tax Return: Miller 362-94-3108 DeaneDocument2 pagesU.S. Individual Income Tax Return: Miller 362-94-3108 DeaneKeith MillerPas encore d'évaluation

- Learning-Module-in-Human-Resource-Management AY 22-23Document45 pagesLearning-Module-in-Human-Resource-Management AY 22-23Theresa Roque100% (2)

- Chapter 8: Organizational LeadershipDocument21 pagesChapter 8: Organizational LeadershipSaludez Rosiellie100% (6)

- Defender of Catholic FaithDocument47 pagesDefender of Catholic FaithJimmy GutierrezPas encore d'évaluation

- English Holiday TaskDocument2 pagesEnglish Holiday Taskchandan2159Pas encore d'évaluation

- Interpretation of Statutes 2023 Question PaperDocument4 pagesInterpretation of Statutes 2023 Question PaperNisha BhartiPas encore d'évaluation

- Omnibus Motion (Motion To Re-Open, Admit Answer and Delist: Republic of The PhilippinesDocument6 pagesOmnibus Motion (Motion To Re-Open, Admit Answer and Delist: Republic of The PhilippinesHIBA INTL. INC.Pas encore d'évaluation

- Phase/State Transitions of Confectionery Sweeteners: Thermodynamic and Kinetic AspectsDocument16 pagesPhase/State Transitions of Confectionery Sweeteners: Thermodynamic and Kinetic AspectsAlicia MartinezPas encore d'évaluation

- Model United Nations at Home Code of ConductDocument3 pagesModel United Nations at Home Code of ConductAryan KashyapPas encore d'évaluation

- VC++ Splitter Windows & DLLDocument41 pagesVC++ Splitter Windows & DLLsbalajisathyaPas encore d'évaluation

- Part 1Document14 pagesPart 1Jat SardanPas encore d'évaluation

- Poetry Analysis The HighwaymanDocument7 pagesPoetry Analysis The Highwaymanapi-257262131Pas encore d'évaluation

- Articles About Gossip ShowsDocument5 pagesArticles About Gossip ShowssuperultimateamazingPas encore d'évaluation

- Part - 1 LAW - 27088005 PDFDocument3 pagesPart - 1 LAW - 27088005 PDFMaharajan GomuPas encore d'évaluation

- W1 MusicDocument5 pagesW1 MusicHERSHEY SAMSONPas encore d'évaluation

- Physics Tadka InstituteDocument15 pagesPhysics Tadka InstituteTathagata BhattacharjyaPas encore d'évaluation

- Unit 4Document2 pagesUnit 4Sweta YadavPas encore d'évaluation

- Republic of The Philippines Legal Education BoardDocument25 pagesRepublic of The Philippines Legal Education BoardPam NolascoPas encore d'évaluation

- RBConcept Universal Instruction ManualDocument19 pagesRBConcept Universal Instruction Manualyan henrique primaoPas encore d'évaluation

- Bartolome vs. MarananDocument6 pagesBartolome vs. MarananStef OcsalevPas encore d'évaluation

- FS 1 - Episode 1Document18 pagesFS 1 - Episode 1Bhabierhose Saliwan LhacroPas encore d'évaluation

- Labor Law Highlights, 1915-2015: Labor Review Has Been in Publication. All The LegislationDocument13 pagesLabor Law Highlights, 1915-2015: Labor Review Has Been in Publication. All The LegislationIgu jumaPas encore d'évaluation

- Your Song.Document10 pagesYour Song.Nelson MataPas encore d'évaluation

- Independent Distributor Price List: DXN Bolivia S.R.LDocument1 pageIndependent Distributor Price List: DXN Bolivia S.R.LAdalid Llusco QuispePas encore d'évaluation