Académique Documents

Professionnel Documents

Culture Documents

Online Submission of Mid ETHICS AND GOVERNANCE

Transféré par

Upwan Prabhakar0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues3 pagesCopyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues3 pagesOnline Submission of Mid ETHICS AND GOVERNANCE

Transféré par

Upwan PrabhakarDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

Online Submission of Mid-Term Assignment-I

Subject: BUSINESS ETHICS AND CORPORATE

GOVERNANCE

Paper Code: MBA (FT) CP-401

Submitted by :- Upwan Prabhakar

Roll no. :- 18MBA061

Ques.1. Reliance Industries Ltd is a typical Indian family

promoted and managed company.

What are the typical governance issues at RIL in

comparison to a professionals-promoted and managed

company like Infosys Ltd?

Answer :-

At Reliance Industries Limited (RIL), Corporate Governance is all about maintaining

a valuable relationship and trust with all stakeholders. We consider stakeholders as

partners in our success, and we remain committed to maximising stakeholders'

value, be it shareholders, employees, suppliers, customers, investors, communities

or policy makers. This approach to value creation emanates from our belief that

sound governance system, based on relationship and trust, is integral to creating

enduring value for all. We have a defined policy framework for ethical conduct of

businesses. We believe that any business conduct can be ethical only when it rests

on the six core values of Customer Value, Ownership Mindset, Respect, Integrity,

One Team and Excellence.

Turning to the corporate governance scenario in Family Managed Companies

(FMCs), the recent amicable settlement of the feud between Ambani brothers of

Reliance was welcomed by the business community and the Government alike.

However, it has thrown open a number of governance issues for debate especially in

widely held , family promoted joint-stock companies where public holding/outside

holding far outstrips the family holding.

The Current Issues

Whether the board of directors of indian family managed

companies have been playing a constructive role in promoting

corporate governance

Issues relating to independence of directors about the

directives regarding proportion,the question of real

independence,and whether there is a problem in getting

independent directors of the right calber,and in sufficient

numbers

Who should oversee the board structure part of corporate

governance, sebi or department of company affairs?the issue

arises because both have come out with recommendations and

guidelines which are different and hence create confusion.

How does corporate governance in India compare with some of

those developed countries and comparable developing

countries?

What best and next practices shall be adopted by India to

assume leadership in the area?

Ques.3. Study the changes in the compensation for the

NEDs since the introduction of Clause 49 guidelines?

Answer :-

Clause 49 of the SEBI guidelines on Corporate Governance as

amended on 29 October 2004 has made major changes in the definition

of independent directors, strengthening the responsibilities of audit

committees, improving quality of financial disclosures, including those

relating to related party transactions and proceeds from public/ rights/

preferential issues, requiring Boards to adopt formal code of conduct,

requiring CEO/CFO certification of financial statements and for

improving disclosures to shareholders. Certain non-mandatory clauses

like whistle blower policy and restriction of the term of independent

directors have also been included.[1]

The term ‘Clause 49’ refers to clause number 49 of the Listing

Agreement between a company and the stock exchanges on which it is

listed (the Listing Agreement is identical for all Indian stock exchanges,

including the NSE and BSE). This clause is a recent addition to the

Listing Agreement and was inserted as late as 2000 consequent to the

recommendations of the Kumarmangalam Birla Committee on Corporate

Governance constituted by the Securities Exchange Board of India

(SEBI) in 1999.

Clause 49, when it was first added, was intended to introduce some

basic corporate governance practices in Indian companies and brought

in a number of key changes in governance and disclosures (many of

which we take for granted today). It specified the minimum number of

independent directors required on the board of a company. The setting

up of an Audit committee, and a Shareholders’ Grievance committee,

among others, were made mandatory as were the Management’s

Discussion and Analysis (MD&A) section and the Report on Corporate

Governance in the Annual Report, and disclosures of fees paid to non-

executive directors. A limit was placed on the number of committees that

a director could serve on.

Vous aimerez peut-être aussi

- Fundamental Role of Marketing in The Banking Sector: OGBADU, E. Elijah ABDULLAHI, UsmanDocument6 pagesFundamental Role of Marketing in The Banking Sector: OGBADU, E. Elijah ABDULLAHI, UsmanUpwan PrabhakarPas encore d'évaluation

- The Hindu Delhi 23.09.2019 PDFDocument20 pagesThe Hindu Delhi 23.09.2019 PDFUpwan PrabhakarPas encore d'évaluation

- 17 - Chapter 11 - 2 PDFDocument20 pages17 - Chapter 11 - 2 PDFUpwan PrabhakarPas encore d'évaluation

- 17 - Chapter 11 PDFDocument20 pages17 - Chapter 11 PDFUpwan PrabhakarPas encore d'évaluation

- 17 - Chapter 11 - 3 PDFDocument20 pages17 - Chapter 11 - 3 PDFUpwan PrabhakarPas encore d'évaluation

- 13 - Chapter 4 PDFDocument48 pages13 - Chapter 4 PDFUpwan PrabhakarPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sample Woksheet For Service ConcernDocument1 pageSample Woksheet For Service ConcernEzekiel LapitanPas encore d'évaluation

- Financial Statement Analysis of Philex Mining Corp. and Abra Mining & Industrial Corp.Document12 pagesFinancial Statement Analysis of Philex Mining Corp. and Abra Mining & Industrial Corp.nesjynPas encore d'évaluation

- FIN 330 Final Project IDocument9 pagesFIN 330 Final Project ISarai SternzisPas encore d'évaluation

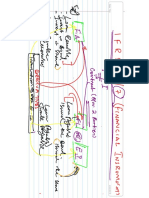

- Fin544 - Mind Mapping (Chapter 2)Document2 pagesFin544 - Mind Mapping (Chapter 2)nur fatihahPas encore d'évaluation

- Cost of Goods Sold: R Manufacturing Company, LahoreDocument38 pagesCost of Goods Sold: R Manufacturing Company, LahoreMirza BabarPas encore d'évaluation

- IFRS 9 NotesDocument42 pagesIFRS 9 NotesSalman Saeed100% (1)

- Audit Mcqs - CparDocument31 pagesAudit Mcqs - Cparjpbluejn50% (2)

- Non-Current Assets Held For Sale and Discontinued OperationsDocument63 pagesNon-Current Assets Held For Sale and Discontinued OperationsElegbede Mariam GbolasiePas encore d'évaluation

- Exercise 8-7: Fadrigalan, Mia P. Gragasin, Charlie S. Gutierrez, Erica Anne N. Hamco, Gian Carlo G. Ibuna, Niño SDocument7 pagesExercise 8-7: Fadrigalan, Mia P. Gragasin, Charlie S. Gutierrez, Erica Anne N. Hamco, Gian Carlo G. Ibuna, Niño Svomawew647Pas encore d'évaluation

- Econ Module 05Document13 pagesEcon Module 05derping lemonPas encore d'évaluation

- IA3 Chapter 14 Problem 31Document3 pagesIA3 Chapter 14 Problem 31Bea TumulakPas encore d'évaluation

- Afar-13 Notes - Joint ArrangementsDocument1 pageAfar-13 Notes - Joint ArrangementsVincent Luigil AlceraPas encore d'évaluation

- 01 Quilvest Familiy Office Landscape PDFDocument16 pages01 Quilvest Familiy Office Landscape PDFJose M AlayetoPas encore d'évaluation

- Greystone Capital Introductory LetterDocument3 pagesGreystone Capital Introductory LetterSumit SagarPas encore d'évaluation

- Attachment 0001Document112 pagesAttachment 0001giuseppe procentesePas encore d'évaluation

- Enron FraudDocument3 pagesEnron FraudRhoselle Mae GenandaPas encore d'évaluation

- Income From Property SummaryDocument39 pagesIncome From Property SummaryINFANTE, RANDOLPH BHUR S.Pas encore d'évaluation

- Fonderia Di Torino SDocument15 pagesFonderia Di Torino SYrnob RokiePas encore d'évaluation

- Bonds Payable Problem - QuizzerDocument3 pagesBonds Payable Problem - QuizzerLouisePas encore d'évaluation

- NYSE Arca Listing Fee ScheduleDocument14 pagesNYSE Arca Listing Fee ScheduleKate Crystel reyesPas encore d'évaluation

- 50923bos40558 p4 PDFDocument22 pages50923bos40558 p4 PDFpiyushPas encore d'évaluation

- FIN 435 SlidesDocument61 pagesFIN 435 SlidesMd. Mehedi HasanPas encore d'évaluation

- Z-Score TestDocument2 pagesZ-Score TestPrashant MishraPas encore d'évaluation

- Altman Z-Score: Presented By: Rutuja Brahmankar - 19368 Sayee Nikam - 19372 Shyamal Marathe - 19313Document12 pagesAltman Z-Score: Presented By: Rutuja Brahmankar - 19368 Sayee Nikam - 19372 Shyamal Marathe - 19313Shreyas BhadanePas encore d'évaluation

- Management Advisory Services: BudgetedDocument26 pagesManagement Advisory Services: Budgetedi hate youtubersPas encore d'évaluation

- SAP MM Account EntriesDocument2 pagesSAP MM Account EntriesRajaravi reddy50% (2)

- Learning Task 2 - Shareholders Equity Transactions & Statements (Problem #7,11-13)Document8 pagesLearning Task 2 - Shareholders Equity Transactions & Statements (Problem #7,11-13)Feiya Liu50% (2)

- 2019 ResultsDocument98 pages2019 ResultsJulieAnnPaguicanPas encore d'évaluation

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoPas encore d'évaluation

- Weighted Average CostDocument5 pagesWeighted Average CostsureshdassPas encore d'évaluation