Académique Documents

Professionnel Documents

Culture Documents

Bank MNC Internasional TBK

Transféré par

adhitya kharismaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bank MNC Internasional TBK

Transféré par

adhitya kharismaDroits d'auteur :

Formats disponibles

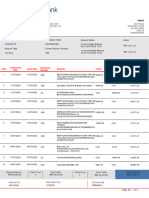

BABP Bank MNC Internasional Tbk.

COMPANY REPORT : JANUARY 2019 As of 31 January 2019

Development Board Individual Index : 57.388

Industry Sector : Finance (8) Listed Shares : 21,567,203,148

Industry Sub Sector : Bank (81) Market Capitalization : 1,078,360,157,400

373 | 1.08T | 0.01% | 98.66%

399 | 0.09T | 0.005% | 99.76%

COMPANY HISTORY SHAREHOLDERS (December 2018)

Established Date : 31-Jul-1989 1. MNC Kapital Indonesia Tbk. 9,309,678,241 : 43.17%

Listing Date : 15-Jul-2002 (IPO Price: 120) 2. Marco Prince Corp. 2,654,374,881 : 12.31%

Underwriter IPO : 3. Public (<5%) 9,603,149,960 : 44.53%

PT Danareksa Sekuritas

Securities Administration Bureau : DIVIDEND ANNOUNCEMENT

PT BSR Indonesia Bonus Cash Recording Payment

F/I

Year Shares Dividend Cum Date Ex Date Date Date

BOARD OF COMMISSIONERS 2002 4.24 20-Jun-03 23-Jun-03 25-Jun-03 30-Jun-03 F

1. Ponky Nayarana Pudjanto *) 2003 6.36 4-Jun-04 7-Jun-04 9-Jun-04 23-Jun-04 F

2. Jeny Gono *) 2004 3.95 13-May-05 16-May-05 18-May-05 2-Jun-05 F

3. Peter Fajar 2006 0.40 26-Apr-07 27-Apr-07 1-May-07 15-May-07 I

4. Purnadi Harjono 2007 1.03 17-Jun-08 18-Jun-08 20-Jun-08 4-Jul-08 F

*) Independent Commissioners 2009 0.45 13-Jul-10 14-Jul-10 16-Jul-10 30-Jul-10 F

2010 0.66 14-Jul-11 15-Jul-11 19-Jul-11 2-Aug-11 F

BOARD OF DIRECTORS

1. Ageng Purwanto ISSUED HISTORY

2. Chisca Mirawati Listing Trading

3. Hermawan No. Type of Listing Shares Date Date

4. Mahdan 1. First Issue 500,000,000 15-Jul-02 15-Jul-02

5. Rita Montagna Siahaan 2. Company Listing 1,480,000,000 T: 15-Jul-02 : 27-Feb-03

3. Right Issue 10,935,786,041 T: 23-Jan-06 : 29-Aug-14

AUDIT COMMITTEE 4. Warrant 486,078,541 T: 27-Aug-10 : 16-Dec-10

1. Ponky Nayarana Pudijanto 5. Delisting (1%) -49,721,570 T: 21-Jan-11 : 30-Jan-15

2. Eddy Yantho Sofwan 6. Convertible Bond 1,485,000,000 22-Sep-14 22-Sep-14

3. Tri Restu Ramadhan Putra 7. Relisting (Adrina's Shares) 44,860,785 30-Jan-15 30-Jan-15

8. Warrant II 9,557 T: 22-Sep-15 : 7-Jul-17

CORPORATE SECRETARY 9. Right Issue V 5,508,164,353 T: 16-Oct-15 : 2-Nov-16

Andri Latif 10. Unlisted Shares -14,519,102 T: 2-Nov-16 : 23-Aug-17

11. Warrant III 930,000,009 T: 7-Jul-17 : 29-Mar-18

HEAD OFFICE 12. Partial Delisting -12,035,803 T: 31-Jan-18 : 27-Jul-18

MNC Financial Building, Floor 6-8 13. Right Issue VI 273,580,271 T: 2-Jul-18 : 10-Jul-18

Jl. Kebon Sirih Raya No. 27 14. Warrant IV 66 29-Jan-19 29-Jan-19

Jakarta 10340

Phone : (021) 2980-5555

Fax : (021) 3983-6700

Homepage : www.mncbank.co.id

Email : corporate.communication@mncbank.co.id

andri@mncbank.co.id

BABP Bank MNC Internasional Tbk.

TRADING ACTIVITIES

Closing Price* and Trading Volume

Bank MNC Internasional Tbk. Closing Price Freq. Volume Value

Day

Closing Volume

Price* January 2015 - January 2019 (Mill. Sh) Month High Low Close (X) (Thou. Sh.) (Million Rp)

120 1,600 Jan-15 91 79 80 5,897 245,444 20,536 21

Feb-15 94 75 92 4,850 214,553 18,131 19

105 1,400 Mar-15 106 82 91 14,217 608,038 58,112 22

Apr-15 107 88 89 17,504 519,994 51,335 21

May-15 94 83 85 2,654 167,209 14,733 19

90 1,200

Jun-15 87 71 75 2,472 133,343 10,169 21

Jul-15 88 74 77 16,470 121,148 9,743 19

75 1,000

Aug-15 83 67 70 6,224 245,305 18,279 20

Sep-15 76 66 71 3,628 123,908 8,703 21

60 800

Oct-15 76 68 72 2,856 113,529 8,186 21

Nov-15 74 66 67 2,061 58,968 4,137 21

45 600 Dec-15 74 57 70 2,517 90,574 5,612 19

30 400 Jan-16 71 59 61 1,632 40,312 3,009 20

Feb-16 64 54 61 1,773 38,727 2,355 20

15 200 Mar-16 87 61 78 11,075 377,346 29,406 21

Apr-16 80 69 74 7,103 202,350 15,212 21

May-16 76 70 72 2,345 76,185 5,469 20

Jun-16 75 69 70 4,219 143,053 10,184 22

Jan-15 Jan-16 Jan-17 Jan-18 Jan-19

Jul-16 86 71 75 9,159 510,581 40,458 16

Aug-16 85 74 76 11,465 559,356 44,102 22

Sep-16 98 65 75 5,175 236,505 17,258 21

Closing Price*, Jakarta Composite Index (IHSG) and Oct-16 76 65 66 3,860 181,623 12,465 21

Finance Index Nov-16 85 61 69 18,458 724,805 53,025 22

January 2015 - January 2019 Dec-16 77 63 68 14,955 360,891 25,656 20

75%

70.0%

Jan-17 84 65 72 78,529 1,309,833 101,841 21

60% Feb-17 75 66 68 17,468 278,653 19,440 19

Mar-17 70 64 67 16,741 229,911 15,494 22

45% Apr-17 72 65 67 35,937 237,877 16,297 17

May-17 67 61 62 6,764 94,707 6,181 20

30% Jun-17 65 58 59 18,904 96,891 5,940 15

24.6% Jul-17 60 50 50 12,772 274,591 14,227 21

Aug-17 54 50 51 2,054 1,425,727 71,358 22

15%

Sep-17 54 50 51 1,305 36,412 1,862 19

Oct-17 54 50 52 1,705 456,181 23,160 22

-

Nov-17 54 50 50 2,130 330,246 16,822 22

Dec-17 53 50 51 911 241,942 12,131 18

-15%

Jan-18 58 50 54 2,874 133,217 7,051 22

-30% Feb-18 57 50 53 7,048 342,987 18,220 19

Mar-18 53 50 51 1,692 97,235 4,898 21

-42.0%

-45% Apr-18 61 50 53 6,965 501,933 27,623 21

Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 May-18 75 50 54 6,954 282,177 15,052 20

Jun-18 62 50 50 3,636 233,415 12,572 13

Jul-18 54 50 50 5,359 137,007 6,925 22

SHARES TRADED 2015 2016 2017 2018 Jan-19 Aug-18 51 50 50 645 11,714 586 21

Volume (Million Sh.) 2,642 3,452 5,013 1,812 85 Sep-18 52 50 50 1,147 59,006 2,964 19

Value (Billion Rp) 228 259 305 97 4 Oct-18 50 50 50 209 11,772 589 23

Frequency (Thou. X) 81 91 195 37 11 Nov-18 51 50 50 144 1,351 68 21

Days 244 246 238 240 22 Dec-18 50 50 50 130 551 24 18

Price (Rupiah) Jan-19 53 50 50 11,096 85,254 4,285 22

High 107 98 84 75 53

Low 57 54 50 50 50

Close 70 68 51 50 50

Close* 72 70 52 50 50

PER (X) 162.10 135.11 -11.48 7.93 7.93

PER Industry (X) 25.09 20.71 19.10 25.63 24.30

PBV (X) 0.78 0.75 0.60 0.79 0.78

* Adjusted price after corporate action

BABP Bank MNC Internasional Tbk.

Financial Data and Ratios Book End : December

Public Accountant : Satrio Bing Eny & Partners

BALANCE SHEET Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(in Million Rp, except Par Value) Assets Liabilities

Cash on Hand 91,556 108,955 144,975 121,769 139,834 13,750

Placements with Other Banks 1,538,436 1,335,254 1,984,523 1,117,872 472,123

11,000

Marketable Securities 503,806 1,173,954 1,375,817 1,101,137 1,011,956

Loans 6,128,833 7,047,265 7,941,795 6,783,806 7,324,239

8,250

Investment - - - - -

Fixed Assets 19,016 50,041 54,151 55,113 47,468

5,500

Other Assets 124,654 194,039 228,820 276,071 472,547

Total Assets 9,430,264 12,137,004 13,057,549 10,706,094 10,695,914 2,750

Growth (%) 28.70% 7.58% -18.01% -0.10%

-

Deposits 7,970,382 10,267,232 10,846,723 9,027,709 8,498,418 2014 2015 2016 2017 Sep-18

Taxes Payable 10,988 13,760 12,727 12,462 8,910

Fund Borrowings - - - - -

Other Liabilities 11,143 8,542 10,521 10,683 18,920 TOTAL EQUITY (Bill. Rp)

Total Liabilities 8,195,695 10,428,800 11,197,144 9,453,546 9,311,965

1,860

Growth (%) 27.25% 7.37% -15.57% -1.50% 1,860

1,708

Authorized Capital 6,000,000 6,000,000 6,000,000 6,000,000 6,000,000 1,384

1,253

1,481

1,235

Paid up Capital 1,503,233 1,912,956 20,581 2,058,147 2,151,155

Paid up Capital (Shares) 15,032 19,130 206 20,581 21,512 1,101

Par Value 100 100 100 100 100

Retained Earnings -209,291 -201,091 -191,742 -876,935 -774,964

722

Total Equity 1,234,569 1,708,204 1,860,405 1,252,548 1,383,949

Growth (%) 38.36% 8.91% -32.67% 10.49%

342

-37

INCOME STATEMENTS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 2014 2015 2016 2017 Sep-18

Total Interest Income 760,698 950,521 1,060,551 1,021,547 704,100

Growth (%) 24.95% 11.58% -3.68%

TOTAL INTEREST INCOME (Bill. Rp)

Interest Expenses 524,417 663,414 693,697 676,858 413,734

1,061

Other Operating Revenue 62,890 72,154 125,415 115,399 188,045 1,022

951

1,061

Other Operating Expenses 370,474 343,793 439,511 1,377,088 386,438

Income from Operations -71,303 10,947 52,758 -917,000 136,899 844

761

704

Growth (%) N/A 381.94% N/A

628

Non-Operating Revenues 1,270 241 -39,623 10,930 -717

Income Before Tax -70,033 11,188 13,135 -906,070 136,182 411

Provision for Income Tax -15,483 3,010 3,786 -220,877 34,211

Profit for the period -54,550 8,178 9,349 -685,193 101,971

195

Growth (%) N/A 14.32% N/A

-21

2014 2015 2016 2017 Sep-18

Period Attributable -54,550 8,178 9,349 -685,193 101,971

Comprehensive Income -33,087 68,070 9,846 -675,859 79,044

Comprehensive Attributable -33,087 68,070 9,846 -675,859 79,044

PROFIT FOR THE PERIOD (Bill. Rp)

RATIOS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 102

Dividend (Rp) - - - - - 2014 8.2 9.3 2017

102

EPS (Rp) -3.63 0.43 45.42 -33.29 4.74

2015 2016 Sep-18

-55

BV (Rp) 82.13 89.30 9,039.23 60.86 64.34 -55

DAR (X) 0.87 0.86 0.86 0.88 0.87 -213

DER(X) 6.64 6.11 6.02 7.55 6.73

ROA (%) -0.58 0.07 0.07 -6.40 0.95 -370

ROE (%) -4.42 0.48 0.50 -54.70 7.37

OPM (%) -9.37 1.15 4.97 -89.77 19.44

-528

NPM (%) -7.17 0.86 0.88 -67.07 14.48 -685

Payout Ratio (%) - - - - - -685

Yield (%) - - - - -

*US$ Rate (BI), Rp 12,436 13,794 13,436 13,548 14,929

Vous aimerez peut-être aussi

- Bank Jtrust Indonesia TBKDocument3 pagesBank Jtrust Indonesia TBKTam sneakersPas encore d'évaluation

- Inti Agri Resources TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesInti Agri Resources TBK.: Company Report: January 2019 As of 31 January 2019Yohanes ImmanuelPas encore d'évaluation

- Bank Windu Kentjana International TBKDocument3 pagesBank Windu Kentjana International TBKMuhammad Ikhlas YasinPas encore d'évaluation

- Bumi Resources TBKDocument3 pagesBumi Resources TBKadjipramPas encore d'évaluation

- Arwana Citramulia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesArwana Citramulia TBK.: Company Report: January 2019 As of 31 January 2019dindakharismaPas encore d'évaluation

- Panca Global Securities TBKDocument3 pagesPanca Global Securities TBKreyPas encore d'évaluation

- Ringkasan Performa Perusahaan Tercatat BTEKDocument3 pagesRingkasan Performa Perusahaan Tercatat BTEKMonalisa FajiraPas encore d'évaluation

- Perusahaan Gas Negara TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesPerusahaan Gas Negara TBK.: Company Report: January 2019 As of 31 January 2019Muhammad Anfaza FirmanzaniPas encore d'évaluation

- Mustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Febrianty HasanahPas encore d'évaluation

- Mrat PDFDocument3 pagesMrat PDFHENI OKTAVIANIPas encore d'évaluation

- BPD Jawa Timur TBKDocument3 pagesBPD Jawa Timur TBKSyawaludin Arsyal AmalaPas encore d'évaluation

- Maya 001Document3 pagesMaya 001selly wangPas encore d'évaluation

- Arwana Citramulia Tbk. (S) : Company Report: July 2015 As of 31 July 2015Document3 pagesArwana Citramulia Tbk. (S) : Company Report: July 2015 As of 31 July 2015adjipramPas encore d'évaluation

- AISADocument3 pagesAISAreniePas encore d'évaluation

- ELSADocument3 pagesELSAAfterneathPas encore d'évaluation

- BipiDocument3 pagesBipiBerbagi GamePas encore d'évaluation

- Bank China Construction Bank Indonesia TBKDocument3 pagesBank China Construction Bank Indonesia TBKDenny NordPas encore d'évaluation

- Wins PDFDocument3 pagesWins PDFMelyana AnggrainiPas encore d'évaluation

- PgasDocument3 pagesPgasMateriPas encore d'évaluation

- Austindo Nusantara Jaya TBKDocument3 pagesAustindo Nusantara Jaya TBKroxasPas encore d'évaluation

- Bank Yudha Bhakti TBKDocument3 pagesBank Yudha Bhakti TBKTam sneakersPas encore d'évaluation

- Bisi PDFDocument3 pagesBisi PDFyohannestampubolonPas encore d'évaluation

- MTLADocument10 pagesMTLAMuchamad AfifPas encore d'évaluation

- Tiga Pilar Sejahtera Food TBKDocument3 pagesTiga Pilar Sejahtera Food TBKnurulPas encore d'évaluation

- Bank Bumi Arta TBK.: Company Report: January 2014 As of 30 January 2014Document3 pagesBank Bumi Arta TBK.: Company Report: January 2014 As of 30 January 2014yohannestampubolonPas encore d'évaluation

- Bank Negara Indonesia (Persero) TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesBank Negara Indonesia (Persero) TBK.: Company Report: January 2017 As of 31 January 2017Eka FarahPas encore d'évaluation

- LAPORAN KEUANGAN 2020 CsapDocument3 pagesLAPORAN KEUANGAN 2020 CsapMT Project EnokPas encore d'évaluation

- Beks PDFDocument3 pagesBeks PDFyohannestampubolonPas encore d'évaluation

- Graha Layar Prima TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesGraha Layar Prima TBK.: Company Report: January 2019 As of 31 January 2019Nur Mita SariPas encore d'évaluation

- Lotte Chemical Titan TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesLotte Chemical Titan TBK.: Company Report: January 2019 As of 31 January 2019Product DevlopmentPas encore d'évaluation

- Bank Mandiri (Persero) TBKDocument3 pagesBank Mandiri (Persero) TBKmasrurin sPas encore d'évaluation

- Laporan Keuangan 2020 TeleDocument3 pagesLaporan Keuangan 2020 TeleMT Project EnokPas encore d'évaluation

- Asuransi Multi Artha Guna TBKDocument3 pagesAsuransi Multi Artha Guna TBKSanesPas encore d'évaluation

- InppDocument3 pagesInppLaraPas encore d'évaluation

- Apic PDFDocument3 pagesApic PDFmasrurin sPas encore d'évaluation

- Cita Mineral Investindo TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesCita Mineral Investindo TBK.: Company Report: January 2019 As of 31 January 2019ElusPas encore d'évaluation

- Asuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Document3 pagesAsuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Marvin ArifinPas encore d'évaluation

- Ades PDFDocument3 pagesAdes PDFyohannestampubolonPas encore d'évaluation

- Lippo Karawaci TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesLippo Karawaci TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniPas encore d'évaluation

- Austindo Nusantara Jaya TBKDocument3 pagesAustindo Nusantara Jaya TBKHarjasa AdhiPas encore d'évaluation

- BLTZDocument3 pagesBLTZBerbagi GamePas encore d'évaluation

- CMNP SumDocument3 pagesCMNP SumadjipramPas encore d'évaluation

- BRPT 2014-2018Document3 pagesBRPT 2014-2018Abdur RohmanPas encore d'évaluation

- BPD Banten TBKDocument3 pagesBPD Banten TBKTam sneakersPas encore d'évaluation

- Mitra Investindo TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMitra Investindo TBK.: Company Report: January 2019 As of 31 January 2019Christian SamuelPas encore d'évaluation

- PP London Sumatra Indonesia TBKDocument3 pagesPP London Sumatra Indonesia TBKRIZAL HARDIANSYAHPas encore d'évaluation

- Barito Pacific TBKDocument3 pagesBarito Pacific TBKTaufik Hidayat LubisPas encore d'évaluation

- Laporan Keuangan BUMIDocument3 pagesLaporan Keuangan BUMIBreak HabitPas encore d'évaluation

- LpgiDocument3 pagesLpgiSyafira FirdausiPas encore d'évaluation

- Bcic PDFDocument3 pagesBcic PDFyohannestampubolonPas encore d'évaluation

- Bank Negara Indonesia (Persero) TBK.: January 2014Document4 pagesBank Negara Indonesia (Persero) TBK.: January 2014yohannestampubolonPas encore d'évaluation

- Arna PDFDocument3 pagesArna PDFyohannestampubolonPas encore d'évaluation

- Astra Agro Lestari TBK Aali: Company History Dividend AnnouncementDocument3 pagesAstra Agro Lestari TBK Aali: Company History Dividend AnnouncementJandri Zhen TomasoaPas encore d'évaluation

- Nippon Indosari Corpindo TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesNippon Indosari Corpindo TBK.: Company Report: January 2019 As of 31 January 2019Septiah Eka FatonahPas encore d'évaluation

- BJBRDocument3 pagesBJBRReski Trimayuda MaraniPas encore d'évaluation

- WikaDocument3 pagesWikaParas FebriayuniPas encore d'évaluation

- Wijaya Karya (Persero) TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesWijaya Karya (Persero) TBK.: Company Report: January 2019 As of 31 January 2019Hafidz RidloiPas encore d'évaluation

- WikaDocument3 pagesWikaParas FebriayuniPas encore d'évaluation

- WIKADocument3 pagesWIKAYodi SATRIA IMANIPas encore d'évaluation

- FR ESSB P&P08 25 - Job Application FormDocument12 pagesFR ESSB P&P08 25 - Job Application Formadhitya kharismaPas encore d'évaluation

- FR ESSB P&P08 25 - Job Application FormDocument12 pagesFR ESSB P&P08 25 - Job Application Formadhitya kharismaPas encore d'évaluation

- Cash Flow StatementDocument1 pageCash Flow StatementIndira BPas encore d'évaluation

- The Effect of Employee Incentive in Correlation With Citizenship Behavior For Millenials (Generation Y)Document5 pagesThe Effect of Employee Incentive in Correlation With Citizenship Behavior For Millenials (Generation Y)adhitya kharismaPas encore d'évaluation

- Minimum Alternate Tax Section 115JbDocument17 pagesMinimum Alternate Tax Section 115JbEmeline SoroPas encore d'évaluation

- Account Statement 10230002147823 3Document2 pagesAccount Statement 10230002147823 3Nabaratna BiswalPas encore d'évaluation

- GM Default - 240308 - 182301Document8 pagesGM Default - 240308 - 182301Raghu DattaPas encore d'évaluation

- Chapter 4 Financial Statement AnalysisDocument44 pagesChapter 4 Financial Statement AnalysisChala EnkossaPas encore d'évaluation

- Chapter One Introduction To Financial Modeling and ValuationDocument6 pagesChapter One Introduction To Financial Modeling and ValuationBobasa S AhmedPas encore d'évaluation

- Ey Ifrs Update 31 March 2023 v2Document22 pagesEy Ifrs Update 31 March 2023 v2Yehor KonievPas encore d'évaluation

- Mumbai Mint 07-07-2023Document18 pagesMumbai Mint 07-07-2023satishdokePas encore d'évaluation

- CFA Level II Mock Exam 5 - Solutions (PM)Document61 pagesCFA Level II Mock Exam 5 - Solutions (PM)Sardonna FongPas encore d'évaluation

- Group Assignment - Tea MarketDocument7 pagesGroup Assignment - Tea Marketkelly aditya japPas encore d'évaluation

- 19698-X 2018 S P Setia BerhadDocument164 pages19698-X 2018 S P Setia BerhadVijay KumarPas encore d'évaluation

- Ch. 3,4,5,6 - Study PlanDocument185 pagesCh. 3,4,5,6 - Study PlanIslamPas encore d'évaluation

- Agriculture IncomeDocument6 pagesAgriculture IncomeDharshini AravamudhanPas encore d'évaluation

- Principle of Macro-Economics Mcq'sDocument6 pagesPrinciple of Macro-Economics Mcq'sSafiullah mirzaPas encore d'évaluation

- Scam 1992: The Story of Harshad Mehta: A Project Report ONDocument3 pagesScam 1992: The Story of Harshad Mehta: A Project Report ONPahulpreet SinghPas encore d'évaluation

- Advantages and Limitations of Ratio AnalysisDocument6 pagesAdvantages and Limitations of Ratio AnalysisRushikeshPas encore d'évaluation

- MID 1 - CH 1 - FIN501 - MahnoorDocument13 pagesMID 1 - CH 1 - FIN501 - MahnoorkhantabassumanikaPas encore d'évaluation

- Accounting Part 2 Test No 01Document1 pageAccounting Part 2 Test No 01Ayman ChishtyPas encore d'évaluation

- Check Request Form RHF RHS RHYDocument1 pageCheck Request Form RHF RHS RHYPhillip GrimesPas encore d'évaluation

- COOPERATIVEDocument8 pagesCOOPERATIVEChristian LugoPas encore d'évaluation

- 9 - 10. Corporate CRTLDocument37 pages9 - 10. Corporate CRTLRaimond DuflotPas encore d'évaluation

- Chapter 2 Measuring The Cost of LivingDocument25 pagesChapter 2 Measuring The Cost of LivingHSE19 EconhinduPas encore d'évaluation

- NI LUH 2021 Company Value Profitability ROADocument11 pagesNI LUH 2021 Company Value Profitability ROAFitra Ramadhana AsfriantoPas encore d'évaluation

- Written Report On Classical Gold Standard and Bretton Woods SystemDocument5 pagesWritten Report On Classical Gold Standard and Bretton Woods SystemMarc Jalen ReladorPas encore d'évaluation

- BB&T Bank Statement Word TemplateDocument6 pagesBB&T Bank Statement Word TemplateKyalo Martins90% (10)

- Application For Permit To Use Cash Register MachineDocument7 pagesApplication For Permit To Use Cash Register MachineChen ClaudioPas encore d'évaluation

- Working Capital Management of Construction Supplies in District I of BatangasDocument68 pagesWorking Capital Management of Construction Supplies in District I of BatangasPatricia Mae BendañaPas encore d'évaluation

- Nas 20Document10 pagesNas 20santosh pandeyPas encore d'évaluation

- Agency: Chapter 1. Nature, Form and Kinds of AgencyDocument10 pagesAgency: Chapter 1. Nature, Form and Kinds of Agencyeugenebriones27yahoo.comPas encore d'évaluation

- 1 PBDocument14 pages1 PBMuhammad FachrizalPas encore d'évaluation

- Business IdiomsDocument22 pagesBusiness IdiomsAileen PalaranPas encore d'évaluation