Académique Documents

Professionnel Documents

Culture Documents

Practice Problems - Capital Budgeting PDF

Transféré par

Ramainne RonquilloTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Practice Problems - Capital Budgeting PDF

Transféré par

Ramainne RonquilloDroits d'auteur :

Formats disponibles

Capital Budgeting

FAR EASTERN UNIVERSITY

Institute of Accounts Business and Finance

FINANCIAL MANAGEMENT II

PRACTICE PROBLEMS – CAPITAL BUDGETING

BRYAN TRINIDAD

PROBLEM NO. 1.

Label Company is planning to purchase a new machine for P840,000. The installation of the new machine costs and

testing runs amount to P60,000. This new machine shall replace an old unit that was acquired 2 years ago at a cost of

P600,000 with an annual depreciation of P120,000. The old unit can be sold at P210,000. If the new equipment is not

purchased, extensive repairs on the old machine will have to be made immediately at a cost of P60,000. The purchase

of the new machine will immediately require P200,000 working capital in order to support the operations. The new

machine will be depreciated for 3 years without any salvage value. The company is subject to 40 percent income tax

and requires a discount rate of 8 for this type of asset. Compute the net cost of investment for the new machine.

PROBLEM NO. 2.

Markado Manufacturing is considering buying an automated machine that costs P3,000,000. Annual cash savings

are anticipated to be P900,000 for five years. The company uses straight-line depreciation. The salvage value at

the end of five years is expected to be P80,000. Assume 8 percent discount rate and 40 percent tax rate.

Requirements:

1. accrual accounting rate of return based on the initial investment;

2. payback period and payback reciprocal;

3. net present value;

4. profitability index;

5. breakeven time;

6. internal rate of return.

PROBLEM NO. 3.

Keila Company manufactures copier equipment and has the opportunity to replace one of its existing machine with a

new model. The existing machine has a net book value of P150,000 and a market value of P70,000. It has an estimated

remaining life of four years at which time it will have no salvage value. The company uses straight-line depreciation of

P37,500 per year on the machine, and its annual cash operating costs are P280,000.

The new model costs P600,000 and has a four-year estimated life with no salvage value. Its annual cash operating

costs are estimated at P170,000. The firm will use straight-line depreciation. The tax rate is 40% and cost of capital is

12%. The purchase of the new more efficient machine will enable the company to reduce its investment in inventory by

P100,000.

Requirements:

1. Determine the investment required to obtain the new machine.

2. Determine the present value of the net cash flows expected from the investment and the NPV of the investment.

3. Suppose that the new machine has a salvage value of P50,000. The company will consider the salvage value in

determining annual depreciation. Determine the NPV of the investment.

4. Suppose that the new machine has a salvage value of P50,000. The company will ignore the salvage value in

determining annual depreciation. Determine the NPV of the investment.

PROBLEM NO. 4.

Soda Company is considering the purchase of a special-purpose bottling machine for P2,800,000. It is expected to

have a useful life of 7 years with a zero terminal disposal price. The plant manager estimates the following savings in

cash-operating costs:

Year Amount

1 P1,400,000

2 1,100,000

3 800,000

4 600,000

5 400,000

6 300,000

7 300,000

Soda Company uses a required rate of return of 16% in its capital-budgeting decisions. Incremental tax rate is 40%.

The company uses straight-line depreciation.

Requirements:

1. Compute the payback period.

2. Compute the net present value.

3. Compute the internal rate of return.

4. Compute the accrual accounting rate of return based on net initial investment.

5. Compute the PV of the net advantage of using SYD instead of straight-line method of computing depreciation.

FIN MGT 2 PRACTICE PROBLEMS – 1 of 2

Capital Budgeting

PROBLEM NO. 5.

Lina Company expects to sell 90,000 units annually for the next four years at P8 each, with variable costs of P3 per

unit, and annual cash fixed costs of P250,000. The product requires machinery costing P300,000 with a four-year life

and no salvage value. The company will depreciate the machinery using straight-line depreciation. Additionally, working

capital (in form of receivables and inventory) will increase by P150,000. This additional working capital will be returned

in full at the end of the four years. The tax rate is 40% and cost of capital is 10%. Determine the net present value of

the investment.

PROBLEM NO. 6.

National Company is considering the purchase of a P600,000 machine, which will be depreciated on the straight -

line method over an 8-year period with no salvage value for both book and tax purposes. The machine is expected

to generate an annual before-tax cash inflow of P175,000. The income tax rate is 40%.

Requirements:

1. Determine the payback period.

2. Compute the accounting rate of return based on; a) original investment; b) average investment.

3. Assuming that the company considers the use of 10 years for book depreciation and 8 years for income tax

depreciation, what is the payback period?

PROBLEM NO. 7.

Punchline Corp. will invest P130,000 in a project that will begin to produce returns by the end of the third year

until the end of the 12 th year. The annual cash flow will be P40,000. If the cost of capital is 15 percent, should this

project be undertaken?

PROBLEM NO. 8.

Trulife Insurance Company’s management is considering an advertising program that would require an initial

expenditure of P165,500 and bring in additional sales over the next five years. The projected additional sales revenue

in year 1 is P75,000, with associated expenses of P25,000. The additional sales revenue and expenses from the

advertising program are projected to increase by 10 percent each year. Loyalty’s tax rate is 40 percent.

Requirements:

1. Compute the payback period for the advertising program.

2. Calculate the advertising program’s net present value, assuming an after-tax hurdle rate of 9 percent.

PROBLEM NO. 9.

The manager of Countryside Company is considering the purchase of a new computer for P150,000. A cost study

indicates that the new computer should save the company P30,000, measured in real pesos, during each of the next

ten years. The real interest rate is 10 percent and the inflation rate is 5 percent. The company is exempted from paying

income taxes.

Requirements:

1. Using cash flows measured in real pesos, compute the net present value of the proposed computer. Use a real

discount rate equal to the real interest rate.

2. Compute the nominal interest rate.

3. Using cash flows measured in nominal pesos, compute the net present value of the proposed computer acquisition.

Use a nominal discount rate equal to the nominal interest rate.

PROBLEM NO. 10.

Ocean View Hospital has purchased new lab equipment for P150,000. The equipment is expected to last for three years

and to provide cash inflows as follows:

Year 1 P45,000

Year 2 60,000

Year 3 ?

Assuming that the equipment will yield exactly a 10% rate of return, what is the expected cash inflows for year 3?

PROBLEM NO. 11.

Quality Products Co. is investigating the purchase of a piece of automated equipment that will save P100,000 each year

in direct labor and inventory carrying costs. This equipment costs P750,000 and is expected to have a 10-year useful

life with no salvage value. The company requires a minimum 15% return on all equipment purchases. Management

anticipates that this equipment will provide intangible benefits such as greater flexibility and higher quality output.

What peso value per year would these intangible benefits have to have in order to make the equipment an acceptable

investment?

– end -

FIN MGT 2 PRACTICE PROBLEMS – 2 of 2

Vous aimerez peut-être aussi

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisD'EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisPas encore d'évaluation

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloPas encore d'évaluation

- Capital Budgeting NotesDocument5 pagesCapital Budgeting NotesCris Joy BiabasPas encore d'évaluation

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezPas encore d'évaluation

- Capital Budgeting Discounted Method - Discussion Problems - Part 1Document11 pagesCapital Budgeting Discounted Method - Discussion Problems - Part 1Deryl GalvePas encore d'évaluation

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesPas encore d'évaluation

- Capital Budgeting ExercisesDocument4 pagesCapital Budgeting ExercisescrissillePas encore d'évaluation

- Capital Budgeting ProblemsDocument4 pagesCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- Problems - Capital BudgetingDocument5 pagesProblems - Capital BudgetingDianne TorresPas encore d'évaluation

- Capital BudgetingDocument4 pagesCapital BudgetingYaj CruzadaPas encore d'évaluation

- Capital Investment Factors7to16Document15 pagesCapital Investment Factors7to16Spencer Tañada100% (1)

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- Capital Budgeting Quiz 1: Multiple ChoiceDocument7 pagesCapital Budgeting Quiz 1: Multiple ChoiceMark Jesus Aristo100% (1)

- Exercises Capital BudgetingDocument3 pagesExercises Capital BudgetingSwap WerdPas encore d'évaluation

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyPas encore d'évaluation

- True or FalseDocument3 pagesTrue or FalseKarlo D. ReclaPas encore d'évaluation

- Cap BudDocument3 pagesCap BudRarajPas encore d'évaluation

- Endterm ExamDocument6 pagesEndterm ExamMasTer PanDaPas encore d'évaluation

- FA1 - Capital BudgetingDocument1 pageFA1 - Capital BudgetingMomena LampatanPas encore d'évaluation

- Learning Packet Template No. 3 Capital BudgetingDocument7 pagesLearning Packet Template No. 3 Capital BudgetingsamanthaPas encore d'évaluation

- 23Document2 pages23Heaven HeartPas encore d'évaluation

- CapBud Problem Quiz 1Document4 pagesCapBud Problem Quiz 1Sittie Ayeenah Yusoph ArindigPas encore d'évaluation

- Finman Midterms Part 1Document7 pagesFinman Midterms Part 1JerichoPas encore d'évaluation

- MAS 2nd Summative TestDocument16 pagesMAS 2nd Summative TestNovie Abel BolivarPas encore d'évaluation

- ANGELICADocument7 pagesANGELICAAngel Reconalla Lapadan100% (2)

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjPas encore d'évaluation

- AFM Capital Budgeting AssignmentDocument5 pagesAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Part 1: Financial ForecastingDocument8 pagesPart 1: Financial ForecastingJustine CruzPas encore d'évaluation

- AcmeDocument2 pagesAcmeAngeline RamirezPas encore d'évaluation

- Acc 223 CB PS1 2021 QDocument8 pagesAcc 223 CB PS1 2021 QAeyjay ManangaranPas encore d'évaluation

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTEPas encore d'évaluation

- Revised Accounting 15Document26 pagesRevised Accounting 15Jennifer Garnette50% (2)

- Maxwell CompanyDocument1 pageMaxwell CompanyAngeline RamirezPas encore d'évaluation

- Operating Cash InflowDocument11 pagesOperating Cash InflowRarajPas encore d'évaluation

- Basic Methods ModuleDocument12 pagesBasic Methods ModuleSarTomPas encore d'évaluation

- Practice Question On Capital BudegetingDocument4 pagesPractice Question On Capital Budegetingaditisarkar080Pas encore d'évaluation

- Yaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Document7 pagesYaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Regine Mae Lustica Yaniza100% (1)

- Capital Budgeting Lecture IIDocument2 pagesCapital Budgeting Lecture IIamormi2702Pas encore d'évaluation

- Engineering Economy 3 April 2024Document4 pagesEngineering Economy 3 April 2024Craeven AranillaPas encore d'évaluation

- Quiz 6.1 Capital BudgetingDocument1 pageQuiz 6.1 Capital BudgetingWinoah HubaldePas encore d'évaluation

- BBDocument3 pagesBBJoshua WacanganPas encore d'évaluation

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeePas encore d'évaluation

- Universal College of Parañaque: Working Capital ManagementDocument23 pagesUniversal College of Parañaque: Working Capital ManagementEmelita ManlangitPas encore d'évaluation

- For Students Capital BudgetingDocument3 pagesFor Students Capital Budgetingwew123Pas encore d'évaluation

- Capital BudgetingDocument23 pagesCapital BudgetingNoelJr. Allanaraiz100% (4)

- Capital BudgetingDocument6 pagesCapital Budgetingkaf_scitPas encore d'évaluation

- Acc14 Exercise Capital-BudgetingDocument3 pagesAcc14 Exercise Capital-BudgetingyeezzzzPas encore d'évaluation

- HO No. 3 - Working Capital ManagementDocument2 pagesHO No. 3 - Working Capital ManagementGrace Chavez ManaliliPas encore d'évaluation

- Cbproblems PDF FreeDocument4 pagesCbproblems PDF FreeAmalgam EnterprisePas encore d'évaluation

- Management Advisory ServicesDocument18 pagesManagement Advisory ServicesAldrin Arcilla Simeon0% (1)

- Notre Dame Educational Association: Mock Board Examination Management Advisory and ServicesDocument11 pagesNotre Dame Educational Association: Mock Board Examination Management Advisory and Servicesirishjade100% (1)

- Capital Budgeting Sample QuestionsDocument2 pagesCapital Budgeting Sample QuestionsNCTPas encore d'évaluation

- Diagnostic Examination (Batch 2020)Document71 pagesDiagnostic Examination (Batch 2020)KriztleKateMontealtoGelogo75% (4)

- Capital Budgeting Sample ProblemDocument1 pageCapital Budgeting Sample ProblemTrizia Bermudo TibesPas encore d'évaluation

- Finman MidtermDocument4 pagesFinman Midtermmarc rodriguezPas encore d'évaluation

- Business Finance Activity.: Problem 2: 1 3Document3 pagesBusiness Finance Activity.: Problem 2: 1 3André MendozaPas encore d'évaluation

- Ae23 Capital Budgeting 2Document2 pagesAe23 Capital Budgeting 2Hanielyn TagupaPas encore d'évaluation

- Capital Budgeting 1 - 1Document103 pagesCapital Budgeting 1 - 1Subhadeep BasuPas encore d'évaluation

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonD'EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonÉvaluation : 5 sur 5 étoiles5/5 (9)

- Double Entry Book Keeping Rules Chapter - 03Document10 pagesDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloPas encore d'évaluation

- Accounting Equation Chapter - 02Document6 pagesAccounting Equation Chapter - 02Ramainne Ronquillo100% (1)

- Obligation PDFDocument1 pageObligation PDFRamainne RonquilloPas encore d'évaluation

- Home Office and Branch AccountingDocument3 pagesHome Office and Branch AccountingRamainne RonquilloPas encore d'évaluation

- Chapter - 1 Introduction To AccountingDocument3 pagesChapter - 1 Introduction To AccountingAnna Olivia MariePas encore d'évaluation

- The Modified Distribution (MODI) : Example 1Document15 pagesThe Modified Distribution (MODI) : Example 1Ramainne RonquilloPas encore d'évaluation

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloPas encore d'évaluation

- AFAR-01 PartnershipDocument6 pagesAFAR-01 PartnershipRamainne Ronquillo0% (1)

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloPas encore d'évaluation

- Service OH Cost Allocation MowenDocument13 pagesService OH Cost Allocation MowenRamainne RonquilloPas encore d'évaluation

- AFAR-03 Revenue RecognitionDocument3 pagesAFAR-03 Revenue RecognitionRamainne RonquilloPas encore d'évaluation

- QUIZ 2 With Answer PDFDocument20 pagesQUIZ 2 With Answer PDFRamainne RonquilloPas encore d'évaluation

- Ronquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodDocument9 pagesRonquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodRamainne RonquilloPas encore d'évaluation

- Ronquillo, Ramainne Chalsea L.-Sec1 - MaximizationDocument4 pagesRonquillo, Ramainne Chalsea L.-Sec1 - MaximizationRamainne RonquilloPas encore d'évaluation

- Professional Review & Training Center, Inc.: Taxation Sia/Tabag TAX 2806 - Income Tax On Individuals MAY 2020Document11 pagesProfessional Review & Training Center, Inc.: Taxation Sia/Tabag TAX 2806 - Income Tax On Individuals MAY 2020Ramainne RonquilloPas encore d'évaluation

- AR Astern Niversity: Atty. Aldren D. Abrigo, CPADocument3 pagesAR Astern Niversity: Atty. Aldren D. Abrigo, CPARamainne RonquilloPas encore d'évaluation

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- Ronquillo, Ramainne Chalsea L.-Sec1 - MaximizationDocument4 pagesRonquillo, Ramainne Chalsea L.-Sec1 - MaximizationRamainne RonquilloPas encore d'évaluation

- Ronquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodDocument9 pagesRonquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodRamainne RonquilloPas encore d'évaluation

- Forecasting ExcelDocument3 pagesForecasting ExcelRamainne RonquilloPas encore d'évaluation

- Taxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Document12 pagesTaxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Ramainne Ronquillo100% (1)

- Daftar Akun UD Buana (Lisa Nabila)Document1 pageDaftar Akun UD Buana (Lisa Nabila)Lisa NabilaPas encore d'évaluation

- Chapter 21 - Investment PropertyDocument3 pagesChapter 21 - Investment PropertyXiena67% (3)

- Bata IndiaDocument10 pagesBata IndiaAnand Shekhar MishraPas encore d'évaluation

- Wa0014 PDFDocument59 pagesWa0014 PDFUthappa T SPas encore d'évaluation

- On January 1 2013 Stamford Reacquires 8 000 of The OutstandingDocument1 pageOn January 1 2013 Stamford Reacquires 8 000 of The OutstandingMiroslav GegoskiPas encore d'évaluation

- BRANCH ACCOUNTS - Assignment SolutionsDocument9 pagesBRANCH ACCOUNTS - Assignment SolutionsNaveen C GowdaPas encore d'évaluation

- Financial Accounting International Financial Reporting Standards Global 9th Edition Horngren Solutions ManualDocument65 pagesFinancial Accounting International Financial Reporting Standards Global 9th Edition Horngren Solutions ManualJordanGibsonmzwyo100% (16)

- 2020 1 Accounting in Organisations and Society Assignment-3Document7 pages2020 1 Accounting in Organisations and Society Assignment-3Abs PangaderPas encore d'évaluation

- Revised Corporation Code MCQDocument25 pagesRevised Corporation Code MCQNiña Yna Franchesca PantallaPas encore d'évaluation

- Teri Buhl On Laidlaw and Barry Honig Sept 12 2018Document7 pagesTeri Buhl On Laidlaw and Barry Honig Sept 12 2018buyersstrikewp100% (1)

- TATA Merger Case StudyDocument98 pagesTATA Merger Case StudyRavi Rock50% (2)

- Capital Structure and Dividend TheoriesDocument16 pagesCapital Structure and Dividend Theoriesmusa_scorpionPas encore d'évaluation

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenPas encore d'évaluation

- Chapter 6 - Job Order CostingDocument63 pagesChapter 6 - Job Order CostingXyne FernandezPas encore d'évaluation

- Capital Structure Decisions - 2 PDFDocument22 pagesCapital Structure Decisions - 2 PDFTashfeen RazzaqPas encore d'évaluation

- PKG 29 KCPDocument1 pagePKG 29 KCPkarthikeyan PPas encore d'évaluation

- Debentures and BondsDocument3 pagesDebentures and Bondsremruata rascalraltePas encore d'évaluation

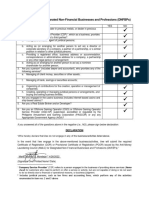

- SIGNED Questionnaire For Designated Non Financial Businesses and Professions DNFBPsDocument2 pagesSIGNED Questionnaire For Designated Non Financial Businesses and Professions DNFBPsCoco MondejarPas encore d'évaluation

- Various Topics in MANAGEMENT ACCOUNTING (RESA)Document2 pagesVarious Topics in MANAGEMENT ACCOUNTING (RESA)Denise ChristinaPas encore d'évaluation

- Solution AldineDocument8 pagesSolution AldineAkshay TulshyanPas encore d'évaluation

- 05 Corporate Tax Planning and ManagementDocument34 pages05 Corporate Tax Planning and ManagementHimanshu SharmaPas encore d'évaluation

- 1920 - Tri 2 2019-20 - UCL3622 - Scheme of Arrangement PDFDocument78 pages1920 - Tri 2 2019-20 - UCL3622 - Scheme of Arrangement PDFJ Enn WooPas encore d'évaluation

- Ashok Leyland - Annual Report 2017-18Document220 pagesAshok Leyland - Annual Report 2017-18Kumar Prakash100% (1)

- Flowers Industries, Inc. (Abridged) : October 2008Document24 pagesFlowers Industries, Inc. (Abridged) : October 2008MJ SapiterPas encore d'évaluation

- Total Assets at DOA FV of Identifiable Net Assets 2,374,000Document14 pagesTotal Assets at DOA FV of Identifiable Net Assets 2,374,000Kevin Jay PagaduanPas encore d'évaluation

- 11 Income-Tax Lecture-NotesDocument6 pages11 Income-Tax Lecture-NotesandreamriePas encore d'évaluation

- Can Slim A Growth Approach Using Technical and Fundamental Data PDFDocument4 pagesCan Slim A Growth Approach Using Technical and Fundamental Data PDFWan ShahmisufiPas encore d'évaluation

- Quiz 12 Budgeting and Profit Planning SolutionsDocument6 pagesQuiz 12 Budgeting and Profit Planning Solutionsralphalonzo100% (1)

- Ey Faas Branch Accounting Deck FinalDocument41 pagesEy Faas Branch Accounting Deck FinalTouseef AslamPas encore d'évaluation

- Chap 8 10 11 NumericalsDocument7 pagesChap 8 10 11 NumericalsDINKAR JAISWALPas encore d'évaluation