Académique Documents

Professionnel Documents

Culture Documents

Introduction To Taxation What Is Taxation?

Transféré par

Monica MonicaDescription originale:

Titre original

Copyright

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Introduction To Taxation What Is Taxation?

Transféré par

Monica MonicaDroits d'auteur :

INTRODUCTION TO TAXATION

WHAT IS TAXATION?

-Taxation may be defined as a State Power, a legislative process and a mode of

government cost distribution

1) As a state power

Taxation is an inherent power of the State to enforce proportional

contribution from its subjects for public purpose

2) As a process

Taxation is a process of laying taxes by the legislature of the state to

enforce proportional contribution from its subject for public purpose

3) As a mode of cost distribution

Taxation is a mode by which the state allocates its cost or burden to

its subjects who are benefited by its spending

THE BASIS OF TAXATION

The government provides benefit to the people in the form of public

services and the people provide the funds that finance the government. The

mutuality of support between the people and the government is referred to as

the basis of taxation.

This mutuality is illustrated as

Public Service

Government People

Taxes

THE LIFEBLOOD DOCTRINE

Taxes are essential and indispensable to the continued subsistence of

the government. Without taxes, the government would be paralyzed for the lack

of motive power to activate or operate it. (CIR vs. Algue)

Taxes are the lifeblood of the Government and their prompt and certain

availability are imperious need. Upon taxation depends the government ability

to serve the people for whose benefit taxes are collected. (Vera vs.

Fernandez)

THE INHERENT POWERS OF THE STATE

1. Taxation power- the power of the State to enforce proportional

contribution from its subjects to sustain itself

2. Police Power- the general power of the State to enact laws to protect

the well-being of the people

3. Eminent Domain- the power of the state to take private property for

public use after paying just compensation

ESCAPES FROM TAXATION

Are the means available to the taxpayer to limit or even avoid the

impact of taxation

1. Tax Evasion- also known as tax dodging, refers to any act or trick

that tends to illegally reduce or avoid the payment of tax. In

income taxation, this can be perpetrated by undue understatement

of income, overstatement of expenses or non- declaration of

income.

2. Tax avoidance- also known as Tax minimization, refers to any act

or trick that reduces or totally escapes taxes by any legally

permissible means.

3. Tax exemption- also known as tax holiday, refers to the immunity,

privilege or freedom from being subject to tax which others are

subject to. Tax exemptions may be granted by the constitution, law

or contract.

SITUS OF TAXATION

Situs is the place of taxation. It is the tax jurisdiction that has the power

to levy taxes upon the tax object. Situs rules serve as frames of reference in

gauging whether the tax object is within or outside the tax jurisdiction of

the taxing authority.

TYPES OF INCOME TAXPAYERS

A. Individuals

1) Citizen

a. Resident Citizen

an individual whose residence is within the Philippines and who is a

citizen thereof

b. Non- resident Citizen

Establishes the fact of the physical presence abroad with a definite

intention to reside therein

Leaves the Philippines during the taxable year to reside abroad,

either as an immigrant or for employment on a permanent basis

Works and derives income from abroad and whose employment requires

him to be physically present most of the time Citizen who has been

previously considered as non-resident citizen and who arrives in the

Philippines at any time during the taxable year to reside permanently

in the Philippines

2) Alien

a. Resident alien

Any individual whose residence is within the Philippines but is not a

resident thereof

b. Non Resident alien- means an individual whose residence is not

within the Philippines and is not a citizen thereof

a. Engaged in trade or business

b. Not engaged in trade or business

3) Taxable estates and trusts

B. Corporations

1. Domestic Corporation

2. Foreign Corporation

a. Resident Foreign Corporation

b. Non Resident Foreign Corporation

TYPES OF INDIVIDUAL INCOME

TAXABLE WITHIN? TAXABLE WITHOUT?

TAXPAYERS

a. Resident Citizen Yes Yes

Yes No

b. Non Resident Citizen

Yes No

c. Resident Alien

d. Non-resident alien engaged in Yes No

trade or business

e. Non-resident alien not engaged Yes No

in trade or business

WHO ARE REQUIRED TO FILE INCOME TAX RETURNS?

Individuals

Resident citizens receiving income from sources within or outside the

Philippines

o Employees deriving purely compensation income from two or more

employers, concurrently or successively at any time during the

taxable year

o Employees deriving purely compensation income regardless of the

amount, whether from a single or several employers during the

calendar year, the income tax of which has not been withheld

correctly (i.e. tax due is not equal to the tax withheld)

resulting to collectible or refundable return

o Self-employed individuals receiving income from the conduct of

trade or business and/or practice of profession

o Individuals deriving mixed income, i.e., compensation income and

income from the conduct of trade or business and/or practice of

profession

o Individuals deriving other non-business, non-professional related

income in addition to compensation income not otherwise subject to

a final tax

o Individuals receiving purely compensation income from a single

employer, although the income of which has been correctly

withheld, but whose spouse is not entitled to substituted filing

Non-resident citizens receiving income from sources within the

Philippines

Aliens, whether resident or not, receiving income from sources within

the Philippines

Non-Individuals

Corporations including partnerships, no matter how created or organized.

Domestic corporations receiving income from sources within and outside

the Philippines

Foreign corporations receiving income from sources within the

Philippines

Estates and trusts engaged in trade or business

RA 10963: TAX REFORM FOR ACCELARATION AND INCLUSION

Background of the tax reform

The TRAIN amends certain provisions of Republic Act

No. 8424(The National Internal Revenue Code of

1997), as amended

The enrolled bill sent to President Duterte for

approval and was signed into law as Republic Act No.

10963 on December 19, 2017. The law takes effect

January 1, 2018 following its complete publication

in the Official Gazette last December 27, 2017.

The President has issued a separate letter vetoing

five provisions of the signed TRAIN law

The law is just the first tax reform package. The

second package (reduction of corporate income tax

and rationalization of fiscal incentives) is

estimated to be released by early 2018.

Key amendments:

1. Individual Income Tax

2. Final Income Tax

3. Estate Tax

4. Donor’s Tax

5. Value Added Tax

6. Documentary Stamp Tax

7. Some Administrative provisions

8. Penalties

9. Excise tax on:

Tobacco

Automobiles

Petroleum Products

Sweetened Beverages

Mineral Products

Cosmetic Procedures (non-essential services)

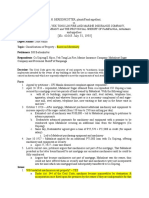

Description RA 8424(Tax code of RA 10963(TRAIN)

1997)

Income tax rates Graduated rates from In general, graduated

for individuals 5% to 32% with 7 rates from 20% to 35%

tiers’ basis from P1 (beg 2023,15% to 35%)

to over P500 000 with zero rate for 1st

250 000 and 5 tiers.

Basis is from over 250

000 to over 8M, with

option under certain

cases of qualified

individuals with income

from business/practice

of profession to opt

for the 8% income tax

rate in lieu of the

graduated rates and the

percentage tax under

Sec 116

Personal/additional Available to None- already included

exemptions & Health qualified taxpayers in the 250 000 exempt

Insurance from income tax; repeal

of Sec 33A of the Magna

Carta for Persons with

disability & Sec 22(B)

of the Foster care Act

of 2012

13th month pay and Maximum of 82 000 Maximum of 90 000

other benefits

Source: Income Taxation by Rex B. Banggawan, CPA, MBA

Certified Tax Technician Training Handbook

https://www.bir.gov.ph/images/bir_files/taxpayers_servi

ce_programs_and_monitoring_1/1701A%20Jan

%202018%20v5%20with%20rates.pdf

Vous aimerez peut-être aussi

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryD'EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryPas encore d'évaluation

- Taxation - FABM Taxation - FABMDocument6 pagesTaxation - FABM Taxation - FABMPdf FilesPas encore d'évaluation

- Fundamental Concepts of Individual Income TaxationDocument43 pagesFundamental Concepts of Individual Income TaxationLawrence Ting100% (1)

- Lesson 4.2 - TAXATION INCOMEDocument4 pagesLesson 4.2 - TAXATION INCOMEIshi MaxinePas encore d'évaluation

- Produced The Income)Document4 pagesProduced The Income)bluesPas encore d'évaluation

- Principles and Practice of Taxation Lecture NotesDocument20 pagesPrinciples and Practice of Taxation Lecture NotesSony Axle100% (11)

- Classification of Individual Taxpayers SummaryDocument2 pagesClassification of Individual Taxpayers SummaryexquisitePas encore d'évaluation

- EC1B1 - Intro TaxationDocument38 pagesEC1B1 - Intro TaxationZen Marcus RodasPas encore d'évaluation

- Chapter 1: Fundamental Principles of TaxationDocument22 pagesChapter 1: Fundamental Principles of TaxationChira Rose Fejedero NeriPas encore d'évaluation

- TaxationDocument26 pagesTaxationReynamae Garcia AbalesPas encore d'évaluation

- Income and Business Taxation Fabm 2Document32 pagesIncome and Business Taxation Fabm 2Daniela Mariz CepresPas encore d'évaluation

- What Is An Itr?Document12 pagesWhat Is An Itr?جاثية عبدالرحمنPas encore d'évaluation

- Group-2 - TaxDocument16 pagesGroup-2 - TaxCamille LibradillaPas encore d'évaluation

- FABM2 12 Q2 M5 Income and Business Taxation V5 PDFDocument19 pagesFABM2 12 Q2 M5 Income and Business Taxation V5 PDFLady Hara100% (1)

- DTB Orientation (PIT & CIT) FINALDocument37 pagesDTB Orientation (PIT & CIT) FINALCourt NanquilPas encore d'évaluation

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroPas encore d'évaluation

- Concepts of Taxation and Income TaxationDocument10 pagesConcepts of Taxation and Income TaxationPinks D'CarlosPas encore d'évaluation

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- TAX - 601 - Individuals - Abapo, Mary Jhudiel G.Document53 pagesTAX - 601 - Individuals - Abapo, Mary Jhudiel G.Mohammad100% (1)

- Situs of Taxation Literally Means Place of TaxationDocument19 pagesSitus of Taxation Literally Means Place of TaxationRowie Ann Arista SiribanPas encore d'évaluation

- Principles of TaxDocument46 pagesPrinciples of TaxPASCUA, ROWENA V.Pas encore d'évaluation

- Tax Follosco PDFDocument216 pagesTax Follosco PDFalicorpanaoPas encore d'évaluation

- Fabm2 TaxationDocument4 pagesFabm2 TaxationFrancine Joy AvenidoPas encore d'évaluation

- Income and Business Taxation: GradeDocument9 pagesIncome and Business Taxation: GradeTinny Casana100% (1)

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Income Taxation: Tabian, Jieza Syra A. 2018-017-4883Document30 pagesIncome Taxation: Tabian, Jieza Syra A. 2018-017-4883WAYNEPas encore d'évaluation

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- Income Taxation Chapter 1Document3 pagesIncome Taxation Chapter 1Armalyn CangquePas encore d'évaluation

- National TaxDocument6 pagesNational TaxRoi RimasPas encore d'évaluation

- Name of Form Bir Form Filing and Payment DescriptionDocument4 pagesName of Form Bir Form Filing and Payment DescriptionMelrose Eugenio ErasgaPas encore d'évaluation

- Income Taxation NotesDocument14 pagesIncome Taxation Notescristiepearl100% (2)

- College of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesDocument3 pagesCollege of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesVel JunePas encore d'évaluation

- TAX Notes AdditionalDocument18 pagesTAX Notes AdditionalJoben Vernan CuencaPas encore d'évaluation

- Merge TaxDocument154 pagesMerge TaxJIM KYRONE GENOBISAPas encore d'évaluation

- Assignment No. 4Document7 pagesAssignment No. 4HannahPauleneDimaanoPas encore d'évaluation

- Introduction To Income TaxationDocument10 pagesIntroduction To Income TaxationKatrina MaglaquiPas encore d'évaluation

- A 3 - Taxation-LawDocument53 pagesA 3 - Taxation-LawRei Clarence De AsisPas encore d'évaluation

- TaxpayersDocument26 pagesTaxpayersJessa Mae IgotPas encore d'évaluation

- Individual Income TaxationDocument76 pagesIndividual Income TaxationRoronoa ZoroPas encore d'évaluation

- Tax 2 TSNDocument38 pagesTax 2 TSNCamille EvePas encore d'évaluation

- Income Tax - Tax ExemptionDocument1 pageIncome Tax - Tax ExemptionStar RamirezPas encore d'évaluation

- Taxation Income TaxationDocument73 pagesTaxation Income TaxationB-an Javelosa0% (1)

- Fabm2 q2 Module 4 TaxationDocument17 pagesFabm2 q2 Module 4 TaxationLady HaraPas encore d'évaluation

- Full Length of Module 1 Income Taxation On Individuals PDFDocument35 pagesFull Length of Module 1 Income Taxation On Individuals PDFHermosura ChristinePas encore d'évaluation

- 06 Overview of Income Taxation and Income Tax For IndividualsDocument7 pages06 Overview of Income Taxation and Income Tax For IndividualsRonn Robby RosalesPas encore d'évaluation

- Module 2 - Part 1Document6 pagesModule 2 - Part 1trixie maePas encore d'évaluation

- Income TaxDocument35 pagesIncome TaxAmer Hussien ManarosPas encore d'évaluation

- Module 3 TaxationDocument10 pagesModule 3 TaxationHinata UmazakiPas encore d'évaluation

- Special Aliens Are Non-Resident Aliens WhoDocument8 pagesSpecial Aliens Are Non-Resident Aliens WhoMary Rose LacsamanaPas encore d'évaluation

- Income TaxationDocument138 pagesIncome TaxationLimberge Paul CorpuzPas encore d'évaluation

- Report in Taxation Group 3Document25 pagesReport in Taxation Group 3Patricia BacatanoPas encore d'évaluation

- CH 3 Intro To Income TaxDocument16 pagesCH 3 Intro To Income TaxGabriel Trinidad SonielPas encore d'évaluation

- Edited FABM2 Q2 MOD3 Income and Business TaxationDocument17 pagesEdited FABM2 Q2 MOD3 Income and Business Taxationleslie sabatePas encore d'évaluation

- Share Taxpayer and Elements of Gross IncomeDocument24 pagesShare Taxpayer and Elements of Gross IncomeJessa Mae IgotPas encore d'évaluation

- Income Tax: Global Income TaxDocument4 pagesIncome Tax: Global Income TaxMichelle Muhrie TablizoPas encore d'évaluation

- Module No 2 - INCOME TAXATION PART1ADocument11 pagesModule No 2 - INCOME TAXATION PART1APrinces S. RoquePas encore d'évaluation

- Chapter 2Document9 pagesChapter 2Sheilamae Sernadilla GregorioPas encore d'évaluation

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesD'EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesPas encore d'évaluation

- Landlord Tax Planning StrategiesD'EverandLandlord Tax Planning StrategiesPas encore d'évaluation

- Tech Com Grammar Correctness and BrevityDocument35 pagesTech Com Grammar Correctness and BrevityMonica MonicaPas encore d'évaluation

- Module 1 - Introduction To Consumption TaxesDocument3 pagesModule 1 - Introduction To Consumption TaxesMonica MonicaPas encore d'évaluation

- Ðöńg Qüïz Šët - : Financial Accounting & ReportingDocument13 pagesÐöńg Qüïz Šët - : Financial Accounting & ReportingMonica MonicaPas encore d'évaluation

- TAXNDocument22 pagesTAXNMonica MonicaPas encore d'évaluation

- Cite Three Notable CICM Missionaries Who Are Known For Their Exemplary Missionary WorksDocument1 pageCite Three Notable CICM Missionaries Who Are Known For Their Exemplary Missionary WorksMonica MonicaPas encore d'évaluation

- Previous ExamsDocument18 pagesPrevious ExamsMonica Monica100% (1)

- AccountingDocument2 pagesAccountingMonica MonicaPas encore d'évaluation

- Market Place Is Often Efficient, But Not Necessarily EquitableDocument9 pagesMarket Place Is Often Efficient, But Not Necessarily EquitableMonica MonicaPas encore d'évaluation

- Vision: Christian Living. Excellence. Professional ResponsibilityDocument4 pagesVision: Christian Living. Excellence. Professional ResponsibilityMonica MonicaPas encore d'évaluation

- TAX 1016 Lesson TWODocument8 pagesTAX 1016 Lesson TWOMonica MonicaPas encore d'évaluation

- ZMSQ 12 Activity Based CostingDocument8 pagesZMSQ 12 Activity Based CostingMonica MonicaPas encore d'évaluation

- Quiz Employee Benifits Income TaxDocument2 pagesQuiz Employee Benifits Income TaxMonica MonicaPas encore d'évaluation

- Income Tax Compliance, Schemes of Income Taxation and Final Income TaxationDocument45 pagesIncome Tax Compliance, Schemes of Income Taxation and Final Income TaxationMonica MonicaPas encore d'évaluation

- Lesson 1 (Week 1) - Financial Assets at Fair Value and Investment in BondsDocument14 pagesLesson 1 (Week 1) - Financial Assets at Fair Value and Investment in BondsMonica MonicaPas encore d'évaluation

- Laws (Week 1&2)Document15 pagesLaws (Week 1&2)Monica MonicaPas encore d'évaluation

- ZMSQ 02 Variable Absorption CostingDocument12 pagesZMSQ 02 Variable Absorption CostingMonica MonicaPas encore d'évaluation

- Anggot, Brian: College of Maritime Education Quality FormDocument2 pagesAnggot, Brian: College of Maritime Education Quality FormMonica MonicaPas encore d'évaluation

- Lesson 2 (Week 2) - Investment in Equity SecuritiesDocument10 pagesLesson 2 (Week 2) - Investment in Equity SecuritiesMonica MonicaPas encore d'évaluation

- Introduction To Income TaxationDocument52 pagesIntroduction To Income TaxationMonica Monica33% (3)

- Standard Costs and Variance Analysis 1236548541Document12 pagesStandard Costs and Variance Analysis 1236548541anon_39534635275% (4)

- Anggot, Brian: College of Maritime Education Quality FormDocument2 pagesAnggot, Brian: College of Maritime Education Quality FormMonica MonicaPas encore d'évaluation

- TAX 1016 Lesson ONE PDFDocument7 pagesTAX 1016 Lesson ONE PDFMonica MonicaPas encore d'évaluation

- Market Intelligence - Includes CustomerDocument5 pagesMarket Intelligence - Includes CustomerMonica MonicaPas encore d'évaluation

- MATH-Problem Solving PolyaDocument16 pagesMATH-Problem Solving PolyaMonica Monica100% (1)

- ZMSQ 12 Activity Based CostingDocument9 pagesZMSQ 12 Activity Based CostingMonica MonicaPas encore d'évaluation

- Introduction To Sacred ScripturesDocument22 pagesIntroduction To Sacred ScripturesMonica MonicaPas encore d'évaluation

- Becoming A Member of SocietyDocument16 pagesBecoming A Member of SocietyMonica MonicaPas encore d'évaluation

- Choose A Social IssueDocument2 pagesChoose A Social IssueMonica MonicaPas encore d'évaluation

- HIST-Cry of BalintawakDocument6 pagesHIST-Cry of BalintawakMonica MonicaPas encore d'évaluation

- Research Reviewer: Finding Answers Through Data CollectionDocument6 pagesResearch Reviewer: Finding Answers Through Data CollectionMonica MonicaPas encore d'évaluation

- Chapter 1 - Computation of Tax LiabilityDocument38 pagesChapter 1 - Computation of Tax LiabilityARUN AGGARWALPas encore d'évaluation

- Cir Vs CA and Ymca (Summary)Document4 pagesCir Vs CA and Ymca (Summary)ian clark MarinduquePas encore d'évaluation

- Midterm Exam - MangayayamDocument6 pagesMidterm Exam - MangayayamNikkiPas encore d'évaluation

- In El Carburetor California Population 1 001 There Is Not MuchDocument1 pageIn El Carburetor California Population 1 001 There Is Not Muchtrilocksp SinghPas encore d'évaluation

- Tax QuizDocument6 pagesTax QuizAshley GanaPas encore d'évaluation

- Certificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncDocument2 pagesCertificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncGuile Gabriel AlogPas encore d'évaluation

- Notification No. 38/2021, Dated 27th April 2021Document4 pagesNotification No. 38/2021, Dated 27th April 2021Community ReminderPas encore d'évaluation

- AIR 1975 SC 1007 M.K. Papiah and Sons v. The Excise Commissioner and Anr.Document7 pagesAIR 1975 SC 1007 M.K. Papiah and Sons v. The Excise Commissioner and Anr.Harsh GargPas encore d'évaluation

- CIR Vs Metro StarDocument4 pagesCIR Vs Metro StarJohnde MartinezPas encore d'évaluation

- Tax ProjectDocument19 pagesTax Projectsanskarbarekar789Pas encore d'évaluation

- Mod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestDocument2 pagesMod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestOjie Santillan100% (1)

- Tax Invoive: Sunny VisionDocument3 pagesTax Invoive: Sunny VisionMR ANIkETPas encore d'évaluation

- 2023 Budget FAQs - Solar Panel Tax IncentiveDocument4 pages2023 Budget FAQs - Solar Panel Tax IncentiveJohn Stupart100% (1)

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulPas encore d'évaluation

- GoodsandServicesTaxGSTinMalaysiaBehindSuccessfulExperiences2 Edit PDFDocument23 pagesGoodsandServicesTaxGSTinMalaysiaBehindSuccessfulExperiences2 Edit PDFAmirahPas encore d'évaluation

- Carolina Hurricanes PNC Arena Cost AllocationDocument8 pagesCarolina Hurricanes PNC Arena Cost AllocationCynthia Botello SalasPas encore d'évaluation

- Purposes of Taxation: What Is BIR?Document2 pagesPurposes of Taxation: What Is BIR?joyPas encore d'évaluation

- Coffee Day Global LTD in 1Document4 pagesCoffee Day Global LTD in 1radhakrishnaPas encore d'évaluation

- Mepco Online Billl PDFDocument2 pagesMepco Online Billl PDFArslanPas encore d'évaluation

- Chapter TwoDocument54 pagesChapter Twoyechale taferePas encore d'évaluation

- Property DigestsDocument7 pagesProperty DigestsJude FanilaPas encore d'évaluation

- Shiawassee County Ballot Proposals Nov. 2020Document3 pagesShiawassee County Ballot Proposals Nov. 2020WILX Krystle HollemanPas encore d'évaluation

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFDocument21 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFaemanPas encore d'évaluation

- Basics International TaxationDocument65 pagesBasics International TaxationKaif UddinPas encore d'évaluation

- Critical Source Review #2Document4 pagesCritical Source Review #2Kyle DuffyPas encore d'évaluation

- Chapter 1 Introduction To Consumption TaxesDocument21 pagesChapter 1 Introduction To Consumption TaxesNacpil, Alyssa JessePas encore d'évaluation

- CHAPTER:-1 Definitions U/s - 2, Basis of Charge and Exclusions From Total IncomeDocument12 pagesCHAPTER:-1 Definitions U/s - 2, Basis of Charge and Exclusions From Total IncomeshyamiliPas encore d'évaluation

- 2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6Document4 pages2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6rian.lee.b.tiangcoPas encore d'évaluation

- Philippine Laws For PWD'sDocument2 pagesPhilippine Laws For PWD'sereca carreonPas encore d'évaluation

- RMO 46-04 AffidaitDocument9 pagesRMO 46-04 Affidaitnathalie velasquezPas encore d'évaluation