Académique Documents

Professionnel Documents

Culture Documents

Corporate Finance2

Transféré par

Daniel ChrisCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporate Finance2

Transféré par

Daniel ChrisDroits d'auteur :

Formats disponibles

1

Instructions: Blue Mesa's Agricultural Chemicals Division has just developed a

new insecticide for treating corn and soybeans. The insecticide should be much

less harmful to the crops than the current chemicals on the market and equally

effective in preve

Judy Abarca, your training manager, has requested that you create a

spreadsheet showing projected cash flows for the first five years of a new

project that Blue Mesa is considering. She wants to make sure that you

know how to apply the principles from your second week of training.

For this assignment, you will use the template provided in Materials below

to create the spreadsheet that Judy Abarca has requested. Your

assignment will be graded based on the accuracy of your calculations.

Read the Blue Mesa Sales and Cost Projections provided in Materials

below and use that information as the basis for your cash flow

projections.

Sales are expected to grow 15 percent in the first year and 10 percent a year for

the next four years.

Gross margin is expected to stay constant as a percentage of sales, as are SG&A

expenses.

PP&E is expected to increase by $350,000 per year, with depreciation expense

remaining at $375,000 per year.

Working capital per year is estimated at 35 cents per dollar of sales.

The tax rate will remain constant at 34 percent. Interest expense remains

constant at $25,000 per year.

In 2002 working capital was $2,275,000.

Solution :

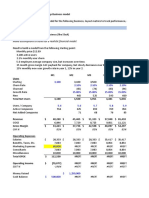

2003 2004 2005 2006 2007

Sales $7,500,000 $8,625,000 ### ### ###

Cost of Sales $5,025,000 $5,778,750 ### ### ###

Gross Margin $2,475,000 $2,846,250 ### ### ###

SG&A Expense $394,737 $453,948 $434,211 $434,211 $434,211

Depreciation $375,000 $375,000 $375,000 $375,000 $375,000

Interest Expense $25,000 $25,000 $25,000 $25,000 $25,000

Taxable Income $1,680,263 $1,992,302 ### ### ###

Taxes $571,289 $677,383 $642,018 $642,018 $642,018

Net Income $1,108,974 $1,314,920 ### ### ###

Copyright ©2009 Cardean Learning Group LLC. All rights reserved.

ust developed a

e should be much

arket and equally

reate a

ars of a new

that you

aining.

terials below

ur

ulations.

terials

w

percent a year for

sales, as are SG&A

eciation expense

sales.

nse remains

2008

###

###

###

$434,211

$375,000

$25,000

###

$642,018

###

Copyright ©2009 Cardean Learning Group LLC. All rights reserved.

2 - Part One

**Note: Be sure to complete Part 2 of this Assignment using the template on sheet 2 in this workbook.

Judy Abarca, she

has requested that you assist her by comparing two projects that Blue

Mesa is considering. Specifically, she would like you to determine which

project would be more profitable by calculating present values (PV) and

analyzing the results.

Your Assignment

For this assignment, you will compute the PV of two projects under

consideration by Blue Mesa. For each project, the company is

considering two options. Ultimately, you will determine which project

would be more profitable. Your analysis will be graded based on the

accuracy of your calculations and recommendations.

When making your calculations, use annual compounding.

Part One Instructions:

The Chinese government is conducting an auction for a joint project involving oil

exploration. Because of a desire for U.S. dollars, they require the winning bidder to make

an up-front, one-time payment for the rights to join the p

Solutio

n:

Option 1: simple interest 15% annually

Copyright ©2009 Cardean Learning Group LLC. All rights reserved.

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

$47 mil

FV = $54 $61 $68 $75 $82 $89 $96 $103 $110 $118

Option 2: 10% annually compounded quarterly

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

$47 mil

FV = $52 $57 $63 $69 $76 $83 $92 $101 $111 $122

Copyright ©2009 Cardean Learning Group LLC. All rights reserved.

3

Your Assignment

For this assignment, you will use an Excel spreadsheet template to

compute the value of a government bond at two different market

interest

rates. The template has more detailed instructions, including all the

figures you will need to complete this assignment. Your analysis will be

graded based on the accuracy of your calculations.

Use the template or a financial calculator to perform your calculations.

(If you decide to use a financial calculator, please input your calculations

into the template provided. Be sure to show your work.)

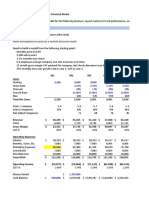

Instructions: Assume a government bond has a face value of $1,000, a coupon of

6 percent, semiannual payments of interest, and a five-year maturity. If the

market interest rate for such a bond is 5 percent, how much is the bond worth?

How much is it worth

Solutio

n: Face value of Bond = $1,000

Coupon Rate = 5%

Semiannual Coupon Payment$25

=

Yield to Maturity = 6%

5% Interest

Year 1 Year 2 Year 3 Year 4 Year 5

$1,000

6%

PV = $895 $796 $702 $614 $531 Application of PV function in excel

Data given,

Face value of Bond = $1,000

Coupon Rate = 8%

Semiannual Coupon Payment$40

=

Yield to Maturity = 6%

8% Interest

Year 1 Year 2 Year 3 Year 4 Year 5

$1,000

Copyright ©2009 Cardean Learning Group LLC. All rights reserved.

6%

PV = $866 $740 $621 $509 $403 Application of PV function in excel

Copyright ©2009 Cardean Learning Group LLC. All rights reserved.

4

Once again, Judy Abarca would like to use a possible new project for

Blue Mesa as an opportunity to see if you can apply what you've been

learning during your training period with her. Specifically, she would like

you to calculate the net present value (NPV) and internal rate of return

(IRR) for the new project.

Your Assignment

For this assignment, you will compute the NPV and IRR of a new project

that Blue Mesa is considering. You will work with the Excel spreadsheet

template provided below. This assignment will be graded according to the

accuracy of your calculations.

The Excel spreadsheet template provided in Materials below contains

detailed directions and figures regarding Blue Mesa's new project. Use

the template to create a cash flow diagram of the project's inflows and

outflows, as follows:

• Input the yearly project inflows

• Compute the discount factor for each year

• Compute the NPV of the project

• Using the cash flows in the template, use the IRR formula to calculate

the IRR of the project

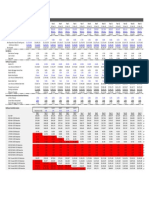

Instructions: Blue Mesa Oil needs to launch a new production facility to reach its strategic goals. The new facility will cost $15 million to acquire. The company will use it for 35 years, at which time the company expects to sell the facility

for $1.2 mi

Solution :

Cash Flow Diagram:

$1,296,170 $1,752,521 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $5,446,271

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

Year 0 $15,000,000

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

Cash Flow: $(15,000,000) $1,296,170 $1,752,521 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $1,621,271 $5,446,271

Discount Factor:

(Assume Discount Rate 12.5%) 1.000 0.889 0.790 0.702 0.624 0.555 0.493 0.438 0.390 0.346 0.308 0.274 0.243 0.216 0.192 0.171 0.152 0.135 0.120 0.107 0.095 0.084 0.075 0.067 0.059 0.053 0.047 0.042 0.037 0.033 0.029 0.026 0.023 0.021 0.018 0.016

NPV: ($2,363,310) Application of NPV function in excel

IRR: 10% Application of IRR function in excel

Copyright ©2009 Cardean Learning Group LLC. All rights reserved.

Vous aimerez peut-être aussi

- 1 B121F Assignment 2 Sep08Document7 pages1 B121F Assignment 2 Sep08Vincent ChuPas encore d'évaluation

- 09 - Mutlistage DDM SolutionsDocument12 pages09 - Mutlistage DDM SolutionsDilan MandhanePas encore d'évaluation

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current InputsÃarthï ArülrãjPas encore d'évaluation

- FcffevaDocument6 pagesFcffevaShobhit GoyalPas encore d'évaluation

- Excel Drill Exercise 1 MDLDocument16 pagesExcel Drill Exercise 1 MDLEugine AmadoPas encore d'évaluation

- Calculating Loan Repayments over Ten YearsDocument9 pagesCalculating Loan Repayments over Ten YearsUmair KamranPas encore d'évaluation

- Double Declining Balance Depreciation TemplateDocument4 pagesDouble Declining Balance Depreciation TemplateEdeon LimPas encore d'évaluation

- Bill Snow Financial Model 2004-03-09Document35 pagesBill Snow Financial Model 2004-03-09nsadnanPas encore d'évaluation

- Case Questions Excel SheetDocument8 pagesCase Questions Excel SheetMustafa MahmoodPas encore d'évaluation

- Excel-Cost Benefit AnalysisDocument23 pagesExcel-Cost Benefit Analysisninjps0% (1)

- CH 11 - CF Estimation Mini Case Sols Word 1514edDocument13 pagesCH 11 - CF Estimation Mini Case Sols Word 1514edHari CahyoPas encore d'évaluation

- Problem Set 3Document7 pagesProblem Set 3Kevin VerhagenPas encore d'évaluation

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138Pas encore d'évaluation

- Assigment 1Document17 pagesAssigment 1Felipe PinedaPas encore d'évaluation

- Finance Case Study For Tech Startup Video.01Document10 pagesFinance Case Study For Tech Startup Video.01koenigPas encore d'évaluation

- Exercise 1Document7 pagesExercise 1yingxuennn1204Pas encore d'évaluation

- Starbucks Share Valuation and Sensitivity AnalysisDocument4 pagesStarbucks Share Valuation and Sensitivity Analysismiranda100% (1)

- EX - 4 - Interest Rate CalculationDocument5 pagesEX - 4 - Interest Rate CalculationVishal SarkarPas encore d'évaluation

- Nike Cost of CapitalDocument23 pagesNike Cost of CapitalSaahil Ledwani100% (1)

- Current Financial Analysis and ValuationDocument30 pagesCurrent Financial Analysis and ValuationAbhinav PandeyPas encore d'évaluation

- Quiz Chapter 5 - Haryo IndraDocument4 pagesQuiz Chapter 5 - Haryo IndraHaryo HartoyoPas encore d'évaluation

- Assignment 2 Group 101 291018Document9 pagesAssignment 2 Group 101 291018Linh ChiPas encore d'évaluation

- Scrub Jay Peripherals: Perform Calculations With Formulas and FunctionsDocument6 pagesScrub Jay Peripherals: Perform Calculations With Formulas and FunctionsJacob SheridanPas encore d'évaluation

- Business Plan Workbook How TODocument19 pagesBusiness Plan Workbook How TOpopye007Pas encore d'évaluation

- Chapter 6 For CompletionDocument6 pagesChapter 6 For CompletionTrixie Mae MuncadaPas encore d'évaluation

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoPas encore d'évaluation

- Snap IPODocument16 pagesSnap IPOKaran NainPas encore d'évaluation

- ACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleDocument8 pagesACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleCoc AndreiPas encore d'évaluation

- Finance Case Study For Tech Startup Video.01Document10 pagesFinance Case Study For Tech Startup Video.01Extreme TourismPas encore d'évaluation

- Week 6 Go LiveDocument3 pagesWeek 6 Go Livewriter topPas encore d'évaluation

- Refinance Analysis v1.01Document1 pageRefinance Analysis v1.01AlexPas encore d'évaluation

- Tugas 3 - Dita Sari LutfianiDocument7 pagesTugas 3 - Dita Sari LutfianiDita Sari LutfianiPas encore d'évaluation

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Damodaran - Corporate Finance - Measuring ReturnDocument91 pagesDamodaran - Corporate Finance - Measuring ReturntweetydavPas encore d'évaluation

- Exercise Solutions Chapter 7-8 Berk DeMarzoDocument3 pagesExercise Solutions Chapter 7-8 Berk DeMarzoeyPas encore d'évaluation

- Math1090pvfv pt2Document5 pagesMath1090pvfv pt2api-291950350Pas encore d'évaluation

- Finance ExamplesDocument15 pagesFinance ExamplescherifsambPas encore d'évaluation

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadPas encore d'évaluation

- Financial Aspect of Apple Inc. by Dr. Zayar NaingDocument8 pagesFinancial Aspect of Apple Inc. by Dr. Zayar Naingzayarnmb_66334156Pas encore d'évaluation

- Chap1 PDFDocument31 pagesChap1 PDFSamarjeet SalujaPas encore d'évaluation

- Exam 3 MBA 631 Fall 22Document4 pagesExam 3 MBA 631 Fall 22Rakesh PatelPas encore d'évaluation

- Paper LBO Model Solutions BIWSDocument10 pagesPaper LBO Model Solutions BIWSDorian de GrubenPas encore d'évaluation

- Chapter 4. Mini Case: SituationDocument8 pagesChapter 4. Mini Case: SituationCool MomPas encore d'évaluation

- How To Get Rich in Silicon Valley MathDocument6 pagesHow To Get Rich in Silicon Valley MathRavi NeppalliPas encore d'évaluation

- Refinance Risk Analysis Tool: Visit This Model's WebpageDocument4 pagesRefinance Risk Analysis Tool: Visit This Model's WebpageAyush PandePas encore d'évaluation

- Value, Case #KEL688Document6 pagesValue, Case #KEL688Andrés AguirrePas encore d'évaluation

- Presentation of EnterpreneurshipDocument10 pagesPresentation of EnterpreneurshipAbdul WaliPas encore d'évaluation

- KPI Dashboard Template InstructionsDocument4 pagesKPI Dashboard Template InstructionsBALSAMI PURUSHOTHAMANPas encore d'évaluation

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobPas encore d'évaluation

- Tutorial 08Document12 pagesTutorial 08hugoleungPas encore d'évaluation

- Name: Da'jone Dennis Date: 4/20Document9 pagesName: Da'jone Dennis Date: 4/20api-356282166Pas encore d'évaluation

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzPas encore d'évaluation

- Saving For Retirement: InvestmentsDocument3 pagesSaving For Retirement: Investmentsnigam34Pas encore d'évaluation

- BMA 12e SM CH 06 Final PDFDocument23 pagesBMA 12e SM CH 06 Final PDFNikhil ChadhaPas encore d'évaluation

- FMA Class Activity 25-07-2021Document16 pagesFMA Class Activity 25-07-2021ABDUL -Pas encore d'évaluation

- Discounted Cash Flow (DCF) Model Tutorial and Dell Inc. Case StudyDocument18 pagesDiscounted Cash Flow (DCF) Model Tutorial and Dell Inc. Case StudySanket AdvilkarPas encore d'évaluation

- Finance Management SolutionsDocument10 pagesFinance Management Solutionsarwa_mukadam03Pas encore d'évaluation

- Manajemen dan Keekonomian Mineral Minggu ke-5Document31 pagesManajemen dan Keekonomian Mineral Minggu ke-5Vicky Faras Barunson PanggabeanPas encore d'évaluation

- Mplab IDE Com Mplab Editor e Mplab SimulatorDocument360 pagesMplab IDE Com Mplab Editor e Mplab SimulatorNando100% (1)

- Youth Alive MinistriesDocument26 pagesYouth Alive MinistriesDaniel ChrisPas encore d'évaluation

- Mplab IDE Com Mplab Editor e Mplab SimulatorDocument360 pagesMplab IDE Com Mplab Editor e Mplab SimulatorNando100% (1)

- List of All CompaniesDocument82 pagesList of All CompaniesDaniel Chris50% (2)

- Harvard ReferencingDocument11 pagesHarvard ReferencingfakhruddinahmedrubaiPas encore d'évaluation

- MarketingDocument18 pagesMarketingDaniel ChrisPas encore d'évaluation

- MarketingDocument18 pagesMarketingDaniel ChrisPas encore d'évaluation

- Chandru (Lemon Pickle) FinalDocument20 pagesChandru (Lemon Pickle) FinalMallik M BPas encore d'évaluation

- Auto Brick Business Plan (Financial Plan)Document36 pagesAuto Brick Business Plan (Financial Plan)Dipto Rzk100% (4)

- Bs Revision GuideDocument64 pagesBs Revision GuideFegason Fegy100% (1)

- Especificaciones Tecnicas Desmantelamiento de ConcretosDocument14 pagesEspecificaciones Tecnicas Desmantelamiento de ConcretoscarlosalbarPas encore d'évaluation

- Finance 16UCF519-FINANCIAL-MANAGEMENTDocument23 pagesFinance 16UCF519-FINANCIAL-MANAGEMENTHuzaifa Aman AzizPas encore d'évaluation

- School ProposalDocument31 pagesSchool ProposalatakiltiPas encore d'évaluation

- NPV Calculation of Euro DisneylandDocument5 pagesNPV Calculation of Euro DisneylandRama SubramanianPas encore d'évaluation

- Cpa Review QuestionsDocument54 pagesCpa Review QuestionsCodeSeeker0% (1)

- IRR and NPVDocument21 pagesIRR and NPVAbdul Qayyum100% (1)

- SABV Topic 2 QuestionsDocument3 pagesSABV Topic 2 QuestionsNgoc Hoang Ngan NgoPas encore d'évaluation

- FM11 CH 11 Mini CaseDocument13 pagesFM11 CH 11 Mini CasesushmanthqrewrerPas encore d'évaluation

- Capital BudgetingDocument6 pagesCapital BudgetingkipovoPas encore d'évaluation

- Final Paper20 Revised Business ValuationDocument698 pagesFinal Paper20 Revised Business ValuationSukumar100% (5)

- WACCDocument2 pagesWACCw_sampathPas encore d'évaluation

- 04 IntroFinancialModel PPA BoonrodDocument15 pages04 IntroFinancialModel PPA BoonrodAgus SupriyonoPas encore d'évaluation

- Finance Internship ReportDocument16 pagesFinance Internship ReportTalha SultanPas encore d'évaluation

- Hoạch định thuếDocument24 pagesHoạch định thuếAn Trần Thị HảiPas encore d'évaluation

- Financial ratios and formulasDocument3 pagesFinancial ratios and formulasLi Jean TanPas encore d'évaluation

- 1185 Chapter 6 Building Financial Functions Into ExcelDocument37 pages1185 Chapter 6 Building Financial Functions Into ExcelAndré BorgesPas encore d'évaluation

- Lecture 5 Investment Decision RulesDocument53 pagesLecture 5 Investment Decision Ruleschenzhi fanPas encore d'évaluation

- Project Management Chapter 8 Investment Criteria Question AnswersDocument6 pagesProject Management Chapter 8 Investment Criteria Question AnswersAkm EngidaPas encore d'évaluation

- Investment Multiplier EffectDocument17 pagesInvestment Multiplier EffectAshish SinghPas encore d'évaluation

- IT2403 - Software Project ManagementDocument140 pagesIT2403 - Software Project ManagementPreethi NilaPas encore d'évaluation

- Fin544 TUTORIAL and FormulaDocument9 pagesFin544 TUTORIAL and FormulaYumi MayPas encore d'évaluation

- C B T P C B B: Tamford Niversity Anglades HDocument75 pagesC B T P C B B: Tamford Niversity Anglades HMarinela DaumarPas encore d'évaluation

- Msdi Alcala de Henares, SpainDocument24 pagesMsdi Alcala de Henares, SpainVineet NairPas encore d'évaluation

- Screenshot 2024-02-19 at 8.03.15 AMDocument42 pagesScreenshot 2024-02-19 at 8.03.15 AMdivyamani1130Pas encore d'évaluation

- Capital Budgeting A Nice Finance Topic Helpful For Mba and Bba StudentsDocument39 pagesCapital Budgeting A Nice Finance Topic Helpful For Mba and Bba StudentsNimish KumarPas encore d'évaluation

- Case Study On Capital BudgetingDocument12 pagesCase Study On Capital BudgetingAa-ckC-restPas encore d'évaluation

- Er - Kumar Dhamala Urban Planner 2023-11-3Document17 pagesEr - Kumar Dhamala Urban Planner 2023-11-3kumardaiPas encore d'évaluation