Académique Documents

Professionnel Documents

Culture Documents

Reading 29, FS Analysis An Introduction

Transféré par

Sotirios TsavarisDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reading 29, FS Analysis An Introduction

Transféré par

Sotirios TsavarisDroits d'auteur :

Formats disponibles

Reading 29

FINANCIAL STATEMENT ANALYSIS: AN INTRODUCTION

I. Financial Reporting and FS Analysis

1. Financial Reporting: The way companies show their financial performance to investors, creditors & other

parties by preparing/ presenting FS.

2. Financial Statement Analysis: use the information in the company’s FS, along with other information, to

make economic decisions.

3. Financing Activities

II. Key roles of FS

1. Income Statement: financial performance over a period of time.

• Revenues

• Expenses

• Gains/ Losses

2. Balance Sheet: Firm’s financial position at a point of time.

• Assets

• Liabilities

• Shareholders’ Equity

• ASSETS = LIABILITIES + OWNERS’ EQUITY

3. Cash Flow Statement: reports cash receipts and payments

• Operating Cash Flows

• Investing Cash Flows

• Financing Cash Flows

4. Statement of changes in owner’s equity: reports the amount and sources of changes in equity investors’

investment over a period of time.

III. FS notes, Supplementary information & Management’s

discussion/ analysis

1. Financial Statement Notes: further details about information in the FS

• Accounting methods, assumptions, estimates

• Audited

• Acquisitions/ Disposals, legal actions, employee benefit plans, contingencies &

commitments, significant customers, sales to related parties, segments of the firm.

2. Supplementary Schedules: additional information

• Operating income by region/ segments

• Reserves for an oil/ gas company

• Hedging activities & financial instruments

• NOT Audited

3. Management’s Discussion & Analysis: assessment of financial performance from the management’s

perspective

• Results form operations (trends in sales/ expenses)

1

• Capital resources and liquidity

• General business overview

• Accounting Policies

• Effects of current trends

• Discontinued operations, extraordinary items, other unusual/ infrequent events.

• Disclosures in interim FS

• Disclosures of segments need for CF or its contribution to revenues or profit

IV. Audits

1. Audit: independent review of the company’s FS (accounting and internal control systems).

2. Standard auditor’s opinion states that:

• FS prepared by management and that the auditor performed an independent review is

management’s responsibility.

• General accepted auditing standards were followed, thus providing reasonable assurance

that FS contain no material errors.

• Auditor is satisfied with the FS, principles & estimates are reasonable.

• ONLY IN GAAP: auditor must state its opinion for the internal controls

3. Unqualified, qualified, adverse opinion & disclaimer of opinion:

• Unqualified opinion: the auditor believes the statement if free from material omissions and errors

• Qualified opinion: the auditor explains any exceptions to accounting principles in the audit report

• Adverse opinion: the auditor believes the statements are not fairly presented or are materially

nonconforming with accounting standards.

• Disclaimer of opinion: the auditor is unable to issue an opinion.

4. Internal Controls:

• Statement that the management is responsible for implementing/ maintaining effective internal

controls.

• Description of how management evaluates internal control systems (framework)

• Statement that the firm’s auditors have assessed management’s report on internal controls

• Statement that the FS are presented fairly

V. Other information sources

1. Interim (Quarterly or Semiannual) reports:

• Not Audited

2. SEC fillings (available from EDGAR)

• 8-K: acquisitions/ disposals form or changes in management/ corporate governance

• 10-K: annual FS

• 10-Q: quarterly FS

3. Proxy Statements: for shareholders’ vote

• Compensation schemes

• Stock performance

• Conflicts of interest

4. Corporate reports and Press releases: public releases or sales material

VI. Steps of Financial Analysis

2

1. State the objectives (purpose) and context of the analysis

2. Gather data

3. Process the data

4. Analyse and interpret the data

5. Report the conclusions or recommendations (analysis report)

6. Update the analysis

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Assignment # 2 Student Zaeem Asif Reg # L1F17BSAF0062 Financial Analysis Submitted To Abid Noor Section BDocument4 pagesAssignment # 2 Student Zaeem Asif Reg # L1F17BSAF0062 Financial Analysis Submitted To Abid Noor Section BWaleed KhalidPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Chapter 3 Portfolio Selection PDFDocument6 pagesChapter 3 Portfolio Selection PDFMariya BhavesPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Chapter 14Document6 pagesChapter 14MaximusPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Olson Et Pagano 2005 A New Application of Sustainable Growth A Multi Dimensional Framework For Evaluating The Long Run Performance of Bank MergersDocument42 pagesOlson Et Pagano 2005 A New Application of Sustainable Growth A Multi Dimensional Framework For Evaluating The Long Run Performance of Bank MergersismailPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Good Info CapsimDocument11 pagesGood Info Capsimmstephens1Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Bond Portfolio Management StrategiesDocument23 pagesBond Portfolio Management Strategiesashudadhich100% (2)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Icici 1Document36 pagesIcici 1Yash AnandPas encore d'évaluation

- What Skills Should You Learn To Be WealthyDocument10 pagesWhat Skills Should You Learn To Be WealthymiteshpatelcbPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- B2 Financial Accounting PDFDocument528 pagesB2 Financial Accounting PDFNicole Taylor86% (7)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Study Notes Trading StrategiesDocument16 pagesStudy Notes Trading Strategiesalok kundaliaPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Rudra TrishatiDocument3 pagesRudra TrishatiAnkurNagpal108Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Modelling in Excel: Leveraged Buyout Model + M&A Model (Accretion/ Dilution)Document62 pagesModelling in Excel: Leveraged Buyout Model + M&A Model (Accretion/ Dilution)Tapas Sam100% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Coop PresentationDocument31 pagesCoop PresentationDayang Suhaina SallehPas encore d'évaluation

- Lahore School of Economics Financial Management II Distributions To Shareholders: Dividends and Share Repurchases - 1 Assignment 19Document1 pageLahore School of Economics Financial Management II Distributions To Shareholders: Dividends and Share Repurchases - 1 Assignment 19HussainPas encore d'évaluation

- The Edge FD - 10 November 2016Document33 pagesThe Edge FD - 10 November 2016mohdkhidirPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Individual Investment AgreementDocument4 pagesIndividual Investment AgreementiKNOWthisPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Berkshire Hathaway Research PaperDocument8 pagesBerkshire Hathaway Research PaperDennis KimPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Toys R Us Bankruptcy CaseDocument2 pagesToys R Us Bankruptcy CaseIan GreyPas encore d'évaluation

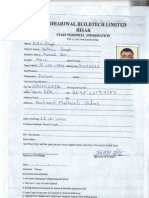

- Dhari/Ryal Buildtech: Limitei)Document5 pagesDhari/Ryal Buildtech: Limitei)dhariwal buildtechPas encore d'évaluation

- Investment PreferenceDocument20 pagesInvestment PreferenceVandita KhudiaPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- JIVAN RAMESHRAO GAWARLE ProjectDocument34 pagesJIVAN RAMESHRAO GAWARLE Projectshubham moonPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- A Research Project On: Financial Modelling and Valuation of Ambuja CementsDocument39 pagesA Research Project On: Financial Modelling and Valuation of Ambuja CementsNIDHI KUMARIPas encore d'évaluation

- Business Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538Document9 pagesBusiness Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538akash yadavPas encore d'évaluation

- Lesson 1-07 Measures of Variation STATDocument12 pagesLesson 1-07 Measures of Variation STATallan.manaloto23Pas encore d'évaluation

- Books For Traders 1807Document1 pageBooks For Traders 1807RameshPas encore d'évaluation

- Risk and Capital BudgetingDocument12 pagesRisk and Capital BudgetingImraanHossainAyaanPas encore d'évaluation

- FAR Prelim For Printing PDFDocument86 pagesFAR Prelim For Printing PDFMico Villegas BalbuenaPas encore d'évaluation

- Capitulo 15Document17 pagesCapitulo 15Andrés CanoPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Introduction To Company: Bharti Airtel LimitedDocument61 pagesIntroduction To Company: Bharti Airtel LimitedDaman Deep Singh ArnejaPas encore d'évaluation

- Problem Set 1: Solutions: Damien Klossner Damien - Klossner@epfl - CH Extranef 128 March 1, 2015Document12 pagesProblem Set 1: Solutions: Damien Klossner Damien - Klossner@epfl - CH Extranef 128 March 1, 2015François VoisardPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)