Académique Documents

Professionnel Documents

Culture Documents

FAR-03 Composition of Equity

Transféré par

Kim Cristian Maaño0 évaluation0% ont trouvé ce document utile (0 vote)

186 vues1 pageTitre original

FAR-03 Composition of Equity

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

186 vues1 pageFAR-03 Composition of Equity

Transféré par

Kim Cristian MaañoDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

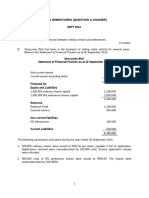

Chapter 03

Shareholders’ Equity – Composition of Equity

Legal Capital

1) The following were lifted from the equity section of an entity’s statement of financial position showed the following

information:

Ordinary shares, P200 par value 3,200,000

6% Preference shares, P400 par value 800,000

Share premium – ordinary shares 1,200,000

Share premium – preference shares 200,000

Subscribed ordinary shares 400,000

Subscription receivable 200,000

Retained earnings 1,600,000

How much is the legal capital of the entity?

A. 5,600,000

B. 5,200,000

C. 4,400,000

D. 4,200,000

Total Shareholders’ Equity & Contributed Capital

Numbers 2 and 3

Shokt Company’s adjusted balance at December 31, 2021, includes the following account balances:

8% Preference stock (preference shares), P100 par 900,000

Common stock (ordinary shares), P3 par 500,000

Subscribed common stock (subscribed ordinary shares) 400,000

Subscription receivable (on ordinary shares) 150,000

Additional paid-in capital (share premium) – common stocks 300,000

Additional paid-in capital (share premium) – preferred stock 250,000

Retained earnings: appropriated for uninsured earthquake losses 100,000

Retained earnings: unappropriated 200,000

Treasury stock at cost 70,000

Net unrealized loss on investment measured at fair value through other comprehensive income 40,000

Net unrealized gain on foreign currency translation adjustment 25,000

Revaluation surplus 280,000

2) The amount that Shokt Company should report as total stockholders’ equity in its December 31, 2021 balance

sheet is

A. 2,695,000

B. 2,775,000

C. 2,995,000

D. 2,970,000

3) What is Shokt Company’s contributed capital?

A. 2,200,000

B. 2,130,000

C. 2,350,000

D. 2,280,000

--- ∞ --- ∞ --- ∞ --- ∞ --- ∞ --- ∞ --- [End of Chapter 3] --- ∞ --- ∞ --- ∞ --- ∞ --- ∞ --- ∞ ---

FAR by: John Bo S. Cayetano, CPA, MBA Page 1 of 1

Vous aimerez peut-être aussi

- Orca Share Media1522073458763 PDFDocument15 pagesOrca Share Media1522073458763 PDFHannah Yncierto100% (1)

- Solutions: D SC - Ordinary Share Premium Retained Earnings Treasury SharesDocument2 pagesSolutions: D SC - Ordinary Share Premium Retained Earnings Treasury SharesQueen VallePas encore d'évaluation

- T R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' EquityDocument12 pagesT R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' Equityprincess sibugPas encore d'évaluation

- UntitledDocument1 pageUntitledJessa Delos SantosPas encore d'évaluation

- Toyota CompanyDocument2 pagesToyota Companykel data100% (2)

- Toyota CompanyDocument2 pagesToyota Companykel dataPas encore d'évaluation

- Shareholder's EquityDocument6 pagesShareholder's EquityRock LeePas encore d'évaluation

- FAR-05 Book Value Per ShareDocument2 pagesFAR-05 Book Value Per ShareKim Cristian MaañoPas encore d'évaluation

- This Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityDocument7 pagesThis Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityAnne Marieline BuenaventuraPas encore d'évaluation

- Balances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareDocument4 pagesBalances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareJhazreel BiasuraPas encore d'évaluation

- Audit of Shareholders EquityDocument5 pagesAudit of Shareholders EquityShane KimPas encore d'évaluation

- Handout One Accounting For Financial StatementsDocument12 pagesHandout One Accounting For Financial StatementsKaith Mendoza100% (1)

- HW On Statement of Changes in EquityDocument2 pagesHW On Statement of Changes in EquityCharles TuazonPas encore d'évaluation

- Financial Accounting and Reporting Ii Final Quiz 2/3Document7 pagesFinancial Accounting and Reporting Ii Final Quiz 2/3jemsPas encore d'évaluation

- Problem-Acc For CorporationDocument2 pagesProblem-Acc For CorporationSabelPas encore d'évaluation

- Audit of EquityDocument6 pagesAudit of EquityEdmar HalogPas encore d'évaluation

- Shareholders Equity - PDF - Treasury Stock - Capital SurplusDocument15 pagesShareholders Equity - PDF - Treasury Stock - Capital SurplusRazel MhinPas encore d'évaluation

- Problem 1: Books of Acquirer/AcquiringDocument6 pagesProblem 1: Books of Acquirer/Acquiringaleigna tan100% (1)

- Audit of SHEDocument13 pagesAudit of SHEChristian QuintansPas encore d'évaluation

- SFP - ExerciseDocument2 pagesSFP - ExerciseJustine SorizoPas encore d'évaluation

- She HandoutsDocument7 pagesShe HandoutsBrent DumangengPas encore d'évaluation

- Finman 2A Midterm Quiz 1 October 2021 34 Points Test 1 Prepare Journal Entries in The Books of COVID Partnership To Record The FollowingDocument22 pagesFinman 2A Midterm Quiz 1 October 2021 34 Points Test 1 Prepare Journal Entries in The Books of COVID Partnership To Record The Followingella alfonsoPas encore d'évaluation

- Problem 9.1-1 Required: (10) Prepare The Journal Entries To Record The Transactions Using The Memorandum MethodDocument3 pagesProblem 9.1-1 Required: (10) Prepare The Journal Entries To Record The Transactions Using The Memorandum MethodDanica Jane RamosPas encore d'évaluation

- Audit in Shareholder's EquityDocument4 pagesAudit in Shareholder's EquityMay Grethel Joy PerantePas encore d'évaluation

- Ford Inc Statement of Financial PositionDocument3 pagesFord Inc Statement of Financial PositionTina PascualPas encore d'évaluation

- AP-100Q: Financing Cycle: A S ' E: Udit of Tockholders QuityDocument12 pagesAP-100Q: Financing Cycle: A S ' E: Udit of Tockholders QuityShiela RengelPas encore d'évaluation

- Chapter 2 Hyperinflation LectureDocument4 pagesChapter 2 Hyperinflation LectureChristine SondonPas encore d'évaluation

- Audit of Financial StatementsDocument8 pagesAudit of Financial Statementsd.pagkatoytoyPas encore d'évaluation

- Shareholders EquityDocument1 pageShareholders EquityJhelRose Lasquite BrosasPas encore d'évaluation

- Presentation and Preparation of FS FINALDocument86 pagesPresentation and Preparation of FS FINALJoen SinamagPas encore d'évaluation

- Shareholder's Equity Problem 2,3Document4 pagesShareholder's Equity Problem 2,3Remie Rose BarcebalPas encore d'évaluation

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutPas encore d'évaluation

- Aud1 Prelim Exercises 1Document4 pagesAud1 Prelim Exercises 1skyvy27Pas encore d'évaluation

- Book Value Per Share PracticeDocument5 pagesBook Value Per Share PracticeRUNEL J. PACOTPas encore d'évaluation

- Shareholders EquityDocument6 pagesShareholders EquityDe Guzman Olchondra Kimberly100% (1)

- P1 (Statement of Change in Equity)Document1 pageP1 (Statement of Change in Equity)Shiela Mae Pon AnPas encore d'évaluation

- AUDIT OF SHAREHOLDERS (Probs)Document4 pagesAUDIT OF SHAREHOLDERS (Probs)wingPas encore d'évaluation

- Exercise 4 Shareholders EquityDocument9 pagesExercise 4 Shareholders EquityNimfa SantiagoPas encore d'évaluation

- Ap She Exam ProbDocument3 pagesAp She Exam Problois martinPas encore d'évaluation

- Parcor TrainingDocument12 pagesParcor TrainingKarl ExacPas encore d'évaluation

- This Study Resource Was: Asian Academy For Excellence Foundation, IncDocument5 pagesThis Study Resource Was: Asian Academy For Excellence Foundation, IncAnne Marieline BuenaventuraPas encore d'évaluation

- This Study Resource Was: Asian Academy For Excellence Foundation, IncDocument5 pagesThis Study Resource Was: Asian Academy For Excellence Foundation, IncAnne Marieline BuenaventuraPas encore d'évaluation

- Book Value Per Share: Name: Date: QuizDocument3 pagesBook Value Per Share: Name: Date: QuizLara FloresPas encore d'évaluation

- QuestionnaireDocument5 pagesQuestionnaireAlex OzfordPas encore d'évaluation

- Allyzza Rey Cassy Alvarado BSA 2-EDocument3 pagesAllyzza Rey Cassy Alvarado BSA 2-EJohn Mikeel FloresPas encore d'évaluation

- Sept 2014 - 230716 - 233727Document22 pagesSept 2014 - 230716 - 233727mohddanialhanaffimustaffiPas encore d'évaluation

- Particulars Debit CreditDocument10 pagesParticulars Debit CreditJasmine ActaPas encore d'évaluation

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocument2 pagesQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DePas encore d'évaluation

- Basic Finance Major OutputDocument3 pagesBasic Finance Major OutputKazia PerinoPas encore d'évaluation

- Group 6 PDFDocument14 pagesGroup 6 PDFramuxePas encore d'évaluation

- Auditing Problems Midterm - 2021 - DDocument17 pagesAuditing Problems Midterm - 2021 - DjasfPas encore d'évaluation

- ShortproblemDocument2 pagesShortproblemLabLab ChattoPas encore d'évaluation

- APC Ch10solDocument10 pagesAPC Ch10solkeith niduelanPas encore d'évaluation

- Acctg 13 - Unit Test Final Answer KeyDocument4 pagesAcctg 13 - Unit Test Final Answer Keyjohn.18.wagasPas encore d'évaluation

- Corporation Part 1Document9 pagesCorporation Part 11701791Pas encore d'évaluation

- EquityDocument2 pagesEquityjethro carlobos0% (1)

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- Corporate Actions: A Guide to Securities Event ManagementD'EverandCorporate Actions: A Guide to Securities Event ManagementPas encore d'évaluation

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuidePas encore d'évaluation

- Mas Second PB 03-11Document12 pagesMas Second PB 03-11Kim Cristian MaañoPas encore d'évaluation

- On December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingDocument12 pagesOn December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingKim Cristian MaañoPas encore d'évaluation

- Practical Accounting II - 2nd PreboardDocument9 pagesPractical Accounting II - 2nd PreboardKim Cristian Maaño0% (1)

- 5rd Batch - P2 Final Pre-Boards - Wid ANSWERDocument11 pages5rd Batch - P2 Final Pre-Boards - Wid ANSWERKim Cristian MaañoPas encore d'évaluation

- AUDITING PROBLEMS - 2nd Preboard Suggested AnswersDocument3 pagesAUDITING PROBLEMS - 2nd Preboard Suggested AnswersKim Cristian MaañoPas encore d'évaluation

- MASedited 2nd Pre-Board ExamsDocument12 pagesMASedited 2nd Pre-Board ExamsKim Cristian MaañoPas encore d'évaluation

- Northern Cpa Review: First Pre-Board ExaminationDocument13 pagesNorthern Cpa Review: First Pre-Board ExaminationKim Cristian MaañoPas encore d'évaluation

- 1st Tax Pre-Board Exam - October 2011 BatchDocument5 pages1st Tax Pre-Board Exam - October 2011 BatchKim Cristian MaañoPas encore d'évaluation

- Aud ThEORY - 2nd PreboardDocument11 pagesAud ThEORY - 2nd PreboardKim Cristian MaañoPas encore d'évaluation

- Solutions Manual Short-Term Sources For Financing Current AssetsDocument2 pagesSolutions Manual Short-Term Sources For Financing Current AssetsKim Cristian MaañoPas encore d'évaluation

- AT - First Preboard (October 2011)Document12 pagesAT - First Preboard (October 2011)Kim Cristian MaañoPas encore d'évaluation

- Auditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DDocument14 pagesAuditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DKim Cristian MaañoPas encore d'évaluation

- 5rd Batch - AP - Final Pre-Boards - EditedDocument11 pages5rd Batch - AP - Final Pre-Boards - EditedKim Cristian Maaño100% (1)

- 5rd Batch - P1 - Final Pre-Boards - EditedDocument11 pages5rd Batch - P1 - Final Pre-Boards - EditedKim Cristian Maaño0% (1)

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoPas encore d'évaluation

- Aud ThEORY - 2nd PreboardDocument11 pagesAud ThEORY - 2nd PreboardKim Cristian MaañoPas encore d'évaluation

- Aud Prob - 2nd PreboardDocument13 pagesAud Prob - 2nd PreboardKim Cristian MaañoPas encore d'évaluation

- 1st Pre-Board - P2 October 2011 BatchDocument8 pages1st Pre-Board - P2 October 2011 BatchKim Cristian MaañoPas encore d'évaluation

- Sample Valuation Exam With Solutions Sample Valuation Exam With SolutionsDocument11 pagesSample Valuation Exam With Solutions Sample Valuation Exam With SolutionsKim Cristian MaañoPas encore d'évaluation

- 1st Pre-Board - MAS October 2011 BatchDocument8 pages1st Pre-Board - MAS October 2011 BatchKim Cristian MaañoPas encore d'évaluation

- CMAPart1F (Long Term Finance and Capital Structure) AnswersDocument43 pagesCMAPart1F (Long Term Finance and Capital Structure) AnswersKim Cristian MaañoPas encore d'évaluation

- Final May 11, Questions and Answers Final May 11, Questions and AnswersDocument9 pagesFinal May 11, Questions and Answers Final May 11, Questions and AnswersKim Cristian MaañoPas encore d'évaluation

- TAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFDocument7 pagesTAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFKim Cristian MaañoPas encore d'évaluation

- Fin 300 CH 1-4 Fin 300 CH 1-4Document17 pagesFin 300 CH 1-4 Fin 300 CH 1-4Kim Cristian MaañoPas encore d'évaluation

- TAXATION 2 Chapter 10 Value Added TaxDocument7 pagesTAXATION 2 Chapter 10 Value Added TaxKim Cristian MaañoPas encore d'évaluation

- TAXATION 2 Chapter 9 Exempt SalesDocument5 pagesTAXATION 2 Chapter 9 Exempt SalesKim Cristian MaañoPas encore d'évaluation

- Lecture Notes 1 - Finance - Principles of Finance Lecture Notes 1 - Finance - Principles of FinanceDocument7 pagesLecture Notes 1 - Finance - Principles of Finance Lecture Notes 1 - Finance - Principles of FinanceKim Cristian MaañoPas encore d'évaluation

- TAXATION 2 Chapter 4 Estate Tax Deductions From Gross EstateDocument8 pagesTAXATION 2 Chapter 4 Estate Tax Deductions From Gross EstateKim Cristian MaañoPas encore d'évaluation

- TAXATION 2 Chapter 8 Percentage Tax PDFDocument4 pagesTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoPas encore d'évaluation

- A Study On Personal Financial Planning in UK and India With The Help of Case StudiesDocument4 pagesA Study On Personal Financial Planning in UK and India With The Help of Case StudiesBOHR International Journal of Financial market and Corporate Finance (BIJFMCF)Pas encore d'évaluation

- Capital MarketDocument32 pagesCapital MarketVaibhav ArwadePas encore d'évaluation

- CH 1Document16 pagesCH 1Mick MalickPas encore d'évaluation

- Unit 2 MCQ Business FinanceDocument6 pagesUnit 2 MCQ Business FinancePrateek Yadav100% (1)

- Account Case StudyDocument9 pagesAccount Case Studyamado_florezPas encore d'évaluation

- Laying Grounds For InternationalizationDocument2 pagesLaying Grounds For Internationalizationkristine contrerasPas encore d'évaluation

- Copywriter (Portfolio)Document17 pagesCopywriter (Portfolio)Aastha NathwaniPas encore d'évaluation

- Chapter 6 - Investment Decisions - Capital BudgetingDocument21 pagesChapter 6 - Investment Decisions - Capital BudgetingYasir ShaikhPas encore d'évaluation

- The Stock Market: Business Organization Stock Market Data Stock Market Data Charts Simple Moving AveragesDocument15 pagesThe Stock Market: Business Organization Stock Market Data Stock Market Data Charts Simple Moving AveragesNaeem Ahmed HattarPas encore d'évaluation

- 1 Lecture Notes DissolutionDocument17 pages1 Lecture Notes DissolutionMaybelle Espenido0% (2)

- Article 1 - Creating Deal FlowDocument5 pagesArticle 1 - Creating Deal FlowRaymund EmperoaPas encore d'évaluation

- Merger and AcquisitionsDocument16 pagesMerger and Acquisitionsanuja kharelPas encore d'évaluation

- Balance - Sheet 1119Document2 pagesBalance - Sheet 1119BASKOROPas encore d'évaluation

- The Worlds Most Successful Investor Is A Swing TraderDocument5 pagesThe Worlds Most Successful Investor Is A Swing TraderPravin PatilPas encore d'évaluation

- FIN301 StudyGuide PDFDocument344 pagesFIN301 StudyGuide PDFOBU GhanPas encore d'évaluation

- DivyaDocument40 pagesDivyasehnazPas encore d'évaluation

- AccDocument4 pagesAccrenoPas encore d'évaluation

- Bharti Airtel LimitedDocument28 pagesBharti Airtel Limited11pintu11Pas encore d'évaluation

- Year Stock A's Returns, Ra Stock B's Returns, RB: Realized Rates of ReturnsDocument2 pagesYear Stock A's Returns, Ra Stock B's Returns, RB: Realized Rates of ReturnsArgie Mae Salvador100% (1)

- Yeo Zhi Wei (U064520X)Document5 pagesYeo Zhi Wei (U064520X)ZhiWei YeoPas encore d'évaluation

- Sample EB 5 Visa Business PlanDocument27 pagesSample EB 5 Visa Business PlanOozax OozaxPas encore d'évaluation

- Company Secretary - Bangladesh PerspectiveDocument10 pagesCompany Secretary - Bangladesh Perspectivenomanpur50% (2)

- How To Deal With INSULTDocument4 pagesHow To Deal With INSULTpratik deshmukhPas encore d'évaluation

- Nliu Law Review Vol V No I April 2016Document104 pagesNliu Law Review Vol V No I April 2016himanshuPas encore d'évaluation

- Far Ifrs Study Manual 2019Document737 pagesFar Ifrs Study Manual 2019Isavic Alsina100% (6)

- Term Sheet WhiteDocument3 pagesTerm Sheet WhiteholtfoxPas encore d'évaluation

- FIN302 Basic Financial Management 13720::harendra Singh 3.0 1.0 0.0 4.0 Courses With Numerical and Conceptual FocusDocument13 pagesFIN302 Basic Financial Management 13720::harendra Singh 3.0 1.0 0.0 4.0 Courses With Numerical and Conceptual FocusSushil RegmiPas encore d'évaluation

- Top 6 Digital Assets: Online Millionaires ClubDocument5 pagesTop 6 Digital Assets: Online Millionaires ClubMohamed IsmailPas encore d'évaluation

- Nigeria's Foreign Investment Determinant: A Multivariate Analysis ApproachDocument9 pagesNigeria's Foreign Investment Determinant: A Multivariate Analysis Approach1moss123Pas encore d'évaluation

- UKTI Social Investment Trade Mission ProgrammeDocument6 pagesUKTI Social Investment Trade Mission ProgrammellewellyndrcPas encore d'évaluation