Académique Documents

Professionnel Documents

Culture Documents

Case: Pepe Jeans: Current Alternative 1 Alternative 2 Sales Revenue

Transféré par

Cristhian ValverdeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Case: Pepe Jeans: Current Alternative 1 Alternative 2 Sales Revenue

Transféré par

Cristhian ValverdeDroits d'auteur :

Formats disponibles

CASE: PEPE JEANS

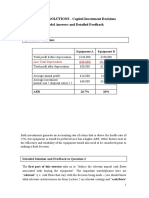

Financial analysis for different alternatives aimed at improving current ordering system is

displayed below.

CURRENT ALTERNATIVE 1* ALTERNATIVE 2**

Sales Revenue £200,000,000 £220,000,000 £220,000,000

(Cost of Goods Sold) (£80,000,000) (£104,000,000) (£72,000,000)

Gross Profit £120,000,000 £116,000,000 £148,000,000

(Operating Expenses) (£56,000,000) (£56,000,000) (£56,000,000)

(Additional Operating Expenses) - - (£2,992,308)

Inventory holding cost*** £2,492,308

Facility operating cost £500,000

Profit Before Taxes £64,000,000 £60,000,000 £89,007,692

Change in Profit Before Taxes (compared to

- -£4,000,000 £25,007,692

current operation)

* Working with a sourcing agent to shorten order lead time

** Building a finishing operation in the United Kingdom

*** Inventory holding cost = [COGS*(6/52)]*0.3

(Six weeks of supply carried at %30 inventory carrying cost)

Additional investment is not needed for alternative 1. Therefore payback period analysis cannot

be carried out.

Alternative 2 has an investment cost of £1,300,000 (£1,000,000 worth of equipment and

renovations with a cost of £300,000). On the other hand, there will be a £25 million increase in

the profit before taxes in case this alternative is implemented.

Payback period for the investment = (£1.3 mil. / £25 mil.)*52 weeks = 2.7 weeks

As seen from the financial analysis, Pepe Jeans should choose to build a finishing operation in

the United Kingdom, since change in profit before taxes is greater compared to alternative 1 and

the payback period for the investment is very small.

On the other hand, the company can consider working with a sourcing agent (use alternative 1)

temporarily for a short period of time in order to minimize complaints from independent retailers

and avoid losing their advantage against their competitors.

In the long term, the company should consider establishing its own manufacturing company.

This way they will have full control of their supply chain, which will ensure quality and

sustainability. Even though this alternative would require a substantial amount of investment, the

company is financially capable of an investment at this scale.

Vous aimerez peut-être aussi

- Pepe JeansDocument2 pagesPepe Jeansa_deodharPas encore d'évaluation

- Management and Cost Accounting 8th Edition Drury Test BankDocument19 pagesManagement and Cost Accounting 8th Edition Drury Test Bankeliasvykh6in8100% (28)

- Pepe Jeans AssignmentDocument7 pagesPepe Jeans AssignmentRay100% (1)

- Absorption CostingDocument32 pagesAbsorption Costingsknco50% (2)

- Relevant Costing: Example 1Document5 pagesRelevant Costing: Example 1Dileepkumar K DiliPas encore d'évaluation

- Assignment 4 - Variances - 50140Document9 pagesAssignment 4 - Variances - 50140Hafsa HayatPas encore d'évaluation

- Absorption CostingDocument33 pagesAbsorption CostingMohit PaswanPas encore d'évaluation

- Relevant CostDocument19 pagesRelevant CostWanIzyanPas encore d'évaluation

- Af201 ASSIGMENTDocument15 pagesAf201 ASSIGMENTdiristiPas encore d'évaluation

- MN20501 Lecture 6 RC In-Class ExerciseDocument3 pagesMN20501 Lecture 6 RC In-Class Exercisesamvrab1919Pas encore d'évaluation

- Case 8 Southampton PLCDocument2 pagesCase 8 Southampton PLCMohit RastogiPas encore d'évaluation

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883Pas encore d'évaluation

- Tutorial 7 QuestionsDocument3 pagesTutorial 7 QuestionsSunay PPas encore d'évaluation

- Solution To QN 6 (PG 135) : Calculation of Overhead Absorption RatesDocument10 pagesSolution To QN 6 (PG 135) : Calculation of Overhead Absorption RatesGeorge BulikiPas encore d'évaluation

- Relevant Cost DruryDocument20 pagesRelevant Cost DruryManzziePas encore d'évaluation

- Management Accounting - AC2097-2018 Answers To Homework Questions Total: 118 PagesDocument118 pagesManagement Accounting - AC2097-2018 Answers To Homework Questions Total: 118 Pagesduong duong100% (1)

- Introduction To Management AccountingDocument55 pagesIntroduction To Management AccountingUsama250100% (1)

- Cost Chapter 1 Introduction To Management AccountingDocument15 pagesCost Chapter 1 Introduction To Management Accountingjp bPas encore d'évaluation

- ACC2125 L3 Flexed Budget, Interpreting Variances Controllability Principle 2021-22Document42 pagesACC2125 L3 Flexed Budget, Interpreting Variances Controllability Principle 2021-22Shruthi RameshPas encore d'évaluation

- Marginal and Absorption CostingDocument10 pagesMarginal and Absorption CostingSandip GhoshPas encore d'évaluation

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalPas encore d'évaluation

- FinanceDocument8 pagesFinanceJøÿå BhardwajPas encore d'évaluation

- Chapter 22 - Answer PDFDocument6 pagesChapter 22 - Answer PDFMA ValdezPas encore d'évaluation

- 2.1. For Process A What Is The Scrap Value of The Normal Loss?Document19 pages2.1. For Process A What Is The Scrap Value of The Normal Loss?Yến Nguyễn100% (1)

- Tutorial 7 SolutionsDocument10 pagesTutorial 7 SolutionsSunay PPas encore d'évaluation

- MGMT and Cost Accounting - Colin DruryDocument25 pagesMGMT and Cost Accounting - Colin Druryapi-24690719550% (2)

- Management Accounting: Level 3Document16 pagesManagement Accounting: Level 3Hein Linn Kyaw100% (1)

- Icaew Cfab Mi 2018 Sample Exam 1Document29 pagesIcaew Cfab Mi 2018 Sample Exam 1Anonymous ulFku1v100% (1)

- Singapore Institute of Management: University of London Preliminary Exam 2015Document10 pagesSingapore Institute of Management: University of London Preliminary Exam 2015Pei TingPas encore d'évaluation

- Instructions To Candidates:: Question 1 Continues OverleafDocument3 pagesInstructions To Candidates:: Question 1 Continues OverleafAung Kyaw HtayPas encore d'évaluation

- Mock Test 2021 PMDocument5 pagesMock Test 2021 PMBao Thy PhoPas encore d'évaluation

- AUD Southampton PLCDocument3 pagesAUD Southampton PLCAivie Pangilinan0% (1)

- Management Accounting Exam 15052013Document8 pagesManagement Accounting Exam 15052013Mai Hạnh DeclanPas encore d'évaluation

- Capital Budgeting 2022Document7 pagesCapital Budgeting 2022ChrysPas encore d'évaluation

- Report 2 - Management Accounting (Reworked)Document11 pagesReport 2 - Management Accounting (Reworked)Янислав БорисовPas encore d'évaluation

- Management Accounting: Level 3Document15 pagesManagement Accounting: Level 3Nida KhanPas encore d'évaluation

- PROBLEM 4 (Evaluation of Performance) : TotalDocument3 pagesPROBLEM 4 (Evaluation of Performance) : TotalArt IslandPas encore d'évaluation

- Chapter 2: Cost-Volume-Profit AnalysisDocument24 pagesChapter 2: Cost-Volume-Profit Analysis潘伟杰Pas encore d'évaluation

- Management and Cost Accounting: Colin DruryDocument14 pagesManagement and Cost Accounting: Colin DruryUmar SulemanPas encore d'évaluation

- Investment AppraisalDocument20 pagesInvestment AppraisalBishwajit ChowdhuryPas encore d'évaluation

- Capital Budgeting Cash Flows: Solutions To ProblemsDocument20 pagesCapital Budgeting Cash Flows: Solutions To ProblemsRau MohdPas encore d'évaluation

- Cost Accounting Level 3/series 4 2008 (3017)Document17 pagesCost Accounting Level 3/series 4 2008 (3017)Hein Linn Kyaw100% (1)

- Income Effects of Alternative Cost Accumulation Systems: Solutions To Chapter 7 QuestionsDocument9 pagesIncome Effects of Alternative Cost Accumulation Systems: Solutions To Chapter 7 QuestionsChansa KapambwePas encore d'évaluation

- Week 8 - Lecture Budgeting v3Document23 pagesWeek 8 - Lecture Budgeting v3NabilPas encore d'évaluation

- Flexible Budgets: Dr. Pinar Guven-Uslu Norwich Business School, UEADocument16 pagesFlexible Budgets: Dr. Pinar Guven-Uslu Norwich Business School, UEATom DinhPas encore d'évaluation

- Absorption and Marginal CostingDocument6 pagesAbsorption and Marginal Costingberyl_hst100% (1)

- ACC 308 2022 ExamDocument15 pagesACC 308 2022 ExamMonowalehippie MangaPas encore d'évaluation

- Solutions To Extra Practice QuestionsDocument3 pagesSolutions To Extra Practice QuestionsPhương Tạ Thị ThanhPas encore d'évaluation

- Planning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredDocument5 pagesPlanning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be Answeredapi-19836745Pas encore d'évaluation

- Management Accounting/Series-3-2007 (Code3023)Document15 pagesManagement Accounting/Series-3-2007 (Code3023)Hein Linn Kyaw100% (1)

- Chapter 5 - A2, B1, & 59Document5 pagesChapter 5 - A2, B1, & 59詹鎮豪Pas encore d'évaluation

- University of London Preliminary Exam 2017Document11 pagesUniversity of London Preliminary Exam 2017Pei TingPas encore d'évaluation

- PEVDec 06 Withrevisedanswerforweb 5 June 07Document7 pagesPEVDec 06 Withrevisedanswerforweb 5 June 07nicklausgertrudePas encore d'évaluation

- Management Accounting: Level 3Document18 pagesManagement Accounting: Level 3Hein Linn KyawPas encore d'évaluation

- CM11 - MIM22 - FinalExamDocument13 pagesCM11 - MIM22 - FinalExamTianshu GaoPas encore d'évaluation

- Capital Budgeting - Cash FlowsDocument18 pagesCapital Budgeting - Cash Flowspranav1931129Pas encore d'évaluation

- CAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalDocument6 pagesCAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalVal SaratePas encore d'évaluation

- Unit 7: Joint and By-Product Costing SystemDocument8 pagesUnit 7: Joint and By-Product Costing SystemCielo PulmaPas encore d'évaluation

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesD'EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesPas encore d'évaluation

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageD'EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Session 6 (Individual) Forum 2: My Autobiography Delivery Week: 2 Type: CompulsoryDocument2 pagesSession 6 (Individual) Forum 2: My Autobiography Delivery Week: 2 Type: CompulsoryCristhian ValverdePas encore d'évaluation

- 1 Karolay Medina Valverde Something I Worked Hard For Week 1 - PresentationDocument1 page1 Karolay Medina Valverde Something I Worked Hard For Week 1 - PresentationCristhian ValverdePas encore d'évaluation

- Presentation Task: Week: Student: Topic: Link To Video: (Paste Your Link) InstructionsDocument1 pagePresentation Task: Week: Student: Topic: Link To Video: (Paste Your Link) InstructionsCristhian ValverdePas encore d'évaluation

- Week 3 - Presentation - Karolay MedinaDocument2 pagesWeek 3 - Presentation - Karolay MedinaCristhian ValverdePas encore d'évaluation

- Writing Task Template - Karolay MDocument1 pageWriting Task Template - Karolay MCristhian ValverdePas encore d'évaluation

- Week 4 - A Story - Karolay MedinaDocument1 pageWeek 4 - A Story - Karolay MedinaCristhian ValverdePas encore d'évaluation

- JIT at The Arnold Palmer Hospital-Walter Long PDFDocument2 pagesJIT at The Arnold Palmer Hospital-Walter Long PDFCristhian ValverdePas encore d'évaluation

- Writing Workshop 4: How To Write A StoryDocument5 pagesWriting Workshop 4: How To Write A StoryCristhian ValverdePas encore d'évaluation

- Chase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestDocument3 pagesChase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestCristhian ValverdePas encore d'évaluation

- 2010 08 21 - 011638 - P15 1Document3 pages2010 08 21 - 011638 - P15 1Happy MichaelPas encore d'évaluation

- Tugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDocument10 pagesTugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDenssPas encore d'évaluation

- Hedge Fund ValuationDocument4 pagesHedge Fund ValuationFarnaz ChavoushiPas encore d'évaluation

- Principles of Accounting Lecture 4Document5 pagesPrinciples of Accounting Lecture 4Masum HossainPas encore d'évaluation

- Module 3 Part 1Document19 pagesModule 3 Part 1Prakhar KulshresthaPas encore d'évaluation

- Cost SheetDocument4 pagesCost SheetQuestionscastle FriendPas encore d'évaluation

- Subject: Fm-07 Assignment: S B Decker, Inc.: Tanley Lack ANDDocument3 pagesSubject: Fm-07 Assignment: S B Decker, Inc.: Tanley Lack ANDSuryakant BurmanPas encore d'évaluation

- Business AccountingDocument16 pagesBusiness AccountingMark 42Pas encore d'évaluation

- Reaction Paper ElasticityDocument2 pagesReaction Paper Elasticityelizabeth_cruz_53100% (1)

- Balance Sheet: Company's Name End PeriodDocument3 pagesBalance Sheet: Company's Name End PeriodEjazAsi100% (1)

- Business Plan TemplateDocument22 pagesBusiness Plan TemplatePevisaPas encore d'évaluation

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayPas encore d'évaluation

- LBO PowerpointDocument36 pagesLBO Powerpointfalarkys100% (1)

- Wells Technical InstituteDocument24 pagesWells Technical Institutelaale dijaanPas encore d'évaluation

- PhilipsFullAnnualReport2013 EnglishDocument250 pagesPhilipsFullAnnualReport2013 Englishjasper laarmansPas encore d'évaluation

- Accounting Capstone ProjectDocument25 pagesAccounting Capstone Projectapi-345078395Pas encore d'évaluation

- CFP - Sample Paper TPEPDocument9 pagesCFP - Sample Paper TPEPSODDEYPas encore d'évaluation

- Pamantasan NG Lungsod NG Valenzuela: Activity #6Document2 pagesPamantasan NG Lungsod NG Valenzuela: Activity #6VickyPas encore d'évaluation

- EBITDA Cheat SheetDocument4 pagesEBITDA Cheat SheetyancePas encore d'évaluation

- Profit CenterDocument8 pagesProfit CenterchandanshaktiPas encore d'évaluation

- Shapoor Vali Principles of Mathematical Economics II Solutions Manual, Supplementary Materials and Supplementary ExercisesDocument296 pagesShapoor Vali Principles of Mathematical Economics II Solutions Manual, Supplementary Materials and Supplementary ExercisesAnonymous knICax100% (4)

- Practice-4Document21 pagesPractice-4Akash KumarPas encore d'évaluation

- CIR vs. Phoenix Assurance L-19727Document1 pageCIR vs. Phoenix Assurance L-19727magenPas encore d'évaluation

- Itad Bir Ruling No. 044-21Document9 pagesItad Bir Ruling No. 044-21Crizedhen VardeleonPas encore d'évaluation

- Chapter 1 Basic Consid & Formation FinalDocument50 pagesChapter 1 Basic Consid & Formation FinalTheresa Timonan86% (14)

- Chapter 22 QuizDocument10 pagesChapter 22 Quizمنیر ساداتPas encore d'évaluation

- RTP CA Final New Course Paper 2 Strategic Financial ManagemeDocument26 pagesRTP CA Final New Course Paper 2 Strategic Financial ManagemeTusharPas encore d'évaluation

- Mgac AnsDocument23 pagesMgac AnsMark Ivan JagodillaPas encore d'évaluation

- Chap 001Document19 pagesChap 001WilliamPas encore d'évaluation

- Shawarma Production and Packaging PDFDocument2 pagesShawarma Production and Packaging PDFjeedanPas encore d'évaluation