Académique Documents

Professionnel Documents

Culture Documents

Bozin Daniel 2020 05 21 TS Complaint

Transféré par

Matt ThomasDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bozin Daniel 2020 05 21 TS Complaint

Transféré par

Matt ThomasDroits d'auteur :

Formats disponibles

NAILAH K.

BYRD

CUYAHOGA COUNTY CLERK OF COURTS

1200 Ontario Street

Cleveland, Ohio 44113

Court of Common Pleas

New Case Electronically Filed: COMPLAINT

May 21,2020 13:04

By: MARC E. DANN 0039425

Confirmation Nbr. 2001679

DANIEL BOZIN, ET AL. CV 20 932778

vs.

Judge: DAVID T.MATIA

DELOITTE CONSULTING LLP

Pages Filed: 21

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

IN THE COURT OF COMMON PLEAS

CUYAHOGA COUNTY, OHIO

DANIEL BOZIN, individually and on behalf Case No.:

of all others similarly situated,

% DannLaw Judge

PO Box 6031040

Cleveland, OH 44103

CLASS ACTION COMPLAINT FOR

AND DAMAGES

TIMOTHY SMITH, individually and on behalf JURY TRIAL DEMANDED

of all others similarly situated,

% DannLaw

PO Box 6031040

Cleveland, OH 44103

AND

ALEXANDRIA POLICHENA, individually

and on behalf of all others similarly situated,

% DannLaw

PO Box 6031040

Cleveland, OH 44103

Plaintiffs,

v.

DELOITTE CONSULTING LLP

% Corporation Service Company

50 West Broad Street, Suite 1330

Columbus, OH 43215

Defendant.

CLASS ACTION COMPLAINT

Plaintiffs DANIEL BOZIN (“Bozin”), TIMOTHY SMITH (“SMITH”), and

ALEXANDRIA POLICHENA (“Polichena”)(“Plaintiffs”), by and through their attorneys, bring

this class action lawsuit on behalf of themselves and all other persons similarly situated, and for

their Class Action Complaint against Defendant DELOITTE CONSULTING LLP (“Deloitte” or

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

“Defendant”), Plaintiffs allege with personal knowledge with respect to themselves individually

and on information and belief derived from, among other things, investigation of counsel and

review of public documents as to all other matters, as follows:

PARTIES

1. Plaintiff DANIEL BOZIN is a natural person with a principal place of residence

located in Cuyahoga County, Ohio.

2. Plaintiff TIMOTHY SMITH is a natural person with a principal place of

residence in Franklin County, Ohio.

3. Plaintiff ALEXANDRIA POLICHENA is a natural person with a principal place

of residence in Portage County, Ohio.

4. Defendant DELOITTE CONSULTING LLP is a Delaware limited liability

company with a principal place of business in Hermitage, TN.

5. Deloitte is a wholly-owned subsidiary of Deloitte LLP.

6. Venue lies in this Court pursuant to Civ. R. 3(B) as a substantial portion, if not

all, of the events that form the basis of this Class Action Complaint occurred in Cuyahoga

County, Ohio; Defendant conducted activity that gave rise to the claims for relief in this County;

and Defendant maintains an office in this county.

THE DATA BREACH

7. Plaintiffs bring this suit on behalf of themselves and a Class of similarly situated

individuals against Defendant for Defendant’s failure to secure and protect Plaintiffs’ and Class

members’ personal and financial information.

8. At one of the worst times in the lives of Plaintiffs and Class members, when they

find themselves unemployed in the midst of a pandemic and resulting recession, Deloitte was

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

brought in as an expert consultant by the State of Ohio to expedite the processing of plaintiffs’

and Class members’ unemployment claims. However, Deloitte negligently and recklessly made

the Plaintiffs’ and Class members’ path to recovery significantly harder by putting their identity

and credit standing at risk.

9. On May 20, 2020, Deloitte sent Bozin an email, which is attached as Exhibit 1 to

this Complaint (the “Notice”).

10. In the Notice, Deloitte advised Bozin of the following:

Dear PUA Applicant:

Deloitte Consulting is currently under contract with the Ohio Department

of Job and Family Services (ODJFS) to assist the state of Ohio in

administering the Pandemic Unemployment Assistance (PUA) program.

Deloitte discovered on May 15, 2020 that your name, Social Security

number, and street address pertaining to your application for and receipt of

unemployment compensation benefits inadvertently had the capability to

be viewed by other unemployment claimants. Thereafter, Deloitte

immediately began an investigation and upon discovering the exposure,

Deloitte immediately took steps to stop further access to and exposure of

your personal information.

At this time, there is no evidence or indication to believe that your

personal information was improperly used; therefore, our actions, as well

as the actions you may want to consider, are preventative.

As a precaution, you may want to monitor your credit by obtaining a copy

of your credit report from one of the three national credit bureaus. Federal

law entitles every individual to one free credit report per year from each of

the three main bureaus.

You may also have a fraud alert placed on your consumer credit file by

contacting one of the national credit bureaus. Once one credit bureau

places a fraud alert on your credit file, it notifies the other two bureaus.

Fraud alerts are typically in effect for 90 days but can be renewed. The

credit bureaus may be contacted at:

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

Equifax: (800) 525-6285 (http://www.equifax.com)

Experian: (888) 397-3742 (http://www.experian.com)

TransUnion: (800) 680-7289 (http://www.tuc.com)

Additionally, Ohio law allows you to place a security freeze on your credit

report by contacting one of the bureaus listed above. Should you wish to

open a new line of credit while your report is frozen, you may temporarily

lift this security freeze by telephone or online by providing a security

code. Credit reporting agencies may charge a fee of no more than $5 for

each freeze and unfreeze of your report.

If you wish to receive free Experian IdentityWorks identity protection

services for the next 12 months, you will receive a follow-up email with

enrollment details that will be sent to you via Deloitte or directly from

Experian within 3-5 days.

Finally, to find out more about protecting your personal information, visit

the Ohio Attorney General's IdentityTheft protection page

(http://www.ohioattorneygeneral.gov/IdentityTheft) and/or the Federal

Trade Commission's identity theft assistance page

(https://www.consumer.ftc.gov/features/feature-0014-identitytheft).

We apologize for any concerns or inconvenience as a result of this

unauthorized incident. Please be assured that we take very seriously our

responsibility to safeguard the personal information you entrust to our

care, and deeply regret that this incident occurred.

If you have questions or concerns that remain unaddressed after reviewing

this information, please email:

DeloitteIdentityhelp@jfs.ohio.gov.

See Exhibit 1 at pp. 1-2.

11. On May 20, 2020, Deloitte sent the same Notice to Smith via e-mail.

12. On May 20, 2020, Deloitte sent the same Notice to Polichena via e-mail.

13. The Notice acknowledges that a treasure trove of highly sensitive personal

information was subject to unauthorized access by foreign IP addresses, as well as other

claimants for pandemic unemployment assistance (the “Data Breach”). See Exhibit 1 at p. 1

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

14. As a result of the Data Breach, Plaintiffs and Class members must now be vigilant

and review their credit reports for suspected incidents of identity theft, and to educate themselves

about security freezes, fraud alerts, and other steps to protect themselves against identity theft.

15. Data security breaches have dominated the headlines for the last two decades, and

it does not take an IT industry expert to know that major businesses like Deloitte are at risk.

16. The general public can tell you the names of some of the biggest data breaches:

LabCorp, Quest Diagnostics, Yahoo, Equifax, Marriott International, Target, Home Depot,

Anthem, Heartland Payment Systems, and TJX Companies, Inc.1

17. Deloitte is no stranger to data breaches and phishing scams of its own

employees.2

18. Upon information and belief, Deloitte failed to implement reasonable industry

standards necessary to prevent a data breach, including the FTC's guidelines, resulting in the

Data Breach.

19. Likewise, Deloitte failed to create, maintain, and/or comply with a written

cybersecurity program that incorporated physical, technical, and administrative safeguards for

the protection of personal information and reasonably conformed to an industry recognized

cybersecurity framework, resulting in the Data Breach.

20. Because of its failure to create, maintain, and/or comply with a necessary

cybersecurity program, Deloitte was unable to ensure the protection of information security and

confidentiality, protect against obvious and readily foreseeable threats to information security

and confidentiality or the unauthorized access of the PII, resulting in the Data Breach.

1 See, e.g., Taylor Armerding, The 18 Biggest Data Breaches of the 21st Century, CSO ONLINE (Dec. 20,

2018), https://www.csoonline.com/article/2130877/the-biggest-data-breaches-of-the-21st-century.html.

2 See, e.g., Source: Deloitte Breach Affected All Company Email, Admin Accounts, Krebsonsecurity.com

(September 25, 2017) (last visited May 20, 2020) https://krebsonsecurity.com/2017/09/source-deloitte-

breach-affected-all-company-email-admin-accounts/

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

DAMAGES FROM DATA BREACHES

21. The United States Government Accountability Office released a report in 2007

regarding data breaches (“GAO Report”) in which it noted that victims of identity theft will face

“substantial costs and time to repair the damage to their good name and credit record.”3

22. The FTC recommends that identity theft victims take several steps to protect their

personal and financial information after a data breach, including contacting one of the credit

bureaus to place a fraud alert (consider an extended fraud alert that lasts for 7 years if someone

steals their identity), reviewing their credit reports, contacting companies to remove fraudulent

charges from their accounts, placing a credit freeze on their credit, and correcting their credit

reports.4

23. Identity thieves use stolen personal information such as SSNs for a variety of

crimes, including credit card fraud, phone or utilities fraud, and bank/finance fraud.

24. Identity thieves can also use SSNs to obtain a driver's license or official

identification card in the victim's name but with the thief's picture; use the victim's name and

SSN to obtain government benefits; or file a fraudulent tax return using the victim's information.

In addition, identity thieves may obtain a job using the victim's SSN, rent a house or receive

medical services in the victim's name, and may even give the victim's personal information to

police during an arrest resulting in an arrest warrant being issued in the victim's name.

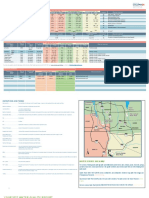

25. A study by the Identity Theft Resource Center show the multitude of harms

caused by fraudulent use of personal and financial information:

3 See “Data Breaches Are Frequent, but Evidence of Resulting Identity Theft Is Limited; However, the

Full Extent Is Unknown,” pg. 2, by U.S. Government Accountability Office, June 2007, at:

https://www.gao.gov/new.items/d07737.pdf (last visited May 20, 2020) (“GAO Report”).

4 See https://www.identitytheft.gov/Steps (last visited May 20, 2020).

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

Americans' expenses/disruptions as a result of

criminal activity in their name [2016]

1 hod to request govern moot assistance 29.5%

1 had to borrow money 60.7%

Hod to use my sowings to pay for expenses 32.3%

Couldn’t qualify for a home loan 32.8%

1 lost my home/place of residence 31.1%

1 couldn't care for my family 34 4%

Had to rely on family/friends for assistance 492%

Lost out on an employment opportunity 44.3%

Lost time away from school 19.7%

Missed time away from work 55.7%

Was generally inconvenienced 73.8%

Other 23%

None of these 3 3%

0% 10% 20% 30% 40% 50% 50% 70% 00%

Source: identity Theft Resource Center credrt&ards+coTn

Source: “Credit Card and ID Theft Statistics” by Jason Steele, 10/24/17, at:

https://www.creditcards.com/credit-card-news/credit-card-security-id-theft-fraud-statistics-

1276.php (last visited May 20, 2020).

26. There may be a time lag between when harm occurs versus when it is discovered,

and also between when personal and financial information is stolen and when it is used.

According to the U.S. Government Accountability Office, which conducted a study regarding

data breaches:

[L]aw enforcement officials told us that in some cases, stolen data may be

held for up to a year or more before being used to commit identity theft.

Further, once stolen data have been sold or posted on the Web, fraudulent

use of that information may continue for years. As a result, studies that

attempt to measure the harm resulting from data breaches cannot

necessarily rule out all future harm.

See GAO Report, at p. 29.

27. Personal and financial information is such a valuable commodity to identity

thieves that once the information has been compromised, criminals often trade the information

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

on the “cyber black-market” for years.

28. Thus, there is a strong probability that entire batches of stolen information have

been dumped on the black market, and are yet to be dumped on the black market, meaning

Plaintiffs and Class members are at an increased risk of fraud and identity theft for many years

into the future.

29. Data breaches are preventable.5 As Lucy Thompson wrote in the Data Breach

and Encryption Handbook, “In almost all cases, the data breaches that occurred could have

been prevented by proper planning and the correct design and implementation of appropriate

security solutions.”6 She added that “[organizations that collect, use, store, and share sensitive

personal data must accept responsibility for protecting the information and ensuring that it is not

compromised . . . ”7

30. “Most of the reported data breaches are a result of lax security and the failure to

create or enforce appropriate security policies, rules, and procedures. . . . Appropriate

information security controls, including encryption, must be implemented and enforced in a

rigorous and disciplined manner so that a data breach never occurs'”8

FACTS RELEVANT TO PLAINTIFF DANIEL BOZIN

31. Bozin is a citizen of Ohio (and was during the period of the Data Breach).

32. On May 13, 2020, Bozin applied online with the Ohio Department of Job and

Family Services (“ODJFS”) for pandemic unemployment assistance (“PUA”).

33. At the time Bozin applied online for PUA, the website was being operated by

Deloitte.

5Lucy L. Thomson, “Despite the Alarming Trends, Data Breaches Are Preventable,” in Data Breach

and Encryption Handbook (Lucy Thompson, ed., 2012).

6Id. at 17.

7Id. at 28.

8Id.

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

34. Shortly after he applied for benefits on May 13, 2020, Bozin emailed ODJFS

through the website to request his application be cancelled, as he discovered he was eligible to

receive unemployment benefits, along with PUA, in another state.

35. On May 15, 2020, Bozin emailed ODJFS through the website to follow-up on his

request.

36. On May 20, 2020, Bozin received the Notice from Deloitte.

37. Shortly after receiving the Notice, Bozin was concerned that his identity may

have been stolen. Therefore, he purchased credit and identity monitoring software with Lifelock.

38. As a direct result of the Data Breach, Bozin will now have to expend additional

time and energy reviewing alerts from Lifelock, verifying his identity with potential creditors,

and monitoring his credit, in addition to the monthly service fee he is now paying.

39. Bozin also intends to close financial accounts in the event that these accounts are

actually compromised as a result of the Data Breach.

FACTS RELEVANT TO PLAINTIFF TIMOTHY SMITH

40. Smith is a citizen of Ohio (and was during the period of the Data Breach).

41. On May 12, 2020, Smith applied online with the ODJFS for PUA.

42. At the time Smith applied online for PUA, the website was being operated by

Deloitte.

43. On May 20, 2020, Smith received the Notice from Deloitte.

44. Shortly after receiving the Notice, Smith was concerned that his identity may

have been stolen. Therefore, he purchased credit and identity monitoring software with Lifelock.

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

45. As a direct result of the Data Breach, Smith will now have to expend additional

time and energy reviewing alerts from Lifelock, verifying his identity with potential creditors,

and monitoring his credit, in addition to the monthly service fee he is now paying.

46. Smith also intends to close financial accounts in the event that these accounts are

actually compromised as a result of the Data Breach.

FACTS RELEVANT TO PLAINTIFF ALEXANDRIA POLICHENA

47. Polichena is a citizen of Ohio (and was during the period of the Data Breach).

48. Prior to May 15, 2020, Polichena applied online with the ODJFS for PUA.

49. At the time Polichena applied online for PUA, the website was being operated by

Deloitte.

50. On May 20, 2020, Polichena received the Notice from Deloitte.

51. Shortly after receiving the Notice, Polichena was concerned that her identity may

have been stolen. Therefore, she purchased credit and identity monitoring software with

Lifelock.

52. As a direct result of the Data Breach, Polichena will now have to expend

additional time and energy reviewing alerts from Lifelock, verifying her identity with potential

creditors, and monitoring her credit, in addition to the monthly service fee she is now paying.

53. Polichena also intends to close financial accounts in the event that these accounts

are actually compromised as a result of the Data Breach.

PLAINTIFFS’ AND CLASS MEMBERS' DAMAGES

54. As a direct and proximate result of Defendant’s conduct, Plaintiffs and the Class

members have been placed at an imminent, immediate, and continuing increased risk of harm

from fraud and identity theft.

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

55. Plaintiffs and members of the Class have or will suffer actual injury as a direct

result of the Data Breach. In addition to fraudulent charges, loss of use of and access to their

account funds and costs associated with inability to obtain money from their accounts, and

damage to their credit, many victims suffer ascertainable losses in the form of out-of-pocket

expenses and the value of their time reasonably incurred to remedy or mitigate the effects of the

Data Breach relating to:

a. Finding fraudulent charges;

b. Canceling and reissuing credit and debit cards linked to their bank

accounts;

c. Purchasing credit monitoring and identity theft prevention;

d. Addressing their inability to withdraw funds linked to compromised

accounts;

e. Taking trips to banks and waiting in line to obtain funds held in limited

accounts;

f. Taking trips to banks and waiting in line to verify their identities in order

to restore access to the accounts;

g. Placing “freezes” and “alerts” with credit reporting agencies which,

pursuant to ORC 1349.52(I), will cost up to $5.00 per security freeze

placed and up to $5.00 per security freeze to be removed;

h. Spending time on the phone with or at the financial institution to dispute

fraudulent charges;

i. Contacting their financial institutions and closing or modifying financial

accounts;

j. Resetting automatic billing and payment instructions from compromised

credit and debit cards to new cards;

k. Paying late fees and declined payment fees imposed as a result of failed

automatic payments that were tied to compromised cards that had to be

cancelled; and

l. Closely reviewing and monitoring bank accounts and credit reports for

unauthorized activity for years to come.

56. Moreover, Plaintiffs and the Class members have an interest in ensuring that their

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

personal and financial information, which is believed to remain in the possession of Defendant,

is protected from further breaches by the implementation of security measures and safeguards,

including making sure that the storage of data or documents containing personal and financial

information is not accessible online and that access to such data is password-protected.

57. In the Notice, Deloitte offers limited guidance to Plaintiffs and Class members

other than boilerplate steps that any Ohioan can take in the event of a data breach.

58. As a direct and proximate result of Defendant’s actions and inactions, Plaintiffs

and Class members have suffered anxiety, emotional distress, loss of privacy, financial damages,

and are at an increased risk of future harm.

CLASS ALLEGATIONS

59. Class Definition: Plaintiffs bring this action pursuant to Fed. R. Civ. P. 23, on

behalf of a statewide class of similarly situated individuals and entities (“the Class”), defined as

follows:

All individuals who applied for pandemic unemployment assistance with

the Ohio Department of Job and Family Services, and whose personal

information and/or financial information was exposed in the Data Breach.

Excluded from the Class are: (1) Defendant, Defendant’s agents,

subsidiaries, parents, successors, predecessors, and any entity in which

Defendant or its parents have a controlling interest, and those entities’

current and former employees, officers, and directors; (2) the Judge to

whom this case is assigned and the Judge’s immediate family; (3) any

person who executes and files a timely request for exclusion from the

Class; (4) any persons who have had their claims in this matter finally

adjudicated and/or otherwise released; and (5) the legal representatives,

successors and assigns of any such excluded person.

60. Numerosity: Upon information and belief, the Class is comprised of tens of

thousands of members, as it was reported that as many as 161,000 Ohioans had applied for PUA

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

assistance at the time of the Data Breach.9 Thus, the Class is so numerous that joinder of all

members is impracticable. Class members can easily be identified through Defendant’s records,

or by other means.

61. Commonality and Predominance: There are several questions of law and fact

common to the claims of Plaintiffs and Class members, which predominate over any individual

issues, including:

a. Whether Defendant adequately protected the personal and financial

information of Plaintiffs and members of the Class;

b. Whether Defendant placed the personal and financial information of

Plaintiffs and members of the Class in an online storage server without a

secure lock on any of the files and was not password-protected;

c. Whether Defendant adopted, implemented, and maintained reasonable

policies and procedures to prevent the unauthorized access to the personal

and financial information of Plaintiffs and members of the Class;

d. Whether Defendant properly trained and supervised its employees to

protect the personal and financial information of Plaintiffs and members

of the Class;

e. Whether Defendant promptly notified Plaintiffs and members of the Class

of the Data Breach;

f Whether Defendant owed a duty to Plaintiffs sand members of the Class to

safeguard and protect their personal and financial information;

g. Whether Defendant breached a duty to Plaintiffs and members of the

Class to safeguard and protect their personal and financial information;

h. Whether Defendant breached a duty to Plaintiffs and members of the

Class by failing to adopt, implement, and maintain reasonable policies and

procedures to safeguard and protect the personal and financial information

of Plaintiffs and members of the Class; and

i. Whether Defendant is liable for the damages suffered by Plaintiffs and

members of the Class as a result of the Data Breach.

9See, e.g. Orie Givens, “ODJFS Reports Potential Exposure of PUA Applicant Data”

Spectrumnews1.com (May 20, 2020) (last visited May 20, 2020)

https://spectrumnews1.com/oh/columbus/news/2020/05/20/odjfs-unemployment-security-issue

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

62. Typicality: Plaintiffs’ claims are typical of the claims of members of the Class.

All claims are based on the same legal and factual issues. Plaintiffs and each of the Class

members provided documents containing their personal and financial information to the ODJFS

and Deloitte, and the information was placed in an online storage server that did not have a

secure lock and was not password-protected. Defendant’s conduct was uniform to Plaintiffs and

all Class members.

63. Adequacy of Representation: Plaintiffs will fairly and adequately represent and

protect the interests of the members of the Class, and have retained counsel competent and

experienced in complex class actions. Plaintiffs have no interest antagonistic to those of

members of the Class, and Defendant has no defenses unique to Plaintiffs. The questions of law

and fact common to the proposed Class predominate over any questions affecting only individual

members of the Class.

64. Superiority: A class action is superior to other available methods for the fair and

efficient adjudication of this controversy. The expense and burden of individual litigation would

make it impracticable or impossible for proposed members of the Class to prosecute their claims

individually. The trial and the litigation of Plaintiffs’ claims are manageable.

COUNT I

Negligence

(On behalf of Plaintiffs and the Class)

65. Plaintiffs repeat and reallege the allegations of paragraphs 1-64 with the same

force and effect as though fully set forth herein.

66. Deloitte knew, or should have known, of the risks inherent in collecting and

storing the personal and financial information of Plaintiffs and Class members and the

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

importance of adequate security. Deloitte was well aware of numerous, well-publicized data

breaches that exposed the personal and financial information of individuals.

67. Deloitte had a common law duty to prevent foreseeable harm to those whose

personal and financial information it was entrusted. This duty existed because Plaintiffs and

Class members were the foreseeable and probable victims of the failure of Deloitte to adopt,

implement, and maintain reasonable security measures so that Plaintiffs’ and Class members'

personal and financial information would not be accessible in an unsecured online storage server

and not password-protected.

68. Deloitte had a special relationship with Plaintiffs and Class members. Deloitte

was entrusted with Plaintiffs’ and Class members’ documents and electronic data containing

their personal and financial information, and Deloitte was in a position to protect the documents

and electronic data (and the personal and financial information stored on them) from public

exposure.

69. The duties of Deloitte also arose under section 5 of the Federal Trade

Commission Act (“FTC Act”), 15 U.S.C. § 45, which prohibits “unfair . . . practices in or

affecting commerce,” including, as interpreted and enforced by the FTC, the unfair practice of

failing to use reasonable measures to protect individuals’ personal and financial information by

companies. Various FTC publications and data security breach orders further form the basis of

the duties of Deloitte.

70. Deloitte had a duty to exercise reasonable care in obtaining, retaining, securing,

safeguarding, deleting, and protecting Plaintiffs’ and Class members’ personal and financial

information in its possession so that the personal and financial information would not come

within the possession, access, or control of unauthorized persons.

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

71. More specifically, the duties of Deloitte included, among other things, the duty to:

a. Adopt, implement, and maintain policies, procedures, and security

measures for protecting documents containing an individual’s personal

and financial information, including policies, procedures, and security

measures to ensure that the documents are not accessible online in

unsecured storage servers and are password-protected;

b. Adopt, implement, and maintain reasonable policies and procedures to

prevent the sharing of documents containing an individual’s personal and

financial information with entities that failed to adopt, implement, and

maintain policies, procedures, and security measures to ensure that the

documents are not accessible online in unsecured storage servers and are

password-protected;

c. Adopt, implement, and maintain reasonable policies and procedures to

ensure that it is sharing documents containing an individual’s personal and

financial information only with entities that have adopted, implemented,

and maintained policies, procedures, and security measures to ensure that

the documents are not accessible online in unsecured storage servers and

are password-protected;

d. Properly train its employees to protect documents containing an

individual’s personal and financial information; and

e. Adopt, implement, and maintain processes to quickly detect a data breach

and to promptly act on warnings about data breaches.

72. Deloitte breached the foregoing duties to exercise reasonable care in obtaining,

retaining, securing, safeguarding, deleting, and protecting the documents and electronic data

containing an individual’s personal and financial information in its possession so that the

documents and electronic data would not come within the possession, access, or control of

unauthorized persons. The Notice acknowledges that the personal information of the Plaintiffs

and the Class members was exposed in the Data Breach.

73. Deloitte acted with reckless disregard for the security of the personal and

financial information of Plaintiffs and the Class because Deloitte knew or should have known

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

that its data security practices were not adequate to safeguard the personal and financial

information that it collected and stored.

74. Deloitte acted with reckless disregard for the rights of Plaintiffs and the Class by

failing to promptly detect the Data Breach so that Plaintiffs and the Class members could take

measures to protect themselves from damages caused by the unauthorized access of the personal

and financial information compromised in the Data Breach.

75. As a result of the conduct of Deloitte, Plaintiffs and Class members have suffered

and will continue to suffer actual damages including, but not limited to, expenses and/or time

spent on credit monitoring; time spent scrutinizing bank statements, credit card statements, and

credit reports; time spent initiating fraud alerts; and increased risk of future harm. Further,

Plaintiffs and Class members have suffered and will continue to suffer other forms of injury

and/or harm including, but not limited to, anxiety, emotional distress, loss of privacy, and other

economic and non-economic losses.

PRAYER FOR RELIEF

WHEREFORE, Plaintiffs DANIEL BOZIN, TIMOTHY SMITH, and ALEXANDRIA

POLICHENA individually, and on behalf of all others similarly situated, respectfully request

that judgment be entered in their favor and against DELOITTE CONSULTING LLP, as follows:

A. That the Court find that this action satisfies the prerequisites for

maintenance as a class action and certifying the Class defined herein;

B. That the Court appoint Plaintiffs as representatives of the Class;

C. That the Court appoint Plaintiffs’ counsel as counsel for the Class;

D. That the Court enter judgment in favor of Plaintiffs and the Class against

Deloitte;

E. That the Court award Plaintiffs and Class members actual damages and all

other forms of available relief, as applicable;

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

F. That the Court award Plaintiffs and Class members punitive damages and

all other forms of available relief, as applicable;

G. That the Court award Plaintiffs and the Class attorney’s fees and costs,

including interest thereon as allowed or required by law;

H. That the Court enter an injunction requiring Deloitte to adopt, implement,

and maintain adequate security measures to protect its customers’ personal

and financial information; and

I. Granting all such further and other relief as the Court deems just and

appropriate.

DEMAND FOR JURY TRIAL

Plaintiffs Daniel Bozin, Timothy Smith, and Alexandria Polichena individually, and on

behalf of all others similarly situated, hereby demand a trial by jury of all claims so triable.

Respectfully submitted,

/s/ Marc E. Dann_____

Marc E. Dann (0039425)

Brian D. Flick (0081605)

DannLaw

P.O. Box 6031040

Cleveland, Ohio 44103

(216) 373-0539 telephone

(216) 373-0536 facsimile

notices@dannlaw.com

Thomas A. Zimmerman, Jr. (pro hac vice anticipated)

tom@attorneyzim.com

Matthew C. De Re (pro hac vice anticipated)

matt@attorneyzim.com

Jeffrey D. Blake (pro hac vice anticipated)

jeff@attorneyzim.com

Zimmerman Law Offices, P.C.

77 W. Washington Street, Suite 1220

Chicago, Illinois 60602

(312) 440-0020 telephone

(312) 440-4180 facsimile

www.attorneyzim.com

Counselfor Plaintiffs and the putative Class

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

EXHIBIT 1

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

Brian Flick <bflick@dannlaw.com>

Fwd: Pandemic Unemployment Assistance

1 message

Dan Bozin ■^^^^@gmail.com> Wed, May 20, 2020 at 5:56 PM

To: bflick@danniaw.COm

Begin forwarded message:

From: noreply@jfs.ohio.gov

Subject: Pandemic Unemployment Assistance

Date: May 20, 2020 at 2:46:12 PM EDT

To: @gmail.com @gmail.com>

May 20, 2020

Dear PUA Applicant:

Deloitte Consulting is currently under contract with the Ohio Department of Job and Family Services

(ODJFS) to assist the state of Ohio in administering the Pandemic Unemployment Assistance (PUA)

program. Deloitte discovered on May 15, 2020 that your name, Social Security number, and street address

pertaining to your application for and receipt of unemployment compensation benefits inadvertently had the

capability to be viewed by other unemployment claimants. Thereafter, Deloitte immediately began an

investigation and upon discovering the exposure, Deloitte immediately took steps to stop further access to

and exposure of your personal information.

At this time, there is no evidence or indication to believe that your personal information was improperly

used; therefore, our actions, as well as the actions you may want to consider, are preventative.

As a precaution, you may want to monitor your credit by obtaining a copy of your credit report from one of

the three national credit bureaus. Federal law entitles every individual to one free credit report per year from

each of the three main bureaus.

You may also have a fraud alert placed on your consumer credit file by contacting one of the national credit

bureaus. Once one credit bureau places a fraud alert on your credit file, it notifies the other two bureaus.

Fraud alerts are typically in effect for 90 days but can be renewed. The credit bureaus may be contacted at:

Equifax: (800) 525-6285 (http://www.equifax.com)

Experian: (888) 397-3742 (http://www.experian.com)

TransUnion: (800) 680-7289 (http://www.tuc.com)

Additionally, Ohio law allows you to place a security freeze on your credit report by contacting one of the

bureaus listed above. Should you wish to open a new line of credit while your report is frozen, you may

temporarily lift this security freeze by telephone or online by providing a security code. Credit reporting

agencies may charge a fee of no more than $5 for each freeze and unfreeze of your report.

If you wish to receive free Experian IdentityWorks identity protection services for the next 12 months, you

will receive a follow-up email with enrollment details that will be sent to you via Deloitte or directly from

Experian within 3-5 days.

Finally, to find out more about protecting your personal information, visit the Ohio Attorney General's Identity

Theft protection page (http://www.ohioattorneygeneral.gov/IdentityTheft) and/or the Federal Trade

Commission's identity theft assistance page (https://www.consumer.ftc.gov/features/feature-0014-identity-

theft).

ElectrWeP^lpyoFoiJgil:z@5i/2r'ian20o13ce4ri/s o YhconvSi^iencC ^iaieantW 'thSOiHauth or-zePncident. Please be

assured that we take very seriously our responsibility to safeguard the personal information you entrust to

our care, and deeply regret that this incident occurred.

If you have questions or concerns that remain unaddressed after reviewing this information, please email:

DeloitteIdentityhelp@jfs.ohio.gov .

Electronically Filed 05/21/2020 13:04 / / CV 20 932778 / Confirmation Nbr. 2001679 / CLLMD

Vous aimerez peut-être aussi

- How to Prevent Identity Theft: How Anyone Can Protect Themselves from Being a Victim of Identity TheftD'EverandHow to Prevent Identity Theft: How Anyone Can Protect Themselves from Being a Victim of Identity TheftPas encore d'évaluation

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsD'EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (12)

- Slaughter v. Aon Consulting, 10C-09-001 (Del. Superior Ct. Jan. 31, 2012)Document10 pagesSlaughter v. Aon Consulting, 10C-09-001 (Del. Superior Ct. Jan. 31, 2012)Venkat BalasubramaniPas encore d'évaluation

- Attorney Misconduct Complaint: Your Contact InformationDocument3 pagesAttorney Misconduct Complaint: Your Contact InformationJon FriedPas encore d'évaluation

- WPS-190338676 613letDocument6 pagesWPS-190338676 613letDennis KingPas encore d'évaluation

- Mead V Sallie Mae Pennsylvania PLUS LoansDocument27 pagesMead V Sallie Mae Pennsylvania PLUS LoansghostgripPas encore d'évaluation

- PPSC Robert PriorDocument5 pagesPPSC Robert PriorPatrik KapuscinskyPas encore d'évaluation

- Estate of Takoda Collins Vs Dayton Children's Hospital ComplaintDocument7 pagesEstate of Takoda Collins Vs Dayton Children's Hospital ComplaintTiffany L Denen100% (1)

- Ballanger, EL Al, V Select Portfolio Servicing Inc, Et AlDocument41 pagesBallanger, EL Al, V Select Portfolio Servicing Inc, Et AlSamuel RichardsonPas encore d'évaluation

- Jeffrey Baudry Arrest 2001Document2 pagesJeffrey Baudry Arrest 2001TMJ4Pas encore d'évaluation

- Plaintiff Motion To Strike Non-Party SubmissionDocument5 pagesPlaintiff Motion To Strike Non-Party SubmissioncopyrightclerkPas encore d'évaluation

- IN RE: DAVID JOHNSON - 6 - Certificate of NoticeDocument3 pagesIN RE: DAVID JOHNSON - 6 - Certificate of NoticeJack RyanPas encore d'évaluation

- Woodie V Chase Receivables FDCPA Letters Exhibit D PDFDocument6 pagesWoodie V Chase Receivables FDCPA Letters Exhibit D PDFghostgripPas encore d'évaluation

- STC v. Wilson, Et Al - Complaint.2014.06.16Document22 pagesSTC v. Wilson, Et Al - Complaint.2014.06.16Toni MombergerPas encore d'évaluation

- 10000021165Document25 pages10000021165Chapter 11 DocketsPas encore d'évaluation

- LETTER OF AUTHORIZATION AND IMFPA AND CIS Doyle AnthonyDocument12 pagesLETTER OF AUTHORIZATION AND IMFPA AND CIS Doyle AnthonySATRIO BUDI LEKSONO100% (1)

- Complaint RedactedDocument11 pagesComplaint RedactedDuncanPas encore d'évaluation

- Class Certification Motion (Compound Property Management v. Build Realty)Document3 pagesClass Certification Motion (Compound Property Management v. Build Realty)Christopher FinneyPas encore d'évaluation

- Peter Njeru ModifiedDocument3 pagesPeter Njeru Modifiedwesley kiptooPas encore d'évaluation

- Richard Keith Alan, II v. Wells Fargo Bank, N.A., 11th Cir. (2015)Document8 pagesRichard Keith Alan, II v. Wells Fargo Bank, N.A., 11th Cir. (2015)Scribd Government DocsPas encore d'évaluation

- JudgesDocument24 pagesJudgesScribd Government DocsPas encore d'évaluation

- Order For Attorney FeesDocument8 pagesOrder For Attorney FeesAnonymous 2NUafApcV100% (1)

- IRS Complaint FormDocument3 pagesIRS Complaint FormSteveManning100% (1)

- David Oles Legal Malpractice Notice TwoDocument16 pagesDavid Oles Legal Malpractice Notice TwoSonny B. Southerland, Sr.Pas encore d'évaluation

- Support Payment Credit Information Sheet: Return Completed Form (S) ToDocument6 pagesSupport Payment Credit Information Sheet: Return Completed Form (S) ToMaria EPas encore d'évaluation

- Barkat v. MedleyDocument75 pagesBarkat v. MedleyEriq GardnerPas encore d'évaluation

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument16 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsPas encore d'évaluation

- David E. Oles Legal Malpractice Notice 7-8-20 3Document6 pagesDavid E. Oles Legal Malpractice Notice 7-8-20 3Sonny B. Southerland, Sr.Pas encore d'évaluation

- Exhibits To The Writ of Mandamus TxsupctDocument56 pagesExhibits To The Writ of Mandamus Txsupctmortgageabuse6970Pas encore d'évaluation

- This Study Resource Was: 002 Virginia Dio V. People of The Philippines and Timothy Desmond (Consolacion)Document3 pagesThis Study Resource Was: 002 Virginia Dio V. People of The Philippines and Timothy Desmond (Consolacion)Kirstine Mae GilbuenaPas encore d'évaluation

- Marc Givler's Lawsuit vs. NevadaBuck and Kirk BartonDocument29 pagesMarc Givler's Lawsuit vs. NevadaBuck and Kirk BartonD.J. ByrnesPas encore d'évaluation

- Cleaning Up The Financial Crisis of 2008: Prosecutorial Discretion or Prosecutorial Abdication?Document7 pagesCleaning Up The Financial Crisis of 2008: Prosecutorial Discretion or Prosecutorial Abdication?DinSFLAPas encore d'évaluation

- Palm Financial Services Vs HeirsDocument10 pagesPalm Financial Services Vs HeirsHorace TolliverPas encore d'évaluation

- Wy DivorceDocument78 pagesWy DivorcenilessorrellPas encore d'évaluation

- Linda C. Bailey of Counsel - SteptoeDocument15 pagesLinda C. Bailey of Counsel - SteptoeMatias SmithPas encore d'évaluation

- Toros IgityanDocument1 pageToros IgityansilvatadevosyanPas encore d'évaluation

- Filing A Fair Housing Complaint Fact SheetDocument2 pagesFiling A Fair Housing Complaint Fact SheetCrimsonPas encore d'évaluation

- Electronic Diversity Visa ProgramDocument1 pageElectronic Diversity Visa ProgramDiyar BakirPas encore d'évaluation

- FOIA Documents OAWP and Government Accountability ProjectDocument83 pagesFOIA Documents OAWP and Government Accountability ProjectmikekvolpePas encore d'évaluation

- Flat TMPDocument30 pagesFlat TMPjayvelliottPas encore d'évaluation

- CFPB Closeout Letter Wrongly Asserts Privacy For Dead PersonsDocument77 pagesCFPB Closeout Letter Wrongly Asserts Privacy For Dead PersonsNeil GillespiePas encore d'évaluation

- Proof of Claim: Federal Deposit Insurance Corporation As Receiver ForDocument3 pagesProof of Claim: Federal Deposit Insurance Corporation As Receiver ForCoral LionPas encore d'évaluation

- Brandon Thoma Sentenced To 50 Years in Prison For Fort Dodge Newborn's DeathDocument4 pagesBrandon Thoma Sentenced To 50 Years in Prison For Fort Dodge Newborn's DeathannaPas encore d'évaluation

- Electronic Diversity Visa Entry Form: Part One - Entrant InformationDocument3 pagesElectronic Diversity Visa Entry Form: Part One - Entrant InformationAchoki Hillary Mariita100% (1)

- Financial CrisisDocument6 pagesFinancial CrisisForeclosure Fraud100% (1)

- Tips, Complaints, and Referrals: Summary Page - Submitted ExternallyDocument7 pagesTips, Complaints, and Referrals: Summary Page - Submitted Externallyvicki forchtPas encore d'évaluation

- California Bar Complaint in RE: Galen A. Phillips California Bar No. 021221Document3 pagesCalifornia Bar Complaint in RE: Galen A. Phillips California Bar No. 021221John DoePas encore d'évaluation

- EEOC Dismissal and Notice of Rights - Depity Clerk Charges - RedactedDocument4 pagesEEOC Dismissal and Notice of Rights - Depity Clerk Charges - RedactedActionNewsJaxPas encore d'évaluation

- Foreclosure Temp Restraining OrderDocument6 pagesForeclosure Temp Restraining OrderBeyond Medicine100% (1)

- Colen Decl Doc 514-1Document18 pagesColen Decl Doc 514-1nocompromisewtruthPas encore d'évaluation

- Higher Education Loans Board: Tvet-Loan/Bursary Application Form - First Time ApplicantDocument3 pagesHigher Education Loans Board: Tvet-Loan/Bursary Application Form - First Time ApplicantMbogi TokaPas encore d'évaluation

- Learn How To Fight Debt LawsuitsDocument5 pagesLearn How To Fight Debt LawsuitsTaimoor Dogar100% (3)

- Response To Individual Defendants Motion To File Motion in LimineDocument3 pagesResponse To Individual Defendants Motion To File Motion in LiminePaulWolfPas encore d'évaluation

- IN RE: DAVID JOHNSON - 24 - Order Denying Emergency Motion (Taitz)Document3 pagesIN RE: DAVID JOHNSON - 24 - Order Denying Emergency Motion (Taitz)Jack RyanPas encore d'évaluation

- Senior Living Letter NIA RA R Czapiewski FINAL 8.25.20 700638 7Document3 pagesSenior Living Letter NIA RA R Czapiewski FINAL 8.25.20 700638 7Trevor DrewPas encore d'évaluation

- 08.02.21 Confirmation SEC Whistle Blower Complaint Against Alpha Capital, AG (Anstalt)Document5 pages08.02.21 Confirmation SEC Whistle Blower Complaint Against Alpha Capital, AG (Anstalt)Thomas WarePas encore d'évaluation

- Niam Knoll - TransUnion Personal Credit Report - 20200802Document4 pagesNiam Knoll - TransUnion Personal Credit Report - 20200802Bruce WaynnePas encore d'évaluation

- Floyd v. Educational Credit, 4th Cir. (2002)Document5 pagesFloyd v. Educational Credit, 4th Cir. (2002)Scribd Government DocsPas encore d'évaluation

- AOLDocument22 pagesAOLPando DailyPas encore d'évaluation

- Fiance and Marriage Visas: A Couple's Guide to U.S. ImmigrationD'EverandFiance and Marriage Visas: A Couple's Guide to U.S. ImmigrationPas encore d'évaluation

- Ohio Board of Education LawsuitDocument45 pagesOhio Board of Education LawsuitMatt ThomasPas encore d'évaluation

- Ohio Senate Select Committee Rail Safety ReportDocument132 pagesOhio Senate Select Committee Rail Safety ReportWKYC.comPas encore d'évaluation

- Bethel RulingDocument52 pagesBethel RulingMatt ThomasPas encore d'évaluation

- Former Columbus Zoo Officials IndictmentDocument104 pagesFormer Columbus Zoo Officials IndictmentMatt ThomasPas encore d'évaluation

- Ohio Board of Education Lawsuit TRODocument7 pagesOhio Board of Education Lawsuit TROMatt ThomasPas encore d'évaluation

- Gov Uscourts Ohsd 275818 26 0Document3 pagesGov Uscourts Ohsd 275818 26 0Matt Thomas100% (1)

- Request For Presidential Disaster Declaration 7.3.2023Document3 pagesRequest For Presidential Disaster Declaration 7.3.2023Matt ThomasPas encore d'évaluation

- EO-01-2023 - Mobile Food Vending OperationsDocument1 pageEO-01-2023 - Mobile Food Vending OperationsMatt ThomasPas encore d'évaluation

- Ordinance Map North High 11x17Document1 pageOrdinance Map North High 11x17Matt ThomasPas encore d'évaluation

- Chapman Contract 6-20-23 FINALDocument8 pagesChapman Contract 6-20-23 FINALMatt ThomasPas encore d'évaluation

- 2022 Columbus Drinking Water ReportDocument8 pages2022 Columbus Drinking Water ReportMatt ThomasPas encore d'évaluation

- 2023 Ohio State Fair Media GuideDocument65 pages2023 Ohio State Fair Media GuideMatt ThomasPas encore d'évaluation

- SOOH SummerGames 2023-2Document32 pagesSOOH SummerGames 2023-2Matt ThomasPas encore d'évaluation

- OPOVDocument15 pagesOPOVJo InglesPas encore d'évaluation

- Lee FlyerDocument1 pageLee FlyerMatt ThomasPas encore d'évaluation

- The Cost of Going To An MLB Game Playma GraphicDocument1 pageThe Cost of Going To An MLB Game Playma GraphicMatt ThomasPas encore d'évaluation

- Directive 2023-07 August 8, 2023 Special Election For Statewide Ballot IssueDocument2 pagesDirective 2023-07 August 8, 2023 Special Election For Statewide Ballot IssueMatt ThomasPas encore d'évaluation

- Skimming State Plan Final With FNS Updates 2.5 Clean SIGNED - RedactedDocument7 pagesSkimming State Plan Final With FNS Updates 2.5 Clean SIGNED - RedactedMatt ThomasPas encore d'évaluation

- Olentangy LawsuitDocument55 pagesOlentangy LawsuitMatt ThomasPas encore d'évaluation

- Morpc Final Draft TipDocument285 pagesMorpc Final Draft TipMatt ThomasPas encore d'évaluation

- Vinton Township Special Audit Report FINALDocument25 pagesVinton Township Special Audit Report FINALMatt ThomasPas encore d'évaluation

- Racing Calendars2023 Eldorado Gaming Scioto DownsDocument2 pagesRacing Calendars2023 Eldorado Gaming Scioto DownsMatt ThomasPas encore d'évaluation

- General PSC Fact Sheet (February 2023)Document1 pageGeneral PSC Fact Sheet (February 2023)Matt ThomasPas encore d'évaluation

- Ky'air Thomas 03102023 CRNR PressRelease Ky'Air ThomasDocument1 pageKy'air Thomas 03102023 CRNR PressRelease Ky'Air ThomasMatt ThomasPas encore d'évaluation

- CORPO 24-27 TIP Final-Draft 20230308Document140 pagesCORPO 24-27 TIP Final-Draft 20230308Matt ThomasPas encore d'évaluation

- Ky'air Thomas AutopsyReport Original 2023-03-08Document6 pagesKy'air Thomas AutopsyReport Original 2023-03-08Matt ThomasPas encore d'évaluation

- Bexley StatementDocument1 pageBexley StatementMatt ThomasPas encore d'évaluation

- Complaint, 2.15.2023Document25 pagesComplaint, 2.15.2023Matt ThomasPas encore d'évaluation

- Policy JFC Student Conduct First Reading of March 8 2023Document2 pagesPolicy JFC Student Conduct First Reading of March 8 2023Matt ThomasPas encore d'évaluation

- Ralph Federal LawsuitDocument22 pagesRalph Federal LawsuitMatt ThomasPas encore d'évaluation

- Cristobal Vs PAL Case DigestDocument2 pagesCristobal Vs PAL Case DigestCamille GracePas encore d'évaluation

- United States v. Alex Shevgert, 11th Cir. (2010)Document15 pagesUnited States v. Alex Shevgert, 11th Cir. (2010)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Ninth CircuitDocument17 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsPas encore d'évaluation

- Santos Ventura Hocorma Foundation Inc. vs. Santos PDFDocument12 pagesSantos Ventura Hocorma Foundation Inc. vs. Santos PDFral cbPas encore d'évaluation

- Ang vs. CA, G.R. No. 182835 (2010)Document6 pagesAng vs. CA, G.R. No. 182835 (2010)Christiaan CastilloPas encore d'évaluation

- Eric Kaprice Richard II ComplaintDocument5 pagesEric Kaprice Richard II Complaintamannix3112Pas encore d'évaluation

- Lindain vs. Court of AppealsDocument2 pagesLindain vs. Court of AppealssikarlPas encore d'évaluation

- George W. Hopkins Vs United Mexican StatesDocument3 pagesGeorge W. Hopkins Vs United Mexican StatesArste GimoPas encore d'évaluation

- Lozano vs. MartinezDocument3 pagesLozano vs. MartinezEra GasperPas encore d'évaluation

- Nevada ADA LawsuitDocument20 pagesNevada ADA LawsuitDave BiscobingPas encore d'évaluation

- Malabanan v. RepublicDocument9 pagesMalabanan v. RepublicelizbalderasPas encore d'évaluation

- Constitution Mbe QuestionsDocument18 pagesConstitution Mbe QuestionsStacy MustangPas encore d'évaluation

- 42 G.R. No. L-57348 May 16, 1985 Depra Vs DumlaoDocument4 pages42 G.R. No. L-57348 May 16, 1985 Depra Vs DumlaorodolfoverdidajrPas encore d'évaluation

- Julian v. DBPDocument7 pagesJulian v. DBPJm BrjPas encore d'évaluation

- il:AY: Gymboree Play Programs, Inc. - UFOC - v. 1.6-7 - 4/1/@ 3Document54 pagesil:AY: Gymboree Play Programs, Inc. - UFOC - v. 1.6-7 - 4/1/@ 3Bimmerboy ChuPas encore d'évaluation

- Mayer Steel Pipe Corporation and Hongkong Government Supplies DepartmentDocument1 pageMayer Steel Pipe Corporation and Hongkong Government Supplies DepartmentJeru SagaoinitPas encore d'évaluation

- Heirs of Fran v. Salas, G.R. No. L-53546, June 25, 1992 (210 SCRA 303)Document16 pagesHeirs of Fran v. Salas, G.R. No. L-53546, June 25, 1992 (210 SCRA 303)ryanmeinPas encore d'évaluation

- Richard Allen - Order IssuedDocument2 pagesRichard Allen - Order IssuedMatt Blac inc.100% (2)

- Judicial Affidavit Loida PaczonDocument5 pagesJudicial Affidavit Loida PaczonRosalinda M. Adriano100% (2)

- CIRCULAR NO. 14-93 July 15, 1993 To: All Regional Trial Courts, Metropolitan TrialDocument5 pagesCIRCULAR NO. 14-93 July 15, 1993 To: All Regional Trial Courts, Metropolitan TrialJhoanna Marie Manuel-AbelPas encore d'évaluation

- Trump, John GDocument16 pagesTrump, John GMBestPas encore d'évaluation

- Rule 23 Deposition Pending ActionDocument16 pagesRule 23 Deposition Pending ActionRonadale Zapata-AcostaPas encore d'évaluation

- Judg GgerDocument39 pagesJudg GgerhansPas encore d'évaluation

- 26maquilan Vs Maquilan, 542 SCRA 166, G.R. No. 155409, June 8, 2007Document18 pages26maquilan Vs Maquilan, 542 SCRA 166, G.R. No. 155409, June 8, 2007Gi NoPas encore d'évaluation

- Epifanio Martinez Juarez, A095 194 852 (BIA March 21, 2011)Document3 pagesEpifanio Martinez Juarez, A095 194 852 (BIA March 21, 2011)Immigrant & Refugee Appellate Center, LLC100% (1)

- Roman Catholic Arch of Manila vs. CADocument5 pagesRoman Catholic Arch of Manila vs. CADee WhyPas encore d'évaluation

- 17-G R - No - 206590Document1 page17-G R - No - 206590Jorg ィ ۦۦPas encore d'évaluation

- G.R. No. 177486, 21 December 2009, 608 SCRA 699Document2 pagesG.R. No. 177486, 21 December 2009, 608 SCRA 699Tricia CruzPas encore d'évaluation

- Beneficial Innovations, Inc. v. AOL, LLC. Et Al - Document No. 41Document2 pagesBeneficial Innovations, Inc. v. AOL, LLC. Et Al - Document No. 41Justia.comPas encore d'évaluation

- Sabena vs. CADocument3 pagesSabena vs. CAJustin Luis Jalandoni100% (1)