Académique Documents

Professionnel Documents

Culture Documents

Evaluation of Mutual Funds Performance and Consistency Test Over The Use of Performance Sizing Methods

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Evaluation of Mutual Funds Performance and Consistency Test Over The Use of Performance Sizing Methods

Droits d'auteur :

Formats disponibles

Volume 5, Issue 6, June – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Evaluation of Mutual Funds Performance

And Consistency test over the use of

Performance Sizing Methods

Eka Kusumawati Ega Bagja Nugraha

Master of Management, Perbanas Institute Master of Management, Gadjah Mada University

Jakarta, Indonesia Yogyakarta, Indonesia

Abstract:- The development of mutual fund industry in because mutual funds are a practical investment place for

Indonesia has increases every year. From those several investors who do not have enough time and knowledge to

types of equity funds, the Net Asset Value (NAV) of manage their money directly in a particular investment

mutual funds has increased by quite high number from instrument.

year to year compared to other types. This research was

assess the performance of mutual funds and examine The development of the mutual fund industry in

those several consistency over the use of performance Indonesia continues to increase every year. From several

sizing methods from Sharpe ratio, Treynor index and types of mutual funds, the Net Asset Value (NAV) of

Jensen's Alpha methods. Current problem who was mutual funds has increased by a fairly high number from

stumbled was how the performance of stock mutual year to year when compared to other types of mutual funds

funds was measured by the Sharpe ratio, Treynor index that can be seen in Table 1 below.

and Jensen's Alpha methods and whether there has

consistency over its performance by using it. The recent Types of Mutual Funds 2009 2010 2011 2012

sample was 37 mutual funds that were registered at Stock 36,507.70 45,628.29 61,184.14 69,561.02

BAPEPAM-LK and still operating in Indonesia from

January 2009 to October 2013. Performance evaluations Money Market 5,219.71 7,721.83 9,883.90 12,348.87

used Sharpe ratio method, Treynor index and Jensen's Mix 13,655.32 18,167.46 20,876.36 21,956.63

Alpha. As for assess those consistency of the use Fixed Income 17,328.64 26,648.18 28,930.22 34,577.74

performance sizing methods was done by Kendall

Protected 34,738.87 42,064.61 41,834.59 40,845.63

coefficient of concordance (W) test. The result over this

research said that Panin Dana Maksima and Panin Table 1:- The growth of Mutual Fund NAV Level

Dana Prima are the best mutual funds, this could be

seen during these surveillance period which found that In stock of mutual funds, investment managers will

mutual fund has superior performance above the allocate most of the funds that have been collected into

market. The result of consistency test over those securities in the form of shares. Furthermore, to find out

performance of stock mutual funds using Kendall W's regards of those mutual funds performance, there has

concordance coefficient found that there has consistency specifications or benchmarks that become standards or

or harmony when evaluated the performance of equity benchmark points to discover those qualities or value of

funds by using Sharpe Ratio, Treynor Index and certain objects (Maginn, Mcleavey, Tuttle, & Pinto, 2007).

Jensen's Alpha methods during those period. Thus through an evaluation, it will be found that the

performance of mutual funds compare to the benchmark is

Keywords:- Mutual Funds, Performance Evaluation, above or below the level. In Indonesia, tool that set up as

Consistency. benchmark for stock mutual funds is the Composite Stock

Price Index (CSPI) return. From this performance

I. INTRODUCTION evaluation it could be found quite a lot of mutual funds that

exceed the benchmark performance when viewed by based

A. Background of the Problem on return.

Investment is a commitment over a number of funds

or other resources made at this time with purpose to gained In mutual fund performance sizing generally has 2

lots of benefits in future (Tandelilin, 2010). The two approaches, such as measuring the level of mutual fund

elements inherent in every investment are return (risk) and returns and measuring the level of risk that adjusted

risk (risk). These two elements always have direct performance. The three types of sizing which commonly

connection, the higher investment risk, the greater chance used are Sharpe, Treynor and Jensen methods (Brigham,

of results obtained and conversely. 2005). From this three methods it could be seen if its

performance of mutual fund said to be outperform or

For investors who want to invest in financial underperform on the market. This can be seen from the

investments but don't have a lot of time and expertise in positive or negative difference in ratio of each mutual fund

calculating their investment risk, therefore you can choose after deducting the IHSG market ratio.

mutual funds as one of their investment instruments. This is

IJISRT20JUN542 www.ijisrt.com 650

Volume 5, Issue 6, June – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

If stock mutual fund was found with outperform mutual funds also have a high risk. Risks can occur due to

performance, the other question is whether the outperform decreasing stock prices (capital loss).

condition owned by each of mutual funds would consistent

from time to time. Then if the findings on stock mutual D. Portfolio Performance Measurement

funds performance was indicate an underperform on the In measuring the portfolio performance, needs

market, does this condition also continue to occur in stock relevant variables such as the level of benefits and risks. Its

mutual fund. another stages of evaluating portfolio investors. At this

stage, portfolio performance will be contrast with other

Thus knowing the consistency over performance of portfolios through standard procedure (Husnan, 2011).

stock mutual funds, both outperform and underperform,

makes each investor could see from broader perspective, E. Sharpe Ratio

not only knowing that the performance of a stock mutual In performance sizing Methods Is based on risk

fund is able to surpass market performance but also the premium. The risk premium is a mismatch or difference

continuation of its performance, whether sustainable or not. between average performance produced by mutual funds

Long-term consistency over past performance is one clue to with average risk-free investment performance, which

the potential of equity funds in the future. assumes the average interest rate of Bank Indonesia

Certificates. In this Sharpe method, beside has positive

B. Research Purposes returns of mutual fund returns should also be above the

The target that need to be achieved through this instrument risk-free rate of return. The greater value of the

research are: Sharpe ratio, the better the mutual fund performance.

Assess the performance of mutual funds in period of

January 2009 until October 2013, which was became F. Treynor Index

the subject of research which measured by the Sharpe Both Treynor and Sharpe method were also a risk

ratio, Treynor index and Jensen's Alpha method. premium but the difference is Treynor method uses beta

Providing the best stock mutual fund information based divider (β) which contained relative risk fluctuations.

on performance evaluation result for period of January

2009 till October 2013 by using Sharpe ratio, Treynor G. Jensen’s Alpha

index and Jensen's Alpha measurement methods. The Jensen method based on developing the Capital

Examination those consistency occours of Sharpe ratio, Asset Pricing Model (CAPM). And was different from

Treynor index and Jensen's Alpha sizing methods on Treynor's size which uses average performance for certain

mutual funds performance during period January 2009 sub-periods, Jensen's method uses the weekly data . Jensen

to October 2013. method Were like, if the shape is higher positive, mutual

fund performance is better. Jensen measured all the

II. THEORITICAL REVIEW methods above from market performance also appropriate

risks.

A. Investation

Investment is a number of funds that used in hope that III. METHODOLOGY

it could earn certain benefits in future. According to Suketi

in Usman and Ratnasari (2004) investment involves A. Population and Sample

spending investors' funds at the present time to get a greater This research population is stock mutual funds in form

return in the future, although the return from an investment of collective investment contracts. The authors used a

is not necessarily in the form of profit. In other words, the purposive sampling method with these following

purpose by investing those funds by investors is to get conditions:

profits in future. The sample taken was a stock mutual fund offered in

the period January 2009 to October 2013, still active

B. Mutual Fund today and has a Net Asset Value (NAV) published in

According to Law Number 8 of 1995 regarding about print media.

Capital Market, mutual funds is tools that used to collect Data on Net Asset Value (NAV) of mutual fund shares

funds from publics investor to be subsequently invested in to be taken as a sample of this writing is monthly data

securities portfolios by investment managers. In other for the year concerned.

words mutual funds are a place for people who want to

invest their funds in securities portfolios through From these requirements, there has 37 samples of

investment managers. mutual fund products were obtained which met the criteria.

Then the data used is historical data that obtained from

C. Stock Mutual Fund various sources, such as:

Stock Mutual Fund is a mutual fund that invests at Monthly NAV data per unit of 37 equity mutual funds

least 80% of the portfolio manages into equity securities to be used as a sample in writing. NAV data per unit of

(shares). Returns were earned by stock mutual funds are participation from the period January 2009 to October

generally relatively higher than other types of mutual funds. 2013, so there are 2146 data which will then be

Returns could be in form of changes in stock prices (capital processed as writing material. Source of data on NAV

gains) or dividends. Beside that to providing high returns, per monthly investment unit of 37 equity funds was

IJISRT20JUN542 www.ijisrt.com 651

Volume 5, Issue 6, June – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

obtained at the Mutual Fund Information funds from January 2009 to October 2013 by using the

Center http://aria.bapepam.go.id. Kendall's coefficient of concordance (W) test.

Monthly CSPI data on the IDX which will then be used

as a benchmark in calculating the performance of IV. RESULTS AND DISCUSSION

mutual funds. The data was taken from the same period,

which is January 2009 to October 2013, so there are 58 A. Mutual Funds Performance

data. IHSG data was obtained From the Table 2 shows that during January 2009 to

from www.yahoofinance.com. October 2013 the average return on mutual funds was lower

Data of 1-month SBI interest rate, which will be used as than the average market return which means that the

a risk free rate in calculating the performance of mutual average return on equity funds was still below the market

funds. The data was taken from the period January 2009 returns during that period. This is inversely proportional to

to October 2013. The data was obtained from the the comparison of the standard deviation values that mutual

internet site www.bi.go.id which in the BI site. funds have with the market. The standard deviation or total

risk value of stock mutual fund returns is higher than the

B. Operational Definition standard deviation of market returns during this period.

The variable on this research is stock mutual funds Thus, during January 2009 to October 2013 with an

Performance whose sizing use the Sharpe, Treynor and average level of stock mutual fund returns which lower

Jensen methods. The steps in analyzing the performance than the average level of market returns, stock mutual fund

evaluation of stock mutual funds are: returns have a higher level of total risk than the level of risk

in market.

Calculating the Average Monthly Mutual Fund Returns

The average return is calculated by adding up all Minimum Maximum Mean Std. Deviation

returns divided by the number of periods. Return on mutual

Stock Mutual fund -0,1723 0,4373 0,0214 0,072

funds was obtained from the NAV per unit participation for

each of the investigated stock mutual funds. Market (IHSG) -0,09 0,2013 0,0215 0,059

Table 2:- Descriptive Statistics of Stock Mutual Funds and

1) Calculating the Average Market Return IHSG

Market return is reflected by the Composite Stock

Price Index (CSPI) for mutual funds. These reflect over the In period of January 2009 to October 2013, there has

stock market Performance which illustrates the movement 17 return values for mutual funds that were higher than

of stock prices. Market returns used as comparison of market returns and there were 20 returns for mutual funds

mutual funds performance. that lower than market returns. During that period, the

highest return on mutual funds was owned by BNI

Calculating the Average Risk-Free Asset Return Berkembang mutual funds in April 2009 and the lowest

The calculation of the average return on risk-free return on mutual funds was owned by Millennium

assets could obtained from the average level of risk-free Danatama mutual Fund in September 2013. While during

returns, such as the average interest rate of Bank Indonesia this period the market return was the lowest in August

Certificates in certain period to assess the mutual funds 2013, and the highest return in April 2009.

performance.

During these period it was seen annually, only in 2009

Calculating the Standard Deviation and 2013 it were seen the average value of stock mutual

Standard deviation used to measure risk, which find fund returns higher than the average market return, beside

out how likely the return obtained deviates from the that the average value of stock mutual fund returns in 2010

expected value (average return). Standard deviations also , 2011 and 2012 were lower than the average market return

indicate the deviations in average return of stock funds. value. Thus during the period of January 2009 to October

2013 it was seen annually, the average value of stock

Mutual Fund Beta Calculation mutual fund returns is lower than the average market return

Beta values are calculated from regression techniques value.

using the CAPM model. Beta for each mutual fund was

calculated by regressing mutual fund return (TRP) as the Sharpe Ratio

dependent variable with market return (RM) as the By using the Sharpe Ratio estimation method it could

independent variable. be describe that the stock mutual fund performance still

below the market performance per year during these period.

C. Evaluation and Examination Methods The Sharpe Ratio value of stock mutual fund performance

In this research the evaluation of the stock mutual was smaller than the Sharpe Ratio value on market

funds performance by using Sharpe Ratio, Treynor Index performance. The cause of that could be traced through the

and Jensen's Alpha in order to obtain an overview to stock Sharpe Ratio estimation formula, where the level of

funds performance compared with market performance. portfolio risk premium was divided by the level of total

Furthermore, the consistency of Sharpe Ratio, Treynor risk.

Index and Jensen's Alpha measurement performance needs

to be tests and conducted on the performance of mutual

IJISRT20JUN542 www.ijisrt.com 652

Volume 5, Issue 6, June – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

With the risk premium level of the performance of performance on the portfolio. The Mandiri Investa UGM

mutual funds was smaller than market performance, it mutual fund was ranked first in 2009 with the highest

becomes one of factors that the performance of mutual Treynor Index value of 0.0689. The first rank of the

funds was smaller aswell. Plus Added with the level of total Treynor Index calculation is the same as the first rank of

risk from mutual funds performance was greater than the Sharpe Ratio calculation in 2010 to 2013. In 2010 the

market performance, making its more smallers than the first rank was still occupied by the Panin Dana Maksima

other one. By comparing the Sharpe Ratio value of stock Portfolio Fund with the highest Treynor Index value of

mutual fund returns which become the object on this 0.1847. In 2011 the first rank was still occupied by Emco

research compared to Sharpe Ratio value of market returns, Mantap mutual fund with the highest Treynor Index value

it can be seen that stock mutual funds which the object of of 0.0118. In 2012 the first rank was still occupied by

research could be outperform or underperform. Syailendra Equity Opportunity with the highest Treynor

Index value of 0.0169. Finally in 2013 the first rank was

Sharpe Ratio estimation results show that 18 equity occupied by Millennium Danatama mutual fund with the

funds that have exceel performance or outperform in 2009, highest Treynor Index value of 0.0302.

only 3 equity funds in 2010, 11 equity funds in 2011, 8

mutual funds in 2012, and 12 stock mutual funds in 2013. Jensen’s Alpha

The rank given based on the value of Sharpe Ratio. The Calculations by using Jensen Alpha method also show

greater the Sharpe Ratio value, the better portfolio that the value of Jensen's Alpha mutual funds was negative

performance is aimed. Panin Dana Maksima Portfolio in 2010, 2011 and 2012, but in 2009 and 2013 the value of

ranked first in 2009 and 2010 with the highest Sharpe Ratio Jensen’s Alpha mutual funds was positive. The value of

values of 0.6441 and 0.9013. In 2011 the first ranking was Jensen's Alpha mutual funds in 2010, 2011 and 2012 was

occupied by Emco Mantap with the highest Sharpe Ratio negative because the level of portfolio risk premium was

value of 0.1847. In 2012 the first rank was occupied by the smaller than the level of market risk, which the result of

Syailendra Equity Opportunity Fund with the highest multiplication of market risk premium and greater than

Sharpe Ratio value of 0.4194. Finally in 2013 the first rank portfolio risk premium, with beta portfolio whose value is

was occupied by the Millennium Danatama Equity Fund greater than 1) By comparing the value of Jensen's Alpha

with the highest Sharpe Ratio value of 0.2796. on the return of mutual funds which is the object on this

research with the value of Jensen's Alpha on return market,

Treynor Index it can be seen that the mutual funds which the object of this

Test results show that the average value of Treynor research have outperform or underperform performance.

index of stock mutual fund performance is smaller than the

value of Treynor index on the market or CSPI in 2010 to The results of Jensen's Alpha calculation compared to

2013, except in 2009 the average value of Treynor index on the market show that 25 mutual funds have performance

stock mutual fund performance is greater than the value of above the market performance or outperform in 2009, only

Treynor market index. The cause of the Treynor index 4 mutual funds in 2010, 11 mutual funds in 2011, 9 mutual

value of equity funds in 2010 to 2013 is smaller than this funds in 2012, and 12 stock mutual funds in 2013. The total

market can be traced through the Treynor index calculation performance outperformed from Jensen's Alpha calculation

formula, where the level of portfolio risk premium is results is exactly the same as the Treynor Index calculation

divided by the systematic risk level or beta. results.

With the risk premium level of mutual funds being In 2010 to 2013, the first ranking from Jensen's Alpha

smaller than the market, it becomes one of the factors in the calculation was the same as the first ranking from the

Treynor index value of mutual funds which smaller than the calculation of the Treynor Index and Sharpe Ratio, namely

Treynor index value of the market. Coupled with the beta the Panin Dana Maksima, Emco Mantap, Syailendra Equity

level or systematic risk of equity funds is greater than the Opportunity and Millennium Danatama mutual fund. Only

market, making the value of Treynor obtained in mutual the first rank of Jensen's Alpha value in 2009 was different

funds will be even smaller than the value of Treynor index from Sharpe Ratio and Treynor Index values, which is

in the market. By comparing the value of the Treynor Index Panin Dana Prima.

on the return of mutual funds which are the object on this

research with value of Treynor Index on return market it Panin Dana Prima mutual fund was ranked first in

can be seen that the mutual funds which are these research 2009 with the highest value of Jensen's Alpha which is

object were outperform or underperform. 0.0145. In 2010, the first rank was still occupied by Panin

Dana Maksima Portfolio mutual fund with the highest

The Treynor Index calculation results show that 25 value of Jensen’s Alpha, 0.0290. In 2011 the first rank was

mutual funds have performance above the market or still occupied by Emco Mantap mutual fund with the

outperform in 2009, only 4 mutual funds in 2010, 11 highest Treynor Index value of 0.0173. In 2012 the first

mutual funds in 2011, 9 mutual funds in 2012, and 12 stock rank was still occupied by Syailendra Equity Opportunity

mutual funds in 2013. The ranking given based on the value with the highest Treynor Index value of 0.0109. Finally in

of the Treynor Index which not much different from the 2013 the first ranking was occupied by Millennium

results of the previous Sharpe Ratio calculation. The greater Danatama Equity Fund with the highest Treynor Index

the value of the Treynor Index, the more it shows good value of 0.0441.

IJISRT20JUN542 www.ijisrt.com 653

Volume 5, Issue 6, June – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Comparison between Sharpe Ratio, Treynor Index and thirty-fifth of the Aggressive Danareksa Mawar mutual

Jensen's Alpha fund. More consistency in ranking is seen from the results

The calculation results of Sharpe Ratio, Treynor and of the calculation of the Treynor Index method and Jensen's

Jensen methods for January 2009 to October 2013, shows Alpha, there are 10 consistent rankings, namely the third

that 2 mutual funds have performance above the market rank of the Millennium Danatama Equity Fund, the fourth

performance or outperform in the Sharpe Ratio (Panin Corfina Capital Grow 2 Prosper, the fifth Emco Mantap,

Dana Maksima and Panin Dana Prima) only 5 mutual fund the eighth Schroder Dana Istimewa, the twelfth Syailendra

Shares the same in the Treynor Index method and Jensen's Equity Opportunity Fund , the thirteenth Batavia Dana

Alpha (Panin Dana Maksima Portfolio, Panin Dana Prima, saham optimal, the fourteenth BNP Paribas Pesona, the

Millennium Danatama Equity Fund, Corfina Capital Grow fifteenth Manulife Saham Andalan, the twentieth Batavia

2 Prosper and Emco Mantap). dana saham and the thirteen seventh BNI Berkembang.

From those above ranking there are 7 ranks that are In plain view, the consistency of the Sharpe Ratio,

consistently measured by the Sharpe Ratio, Treynor Index Treynor Index and Jensen's Alpha methods can be seen by

and Jensen's Alpha methods, namely the first rank of the ranking the results of calculations with the Sharpe Ratio,

Panin Dana Maksima Portfolio, the second Panin Dana Treynor Index and Jensen’s Alpha methods. From the test

Prima, the seven Trimegah Trim Kapital Plus, the nine results, it can be seen that using the Sharpe Ratio, Treynor

BNP Paribas Solaris Fund, the thirty-one NISP Index Index and Jensen's Alpha methods, the ranking obtained for

Progressive Shares, thirty-two Mandiri Investa Atraktif and each equity fund is not much different. This clearly shows

thirty-eight Batavia Agro Funds. that the results of the mutual funds Performance sizing

methods by the Sharpe Ratio, Treynor Index and Jensen's

The results of calculations with the Sharpe Ratio and Alpha methods have consistency. This consistency could

Treynor Index methods have 2 consistent rankings, namely also be tested by statistical methods.

the thirty-third ranking of Lautandhana Equity and the

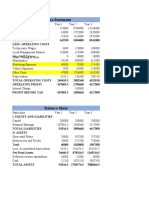

No Stock Mutual Funds Sharpe Ratio Treynor Index Jensen’s Alpha

1 Bahana TCW Dana Prima 0,2141 0,0128 -0,0038

2 Batavia Dana Saham 0,2323 0,0141 -0,0025

3 Batavia Dana Saham Agro 0,0604 0,0041 -0,0148

4 Batavia Dana Saham Optimal 0,2523 0,0156 -0,0007

5 BNI Berkembang 0,1441 0,0098 -0,0081

6 BNP Paribas Ekuitas 0,242 0,0144 -0,002

7 BNP Paribas Infrastruktur Plus 0,2244 0,0134 -0,0032

8 BNP Paribas Pesona 0,2495 0,0148 -0,0015

9 BNP Paribas Solaris Fund 0,252 0,016 -0,0002

10 CIMB-Principal Equity Aggressive 0,164 0,0098 -0,0068

11 Corfina Capital - Grow 2 Prosper 0,2648 0,0173 0,0013

12 Dana Ekuitas Andalan 0,214 0,0127 -0,0037

13 Dana Ekuitas Prima 0,2303 0,0138 -0,0027

14 Danareksa Mawar 0,2316 0,014 -0,0023

15 First State IndoEquity Dividend Yield Fund 0,2268 0,0135 -0,0026

16 First State Indoequity Value Select Fund 0,2262 0,0135 -0,0027

17 GMT Dana Ekuitas 0,2562 0,0158 -0,0004

18 Lautandhana Equity 0,1791 0,011 -0,0056

19 Mandiri Investa Atraktif 0,1919 0,0116 -0,0051

20 Mandiri Investa UGM 0,1314 0,0102 -0,0053

21 Manulife Dana Saham 0,2411 0,0144 -0,0018

22 Manulife Saham Andalan 0,2438 0,0146 -0,0018

23 Millennium Danatama Equity Fund 0,2205 0,0198 0,0034

24 NISP Indeks Saham Progresif 0,2014 0,012 -0,0042

25 Panin Dana Prima 0,3347 0,0214 0,006

26 Portfolio Panin Dana Maksima 0,3777 0,0237 0,0087

27 Pratama Ekuitas 0,2202 0,0143 -0,0025

28 Pratama Saham 0,2453 0,0159 -0,0005

29 Reksa Dana Danareksa Mawar Agresif 0,1592 0,01 -0,0073

30 Rencana Cerdas 0,2155 0,013 -0,0034

31 Schroder Dana Istimewa 0,2651 0,016 -0,0002

32 Schroder Dana Prestasi Plus 0,2301 0,0137 -0,0025

33 Syailendra Equity Opportunity Fund 0,2485 0,0157 -0,0006

34 Trimegah - Trim Kapital 0,229 0,0141 -0,0025

35 Trimegah - Trim Kapital Plus 0,255 0,0161 0.0000

36 Emco Growth 0,2128 0,0141 -0,0022

37 Emco Mantap 0,2376 0,0165 0,0005

Rata-rata Reksa Dana Saham 0,225 0,0141 -0,0023

Market (IHSG) 0,2757 0,0162 0

Table 3:- Comparison between Sharpe Ratio, Treynor Index and Jensen's Alpha Results

IJISRT20JUN542 www.ijisrt.com 654

Volume 5, Issue 6, June – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

B. Examinations over the Consistency of Sizing Methods V. CONCLUSIONS AND SUGGESTIONS

Analysis of the consistency results shows that in

period January 2009 to October 2013 the value of W was A. Conclusion

0.182. The test results show that only the measurement The conclusions that the authors could drawn based

method in period January 2009 to October 2013 was proved on the research results above as follows:

significant at a probability level of 5%, this can be seen Panin Dana Maksima and Panin Dana Prima Portfolio

asympt.sig value < 0.05. Thus, it could be Stated that there are the best stock mutual funds because they are

has consistency or harmony in evaluating the performance consistently appeared in every list of high levels stock

of mutual funds by using the Sharpe Ratio, Treynor Index mutual funds above the market, such as computing

and Jensen Alpha methods in period Of january 2009 to using average returns, Sharpe Ratio method, Treynor

October 2013. Index and Jensen's Alpha during the period of January

2009 to October 2013.

Test Statistics The performance assesment result when viewed based

on the average returns of 37 sample stock mutual fund

Value during the period January 2009 to October 2013 and

obtained an average value of stock mutual fund returns

Kendall's W a 0,182

lower than the average market return only 17 stock

Asymp. Sig. 0,001* mutual funds that exceeded market performance and 20

other mutual funds below market performance. Then it

a. Kendall's Coefficient of Concordance

was indicated that performance was efficient during this

Table 4:- Kendall's W Test Statistical Results period

From performance sizing result in 2009, the Sharpe

Total risk consists of systematic and unsystematic Ratio method ranked first was Panin Dana Maksima ,

risk. Systematic risk cannot be eliminated, while Treynor Index method ranked first was Mandiri Investa

unsystematic risk can be minimized through efficient UGM and Jensen Alpha's first ranking was Panin Dana

diversification, so the total remaining risk is systematic risk Prima. Furthermore, in 2010, 2011, 2012 and 2013 the

(Kaaro, 2007). Thus mutual fund risk has been managed first ranking of Sharpe Ratio, Treynor Index and

efficiently when total risk is the same as systematic risk, Jensen's Alpha performance sizing methods is

because unique risks are well diversified. consistent like such as in 2010 Panin Dana Maksima

Portfolio, in 2011 Emco Mantap mutual fund, 2012

A consistent sequence of mutual fund performance Syailendra Equity Opportunity Fund and 2013 Panin

shows that mutual fund risk management has been carried dana maksima. The sizing results of sharpe Ratio,

out efficiently. Treynor Index emphasizes systematic risk, Treynor Index and Jensen Alpha method during the

Sharpe Ratio emphasizes total risk. If the performance period January 2009 to October 2013, the first and

sequence is inconsistent, it means that mutual fund second ranks are consistently occupied by Panin Dana

management has not been able to eliminate the unique risks Maksima and Panin Dana Prima.

of the portfolio formed. The consistency test result over mutual funds

performance during period of January 2009 to October

C. Discussion 2013 by Kendall W concordance coefficient, has earned

The performance evaluation study result has shown that W value is 0.182 and Authenticated significant at

that mutual funds view through Sharpe Ratio, Treynor and 5% probability level. Therefore it stated that there has

Jensen calculation methods during the surveillance period occur the consistency or harmony in evaluating mutual

and It appears that there are two mutual funds that exceel funds performance by using Sharpe Ratio, Treynor

above market or outperform according to Sharpe Ratio Index and Jensen Alpha methods in period of January

(Panin Dana Maksima and Panin Dana Prima Portfolios) 2009 to October 2013.

and there was only 5 shares are the same for Treynor Index

and Jensen Alpha (Panin Dana Maksima Portfolio, Panin B. Suggestion

Dana Prima, Millennium Danatama Equity Fund, Corfina Based on these research results , the author tries to

Capital Grow 2 Prosper and Emco Mantap). offered several suggestions, such as:

For investors, the Panin Dana Maksima and Panin Dana

The consistency Analysist test results was Described Prima could be used as an choice to invest in portfolio

during Research period that the value of W was 0.182. The programme. The two mutual funds are continually made

test results was indicated that the sizing method during the it in every list of mutual funds with good performance

observation period has Authentic significant value at the levels above the market, both estimate average returns

5% probability level, seen asympt.sig value <0.05. or by using Sharpe Ratio, Treynor Index, and Jensen

Therefore It said that there has consistency Occurs or Alpha methods during period of January 2009 to

harmonized in this periods assessed from Sharpe Ratio, October 2013.

Treynor Index and Jensen's Alpha.

IJISRT20JUN542 www.ijisrt.com 655

Volume 5, Issue 6, June – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Performance calculations using the Sharpe Ratio,

Treynor Index, and Jensen's Alpha methods during the

period of January 2009 to October 2013 were also

according to the previous research. The results obtained

could be taken into recommendation for investors

to evaluating the performance of stock mutual fund

when making investment decisions in the future.

nevertheless this results cannot be used as a source of

information it is because the level of performance wont

be similiar in the future. Various aspects will affect the

performance of those indexs in the future. So analyzes

are needed before making investment decisions.

REFERENCES

[1]. Husnan, Suad. (2001). Dasar-dasar Teori Portofolio

dan Analisis Sekuritas, edisi ketiga, Yogyakarta: UPP

AMP YKPN.

[2]. Republik Indonesia. (1995). Undang-Undang (UU)

Nomor 8 Tahun 1995 tentang Pasar Modal

[3]. Usman, Bahtiar dan Indri Ratnasari. 2004. “Evaluasi

Kinerja Reksa Dana Berdasarkan Metode Sharpe,

Treynor, Jensen dan M2 .” Media Riset Bisnis dan

Manajemen, Vol. 4 No. 2, Hal 165-202.

[4]. http://aria.bapepam.go.id.

[5]. www.bi.go.id

[6]. www.yahoofinance.com.

IJISRT20JUN542 www.ijisrt.com 656

Vous aimerez peut-être aussi

- Detection and Counting of Fake Currency & Genuine Currency Using Image ProcessingDocument6 pagesDetection and Counting of Fake Currency & Genuine Currency Using Image ProcessingInternational Journal of Innovative Science and Research Technology100% (9)

- An Overview of Lung CancerDocument6 pagesAn Overview of Lung CancerInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Entrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisDocument10 pagesEntrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Digital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaDocument10 pagesDigital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Impact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaDocument6 pagesImpact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Auto Tix: Automated Bus Ticket SolutionDocument5 pagesAuto Tix: Automated Bus Ticket SolutionInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Designing Cost-Effective SMS based Irrigation System using GSM ModuleDocument8 pagesDesigning Cost-Effective SMS based Irrigation System using GSM ModuleInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Computer Vision Gestures Recognition System Using Centralized Cloud ServerDocument9 pagesComputer Vision Gestures Recognition System Using Centralized Cloud ServerInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Effect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictDocument13 pagesEffect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Utilization of Waste Heat Emitted by the KilnDocument2 pagesUtilization of Waste Heat Emitted by the KilnInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Ambulance Booking SystemDocument7 pagesAmbulance Booking SystemInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Predictive Analytics for Motorcycle Theft Detection and RecoveryDocument5 pagesPredictive Analytics for Motorcycle Theft Detection and RecoveryInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Smart Cities: Boosting Economic Growth Through Innovation and EfficiencyDocument19 pagesSmart Cities: Boosting Economic Growth Through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Factors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaDocument6 pagesFactors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Study Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoDocument6 pagesStudy Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Forensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsDocument12 pagesForensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Cyber Security Awareness and Educational Outcomes of Grade 4 LearnersDocument33 pagesCyber Security Awareness and Educational Outcomes of Grade 4 LearnersInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Unmasking Phishing Threats Through Cutting-Edge Machine LearningDocument8 pagesUnmasking Phishing Threats Through Cutting-Edge Machine LearningInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- An Industry That Capitalizes Off of Women's Insecurities?Document8 pagesAn Industry That Capitalizes Off of Women's Insecurities?International Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Blockchain Based Decentralized ApplicationDocument7 pagesBlockchain Based Decentralized ApplicationInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Smart Health Care SystemDocument8 pagesSmart Health Care SystemInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Visual Water: An Integration of App and Web To Understand Chemical ElementsDocument5 pagesVisual Water: An Integration of App and Web To Understand Chemical ElementsInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Parastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueDocument2 pagesParastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Implications of Adnexal Invasions in Primary Extramammary Paget's Disease: A Systematic ReviewDocument6 pagesImplications of Adnexal Invasions in Primary Extramammary Paget's Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Impact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldDocument6 pagesImpact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Insights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDocument8 pagesInsights Into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Compact and Wearable Ventilator System For Enhanced Patient CareDocument4 pagesCompact and Wearable Ventilator System For Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Parkinson's Detection Using Voice Features and Spiral DrawingsDocument5 pagesParkinson's Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Air Quality Index Prediction Using Bi-LSTMDocument8 pagesAir Quality Index Prediction Using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Predict The Heart Attack Possibilities Using Machine LearningDocument2 pagesPredict The Heart Attack Possibilities Using Machine LearningInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Fa2 Tut 5Document5 pagesFa2 Tut 5Truong Thi Ha Trang 1KT-19Pas encore d'évaluation

- Assignment 3 Student Copy 3659645125042566Document1 pageAssignment 3 Student Copy 3659645125042566John DembaPas encore d'évaluation

- FR G13 - ME AnalysisDocument12 pagesFR G13 - ME AnalysisNavhin MichealPas encore d'évaluation

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelPas encore d'évaluation

- Icpu Registration FormDocument1 pageIcpu Registration FormGhulam AbbasPas encore d'évaluation

- Quiz 10Document1 pageQuiz 10Lalaine BeatrizPas encore d'évaluation

- Account Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceGirish ChowdaryPas encore d'évaluation

- Settlement LetterDocument1 pageSettlement LetterAmrish VenkatesanPas encore d'évaluation

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Document5 pagesRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTAPas encore d'évaluation

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Falin-Math of Finance and Investment 3 PDFDocument97 pagesFalin-Math of Finance and Investment 3 PDFAlfred alegadoPas encore d'évaluation

- Wilmington Trust IndictmentDocument6 pagesWilmington Trust IndictmentPhiladelphiaMagazinePas encore d'évaluation

- SWIFT-gpi Final JAnuary-2018 PDFDocument30 pagesSWIFT-gpi Final JAnuary-2018 PDFxyPas encore d'évaluation

- Dividend FormDocument1 pageDividend FormCRS Region VII100% (3)

- Dewan Cement: Internal ComparisonDocument24 pagesDewan Cement: Internal ComparisonOsama JavedPas encore d'évaluation

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerPas encore d'évaluation

- Shinhan Bank ServiceDocument2 pagesShinhan Bank ServiceNguyễn Quang MinhPas encore d'évaluation

- I. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 9, 2020. (2 Pts Each)Document9 pagesI. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 9, 2020. (2 Pts Each)Hazel Seguerra BicadaPas encore d'évaluation

- Attain Checking Product DisclosureDocument2 pagesAttain Checking Product DisclosureieatpinktacozPas encore d'évaluation

- Chapter 10 - Cash and Financial InvestmentsDocument2 pagesChapter 10 - Cash and Financial InvestmentsLouiza Kyla AridaPas encore d'évaluation

- Intermediate Accounting II Chapter 17Document2 pagesIntermediate Accounting II Chapter 17izza zahratunnisaPas encore d'évaluation

- XXXXXX: Account Assistant (Feb 2015 To Sep 2017)Document4 pagesXXXXXX: Account Assistant (Feb 2015 To Sep 2017)Vicky APas encore d'évaluation

- Chapter 14 Non Current Liabilities Test BankDocument36 pagesChapter 14 Non Current Liabilities Test BankSlamet Tri Prastyo100% (2)

- ATM Interface:: K. Rasi TirupathammaDocument17 pagesATM Interface:: K. Rasi Tirupathamma31 RasiPas encore d'évaluation

- Job Order Costing Problems and SolutionsDocument14 pagesJob Order Costing Problems and SolutionsErika GuillermoPas encore d'évaluation

- Metapath Software CorpDocument2 pagesMetapath Software Corpsunil kumarPas encore d'évaluation

- AFM Sample Model - 2 (Horizontal)Document18 pagesAFM Sample Model - 2 (Horizontal)munaftPas encore d'évaluation

- Review Material For Traditional Life InsuranceDocument2 pagesReview Material For Traditional Life InsuranceS4M1Y4100% (1)

- Geo 1Document21 pagesGeo 1Ermias Asnake YilmaPas encore d'évaluation

- Coc Model Level Iv ChoiceDocument22 pagesCoc Model Level Iv ChoiceBeka Asra100% (3)