Académique Documents

Professionnel Documents

Culture Documents

Coca-Cola vs. CBCPI Union

Transféré par

RobTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Coca-Cola vs. CBCPI Union

Transféré par

RobDroits d'auteur :

Formats disponibles

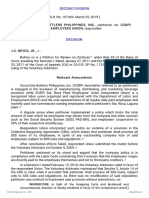

G.R. No.

197494

COCA-COLA* BOTTLERS PHILIPPINES, INC. , Petitioner

vs.

CCBPI STA. ROSA PLANT EMPLOYEES UNION, Respondent

Facts: Coca-Cola Bottlers Philippines, Inc. (CCBPI) is engaged in the business of

manufacturing, distributing, and marketing beverage products while CCBPI Sta. Rosa Plant

Employees' Union (respondent Union) is a recognized labor union organized and registered with

the Department of Labor and Employment (DOLE) and the sole representative of all regular

daily paid employees and monthly paid non-commission earning employees within petitioner's

Sta. Rosa, Laguna plant.

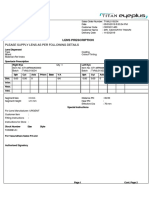

A dispute arose when petitioner implemented a policy which limits the total amount of loan

which its employees may obtain from the company and other sources such as the Social

Security System (SSS), PAG-IBIG, and employees' cooperative to 50% of their respective

monthly pay.

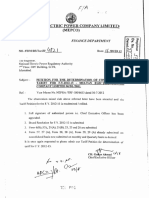

Respondent Union interpreted such policy as violative of a provision in the Collective Bargaining

Agreement (CBA), which states that petitioner shall process all SSS loans of its employees, in

spite of any outstanding company loan of said employees, subject to SSS rules and

regulations.5

Issue: Whether or not petitioner's company policy which limits the availment of loans depending

on the average take home pay of its employees violates a provision in the CBA.

Held: Yes. It is a familiar and fundamental doctrine in labor law that the CBA is the law between

the parties and they are obliged to comply with its provisions. Verily, the force and effect of the

CBA is that of a law, requiring that parties thereto yield to its provisions; otherwise, the purpose

for which the same was executed would be rendered futile.

A plain reading of the CBA provision provides for the commitment of the petitioner to process

SSS salary loans, in particular, of its employees. The only limitation is the application of SSS

rules and regulations pertaining to the same. Undoubtedly, the company policy is not an SSS

rule or regulation. Hence, it is important to discuss whether said company policy is sanctioned

under SSS rules and regulations.

It appears that the qualification of a member-borrower is dependent on the amount of loan to be

taken, updated payment of his contributions and other loans, and age, which should be below

65 years. On the other hand, the responsibility of an employer is limited to the collection and

remittance of the employee's amortization to SSS as it causes the deduction of said

amortizations from the employee's salary. Based on said terms and conditions, it does not

appear that the employer has the prerogative to impose other conditions which does not involve

its duty to collect and remit amortizations. The 50% net take home pay requirement, in effect,

further adds a condition for an employee to obtain an SSS salary loan, on top of the

requirements issued by the SSS. Hence, when petitioner requires that the employee should

have at least 50% net take home pay before it processes a loan application, the same violates

the CBA provision when a qualified employee chooses to apply for an SSS loan.

With these, we rule that the company policy violated the provision of the CBA as it imposes a

restriction with respect to the right of the employees under the CBA to avail SSS salary loans.

The implementation of the company policy is not a valid exercise of management prerogative,

which must be exercised in good faith and with due regard to the rights of labor. Its violation of a

provision in the CBA demerits the presence of good faith.

In the absence of an SSS rule or regulation which limits the qualification of employees to obtain

a loan, petitioner has the obligation to process the same so as to comply with the provisions of

the CBA.

Vous aimerez peut-être aussi

- 1 of 25 MGVD - Wages Case Digest Compilation - Labor Law B - Atty. Chan-GonzagaDocument25 pages1 of 25 MGVD - Wages Case Digest Compilation - Labor Law B - Atty. Chan-GonzagaJefferson Maynard RiveraPas encore d'évaluation

- Jurisprudence in Labor LawDocument14 pagesJurisprudence in Labor Lawidko2wPas encore d'évaluation

- 6 - Kimberly Clark Phils V SecDocument2 pages6 - Kimberly Clark Phils V SecGino Alejandro Sison100% (1)

- Right To Association DigestDocument2 pagesRight To Association DigestGat Jose RizalPas encore d'évaluation

- Equi-Asia Placement Inc. v. Department of Foreign AffairsDocument11 pagesEqui-Asia Placement Inc. v. Department of Foreign AffairsVanityHughPas encore d'évaluation

- Lb11. Nazaro Vs EccDocument2 pagesLb11. Nazaro Vs Eccangelli45Pas encore d'évaluation

- Caltex Union v. CaltexDocument2 pagesCaltex Union v. CaltexKim Michael de JesusPas encore d'évaluation

- PLDT V ArceoDocument3 pagesPLDT V ArceoS.Pas encore d'évaluation

- 2labor Digest NotesDocument6 pages2labor Digest NotesRoseanne MateoPas encore d'évaluation

- JESUS REYES Vs Glaucoman Research FoundationDocument1 pageJESUS REYES Vs Glaucoman Research FoundationJessie Albert CatapangPas encore d'évaluation

- PAL Vs NLRCDocument5 pagesPAL Vs NLRCAbigail DeePas encore d'évaluation

- States Marine Corp v. Cebu Seamen's AssociationDocument16 pagesStates Marine Corp v. Cebu Seamen's Associationonlineonrandomdays100% (2)

- Lazaro Vs SSSDocument2 pagesLazaro Vs SSSAshley CandicePas encore d'évaluation

- MBTC vs. NWPC G.R. No. 144322Document2 pagesMBTC vs. NWPC G.R. No. 144322Mae Clare BendoPas encore d'évaluation

- Filamer V IAC DigestDocument1 pageFilamer V IAC DigestVoidèPas encore d'évaluation

- (7-4) Villalon vs. RB of AgooDocument3 pages(7-4) Villalon vs. RB of AgooJan Carlo SanchezPas encore d'évaluation

- TORTS - (5) Baksh v. CADocument2 pagesTORTS - (5) Baksh v. CAjosephPas encore d'évaluation

- Davao Fruits Corporation Vs Associated Labor UnionsDocument1 pageDavao Fruits Corporation Vs Associated Labor UnionsBryan Nartatez BautistaPas encore d'évaluation

- San Juan de Dios Hospital V NLRC (1997)Document15 pagesSan Juan de Dios Hospital V NLRC (1997)J.N.Pas encore d'évaluation

- Nitto Vs NLRC DigestDocument4 pagesNitto Vs NLRC DigestRal CaldiPas encore d'évaluation

- Ecal Vs NLRCDocument7 pagesEcal Vs NLRCnat_wmsu2010Pas encore d'évaluation

- 5) SHS Perforated v. DiazDocument2 pages5) SHS Perforated v. DiazRaymund CallejaPas encore d'évaluation

- 167 Ortega Vs SSSDocument1 page167 Ortega Vs SSSRobelle RizonPas encore d'évaluation

- 282 Achilles Manufacturing Corp V NLRCDocument1 page282 Achilles Manufacturing Corp V NLRCKim CajucomPas encore d'évaluation

- EMILIO GONZALEZ LA O, Plaintiff and Appellee, vs. THE YEK TONG LIN FIRE & MARINE INSURANCE Co., LTD., Defendant and Appellant.Document14 pagesEMILIO GONZALEZ LA O, Plaintiff and Appellee, vs. THE YEK TONG LIN FIRE & MARINE INSURANCE Co., LTD., Defendant and Appellant.ailynvdsPas encore d'évaluation

- 001 NAPA Negros Metal V LamayoDocument2 pages001 NAPA Negros Metal V LamayoClar NapaPas encore d'évaluation

- Metrobank v. National Wages and Productivity Commission (2007)Document2 pagesMetrobank v. National Wages and Productivity Commission (2007)Erika C. Dizon100% (1)

- Phil. Duplicators v. NLRCDocument2 pagesPhil. Duplicators v. NLRCIldefonso HernaezPas encore d'évaluation

- Apex Mining Co. V NLRC PDFDocument2 pagesApex Mining Co. V NLRC PDFPaulo TapallaPas encore d'évaluation

- PP Vs Delos ReyesDocument3 pagesPP Vs Delos ReyestinctPas encore d'évaluation

- Garcia de Lara vs. Gonzales de Lara (G.R. No. 1111 May 16, 1903)Document3 pagesGarcia de Lara vs. Gonzales de Lara (G.R. No. 1111 May 16, 1903)Kimberly Sendin100% (1)

- Labor Standards - 1st Sem, AY 2018-19Document14 pagesLabor Standards - 1st Sem, AY 2018-19anonymous0914Pas encore d'évaluation

- (TWO CASES) People's Broadcasting v. Secretary, May 8, 2009 and March 6, 2012, G.R. No. 179652Document6 pages(TWO CASES) People's Broadcasting v. Secretary, May 8, 2009 and March 6, 2012, G.R. No. 179652SSPas encore d'évaluation

- Shell Company of The Philippines Islands, Ltd. vs. National Labor UnionDocument2 pagesShell Company of The Philippines Islands, Ltd. vs. National Labor Uniontalla aldoverPas encore d'évaluation

- Indophil Textile Mills, Inc. vs. Salvador Adviento, G.R. No. 171212, August 4, 2014Document3 pagesIndophil Textile Mills, Inc. vs. Salvador Adviento, G.R. No. 171212, August 4, 2014MJ AroPas encore d'évaluation

- Jamias V NLRCDocument1 pageJamias V NLRCMark Oliver EvangelistaPas encore d'évaluation

- Nagusara v. National Labor RelationsDocument8 pagesNagusara v. National Labor RelationsTen LaplanaPas encore d'évaluation

- Royale Homes v. Alcantara DigestDocument1 pageRoyale Homes v. Alcantara DigestCM EustaquioPas encore d'évaluation

- 5 SSS V UbanaDocument2 pages5 SSS V UbanaJonas TPas encore d'évaluation

- 03 J.K. Mercado & Sons Agricultural Enterprises, Inc. v. Sto. TomasDocument2 pages03 J.K. Mercado & Sons Agricultural Enterprises, Inc. v. Sto. TomasMikhel BeltranPas encore d'évaluation

- Orient Hope Agencies, Inc. v. Michael E. Jara G.R. No. 204307, June 06, 201847Document1 pageOrient Hope Agencies, Inc. v. Michael E. Jara G.R. No. 204307, June 06, 201847AlyssaOgao-ogaoPas encore d'évaluation

- Philman vs. Cabanban (Topic 27 Social Legislation)Document4 pagesPhilman vs. Cabanban (Topic 27 Social Legislation)Seth RavenPas encore d'évaluation

- Case Digest Updated 4th Year Batch 2011-2012Document127 pagesCase Digest Updated 4th Year Batch 2011-2012Angel Arriesgado-Ponla Yap100% (1)

- Corporal SR Vs NLRC PDF FreeDocument3 pagesCorporal SR Vs NLRC PDF FreeKeyan MotolPas encore d'évaluation

- Stolt-Nielsen Vs MedequilloDocument1 pageStolt-Nielsen Vs MedequilloASDF GHJKPas encore d'évaluation

- PAL Employees vs. NLRCDocument2 pagesPAL Employees vs. NLRCAndrewPas encore d'évaluation

- Maria Carmela P. Umali vs. Hobbywing Solutions, IncDocument7 pagesMaria Carmela P. Umali vs. Hobbywing Solutions, IncErole John AtienzaPas encore d'évaluation

- Republic of The Phils Vs Asiapro CoopDocument1 pageRepublic of The Phils Vs Asiapro Cooppja_14Pas encore d'évaluation

- 6 The Heritage Hotel Manila (Owned and Operated by Grand Plaza Hotel Corporation) v. Pinag-Isang Galing at Lakas NG Mga Manggagawa Sa Heritage Manila (PiglasHeritage)Document12 pages6 The Heritage Hotel Manila (Owned and Operated by Grand Plaza Hotel Corporation) v. Pinag-Isang Galing at Lakas NG Mga Manggagawa Sa Heritage Manila (PiglasHeritage)kimPas encore d'évaluation

- Del Monte Philippines V VelascoDocument1 pageDel Monte Philippines V VelascoCedricPas encore d'évaluation

- 037a. Manila Terminal Co. Inc. V CIRDocument4 pages037a. Manila Terminal Co. Inc. V CIRlovesresearchPas encore d'évaluation

- Dealco Farms DigestDocument2 pagesDealco Farms DigestkarlonovPas encore d'évaluation

- Mago Vs SunpowerDocument1 pageMago Vs SunpowerDon AmboyPas encore d'évaluation

- Aro Vs NLRCDocument1 pageAro Vs NLRCAnonymous C8wzGOxwPas encore d'évaluation

- 101 University of Pangasinan Faculty Union V University of PangasinanDocument2 pages101 University of Pangasinan Faculty Union V University of PangasinanMarielle ReynosoPas encore d'évaluation

- Coca-Cola vs. CCBPI Sta. Rosa, Plant Employees UnionDocument2 pagesCoca-Cola vs. CCBPI Sta. Rosa, Plant Employees UnionCZARINA ANN CASTRO100% (1)

- Coca-Cola v. CCBPI UnionDocument2 pagesCoca-Cola v. CCBPI UnionAngeli Pauline JimenezPas encore d'évaluation

- 11 Coca-Cola - Bottlers - Philippines - Inc. - v. - CCBPI PDFDocument6 pages11 Coca-Cola - Bottlers - Philippines - Inc. - v. - CCBPI PDFThea capuyanPas encore d'évaluation

- Coca-Cola Bottlers Inc. vs. Sta. Rosa Plant Employees UnionDocument6 pagesCoca-Cola Bottlers Inc. vs. Sta. Rosa Plant Employees UnionJohanna Mae L. AutidaPas encore d'évaluation

- 6 Coca-Cola Vs CCBPIDocument5 pages6 Coca-Cola Vs CCBPINunugom SonPas encore d'évaluation

- Jurado vs. Spouses ChaiDocument2 pagesJurado vs. Spouses ChaiRobPas encore d'évaluation

- Sevilla vs. Atty. MilloDocument2 pagesSevilla vs. Atty. MilloRobPas encore d'évaluation

- People vs. CarinoDocument2 pagesPeople vs. CarinoRobPas encore d'évaluation

- Central Visayas Finance Corporation vs. Spouses AdlawanDocument2 pagesCentral Visayas Finance Corporation vs. Spouses AdlawanRob50% (2)

- LBP vs. ReyesDocument2 pagesLBP vs. ReyesRob100% (1)

- People vs. ObiasDocument2 pagesPeople vs. ObiasRobPas encore d'évaluation

- Central Visayas Finance Corporation vs. Spouses AdlawanDocument2 pagesCentral Visayas Finance Corporation vs. Spouses AdlawanRob50% (2)

- Fil-Estate Management vs. RepublicDocument2 pagesFil-Estate Management vs. RepublicRobPas encore d'évaluation

- People vs. ObiasDocument2 pagesPeople vs. ObiasRobPas encore d'évaluation

- Republic vs. DeangDocument1 pageRepublic vs. DeangRobPas encore d'évaluation

- CIR vs. V.Y. Domingo JewellersDocument2 pagesCIR vs. V.Y. Domingo JewellersRob100% (2)

- Puerto Del Sol Palawan vs. Hon. GabaenDocument2 pagesPuerto Del Sol Palawan vs. Hon. GabaenRob100% (1)

- People vs. LumahangDocument2 pagesPeople vs. LumahangRobPas encore d'évaluation

- Filipinas Elson Manufacturing vs. Heirs of LlanesDocument2 pagesFilipinas Elson Manufacturing vs. Heirs of LlanesRob100% (5)

- Coca-Cola vs. CBCPI UnionDocument2 pagesCoca-Cola vs. CBCPI UnionRobPas encore d'évaluation

- People vs. GonzalesDocument2 pagesPeople vs. GonzalesRob0% (1)

- Dizon vs. PeopleDocument2 pagesDizon vs. PeopleRobPas encore d'évaluation

- Huang vs. Atty. ZambranoDocument2 pagesHuang vs. Atty. ZambranoRob100% (2)

- San Gabriel vs. Atty. SempioDocument2 pagesSan Gabriel vs. Atty. SempioRob0% (1)

- Domingo vs. Atty. SacdalanDocument2 pagesDomingo vs. Atty. SacdalanRob33% (3)

- Puerto Del Sol Palawan vs. Hon. GabaenDocument3 pagesPuerto Del Sol Palawan vs. Hon. GabaenRobPas encore d'évaluation

- Dizon vs. MattiDocument2 pagesDizon vs. MattiRobPas encore d'évaluation

- Logrosa vs. Spouses AzaresDocument2 pagesLogrosa vs. Spouses AzaresRob50% (4)

- Bucag vs. Atty. OlaliaDocument2 pagesBucag vs. Atty. OlaliaRobPas encore d'évaluation

- Davao ACF Bus Lines vs. AngDocument3 pagesDavao ACF Bus Lines vs. AngRobPas encore d'évaluation

- Nunez vs. Moises-PalmaDocument3 pagesNunez vs. Moises-PalmaRobPas encore d'évaluation

- Park vs. ChoiDocument2 pagesPark vs. ChoiRob100% (1)

- Fajardo vs. MalateDocument2 pagesFajardo vs. MalateRobPas encore d'évaluation

- People vs. Don VegaDocument2 pagesPeople vs. Don VegaRobPas encore d'évaluation

- DPRC vs. MIAADocument2 pagesDPRC vs. MIAARobPas encore d'évaluation

- Career Objective For A Fresher EngineerDocument4 pagesCareer Objective For A Fresher Engineerlisa arifaniaPas encore d'évaluation

- The High Probability Trading Strategy SummaryDocument2 pagesThe High Probability Trading Strategy SummaryJulius Mark Carinhay TolitolPas encore d'évaluation

- 3.SAP Retail Using FioriDocument7 pages3.SAP Retail Using FioriGirishPas encore d'évaluation

- Prelim Exam ManuscriptDocument10 pagesPrelim Exam ManuscriptJulie Mae Caling MalitPas encore d'évaluation

- MKT1612 - LAW102 - Nguyễn Quỳnh Nga 3Document4 pagesMKT1612 - LAW102 - Nguyễn Quỳnh Nga 3Quỳnh VânPas encore d'évaluation

- DuPont AnalysisDocument11 pagesDuPont AnalysisShashidhar dPas encore d'évaluation

- Mission StatementsDocument14 pagesMission StatementsSatyam DixitPas encore d'évaluation

- DMAS Financial Statement 31 Mar 2022Document82 pagesDMAS Financial Statement 31 Mar 2022Fendy HendrawanPas encore d'évaluation

- Trend Lines and PatternsDocument6 pagesTrend Lines and PatternsUpasara WulungPas encore d'évaluation

- Management Accounting Level 3/series 2 2008 (Code 3024)Document14 pagesManagement Accounting Level 3/series 2 2008 (Code 3024)Hein Linn Kyaw67% (3)

- Idterm XAM: Acct Pring Nstructor Peter HENDocument12 pagesIdterm XAM: Acct Pring Nstructor Peter HENbernicePas encore d'évaluation

- 150 Amazing US StartupsDocument96 pages150 Amazing US StartupsAnkit GuptaPas encore d'évaluation

- Manufacturing Accounts FormatDocument6 pagesManufacturing Accounts Formatkerwinm6894% (16)

- Entrepreneurial Finance 6th Edition Adelman Test BankDocument25 pagesEntrepreneurial Finance 6th Edition Adelman Test BankWilliamBeckymce100% (53)

- Struktur Organisasi GZ Kuta-BaliDocument1 pageStruktur Organisasi GZ Kuta-BalioxiPas encore d'évaluation

- Qs Documents 11010 Brand - Com and Marketplace in The Evolving Online Path To Purchase ReportDocument69 pagesQs Documents 11010 Brand - Com and Marketplace in The Evolving Online Path To Purchase ReportDhea AgistaPas encore d'évaluation

- Master of Business Administration: Submitted in Partial Fulfilment of The Requirements For The Award ofDocument54 pagesMaster of Business Administration: Submitted in Partial Fulfilment of The Requirements For The Award ofKannan CPas encore d'évaluation

- Adissalem Asefa FinalDocument55 pagesAdissalem Asefa FinalSteven Kisamo AmbrosePas encore d'évaluation

- TVML019234 PDFDocument2 pagesTVML019234 PDFSIDHARTH TiwariPas encore d'évaluation

- CHAPTER 1 The World of AccountingDocument12 pagesCHAPTER 1 The World of AccountingChona MarcosPas encore d'évaluation

- Audit Chapter 7 SlidesDocument46 pagesAudit Chapter 7 Slidessandra0104sPas encore d'évaluation

- Ist 3 ChaptersDocument19 pagesIst 3 Chaptersrkpreethi100% (1)

- Davis Langdon Africa Handbook Jan 2009Document94 pagesDavis Langdon Africa Handbook Jan 2009Caesar 'Dee' Rethabile SerumulaPas encore d'évaluation

- Presentation On HUL Wal-MartDocument31 pagesPresentation On HUL Wal-MartAmit GuptaPas encore d'évaluation

- Sony ProjectDocument12 pagesSony ProjectfkkfoxPas encore d'évaluation

- 10 SupplyDocument28 pages10 SupplySanjana ManchandaPas encore d'évaluation

- Tariff Petition MEPCO PDFDocument170 pagesTariff Petition MEPCO PDFahmed khanPas encore d'évaluation

- 601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEDocument5 pages601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEDomingo VillanuevaPas encore d'évaluation

- 22509-mcq-MAN-McQ 1Document13 pages22509-mcq-MAN-McQ 1RAVI kumar100% (2)

- Client Needs AssessmentDocument3 pagesClient Needs AssessmentNunoPas encore d'évaluation

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterD'EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterÉvaluation : 3.5 sur 5 étoiles3.5/5 (487)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedÉvaluation : 2.5 sur 5 étoiles2.5/5 (5)

- All The Beauty in the World: The Metropolitan Museum of Art and MeD'EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeÉvaluation : 4.5 sur 5 étoiles4.5/5 (83)

- System Error: Where Big Tech Went Wrong and How We Can RebootD'EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootPas encore d'évaluation

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeD'EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeÉvaluation : 4 sur 5 étoiles4/5 (88)

- The United States of Beer: A Freewheeling History of the All-American DrinkD'EverandThe United States of Beer: A Freewheeling History of the All-American DrinkÉvaluation : 4 sur 5 étoiles4/5 (7)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesD'EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseD'EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseÉvaluation : 3.5 sur 5 étoiles3.5/5 (12)

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewD'EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewÉvaluation : 4.5 sur 5 étoiles4.5/5 (26)

- AI Superpowers: China, Silicon Valley, and the New World OrderD'EverandAI Superpowers: China, Silicon Valley, and the New World OrderÉvaluation : 4.5 sur 5 étoiles4.5/5 (398)

- All You Need to Know About the Music Business: Eleventh EditionD'EverandAll You Need to Know About the Music Business: Eleventh EditionPas encore d'évaluation

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyD'EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyPas encore d'évaluation

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumD'EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumÉvaluation : 3 sur 5 étoiles3/5 (12)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerD'EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerÉvaluation : 4 sur 5 étoiles4/5 (121)

- All You Need to Know About the Music Business: 11th EditionD'EverandAll You Need to Know About the Music Business: 11th EditionPas encore d'évaluation

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomD'EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomPas encore d'évaluation

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsD'EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsÉvaluation : 4.5 sur 5 étoiles4.5/5 (10)

- The World's Most Dangerous Geek: And More True Hacking StoriesD'EverandThe World's Most Dangerous Geek: And More True Hacking StoriesÉvaluation : 4 sur 5 étoiles4/5 (49)

- Pit Bull: Lessons from Wall Street's Champion TraderD'EverandPit Bull: Lessons from Wall Street's Champion TraderÉvaluation : 4 sur 5 étoiles4/5 (17)

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportD'EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportPas encore d'évaluation