Académique Documents

Professionnel Documents

Culture Documents

Part A Answer ALL Questions.: Confidential AC/APR 2010/FAR360 2

Transféré par

Syazliana KasimDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Part A Answer ALL Questions.: Confidential AC/APR 2010/FAR360 2

Transféré par

Syazliana KasimDroits d'auteur :

Formats disponibles

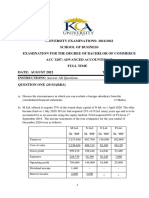

CONFIDENTIAL 2 AC/APR 2010/FAR360

PART A

Answer ALL questions.

1. The preparation of the financial statements involved the application of various accounting

concepts. Explain by giving one (1) example to each of the following accounting

concepts:

a) Materiality concept

b) Prudence concept

(6 marks)

2. Explain the differences between capital expenditure and revenue expenditure and

provide one (1) example for each type of expenditure.

(6 marks)

3. Cost-volume-profit (CVP) analysis is a technique which analyses cost behaviour to

assess the effect of different activity levels on costs, revenues and profits. In

particular, it will identify the activity level at which there is neither a profit nor a loss

(the breakeven activity level). Identify three (3) major assumptions inherent in the

CVP analysis.

(6 marks)

4. Activity-based costing (ABC) is a costing system which assigns costs based on activities

that drive costs rather than on the volume or number of units produced. Explain three

(3) potential benefits which might result from the introduction of ABC system.

(6 marks)

5. Capital budgeting techniques can be divided into two categories, namely the non-

discounted cash flow methods and discounted cash flow methods. One of the

methods under the discounted cash flow category is the net present value method.

Explain two (2) advantages and two (2) disadvantages of using net present value

method in the capital budgeting decision-making process.

(8 marks)

6. Discuss the situations where donation can be considered as approved donation in the

tax computation of a company.

(6 marks)

7. In the context of tax computation, explain how to find accounting profit from an adjusted

income.

(4 marks)

8. An auditor may apply various audit procedures to obtain audit evidences to support

his/her opinion on the financial statements. Explain any four (4) of audit procedures

that auditor may apply in doing so. For each procedure, provide one example of its

uses during the course of an audit.

(8 marks)

(Total: 50 marks)

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/APR 2010/FAR360

PART B

Answer ALL questions.

QUESTION 1

Terbilang Sdn Bhd is a medium-sized manufacturing company producing spare parts for a

national car manufacturer, Neutron Bhd. The company commenced its business in 2006.

The Income Statements and Balance Sheets of the company for the year ended 31

December 2008 and 2009 are as follows:

Terbilang Sdn Bhd

Balance Sheets as at 31 December

2009 2008

ASSETS RM'000 RM'000 RM'000 RM'000

Non-current assets

Property, Plant & Equipment 950 550

Intangibles 330 -

Current assets

Inventory 240 130

Receivables 202 90

Bank - 442 205 425

Total assets 1,722 975

EQUITY AND LIABILITIES

Equity

Ordinary Share Capital 600 550

Revaluation reserve 50 50

Retained earnings 188 100

Total equity 838 700

Liabilities

Non-current liabilities

Long term loans 420 80

Current liabilities

Bank Overdraft 197 -

Payables 187 145

Tax payable 80 464 50 195

Total equity and liabilities 1,722 975

Terbilang Sdn Bhd

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/APR 2010/FAR360

Income Statements for the year ended 31 December

2009 2008

RM'000 RM'000

Sales revenue 1,867 1,300

Cost of sales (940) (680)

Gross profit 927 620

Interest income 3 2

Administration costs (349) (223)

Distribution costs (185) (115)

Profit from operations 396 284

Finance costs (70) (25)

Profit before tax 326 259

Taxation (88) (58)

Profit for the year 238 201

Additional information

(i) Dividends declared and paid during the year ended 31 December 2009 were

RM150,000.

(ii) There were no amounts outstanding in respect of interest payable or receivable as at

31 December 2008 and 2009.

(iii) Total depreciation for the year 2009 was RM125,000. No disposal of assets during

the year ended 31 December 2009.

(iv) Bad debt written off during the year ended 31 December 2009 were RM50,000 due

to long outstanding of the debts.

(v) The company acquired additional loan facility from Mine Bank during the year ended

31 December 2009 amounting to RM400,000.

(vi) The only revaluation of non-current assets was of a piece of freehold land.

Required:

a) Prepare a Cash Flow Statement for Terbilang Sdn Bhd for the year ended 31 December

2009 in accordance with FRS 107 – Cash Flow Statements, using the indirect

method.

(20 marks)

b) Comment on the financial position of Terbilang Sdn Bhd as shown by the cash flow

statement you have prepared.

(5 marks)

c) Discuss three (3) benefits of preparing the Cash Flow Statement.

(3 marks)

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/APR 2010/FAR360

d) Calculate the following financial ratios for 2008 and 2009, which could be used to

analyse the financial performance and liquidity of Terbilang Sdn Bhd. State the

formula used in calculating the ratios.

i. Gross profit margin

ii. Current ratio

iii. Acid-test ratio

iv. Debtor’s collection period

v. Creditor’s days

vi. Return on capital employed

(9 marks)

e) Using the ratios you have calculated in part (d), comment on the performance and

liquidity of Terbilang Sdn Bhd.

(6 marks)

f) What additional information would be essential to help you to interpret the ratio and to

conclude the overall performance of Terbilang Sdn Bhd?

(3 marks)

g) Discuss two (2) limitations of financial ratio analysis.

(4 marks)

(Total: 50 marks)

END OF QUESTION PAPER

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

Vous aimerez peut-être aussi

- Part A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Syazliana KasimPas encore d'évaluation

- Part A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Document5 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Syazliana KasimPas encore d'évaluation

- P1 Auditing August 2020Document26 pagesP1 Auditing August 2020paul sagudaPas encore d'évaluation

- L5-BFE Assignment Guide 2023Document9 pagesL5-BFE Assignment Guide 2023himanshusharma9435Pas encore d'évaluation

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiPas encore d'évaluation

- BCC620 Business Financial Management Main (NOV) E1 21-22Document9 pagesBCC620 Business Financial Management Main (NOV) E1 21-22Rukshani RefaiPas encore d'évaluation

- MABALAZADocument4 pagesMABALAZAMahasa R HajiiPas encore d'évaluation

- Paper 19Document6 pagesPaper 19mohanraj parthasarathyPas encore d'évaluation

- BBA 311-Financial Management Set 1Document10 pagesBBA 311-Financial Management Set 1Innocent BwalyaPas encore d'évaluation

- AccntsDocument10 pagesAccntsLav RamgopalPas encore d'évaluation

- Assessment Instructions (PGBM01 22-23 Semester 1)Document7 pagesAssessment Instructions (PGBM01 22-23 Semester 1)Md. Real MiahPas encore d'évaluation

- Advanced Accounting 2eDocument3 pagesAdvanced Accounting 2eHarusiPas encore d'évaluation

- MMPC-004 Accounting For ManagersDocument4 pagesMMPC-004 Accounting For Managersbhavan pPas encore d'évaluation

- Accounting Grade 12 Test 1 Self-Study (Lockdown Period)Document5 pagesAccounting Grade 12 Test 1 Self-Study (Lockdown Period)pleasuremaome06Pas encore d'évaluation

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiPas encore d'évaluation

- Annual Report 2018 20191561456240Document144 pagesAnnual Report 2018 20191561456240hinbox7Pas encore d'évaluation

- FRSA Practice Questions For AssignmentDocument8 pagesFRSA Practice Questions For AssignmentSrikar WuppalaPas encore d'évaluation

- 2006 LCCI Level 3 (IAS) Series 2Document15 pages2006 LCCI Level 3 (IAS) Series 2rachelmakiyo100% (2)

- NR 310106 MepaDocument8 pagesNR 310106 MepaSrinivasa Rao GPas encore d'évaluation

- MSC F&A AFG 09101 Supplementary Examination 2023Document9 pagesMSC F&A AFG 09101 Supplementary Examination 2023Sebastian MlingwaPas encore d'évaluation

- December 2006 P4 QuestionDocument11 pagesDecember 2006 P4 QuestionKrishantha WeerasiriPas encore d'évaluation

- Advanced Financial Management (Singapore) : Thursday 4 June 2009Document13 pagesAdvanced Financial Management (Singapore) : Thursday 4 June 2009Lim CZPas encore d'évaluation

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwanePas encore d'évaluation

- Assignment For Finanacial Management IDocument12 pagesAssignment For Finanacial Management IHailu DemekePas encore d'évaluation

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedPas encore d'évaluation

- Vitrox q12008Document11 pagesVitrox q12008Dennis AngPas encore d'évaluation

- Aff - Ol 2 May'18 (E)Document8 pagesAff - Ol 2 May'18 (E)Shahid MahmudPas encore d'évaluation

- BFC 3225 Intermediate Accounting I - 5Document4 pagesBFC 3225 Intermediate Accounting I - 5karashinokov siwoPas encore d'évaluation

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviPas encore d'évaluation

- CHB Mar19 PDFDocument14 pagesCHB Mar19 PDFSajeetha MadhavanPas encore d'évaluation

- Afm 2810001 May 2018Document4 pagesAfm 2810001 May 2018PILLO PATELPas encore d'évaluation

- 4 Investment Property Financial StatementsDocument30 pages4 Investment Property Financial Statementssoarpsy100% (3)

- Account Must Do List For May 2021Document129 pagesAccount Must Do List For May 2021Akshay PatilPas encore d'évaluation

- Arid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherDocument3 pagesArid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherDeadPool Pool100% (1)

- IAS 38 - Intangible Assets Question BankDocument37 pagesIAS 38 - Intangible Assets Question Bankcouragemutamba3Pas encore d'évaluation

- Valuation of Intangible AssetsDocument23 pagesValuation of Intangible AssetsGaurav KumarPas encore d'évaluation

- Financial Statement Anaysis-Cat1 - 2Document16 pagesFinancial Statement Anaysis-Cat1 - 2cyrusPas encore d'évaluation

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340Pas encore d'évaluation

- Ac PaperDocument6 pagesAc PaperAshwini SakpalPas encore d'évaluation

- Bacc 237 Assignment Two (Multiple Choice)Document10 pagesBacc 237 Assignment Two (Multiple Choice)TarusengaPas encore d'évaluation

- MSA 1 February 2023Document15 pagesMSA 1 February 2023muhammadaligt1Pas encore d'évaluation

- Tutorial 12 Performance MeasurementDocument4 pagesTutorial 12 Performance MeasurementEsther LuehPas encore d'évaluation

- As GR 1 Ipcc Compiler 2015-18Document24 pagesAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOIPas encore d'évaluation

- Accounting Level 3/series 2 2008 (Code 3001)Document16 pagesAccounting Level 3/series 2 2008 (Code 3001)Hein Linn Kyaw67% (3)

- Attempt All Questions From PART-I and Any Two From Part-IiDocument23 pagesAttempt All Questions From PART-I and Any Two From Part-IiMalik AwaisPas encore d'évaluation

- Tutorial Questions - Trimester - 2210.Document26 pagesTutorial Questions - Trimester - 2210.premsuwaatiiPas encore d'évaluation

- This Assessment Is in Three Parts, Please Answer All ElementsDocument5 pagesThis Assessment Is in Three Parts, Please Answer All ElementsAyesha SheheryarPas encore d'évaluation

- McomDocument302 pagesMcommostfaPas encore d'évaluation

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeonePas encore d'évaluation

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GPas encore d'évaluation

- Financial Accounting BBAW 2103Document26 pagesFinancial Accounting BBAW 2103VignashPas encore d'évaluation

- Accounting IAS (Malaysia) Model Answers Series 2 2005 Old SyllabusDocument20 pagesAccounting IAS (Malaysia) Model Answers Series 2 2005 Old SyllabusAung Zaw HtwePas encore d'évaluation

- Heriot-Watt University Accounting - June 2016 Section II Case Studies Case Study 1Document5 pagesHeriot-Watt University Accounting - June 2016 Section II Case Studies Case Study 1sanosyPas encore d'évaluation

- 1.a. Divisional Performance Revision Questions ROI V RIDocument3 pages1.a. Divisional Performance Revision Questions ROI V RIK Lam LamPas encore d'évaluation

- Part A': Winter Exam-2013Document29 pagesPart A': Winter Exam-2013fareha riazPas encore d'évaluation

- Icma.: PakistanDocument3 pagesIcma.: Pakistangfxexpert36Pas encore d'évaluation

- 12 - Advanced Corporate Reporting For Strategic BusinessDocument3 pages12 - Advanced Corporate Reporting For Strategic BusinessFatima FXPas encore d'évaluation

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- Schaum's Outline of Principles of Accounting I, Fifth EditionD'EverandSchaum's Outline of Principles of Accounting I, Fifth EditionÉvaluation : 5 sur 5 étoiles5/5 (3)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Tut Solution FA - CombineDocument10 pagesTut Solution FA - CombineSyazliana KasimPas encore d'évaluation

- (Incorporated in Malaysia) : Company No.: XXXXXXDocument6 pages(Incorporated in Malaysia) : Company No.: XXXXXXSyazliana KasimPas encore d'évaluation

- 2 Solution Audit COMBINEDocument10 pages2 Solution Audit COMBINESyazliana KasimPas encore d'évaluation

- Amendment 1 To The Case StudyDocument2 pagesAmendment 1 To The Case StudySyazliana KasimPas encore d'évaluation

- Tut Tax Solution - CombineDocument5 pagesTut Tax Solution - CombineSyazliana KasimPas encore d'évaluation

- D4 Audit Working PaperDocument5 pagesD4 Audit Working PaperSyazliana KasimPas encore d'évaluation

- Template D1D2Document1 pageTemplate D1D2kamarul861Pas encore d'évaluation

- Case Study FAR 360 20.06Document22 pagesCase Study FAR 360 20.06Syazliana KasimPas encore d'évaluation

- 2 Solution Audit COMBINEDocument10 pages2 Solution Audit COMBINESyazliana KasimPas encore d'évaluation

- Template D6Document3 pagesTemplate D6kamarul861Pas encore d'évaluation

- Template D6Document19 pagesTemplate D6Syazliana KasimPas encore d'évaluation

- FAR360 (Apr09) - Q & ADocument14 pagesFAR360 (Apr09) - Q & ASyazliana KasimPas encore d'évaluation

- Cover Case Study Far 360 Sept 2011Document1 pageCover Case Study Far 360 Sept 2011Syazliana KasimPas encore d'évaluation

- Client Balance Date Nature of WPDocument6 pagesClient Balance Date Nature of WPSyazliana KasimPas encore d'évaluation

- Far360 Case Study April 2011Document25 pagesFar360 Case Study April 2011Syazliana KasimPas encore d'évaluation

- Template D1D2Document1 pageTemplate D1D2kamarul861Pas encore d'évaluation

- Prepared By: Syazliana Hj. Kasim Kamaruzzaman Muhammad Faculty of Accountancy Uitm Shah AlamDocument61 pagesPrepared By: Syazliana Hj. Kasim Kamaruzzaman Muhammad Faculty of Accountancy Uitm Shah AlamSyazliana KasimPas encore d'évaluation

- Tutorial On AuditingDocument6 pagesTutorial On AuditingSyazliana KasimPas encore d'évaluation

- 5 - AuditingDocument101 pages5 - AuditingSyazliana KasimPas encore d'évaluation

- Part A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Syazliana KasimPas encore d'évaluation

- Activity-Based CostingDocument11 pagesActivity-Based CostingSyazliana KasimPas encore d'évaluation

- Far 360 Case Study April 2011 AppendicesDocument6 pagesFar 360 Case Study April 2011 AppendicesSyazliana KasimPas encore d'évaluation

- Tutorial Questions On Financial Ratio AnalysisDocument9 pagesTutorial Questions On Financial Ratio AnalysisSyazliana Kasim100% (9)

- Module 1 - Management AccountingDocument153 pagesModule 1 - Management AccountingNina KasimPas encore d'évaluation

- Module 2 - Financial ManagementDocument30 pagesModule 2 - Financial ManagementSyazliana KasimPas encore d'évaluation

- Module 1 - Management AccountingDocument153 pagesModule 1 - Management AccountingNina KasimPas encore d'évaluation

- Module 1 - Management AccountingDocument153 pagesModule 1 - Management AccountingNina KasimPas encore d'évaluation

- Zendiggi Kebab House MenuDocument2 pagesZendiggi Kebab House MenukatayebPas encore d'évaluation

- Industrial Visit Report of Surya NepalDocument24 pagesIndustrial Visit Report of Surya NepalSuman Poudel0% (1)

- Swot Analysis - DHA 1Document15 pagesSwot Analysis - DHA 1Laxmi PriyaPas encore d'évaluation

- McDonalds' Trademark RegistrationsDocument10 pagesMcDonalds' Trademark RegistrationsDaniel BallardPas encore d'évaluation

- EC2101 Practice Problems 9 SolutionDocument4 pagesEC2101 Practice Problems 9 Solutiongravity_corePas encore d'évaluation

- Verb Tense Exercise 5 8Document8 pagesVerb Tense Exercise 5 8Delia CatrinaPas encore d'évaluation

- Entrepreneurship EXAM AugDocument3 pagesEntrepreneurship EXAM AugBJ ShPas encore d'évaluation

- Kopie Van The Lazy Goldmaker's Jewelcrafting SpreadsheetDocument14 pagesKopie Van The Lazy Goldmaker's Jewelcrafting SpreadsheetAnonymous 7jb17EQPPas encore d'évaluation

- Week 4-1 Types of MAJOR AccountsDocument2 pagesWeek 4-1 Types of MAJOR AccountsSelenaPas encore d'évaluation

- Lesson - 1.1 - Six Sigma and Organizational GoalsDocument70 pagesLesson - 1.1 - Six Sigma and Organizational Goalsvineesh priyanPas encore d'évaluation

- BCG Matrix, Ansoff Matrix & GE Matrix: Marketing ManagementDocument26 pagesBCG Matrix, Ansoff Matrix & GE Matrix: Marketing ManagementTerjani Khanna GoyalPas encore d'évaluation

- F18, H24 Parts CatalogDocument299 pagesF18, H24 Parts CatalogKLE100% (6)

- UNITED - Flight World MapDocument1 pageUNITED - Flight World MaparquitrolPas encore d'évaluation

- ECE 240 - Project1-CMOS InverterDocument7 pagesECE 240 - Project1-CMOS InverterAbhishek Sthanik GubbiPas encore d'évaluation

- Pmo Framework and Pmo Models For Project Business ManagementDocument22 pagesPmo Framework and Pmo Models For Project Business Managementupendras100% (1)

- Chapter 15: Equity Portfolio Management Strategies: Analysis of Investments Management of PortfoliosDocument33 pagesChapter 15: Equity Portfolio Management Strategies: Analysis of Investments Management of PortfoliosKavithra KalimuthuPas encore d'évaluation

- Portfolio AnalysisDocument36 pagesPortfolio Analysissalman200867100% (2)

- Main Paper EC-306Document2 pagesMain Paper EC-306Sachin PalPas encore d'évaluation

- Eess Alumini 2Document11 pagesEess Alumini 2mohammed.irfan@newprojectdeals.comPas encore d'évaluation

- Placard IngDocument3 pagesPlacard IngNaresh LalwaniPas encore d'évaluation

- Finman - Q2 Cost Os CaptDocument2 pagesFinman - Q2 Cost Os CaptJennifer RasonabePas encore d'évaluation

- Book On Marine InsuranceDocument64 pagesBook On Marine InsurancenipundaPas encore d'évaluation

- HDR and Poverty IndexDocument9 pagesHDR and Poverty IndexSumit SinghPas encore d'évaluation

- Eurocode 2 1992 PDFDocument2 pagesEurocode 2 1992 PDFMarcus0% (1)

- Fisa Stocuri - Bar 04.04.2012Document3 pagesFisa Stocuri - Bar 04.04.2012Georgiana FintoiuPas encore d'évaluation

- National Sales Account Manager in Cincinnati OH Resume Robert TeetsDocument2 pagesNational Sales Account Manager in Cincinnati OH Resume Robert TeetsRobertTeetsPas encore d'évaluation

- Country RiskDocument3 pagesCountry RiskBet TranPas encore d'évaluation

- Barringer E3 TB 06 PDFDocument17 pagesBarringer E3 TB 06 PDFXiAo LengPas encore d'évaluation

- C1 Entrepreneurship ModuleDocument19 pagesC1 Entrepreneurship ModuleLENA ELINNA OLIN BINTI AMBROSEPas encore d'évaluation

- Images Janatics Brief ProfileDocument18 pagesImages Janatics Brief ProfileHarsha KolarPas encore d'évaluation