Académique Documents

Professionnel Documents

Culture Documents

Part A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2

Transféré par

Syazliana KasimDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Part A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2

Transféré par

Syazliana KasimDroits d'auteur :

Formats disponibles

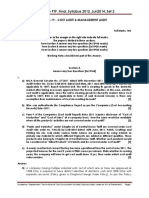

CONFIDENTIAL 2 AC/OCT 2010/FAR360

PART A

Answer ALL questions.

1. Accountancy is the art of communicating financial information about a business entity

to users. The communication is generally, in the form of financial statements which

includes five (5) statements.

Required:

a) State and describe any FOUR (4) of the statements.

(8 marks)

b) Explain the following FOUR (4) accounting principles that need to be followed when

presenting financial statements in accordance to Financial Reporting Standards

(FRS) 101 Presentation of Financial Statements:

• Going concern

• Consistency

• Accrual basis

• Materiality

(8 marks)

2. Payback period and net present value (NPV) are among the common techniques that

are used for capital budgeting. Discuss each of these techniques.

(6 marks)

3. Management accountant must be able to justify any kind of cost as either direct or

indirect. Distinguish between direct and indirect cost. Please provide TWO (2)

examples of each cost.

(4 marks)

4. Break-even analysis or cost volume profit relationship as it is also known is

concerned with relationships between cost, volume and profit. Briefly explain FOUR

(4) uses of break-even analysis.

(4 marks)

5. MIA By-Laws (on professional ethics, conduct and practice) provides a set of

principles and rules that offer guidance to the members. Explain the following

fundamental principles stipulated under the by-laws:

a. Professional competence and due care

(4 marks)

b. Confidentiality

(4 marks)

6. Financial analysis is the assessment of a firm’s past, present and anticipated future

financial performance that is made based on the firm’s financial statements. Explain

THREE (3) purposes of analyzing the financial statements.

(3 marks)

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/OCT 2010/FAR360

7. Under self assessment system, companies are required to furnish an estimate of

income tax payable for a year of assessment (YA) in a prescribed form (CP 204) not

later than 30 days before the beginning of the basis period. Briefly explain the penalty

to be imposed by Inland Revenue Board for underestimation of income tax payable.

Determine the timing for the submission of the tax return form.

(5 marks)

8. Double deduction refers to expenses incurred that are given twice deduction in

calculating income tax expense of a company. State TWO (2) conditions that a

company needs to fulfill in order to obtain this relief? Provide TWO (2) examples of

expenses qualified for double deduction.

(4 marks)

(Total: 50 marks)

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

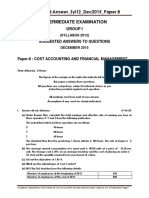

CONFIDENTIAL 4 AC/OCT 2010/FAR360

PART B

QUESTION 1

Sejiwa Sdn Bhd is a newly established company which concentrates in producing two types

of television models TV-52 and TD-54. The company was incorporated in early 2009 and is

currently operating from its permanent premise located in Oakland, Seremban. The

company has two production cost centers (Department A and B) and one service cost center

(Department S) in its factory.

Encik Lokman, Chief Executive Officer (CEO) was so excited to know the actual

performance of the company. The list of account balances of the company for the year

ended 31 December 2009 are as follows:

RM

Plant and machinery at cost 250,000

Motor vehicles at cost 75,000

Sales 1,006,170

Direct factory wages 90,000

Raw material purchased 480,000

Light and power 95,000

Rent and insurance 85,000

Indirect factory wages 20,000

Machinery repairs 30,000

Motor vehicles expenses 35,000

Administration expenses 10,000

Administrative salaries 50,000

Sales and distributions staff salaries 15,000

Share capital 3,500,000

Account receivables 160,000

Account payables 270,000

Bank 100,950

The following are the additional information for the above balances:

1. The closing inventory as at 31 December 2009 for raw materials is RM30,000, work

in progress is RM40,000 and no finished good in hand.

2. It is the policy of the company to depreciate its assets using the straight line method.

The company estimates the plant and machinery and motor vehicles will be used in the

business for 10 years and 5 years respectively. Both of the assets have no residual

values.

3. Insurance paid during the year amounted to RM50,000 which is included in the rent

and insurance account. This payment is for one year’s premium beginning 1 April 2009.

4. 30% of depreciation of motor vehicles and motor vehicle expenses and three quarter

of expenses for light and power, rent and insurance will be charged to factory.

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/OCT 2010/FAR360

5. Goods manufactured during the year are to be transferred from the factory to income

statement at cost plus 10% mark-up.

Required:

a) As an accountant of the company, you are required to prepare the manufacturing

account and income statement of the company for the year ended 31 December 2009.

(16 marks)

b) In addition to question 1(a), Encik Lokman is also concerned about the sales of the

products and his target to achieve 10% of the market share within the television

industry. He would like to know the detail information about the costs of the products.

This will help him to make better decision whether the company sells its products at

accurate price in order to attract more customers.

Sejiwa Sdn Bhd calculates the departmental predetermined overhead absorption rate

for each of its production cost centers on the basis of budgeted machine hours.

According to the production manager, the budgeted machine hours was used because

the company highly depends on machine to manufacture the products. The budgeted

production overhead data for the year 2009 is as follows:

Department A Department B Department S

Allocated costs RM105,000 RM115,000 RM80,000

Reapportioned costs RM52,000 RM28,000 (RM80,000)

Machine hours 21,750 hours 15,250 hours

Direct labour hours 7,700 hours 37,300 hours

The following information is also related to the production of TV-52 and TD-54:

TV-52 TD-54

Prime costs RM 85 RM 150

Machine hours:

Department A 5 hours 8 hours

Department B 2 hours 6 hours

Profit mark-up 25% from production cost 25% from production cost

However, En. Remy, the finance manager, believes that the company’s current product

costing system produces misleading costs information. He argues that the company has

over and under estimated its product cost for TV-52 and TD-54 respectively. He

suggests to use the activity based costing system to allocate the overhead cost into

product cost as an alternative method. The following cost pools and cost drivers are

established:

Cost pools Cost drivers RM .

Order processing No. of order processed 30,250

Machine processing Machine hours worked 210,000

Product inspection Inspection hours 59,750

300,000

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/OCT 2010/FAR360

Data relevant to these activities are as follows:

Products Total units No. of cost driver volume consumed

produced 2009 Orders Machine Inspection

processed hours worked hours

TV-52 5,000 350 35,000 10,000

TD-54 500 200 7,000 15,000

Required:

i. Calculate the overhead absorption rate for each production cost center for the

period using the company’s current policy. (Answers to be rounded to two

decimal places in RM)

(2 marks)

ii. Calculate the unit selling price for both TV-52 and TD-54 using traditional costing

system and activity based costing system (show all working).

(13 marks)

iii. Advice Encik Lokman on how the company’s traditional costing system distorts

product costs and selling prices.

(5 marks)

c) Yusof Kadir & Co. Chartered Accountants has been approached by the management

of Sejiwa Sdn Bhd to become the company’s external auditor.

Required:

i. Discuss briefly the procedures to be carried out by the auditor prior to accepting

the appointment.

(5 marks)

ii. Discuss the main contents of an engagement letter.

(6 marks)

iii. State three (3) reasons why the auditor should properly plan an engagement?

(3 marks)

(Total: 50 marks)

END OF QUESTION PAPER

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

Vous aimerez peut-être aussi

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- Unit 5-People Should Manage Nature-Ts-Planning Guide-Grade 5Document1 pageUnit 5-People Should Manage Nature-Ts-Planning Guide-Grade 5api-457240136Pas encore d'évaluation

- Cost Accounting Past PapersDocument66 pagesCost Accounting Past Paperssalamankhana100% (2)

- Ssg-Ng01012401-Gen-Aa-5880-00012 - C01 - Ssags Nigerian Content PlanDocument24 pagesSsg-Ng01012401-Gen-Aa-5880-00012 - C01 - Ssags Nigerian Content PlanStroom Limited100% (2)

- A Study of the Supply Chain and Financial Parameters of a Small BusinessD'EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- D4 Audit Working PaperDocument5 pagesD4 Audit Working PaperSyazliana KasimPas encore d'évaluation

- Chirimuuta, Mazviita - Outside Color - Perceptual Science and The Puzzle of Color in Philosophy-The MIT Press (2017)Document263 pagesChirimuuta, Mazviita - Outside Color - Perceptual Science and The Puzzle of Color in Philosophy-The MIT Press (2017)Karishma borgohainPas encore d'évaluation

- AS Film Production Lesson.Document13 pagesAS Film Production Lesson.MsCowanPas encore d'évaluation

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- Tutorial Questions On Financial Ratio AnalysisDocument9 pagesTutorial Questions On Financial Ratio AnalysisSyazliana Kasim100% (9)

- Mitsubishi IC Pneumatic Forklift PDFDocument5 pagesMitsubishi IC Pneumatic Forklift PDFfdpc1987Pas encore d'évaluation

- Performance Task 1st Quarter Poetry Writing WorkshopDocument3 pagesPerformance Task 1st Quarter Poetry Writing WorkshopNicole john ZuluetaPas encore d'évaluation

- Webinar WinCC SCADA NL 29052018Document62 pagesWebinar WinCC SCADA NL 29052018AlexPas encore d'évaluation

- Part A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Syazliana KasimPas encore d'évaluation

- MCO-05 ENG IgnouDocument51 pagesMCO-05 ENG Ignousanthi0% (1)

- Part A Answer ALL Questions.: Confidential AC/APR 2010/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/APR 2010/FAR360 2Syazliana KasimPas encore d'évaluation

- Part A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Syazliana KasimPas encore d'évaluation

- CIMA - P2 - Performance Management - Specimen Papers - Qs - Nov - 2009Document16 pagesCIMA - P2 - Performance Management - Specimen Papers - Qs - Nov - 2009e_NomadPas encore d'évaluation

- (4870) - 2002 M.B.A. 202: Financial Management (CBCS) (2013 Pattern) (Semester - II)Document5 pages(4870) - 2002 M.B.A. 202: Financial Management (CBCS) (2013 Pattern) (Semester - II)AK Aru ShettyPas encore d'évaluation

- FAR360 (Apr09) - Q & ADocument14 pagesFAR360 (Apr09) - Q & ASyazliana KasimPas encore d'évaluation

- Tutorial Questions FMF June 2022 Tutorial 3 B - 6Document12 pagesTutorial Questions FMF June 2022 Tutorial 3 B - 6Clarinda LeePas encore d'évaluation

- AFIN210-D-1-2020-1 - Costing PDFDocument5 pagesAFIN210-D-1-2020-1 - Costing PDFnathan0% (1)

- Paper 19Document6 pagesPaper 19mohanraj parthasarathyPas encore d'évaluation

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93Pas encore d'évaluation

- Issues in Management Accounting Bac 4407Document6 pagesIssues in Management Accounting Bac 4407Rugeyye RashidPas encore d'évaluation

- Sri Sairam Institute of Management Studies Chennai - 44Document4 pagesSri Sairam Institute of Management Studies Chennai - 44Anbarasu KrishnanPas encore d'évaluation

- Bchcr410 CIADocument4 pagesBchcr410 CIA15Nabil ImtiazPas encore d'évaluation

- 2014 December Management Accounting L2Document17 pages2014 December Management Accounting L2Dixie CheeloPas encore d'évaluation

- K00200 - 20211027174042 - Group Assignment Paf3113 A211Document5 pagesK00200 - 20211027174042 - Group Assignment Paf3113 A211huuuuuuuaaaaaaaPas encore d'évaluation

- Managerial Finance: Professional 1 Examination - April 2019Document21 pagesManagerial Finance: Professional 1 Examination - April 2019MahediPas encore d'évaluation

- First Time Login Guide MsDocument6 pagesFirst Time Login Guide MskonosubaPas encore d'évaluation

- Siddharth Education Services LTD: Tel:2443455 TelDocument3 pagesSiddharth Education Services LTD: Tel:2443455 TelBasanta K SahuPas encore d'évaluation

- Past Papers ValuationDocument472 pagesPast Papers ValuationakshathmahajanPas encore d'évaluation

- Management Accounting: Formation 2 Examination - August 2007Document19 pagesManagement Accounting: Formation 2 Examination - August 2007Chansa KapambwePas encore d'évaluation

- Tutorial PMS - Financial Question PDFDocument4 pagesTutorial PMS - Financial Question PDFCode PutraPas encore d'évaluation

- Output PDFDocument81 pagesOutput PDFPravin ThoratPas encore d'évaluation

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaPas encore d'évaluation

- Solution 19Document19 pagesSolution 19Vaihnavi ChauhanPas encore d'évaluation

- P7mys 2007 Dec Q 3Document8 pagesP7mys 2007 Dec Q 3ThomasPas encore d'évaluation

- 256 - MCO-5 - ENG D18 - CompressedDocument3 pages256 - MCO-5 - ENG D18 - CompressedTushar SharmaPas encore d'évaluation

- SA Syl12 Jun2014 P10 PDFDocument21 pagesSA Syl12 Jun2014 P10 PDFpatil_viny1760Pas encore d'évaluation

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)gulzar ahmadPas encore d'évaluation

- Managerial Acc QnaireDocument5 pagesManagerial Acc QnaireMutai JoseahPas encore d'évaluation

- 2.4 Dec 04 - QDocument9 pages2.4 Dec 04 - Qomarkhalid3000Pas encore d'évaluation

- Maf151 July 2021Document9 pagesMaf151 July 2021FATIN BATRISYIA MOHD FAZILPas encore d'évaluation

- Aff - Ol 2 May'18 (E)Document8 pagesAff - Ol 2 May'18 (E)Shahid MahmudPas encore d'évaluation

- BBA 311-Financial Management Set 1Document10 pagesBBA 311-Financial Management Set 1Innocent BwalyaPas encore d'évaluation

- FM 02Document3 pagesFM 02Sudhan RPas encore d'évaluation

- Time: 3 Hours Maximum Marks: 100 Note: Attempt Any Five Questions. All Questions Carry Equal Marks. Use of Calculators Is AllowedDocument4 pagesTime: 3 Hours Maximum Marks: 100 Note: Attempt Any Five Questions. All Questions Carry Equal Marks. Use of Calculators Is AllowedashishvasekarPas encore d'évaluation

- Tut 11Document4 pagesTut 11Tang TammyPas encore d'évaluation

- Model Paper-I: Sri Balaji Society PGDM (Finance) Ii Semester Examination BATCH: 2010 - 2012Document10 pagesModel Paper-I: Sri Balaji Society PGDM (Finance) Ii Semester Examination BATCH: 2010 - 2012kalpitgupta786Pas encore d'évaluation

- Wef2012 Pilot MAFDocument9 pagesWef2012 Pilot MAFdileepank14Pas encore d'évaluation

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotPas encore d'évaluation

- Tutorial 3 Activity Based Costing QDocument6 pagesTutorial 3 Activity Based Costing QnurathirahPas encore d'évaluation

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8Document15 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8JOLLYPas encore d'évaluation

- p1 Question June 2018Document5 pagesp1 Question June 2018S.M.A AwalPas encore d'évaluation

- Afin317 FPD 1 2020 1Document8 pagesAfin317 FPD 1 2020 1Daniel Daka100% (1)

- Tutorial - FMA - Activity 4Document5 pagesTutorial - FMA - Activity 4Anonymous cdbGe8bFJoPas encore d'évaluation

- Advanced Management Accounting RTPDocument25 pagesAdvanced Management Accounting RTPSamir Raihan ChowdhuryPas encore d'évaluation

- FMA Assgnments - EX 2022Document12 pagesFMA Assgnments - EX 2022Natnael BelayPas encore d'évaluation

- Ac5011 Ma Tca QuestionsDocument14 pagesAc5011 Ma Tca QuestionsyinlengPas encore d'évaluation

- CT Maf251 - April 2023 - QDocument4 pagesCT Maf251 - April 2023 - Q2022890872Pas encore d'évaluation

- 05 s601 SFM PDFDocument4 pages05 s601 SFM PDFMuhammad Zahid FaridPas encore d'évaluation

- Every Sheet of Answers Should Bear Your Roll NoDocument5 pagesEvery Sheet of Answers Should Bear Your Roll NoKushalPas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerRahul AgrawalPas encore d'évaluation

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalPas encore d'évaluation

- Last MCSDocument7 pagesLast MCSNikhil KhobragadePas encore d'évaluation

- Paper - 3: Cost and Management Accounting Questions Material CostDocument33 pagesPaper - 3: Cost and Management Accounting Questions Material CostEFRETPas encore d'évaluation

- (Incorporated in Malaysia) : Company No.: XXXXXXDocument6 pages(Incorporated in Malaysia) : Company No.: XXXXXXSyazliana KasimPas encore d'évaluation

- Tut Tax Solution - CombineDocument5 pagesTut Tax Solution - CombineSyazliana KasimPas encore d'évaluation

- Tut Solution FA - CombineDocument10 pagesTut Solution FA - CombineSyazliana KasimPas encore d'évaluation

- 2 Solution Audit COMBINEDocument10 pages2 Solution Audit COMBINESyazliana KasimPas encore d'évaluation

- Client Balance Date Nature of WPDocument6 pagesClient Balance Date Nature of WPSyazliana KasimPas encore d'évaluation

- 5 - AuditingDocument101 pages5 - AuditingSyazliana KasimPas encore d'évaluation

- Prepared By: Syazliana Hj. Kasim Kamaruzzaman Muhammad Faculty of Accountancy Uitm Shah AlamDocument61 pagesPrepared By: Syazliana Hj. Kasim Kamaruzzaman Muhammad Faculty of Accountancy Uitm Shah AlamSyazliana KasimPas encore d'évaluation

- Revision Questions On Management AccountingDocument15 pagesRevision Questions On Management AccountingSyazliana Kasim100% (1)

- Tutorial On AuditingDocument6 pagesTutorial On AuditingSyazliana KasimPas encore d'évaluation

- FAR360 (Apr09) - Q & ADocument14 pagesFAR360 (Apr09) - Q & ASyazliana KasimPas encore d'évaluation

- The Business Environment and Accounting Information SystemsDocument25 pagesThe Business Environment and Accounting Information SystemsSyazliana Kasim100% (1)

- Module 2 - Financial ManagementDocument30 pagesModule 2 - Financial ManagementSyazliana KasimPas encore d'évaluation

- (Application Transfer Manual Volume: Be The CadreDocument2 pages(Application Transfer Manual Volume: Be The CadreVishnu MuralidharanPas encore d'évaluation

- Fundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFDocument68 pagesFundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFbrainykabassoullw100% (10)

- Bike LanesDocument12 pagesBike LanesChitikala RajeshPas encore d'évaluation

- 3 - 0 - D Copia403mfen 404mfen Smy113840 1Document253 pages3 - 0 - D Copia403mfen 404mfen Smy113840 1Serge MaciaPas encore d'évaluation

- The Normal DistributionDocument9 pagesThe Normal DistributionElfren BulongPas encore d'évaluation

- ATMPP Diabetes Change and Review Proposal Npa 2012-18Document8 pagesATMPP Diabetes Change and Review Proposal Npa 2012-18Juha TamminenPas encore d'évaluation

- CV (Martin A Johnson)Document7 pagesCV (Martin A Johnson)kganesanPas encore d'évaluation

- 2022+ACCF+111+Class+test+2 Moderated+versionDocument8 pages2022+ACCF+111+Class+test+2 Moderated+versionLucas LuluPas encore d'évaluation

- Legal Aspects of Construction Ethics PaperDocument11 pagesLegal Aspects of Construction Ethics PaperbikaresPas encore d'évaluation

- Application of Geosynthetics in Pavement DesignDocument7 pagesApplication of Geosynthetics in Pavement DesignAnonymous kw8Yrp0R5rPas encore d'évaluation

- Planting Guide For Rice 1. Planning and BudgetingDocument4 pagesPlanting Guide For Rice 1. Planning and BudgetingBraiden ZachPas encore d'évaluation

- Sacramento County Compensation Survey Board of SupervisorsDocument13 pagesSacramento County Compensation Survey Board of SupervisorsCBS13Pas encore d'évaluation

- Capital BudgetingDocument24 pagesCapital BudgetingHassaan NasirPas encore d'évaluation

- Hotplate Stirrer PDFDocument1 pageHotplate Stirrer PDFKuljinder VirdiPas encore d'évaluation

- Concept PaperDocument4 pagesConcept Paperjanet a. silosPas encore d'évaluation

- National Industrial Policy 2010 (Bangla)Document46 pagesNational Industrial Policy 2010 (Bangla)Md.Abdulla All Shafi0% (1)

- Analog Digital Thermopile Application Note PDFDocument18 pagesAnalog Digital Thermopile Application Note PDFGopal HegdePas encore d'évaluation

- Creating A Pathway For Every Student: Holyoke High School Redesign Strategic PlanDocument29 pagesCreating A Pathway For Every Student: Holyoke High School Redesign Strategic PlanMike PlaisancePas encore d'évaluation

- Definite NessDocument398 pagesDefinite NessKbraPas encore d'évaluation

- The Impact of Teaching PracticeDocument14 pagesThe Impact of Teaching PracticemubarakPas encore d'évaluation

- Checkpoints Before Transformer InstallationDocument3 pagesCheckpoints Before Transformer InstallationBeaBustosPas encore d'évaluation

- Lazard Levelized Cost of Storage v20Document46 pagesLazard Levelized Cost of Storage v20macPas encore d'évaluation

- Etm API 600 Trim MaterialDocument1 pageEtm API 600 Trim Materialmayukhguhanita2010Pas encore d'évaluation