Académique Documents

Professionnel Documents

Culture Documents

EBLSL Daily Market Update - 20th July 2020

Transféré par

Moheuddin SehabTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EBLSL Daily Market Update - 20th July 2020

Transféré par

Moheuddin SehabDroits d'auteur :

Formats disponibles

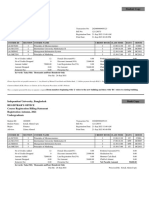

DAILY MARKET REVIEW

Monday, July 20, 2020

TODAY'S MARKET COMMENTARY

DSEX, the prime index at the Dhaka Stock Exchange witnessed positive trend and went up by 19.50 points or 0.48 percent and settled at 4,070.15 points at the end of the today’s trading session. The

core index remained upward throughout the session with some volatility at the begining as investors kept on taking fresh positions at lowest possible prices following current floor price system and

growing optimism from ongoing earnings declarations. Investors have regained their confidence as economy is showing slower state of recovery evoke from remittance hitting $1.36 billion in the first

two weeks of July after the downward trend and marginal improvement in banks' interest rate spread. However, investors’ attention were mostly concentrated on Bank (24.68%), General Insurance

(20.42%) and Pharmaceuticals & Chemicals (17.62%) sectors. ISLAMIBANK topped the scrip-wise turnover board and contributed 13.17% of the total. Most of the sectors exhibited price appreciation

today. Among all the sectors General Insurance (4.3%), Life Insurance (2.6%) and IT (1.3%) sectors showed highest price appreciation in today’s session while only Food & Allied (-0.2%) sector showed

price correction in today’s session. Out of 333 issues traded, 113 issues advanced, 17 issues declined and 203 issues remain unchanged.

The port city's bourse, Chittagong Stock Exchange also registered upward trend at the end of the session. The selected index, CSCX and CASPI increased by 37.5 and 62.3 points respectively.

DAY'S SECTOR MOVEMENT DSE MARKET SUMMARY

Sector Return Turnover (mn) % Turnover M.Cap (mn) % of M.Cap P/E (x) P/NAV (x) Today Yday Change %

Bank 0.0% 592.0 24.7% 458,386 17.5% 6.0 0.6 DSEX 4,070 4,051 19.50 0.48%

Cement 0.0% 0.8 0.0% 71,888 2.7% 22.1 1.8 DS30 1,365 1,357 8.04 0.59%

Ceramics 0.0% 3.2 0.1% 19,761 0.8% 27.0 1.3 DSES 944 939 5.06 0.54%

Engineering 0.3% 122.6 5.1% 132,995 5.1% 16.0 0.9 Market Cap (BDT bn) 3,163 3,151 11.66 0.37%

Financial Institutions 0.5% 42.9 1.8% 126,418 4.8% 21.0 2.5 Turnover (BDT mn) 2,405 2,344 60.3 2.6%

Food & Allied -0.2% 81.4 3.4% 208,969 8.0% 14.0 4.4 Volume (mn) 84 77 6.9 9%

Fuel & Power 0.4% 111.5 4.6% 367,736 14.1% 10.8 1.2 Market Forward P/E 10.80 10.77

General Insurance 4.3% 489.7 20.4% 51,781 2.0% 12.5 1.0

IT 1.3% 43.9 1.8% 19,922 0.8% 17.0 1.7 SCRIP WISE PERFORMANCE

Jute 0.3% 2.5 0.1% 1,756 0.1% 44.6 7.3 No of Issues Advanced No of Issues Declined Issues Unchanged

Life Insurance 2.6% 103.2 4.3% 52,522 2.0% n/a n/a 113 17 203

Miscellaneous 0.1% 85.1 3.5% 92,772 3.5% 19.7 1.0

Mutual Fund 0.2% 25.7 1.1% 28,103 1.1% n/a n/a RECENT MARKET MOVEMENT

Paper & Printing 0.1% 20.4 0.9% 10,685 0.4% 39.7 1.1 5100 Turnover in BDT (mn) DSEX Index 30000

4800 25000

Pharma. & Chemicals 0.7% 422.6 17.6% 473,571 18.1% 14.9 2.1 4500 20000

4200 15000

Services & Real Estate 0.1% 1.0 0.0% 13,139 0.5% 11.6 0.6 3900

3600 10000

Tannery 0.0% 0.3 0.0% 17,812 0.7% 49.8 1.6 3300 5000

Telecommunication 0.9% 170.6 7.1% 347,177 13.3% 9.4 6.0 3000 0

Jan-20

Jan-20

Jan-20

May-20

Mar-20

Mar-20

Mar-20

May-20

May-20

Jan-20

Mar-20

Jul-20

Jul-20

Feb-20

Feb-20

Jun-20

Jun-20

Jun-20

Apr-20

Apr-20

Apr-20

Textile 0.1% 77.3 3.2% 95,596 3.7% 13.5 0.6

Travel & Leisure 0.0% 1.7 0.1% 24,225 0.9% 26.6 0.7

SECTOR RETURN TURNOVER DISTRIBUTION EARNINGS (EPS) UPDATE (BDT)

Name This Yr. Last Yr. Growth Period

Gen Ins 4.3% Bank 24.68%

Life Ins 2.6% Gen Ins 20.42% JAMUNABANK 2.07 1.68 23.2% Jan-Jun'20

IT 1.3% Pharma 17.62% UCB 0.76 1.01 -24.8% Jan-Jun'20

Telecom 0.9% Telecom 7.11% ISLAMIBANK 0.43 0.40 7.5% Jan-Mar'20

Pharma 0.7% Engineering 5.11%

Fin Inst 0.5% Fuel & Power 4.65%

Fuel & Power 0.4% Life Ins 4.30% DSE NEWS IN BRIEF

Engineering 0.3% Misc 3.55% JAMUNABANK: Company has further informed that the Board of Directors of Jamuna Bank Limited in

Jute 0.3% Food 3.39%

Mutual Fund 0.2% its 370th meeting held on July 19, 2020 decided to redeem the Bond ( BDT 2000 million) fully by

Textile 3.22%

Services 0.1% IT 1.83% exercising of its option for early redemption of the Bonds in full in accordance with condition

Misc 0.1% Fin Inst 1.79% stipulated in the 'Trust Deed' subject to the approval from the concerned Regulatory Authorities. The

Textile 0.1% Mutual Fund 1.07% date of early redemption is fixed on 28 July 2020 (the "Early Redemption Date").

Paper 0.1% Paper 0.85%

Cement 0.0% Ceramic 0.13% TODAY'S WORLD STOCK INDICES

Ceramics 0.0% Jute 0.11%

Tannery 0.0% Travel 0.07% Indices Country Today Yday Change % Change

Travel & Leisure 0.0% Services 0.04% DJIA USA 26,672 26,735 -62.8 -0.23%

Bank 0.0% Cement 0.03% FTSE 100 UK 6,279 6,290 -10.9 -0.17%

Food -0.2% Tannery 0.01%

SENSEX India 37,387 37,020 366.5 0.99%

-1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 0.0% 15.0% 30.0%

Nikkei 225 Japan 22,717 22,696 21.1 0.09%

TOP 15 GAINERS TOP 15 LOSERS TOP 10 TURNOVER* (BDT mn)

DHAKAINS

TickerUNITEDINS Price Change**9.89% Forward P/E Ticker UCB -4.26% Price Change** Forward P/E TICKER Turnover % Turnover Price %∆ in Price

9.80% MBL1STMF -2.99%

KARNAPHULI 9.18% DULAMIACOT -2.62% ISLAMIBANK 315.8 13.17% 20.3 0.50%

NORTHRNINS 9.18% BDWELDING -2.01%

PURABIGEN 8.90% EBL 160.2 6.68% 31.0 -0.32%

AMCL(PRAN) -1.82%

GLOBALINS 8.84% OLYMPIC -1.62% GP 124.1 5.17% 245.9 0.74%

DACCADYE 8.33% ADVENT -1.30%

SHYAMPSUG 8.30% IFIC -1.15% SQURPHARMA 97.6 4.07% 175.3 0.40%

EASTLAND 8.10% PRAGATILIF -1.13% BXPHARMA 74.6 3.11% 74.4 5.08%

FEDERALINS 8.04% MPETROLEUM -1.06%

NITOLINS 7.46% PADMAOIL -0.77% PIONEERINS 63.9 2.67% 35.8 6.87%

APOLOISPAT 7.14% PROGRESLIF -0.72% IBP 61.8 2.58% 21.3 3.90%

METROSPIN 7.06% LINDEBD -0.42%

PIONEERINS 6.87% EBL -0.32% NAHEEACP 56.9 2.37% 54.0 3.45%

PHENIXINS 6.84% ANWARGALV -0.29%

BEACONPHAR 56.0 2.34% 67.9 1.49%

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% -6.0% -1.0%

SONARBAINS 46.6 1.94% 39.3 3.69%

EXCHANGE RATES TOP MKT CAP (BDT) CSE MARKET UPDATES

USD EURO RUPEE GBP Ticker Price M. Cap (mn) % M.Cap Today Yday Change %

84.80 96.93 1.17 106.59 GP 245.9 332,039 12.70% CSCX 7,017 6,979 37.5 0.5%

BATBC 907.6 163,368 6.25% CASPI 11,577 11,515 62.3 0.5%

UPCOMING DIVIDENDS/ RIGHTS OFFERINGS SQURPHARMA 175.3 147,995 5.66% CSI 837 832 4.6 0.5%

Ticker Record Date AGM Date Declaration UPGDCL 220.2 116,044 4.44% Market Cap (BDT bn) 2,497 2,484 12.1 0.5%

MTB 21-Jul-20 27-Aug-20 5%C & 5%B RENATA 1035 91,690 3.51% Turnover (BDT mn) 63 68 (5) -8%

ISLAMIBANK 21-Jul-20 20-Aug-20 10%C BERGERPBL 1308.6 60,690 2.32% Volume ('000) 2,131 3,174 (1,043) -33%

Source: DSE, http://www.dsebd.org; http://www.bloomberg.com; EBLSL Research Team Website: www.eblsecurities.com

*Turnover includes block trade; **Changes/ return has calculated based on the dividend adjusted price on record date: PE excludes stocks with negetive earnings e-mail: research@eblsecurities.com

Disclaimer: This document has been prepared by EBL Securities Ltd. (EBLSL) for information only of its clients on the basis of the publicly available information in the market and own research. This document has been prepared for information

purpose only and does not solicit any action based on the material contained herein and should not be construed as an offer or solicitation to buy or sell or subscribe to any security. Neither EBLSL nor any of its directors, shareholders, member of the

management or employee represents or warrants expressly or impliedly that the information or data of the sources used in the documents are genuine, accurate, complete, authentic and correct. However all reasonable care has been taken to

ensure the accuracy of the contents of this document. EBLSL will not take any responsibility for any decisions made by investors based on the information herein.

Vous aimerez peut-être aussi

- Registration Bill 2020899Document1 pageRegistration Bill 2020899Moheuddin SehabPas encore d'évaluation

- Registration Bill 2020899Document1 pageRegistration Bill 2020899Moheuddin SehabPas encore d'évaluation

- Registration Bill 2020899Document1 pageRegistration Bill 2020899Moheuddin SehabPas encore d'évaluation

- Registration Bill 2020899Document1 pageRegistration Bill 2020899Moheuddin SehabPas encore d'évaluation

- EBLSL Daily Market Update - 22nd July 2020Document1 pageEBLSL Daily Market Update - 22nd July 2020Moheuddin SehabPas encore d'évaluation

- Registration Bill 2020899Document1 pageRegistration Bill 2020899Moheuddin SehabPas encore d'évaluation

- EBLSL Daily Market Update 6th August 2020Document1 pageEBLSL Daily Market Update 6th August 2020Moheuddin SehabPas encore d'évaluation

- Daily market review sees DSEX rise marginally above 4300Document1 pageDaily market review sees DSEX rise marginally above 4300Moheuddin SehabPas encore d'évaluation

- EBLSL Daily Market Update 4th August 2020Document1 pageEBLSL Daily Market Update 4th August 2020Moheuddin SehabPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sama A&c AnalystDocument2 pagesSama A&c Analystsusreel.somavarapuPas encore d'évaluation

- 2018 Bond IssueDocument13 pages2018 Bond Issuethe kingfishPas encore d'évaluation

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayPas encore d'évaluation

- Handbook of Value Added Tax by Farid Mohammad NasirDocument15 pagesHandbook of Value Added Tax by Farid Mohammad NasirSamia SultanaPas encore d'évaluation

- Assignment On Mid-Term ExamDocument12 pagesAssignment On Mid-Term ExamTwasin WaresPas encore d'évaluation

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7Pas encore d'évaluation

- Module 1 - 2 Introduction and The ConceptsDocument17 pagesModule 1 - 2 Introduction and The ConceptsIza SagradoPas encore d'évaluation

- Managing Human Resources: Chapter # 12Document17 pagesManaging Human Resources: Chapter # 12Malaika Maryam CPas encore d'évaluation

- New Amazon BPLDocument19 pagesNew Amazon BPLpallraunakPas encore d'évaluation

- Bank Company Act - 1991: ATM Tahmiduzzaman, FCS EVP & Company SecretaryDocument21 pagesBank Company Act - 1991: ATM Tahmiduzzaman, FCS EVP & Company Secretarysaiful2522Pas encore d'évaluation

- Ethics in Advertising and Marketing: Presenting byDocument54 pagesEthics in Advertising and Marketing: Presenting byParihar BabitaPas encore d'évaluation

- Responsibility Centers Management AccountingDocument3 pagesResponsibility Centers Management AccountingRATHER ASIFPas encore d'évaluation

- SWOT Analysis of The IdeaDocument5 pagesSWOT Analysis of The IdeaSaim QadarPas encore d'évaluation

- Tradenet Funded Account Review - ($14,000 Buying Power)Document3 pagesTradenet Funded Account Review - ($14,000 Buying Power)Enrique BlancoPas encore d'évaluation

- HR Management Key to Success of Virtual Firm iGATEDocument20 pagesHR Management Key to Success of Virtual Firm iGATERajanMakwanaPas encore d'évaluation

- Design Bid BuildDocument4 pagesDesign Bid Buildellenaj.janelle6984Pas encore d'évaluation

- Assignment - Business Model Canvas Presentation - Fall - 2020Document2 pagesAssignment - Business Model Canvas Presentation - Fall - 2020MattPas encore d'évaluation

- Business Studies Redspot 2011-2019Document943 pagesBusiness Studies Redspot 2011-2019amafcomputersPas encore d'évaluation

- Textileetp Sira 2016Document64 pagesTextileetp Sira 2016Andrei PopescuPas encore d'évaluation

- SM AssignmentDocument17 pagesSM AssignmentElvinPas encore d'évaluation

- "A Study of Financial Performance Analysis of IT Company": Project ReportDocument48 pages"A Study of Financial Performance Analysis of IT Company": Project ReportRohit MishraPas encore d'évaluation

- University of Mauritius MSC - Applied - EconomicsDocument8 pagesUniversity of Mauritius MSC - Applied - EconomicsChiena LayugPas encore d'évaluation

- Book 1Document2 pagesBook 1Laika DuradaPas encore d'évaluation

- Study Guide 7 Entrepreneurship 1Document43 pagesStudy Guide 7 Entrepreneurship 1Cathlyne Mejia NatnatPas encore d'évaluation

- Industrial RelationsDocument20 pagesIndustrial RelationsankitakusPas encore d'évaluation

- Hana Simplification List: 30th July 2018Document12 pagesHana Simplification List: 30th July 2018Raj ShekherPas encore d'évaluation

- Trade Union-SEUSL-2Document41 pagesTrade Union-SEUSL-2dinukadamsith_287176Pas encore d'évaluation

- Free SWOT Analysis Template MacDocument1 pageFree SWOT Analysis Template MacGirish Des ManchandaPas encore d'évaluation

- C - 12 LCNRV - Multiple Choice Problem-1 PDFDocument2 pagesC - 12 LCNRV - Multiple Choice Problem-1 PDFJeza Mae Carno FuentesPas encore d'évaluation

- ManualDocument499 pagesManualsdgsg100% (1)