Académique Documents

Professionnel Documents

Culture Documents

Putnam Alternating Market Leadership

Transféré par

Putnam InvestmentsDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Putnam Alternating Market Leadership

Transféré par

Putnam InvestmentsDroits d'auteur :

Formats disponibles

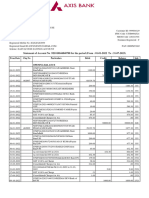

Alternating Market Leadership

Annual returns for key indexes (19912011) ranked in order of performance (highest to lowest).

1991

HIGHEST RETURN

Small Cap Growth 51.19% Small Cap Value 41.70% Mid Cap Stocks 41.51% Large Cap Growth 41.27% Large Cap Stocks 30.47% Large Cap Value 24.55% U.S. Bonds

Investor Education

Q4 | 2011

1992

Small Cap Value 29.14% Mid Cap Stocks 16.34% Large Cap Value 13.58% Small Cap Growth 7.77% Large Cap Stocks 7.62% U.S. Bonds 7.40% Large Cap Growth 4.99% Cash 3.93% Intl Stocks -12.17%

1993

Intl Stocks 32.56% Small Cap Value 23.77% Large Cap Value 18.07% Mid Cap Stocks 14.30% Small Cap Growth 13.37% Large Cap Stocks 10.08% U.S. Bonds 9.75% Cash 3.19% Large Cap Growth 2.87%

1994

Intl Stocks 7.78% Cash 4.19% Large Cap Growth 2.62% Large Cap Stocks 1.32% Small Cap Value -1.54% Large Cap Value -1.98% Mid Cap Stocks -2.09% Small Cap Growth -2.43% U.S. Bonds -2.92%

1995

Large Cap Value 38.36% Large Cap Stocks 37.58% Large Cap Growth 37.18% Mid Cap Stocks 34.45% Small Cap Growth 31.04% Small Cap Value 25.75% U.S. Bonds 18.47% Intl Stocks 11.21% Cash 6.03%

1996

Large Cap Growth 23.12% Large Cap Stocks 22.96% Large Cap Value 21.64% Small Cap Value 21.37% Mid Cap Stocks 19.00% Small Cap Growth 11.26% Intl Stocks 6.05% Cash 5.31% U.S. Bonds 3.63%

1997

Large Cap Value 35.18% Large Cap Stocks 33.36% Small Cap Value 31.78% Large Cap Growth 30.49% Mid Cap Stocks 29.01% Small Cap Growth 12.95% U.S. Bonds 9.65% Cash 5.33% Intl Stocks 1.78%

1998

Large Cap Growth 38.71% Large Cap Stocks 28.58% Intl Stocks 20.00% Large Cap Value 15.63% Mid Cap Stocks 10.09% U.S. Bonds 8.69% Cash 5.23% Small Cap Growth 1.23% Small Cap Value -6.45%

1999

Small Cap Growth 43.09% Large Cap Growth 33.16% Intl Stocks 26.96% Large Cap Stocks 21.04% Mid Cap Stocks 18.23% Large Cap Value 7.35% Cash 4.85% U.S. Bonds -0.82% Small Cap Value -1.49%

2000

Small Cap Value 22.83% U.S. Bonds 11.63% Mid Cap Stocks 8.25% Large Cap Value 7.01% Cash 6.18% Large Cap Stocks -9.10% Intl Stocks -14.17% Large Cap Growth -22.42% Small Cap Growth -22.43%

2001

Small Cap Value 14.02% U.S. Bonds 8.44% Cash 4.42% Large Cap Value -5.59% Mid Cap Stocks -5.62% Small Cap Growth -9.23% Large Cap Stocks -11.89% Large Cap Growth -20.42% Intl Stocks -21.44%

2002

U.S. Bonds 10.25% Cash 1.78% Small Cap Value -11.43% Large Cap Value -15.52% Intl Stocks -15.94% Mid Cap Stocks -16.19% Large Cap Stocks -22.10% Large Cap Growth -27.88% Small Cap Growth -30.26%

2003

Small Cap Growth 48.54% Small Cap Value 46.03% Mid Cap Stocks 40.06% Intl Stocks 38.59% Large Cap Value 30.03% Large Cap Growth 29.75% Large Cap Stocks 28.68% U.S. Bonds 4.10% Cash 1.15%

2004

Small Cap Value 22.25% Intl Stocks 20.25% Mid Cap Stocks 20.22% Large Cap Value 16.49% Small Cap Growth 14.31% Large Cap Stocks 10.88% Large Cap Growth 6.30% U.S. Bonds 4.34% Cash 1.33%

2005

Intl Stocks 13.54% Mid Cap Stocks 12.65% Large Cap Value 7.05% Large Cap Growth 5.26% Large Cap Stocks 4.91% Small Cap Value 4.71% Small Cap Growth 4.15% Cash 3.07% U.S. Bonds 2.43%

2006

Intl Stocks 26.34% Small Cap Value 23.48% Large Cap Value 22.25% Large Cap Stocks 15.79% Mid Cap Stocks 15.26% Small Cap Growth 13.35% Large Cap Growth 9.07% Cash 4.85% U.S. Bonds 4.33%

2007

Large Cap Growth 11.81% Intl Stocks 11.17% Small Cap Growth 7.05% U.S. Bonds 6.97% Mid Cap Stocks 5.60% Large Cap Stocks 5.49% Cash 5.00% Large Cap Value -0.17% Small Cap Value -9.78%

2008

U.S. Bonds 5.24% Cash 2.06% Small Cap Value -28.92% Large Cap Value -36.85% Large Cap Stocks -37.00% Large Cap Growth -38.44% Small Cap Growth -38.54% Mid Cap Stocks -41.46% Intl Stocks -43.38%

2009

Mid Cap Stocks 40.48% Large Cap Growth 37.21% Small Cap Growth 34.47% Intl Stocks 31.78% Large Cap Stocks 26.46% Small Cap Value 20.58% Large Cap Value 19.69% U.S. Bonds 5.93% Cash 0.21%

2010

Small Cap Growth 29.09% Mid Cap Stocks 25.48% Small Cap Value 24.50% Large Cap Growth 16.71% Large Cap Value 15.51% Large Cap Stocks 15.06% Intl Stocks 7.75% U.S. Bonds 6.54% Cash 0.13%

2011

U.S. Bonds 7.84% Large Cap Growth 2.64% Large Cap Stocks 2.11% Large Cap Value 0.39% Cash 0.10% Mid Cap Stocks -1.55% Small Cap Growth -2.91% Small Cap Value -5.50% Intl Stocks -12.14%

LOWEST RETURN

16.00% Intl Stocks 12.13% Cash 6.38%

Large-Cap Growth Stocks are represented by the Russell 1000 Growth Index, which is an unmanaged index of capitalization-weighted stocks chosen for their growth orientation. Small-Cap Growth Stocks are represented by the Russell 2000 Growth Index, which is an unmanaged index of those companies in the Russell 2000 Index chosen for their growth orientation. Large-Cap Value Stocks are represented by the Russell 1000 Value Index, which is an unmanaged index of capitalization-weighted stocks chosen for their value orientation.

Small-Cap Value Stocks are represented by the Russell 2000 Value Index, which is an unmanaged index of those companies in the Russell 2000 Index chosen for their value orientation. Large-Cap Stocks are represented by the S&P 500 Index, which is an unmanaged index of common stock performance. Mid-Cap Stocks are represented by the Russell Midcap Index, an unmanaged index that measures the performance of the 800 smallest companies in the Russell 1000 Index.

International Stocks are represented by the MSCI EAFE Index (ND), which is an unmanaged index of international stocks from Europe, Australasia, and the Far East. U.S. Bonds are represented by the Barclays Capital U.S. Aggregate Bond Index, which is an unmanaged index used as a general measure of fixed-income securities. Cash is represented by the BofA Merrill Lynch U.S. 3-month T-Bill Index, which is an unmanaged index used as a general measure for money market or cash instruments.

Data is historical. Past performance is not a guarantee of future results. It is not possible to invest directly in an index.

How proper diversification can help your strategy

Over time, diversifying across several asset classes can help manage risk and potentially boost returns. Consider the three scenarios below, illustrating different asset allocation strategies. In each situation, $10,000 was invested annually from 1991 to 2011. The first scenario shows the results of investing in last years winner (the best-performing asset class), while the second shows the returns generated by investing in last years loser (the worst-performing asset class). The third scenario shows the results of an asset allocation plan that consistently invests across several asset classes in equal proportion each year.

Putnam funds in every investment style TAXABLE INCOME American Government Income Fund Diversified Income Trust Floating Rate Income Fund Global Income Trust High Yield Advantage Fund High Yield Trust Income Fund Money Market Fund* U.S. Government Income Trust VALUE Convertible Securities Fund Equity Income Fund George Putnam Balanced Fund International Value Fund Multi-Cap Value Fund The Putnam Fund for Growth and Income Small Cap Value Fund BLEND Asia Pacific Equity Fund Capital Opportunities Fund Capital Spectrum Fund Emerging Markets Equity Fund Equity Spectrum Fund Europe Equity Fund Global Equity Fund International Capital Opportunities Fund International Equity Fund Investors Fund Multi-Cap Core Fund Research Fund GROWTH Growth Opportunities Fund International Growth Fund Multi-Cap Growth Fund Small Cap Growth Fund Voyager Fund GLOBAL SECTOR Global Consumer Fund Global Energy Fund Global Financials Fund Global Health Care Fund Global Industrials Fund Global Natural Resources Fund Global Sector Fund Global Technology Fund Global Telecommunications Fund Global Utilities Fund ABSOLUTE RETURN Putnam Absolute Return 100 Fund Putnam Absolute Return 300 Fund Putnam Absolute Return 500 Fund Putnam Absolute Return 700 Fund

CHASING THE WINNERS

Investing in last years best-performing asset class $366,189 average annual total return 5.46%

INVESTING WITH THE LOSERS

Investing in last years worst-performing asset class $369,014 average annual total return 5.53%

ASSET ALLOCATION

Investing consistently across several asset classes $411,898 average annual total return 6.47%

PERFORMANCE RESULTS THROUGH 12/31/11

1 year Russell 2000 Growth Index Russell Midcap Index Russell 2000 Value Index Russell 1000 Growth Index Russell 1000 Value Index S&P 500 Index MSCI EAFE Index (ND) Barclays Capital U.S. Aggregate Bond Index BofA Merrill Lynch 3-month Treasury Bill Index Source: Putnam Investments. -2.91% -1.55 -5.50 2.64 0.39 2.11 -12.14 7.84 0.10 5 years 2.09% 1.41 -1.87 2.50 -2.64 -0.25 -4.72 6.50 1.48 10 years 4.48% 6.99 6.40 2.60 3.89 2.92 4.67 5.78 1.95

Consider these risks before investing: The indexes and corresponding alternating market leadership chart represent various investment styles referred to in the three hypothetical scenarios. The asset allocation scenario represents an investment allocated across all nine indexes shown in the chart at left. It is not possible to invest directly in an index. All indexes are unmanaged and measure common sectors of the stock, growth, value, non-U.S., and bond indexes. Mutual fund performance may differ from the performance of the relevant index(es). Past performance does not indicate future results. This analysis has been figured on an annual basis. More recent returns may be lower or higher than those shown. Securities indexes assume reinvestment of distributions and interest payments and do not take into account brokerage fees and taxes. Securities in the indexes do not match those in Putnam funds, and performance will differ. It is not possible to invest directly in an index. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small companies involve higher risk of volatility. The use of derivatives involves additional risks, such as the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. There is a risk that you may have more or less than the original amount invested when you sell your shares. Mutual funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Longterm bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Diversification does not assure a profit or protect against loss. It is possible to lose money in a diversified portfolio. * Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in this fund.

Putnam Retail Management SU5252724292/12

Investors should carefully consider the investment objectives, risks, charges, and expenses of a fund before investing. For a prospectus, or a summary prospectus if available, containing this and other information for any Putnam fund or product, call your financial representative. Please read the prospectus carefully before investing.

Putnam Investments | One Post Office Square | Boston, MA 02109 | putnam.com

Vous aimerez peut-être aussi

- Assetclasses HistoricallyDocument0 pageAssetclasses HistoricallyHector T Villalona-tDsPas encore d'évaluation

- Applied Financial Macroeconomics and Investment Strategy: A Practitioner’s Guide to Tactical Asset AllocationD'EverandApplied Financial Macroeconomics and Investment Strategy: A Practitioner’s Guide to Tactical Asset AllocationPas encore d'évaluation

- 2010 Callan Chart - The Periodic Table of InvestmentsDocument2 pages2010 Callan Chart - The Periodic Table of InvestmentsAJLPas encore d'évaluation

- Q2 2013 Market UpdateDocument57 pagesQ2 2013 Market Updaterwmortell3580Pas encore d'évaluation

- The Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andD'EverandThe Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andPas encore d'évaluation

- Trading with Intermarket Analysis: A Visual Approach to Beating the Financial Markets Using Exchange-Traded FundsD'EverandTrading with Intermarket Analysis: A Visual Approach to Beating the Financial Markets Using Exchange-Traded FundsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Q3 2012 Quarterly Market ReviewDocument14 pagesQ3 2012 Quarterly Market Reviewlivmoore94Pas encore d'évaluation

- February 2011Document3 pagesFebruary 2011gradnvPas encore d'évaluation

- SPIVA Scorecard Year End 2010Document31 pagesSPIVA Scorecard Year End 2010pkfinancialPas encore d'évaluation

- Q3 2012 Quarterly Market ReviewDocument14 pagesQ3 2012 Quarterly Market Reviewlivmoore94Pas encore d'évaluation

- Q4 2012 Quarterly Market ReviewDocument14 pagesQ4 2012 Quarterly Market Reviewlivmoore94Pas encore d'évaluation

- The Index Revolution: Why Investors Should Join It NowD'EverandThe Index Revolution: Why Investors Should Join It NowPas encore d'évaluation

- JPM Weekly Market Recap October 10, 2011Document2 pagesJPM Weekly Market Recap October 10, 2011everest8848Pas encore d'évaluation

- JPM Weekly Commentary 12-26-11Document2 pagesJPM Weekly Commentary 12-26-11Flat Fee PortfoliosPas encore d'évaluation

- Market Divergence: Peter Mallouk, J.D., MBA, CFP Chief Investment OfficerDocument4 pagesMarket Divergence: Peter Mallouk, J.D., MBA, CFP Chief Investment Officerakavia01Pas encore d'évaluation

- Characteristics of The Stocks and Bonds In: 7twelveDocument3 pagesCharacteristics of The Stocks and Bonds In: 7twelveadamcohen81Pas encore d'évaluation

- Weekly Market Recap-Week of May 6th-MSFDocument2 pagesWeekly Market Recap-Week of May 6th-MSFasmith2499Pas encore d'évaluation

- Private Equity Investing in Emerging Markets: Opportunities for Value CreationD'EverandPrivate Equity Investing in Emerging Markets: Opportunities for Value CreationPas encore d'évaluation

- Dividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock MarketD'EverandDividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock MarketPas encore d'évaluation

- Weekly Market Recap, May 13-Main Street FinancialDocument2 pagesWeekly Market Recap, May 13-Main Street Financialasmith2499Pas encore d'évaluation

- The Conceptual Foundations of Investing: A Short Book of Need-to-Know EssentialsD'EverandThe Conceptual Foundations of Investing: A Short Book of Need-to-Know EssentialsPas encore d'évaluation

- Weekly Trends Nov 21Document5 pagesWeekly Trends Nov 21dpbasicPas encore d'évaluation

- JPM Weekly MKT Recap 5-21-12Document2 pagesJPM Weekly MKT Recap 5-21-12Flat Fee PortfoliosPas encore d'évaluation

- JPM Weekly MKT Recap 8-13-12Document2 pagesJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosPas encore d'évaluation

- Pepsi New LogoDocument16 pagesPepsi New LogoBobicmonPas encore d'évaluation

- JPM Weekly MKT Recap 9-10-12Document2 pagesJPM Weekly MKT Recap 9-10-12Flat Fee PortfoliosPas encore d'évaluation

- Quarter 4 2015 ReportDocument15 pagesQuarter 4 2015 ReportsamanthaPas encore d'évaluation

- Second Quarter Market ReviewDocument15 pagesSecond Quarter Market ReviewsamanthaPas encore d'évaluation

- Quarterly Market Review: Second Quarter 2016Document15 pagesQuarterly Market Review: Second Quarter 2016Anonymous Ht0MIJPas encore d'évaluation

- Quarter Report Q1.13Document3 pagesQuarter Report Q1.13DEButtPas encore d'évaluation

- OSAM - The Big Picture 10-8-13 - Jim OShaughnessy - UNLINKEDDocument27 pagesOSAM - The Big Picture 10-8-13 - Jim OShaughnessy - UNLINKEDcaitlynharveyPas encore d'évaluation

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsD'EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsÉvaluation : 4 sur 5 étoiles4/5 (1)

- Tactical Portfolios: Strategies and Tactics for Investing in Hedge Funds and Liquid AlternativesD'EverandTactical Portfolios: Strategies and Tactics for Investing in Hedge Funds and Liquid AlternativesPas encore d'évaluation

- JPM Weekly MKT Recap 3-05-12Document2 pagesJPM Weekly MKT Recap 3-05-12Flat Fee PortfoliosPas encore d'évaluation

- JPM Weekly MKT Recap 10-1-12Document2 pagesJPM Weekly MKT Recap 10-1-12Flat Fee PortfoliosPas encore d'évaluation

- Weeklymarket: UpdateDocument2 pagesWeeklymarket: Updateapi-94222682Pas encore d'évaluation

- JPM Weekly Commentary 01-02-12Document2 pagesJPM Weekly Commentary 01-02-12Flat Fee PortfoliosPas encore d'évaluation

- Fidelity Real Estate Investment PortfolioDocument5 pagesFidelity Real Estate Investment PortfolioMaryna BolotskaPas encore d'évaluation

- Investments CFADocument31 pagesInvestments CFAVasilIvanovPas encore d'évaluation

- Spiva Us Yearend 2015Document29 pagesSpiva Us Yearend 2015jbercini9602Pas encore d'évaluation

- JPM Weekly MKT Recap 10-15-12Document2 pagesJPM Weekly MKT Recap 10-15-12Flat Fee PortfoliosPas encore d'évaluation

- The Future For Investors - Siegel - Group 4Document58 pagesThe Future For Investors - Siegel - Group 4SrilakshmiPas encore d'évaluation

- Q4 2011 Quarterly Market ReviewDocument12 pagesQ4 2011 Quarterly Market Reviewlivmoore94Pas encore d'évaluation

- JPM Weekly MKT Recap 10-08-12Document2 pagesJPM Weekly MKT Recap 10-08-12Flat Fee PortfoliosPas encore d'évaluation

- Nonprofit Finance for Hard Times: Leadership Strategies When Economies FalterD'EverandNonprofit Finance for Hard Times: Leadership Strategies When Economies FalterÉvaluation : 2 sur 5 étoiles2/5 (1)

- JPM Weekly MKT Recap 2-27-12Document2 pagesJPM Weekly MKT Recap 2-27-12Flat Fee PortfoliosPas encore d'évaluation

- Confident Guidance CG 09-2013Document4 pagesConfident Guidance CG 09-2013api-249217077Pas encore d'évaluation

- March11 Vanguard PresentationDocument32 pagesMarch11 Vanguard Presentationcnvb alskPas encore d'évaluation

- Putnam Absolute Return Funds BrochureDocument5 pagesPutnam Absolute Return Funds BrochurePutnam InvestmentsPas encore d'évaluation

- Weeklymarket: UpdateDocument2 pagesWeeklymarket: Updateapi-94222682Pas encore d'évaluation

- JPM Weekly MKT Recap 9-17-12Document2 pagesJPM Weekly MKT Recap 9-17-12Flat Fee PortfoliosPas encore d'évaluation

- TD Ameritrade Commission-Free EtfsDocument6 pagesTD Ameritrade Commission-Free EtfsVaro LiouPas encore d'évaluation

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsD'EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Pitchbook StrategyDocument25 pagesPitchbook Strategydfk1111Pas encore d'évaluation

- ValuEngine Weekly Newsletter April 20, 2012Document10 pagesValuEngine Weekly Newsletter April 20, 2012ValuEngine.comPas encore d'évaluation

- 2011-10-24 Horizon CommentaryDocument3 pages2011-10-24 Horizon CommentarybgeltmakerPas encore d'évaluation

- Putnam White Paper: The Outlook For U.S. and European BanksDocument12 pagesPutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsPas encore d'évaluation

- Putnam International Equity Fund Q&A Q3 2012Document4 pagesPutnam International Equity Fund Q&A Q3 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Capital Markets Outlook Q4 2012Document8 pagesPutnam Capital Markets Outlook Q4 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Municipal Bond Funds Q&A Q3 2012Document3 pagesPutnam Municipal Bond Funds Q&A Q3 2012Putnam InvestmentsPas encore d'évaluation

- Putnam International Value Fund Q&A Q3 2012Document3 pagesPutnam International Value Fund Q&A Q3 2012Putnam InvestmentsPas encore d'évaluation

- Independent Equity Research: How We Do It, and Why It Matters To InvestorsDocument12 pagesIndependent Equity Research: How We Do It, and Why It Matters To InvestorsPutnam InvestmentsPas encore d'évaluation

- Optimizing Your LinkedIn ProfileDocument2 pagesOptimizing Your LinkedIn ProfilePutnam Investments60% (5)

- Putnam Global Equity Fund Q&A Q3 2012Document4 pagesPutnam Global Equity Fund Q&A Q3 2012Putnam InvestmentsPas encore d'évaluation

- Financial Advisors' Use of Social MediaDocument2 pagesFinancial Advisors' Use of Social MediaPutnam InvestmentsPas encore d'évaluation

- Affluent Investors Use of Social MediaDocument2 pagesAffluent Investors Use of Social MediaPutnam InvestmentsPas encore d'évaluation

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsPas encore d'évaluation

- Putnam Investors Fund Q&A Q3 2012Document3 pagesPutnam Investors Fund Q&A Q3 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Research Fund Q&A Q3 2012Document4 pagesPutnam Research Fund Q&A Q3 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Equity Income Fund Q&A Q3 2012Document3 pagesPutnam Equity Income Fund Q&A Q3 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Where Are Rates Headed Next?Document2 pagesPutnam Where Are Rates Headed Next?Putnam InvestmentsPas encore d'évaluation

- Putnam White Paper: Policy Impasse and The Repricing of RiskDocument8 pagesPutnam White Paper: Policy Impasse and The Repricing of RiskPutnam InvestmentsPas encore d'évaluation

- Putnam Optimizing Your LinkedIn ProfileDocument2 pagesPutnam Optimizing Your LinkedIn ProfilePutnam InvestmentsPas encore d'évaluation

- Putnam White Paper: Keys To Success in Defined Contribution SavingsDocument8 pagesPutnam White Paper: Keys To Success in Defined Contribution SavingsPutnam InvestmentsPas encore d'évaluation

- Putnam Capital Markets Outlook Q3 2012Document8 pagesPutnam Capital Markets Outlook Q3 2012Putnam InvestmentsPas encore d'évaluation

- Affluent Investors Use of Social MediaDocument2 pagesAffluent Investors Use of Social MediaPutnam InvestmentsPas encore d'évaluation

- Financial Advisors' Use of Social MediaDocument2 pagesFinancial Advisors' Use of Social MediaPutnam InvestmentsPas encore d'évaluation

- Putnam Perspectives: Lifetime Income Scores IIDocument12 pagesPutnam Perspectives: Lifetime Income Scores IIPutnam InvestmentsPas encore d'évaluation

- A Call To Action On Retirement SecurityDocument6 pagesA Call To Action On Retirement SecurityPutnam InvestmentsPas encore d'évaluation

- Putnam Tax Planning 2012 and BeyondDocument8 pagesPutnam Tax Planning 2012 and BeyondPutnam InvestmentsPas encore d'évaluation

- Putnam Gifting Opportunities in 2012Document4 pagesPutnam Gifting Opportunities in 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Business Succession PlanningDocument4 pagesPutnam Business Succession PlanningPutnam InvestmentsPas encore d'évaluation

- Putnam: Capital Markets Outlook Q2 2012Document12 pagesPutnam: Capital Markets Outlook Q2 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Perspectives: Fixed-Income Outlook Q4 2012Document8 pagesPutnam Perspectives: Fixed-Income Outlook Q4 2012Putnam InvestmentsPas encore d'évaluation

- Putnam Spectrum FundDocument1 pagePutnam Spectrum FundPutnam InvestmentsPas encore d'évaluation

- Putnam Retirement Advantage Funds Q&A Q1 2012Document5 pagesPutnam Retirement Advantage Funds Q&A Q1 2012Putnam InvestmentsPas encore d'évaluation

- Sun Life Assurance v. CADocument2 pagesSun Life Assurance v. CAJellynPas encore d'évaluation

- Topic 9 & 10 - 3rd Party & InterpleaderDocument9 pagesTopic 9 & 10 - 3rd Party & InterpleaderPrisyaRadhaNairPas encore d'évaluation

- James X. Mullen and Mullen Advertising, Inc. v. St. Paul Fire and Marine Insurance Company, 972 F.2d 446, 1st Cir. (1992)Document10 pagesJames X. Mullen and Mullen Advertising, Inc. v. St. Paul Fire and Marine Insurance Company, 972 F.2d 446, 1st Cir. (1992)Scribd Government DocsPas encore d'évaluation

- 10000019287Document165 pages10000019287Chapter 11 DocketsPas encore d'évaluation

- Financial Services and Delivery Channels: AOU-B240-Microfinance 1Document78 pagesFinancial Services and Delivery Channels: AOU-B240-Microfinance 1Ahmad BakerPas encore d'évaluation

- Chola MS: Motor Policy Schedule Cum Certificate of InsuranceDocument2 pagesChola MS: Motor Policy Schedule Cum Certificate of InsuranceAjay PrajapatiPas encore d'évaluation

- 202 Ways To Supplement Your Retirement Income PDFDocument344 pages202 Ways To Supplement Your Retirement Income PDFMauricio LustosaPas encore d'évaluation

- Rajeev Gupta 1 LacDocument5 pagesRajeev Gupta 1 LacAmit SharmaPas encore d'évaluation

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document4 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Loan LoanPas encore d'évaluation

- CSR 2022 NhaDocument457 pagesCSR 2022 NhaJaved ismailPas encore d'évaluation

- Restituto L. Joson For Plaintiffs-Appellants. Bartolome S. Palma For Defendant-AppelleeDocument1 pageRestituto L. Joson For Plaintiffs-Appellants. Bartolome S. Palma For Defendant-AppelleeLee Sung YoungPas encore d'évaluation

- Inter - Orient Maritime v. NLRC, GR NO. 115286, August 11, 1994Document2 pagesInter - Orient Maritime v. NLRC, GR NO. 115286, August 11, 1994Juvial Guevarra BostonPas encore d'évaluation

- Method of Statement For BuildingDocument30 pagesMethod of Statement For BuildingEmad Rakat86% (7)

- D 1 FHDocument12 pagesD 1 FHfede444Pas encore d'évaluation

- XXXXXXXXXXX0788-01-01-2022to31-07-2023 ASHUDocument3 pagesXXXXXXXXXXX0788-01-01-2022to31-07-2023 ASHUashokchaturvedi1990Pas encore d'évaluation

- Unit 6 PreparationDocument6 pagesUnit 6 Preparationapi-317284264Pas encore d'évaluation

- SampoornaDocument1 pageSampoornaimam janiPas encore d'évaluation

- TDS Final May 24Document1 pageTDS Final May 24Kochu KuchuPas encore d'évaluation

- Ug Course DescrDocument295 pagesUg Course DescrJohn BrownPas encore d'évaluation

- Contract of Indemnity Case Laws: Ankita Toppo, Sanchita TiwariDocument4 pagesContract of Indemnity Case Laws: Ankita Toppo, Sanchita TiwariSruti BansalPas encore d'évaluation

- Maybank IntroductionDocument1 pageMaybank IntroductionKoay Geok Hwa100% (8)

- Motor Policy With Reference To New India Assurance Company LTDDocument70 pagesMotor Policy With Reference To New India Assurance Company LTDkevalcool2500% (1)

- In The High Court of Tanzania (Commercial Division) at Dar Es SalaamDocument10 pagesIn The High Court of Tanzania (Commercial Division) at Dar Es SalaamSuzie TumainiPas encore d'évaluation

- Strategic Marketing Management. The Case of Islamic BankingDocument17 pagesStrategic Marketing Management. The Case of Islamic BankingNabil LahhamPas encore d'évaluation

- Cargo InsuranceDocument82 pagesCargo InsuranceSalman SathiPas encore d'évaluation

- Solution Guide For PpeDocument45 pagesSolution Guide For PpeTrek Apostol57% (7)

- Dave Ramsey Is Wrong About Internal Rate of Return On Whole Life InsuranceDocument3 pagesDave Ramsey Is Wrong About Internal Rate of Return On Whole Life InsurancewellsfordPas encore d'évaluation

- Carrier PacketDocument14 pagesCarrier PacketJustin HatcherPas encore d'évaluation

- Cash Disbursement 2007Document48 pagesCash Disbursement 2007api-3740993Pas encore d'évaluation

- Insurance RegulationDocument186 pagesInsurance RegulationVaibhav ChudasamaPas encore d'évaluation