Académique Documents

Professionnel Documents

Culture Documents

From The Ground Up - January - 2011

Transféré par

Ian FichtenbaumDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

From The Ground Up - January - 2011

Transféré par

Ian FichtenbaumDroits d'auteur :

Formats disponibles

See Last Page for Important Disclosure

Member FINRA

SPECIALISTS IN SATELLITE, TELECOM AND AEROSPACE INVESTMENT BANKING

FROM THE GROUND UP

January 2011

Inside this Issue: Near Earth Indices ‐ Last Twelve Months

Satellite Telecom NASDAQ New Media

Page 1: The Way We See It… 140

Satellite, Telecom and Aerospace News

130

Page 2: Guest Article: Future Technology Intersections - an

Investment and Leadership Opportunity 120

110

Page 8: The Future of FSS is Not Fixed

100

Page 14: AT&T Goes Shopping

90

Page 16: There’s Plenty of Room at the Top

80

Page 23: Near Earth Analysis: Market Comparables

70

Page 25: Near Earth Analysis: M&A Transactions Dec‐ Jan‐ Feb‐ Mar‐ Apr‐ May‐ Jun‐ Jul‐ Aug‐ Sep‐ Oct‐ Nov‐ Dec‐

09 10 10 10 10 10 10 10 10 10 10 10 10

See page 23 and 24 for details on index components

THE WAY WE SEE IT…

Satellite:

Following its 3 Ka-band high throughput satellite order from Inmarsat in August, The Boeing Company has now won another 3

satellite order (one to be provided by subcontractor Orbital Sciences); this time from the Mexican government. Two of the birds are

L-Band MSS satellites – essentially twins to the SkyTerra birds they already have completed, while the third is a C/Ku hybrid bird.

As demand for higher throughput satellites and new spectral bands increases we would expect to see Boeing re-emerge as a major

supplier of commercial satellites. Avanti Communication’s HYLAS-1 and Eutelsat’s KA-SAT satellite both launch successfully,

heralding a new era of Ka broadband services over Europe. CPI International finally finds a home after the collapse of the

Comtech deal, as Veritas Capital bids $19.50 per share, or about $525 million for the microwave components builder. Harris

Corporation continues its rollup of the oil and gas communications market, adding to recent pickup CapRock with an acquisition of

Schlumberger GCS for $347.5 million. Hot on the heels of their acquisition of Crawford Satellite, the folks at Encompass Media

announced plans to acquire the content distribution business of Ascent Media for $113 million – creating a powerhouse in satellite

broadcast services.

Telecom:

In early December, Clearwire completed a $1.33 billion debt offering, but continued to face liquidity concerns about the expenses

nd

for the rollout of its 4G network. Subsequently, Clearwire’s majority owner Sprint let pass a January 2 option to invest an

additional $760 million. Amidst all this turbulence, Clearwire Chairman Craig McCaw resigned without citing differences with

management. The company was also in the market seeking bids for up to $2 billion of its spectrum holdings, and is laying off 15% of

its employees to save cash. Clearwire clearly needs a white knight – but will it be T-Mobile, Sprint, or someone else? And, what

will they want in return? Energy industry satcom provider RigNet completed a $60 million IPO at an offering price of $12 which rose

nicely in the aftermarket.

Aerospace:

M&A activity has been red hot in the geospatial and signals intelligence world, proving how net-centric warfare is changing the

aerospace and defense landscape. Following a cue from the Argon ST acquisition earlier this year, Veritas Capital picks up

Lockheed Martin’s Enterprise Integration Group for $815 million, GeoEye acquires imaging analytics firm SPADAC for $46 million,

and Raytheon made a bid for Applied Signal Technology at $38 a share, or about $500 million. Continuing their record of

groundbreaking success, SpaceX launched their Dragon cargo module on a Falcon 9 and recovered it intact, in a first for a privately

held enterprise. With 2 successful launches and the flight success for Dragon, SpaceX has jumped to a clear lead in NASA COTS

business, but we suspect Orbital’s significant capabilities and launch experience will guarantee a two horse race. Finally, one of our

favorite space vehicles, Boeing’s mysterious X-37B – the miniature unmanned space shuttle, successfully returned to a soft landing

after a six month mission. Whatever the nature of the classified mission, it does point to a future of greater on-orbit servicing.

Hoyt Davidson John Stone Ian Fichtenbaum Rich Pournelle

hoyt@nearearthllc.com john@nearearthllc.com ian@nearearthllc.com rich@nearearthllc.com

(212) 551-7960 (646) 290-7796 (646) 290-7794 (646) 290-7794

Near Earth LLC Page 1/27

From The Ground Up Volume 7, Issue 1

Please visit Near Earth’s new offices at

250 Park Avenue, 7th Floor, New York, New York, 10077

Between 46th & 47th Streets, across from the Helmsley Building, 2 blocks from Grand Central Terminal

Near Earth LLC is pleased to announce an affiliation with Viriathus Capital

www.viriathus.com

a New York-based advisory firm for emerging growth companies and a specialist in PIPES

placements (Private Investment in Public Equity Securities)

Near Earth LLC is the recognized expert for specialized investment banking and advisory services to

management and boards in the satellite, telecom and aerospace sectors. Near Earth also makes its

capabilities available to hedge funds, private equity firms and government. Our boutique level of service

and dedicated industry focus differentiate our services.

Near Earth LLC Page 2/27

From The Ground Up Volume 7, Issue 1

Future Technology Intersections - an Investment and Leadership Opportunity

It was sometime early-1995. I’d just seen the first World Wide Web

address broadcast on the bottom of the screen at the end of a television

commercial. I remember thinking to myself, how foolish, why would

anyone want to leave their television set, rush over to their computer, dial

into their service provider (at a blistering 33.6Kbps), try to remember what

the exact address was (consumer DNS resolution in those days left a lot

to be desired) and then use one of the early web browsers to look up more

How many of us information about the product that had just been advertised? I’d spent my

remember the first career working in the high-tech networking business. I couldn’t imagine

cell phone we what ‘regular’ people would think when they saw an internet address

carried? Was it in broadcast on TV.

a bag with a

cigarette lighter How many of us remember the first cell phone we carried? Was it in a bag

power adapter like with a cigarette lighter power adapter like mine was? Did you opt for the

mine was? super-high tech and equally expensive ‘brick’ phone route?

Any longer-term mariners amongst you? Do you remember the state-of-

the-art in commercial navigation systems in the late 80’s and early 90’s?

Loran-C systems with 9’ antennas dominated the commercial boating

industry www.navcen.uscg.gov/?pageName=loranMain. Were you an

early adopter of commercial marine grade GPS navigation systems?

Remember spending $5K-$8K+ for those early units or even more if you

opted for the 3’ differential whip antenna that allowed you to increase

positional resolution during the days of Selective Availability

www.pnt.gov/public/sa/? Beyond marine HF/VHF radios, how exciting was

it when we could install an 8’ marine-grade cellular antenna that matched

our VHF one, for good symmetry on the radar arch, and make cellular

calls when we were away from the dock?

What would your reaction have been to the person in 1998 who told you

that, within 10 years, you would be able to hold all of the above

Even if you technologies literally in the palm of your hand, use them globally, pay less

thought the than $300 for the equipment and roughly $150/month for the service to

technical make it all possible? Even if you thought the technical confluence was

confluence was plausible, would you have believed companies could actually make money

plausible, would in the process?

you have believed

companies could Flash forward to 2011. With Moore’s Law continuing to drive the

actually make semiconductor industry more than 40 years after Dr. Moore’s prediction,

money in the organizations across the technology marketplace are delivering new

process? capabilities and services at record pace.

Emerging wireless standards like 4G

www.wired.com/gadgetlab/2010/06/wired-explains-4g/ to enable the

gigabit-class cellular market, Zigbee www.zigbee.org/Home.aspx to

support highly adaptive and autonomous sensor and control networks,

Near Earth LLC Page 3/27

From The Ground Up Volume 7, Issue 1

Future Technology Intersections (cont.)

Personal Area Networks (PANs) standardized around IEEE 802.15

grouper.ieee.org/groups/802/15/ to support small group and radius ad-hoc

wireless networks, all enabled by advancements in low-power Wi-Fi

technologies are quickly advancing businesses in their core markets.

In the Satellite market, the emergence of 100+Gbit class COMSATs,

proliferation of sub-meter resolution commercial imaging, continuing

advances in on-board processor and sensor technologies, and more

efficient modulation, compression and coding schemes are enabling

Geospatial significantly lower cost and greater efficiency of point-to-point connectivity

Services are a for next generation mobile applications, significantly enhanced satellite

prime example of broadband services and the commercial communications on the move

where the marketplaces.

combinations of

advancements Geospatial Services are a prime example of where the combinations of

across technology advancements across technology sectors are enabling a brand new

sectors are market. The preponderance of embedded GPS receivers in automobiles

enabling a brand and smart phones for navigation, satellite and aerial imagery for

new market commercial and consumer mapping and geo-location applications, and the

emergence of web-based geospatial services underpin this new core

market area.

Another example is in the Unmanned Aerial Vehicle market where the

combination of advances in automation, precision navigation, composite

materials, communications, sensors and propulsion are improving the

versatility, maintainability, survivability and affordability of UAVs. The

result of which is an expanded market opportunity supporting inchoate civil

and commercial applications.

There is no shortage of new investment opportunity in the Space and

technology marketplaces. Companies, organizations and individuals are

continuing to advance, amongst many others, the state of the art in each

There is no of the aforementioned core market and sub-market areas. In addition to a

shortage of new standard checklist used to evaluate new investment opportunities

investment including:

opportunity in the • The extent of the investment and can the business meet the

Space and expense?

technology • How long will it take to repay the investment?

marketplaces. • When will the investment begin to yield returns?

• What is the return on investment?

• Would the money be better employed elsewhere?

• What is the average rate of return? The net present value? The

internal rate of return?

It’s important to think about where a potential investment technology might

intersect with another at some point in the future and either engender an

adjacent opportunity or an altogether new market. As Steven L’Heureux

Near Earth LLC Page 4/27

From The Ground Up Volume 7, Issue 1

Future Technology Intersections (cont.)

discusses in his Special Report ‘Accelerating Revenue Growth’

www.slideshare.net/guestc4d058/accelerating-revenue-growth-

presentation, market adjacency is all about creating growth by expanding

the total addressable market. He goes on to talk about the fact that

markets are characterized by a commonality in key attributes such as

product needs, customers, cost structure and competitors. Slight

variations in one or more of the characteristics create market segments

within the same market. Significant differences in some, but not all

attributes create separate, but adjacent markets. Many high-tech

As organizations companies have notably increased revenue by expanding their core

enter new or markets into adjacencies. Investment methodologies, risk and return

expand their core analysis surrounding adjacencies are well understood.

markets … are

they looking at As organizations enter new or expand their core markets and seek either

where the internal or external investment dollars to drive innovation, are they looking

technology may at where the technology may take them in terms of intersections down the

take them in terms road? A good example from above is in the combination of GPS receivers

of intersections and smart phones to enable personal navigation applications. I don’t think

down the road? anyone would have even tried to make the case, during development of

the GPS constellation or the smart phone handset, that there was a future

technology intersection between the two that would result in an application

and market that would eventually combine them. Today, however, I think

it’s critical that leaders try to anticipate those intersections with every

opportunity.

Beyond market adjacencies, it’s become commonplace to assume the

intersection of technologies will create new business opportunities at

some point in the future. It’s easy to take for granted, for example, that we

can purchase a new vehicle or replacement audio head unit with

integrated voice-controlled GPS navigation, DVD video player, satellite

radio, RBDS/RDS traffic receiver, iPod control, auxiliary control interface

for USB key media, and integrated Bluetooth mobile phone control.

However, when each of the systems was originally developed, did the

…is it possible to

designers, leadership or investors forecast opportunity from the multiple

anticipate future

intersections of those technologies? Are we asking different questions

technology

today during our investment discussions in light of the fact that these

intersections that

successful intersections happened?

might maximize

returns? Does the

It’s important to develop metrics, or at least placeholders in our business

business plan look

plans, to capture the ‘unknown, unknowns’ in how users adapt, leverage

that far ahead?

and engage the technology or solution in ways that aren’t necessarily by

design. Concurrent with making new, core or adjacent investment

decisions, is it possible to anticipate future technology intersections that

might maximize returns? Does the business plan look that far ahead?

Has the organization considered incorporating that thought process into

the research, design, marketing, engineering and fund raising efforts?

Does the organization’s leadership have enough perspective about the

new possibilities to sustain the vision and execute on the promise?

Near Earth LLC Page 5/27

From The Ground Up Volume 7, Issue 1

Future Technology Intersections (cont.)

To the last point, leadership is critically important. Anticipating future

technology intersections, in the context of Geoffrey Moore’s technology

adoption lifecycle model en.wikipedia.org/wiki/File:Technology-Adoption-

Lifecycle.png, demands leadership that is incontrovertibly comfortable

leading across the entire lifecycle model, not just during the early and late

majority phases when revenue rules the day. ‘Leaders’ that purport

understanding innovation and/or the intersection of technologies or don’t

take the time to understand the totality of the opportunity engendered are

usually the same people that virtually hide while the technology crosses

…institutionalize the chasm to the early adopters. They may be great at driving tactical

the notion of opportunities in proven markets, which, depending on the health of the

capturing future business, is equally if not more important, but will never be successful

technology creating new business paradigms for technology intersections that

intersection capitalize on the progenerate market opportunities.

opportunities

I’m not suggesting abandoning proven business practices or core markets

in favor of some nebulous future opportunity. Organizations should

positively continue to innovate and drive opportunities in their core and

adjacent market ecosystems and realize organic growth as a result.

Investors should absolutely continue to use proven evaluation methods for

new opportunities. I’m suggesting that organizations and investors

consider adding to what they’re already doing in order to institutionalize

the notion of capturing future technology intersection opportunities.

Thinking about potential technology intersections in the areas highlighted

earlier, and focusing on the Space Marketplace, here are some example

questions to think about.

How will 4G wireless, Zigbee and PANs change with the advent of 5th

generation wireless technology? Do any of these technologies potentially

apply to the next generation of satellite bus architectures? Are they

leveraged as-is? What modifications are required to make them

commercially survivable and safe to use in space?

What other

applications could

As innovation in the satellite market progresses, what happens when

be hosted aboard

terrestrial communication standards are incorporated with Terabit-class

the spacecraft to

satellite buses (internet protocol, wireless)? What do future on board

enable new or

processors look like and can we use terrestrial designs as a baseline?

enhanced services

What happens to the video distribution market if content servers are

on the ground?

deployed aboard spacecraft? What other applications could be hosted

aboard the spacecraft to enable new or enhanced services on the ground?

Does it make sense to trade these questions during the R&D phase of

future satellite designs? What applications would be required to take

advantage of these enhanced capabilities? Do they have to be different

than their terrestrial counterparts?

What happens to the Geospatial Services market when advancements in

on-board spacecraft processing and UAV technologies progress to the

Near Earth LLC Page 6/27

From The Ground Up Volume 7, Issue 1

Future Technology Intersections (cont.)

point where users can control their own Geo-information? Can we overlay

weather services or even user-controlled live weather data as part of this

information?

What do next generation UAVs look like? Can they incorporate similar

advancements from the wireless market to provide enhanced functionality

and services? How does the combination of next generation terrestrial

Have you asked

wireless infrastructures, spacecraft that also incorporate terrestrial

the question about

wireless and other terrestrial communications standards potentially impact

technology

future fleets of UAVs? What new applications and user communities are

intersections? Are

served as a result?

you prepared for

the answer?

How does a combination or subset of all the above support the next

generation of Commercial Space companies like Virgin Galactic, Bigelow

Aerospace, SpaceX, Scaled Composites and others in their quest to

extend human presence beyond the boundaries of earth?

What does the potential matrix of these opportunities look like? What do

the dreamers or visionaries in your organization see as the potential for

your technology in the future? Have you asked the question about

technology intersections? Are you prepared for the answer? Can you

afford not to be?

By Rick Sanford

SpaceGroundAmalgam, LLC

Rick Sanford is the President of SpaceGroundAmalgam, LLC. He sits on the Board of the International

Space University and also serves as the Vice President Strategic Programs for Odyssey Moon Limited.

Mr. Sanford has over 20 years of experience in the global networking and satellite marketplaces. Prior to

founding SGA, LLC, he was the Chief Operating Officer of Cisco IRIS and the Director, Space and

Intelligence for Cisco Systems, Inc. He may be reached via email at rick@spacegroundamalgam.com.

SGA, LLC specializes in Global Market Creation, Market Transformation, Strategy Development, Business

Development, Marketing and Implementation Planning in the areas of global space communications

(government, civil, commercial), next generation command & control, intelligence and mobility.

Near Earth LLC Page 7/27

From The Ground Up Volume 7, Issue 1

The Future of FSS is not Fixed

There has been no more important engine for growth in the satellite

industry than the fixed satellite service (FSS) sector. The recent

remarkable resilience of FSS during this global economic downturn has

also been well noted: mid to high single digit revenue growth, stable to

rising operating cash flow margins and high fill rates. The demand of the

FSS operators for new satellites, launch services, ground facilities and

customer premise equipment has also kept a broad swath of the satellite

Does this mean industry’s value chain profitably employed. In 2010, over 800 36-MHz

boom times are transponder equivalents of capacity were added in 22 commercial satellite

ahead or are we launches. This launch rate reflects the 21 new satellites ordered in 2008.

just reaching Capacity additions in 2008 and 2009 were in the same general range of

another temporary 750-850 36-MHz equivalents. But, note there were 40 new satellites

peak…? ordered in 2009 that should be launching in the 2011-12 time frame; a

significantly higher rate than recent levels. Does this mean boom times

are ahead or are we just reaching another temporary peak in FSS

capacity growth?

Most predictions point to a near term peak in capacity replacement and

additions with a gradual decline after 2011-12 in satellite orders and

launches that bottoms out in 2018. If true, that will certainly have a

material effect on the launch and manufacturing providers, or at least to

the extent they are dependent on the commercial versus government

market, but may or may not negatively affect other sectors of the industry.

First of all, this is not of course, the first such cycle of capacity expansion

for FSS and not all bad news. If you are an investor in FSS, you may be

looking forward to the higher levels of free cash flow generated from the

lower levels of capital expenditures. A period of reduced investment in

new capacity could be great for an industry with some balance sheets far

more levered than perhaps comfortable in this ever fragile global

economy.

What appears to

be a peaking or But what about top line growth? Clearly, if the industry is looking forward

maturing FSS to a period of lower capacity investment it is because its participants

industry could just believe they will be able to comfortably handle demand growth for several

be an industry in years with markedly lower investment. That suggests expectations of low

transition from one to moderate revenue growth and an increasing ability to predict near term

set of primary demand. Does that sound like a fast moving, volatile, high technology

drivers to another industry or a large, profitable and increasingly predictable industry

set. enjoying its mature years? It appears as if the engine of the satellite

industry’s growth is approaching a cyclical peak, or even worse, a level of

maturity that while financially enviable lacks some of the dynamism we

have enjoyed in the past --- or is it? What appears to be a peaking or

maturing FSS industry could just be an industry in transition from one set

of primary drivers to another set.

Near Earth LLC Page 8/27

From The Ground Up Volume 7, Issue 1

The Future of FSS is not Fixed

If the FSS industry as we know it today is peaking/maturing and perhaps

evolving to something new, a couple of questions come to mind that we

would like to address:

1. Why is traditional FSS peaking/maturing; why should future growth

expectations be lower?

2. If you are an FSS operator, how do you position yourself for superior

growth in a peaking/maturing and evolving market?

Why is traditional FSS maturing

First, it should be noted that the FSS industry is already in its second life;

the first being one driven be international trunking of telephone traffic. The

…cellular backhaul current life began when video broadcasting and video contribution became

and Internet the new demand drivers, quickly outpacing the secular decline in the

should continue to trunking business. Today’s FSS market is driven by several applications,

grow, but fiber, each with its own level of maturity and growth expectations. Here is a

wireless and even summary of the major contributors along with commentary on near term

non-FSS satellite growth expectations of old and new applications.

solutions… may

eventually eat into • Traffic trunking (flat growth)

much of this o Old - The traditional voice telephony part of this business has been

demand declining for decades.

o New - Increasing levels of cellular backhaul and Internet data

transport have been offsetting the decline in the legacy trunking

business. In the near term, cellular backhaul and Internet should

continue to grow, but fiber, wireless and even non-FSS satellite

solutions, such as contemplated by O3B, may eventually eat into

much of this demand.

• Private networks (15% growth)

o Old – Driven largely by corporate VSAT networks, loss of

addressable market in developed countries due to fiber and

wireless penetration has been offset by rising average demand per

user with richness of Internet media and applications.

Internet o New – Increasing deployments in developing economies, as

connectivity is no Internet connectivity is no longer a luxury, but a necessity, has

longer a luxury, but driven above average growth. Government growth has also been a

a necessity major recent phenomenon and looks robust for the foreseeable

future as there is less threat of terrestrial competition for Comms-

on-the-Move applications and support of high bandwidth UAV and

aerial applications. There is also the more recent emergence of

direct to home Internet connectivity via satellite, especially with the

high throughput satellites employing spot beams and Ka-band.

Bandwidth requirements for this application could be one of the

major drivers going forward.

• Video contribution (flat growth)

Near Earth LLC Page 9/27

From The Ground Up Volume 7, Issue 1

The Future of FSS is not Fixed (cont.)

o Old/New - Growth has been relatively flat for several years with

fiber transport cutting into any gains from video proliferation. Would

expect declines in future years.

• Broadcasting (5-10% growth)

… the consumer o Old - Worldwide, roughly 27,000 channels are currently broadcast

market will support by satellite. These are standard definition channels and some

only so many analog holdovers. This number is up approximately 3,000 channels

economically from a year ago. There are also approximately 120 direct-to-home

viable channels (DTH) service operators, with 10 new DTH operators added last

and DTH operators year. However, both channel growth and growth in DTH operators

appear to be leveling off and would be expected to as the

consumer market will support only so many economically viable

channels and DTH operators. We believe ARPU growth is unlikely

to support significant additional channel growth. For a back of the

envelope demonstration consider a world with a billion households

capable of paying $50 per month for video with half of that value

going to the content providers. For 30,000 channels that works out

to an average of $10 million of revenue per channel. Now, there are

certainly many channels produced for less than $10 million per

year, but as there is something like an 80/20 rule in effect in most

media businesses (20% of the media getting 80% of the revenue)

the major channels are probably taking the lion’s share of the

revenue. The amount left to produce the long tail (the lower earning

80%) is far less than $10 million per channel. For the number of

channels to double from here, ARPU in real terms would probably

also have to double. Unlikely, and even if ARPU did double in real

terms, much of the increase would go to supporting new services

such as wireless or satellite Internet connectivity or the switch of

… But have no some channels to higher definition or 3D formats. It should also be

fear, high definition noted that this channel growth has not necessary driven demand

(HD) is here… for a like amount of transponder capacity as more efficient wave

forms, modulation and compression technologies are allowing more

bits to be squeezed into the same amount of spectrum. The

number of transponders needed to handle broadcasting of standard

definition video channels may be peaking as bandwidth efficiency

upgrades have kept pace with channel growth.

o New – But have no fear, high definition (HD) is here. Excluding the

HD channels broadcast by DISH and DIRECTV, there are currently

roughly 440 HD channels broadcast in North America and another

560 outside of North America. At 3x the bandwidth requirement for

HD versus standard definition (SD) that represents a lot of potential

incremental transponder demand. The key question is how many of

the 27,000 SD channels will be converted to HD and over what time

period. It is beyond our scope of expertise to opine on that answer

other than to say, clearly the HD phenomenon has not played out

yet, is well liked by consumers in a world of large flat screen TVs

Near Earth LLC Page 10/27

From The Ground Up Volume 7, Issue 1

The Future of FSS is not Fixed

and is likely to be a major driver of transponder capacity for many

years. However, at its current rate of adoption, growth has only

been sufficient to enable single digit top line sales growth. There

has been some hope that 3D video channels, which require 6x the

bandwidth of SD, would provide the higher growth levels desired.

… There has been

Initial results have not been that stellar, especially for sales of 3D

some hope that 3D

enabled TV sets. As anecdotal evidence, my three children came

video channels,

across a 3D demo at Costco over the Holiday period. It was set up

which require 6x

on a huge screen with specially chosen content to highlight the 3D

the bandwidth of

effects. All three took the glasses off within a few seconds saying it

SD, would provide

was nothing special and not worth wearing glasses to get. Granted

the higher growth

it is hard to impress technophile U.S. children these days, but that

levels

was not a ringing endorsement.

How should an FSS operator position itself for superior growth

This is not the first time the FSS industry has appeared to peak and

certainly not the first industry to reach a higher level of maturity. Such

situations may mean the traditional market pie may not be growing as

rapidly, but it does not at all mean clever companies are out of growth

opportunities. There will be many avenues for growth, but each involves

the FSS operator taking on a new set of risks. Here is our summary of the

key options they face and some Near Earth commentary.

• Growth through acquisition. Growth by acquisition is nothing new for

most of the major FSS operators and there are a few juicy targets out

there already, notably Telesat. However, with the top three operators

already controlling such a large share of the market there could be

some resistance to combinations of large operators. Even with ongoing

… The Asian consolidation, the total number of operators remains high as most

market has been nations dream of becoming “spacefaring” and having their own national

particularly satellite provider. These fleets of one to three satellites are very

fragmented … inefficient, but in many cases protected politically from consolidation

however, the and other economic realities - that is until times get tough or expensive

practical satellites need to be replaced. The Asian market has been particularly

constraints on fragmented and overdue for consolidation, however, the practical

achieving a major constraints on achieving a major roll-up in this region are considerable.

roll-up in this If it is to happen, we believe it will be far more likely to happen through

region are a primarily Asian controlled entity, perhaps with private equity backing.

considerable This is especially true as the “magic” operating efficiency level of 12 –

15 satellites has not been achieved by any purely Asian operator.

Funding such an efficiency gain would make for a lower risk

investment. The same can also be said for the Africa/Middle East

market. In short, while acquisitions are always an avenue for growth,

there is little to suggest there will be heightened activity other than

perhaps the emergence of one or two moderate consolidators in

developing regions.

Near Earth LLC Page 11/27

From The Ground Up Volume 7, Issue 1

The Future of FSS is not Fixed (cont.)

• Growth through vertical integration. To some extent, this has been tried

before, but with little sustainable success outside of government

services. Operators have become efficient wholesalers and B2B

service providers, but can lose their way when striving to get closer to

end users, especially all the way down to consumers. Most operators

… Operators have realize this and have avoided any direct retail or B2C type activities.

become efficient Interestingly, EchoStar is an example of the reverse: a B2C direct

wholesalers and broadcast satellite company looking to become an FSS operator.

B2B service Performance to date, suggests the reverse path has been just as hard

providers, but can and challenging. Part of the problem is the difference in mindset

lose their way required for success in these two different types of business, as well as

when striving to issues of incumbency, but there may also be strong resistance from

get closer to end the shareholder base. If you own an FSS stock and like 80% EBITDA

users margins, you may be quite shocked to learn management decreased

that margin to 60% while chasing higher revenue growth. For all of the

above reasons, we do not believe vertical integration is likely to be a

major source of growth for the FSS operators.

• Growth through geographic market expansion. If you are a small

operator, there is of course enormous theoretical room to expand your

geographic coverage, other than the fact that most good C and Ku-

band slots have been developed. On the other hand, there are quite a

few interesting Ka-band slots that could be developed and growing

acceptance of this new band as evidenced by Inmarsat-5 and other

such announcements. These Ka-band slots will be increasingly

interesting to the larger operators as well. In many cases, however, it is

becoming increasingly hard to get good orbital slots without strong

political support from the countries and major customers within the

… it is becoming footprint. The risks of developing some of these new slots and

increasingly hard spectrum may be too high for many investors unless there are export

to get good orbital credit agency loan supports or special joint venture relationships with

slots without in-country partners. We are already seeing such joint ventures as with

strong political New Dawn between Intelsat and an African investor group led by

support Convergence Partners. We do expect to see more such joint ventures

in the future, as both sides gain and overall development risk and cost

is reduced.

• Growth through provision of new services. As we discussed above, the

FSS industry may be transitioning away from a video driven business

and toward a business driven more by the need for Internet

connectivity and the backhaul of cellular and data traffic. Purists will

argue the superiority of a geosynchronous satellite’s point to multi-

point broadcasting can never be topped by terrestrial alternatives. We

would agree, but that does not alter the fact that the broadcasting of

video may be peaking for the simple reason that linear broadcasting

applications are peaking in this new world of time-shifted, device-

flexible, video on demand, IPTV, user generated, short form video

Near Earth LLC Page 12/27

From The Ground Up Volume 7, Issue 1

The Future of FSS is not Fixed (cont.)

content. What isn’t peaking is Internet and cellular traffic (other than

because of infrastructure bottlenecks) and even if the satellite industry

only gets a small slice of the total pie, it will make for one everlasting

gobstopper (to borrow from Willy Wonka). This is what we see as the

major source of growth for the FSS industry for ensuing decades.

Companies that position themselves to capture this market will be the

winners. The large FSS incumbents have many advantages, but

companies such as ViaSat, Hughes, O3B and Avanti may also rise in

global importance. For a “maturing” industry, it may be one hell of a

ride to a new higher plateau.

By Hoyt Davidson

Near Earth LLC

Near Earth LLC Page 13/27

From The Ground Up Volume 7, Issue 1

AT&T Goes Shopping

On December 20th, AT&T did a little Holiday shopping, picking up a nice

chunk of “beachfront property” of lower 700 MHz spectrum from the folks

at Qualcomm. Until now, Qualcomm has been using the spectrum for its

MediaFLO mobile video service, which it is shutting down in March 2011.

For the princely sum of $1.93 billion, AT&T walked away with 6 MHz of

unpaired spectrum licenses covering the U.S., and an extra 6 MHz in 12

First and foremost, metropolitan markets totaling an additional 70 million people – a total of

what does AT&T 2.2 billion MHz-POPs of spectrum. With a deal of this size, there are

have in mind for bound to be conclusions to be had and consequences to anticipate – what

this new toy of might they be?

theirs?

First and foremost, what does AT&T have in mind for this new toy of

theirs? Fortunately, in this case we really don’t have to do a lot of

guesswork, since they were nice enough to tell us. As stated in their

release, AT&T intends to use this spectrum for “supplemental downlink”

capacity using carrier aggregation technology. Translated to English, this

means simply that the spectrum in question will principally be used for

streaming audio and video content – a use quite similar to the mediaFLO

application, but with a critical difference: the transmissions will be unicast

and not broadcast. Which leads us to the second important conclusion:

Broadcast video to

handsets is dead. Broadcast video to handsets is dead. Stick a fork in it. With apologies to

Stick a fork in it. Month Python, it’s not pining for the fjords, it’s an ex-business model.

Despite the backing of names like Verizon, AT&T, Qualcomm and even

the vaunted ESPN, mobile TV in the U.S. has failed again, joining its

brethren in Japan, Korea and casting severe doubts about the future of

Sirius’ Backseat TV service and the yet to roll out ICO MIMS and Solaris

mobile video services. As demonstrated by AT&T, the resources for

providing mobile broadcast video simply have higher and greater uses –

giving people customized video when they want it. The implications for

fixed video providers like the cable and satellite MSOs are obvious – go

unicast (i.e. video on demand) or be a dinosaur. And the mammals are

taking over.

The third implication takes a little math. While Qualcomm crowed in its

announcement about the sale that it was getting a nice profit by selling

spectrum for $1.93 billion that it had “only” paid $683 million for between

2003 and 2008, the fact of the matter is that the sale price represents a

significant retreat in prices from the FCC’s 2008 700 MHz auction. In that

auction, a de facto national spectrum license went to Verizon Wireless for

$1.10 per MHz-POP, but AT&T’s purchase only comes to $0.87 per MHz-

POP, a 21% discount. Some of this discount probably reflects the

unpaired nature of the spectrum, which makes it less suited for LTE

(which requires carrier aggregation technology), but we think a significant

Near Earth LLC Page 14/27

From The Ground Up Volume 7, Issue 1

AT&T Goes Shopping (cont.)

portion of the discount reflects an actual decline in valuations since March

2008.

While many have continued to argue that spectrum valuations can only go

while demand for up, here we have a real transaction comp that argues otherwise. Much of

spectrum is indeed the basis for our position is that while demand for spectrum is indeed

exploding … there exploding (thank you Apple!), there is substantial supply overhang and the

is substantial ability to pay for more spectrum is not boundless given the consumer

supply overhang resistance to higher ARPU.

and the ability to

pay for more On the supply side, we have the following sources:

spectrum is not • Potential re-auction of the 700 MHz D (“public safety”) block that

boundless … failed (3 billion MHz-POPs)

• Clearwire selling excess spectrum (potentially over 20 billion or

more MHz-POPs)

• Spectrumco AWS spectrum holdings (5.3 billion MHz-POPs)

• Nextwave WCS, BRS and AWS spectrum holdings (3.9 billion

MHz-POPs)

• Lightsquared wholesaling capacity on their anticipated 4G network

• Terrestar’s and DBSD’s ATC holdings of 6 billion MHz-POPs each

Now, we’re the first to acknowledge that these various flavors of spectrum

have varying utility due to their associated regulatory constraints, but in

the aggregate that’s a lot of spectrum (40 – 60 billion MHz-POPs). And the

white space bands offer potentially even more.

in the aggregate

that’s a lot of On the ability to pay issue, we note that the source of funds for spectrum

spectrum… purchases is the carriers themselves – who also have to fund

maintenance capex, expansion capex and ultimately, dividends and

interest for their security holders. While there has been marked

improvement of late, the fact remains that the enterprise values of every

substantial wireless carrier are below their values in March 2008.

So, given this landscape, we find the discount AT&T received to be pretty

reasonable – proving once again that trees do not grow to the sky.

By John Stone

Near Earth LLC

Near Earth LLC Page 15/27

From The Ground Up Volume 7, Issue 1

There’s Plenty of Room at the Top

Surely and steadily, commercial space activities have crept further along

in both their development and their public prominence. Every few weeks

brings a new headline to the news about a new accomplishment by Virgin

Galactic or SpaceX or any of the many other ventures planning to do

things no commercial company has done before. These are exciting times

and it is equally exciting to have a front row seat for these developments

…many and be able to see things as they get started. 2010 has been a great year

commercial and 2011 promises to hold more progress to come.

entities vying to

participate in this For casual viewers, this narrative has been that of startups and

market are also entrepreneurs stepping up to offer services that have long been the

very established, exclusive domain of government. This is not entirely accurate, as many

large companies commercial entities vying to participate in this market are also very

established, large companies that are now offering services that are more

in keeping with the newer, fixed-price commercial procurement practices

that NASA is seeking to adopt.

However, there is another, more subtle, misconception about this new

industry. At first glance, the ecosystem appears divided between

aerospace firms providing systems and engineering services (e.g. Boeing,

Lockheed Martin, Raytheon and so forth); and operators which seek to

provide commercial services on platforms which they intend to develop

(e.g. SpaceX, Orbital, Virgin Galactic and others). This duality entirely

ignores many players, like satellite operators or payload integrators, which

don’t fit into either category, but which we think will also play a large role in

the evolution of this industry.

We would like to highlight some of these companies to give a larger

a larger picture of picture of the kind of activities we will start seeing in the next few years as

the kind of many new space companies enter commercial operation. This list certainly

activities we will isn’t and isn’t meant to be comprehensive and we are probably leaving out

start seeing in the many others of importance, but we think it’s a good start.

next few years as

many new space United Launch Alliance

companies enter When the United Launch Alliance was formed, it produced many howls

commercial from industry observers. After all, its formation represented the merger of

operation… the principal launch businesses of both Boeing (with Delta IV) and

Lockheed Martin (with Atlas V), both of whom loom very large on the US

aerospace stage. Although it eliminated competition, it was likely

necessary due to the dropoff in launch demand in the first half of the

2000s. It was also just as well for operators, since the two launchers have

not been particularly competitive on price, but not so good for US

taxpayers, who are mostly captive to the ULA for their government

launches, for exactly the same reasons.

Near Earth LLC Page 16/27

From The Ground Up Volume 7, Issue 1

There’s Plenty of Room at the Top (cont.)

Change is arriving at ULA. It couldn’t hurt that space module mogul Robert

Bigelow came to visit their facilities in Decatur, Alabama to talk about his

plans for 24 launches per year. Nice if that happens, but we wouldn’t

expect ULA to be counting on that just yet. A little better and slightly

nearer are NASA’s plans to support commercial crew transport. With

SpaceX having not enough launches of the Falcon 9 under their belt to

alleviate reliability concerns, the ULA is filling the breech and NASA

CCDev-2 participants are taking notice by including ULA rockets in almost

all their proposals. And speaking of SpaceX – a little domestic competition

The true test of is keeping ULA on its toes. In a recent Space News, one article reported

ULA will come that ULA was cutting costs and reviewing processes in pursuit of lower

when competition launch prices. We like where this is headed. It gets taxpayers a better deal

for Delta/Atlas while bringing sorely-needed competition and launch price pressure. In the

class DoD meanwhile, demand from traditional defense customers and science

launches is missions is picking up, leaving ULA rather busy. The true test of ULA will

opened up to other come when competition for Delta/Atlas class DoD launches is opened up

U.S. launch to other U.S. launch service providers such as SpaceX and Orbital.

service providers

Space Systems / Loral

From a distance, Space Systems / Loral looks a lot like a typical

aerospace company. In reality, it is a most rare and possibly unique beast

in the space ecosystem – a prime contractor with a customer base almost

exclusively commercial. Actually, we can take that even one step further,

as many of SS/L’s customers are themselves almost exclusively

consumer oriented, such as those for DirecTV and Sirius XM, delinking

themselves from the year-to-year swings in government spending. Having

over sixty of its spacecraft on orbit, with more joining every year, certainly

makes them a premier example of a commercial space company and one

just as different from the traditional large aerospace companies as

emerging NewSpace-type ventures are.

…leveraging the

commonalities

So far, SS/L has been below the radar in its support of commercial space

between

outside of its core telecom satellite manufacturing business. However, we

commercial

find the few steps it’s taken outside of that business most intriguing. Early

telecom satellite

in 2010, SS/L was awarded a contract by NASA Ames to develop the

systems and other

propulsion system for LADEE, a lunar science mission. This followed

types of spacecraft

SS/L’s provision of a Ka-band antenna for NASA’s Solar Dynamics

Observatory, leveraging the commonalities between commercial telecom

satellite systems and other types of spacecraft. We hope this work will

continue and although we think that all satellite manufacturers (including

Boeing, Lockheed, Orbital and the European manufacturers) will have a

role to play, we think that the combination of SS/L’s technical heritage,

experience and prowess and its unique commercial orientation could be a

powerful asset in the years to come.

Near Earth LLC Page 17/27

From The Ground Up Volume 7, Issue 1

There’s Plenty of Room at the Top (cont.)

The Satellite Operators

Being frequent attendees of both space and satellite conferences, we are

sometimes taken aback by how separate their worlds often are. On closer

consideration, this shouldn’t be too surprising. The satellite industry is

focused on telecom and broadcast markets while space is focused on

aerospace systems and services; two different industries which happen to

connect in some key areas. But just because the operators are focused on

telecom markets, doesn’t mean they can’t play a role in other areas. For

Operators may instance, we’ve covered the hosted payload phenomenon here before

also be eventual (See article in August 2009’s newsletter “Bumming a Ride to Orbit”). It’s

adopters and gotten a lot of attention by Intelsat, SES, Iridium and others and will

beneficiaries of in- certainly continue to play a role in their business plans. Their satellites are

orbit services, convenient platforms for technology demonstration, earth observation and

such as refueling, space situational awareness. Civil space agencies and commercial

refurbishing and entities just can’t ignore such a convenient new route to orbit.

relocation services

Operators may also be eventual adopters and beneficiaries of in-orbit

services, such as refueling, refurbishing and relocation services provided

by robotic vehicles while benefiting from the renewed focus on debris

removal and mitigation. Operators will also be a source of institutional

knowledge, providing expertise on operations and procurement of

commercial spacecraft. Finally, operators will continue to push the limits of

the capabilities of their spacecraft, demanding greater power, more

bandwidth, greater frequency agility, even pushing the limits of satellite

propulsion systems and other bus components. Although pursued by

satellite operators for the benefit of their customers, these improvements

will benefit all.

Universal Space Network and Telesat

Ground systems

When the space age was getting started, everything had to be built from

are just the type of

scratch. Not only did this include building the satellite itself, but often very

business that

costly ground systems to monitor, track and control the satellite wherever

yearns for a

it was in the sky. In many cases, these systems are a large portion of the

provider of shared

costs. But it doesn’t really make economic sense for each operator to

services…

have dedicated ground systems. Ground systems are just the type of

business that yearns for a provider of shared services.

Although a number of satellite operators and aerospace firms offer

outsourced engineering services, we highlight Universal Space Network

(along with its partner and parent company, Swedish Space Corporation)

and operator Telesat as being particularly prominent in providing full end-

to-end satellite control, monitoring and operations services to a wide

variety of both large and small clients. USN and SSC operates a

worldwide network of ground stations, already providing services for a

wide variety of civil, commercial and defense satellites. Telesat leverages

its existing network used for its own satellites to take care of others’, and it

does it very well. Even the largest of operators, like Echostar and DirecTV

Near Earth LLC Page 18/27

From The Ground Up Volume 7, Issue 1

There’s Plenty of Room at the Top (cont.)

use outsourced services nowadays and it is in no small measure due to

the technical competency and range of services these companies offer.

Except in the case of unique constellations or systems, or in the case of

sensitive national assets, we think outsourcing ground systems operations

just makes sense. With remote presence now available essentially

anywhere in the world and the cost of setting up a monitoring terminal little

With remote more than that of a home computer, many users will be able to benefit

presence now from the economies of scale and reduced capital expenditure. In a new

available commercial space market, this area should see lots of growth. Although

essentially there are other participants in this area (such as SES, SED Calian) and

anywhere in the room for new entrants, we think these two are positioned particularly well.

world … many

users will be able Component builders

to benefit Travel down the long list of components and subsystems that go into most

communications satellites and you’ll usually find for each item one or two

major, sometimes exclusive, vendors. For instance, solar panels are

dominated by Spectrolab (a division of Boeing) and Emcore while Saft,

EaglePicher and ABSL are some of the leaders in batteries. Honeywell is

a very significant producer of reaction wheels, Aerojet and AMPAC ISP

dominates propulsion systems while Harris Corporation essentially owns

the market for very large mesh antennas. A list like this can go on and on.

Our point isn’t to highlight these vendors or their products in any way that

is bad or good (although we are certain they all make excellent products),

only to highlight that relatively small markets for highly complex items

naturally result in vendor concentration with high barriers to entry. While

this is good for those companies that have positioned themselves and

their wares in these privileged positions, we can’t help wondering the

extent this stifles technical innovation and increases costs for satellite

manufacturers across the board. For up-and-coming developers of space

…platforms components, getting over subcontractor incumbency and space heritage

needing to requirements can be frustrating barriers to entry.

compete in a more

aggressive New markets and expanded markets have been known to shake things up

commercial and we think this presents a distinct opportunity for new entrants. New

environment may customers and platforms needing to compete in a more aggressive

look to adopt commercial environment may look to adopt newer, more cost-effective

newer, more cost- and higher performance technologies at a more rapid pace than current

effective and customers. With more opportunities and more avenues of gaining space

higher heritage (through small satellites, suborbital platforms, upper stages or

performance secondary payloads), we think this may be the time to get into developing

technologies new, more agile technologies. Particularly interesting will be the providers

of cross-platform components, such as radiation-hardened electronics,

solar panels, robotic mechanisms, ion propulsion systems or new star

sensors or deployable composite reflectors, although the list doesn’t stop

here.

Near Earth LLC Page 19/27

From The Ground Up Volume 7, Issue 1

There’s Plenty of Room at the Top (cont.)

The Boeing Company

No, we weren’t lying when we said we’d wouldn’t be looking at the large,

traditional aerospace firms in this article. So why are we talking about

Boeing here? We’ll get to that soon. Early in 2010, Boeing and its

development partner, Bigelow Aerospace, unveiled the CST-100 crew

spacecraft, their entrant in the new commercial space race and winner of

Some inevitable NASA CCDev development money. Later in the year, we heard of a

comments were partnership between Boeing and Space Adventures, the travel brokerage

made about firm made famous for sending centi-millionaires to the Space Station, an

luggage lost in announcement which sent commentators wagging about Boeing getting

space, but let’s into the space passenger business just as it would develop a new airliner.

leave those Some inevitable comments were made about luggage lost in space, but

aside… let’s leave those aside…

From our usual perspective, we see Boeing as a giant defense and space

contractor, through its Defense, Space and Security (DSS) division. Were

it not for the fact that we often travel by air too, we would almost overlook

the side of Boeing most of the rest of the world knows it by, its very

prominent Commercial Airplanes division. This dual nature of Boeing

distills the very distinct dichotomy in the world of aerospace – between

that of government contractors working on a diversity of unique defense

systems, often on cost-plus contracts, and that of developers of

commercial aircraft, which serve a worldwide market for air travel and

transport. This is a fact of life in the aerospace business and makes for

very different cultures on either side of the divide.

By all accounts, the CST-100 is a project of the DSS side of Boeing and

likely to remain so for some time, owing to the institutional engineering

expertise available there. But from a sales and marketing point of view, we

…competitively wonder how much the Defense side of Boeing can learn from the

offering large Commercial Airplane side. While it’ll be a long while before selling

aerospace spacecraft is anything like selling aircraft, if ever, the fact remains that

systems to competitively offering large aerospace systems to commercial clients

commercial clients around the globe is what Boeing Commercial Airplanes does best. There

around the globe is may even be sales synergies. A recent leaked cable from the US embassy

what Boeing in Turkey indicated that the Turkish government wanted the US

Commercial government (through NASA) to send an astronaut into space in exchange

Airplanes does for ordering Boeing aircraft. It doesn’t appear that anything like that came

best out of the request but with the CST-100, Boeing could offer its own rides

as sales incentives. We’d like to see Airbus try to match that. As long as

Boeing avoids the same supply chain and procurement problems that

have dogged the 787 Dreamliner, taking a commercial aircraft approach to

space may be a way to go.

Channel Partners

New businesses and platforms don’t exist in a vacuum. If successful, they

cultivate an ecosystem of brokers, agents, value added resellers and other

Near Earth LLC Page 20/27

From The Ground Up Volume 7, Issue 1

There’s Plenty of Room at the Top (cont.)

components of a mature sales channel. In the satellite industry, this has

meant the employment of transponder brokers and exchanges and

bundling of specialized managed networking and teleporting services as

the needs of users demand. For something like Virgin Galactic, it means

engaging travel agents to include once-in-a-lifetime vacations to beyond

the upper atmosphere as part of their portfolio of destinations. If we are

If we are going to going to start getting commercial spacecraft with government as an initial

start getting anchor tenant and user, it won’t be long before someone comes up with a

commercial way to make good economic use of spare capacity.

spacecraft … it

won’t be long While the passenger partnership between Boeing and Space Adventure

before someone got a lot of press, we think there are lots of opportunities on the payload

comes up with a side. SpaceX is looking for clients of its freeflying DragonLab vehicle and

way to make good Bigelow’s potential sovereign clients will want to find favorite-son users of

economic use of whatever modules they lease. Businesses can surely be made on the

spare capacity. back of providing end-to-end turnkey integration and payload

management services - the kind of things NASA didn’t and couldn’t offer to

users because of its role as a government agency. A good start would be

to make better use of the International Space Station, which is sorely

underutilized and is yearning for the right operations and the right

economic incentives to start producing the kinds of results that it is now

uniquely able and positioned to do. One firm, NanoRacks, has already

entered this space and already has dedicated rack space on ISS from

which it is marketing micro-gravity research services.

Users

Commercial infrastructure and services are nothing without users,

customer demand and markets. The space and satellite industries have

long rested on two major pillars of economic demand and user

communities. One pillar has been telecom and broadcast, which has been

we are intrigued at

responsible for much of the commercial satellite industry. The other pillar

the opening up of

has been government, which has provided the demand for a multitude of

other markets,

activities, from science and exploration of the universe, to

particularly those

communications, surveillance, navigation and intelligence in pursuit of

that use the unique

national security. A new commercial spaceflight industry, while initially

zero-gravity

government-dominated, will eventually need to open into new markets and

environment for

sectors of the civil economy, much as satellite telecom has largely done

R&D into materials

and how satellite imaging is now on its way to accomplishing.

science and

biotechnology…

Much has been made of the new “travel and leisure” side of spaceflight;

that is, providing avenues for tourists to experience space travel. This

market exists now but we wonder how big this will be in the short term. On

the other hand, we are intrigued at the opening up of other markets,

particularly those that use the unique zero-gravity environment for R&D

into materials science and biotechnology. No doubt this is still in its

infancy, but it is enticing to look at the tens of billions of dollars spent in

the R&D budgets of Johnson & Johnson, 3M, Pfizer, Amgen,

Near Earth LLC Page 21/27

From The Ground Up Volume 7, Issue 1

There’s Plenty of Room at the Top (cont.)

GlaxoSmithKline and many other very large organizations. The space

the discovery of agencies of the world have laid the scientific groundwork for much of this

significant value over the decades - now it’s time for applied researchers to pick up the ball

through and run with it. While our expertise is in telecom and aerospace, and thus

commercial don’t feel it’s our perogative to make any analysis of what demand from

applied micro- biotech and pharma could look like, it would seems to us that the

gravity research discovery of significant value through commercial applied micro-gravity

could open the research could open the floodgates to a whole new user community.

floodgates to a Whatever the scale and nature of this demand, assisting and servicing this

whole new user user base may well be a significant ongoing opportunity for commercial

community … providers able to deliver efficient and useful turnkey operational platforms.

If those are successful and economically sustainable, who knows where

we can go next. We all know there’s plenty of room at the top.

By Ian Fichtenbaum

Near Earth LLC

Near Earth LLC Page 22/27

From The Ground Up Volume 7, Issue 1

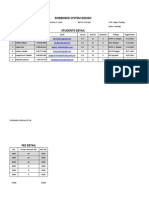

NEAR EARTH ANALYSIS: MARKET COMPARABLES

Public Market Valuation Analysis of Selected Companies in the NEAR EARTH MEDIA INDEX

($ in millions, except per share data) Stock Price: Enterprise Value as a Multiple of: Price as a Multiple of:

Market

Value of Enterprise LTM LTM LTM LTM Trailing Forward

1/7/11 Equity Value (a) Sales EBITDA EBIT EPS EPS (b) EPS (b)

Satellite Broadcast (DBS and DARS)

BSY.L British Sky Broadcasting (f) £ 7.47 $20,347.10 $23,160.09 2.5x 5.9x 18.0x 19.3x 29.7x 24.6x

DISH Dish Network Corp $ 21.14 $9,366.08 $13,222.36 1.1x 4.2x 6.1x 8.3x 9.9x 8.9x

DTV DirecTV Group Inc. $ 41.86 $36,236.11 $44,419.11 1.9x 7.1x 11.9x 20.1x 17.7x 13.6x

SIRI Sirius XM Radio $ 1.61 $6,317.38 $9,028.49 3.3x 11.6x 17.7x 23.1x n/m n/m

Mean 2.2x 7.2x 13.4x 17.7x 19.1x 15.7x

Cable Television

CMCSA Comcast Corporation $ 22.70 $63,787.00 $90,439.00 2.4x 6.3x 11.6x 17.7x 18.0x 15.5x

MCCC Mediacom Communications Corp. $ 8.60 $585.83 $3,859.48 2.6x 7.1x 12.8x 0.8x 35.8x 10.2x

TWC Time Warner Cable Inc. $ 66.75 $23,736.30 $44,230.30 2.4x 6.6x 12.4x 16.6x 18.7x 15.0x

CVC Cablevision Systems Corp $ 34.64 $10,394.42 $21,288.13 2.6x 8.1x 13.3x 22.7x 26.4x 17.6x

Mean 2.5x 7.0x 12.5x 14.5x 24.7x 14.6x

Television

TVL LIN TV Corp. $ 5.10 $280.25 $912.82 2.3x 5.9x 9.8x 9.6x 8.6x 12.4x

SBGI Sinclair Broadcast Group $ 7.95 $638.78 $1,852.24 2.6x 5.6x 8.9x 11.7x 8.4x 8.7x

FSCI Fisher Communications Inc $ 24.96 $219.40 $283.88 1.8x 9.0x n/m n/m n/m n/m

Mean 2.2x 6.9x 9.3x n/m n/m 10.6x

Radio

CMLS Cumulus Media Inc. $ 4.26 $179.05 $770.03 2.9x 10.0x 11.5x 5.8x n/m n/a

ETM Entercom Communications $ 11.08 $411.18 $1,096.50 2.8x 10.5x 11.9x 8.6x 9.6x 8.5x

Mean 2.9x 10.2x 11.7x n/m 9.6x 8.5x

New Media

MSFT Microsoft Corporation $ 28.30 $245,304.40 $213,455.40 3.4x 8.0x 8.8x 13.1x 11.6x 10.5x

AAPL Apple Inc. $ 336.12 $307,875.84 $256,864.84 3.9x 13.3x 14.0x 22.0x 17.4x 14.9x

YHOO Yahoo! Inc. $ 16.90 $22,001.43 $19,353.75 3.0x 14.3x 28.1x 25.1x 19.7x 21.4x

GOOG Google Inc. $ 616.44 $196,786.14 $165,528.14 6.0x 14.7x 16.8x 24.8x 21.3x 18.3x

ERTS Electronic Arts Inc. $ 16.05 $5,296.50 $3,639.50 1.0x 33.1x n/m n/m 25.1x 19.1x

Mean 3.5x 16.7x 16.9x 21.2x 19.0x 16.8x

Satellite Imagery

GEOY GeoEye $ 40.60 $897.67 $983.30 3.1x 5.9x 9.9x 25.1x 21.6x 21.6x

DGI DigitalGlobe Inc. $ 30.46 $1,388.06 $1,545.66 5.0x 9.3x 25.9x n/m n/m n/m

Mean 4.0x 7.6x 17.9x 25.1x 21.6x 21.6x

MEDIA SERVICES INDEX

High 6.0x 33.1x 28.1x 25.1x 35.8x 24.6x

Mean 2.7x 9.8x 13.8x 18.3x 17.6x 13.4x

Low 1.0x 4.2x 6.1x 0.8x 8.4x 8.5x

(b) EPS estimates from Thompson First Call. Near Earth does not estimate EPS and does not condone or v alidate these estimates. n/m Not Meaningful.

(c ) Conv erted to US $ from Euro at an ex change rate of 1.291 US $ per Euro. n/a Not Av ailable

(d ) Conv erted to US $ from C$ at an ex change rate of 1.0078 US $ per C$.

(f) Conv erted to US $ from British Pound at an ex change rate of 1.555 US $ per British Pound.

Member of NEAR EARTH SATELLITE INDEX

Near Earth LLC Page 23/27

From The Ground Up Volume 7, Issue 1

NEAR EARTH ANALYSIS: MARKET COMPARABLES

Public Market Valuation Analysis of Selected Companies in the NEAR EARTH TELECOM INDEX

($ in millions, except per share data) Stock Price: Enterprise Value as a Multiple of: Price as a Multiple of:

Market

Value of Enterprise LTM LTM LTM LTM Trailing Forward

1/7/11 Equity Value (a) Sales EBITDA EBIT EPS EPS (b) EPS (b)

Fixed Satellite Services (FSS)

ETL.PA Eutelsat Communications ( c) € 28.39 $8,066.74 $11,279.47 8.1x 10.6x 17.2x 22.1x 20.1x 18.1x

SESG.PA SES Global S.A. ( c) € 18.22 $9,398.98 $14,427.42 6.3x 9.0x 15.0x 16.3x 14.9x 13.9x

Mean 7.2x 9.8x 16.1x 19.2x 17.5x 16.0x

Mobile Satellite Services (MSS)

ISAT.L Inmarsat (f) £ 6.72 $4,809.61 $6,130.51 5.3x 9.6x 14.7x 25.2x 12.9x 10.7x

IRDM Iridium Communications Inc. $ 8.25 $579.56 $474.92 1.4x 5.0x 10.7x 27.1x 27.5x 15.6x

ORBC ORBCOMM Inc. $ 2.89 $123.13 $37.30 1.0x 3.9x n/m n/m n/m n/m

GSAT Globalstar Inc. $ 1.42 $436.42 $1,004.47 14.9x n/m n/m n/m n/m n/m

Mean 5.7x 6.2x 12.7x 26.1x 20.2x 13.1x

Satellite Ground Segment

CMTL Comtech Telecommunications $ 27.92 $772.27 $369.57 0.4x 2.5x 2.8x 10.0x 14.0x 19.3x

GCOM Globecomm Systems Inc. $ 10.15 $219.14 $188.16 0.8x 10.3x 17.4x 26.0x 19.2x 15.4x

GILT Gilat Satellite Networks $ 5.78 $234.21 $111.72 0.6x 7.7x n/m 6.2x 6.9x n/m

HUGH Hughes Communications, Inc. $ 41.29 $901.36 $1,398.18 1.4x 6.9x 17.7x n/m n/m 16.7x

ISYS Integral Systems Inc. $ 11.41 $200.47 $230.02 1.3x n/m n/m n/m n/m n/a

VSAT ViaSat Inc. $ 44.85 $1,836.16 $2,102.13 2.8x 16.3x n/m n/m 30.5x 30.3x

Mean 1.2x 8.7x 12.6x 14.0x 17.6x 20.4x

Satellite Space Segment

ORB Orbital Sciences $ 17.80 $1,032.40 $879.43 0.7x 10.2x 13.8x 29.0x 25.8x 21.2x

CDV.TO COM DEV International (d) $ 2.45 $188.05 $187.61 0.8x 10.2x 26.2x 32.9x n/m 11.7x

MDA.TO McDonald Dettwiler and Associates (d) $ 49.65 $2,049.53 $2,229.42 2.2x 12.0x 14.9x 17.3x 15.2x 13.4x

OHB.DE OHB Technologies (c ) € 16.52 $371.10 $362.36 0.7x 8.5x 13.1x 15.1x 21.2x 17.2x

Mean 1.1x 10.2x 17.0x 23.6x 20.7x 15.9x

Towers

AMT American Tower $ 50.50 $20,180.31 $24,573.73 13.0x 20.5x 32.0x n/m n/m n/m

CCI Crown Castle $ 42.60 $12,393.19 $19,021.27 10.4x 17.6x 33.9x n/m n/m n/m

SBAC SBA Communications $ 39.66 $4,546.23 $7,167.95 11.8x 20.4x n/m n/m n/m n/m

Mean 11.8x 19.5x 33.0x n/m n/m n/m

General Telecom

S Sprint Nextel Corporation $ 4.68 $13,974.48 $29,606.48 0.9x 5.1x n/m n/m n/m n/m

T AT&T $ 28.85 $170,499.46 $236,518.46 1.9x 5.6x 10.5x 8.1x 12.6x 11.5x

VZ Verizon Communications, Inc. $ 35.93 $101,566.21 $195,468.21 1.8x 5.4x 10.1x 18.5x 16.0x 15.9x

Mean 1.5x 5.4x 10.3x 13.3x 14.3x 13.7x

TELECOM SERVICES INDEX (excludes Towers stocks)

High 14.9x 16.3x 26.2x 32.9x 30.5x 30.3x

Mean 2.8x 7.7x 14.2x 19.5x 21.5x 17.7x

Low 0.4x 2.5x 2.8x 6.2x 6.9x 10.7x

(b) EPS estimates from Thompson First Call. Near Earth does not estimate EPS and does not condone or v alidate these estimates. n/m Not Meaningful.

(c ) Conv erted to US $ from Euro at an ex change rate of 1.291 US $ per Euro. n/a Not Av ailable

(d ) Conv erted to US $ from C$ at an ex change rate of 1.0078 US $ per C$.

(f) Conv erted to US $ from British Pound at an ex change rate of 1.555 US $ per British Pound.

Member of NEAR EARTH SATELLITE INDEX

Near Earth LLC Page 24/27

From The Ground Up Volume 7, Issue 1

NEAR EARTH ANALYSIS: M&A TRANSACTIONS

Selected Satellite, Telecom, Media & Aerospace Transactions

(US$ in millions unless noted)

Transaction Value/

Date Equity Transaction LTM LTM

Announced Acquiror Target Value (a) Value (b) Sales EBITDA

Satellite Operators

12/05/06 Abertis Telecom EutelSat (32% share) 1,000.0 1,838.0 7.3x 9.7x

12/18/06 Telesat (new) Telesat/Skynet Combined 3,491.0 3,990.0 7.1x 13.4x

06/19/07 BC Partners Intelsat 5,000.0 16,400.0 7.7x 11.3x

08/02/07 Abertis Telecom Hispasat (28.4% share) 199.0 199.0 5.8x 7.9x

09/23/09 GHL Acquisition Corp Iridium Satellite LLC 500.0 517.3 1.6x 5.6x

10/01/09 ViaSat, Inc WildBlue Coimmunications, Inc. 568.0 500.0 2.4x 6.6x

Mean 5.3x 9.1x

Ground Equipment & Systems Integrators

05/12/08 Comtech Telecommunications Cor Radyne 201.9 223.6 1.5x 16.0x

05/09/09 Rockwell Collins Datapath, Inc. 130.0 130.0 0.5x n/d

03/05/10 Integral Systems CVG-Avtec Systems, Inc. 34.7 34.7 1.0x n/d

06/16/10 Teledyne Technologies, Inc. Intelek plc 28.0 35.0 0.9x 6.0x

10/13/10 Gilat Satellite Networks Wavestream Corporation 130.0 130.0 1.9x 10.6x

11/26/10 Veritas Capital CPI International, Inc. 393.1 545.2 1.5x 14.1x

Mean 0.6x 11.7x

Satellite Managed Network Services

03/19/07 CIP Canada Investment Inc. Stratos Global Corporation 293.3 621.5 1.2x 6.3x

06/01/09 Globecomm Systems Inc. Telaurus Communications LLC 7.6 7.6 0.6x n/d

11/23/09 Inmarsat plc Segovia, Inc. 110.0 110.0 1.6x n/d

03/08/10 Globecomm Systems Inc. Carrier to Carrier Telecom BV 15.0 15.0 0.8x n/d

05/21/10 Harris Corporation CapRock Communications 525.0 525.0 1.5x 9.7x

11/08/10 Harris Corporation Schlumberger GCS 347.5 347.5 2.0x 8.5x

Mean 0.6x 6.1x

Aerospace and Defense

05/12/08 Finmeccanica SPA DRS Technologies Inc 3,358.0 4,930.0 1.4x 11.0x

05/13/08 Cobham plc M/A-COM 425.0 425.0 0.9x 6.8x

06/04/08 Cobham plc Sparta Inc 416.0 416.0 1.4x 12.1x

12/16/08 Sierra Nevada Corporation SpaceDev, Inc. 31.7 26.6 0.7x 23.3x

12/23/09 OM Group EaglePicher Technologies LLC 171.9 171.9 1.4x n/d

03/05/10 Orbital Sciences Corp. GD Advanced Information Systems 55.0 55.0 1.1x n/d

06/30/10 The Boeing Company Argon ST, Inc 807.1 765.4 2.5x 31.4x

10/13/10 Veritas Capital Lockheed Martin EIG 815.0 815.0 1.3x n/d

12/08/10 GeoEye, Inc. SPADAC Inc. 46.0 46.0 1.7x n/d

12/20/10 Raytheon Company Applied Signal Technology, Inc. 539.0 505.5 2.2x 17.3x

Mean 1.3x 17.0x

Video Distribution

04/23/07 Motorola Terayon Communication Systems Inc. 139.7 127.2 1.9x n/m

12/07/07 Macrovision Corp Gemstar-TV Guide Intl Inc 2,842.1 2,325.1 3.7x 21.9x

03/12/09 Harmonic Inc. Scopus Video Networks 78.3 47.6 0.8x n/m

10/01/09 Cisco Systems Inc. TANDBERG ASA 3,322.0 3,622.0 4.0x 18.7x

05/06/10 Harmonic Inc. Omneon, Inc. 274.0 274.0 2.6x n/d

Mean 2.6x 20.3x

Towers

03/17/06 Crown Castle Trintel Communications 145.0 145.0 10.1x n/d

03/17/06 SBA Communications Corp AAT Communications Corp 1,002.0 1,002.0 12.0x 17.9x

05/08/06 Crown Castle Mountain Union Telecom LLC 309.0 309.0 11.9x n/d

10/06/06 Crown Castle Global Signal 4,000.0 5,800.0 12.1x 26.6x

07/21/08 SBA Communications Corp Optasite Towers 253.2 428.2 14.8x n/m

Mean 12.2x 22.2x

General Telecom (Wireless)

03/06/06 AT&T (new) Bell South 67,000.0 89,000.0 4.3x 10.7x

08/07/08 Verizon Wireless Rural Cellular Corp 728.0 2,757.0 4.1x 9.7x

01/10/09 Verizon Wireless Alltel Wireless 5,900.0 28,100.0 2.9x 8.3x

12/24/09 Sprint Nextel Corp. Virgin Mobile USA 348.0 509.0 0.4x 4.4x

Mean 2.9x 8.3x

Telematics

11/21/08 EMS Technologies Inc. Satamatics Global Ltd. £30.67 £30.67 3.0x 6.9x

12/02/08 Sierra Wireless Inc. Wavecom SA 306.0 271.0 2.3x n/m

07/01/09 Inmarsat plc SkyWave Mobile (19%) 113.2 113.2 2.8x 7.5x

01/22/10 Francisco Partners Cybit £22.85 £22.91 1.0x 3.9x

06/29/10 Gemalto NV Cinterion Wireless Modules GmbH € 163.0 € 163.0 1.1x 8.2x