Académique Documents

Professionnel Documents

Culture Documents

AMP Performance

Transféré par

aboodjDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AMP Performance

Transféré par

aboodjDroits d'auteur :

Formats disponibles

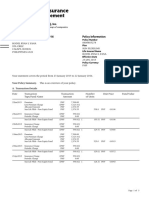

Mr.

John Abood portfolio

report

John Abood

as at October 12, 2010

PO Box 262 STONES CORNER QLD 4120

Mr. John Abood portfolio report

Portfolio Summary Report

Assets & Liabilities

Superannuation

AMP Flexible Lifetime - Super 918282725 $11,154.01

Net Worth $11,154.01

Insurance

Life, Income Protection and Disability Insurance

AMP Flexible Lifetime - Super 918282725

Investment Asset Allocation as at 12 October, 2010

Investment Asset Allocation as at 12 October, 2010

Australian Fixed Interest $1,458.94 13.1%

Australian Shares $3,905.02 35.0%

Cash $442.81 4.0%

International Fixed Interest $490.78 4.4%

International Shares $2,533.08 22.7%

Other $774.09 6.9%

Property $1,549.29 13.9%

Total: $11,154.01 100.0%

October 12, 2010 Page 2 of 15

Mr. John Abood portfolio report

AMP Flexible Lifetime - Super (918282725)

Summary details

General details

Member name John Abood

Date of birth 01 Jun 1968

Tax file number held Yes

Employer name

ABOODS JEWELLERS

Plan details

Plan name ABOODS JEWELLERS

Member number 918282725

Date joined plan 15 Aug 2002

Total account balance $11,154.01

Insurance group code Individual

Estimated contribution tax $16.36

Insurance Details

Total death benefit $580,726.06

Total and permanent disablement benefit $580,726.06

Insured death cover $569,496.25

Insured total and permanent disablement cover $569,496.25

Total insurance premium deductions per month $109.06

Personalised fee structure *

Contribution fee 4.50%

Contact details

John Abood

po box 262

STONES CORNER, QLD 4120

Australia

07 3204 4438

john.abood@gmail.com

Financial planner details

Financial planner name Scott Blake

Business telephone number 07 3421 3950

Account at a glance details

[1][2] Refer to last page

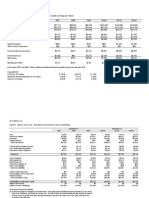

Account summary from 01/07/2010 to 08/10/2010

Opening value $10,780.73

Contributions $112.65

Insurance premiums -$327.18

Tax on contributions $32.18

Contribution & non-recurring fees -$4.32

Net investment earnings $547.24

Closing value $11,141.30

Estimated personal rate of return 5.11%

Estimated annualised personal rate of return 20.16% p.a

Graphical representation of account summary from 01/07/2010 to 08/10/2010

October 12, 2010 Page 3 of 15

Mr. John Abood portfolio report

Graphical representation of account summary from 01/07/2010 to 08/10/2010

$12,000.00

$10,000.00

$8,000.00

$6,000.00

$10,781 $11,141

$4,000.00

$2,000.00

$547

$113 $32

$0.00 -$327 -$4

-$2,000.00

Opening value Contributions Insurance Tax on Contribution & Net investment Closing value

premiums contributions non-recurring fees earnings

Estimated personal rate of return by investment option for the period from 01/07/2010 to 08/10/2010

Investment option name Investment date range Rate of return Annualised

(%) rate of return

(%)

AMP BALANCED GROWTH 01/07/2010 - 08/10/2010 5.11% 20.16% p.a

Contribution details

BPay contributions

BPay Customer Reference Number 9182827254

Account Member contributions

BPay Biller Code 879080

Account Spouse contributions

BPay Biller Code 879098

Account Salary sacrifice contributions

BPay Biller Code 443721

Account Employer contributions

BPay Biller Code 879072

Employer contributions

Employer name ABOODS JEWELLERS

Employer number 900463945

Contribution amount $37.56

Contribution frequency Monthly

Contribution increase with inflation Yes

Contribution method Direct Debit

Next bill date 22 Oct 2010

BPay Biller Code (employer) 879072

BPay Customer Reference Number 9182827254

Contribution account details

October 12, 2010 Page 4 of 15

Mr. John Abood portfolio report

Employer Main Sub-Account

Account balance $2,512.94

Last contribution amount received $37.55

Date last contribution received 22 Sep 2010

Member Sub-Account

[3] Refer to last page

Account balance -$2.41

Rollover Sub-Account

Account balance $8,643.23

Last contribution amount received $89.38

Date last rollover received 17 Oct 2002

Investment details

AMP Flexible Lifetime - Super LifeStages

Age Investment Portfolio

Age under 30 AMP All Growth

Age 30 to 39 AMP High Growth

Age 40 to 49 AMP Balanced Growth

Age 50 to 59 AMP Moderate Growth

Age 60 & over AMP Conservative

Investment option values

Investment option name Number of Unit price ($) Amount ($) Unit price

units effective date

AMP Balanced Growth 4,489.71 $2.48435 $11,154.01 11 Oct 2010

Total $11,154.01

Investment option values

Investment option values

AMP Balanced Growth $11,154.01 100.0%

Total: $11,154.01 100.0%

Future contribution split

Investment option name Future

contribution

percentage

AMP Balanced Growth 100.00%

October 12, 2010 Page 5 of 15

Mr. John Abood portfolio report

AMP Balanced Growth $100.00 100.0%

Total: $100.00 100.0%

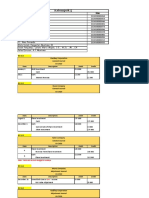

Asset Allocation as at 12 October, 2010

Asset class Actual % ($)

Cash 3.97% $442.81

Australian Fixed Interest 13.08% $1,458.94

Property 13.89% $1,549.29

Australian Shares 35.01% $3,905.02

International Fixed Interest 4.40% $490.78

International Shares 22.71% $2,533.08

Other 6.94% $774.09

Total 100.00% $11,154.01

Asset Allocation as at 12 October, 2010

Asset Allocation as at 12 October, 2010

Australian Fixed Interest $1,458.94 13.1%

Australian Shares $3,905.02 35.0%

Cash $442.81 4.0%

International Fixed Interest $490.78 4.4%

International Shares $2,533.08 22.7%

Other $774.09 6.9%

Property $1,549.29 13.9%

Total: $11,154.01 100.0%

Unit Price History

October 12, 2010 Page 6 of 15

Mr. John Abood portfolio report

Unit Price History

2.540

2.520

2.500

2.480

2.460

2.440

2.420

2.400

2.380

12/10/09 12/12/09 12/02/10 12/04/10 12/06/10 12/08/10 12/10/10

AMPBalanced Growth

Historical investment details

Investment option values as at 11 Oct 2010

Investment option name Number of Unit price ($) Amount ($) Unit price

units effective date

AMP BALANCED GROWTH 4,489.71 $2.48435 $11,154.01 11 Oct 2010

Total account balance $11,154.01

Current Investment option values

Investment option name Number of Unit price ($) Amount ($) Unit price

units effective date

AMP Balanced Growth 4,489.71 $2.48435 $11,154.01 11 Oct 2010

Total account balance $11,154.01

Superannuation Benefit details

Eligible service period

Eligible start date 26 Jul 1990

Superannuation Benefit is calculated to this date 11 Oct 2010

Superannuation Benefit commencement date 26 Jul 1990

Superannuation Benefit Components

Taxable $4,084.96

Tax Free $7,144.85

Total Superannuation Benefit $11,229.81

Preservation amounts

Preserved amount $11,140.43

Restricted non-preserved amount $0.00

Un-restricted non-preserved amount $89.38

Insurance cover details

October 12, 2010 Page 7 of 15

Mr. John Abood portfolio report

Extra Death Benefit

Insured cover $569,496.25

Cover start date 22 Aug 2002

Cover end date 01 Jun 2067

Monthly premium amount $52.87

Benefit indexed with inflation Yes

Smoking status Non-smoker

Total and Permanent Disablement Benefit

Insured cover $569,496.25

Cover start date 22 Aug 2002

Cover end date 01 Jun 2067

Monthly premium amount $56.19

Benefit indexed with inflation Yes

Smoking status Non-smoker

Stamp Duty

Stamp Duty $0.00

Beneficiary details

Binding nominated beneficiary details

Beneficiary name Vivienne Jane Abood

Beneficiary percentage 100.00%

Relationship Spouse

Expiry Date 22 Jun 2013

Investment transaction details

AMP Balanced Growth

October 12, 2010 Page 8 of 15

Mr. John Abood portfolio report

Effective date Description Account Amount Units

01 Oct 2010 Accruals Rollover -$84.49 -34.36

01 Oct 2010 Accruals Employer -$24.57 -9.99

23 Sep 2010 Contribution Tax Employer -$6.03 -2.45

23 Sep 2010 Contribution Tax Rollover $38.21 15.53

22 Sep 2010 Accruals Employer -$1.44 -0.59

22 Sep 2010 Employer payments Employer $37.55 15.27

01 Sep 2010 Accruals Employer -$24.42 -10.10

01 Sep 2010 Accruals Rollover -$84.64 -35.01

23 Aug 2010 Employer payments Employer $37.55 15.62

23 Aug 2010 Accruals Employer -$1.44 -0.60

01 Aug 2010 Accruals Rollover -$84.92 -35.17

01 Aug 2010 Accruals Employer -$24.14 -10.00

22 Jul 2010 Employer payments Employer $37.55 15.72

22 Jul 2010 Accruals Employer -$1.44 -0.60

01 Jul 2010 Accruals Rollover -$85.20 -36.09

01 Jul 2010 Accruals Employer -$23.86 -10.11

30 Jun 2010 Investment return Rollover $699.35 0.00

30 Jun 2010 Investment return Member -$0.15 0.00

30 Jun 2010 Investment return Employer $162.66 0.00

24 Jun 2010 Contribution Tax Rollover $32.76 13.60

24 Jun 2010 Contribution Tax Employer -$7.45 -3.09

22 Jun 2010 Employer payments Employer $36.49 15.04

22 Jun 2010 Accruals Employer -$1.39 -0.57

01 Jun 2010 Accruals Rollover -$72.58 -30.26

01 Jun 2010 Accruals Employer -$20.16 -8.40

24 May 2010 Employer payments Employer $36.49 15.25

24 May 2010 Accruals Employer -$1.39 -0.58

01 May 2010 Accruals Employer -$19.94 -7.99

01 May 2010 Accruals Rollover -$72.80 -29.18

22 Apr 2010 Employer payments Employer $36.49 14.50

22 Apr 2010 Accruals Employer -$1.39 -0.55

01 Apr 2010 Accruals Employer -$19.72 -7.86

01 Apr 2010 Accruals Rollover -$73.02 -29.11

25 Mar 2010 Contribution Tax Rollover $33.01 13.22

25 Mar 2010 Contribution Tax Employer -$7.70 -3.08

22 Mar 2010 Employer payments Employer $36.49 14.67

22 Mar 2010 Accruals Employer -$1.39 -0.56

01 Mar 2010 Accruals Employer -$19.60 -8.04

01 Mar 2010 Accruals Rollover -$73.14 -30.01

22 Feb 2010 Accruals Employer -$1.39 -0.57

22 Feb 2010 Employer payments Employer $36.49 14.97

01 Feb 2010 Accruals Rollover -$73.36 -30.57

01 Feb 2010 Accruals Employer -$19.38 -8.08

22 Jan 2010 Employer payments Employer $36.49 14.93

22 Jan 2010 Accruals Employer -$1.39 -0.57

01 Jan 2010 Accruals Rollover -$73.59 -29.74

01 Jan 2010 Accruals Employer -$19.15 -7.74

23 Dec 2009 Contribution Tax Rollover $33.26 13.57

23 Dec 2009 Contribution Tax Employer -$7.96 -3.25

22 Dec 2009 Accruals Employer -$1.39 -0.57

22 Dec 2009 Employer payments Employer $36.49 14.94

01 Dec 2009 Accruals Rollover -$73.71 -30.29

01 Dec 2009 Accruals Employer -$19.03 -7.82

23 Nov 2009 Accruals Employer -$1.39 -0.57

23 Nov 2009 Employer payments Employer $36.49 15.02

01 Nov 2009 Accruals Employer -$18.80 -7.83

01 Nov 2009 Accruals Rollover -$0.03 -0.01

01 Nov 2009 Accruals Rollover -$73.90 -30.77

22 Oct 2009 Employer payments Employer $36.49 14.91

22 Oct 2009 Accruals Employer -$1.39 -0.57

October 12, 2010 Page 9 of 15

Mr. John Abood portfolio report

Transaction details

October 12, 2010 Page 10 of 15

Mr. John Abood portfolio report

Effective date Description Account Amount Total

Amount($)

01 Oct 2010 Charge for insurance benefits EDB -$52.87

01 Oct 2010 Charge for insurance benefits TPD -$56.19

23 Sep 2010 Contribution Tax Rollover $38.21

23 Sep 2010 Contribution Tax Employer -$6.03

Contribution Tax $32.18

22 Sep 2010 Contribution fees/member fees -$1.44

22 Sep 2010 Employer payments Employer $37.55

Total Payments $37.55

01 Sep 2010 Charge for insurance benefits EDB -$52.87

01 Sep 2010 Charge for insurance benefits TPD -$56.19

23 Aug 2010 Contribution fees/member fees -$1.44

23 Aug 2010 Employer payments Employer $37.55

Total Payments $37.55

01 Aug 2010 Charge for insurance benefits EDB -$52.87

01 Aug 2010 Charge for insurance benefits TPD -$56.19

22 Jul 2010 Contribution fees/member fees -$1.44

22 Jul 2010 Employer payments Employer $37.55

Total Payments $37.55

01 Jul 2010 Charge for insurance benefits EDB -$52.87

01 Jul 2010 Charge for insurance benefits TPD -$56.19

30 Jun 2010 Investment return $861.86

24 Jun 2010 Contribution Tax Rollover $32.76

24 Jun 2010 Contribution Tax Employer -$7.45

Contribution Tax $25.31

22 Jun 2010 Contribution fees/member fees -$1.39

22 Jun 2010 Employer payments Employer $36.49

Total Payments $36.49

01 Jun 2010 Charge for insurance benefits EDB -$46.42

01 Jun 2010 Charge for insurance benefits TPD -$46.32

24 May 2010 Contribution fees/member fees -$1.39

24 May 2010 Employer payments Employer $36.49

Total Payments $36.49

01 May 2010 Charge for insurance benefits EDB -$46.42

01 May 2010 Charge for insurance benefits TPD -$46.32

22 Apr 2010 Contribution fees/member fees -$1.39

22 Apr 2010 Employer payments Employer $36.49

Total Payments $36.49

01 Apr 2010 Charge for insurance benefits EDB -$46.42

01 Apr 2010 Charge for insurance benefits TPD -$46.32

25 Mar 2010 Contribution Tax Employer -$7.70

25 Mar 2010 Contribution Tax Rollover $33.01

Contribution Tax $25.31

22 Mar 2010 Contribution fees/member fees -$1.39

22 Mar 2010 Employer payments Employer $36.49

Total Payments $36.49

01 Mar 2010 Charge for insurance benefits EDB -$46.42

01 Mar 2010 Charge for insurance benefits TPD -$46.32

22 Feb 2010 Contribution fees/member fees -$1.39

22 Feb 2010 Employer payments Employer $36.49

Total Payments $36.49

01 Feb 2010 Charge for insurance benefits EDB -$46.42

01 Feb 2010 Charge for insurance benefits TPD -$46.32

22 Jan 2010 Contribution fees/member fees -$1.39

22 Jan 2010 Employer payments Employer $36.49

Total Payments $36.49

01 Jan 2010 Charge for insurance benefits EDB -$46.42

01 Jan 2010 Charge for insurance benefits TPD -$46.32

23 Dec 2009 Contribution Tax Employer -$7.96

23 Dec 2009 Contribution Tax Rollover $33.26

October 12, 2010 Page 11 of 15

Mr. John Abood portfolio report

Effective date Description Account Amount Total

Amount($)

Contribution Tax $25.30

22 Dec 2009 Contribution fees/member fees -$1.39

22 Dec 2009 Employer payments Employer $36.49

Total Payments $36.49

01 Dec 2009 Charge for insurance benefits EDB -$46.42

01 Dec 2009 Charge for insurance benefits TPD -$46.32

23 Nov 2009 Contribution fees/member fees -$1.39

23 Nov 2009 Employer payments Employer $36.49

Total Payments $36.49

01 Nov 2009 Charge for insurance benefits EDB -$47.05

01 Nov 2009 Charge for insurance benefits TPD -$45.68

22 Oct 2009 Contribution fees/member fees -$1.39

22 Oct 2009 Employer payments Employer $36.49

Total Payments $36.49

Withdrawal details

Accrual $69.07

Withdrawal value $11,229.81

Superannuation Benefit details

Eligible service period

Eligible start date 26 Jul 1990

Superannuation Benefit is calculated to this date 11 Oct 2010

Superannuation Benefit commencement date 26 Jul 1990

Superannuation Benefit Components

Taxable $4,084.96

Tax Free $7,144.85

Total Superannuation Benefit $11,229.81

Preservation Amounts

Preserved amount $11,140.43

Restricted non-preserved amount $0.00

Unrestricted non-preserved amount $89.38

Employer details

Employer 1

Name ABOODS JEWELLERS

Contact Mr john abood

Address po box 262

STONES CORNER QLD 4120

October 12, 2010 Page 12 of 15

Mr. John Abood portfolio report

Important Notes

The information provided in this Portfolio Report is current as at 12/10/10. This Portfolio Report is provided as

factual information only and should not be considered a substitute for professional financial advice or a review of

your current financial situation. The information in this Portfolio Report has been prepared without taking into

account any individual needs, financial situation or objectives.

October 12, 2010 Page 13 of 15

Mr. John Abood portfolio report

AMP Flexible Lifetime - Super (918282725)

The total account balance displayed may not include recent investment transactions.

The total death or total and permanent disablement benefit is the withdrawal value plus the insured benefit.

For unit linked investment options:

- we calculate the account balance using the latest unit price;

- unit prices may go up or down;

- the withdrawal value depends on the unit price when we pay the benefit.

For interest bearing investment options, no interest has been allocated since the last member statement.

For AMP Term Deposit Investment Options (not available within all products):

- The initial amount invested is included in the account balance and withdrawal value;

- Notional investment earnings are included in the withdrawal value;

- Adjusted crediting rates apply if a Term Deposit is terminated early.

All or part of the withdrawal value may be preserved, so it cannot normally be cashed until after the preservation

age.

We deduct insurance premiums and member fees at the beginning of the month, so the charges for this month

have already been deducted.

The account balance may be reduced by any tax or surcharge liability outstanding at the time it is cashed.

* The fee(s) outlined in the 'Personalised fee structure' section refers to your agreed non-standard fee(s). Refer to

your Product Disclosure Statement for information about standard fees.

Benefits are governed by the Flexible Lifetime – Super rules — in the trust deed, the policy document

and the Product Disclosure Statement. We believe the amounts shown are correct. If we find they are

not, we will correct them.

The Opening and Closing values used to calculate the personal rate of return, should only be used as a

guide, as these values may contain an estimate for interest earned from any interest bearing investment options.

Net investment earnings are after deduction of all ongoing account keeping fees and charges (including tax on

investment earnings), and after applying any rebates relevant to those fees and charges. For unit linked

investment options, we calculate net investment earnings in regard to the account balance using the latest unit

price. For interest bearing investment options, net investment earnings includes interest calculated using the

latest available interest rate up to the beginning of the month.

For AMP Term Deposits Investment Options investment earnings will only be included at maturity, on

anniversary or when the term is broken earlier than the maturity date.

Member fees and rebates are applied at the end of each month, so net investment earnings shown above have

not been adjusted for any member fees and/or rebates for the current month. Insurance premiums, contribution

fees and non-recurring fees are not deducted to calculate investment earnings.

The personal rate of return and the personalised annualised rate of return are based on the account's

net investment earnings for the period shown and the average balance invested over that period. Where the

period is less than one year, the personal rate of return is for the period shown, it is not the equivalent annual

rate.

The personal rate of return and the personal annualised rate of return are affected by the timing and

amount of the transactions on the account and will usually differ from returns reported elsewhere for the

account's investment options.

October 12, 2010 Page 14 of 15

Mr. John Abood portfolio report

Important:

Benefits are governed by the trust deed, the policy document and the Product Disclosure Statement.

The data presented reflects values within AMP product systems. Should you suspect any data is

inaccurate, please report these to the customer service centre.

The account balance may also be reduced by any tax or surcharge liability outstanding at the time it is cashed.

Amounts shown on this page are as at 12/10/2010. Recent transactions may not be included. The calculated

personal rate of return and the personal annualised rate of return should therefore only be used as a guide.

Stamp duty is a State/Territory Government levy payable on certain types of insurance cover and may be

included within your insurance premium or be an additional amount payable. If the stamp duty amount is an

additional amount, it will be shown separately on your statement. Stamp duty may vary from time to time due to

changes imposed by the State/Territory Revenue Office, or if you change State/Territory.

Note and disclaimers

1. The value of each of these investment options is reflected in unit prices. These unit prices can rise and fall on

a daily basis, as a result of movements in the value of the underlying assets that back each option.

The unit prices quoted will not apply to any subsequent investment transaction. The prices used for

transactions are prices that are struck after the transaction, so they are not known at the time.

2. The investment managers for the AMP Capital Enhanced Yield investment option and the Challenger High

Yield investment option have delayed withdrawal and switch requests due to extraordinary market conditions (for

example because of lack of liquidity and/or pricing issues). In response to these changes, we have closed these

investment options to new investors and generally will not accept any additional contributions into these options.

There may be significant delays in processing withdrawal and switch requests from these investment options. If

you are invested in any of the investment options listed above, the closure of these investment options may

affect any withdrawal values referred to on this page. Please contact AMP on 131 267 for further information.

3. Please note: Any spouse contributions and Government co-contributions that may be applied to this plan are

placed into the 'Member Sub-Account'

4. Your superannuation savings with FL are invested in the AMP LifeStages facility. LifeStages is an investment

approach that takes the hard work out of deciding how to invest your super. It automatically lowers your risk

profile by switching your super savings to less risky investments, as you get older. It therefore reduces the need

for you to continually reassess your investment strategy.

5. Asset allocation data is provided by MorningStar, a third party provider, and is an indicative measure only. It

reflects your investment option profile and the most recent asset allocations advised by the relevant fund

managers.

October 12, 2010 Page 15 of 15

Vous aimerez peut-être aussi

- Trust Agreement: Back To Table of ContentsDocument16 pagesTrust Agreement: Back To Table of ContentsJurisprudence Law100% (1)

- Intrinsic Value CalculationDocument9 pagesIntrinsic Value Calculationmumbaideepika100% (1)

- Maynard CompanyDocument5 pagesMaynard CompanyNikitha Andrea SaldanhaPas encore d'évaluation

- Revised IFRS 16 Lease Math 1, 2Document8 pagesRevised IFRS 16 Lease Math 1, 2Feruz Sha Rakin100% (1)

- HW 4Document4 pagesHW 4Mishalm96Pas encore d'évaluation

- Financial UnderwritingDocument19 pagesFinancial UnderwritingPritish PatnaikPas encore d'évaluation

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Malta CBI Brochure 2022 CompressedDocument52 pagesMalta CBI Brochure 2022 Compressedcelal kerePas encore d'évaluation

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Eaton Corporation WaccDocument21 pagesEaton Corporation WaccDee-Annee Dottin0% (2)

- Tugas Ch.14Document6 pagesTugas Ch.14Chupa HesPas encore d'évaluation

- Echnical Eport: FWPRDC Project No: 02.1209Document9 pagesEchnical Eport: FWPRDC Project No: 02.1209aboodjPas encore d'évaluation

- Echnical Eport: FWPRDC Project No: 02.1209Document9 pagesEchnical Eport: FWPRDC Project No: 02.1209aboodjPas encore d'évaluation

- Flash Memory IncDocument9 pagesFlash Memory Incxcmalsk100% (1)

- Perez vs. CA and BF Lifeman InsuranceDocument2 pagesPerez vs. CA and BF Lifeman InsuranceLaika CorralPas encore d'évaluation

- Ch14 P13 Build A ModelDocument6 pagesCh14 P13 Build A ModelRayudu Ramisetti0% (2)

- Net MeteringDocument40 pagesNet MeteringSadaf MaqsoodPas encore d'évaluation

- Financial Statements, Cash Flows & TaxesDocument26 pagesFinancial Statements, Cash Flows & TaxesCathrene Jen Balome100% (1)

- Carley NDocument11 pagesCarley NaliPas encore d'évaluation

- Tugas Responsi (Individu 2) AKT - Keuangan Ramelinium Purba (190120144)Document5 pagesTugas Responsi (Individu 2) AKT - Keuangan Ramelinium Purba (190120144)Ramelinium PurbaPas encore d'évaluation

- MBF5207201004 Strategic Financial ManagementDocument5 pagesMBF5207201004 Strategic Financial ManagementtawandaPas encore d'évaluation

- Financial & Managerial Accounting - JunXianDocument5 pagesFinancial & Managerial Accounting - JunXianhashtagjxPas encore d'évaluation

- 770976ce9 - DLeon Part IDocument5 pages770976ce9 - DLeon Part IMuhammad sohailPas encore d'évaluation

- Mcclintock 4356 Mcclintock Street San Diego, Ca 92105: 8 Well Maintained Units in City HeightsDocument5 pagesMcclintock 4356 Mcclintock Street San Diego, Ca 92105: 8 Well Maintained Units in City Heightsassistant_sccPas encore d'évaluation

- Payslip 16147502Document1 pagePayslip 16147502jamesmunro49Pas encore d'évaluation

- TUGAS - Zulfahmi - Pend. Akuntansi - Kelas A-DikonversiDocument5 pagesTUGAS - Zulfahmi - Pend. Akuntansi - Kelas A-DikonversiValdiPas encore d'évaluation

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohPas encore d'évaluation

- IFRS 16 Lease MathDocument2 pagesIFRS 16 Lease MathFeruz Sha RakinPas encore d'évaluation

- Proposal Tanaman MelonDocument3 pagesProposal Tanaman Melondr walferPas encore d'évaluation

- Mid Term ExamDocument4 pagesMid Term ExamChris Rosbeck0% (1)

- Solutions To IFM 2020 JanDocument4 pagesSolutions To IFM 2020 Janrahul krishnaPas encore d'évaluation

- Tax Invoice/Receipt: Product and Description Qty Reference No: EGOVE8WBTI Main Applicant: Safiatou Diallo (18.10.2001)Document1 pageTax Invoice/Receipt: Product and Description Qty Reference No: EGOVE8WBTI Main Applicant: Safiatou Diallo (18.10.2001)MoutagaPas encore d'évaluation

- CH 17 InvestmentsDocument18 pagesCH 17 InvestmentsAbdi hasenPas encore d'évaluation

- 5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsDocument2 pages5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsvedeshPas encore d'évaluation

- Bellingham Crossroads Economics 9-23-22Document7 pagesBellingham Crossroads Economics 9-23-22deresensPas encore d'évaluation

- 2024 Truth in Taxation PresentationDocument19 pages2024 Truth in Taxation PresentationinforumdocsPas encore d'évaluation

- Rent vs. Buy Calculation: Inflation RateDocument3 pagesRent vs. Buy Calculation: Inflation RateOthman Alaoui Mdaghri BenPas encore d'évaluation

- Nunc Pro Tunc To March 5, 2019Document57 pagesNunc Pro Tunc To March 5, 2019Kirk HartleyPas encore d'évaluation

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderPas encore d'évaluation

- Property Investor CondoDocument1 pageProperty Investor CondoNeedsterPas encore d'évaluation

- Aol AccDocument19 pagesAol AccANGELYCA LAURAPas encore d'évaluation

- Flash MemoryDocument14 pagesFlash MemoryPranav TatavarthiPas encore d'évaluation

- Valuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCDocument10 pagesValuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCAndy SananoPas encore d'évaluation

- Tugas KB Aklan TM 13-Kelompok 1Document10 pagesTugas KB Aklan TM 13-Kelompok 1AdnanPas encore d'évaluation

- Pindi YulinarRosita - Chapter 15 IA 2Document10 pagesPindi YulinarRosita - Chapter 15 IA 2Pindi YulinarPas encore d'évaluation

- Jack Kelly Presentation On Jersey City's BudgetDocument12 pagesJack Kelly Presentation On Jersey City's BudgetThe Jersey City IndependentPas encore d'évaluation

- PR 4-6A - Senapati Yudha Garda PerkasaDocument14 pagesPR 4-6A - Senapati Yudha Garda PerkasaSenapati PerkasaPas encore d'évaluation

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisPas encore d'évaluation

- Mea NoaiaDocument1 pageMea NoaiaTaniela FuataimiPas encore d'évaluation

- Financial Analysis of National Underground Railroad Freedom Center, IncDocument6 pagesFinancial Analysis of National Underground Railroad Freedom Center, IncCOASTPas encore d'évaluation

- HE 6 Questions - Updated-1Document8 pagesHE 6 Questions - Updated-1halelz69Pas encore d'évaluation

- Group AssignmentDocument4 pagesGroup Assignmentmichaelbarbosa0265Pas encore d'évaluation

- Practice 5 InvestmentDocument12 pagesPractice 5 InvestmentParal Fabio MikhaPas encore d'évaluation

- AC 414 814 - Exam 2 - Practice ProblemsDocument2 pagesAC 414 814 - Exam 2 - Practice ProblemsCameron McGaffiganPas encore d'évaluation

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMAPas encore d'évaluation

- 36220602Document14 pages36220602Aijaz ShaikhPas encore d'évaluation

- 04-12-2021 Financial Ration 2Document2 pages04-12-2021 Financial Ration 2Charles Harvey PoncePas encore d'évaluation

- Healthcare UsageDocument81 pagesHealthcare UsageglasscityjunglePas encore d'évaluation

- Assignment #1Document5 pagesAssignment #1FreelansirPas encore d'évaluation

- Sports HavenDocument3 pagesSports HavenKailash Kumar100% (1)

- Student Workbook Flash Amended Final PDFDocument21 pagesStudent Workbook Flash Amended Final PDFGaryPas encore d'évaluation

- Flash Memory ExcelDocument4 pagesFlash Memory ExcelHarshita SethiyaPas encore d'évaluation

- Tgas 1 Kelompok 5 (PA 2)Document9 pagesTgas 1 Kelompok 5 (PA 2)Muhammad RiskiPas encore d'évaluation

- 14-NURFC Financial Analysis 3.07Document3 pages14-NURFC Financial Analysis 3.07COASTPas encore d'évaluation

- Solution To Ch14 P13 Build A ModelDocument6 pagesSolution To Ch14 P13 Build A ModelALI HAIDERPas encore d'évaluation

- Latihan KP - Muhamad Imam Dharmawan - 2502017162hhDocument9 pagesLatihan KP - Muhamad Imam Dharmawan - 2502017162hhNatasha HerlianaPas encore d'évaluation

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsD'EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsPas encore d'évaluation

- Raga70 GRANDFATHER CLOCKDocument1 pageRaga70 GRANDFATHER CLOCKaboodjPas encore d'évaluation

- Color SelectionDocument18 pagesColor SelectionaboodjPas encore d'évaluation

- Critical Reasoning PracticeDocument84 pagesCritical Reasoning PracticetiaraalfenzaPas encore d'évaluation

- Swati Bajaj ProjDocument88 pagesSwati Bajaj ProjSwati SoodPas encore d'évaluation

- TempDocument50 pagesTempHeru H. DayPas encore d'évaluation

- Contractor's Obligation: Construct and Complete The Works Provide Everything Necessary, I.EDocument14 pagesContractor's Obligation: Construct and Complete The Works Provide Everything Necessary, I.EGenie LoPas encore d'évaluation

- Insurance Agent Resume No ExperienceDocument4 pagesInsurance Agent Resume No Experiencewkiqlldkg100% (1)

- Business Standard 31th AugDocument17 pagesBusiness Standard 31th AugSandeep SinghPas encore d'évaluation

- Anniversary Statement 25 January 2016Document3 pagesAnniversary Statement 25 January 2016Rodel Ryan YanaPas encore d'évaluation

- Ewealth Insurance - BrochureDocument16 pagesEwealth Insurance - BrochurerajendranrajendranPas encore d'évaluation

- Unicon Investment SolutionDocument81 pagesUnicon Investment SolutionArfana YasminPas encore d'évaluation

- USGICL - Accidental Insurance - Common Claim FormDocument4 pagesUSGICL - Accidental Insurance - Common Claim FormKôtî MśdiañPas encore d'évaluation

- Mapil Civil Engineering ConstructionDocument2 pagesMapil Civil Engineering ConstructionakilaPas encore d'évaluation

- Bajaj Allianz General Insurance Co. LTDDocument20 pagesBajaj Allianz General Insurance Co. LTDAnudeep SekharPas encore d'évaluation

- If Undelivered, Please Return ToDocument1 pageIf Undelivered, Please Return ToSri VasaPas encore d'évaluation

- 1 Insurance ClaimDocument10 pages1 Insurance ClaimBAZINGA100% (1)

- Bar Questions and Answers in Mercantile Law (Repaired)Document208 pagesBar Questions and Answers in Mercantile Law (Repaired)Ken ArnozaPas encore d'évaluation

- Accountancy 12th Part-2Document292 pagesAccountancy 12th Part-2King ClasherARPas encore d'évaluation

- E Bao Tech Life System enDocument8 pagesE Bao Tech Life System enBlankOn BlackPas encore d'évaluation

- Commerce Project On Consumer Cases in IndiaDocument16 pagesCommerce Project On Consumer Cases in IndiaKaveesh S80% (10)

- Bankers Blanket Bond and Electronic & Computer Crime InsuranceDocument5 pagesBankers Blanket Bond and Electronic & Computer Crime InsuranceAvatarPas encore d'évaluation

- Competition in Salaries, Credentials, and Signaling Prerequisites For Job (A J) 1976Document25 pagesCompetition in Salaries, Credentials, and Signaling Prerequisites For Job (A J) 1976pedronuno20Pas encore d'évaluation

- Copy PolisDocument2 pagesCopy PolisSiroji AhmadPas encore d'évaluation

- En 2015 04 10-Auslandspraktika-Bei-Volkswagen PDFDocument23 pagesEn 2015 04 10-Auslandspraktika-Bei-Volkswagen PDFVaibhav PunethaPas encore d'évaluation

- Advantages of Life InsuranceDocument12 pagesAdvantages of Life InsuranceKumaran KishorPas encore d'évaluation

- Health-Optimizing P.E. (H.O.P.E.) 2: Sports: Organizing A Sports EventsDocument6 pagesHealth-Optimizing P.E. (H.O.P.E.) 2: Sports: Organizing A Sports Events11 STEM Crocus Pia ArevaloPas encore d'évaluation

- Brochure Filing A Tax Return in The NetherlandsDocument8 pagesBrochure Filing A Tax Return in The Netherlandssonazinus6847Pas encore d'évaluation