Académique Documents

Professionnel Documents

Culture Documents

Mccaw 1992

Transféré par

jeffrey friedmanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mccaw 1992

Transféré par

jeffrey friedmanDroits d'auteur :

Formats disponibles

McCawtn.

xls

This spreadsheet is provided to support instructor preparation of UVA-F-1142 and 1143, "McCaw Cellular" and "AT

Assumptions may be toggled between ATT and McCaw outlooks by changing the entry in cell B9: either "mccaw" o

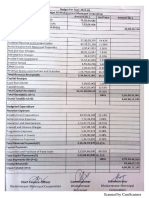

Exhibit TN10

Financial Forecast of McCaw Cellular Prepared By AT&T, Remaining Portion of LIN Broadcasting Purchased

Modeling Assumptions:

att

AT&T

Annual Pop 0.01

Annual Pen 0.16

Purchase Ry

33603

Direct Costs & Exp. (e 0.331906 0.3297942 0.3215772 0.3135106

Direct Cost Increment -0.025

Marketing Expenses (%0.264339 0.2559573 0.225341 0.1982133

Marketing Expense In -0.12

Depreciation + Amortiz 0.352406 0.3478795 0.3305435 0.3139612

D&A Increment (%) -0.05

CapEx per Net Subscri 1190 1020 870 785

1190 ATT 1020 870 785

1147 McCaw 1000 850 750

Net Working Captial ( 198 150 75 38

198 ATT 150 75 38

198 McCaw 150 60 24

Tax Rate 0.36

3 Mths Full Year

Date 9/30/1992 12/31/1992 12/31/1993 12/31/1994

Discount Periods 0 0.2520548 1.2486339 2.2520548

McCaw Pops (millions) 45 45.113003 45.562582 46.019774

Penetration (From Penetration Growth Factor 0.0212 0.0220081 0.0255165 0.0296141

McCaw Subscribers 0.94 0.9928521 1.1625954 1.362835

LIN Pops (millions) 26.4 26.466295 26.730048 26.998268

LIN Penetration 0.0238 0.0247072 0.0286458 0.033246

LIN Subscribers 0.595 0.6539086 0.7657044 0.8975854

McCaw Share of LIN Subscribers 0.3094 0.3400325 0.3981663 0.4667444

McCaw Share of LIN POPs 13.728 13.762473 13.899625 14.039099

Proportionate McCaw POPs 58.5 58.875476 59.462207 60.058873

Proportionate McCaw Subscribers

Beginning Subscribers (millions) 0 1.2494 1.3328845 1.5607617

Subscribers Added 0 0.0834845 0.2278772 0.2688177

Ending Subscribers 1.2494 1.3328845 1.5607617 1.8295794

Period Average Subscribers 0 1.2911423 1.4468231 1.6951705

Avg. Net Rev./Sub/month ($) 76.88627 72.7788 68.70354

Total Net Service Revenue (millions) 297.81334 1263.5766 1397.5706

% Growth Net Service Revenue 0.1060434

Direct Costs & Expenses (except Mktg) -98.217122 -406.33747 -438.15326

Marketing -76.227504 -284.73557 -277.01715

Operating Cash Flow 123.36871 572.50358 682.4002

Depreciation & Amortization (millions) -103.60314 -417.667 -438.78295

Cellular Operating Income (millions) 19.765571 154.83657 243.61724

After-Tax Cellular Operating Income (millions) 12.649966 99.095405 155.91504

(+) Depreciation & Amortization 103.60314 417.667 438.78295

(-) CapEx -85.154229 -198.25315 -211.02186

(-) DNWC 0 85.159606 44.095254

Free Cash Flow 31.098878 403.66887 427.77138

1143, "McCaw Cellular" and "AT&T".

entry in cell B9: either "mccaw" or "att".

N Broadcasting Purchased

0.3056729 0.2980104 0.2905601 0.2832961 0.2762137 0.2694436 0.2625575 0.2559935

0.1744277 0.1534427 0.1350295 0.118826 0.1045669 0.0922523 0.0809482 0.0712344

0.2982631 0.2833102 0.2691447 0.2556874 0.2429031 0.2309926 0.2191892 0.2082297

745 700 650 600 550 500 450 450

745 700 650 600 550 500 450 450

650 575 550 520 500 500 450 450

19 9 5 2.5 2.5 2.5 2.5 2.5

19 9 5 2.5 2.5 2.5 2.5 2.5

10 4 2 2 2 2 2 2

12/31/1995 12/31/1996 12/31/1997 12/31/1998 12/31/1999 12/31/2000 12/31/2001 12/31/2002

3.2520548 4.2547945 5.2547945 6.2547945 7.2547945 8.2349727 9.2575342 10.257534

46.479972 46.946052 47.415512 47.889667 48.368564 48.842615 49.342117 49.835538

0.0343524 0.039865 0.0462434 0.0536423 0.0622251 0.071969 0.0837641 0.0971664

1.5966975 1.8715026 2.1926524 2.5689116 3.0097368 3.5151556 4.1330978 4.8423374

27.26825 27.541684 27.8171 28.095271 28.376224 28.654334 28.947375 29.236849

0.0385654 0.0447541 0.0519147 0.0602211 0.0698564 0.0807954 0.0940371 0.109083

1.0516111 1.2326022 1.4441167 1.6919272 1.9822619 2.3151389 2.7221258 3.1892426

0.5468377 1.2326022 1.4441167 1.6919272 1.9822619 2.3151389 2.7221258 3.1892426

14.17949 27.541684 27.8171 28.095271 28.376224 28.654334 28.947375 29.236849

60.659462 74.487735 75.232612 75.984939 76.744788 77.496949 78.289492 79.072387

1.8295794 2.1435352 3.1041048 3.6367692 4.2608388 4.9919987 5.8302945 6.8552236

0.3139558 0.9605696 0.5326644 0.6240696 0.7311599 0.8382958 1.0249291 1.1763564

2.1435352 3.1041048 3.6367692 4.2608388 4.9919987 5.8302945 6.8552236 8.03158

1.9865573 2.62382 3.370437 3.948804 4.6264187 5.4111466 6.3427591 7.4434018

65.18496 62.06456 59.70215 57.53255 55.61654 53.33467 51.10382 49.21458

1553.9239 1954.1548 2414.668 2726.2171 3087.6648 3463.2206 3889.6706 4395.8867

0.111875 0.2575615 0.2356585 0.1290236 0.1325821 0.121631 0.1231368 0.1301437

-474.99239 -582.35842 -701.60624 -772.32674 -852.85538 -933.1425 -1021.262 -1125.3185

-271.04744 -299.85073 -326.05153 -323.94548 -322.86748 -319.49013 -314.86198 -313.13857

807.88406 1071.9457 1387.0102 1629.9449 1911.942 2210.588 2553.5466 2957.4296

-463.47823 -553.63193 -649.89501 -697.05946 -750.00323 -799.97848 -852.57381 -915.35437

344.40583 518.31372 737.11523 932.88546 1161.9387 1410.6095 1700.9728 2042.0753

220.41973 331.72078 471.75375 597.04669 743.64079 902.79009 1088.6226 1306.9282

463.47823 553.63193 649.89501 697.05946 750.00323 799.97848 852.57381 915.35437

-233.89709 -319.0574 -346.23185 -374.44175 -402.13796 -419.1479 -461.2181 -529.36037

26.671892 14.130208 6.762195 6.980175 -1.6940369 -1.9618197 -2.3290311 -2.7516069

476.67276 580.42552 782.17911 926.64457 1089.812 1281.6588 1477.6493 1690.1706

Vous aimerez peut-être aussi

- United States Census Figures Back to 1630D'EverandUnited States Census Figures Back to 1630Pas encore d'évaluation

- Date Time Integrity Lte Cell Group Radio Availability (%) Radio Unavailabilit Y (%) Cell Available Time (S) (S)Document55 pagesDate Time Integrity Lte Cell Group Radio Availability (%) Radio Unavailabilit Y (%) Cell Available Time (S) (S)Suleman YaqoobPas encore d'évaluation

- Group A - Exp 7 - RTD - CSTRDocument8 pagesGroup A - Exp 7 - RTD - CSTRAkhilesh ChauhanPas encore d'évaluation

- TDLM 2022834 Qhum 11Document14 pagesTDLM 2022834 Qhum 11lolaPas encore d'évaluation

- EQ Base ShearDocument9 pagesEQ Base Shearnazeer_mohdPas encore d'évaluation

- Assignment 3 - 1180100739Document1 pageAssignment 3 - 1180100739mayuriPas encore d'évaluation

- Distribusion y IdfDocument32 pagesDistribusion y IdfRonald CáritasPas encore d'évaluation

- Discrete Compound Interest FactorDocument26 pagesDiscrete Compound Interest FactorHaizun SabihaPas encore d'évaluation

- Tablas de Interés CompuestoDocument31 pagesTablas de Interés CompuestoGloria SepúlvedaPas encore d'évaluation

- Bases ShearDocument9 pagesBases ShearBPas encore d'évaluation

- Tables NewDocument27 pagesTables Newnon31863Pas encore d'évaluation

- Tahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanDocument9 pagesTahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanElis Lisa Pantolosang RegelPas encore d'évaluation

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- 1 - Emf Unit Conversion / Equivalent Chart - Cem Table Conversion / ÉquivalenceDocument3 pages1 - Emf Unit Conversion / Equivalent Chart - Cem Table Conversion / ÉquivalenceMike WolPas encore d'évaluation

- Earthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSVDocument9 pagesEarthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSVEr Rakesh SharmaPas encore d'évaluation

- Client ID SA0726 Eq Holdings Statement As On 2020-08-31Document6 pagesClient ID SA0726 Eq Holdings Statement As On 2020-08-31hidulfiPas encore d'évaluation

- Earthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSVDocument9 pagesEarthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSV4geniecivilPas encore d'évaluation

- Earthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSVDocument9 pagesEarthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSVeco protectionPas encore d'évaluation

- Contoh IVP Sistem PDBDocument6 pagesContoh IVP Sistem PDBMuhammad RizaldiPas encore d'évaluation

- ICO of An AssetDocument24 pagesICO of An Assetconsultnadeem70Pas encore d'évaluation

- CE 406 Compound Interest Factor TablesDocument29 pagesCE 406 Compound Interest Factor TablesJenna HagenPas encore d'évaluation

- C:/Users/carre/Desktop/Simulacion Produccion de Caprolactama, HSC MainDocument22 pagesC:/Users/carre/Desktop/Simulacion Produccion de Caprolactama, HSC MainCamila Florencia ScarlatoPas encore d'évaluation

- C:/Users/carre/Desktop/Simulacion Produccion de Caprolactama, HSC MainDocument22 pagesC:/Users/carre/Desktop/Simulacion Produccion de Caprolactama, HSC MainCamila Florencia ScarlatoPas encore d'évaluation

- Thermo#8Document6 pagesThermo#8William .BryantPas encore d'évaluation

- Supreme Annual Report 15 16Document104 pagesSupreme Annual Report 15 16adoniscalPas encore d'évaluation

- TDLM 2022834 Qhum 1Document11 pagesTDLM 2022834 Qhum 1lolaPas encore d'évaluation

- C:/Users/carre/Desktop/hysys Giu, HSC Main: Case: Flowsheet: Main Current Flowsheet EnvironmentDocument28 pagesC:/Users/carre/Desktop/hysys Giu, HSC Main: Case: Flowsheet: Main Current Flowsheet EnvironmentCamila Florencia ScarlatoPas encore d'évaluation

- Compound Interest Factor TablesDocument26 pagesCompound Interest Factor TablesHa Eun KimPas encore d'évaluation

- Load Vs DisplacementDocument1 358 pagesLoad Vs DisplacementdeathesPas encore d'évaluation

- Stowage Factor Conversion TableDocument3 pagesStowage Factor Conversion TableGary LampenkoPas encore d'évaluation

- Book 1Document5 pagesBook 1liriyok206Pas encore d'évaluation

- Time (S) Conducti Vity (MS) Conc (Gmol/l) C (T) Del T E (T) T E (T) T 2 E (T) F (T) T E (T) DT Tetha E (Tetha) T 2 E (T) DTDocument4 pagesTime (S) Conducti Vity (MS) Conc (Gmol/l) C (T) Del T E (T) T E (T) T 2 E (T) F (T) T E (T) DT Tetha E (Tetha) T 2 E (T) DTPraneethPas encore d'évaluation

- International Machine Corporation Case Analysis - International Financial ManagementDocument6 pagesInternational Machine Corporation Case Analysis - International Financial ManagementRavi JainPas encore d'évaluation

- Earthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSVDocument8 pagesEarthquake Load Calculations As Per IS1893-2002.-: Building Xyz at Mumbai. Rev - Mar2003 HSVanirudh modhalavalasaPas encore d'évaluation

- Saturation TablesDocument44 pagesSaturation TablesPrathik KaundinyaPas encore d'évaluation

- 0809 Sem 1Document22 pages0809 Sem 1Kent Choo100% (1)

- Triaxal MutikDocument114 pagesTriaxal MutikMuhammad RaflyPas encore d'évaluation

- In-Class FM 20calculationsDocument12 pagesIn-Class FM 20calculationsDivyanshuPas encore d'évaluation

- Tabel Diskonto Compound Interest PDFDocument26 pagesTabel Diskonto Compound Interest PDFLintangHzPas encore d'évaluation

- GoCJ DataSet Monte CarloDocument417 pagesGoCJ DataSet Monte CarlobisniskuyPas encore d'évaluation

- Grafica Parte 4 6-14 y 6-16 Fogler ProblemasDocument12 pagesGrafica Parte 4 6-14 y 6-16 Fogler ProblemasyuriPas encore d'évaluation

- DataDocument5 pagesDataKaushal GangradePas encore d'évaluation

- Run No DD (FT) DL (FT) Tli (FT) BLT (Degf)Document10 pagesRun No DD (FT) DL (FT) Tli (FT) BLT (Degf)eric edwinPas encore d'évaluation

- F19 ME2 Hatcher Assignment4Document46 pagesF19 ME2 Hatcher Assignment4Matthew HatcherPas encore d'évaluation

- Tablero de Indicadores de Mtto - Garibay - Ortiz - Brian - RaynerDocument18 pagesTablero de Indicadores de Mtto - Garibay - Ortiz - Brian - RaynerРайнер Ортис РохасPas encore d'évaluation

- Exercise 1 DataDocument5 pagesExercise 1 DataAnh PhongPas encore d'évaluation

- Nh-58 Axle Load Data - Xls - 2 Axle - 1Document6 pagesNh-58 Axle Load Data - Xls - 2 Axle - 1Nishanth PawarPas encore d'évaluation

- Lampiran 3 - Tabel BungaDocument7 pagesLampiran 3 - Tabel Bungakhadavi kulonPas encore d'évaluation

- Name Roll No (In Numbers Only) Batch Semster: Student PortalDocument18 pagesName Roll No (In Numbers Only) Batch Semster: Student PortalNirajanPas encore d'évaluation

- 5-9-2019 AfDocument705 pages5-9-2019 AfVipul AgrawalPas encore d'évaluation

- Case 8-Group 16Document14 pagesCase 8-Group 16reza041Pas encore d'évaluation

- Ket: Diambil Curah Hujan Maksimum Tiap TahunDocument11 pagesKet: Diambil Curah Hujan Maksimum Tiap TahunBeby RizcovaPas encore d'évaluation

- Tablas MFPDocument19 pagesTablas MFPGuillermoPas encore d'évaluation

- Tabel MortalitasDocument23 pagesTabel Mortalitasnisrina sausanPas encore d'évaluation

- Sistema Estructural de Tres Capas (Jones)Document4 pagesSistema Estructural de Tres Capas (Jones)Andrés VacaPas encore d'évaluation

- Formula GeomekanikaDocument9 pagesFormula GeomekanikaFsocietyPas encore d'évaluation

- My Assignment (LMT) - Corporate FinanceDocument13 pagesMy Assignment (LMT) - Corporate Financeesmailkarimi456Pas encore d'évaluation

- Concrete Tensile CDP PropsDocument22 pagesConcrete Tensile CDP PropsHizbawi Sisay100% (1)

- Trifasico 3.0 Version CerrarDocument22 pagesTrifasico 3.0 Version CerrarCamila Florencia ScarlatoPas encore d'évaluation

- Pilar EEMDocument17 pagesPilar EEMjesusmemPas encore d'évaluation

- Course Code: CET 408 Gths/Rs - 19 / 7604 Eighth Semester B. E. (Civil Engineering) ExaminationDocument3 pagesCourse Code: CET 408 Gths/Rs - 19 / 7604 Eighth Semester B. E. (Civil Engineering) ExaminationRajput Ayush ThakurPas encore d'évaluation

- Banking 18-4-2022Document17 pagesBanking 18-4-2022KAMLESH DEWANGANPas encore d'évaluation

- Financial RatiosDocument4 pagesFinancial RatiosRajdeep BanerjeePas encore d'évaluation

- Fabm Quiz1Document1 pageFabm Quiz1Renelino SacdalanPas encore d'évaluation

- SG Topic5FRQs 63e05ca0641463.63e05ca17faee7.84818972Document17 pagesSG Topic5FRQs 63e05ca0641463.63e05ca17faee7.84818972notinioPas encore d'évaluation

- CIR v. MarubeniDocument3 pagesCIR v. MarubeniCharmila SiplonPas encore d'évaluation

- CH 8 Prospects Barriersand Impedimentsto Islamic Bankingin LibyaDocument9 pagesCH 8 Prospects Barriersand Impedimentsto Islamic Bankingin LibyaMaalejPas encore d'évaluation

- Philippine Christian University: Dasmarinas CampusDocument16 pagesPhilippine Christian University: Dasmarinas CampusRobin Escoses MallariPas encore d'évaluation

- Linkedin 7 Ways Sales Professionals Drive Revenue With Social Selling en UsDocument11 pagesLinkedin 7 Ways Sales Professionals Drive Revenue With Social Selling en UsJosiah PeacePas encore d'évaluation

- The Kerala Account Code Vol IIIDocument207 pagesThe Kerala Account Code Vol IIINripen MiliPas encore d'évaluation

- Event Management Principles and MethodsDocument73 pagesEvent Management Principles and Methodskarndev singh100% (20)

- Meaning and Definition of Audit ReportDocument50 pagesMeaning and Definition of Audit ReportomkintanviPas encore d'évaluation

- Sra Verbal Form QuestionaireDocument5 pagesSra Verbal Form QuestionaireRal IlagaPas encore d'évaluation

- Board Chair Marjorie Del Toro Reappointed by The California Underground Safety Board-Division of The California Office of Energy InfrastructureDocument4 pagesBoard Chair Marjorie Del Toro Reappointed by The California Underground Safety Board-Division of The California Office of Energy InfrastructurePR.comPas encore d'évaluation

- PRA Public-Private Partnership Guide: Alberto C. AgraDocument34 pagesPRA Public-Private Partnership Guide: Alberto C. AgraAlexander PinedaPas encore d'évaluation

- Postpaid Bill 8197545758 BM2229I010262570Document4 pagesPostpaid Bill 8197545758 BM2229I010262570Mohammad MAAZPas encore d'évaluation

- ReportDocument53 pagesReportJemin SultanaPas encore d'évaluation

- Suggested Solution Far 660 Final Exam JUNE 2016Document8 pagesSuggested Solution Far 660 Final Exam JUNE 2016Nur ShahiraPas encore d'évaluation

- Noor Arfa BatikDocument14 pagesNoor Arfa BatikCkyn Rahman25% (4)

- Budget 2019-20Document21 pagesBudget 2019-20Pranati RelePas encore d'évaluation

- Rancangan MalaysiaDocument33 pagesRancangan MalaysiacadburyboyPas encore d'évaluation

- Anand Dani Project SAPMDocument70 pagesAnand Dani Project SAPMJiavidhi SharmaPas encore d'évaluation

- 13 Colonies Scavenger HuntDocument2 pages13 Colonies Scavenger Huntapi-352817753Pas encore d'évaluation

- Marketing Process: Analysis of The Opportunities in The MarketDocument7 pagesMarketing Process: Analysis of The Opportunities in The Marketlekz rePas encore d'évaluation

- Fusion Receivables Reconciliation TrainingDocument59 pagesFusion Receivables Reconciliation Training林摳博Pas encore d'évaluation

- FIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument5 pagesFIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesGoutham Kumar'sPas encore d'évaluation

- Business Process Management Journal: Article InformationDocument24 pagesBusiness Process Management Journal: Article InformationAnys PiNkyPas encore d'évaluation

- Affiliate Marketing Course EMarketing Institute Ebook 2018 EditionDocument164 pagesAffiliate Marketing Course EMarketing Institute Ebook 2018 EditionHow To Grow100% (2)