Académique Documents

Professionnel Documents

Culture Documents

Buy Back of Its Own Shares by A Company Is

Transféré par

venkyraju0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues4 pagesBuy back of its own shares by a company is nothing but reduction of share capital. It is a process which enables a company to go back to the holders of its shares and offer to purchase from them the shares that they hold. After recent amendments in the companies Act, 1956 buy back is allowed without sanction of the Court. There are three main reasons why a company would opt for buy back. 1. To improve shareholder value, since with fewer shares earning per share of the remaining shares will increase. 2. As

Description originale:

Titre original

Buybuybackof sharesnotes

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBuy back of its own shares by a company is nothing but reduction of share capital. It is a process which enables a company to go back to the holders of its shares and offer to purchase from them the shares that they hold. After recent amendments in the companies Act, 1956 buy back is allowed without sanction of the Court. There are three main reasons why a company would opt for buy back. 1. To improve shareholder value, since with fewer shares earning per share of the remaining shares will increase. 2. As

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues4 pagesBuy Back of Its Own Shares by A Company Is

Transféré par

venkyrajuBuy back of its own shares by a company is nothing but reduction of share capital. It is a process which enables a company to go back to the holders of its shares and offer to purchase from them the shares that they hold. After recent amendments in the companies Act, 1956 buy back is allowed without sanction of the Court. There are three main reasons why a company would opt for buy back. 1. To improve shareholder value, since with fewer shares earning per share of the remaining shares will increase. 2. As

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

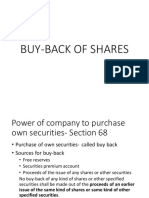

Buy-back of shares : Buy back of its own shares by a company is

nothing but reduction of share capital. After the recent

amendments in the Companies Act, 1956 buy back of its own

shares by a company is allowed without sanction of the Court. It is

nothing but a process which enables a company to go back to the

holders of its shares and offer to purchase from them the shares

that they hold.

There are three main reasons why a company would opt for buy

back :-

1. To improve shareholder value, since with fewer shares

earning per share of the remaining shares will increase.

2. As a defense mechanism against hostile take-overs since

there are fewer shares available for the hostile acquirer to

acquire.

3. Public Signaling of the Management’s Policy.

A company may purchase its own shares or other specified

securities out of :-

i. its free reserves; or

ii. the securities premium account; or

iii. the proceeds of any shares or other specified securities:

No buy-back of any kind of shares or other specified securities can

be made out of the earlier proceeds of an earlier issue of the same

kind of shares or same kind of other specified securities.

No company can purchase its own shares or other specified

securities unless :-

a. the buy-back is authorized by its articles;

b. a special resolution has been passed in general meeting of the

company authorizing the buy-back;

c. the buy-back is of less than twenty five per cent of the total

paid-up capital and free reserves of the company:

d. the buy-back of equity shares in any financial year shall not

exceed twenty five per cent of its total paid-up equity capital

in that financial year

e. the ratio of the debt owned by the company is not more than

twice the capital and its free reserves after such buy-back.

However, the Central Government may prescribe a higher

ratio of the debt than that specified under this clause for a

class or classes of companies.

f. all the shares or other specified securities for buy-back are

fully paid-up;

g. the buy-back of the shares or other specified securities listed

on any recognized stock exchange is in accordance with the

regulations made by the Securities and Exchange Board of

India in this behalf;

h. the buy-back in respect of shares or other specified securities

other than those specified in clause (g) is in accordance with

the guidelines as may be prescribed.

The notice of the meeting at which special resolution is proposed

to be passed shall be accompanied by an explanatory statement

stating

a. a full and complete disclosure of all material facts

b. the necessity for the buy-back

c. the class of security intended to be purchased under the buy-

back

d. the amount to be invested under the buy-back and

e. the time limit for completion of buy-back.

Every buy-back must be completed within twelve months from the

date of passing the special resolution.

The buy-back may be :-

a. from the existing security holders on a proportionate basis;

b. from the open market or

c. from odd lots, that is to say, where the lot of securities of a

listed public company whose shares are listed on a

recognized stock exchange is smaller than such marketable

lot as may be specified by the stock exchange;

d. by purchasing the securities issued to employees of the

company pursuant to a scheme of stock option or sweat

equity.

Where a company has passed a special resolution to buy-back its

own shares or other securities under this section, it shall, before

making such buy-back, file with the Registrar and the Securities

and Exchange Board of India a declaration of solvency in the form

as may be prescribed and verified by an affidavit to the effect that

the Board has made a full inquiry into the affairs of the company

as a result of which they have formed an opinion that it is capable

of meeting its liabilities and will not be rendered insolvent within a

period of one year of the date of declaration adopted by the Board,

and signed by at least two directors of the company, one of whom

shall be the managing director, if any:

Such a declaration of solvency need not be filed with the Securities

and Exchange Board of India by a company whose shares are not

listed on any recognized stock exchange.

Where a company buys back its own securities, it shall extinguish

and physically destroy the securities so bought back within seven

days of the last date of completion of buy-back.

Where a company completes a buy-back of its shares or, other

specified securities under this section, it shall not make further

issue of the same kind of shares or other specified securities within

a period of twenty four months except by way of bonus issue or in

the discharge of subsisting obligations such as conversion of

warrants, stock option schemes, sweat equity or conversion of

preference shares or debentures into equity shares.

Where a company buys back its securities under this section it

shall maintain a register of the securities so bought, the

consideration paid for the securities bought-back, the date of

cancellation of securities, the date of extinguishing and physically

destroying of securities and such other particulars as may be

prescribed.

A company shall, after the completion of the buy-back under this

section, file with the Registrar and the Securities and Exchange

Board of India, a return containing such particulars relating to the

buy-back within thirty days of such completion as may be

prescribed. However such return need not be filed with the

Securities and Exchange Board of India by a company whose

shares are not listed on any recognized stock exchange.

If a company makes default in complying with the provisions of

this section or any rules or any regulations, the company or any

officer of the company who is in default shall be punishable with

imprisonment for a term which may extend to two years, or with

fine which may extend to fifty thousand rupees, or with both.

For the purposes of buy back, "specified securities" includes

employees' stock option or other securities as may be notified by

the Central Government from time to time;

Where a company purchases its own shares out of free reserves,

then a sum equal to the nominal value of the share so purchased

shall be transferred to the capital redemption reserve account and

details of such transfer shall be disclosed in the balance sheet."

No company shall directly or indirectly purchase its own shares or

other specified securities -

(a) through any subsidiary company including its own subsidiary

companies; or

(b) through any investment company or group of investment

companies; or

(c) if a default, by the company, in repayment of deposit or interest

payable thereon, redemption of debentures, or preference shares or

payment of dividend to any shareholder or repayment of any term

loan or interest payable thereon to any financial institution or bank,

is subsisting.

No Company can, directly or indirectly, purchase its own shares or

other specified securities in case such company has not filed its

annual returns with the Registrar of Companies, or has not paid the

dividends declared by it within 42 days from the date of

declaration or has not prepared its annual accounts in the

prescribed manner.

Vous aimerez peut-être aussi

- Buy Back of SecuritiesDocument7 pagesBuy Back of SecuritiesTaruna SanotraPas encore d'évaluation

- Crowdfunding on SteroidsD'EverandCrowdfunding on SteroidsÉvaluation : 3 sur 5 étoiles3/5 (1)

- Buy Back of SharesDocument3 pagesBuy Back of SharesNagalakshmi ChagantiPas encore d'évaluation

- Buy Back of Shares Under The Companies Act, 1956 - An InsightDocument4 pagesBuy Back of Shares Under The Companies Act, 1956 - An InsightHrdk DvePas encore d'évaluation

- CHP 4 Buy BackDocument52 pagesCHP 4 Buy BackRonak ChhabriaPas encore d'évaluation

- Buy-Back of Securities and Equity Shares With Differential RightsDocument52 pagesBuy-Back of Securities and Equity Shares With Differential RightsSandeep As SandeepPas encore d'évaluation

- Buy Back of SharesDocument6 pagesBuy Back of SharesSathish V MenonPas encore d'évaluation

- ADVANCED FINANCIAL ACCOUNTING: AN OUTLOOK ON RELIANCE INFRASTRUCTURE'S BUYBACKDocument9 pagesADVANCED FINANCIAL ACCOUNTING: AN OUTLOOK ON RELIANCE INFRASTRUCTURE'S BUYBACKNishant AjitsariaPas encore d'évaluation

- Buy Back of SharesDocument7 pagesBuy Back of SharesChandan Kumar TripathyPas encore d'évaluation

- A Company May Buy-Back Its Securities Out Of:: Free Reserves and Securities Premium AccountDocument8 pagesA Company May Buy-Back Its Securities Out Of:: Free Reserves and Securities Premium Accountvishal_90Pas encore d'évaluation

- Project Report On Buy - Back of Shares-KhushbuDocument7 pagesProject Report On Buy - Back of Shares-KhushbucahimanianandPas encore d'évaluation

- Buy Back of SharesDocument32 pagesBuy Back of SharesSiddhant Raj PandeyPas encore d'évaluation

- Comprehensive Study of Buy Back of SharesDocument6 pagesComprehensive Study of Buy Back of SharesIndrajeet kumar pandayPas encore d'évaluation

- Taxguru - in-Buy-Back of Securities Shares Under Companies Act 2013Document10 pagesTaxguru - in-Buy-Back of Securities Shares Under Companies Act 2013Abhinay KumarPas encore d'évaluation

- Buy Back of Shares ExplainedDocument31 pagesBuy Back of Shares ExplainedRamya NairPas encore d'évaluation

- Companies Act 2013Document15 pagesCompanies Act 2013biplav2uPas encore d'évaluation

- BUY BACK OF SECURITIES GUIDEDocument9 pagesBUY BACK OF SECURITIES GUIDEShilpa LallerPas encore d'évaluation

- Corporate Tax ProjectDocument20 pagesCorporate Tax ProjectSubu MariapanPas encore d'évaluation

- 6 Updates Buy Back of SecDocument14 pages6 Updates Buy Back of SecsanathgowdaPas encore d'évaluation

- Companies Act Buy-Back ProvisionsDocument2 pagesCompanies Act Buy-Back ProvisionsRicha PahwaPas encore d'évaluation

- Companies Act 1956Document6 pagesCompanies Act 1956DHIRENDRA KUMARPas encore d'évaluation

- Accounts I ProjectDocument6 pagesAccounts I ProjectUrvi ShahPas encore d'évaluation

- Corporate Law PSDA: Submitted ToDocument7 pagesCorporate Law PSDA: Submitted ToharshkumraPas encore d'évaluation

- Provisions of Buyback Under Section 68Document5 pagesProvisions of Buyback Under Section 68jinisha sharmaPas encore d'évaluation

- Buyback PPTDocument16 pagesBuyback PPTSubham MundhraPas encore d'évaluation

- buybackDocument5 pagesbuybackGarima BothraPas encore d'évaluation

- Buy Back of Shares-Overview: Specified SecuritiesDocument2 pagesBuy Back of Shares-Overview: Specified SecuritiesAlok KumarPas encore d'évaluation

- BUYBACK OF SHARES EXPLAINEDDocument19 pagesBUYBACK OF SHARES EXPLAINEDChirag VashishtaPas encore d'évaluation

- Buy Back, DividentDocument13 pagesBuy Back, DividentVishal ChandakPas encore d'évaluation

- Company Law BlogDocument6 pagesCompany Law Blogbhavitha birdalaPas encore d'évaluation

- Buy Back of ShareDocument50 pagesBuy Back of SharejshashimohanPas encore d'évaluation

- CS Varun Kapoor: Section 68-Power of Company To Purchase Its Own SecuritiesDocument9 pagesCS Varun Kapoor: Section 68-Power of Company To Purchase Its Own SecuritiesShashank DashPas encore d'évaluation

- Note On Buy BackDocument6 pagesNote On Buy BacksravyaPas encore d'évaluation

- Buy BackDocument12 pagesBuy BackNiraj PandeyPas encore d'évaluation

- Buy-Back of Securities: SynopsisDocument31 pagesBuy-Back of Securities: SynopsisbharatPas encore d'évaluation

- TAXATION OF BUY-BACK OF SHARES: AN OVERVIEWDocument20 pagesTAXATION OF BUY-BACK OF SHARES: AN OVERVIEWSubu MariapanPas encore d'évaluation

- Taxguru - in-Buy-Back of Securities Unlisted Public Company and Private CompanyDocument10 pagesTaxguru - in-Buy-Back of Securities Unlisted Public Company and Private CompanyRam IyerPas encore d'évaluation

- 3.Issue-of-Shares-various-regulations-relating-to-issue-of-various-shares_Sushita-Chakraborty_-UGDocument7 pages3.Issue-of-Shares-various-regulations-relating-to-issue-of-various-shares_Sushita-Chakraborty_-UGSyed aliPas encore d'évaluation

- Buy Back of SecuritiesDocument5 pagesBuy Back of SecuritiesRishi ShrivastavaPas encore d'évaluation

- On Buy Back of ShareDocument30 pagesOn Buy Back of Shareranjay260Pas encore d'évaluation

- Procedural Checklist For Buyback of Shares by An Unlisted CompanyDocument8 pagesProcedural Checklist For Buyback of Shares by An Unlisted CompanyRamji SukumarPas encore d'évaluation

- Buy Back Regulation 2018Document15 pagesBuy Back Regulation 2018Ranjana YadavPas encore d'évaluation

- Part 6 - Share Capital and DebenturesDocument6 pagesPart 6 - Share Capital and Debentures8928Pas encore d'évaluation

- (B) Share Capital of A CompanyDocument34 pages(B) Share Capital of A CompanyGhulam Murtaza KoraiPas encore d'évaluation

- Corporate Law - Unit 2Document17 pagesCorporate Law - Unit 2Shem W LyngdohPas encore d'évaluation

- 51 Checklist Buy BackDocument3 pages51 Checklist Buy BackvrkesavanPas encore d'évaluation

- Buy Back of SharesDocument12 pagesBuy Back of SharesShashank AgrawalPas encore d'évaluation

- Buy Back of SharesDocument17 pagesBuy Back of SharesTayyeb RangwalaPas encore d'évaluation

- Everything You Need to Know About Share CapitalDocument34 pagesEverything You Need to Know About Share Capitalwaqasjaved869673Pas encore d'évaluation

- Share and Share CapitalDocument63 pagesShare and Share Capitaldolly bhati100% (4)

- History And: Company Buys Its Share Back From Its ShareholderDocument9 pagesHistory And: Company Buys Its Share Back From Its ShareholderJankiTrivediPas encore d'évaluation

- The Corporation Code of The PhilippinesDocument95 pagesThe Corporation Code of The PhilippinesFaith Foo LeePas encore d'évaluation

- Buyback of Shares Vis-A-Vis M&aDocument21 pagesBuyback of Shares Vis-A-Vis M&aDrRajesh GanatraPas encore d'évaluation

- Buyback of Shares Report SummaryDocument8 pagesBuyback of Shares Report Summaryjrashi18Pas encore d'évaluation

- CH 4 Buy Back & Reduction of Share Capital PDFDocument12 pagesCH 4 Buy Back & Reduction of Share Capital PDFYashJainPas encore d'évaluation

- Corporate Laws: Page 1 of 7Document7 pagesCorporate Laws: Page 1 of 7saadi_2713173Pas encore d'évaluation

- Notes On Stock and StockholdersDocument19 pagesNotes On Stock and Stockholderscharmagne cuevasPas encore d'évaluation

- Lecture - 7 - Invitation of Deposits - 88-89, 100Document4 pagesLecture - 7 - Invitation of Deposits - 88-89, 100Ahsan RazaPas encore d'évaluation

- Buy-Back Process Under Companies Act & RulesDocument8 pagesBuy-Back Process Under Companies Act & Rulesdevendra bankarPas encore d'évaluation

- Retail HandbookDocument49 pagesRetail HandbookvenkyrajuPas encore d'évaluation

- Anup ReportDocument1 pageAnup ReportvenkyrajuPas encore d'évaluation

- Samarth Shivaji AnyonyaDocument125 pagesSamarth Shivaji AnyonyavenkyrajuPas encore d'évaluation

- Particulars Details PV49 PV251 PV13 PV41 Plan Voucher 38 Plan Voucher 231Document1 pageParticulars Details PV49 PV251 PV13 PV41 Plan Voucher 38 Plan Voucher 231venkyrajuPas encore d'évaluation

- Anup ReportDocument1 pageAnup ReportvenkyrajuPas encore d'évaluation

- Overview of Sales-A/R Process5: (Abstract)Document15 pagesOverview of Sales-A/R Process5: (Abstract)venkyrajuPas encore d'évaluation

- Aupl BBP Draft v2 0Document45 pagesAupl BBP Draft v2 0venkyrajuPas encore d'évaluation

- IRCTC LTD, Booked Ticket PrintingDocument2 pagesIRCTC LTD, Booked Ticket PrintingvenkyrajuPas encore d'évaluation

- Tp14114 en FinalDocument96 pagesTp14114 en FinalvenkyrajuPas encore d'évaluation

- Sr. No. Sizes Required Rate / Block No. of Blocks Per Truck Total Quantity Required Total Amount Delivery Schedule Remarks CBMDocument1 pageSr. No. Sizes Required Rate / Block No. of Blocks Per Truck Total Quantity Required Total Amount Delivery Schedule Remarks CBMvenkyrajuPas encore d'évaluation

- Ecolite AAC Blocks LowRes PDFDocument6 pagesEcolite AAC Blocks LowRes PDFvenkyrajuPas encore d'évaluation

- List of Approved BuildersDocument20 pagesList of Approved Buildersvenkyraju100% (1)

- Sr. No. Sizes Required Rate / Block No. of Blocks Per Truck Total Quantity Required Total Amount Delivery Schedule Remarks CBMDocument1 pageSr. No. Sizes Required Rate / Block No. of Blocks Per Truck Total Quantity Required Total Amount Delivery Schedule Remarks CBMvenkyrajuPas encore d'évaluation

- Stockist Application FormDocument1 pageStockist Application FormvenkyrajuPas encore d'évaluation

- Builders ListDocument4 pagesBuilders Listvenkyraju100% (2)

- Date Name & Address of Customer/ Company Visited Concerned Person Name & No. Customer Category Discussion Follow Up Action Enquiries, If AnyDocument5 pagesDate Name & Address of Customer/ Company Visited Concerned Person Name & No. Customer Category Discussion Follow Up Action Enquiries, If AnyvenkyrajuPas encore d'évaluation

- List of Approved BuildersDocument20 pagesList of Approved Buildersvenkyraju100% (1)

- Problem 1: The Statement of Affairs: Straight ProblemsDocument5 pagesProblem 1: The Statement of Affairs: Straight ProblemsJemPas encore d'évaluation

- Retail Method and Biological AssetDocument3 pagesRetail Method and Biological AssetLuiPas encore d'évaluation

- Capitallization Table Template: Strictly ConfidentialDocument3 pagesCapitallization Table Template: Strictly Confidentialsh munnaPas encore d'évaluation

- Accounts InternalDocument6 pagesAccounts Internalaarav balujaPas encore d'évaluation

- Singer Industries Ceylon PLC FY 21 22Document200 pagesSinger Industries Ceylon PLC FY 21 22afra.mff30Pas encore d'évaluation

- Anagram 2011 PicksDocument17 pagesAnagram 2011 Picksnarsi76Pas encore d'évaluation

- Warren Buffett Biography PDFDocument8 pagesWarren Buffett Biography PDFtarana2000100% (6)

- Bank and NBFC - MehalDocument38 pagesBank and NBFC - Mehalsushrut pawaskarPas encore d'évaluation

- IasDocument229 pagesIasPeter Apollo Latosa100% (1)

- Secrets of A Forex Millionaire TraderDocument61 pagesSecrets of A Forex Millionaire TraderEric PlottPalmTrees.Com75% (12)

- Dealings in PropertiesDocument2 pagesDealings in PropertiesJamaica DavidPas encore d'évaluation

- Corporate Level StrategyDocument33 pagesCorporate Level StrategyDave NamakhwaPas encore d'évaluation

- FinQuiz Level2Mock2016Version3JuneAMQuestionsDocument33 pagesFinQuiz Level2Mock2016Version3JuneAMQuestionsDavid LêPas encore d'évaluation

- Assignement No 3Document2 pagesAssignement No 3Elina aliPas encore d'évaluation

- Portfolio Management Study at Motilal OswalDocument11 pagesPortfolio Management Study at Motilal Oswalv raviPas encore d'évaluation

- Income Statement: Cost of Goods Sold 540,000 768000 999600 1300920Document4 pagesIncome Statement: Cost of Goods Sold 540,000 768000 999600 1300920ASIF RAFIQUE BHATTIPas encore d'évaluation

- SAB 107 SEC Share Based PaymentsDocument64 pagesSAB 107 SEC Share Based PaymentsAlycia SkousenPas encore d'évaluation

- HCL Technologies - May22 - MSDocument9 pagesHCL Technologies - May22 - MSAnmol GargPas encore d'évaluation

- Awareness Among The Traders About The Settlement of Online TradingDocument13 pagesAwareness Among The Traders About The Settlement of Online TradingElson Antony PaulPas encore d'évaluation

- Capital Budgeting: Project Life-CycleDocument31 pagesCapital Budgeting: Project Life-CycleaauaniPas encore d'évaluation

- Lot Traded Profit and Capital Table Shows Trading Strategy Over TimeDocument14 pagesLot Traded Profit and Capital Table Shows Trading Strategy Over TimeAmandeep SinghPas encore d'évaluation

- 23 P1 (1) .1y ch22 PDFDocument20 pages23 P1 (1) .1y ch22 PDFAdrian NutaPas encore d'évaluation

- Cost-Volume-Profit - CVP Analysis Definition PDFDocument4 pagesCost-Volume-Profit - CVP Analysis Definition PDFPrince Nanaba EphsonPas encore d'évaluation

- Findings: Mutual FundDocument4 pagesFindings: Mutual FundAbdulRahman ElhamPas encore d'évaluation

- Multiple Choice Questions: Chapter 8 Consolidations - Changes in Ownership InterestsDocument36 pagesMultiple Choice Questions: Chapter 8 Consolidations - Changes in Ownership InterestsHamza JalalPas encore d'évaluation

- 5 Important Elements in Fundamental AnalysisDocument5 pages5 Important Elements in Fundamental AnalysisSaverio NatalePas encore d'évaluation

- FAC1601 Assignment 5Document73 pagesFAC1601 Assignment 5Kgomotso RamodikePas encore d'évaluation

- Test Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve DolvinDocument48 pagesTest Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve Dolvinchrisrasmussenezsinofwdr100% (28)

- Test Bank Ch. 8 Developing New Product-1Document5 pagesTest Bank Ch. 8 Developing New Product-1Hạ XuânPas encore d'évaluation

- Ishares Core Canadian Universe Bond Index Etf: Key FactsDocument2 pagesIshares Core Canadian Universe Bond Index Etf: Key FactsChrisPas encore d'évaluation

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000D'EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Évaluation : 4.5 sur 5 étoiles4.5/5 (86)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingD'EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingÉvaluation : 4.5 sur 5 étoiles4.5/5 (97)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- Introduction to Negotiable Instruments: As per Indian LawsD'EverandIntroduction to Negotiable Instruments: As per Indian LawsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsD'EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsPas encore d'évaluation

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityD'EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorD'EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorÉvaluation : 4.5 sur 5 étoiles4.5/5 (63)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)D'EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Évaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorD'EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthD'EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthPas encore d'évaluation

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpD'EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpÉvaluation : 4 sur 5 étoiles4/5 (214)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorD'EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorPas encore d'évaluation

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Joy of Agility: How to Solve Problems and Succeed SoonerD'EverandJoy of Agility: How to Solve Problems and Succeed SoonerÉvaluation : 4 sur 5 étoiles4/5 (1)

- Financial Risk Management: A Simple IntroductionD'EverandFinancial Risk Management: A Simple IntroductionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessD'EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessPas encore d'évaluation

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesD'EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesÉvaluation : 4 sur 5 étoiles4/5 (1)