Académique Documents

Professionnel Documents

Culture Documents

Fixed Income in Excel

Transféré par

CRMD JodhpurCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fixed Income in Excel

Transféré par

CRMD JodhpurDroits d'auteur :

Formats disponibles

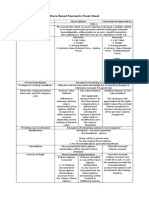

Programme on Fixed Income in Excel

Target Audience

Junior and Middle level Officers in the following functional areas: Risk Management,

Treasury and Portfolio Management.

Overview of the Course

This course discusses the concepts and quantitative aspects of bond pricing,

sensitivity and risk measure and management along with term structure and

economic indicators for traders and risk managers. Subsequently this course also

discusses the dangers of misinterpretation and subsequent unintentional wrong

application of above concepts and then, the correctional measures. Though the focus

is on government securities, option embedded bonds and interested rate derivatives

may also be included depending on the interest of the participants. This course will

also work as prelude to market risk part in GARP examination.

Objective: To develop the knowledge base and computing skill in Fixed Income. For

the best use of the course, participants are requested to carry a simple or scientific

calculator, if they do not prefer to carry laptop.

Contents

Economic concepts and indicators for traders and risk managers: Industrial

index of production, inflation, stock index, monetary policy rates, RBI’s annual

policy / credit policy, money market rates, 10 year benchmark rate, OIS rate,

MIBOR and LIBOR.

Computing Tools in Excel for Fixed Income Management: Application of

quantitative tools in Excel (e.g. standard deviation, normal distribution, goal

seek, solver, price, yield, limits of 99% VaR etc)

Basic Concepts in Fixed Income: Compounding vs. Discounting in the Context

of Time Value of Money – discreet and continuous

Valuation Methodologies: Valuation of treasury bills and long term dated

securities (i) Application of YTM, (ii) Application Spot Rates, (iii) Interpretation of

Premiums and Discounts

Valuation of option embedded bonds: Valuation of securities with call option,

put option and convertible debentures

Credit risk of corporate bonds: Measuring credit risk premium, credit rating of

corporate bonds

Alternative Return Measures: (i) Holding Period Return, (iii) Inter-Instrument

Performance Assessment in Scenario Analysis for Stress Testing

Term Structure: (i) Anatomy of Term Structure, (ii) Determining Spot and

Forward Rates, (iii) Different Interest Rate Models

Sensitivity Analysis: (i) Modified Duration, (ii) Convexity Analysis, (iii) Portfolio

Immunization

Value-at-Risk (VaR): (i) Critique to Duration and Need for VaR, (ii) Alternative

Methods of VaR calculation

Validating VaR Model: (i) Back Testing (ii) Stress-Testing

Extreme Tail Losses: Calculation of probable tail losses beyond the lower limit

of 99% confidence interval under continuous normal distribution.

Fixed Income Derivatives: IRS, FRA, Swaption, Interest Rate Floor, Interest

Rate Collar, Interest Rate Collar

Venue and Fees: For details mail Dr.RituparnaDas@Gmail.com

Vous aimerez peut-être aussi

- Structured Financial Product A Complete Guide - 2020 EditionD'EverandStructured Financial Product A Complete Guide - 2020 EditionPas encore d'évaluation

- The Advanced Fixed Income and Derivatives Management GuideD'EverandThe Advanced Fixed Income and Derivatives Management GuidePas encore d'évaluation

- Essays in Derivatives: Risk-Transfer Tools and Topics Made EasyD'EverandEssays in Derivatives: Risk-Transfer Tools and Topics Made EasyPas encore d'évaluation

- Bonds Are Not Forever: The Crisis Facing Fixed Income InvestorsD'EverandBonds Are Not Forever: The Crisis Facing Fixed Income InvestorsPas encore d'évaluation

- Quantitative Equity Investing: Techniques and StrategiesD'EverandQuantitative Equity Investing: Techniques and StrategiesÉvaluation : 4 sur 5 étoiles4/5 (1)

- Problems and Solutions in Mathematical Finance, Volume 2: Equity DerivativesD'EverandProblems and Solutions in Mathematical Finance, Volume 2: Equity DerivativesPas encore d'évaluation

- CLO Investing: With an Emphasis on CLO Equity & BB NotesD'EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesPas encore d'évaluation

- Fixed Income and Interest Rate Derivative AnalysisD'EverandFixed Income and Interest Rate Derivative AnalysisPas encore d'évaluation

- Portfolio Representations: A step-by-step guide to representing value, exposure and risk for fixed income, equity, FX and derivativesD'EverandPortfolio Representations: A step-by-step guide to representing value, exposure and risk for fixed income, equity, FX and derivativesÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Sterling Bonds and Fixed Income Handbook: A practical guide for investors and advisersD'EverandThe Sterling Bonds and Fixed Income Handbook: A practical guide for investors and advisersÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresD'EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresPas encore d'évaluation

- The Management of Bond Investments and Trading of DebtD'EverandThe Management of Bond Investments and Trading of DebtPas encore d'évaluation

- Alternative Investment Strategies A Complete Guide - 2020 EditionD'EverandAlternative Investment Strategies A Complete Guide - 2020 EditionPas encore d'évaluation

- Understanding Credit Derivatives and Related InstrumentsD'EverandUnderstanding Credit Derivatives and Related InstrumentsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Financial Risk Modelling and Portfolio Optimization with RD'EverandFinancial Risk Modelling and Portfolio Optimization with RÉvaluation : 4 sur 5 étoiles4/5 (2)

- Alternative Investments Complete Self-Assessment GuideD'EverandAlternative Investments Complete Self-Assessment GuidePas encore d'évaluation

- Introduction to Fixed Income Analytics: Relative Value Analysis, Risk Measures and ValuationD'EverandIntroduction to Fixed Income Analytics: Relative Value Analysis, Risk Measures and ValuationPas encore d'évaluation

- Portfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationD'EverandPortfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationÉvaluation : 3 sur 5 étoiles3/5 (1)

- Pricing and Hedging Interest and Credit Risk Sensitive InstrumentsD'EverandPricing and Hedging Interest and Credit Risk Sensitive InstrumentsPas encore d'évaluation

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideD'EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuidePas encore d'évaluation

- Advanced Bond Portfolio Management: Best Practices in Modeling and StrategiesD'EverandAdvanced Bond Portfolio Management: Best Practices in Modeling and StrategiesPas encore d'évaluation

- Value at Risk and Bank Capital Management: Risk Adjusted Performances, Capital Management and Capital Allocation Decision MakingD'EverandValue at Risk and Bank Capital Management: Risk Adjusted Performances, Capital Management and Capital Allocation Decision MakingPas encore d'évaluation

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketD'EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketPas encore d'évaluation

- Practical Portfolio Performance Measurement and AttributionD'EverandPractical Portfolio Performance Measurement and AttributionÉvaluation : 3.5 sur 5 étoiles3.5/5 (2)

- Managed Futures for Institutional Investors: Analysis and Portfolio ConstructionD'EverandManaged Futures for Institutional Investors: Analysis and Portfolio ConstructionPas encore d'évaluation

- The New Science of Asset Allocation: Risk Management in a Multi-Asset WorldD'EverandThe New Science of Asset Allocation: Risk Management in a Multi-Asset WorldPas encore d'évaluation

- Managing Downside Risk in Financial MarketsD'EverandManaging Downside Risk in Financial MarketsÉvaluation : 3 sur 5 étoiles3/5 (1)

- Yield Curve Modeling and Forecasting: The Dynamic Nelson-Siegel ApproachD'EverandYield Curve Modeling and Forecasting: The Dynamic Nelson-Siegel ApproachÉvaluation : 4 sur 5 étoiles4/5 (2)

- Financial Risk Management: A Practitioner's Guide to Managing Market and Credit RiskD'EverandFinancial Risk Management: A Practitioner's Guide to Managing Market and Credit RiskÉvaluation : 2.5 sur 5 étoiles2.5/5 (2)

- How to Invest in Structured Products: A Guide for Investors and Asset ManagersD'EverandHow to Invest in Structured Products: A Guide for Investors and Asset ManagersPas encore d'évaluation

- Corporate Bonds and Structured Financial ProductsD'EverandCorporate Bonds and Structured Financial ProductsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Forecasting Expected Returns in the Financial MarketsD'EverandForecasting Expected Returns in the Financial MarketsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Insider's Guide to Fixed Income Securities & MarketsD'EverandInsider's Guide to Fixed Income Securities & MarketsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Mortgage-Backed Securities: Products, Structuring, and Analytical TechniquesD'EverandMortgage-Backed Securities: Products, Structuring, and Analytical TechniquesPas encore d'évaluation

- C++ for Financial Engineers Complete Self-Assessment GuideD'EverandC++ for Financial Engineers Complete Self-Assessment GuidePas encore d'évaluation

- Continuous-Time Models in Corporate Finance, Banking, and Insurance: A User's GuideD'EverandContinuous-Time Models in Corporate Finance, Banking, and Insurance: A User's GuidePas encore d'évaluation

- Interest Rate Markets: A Practical Approach to Fixed IncomeD'EverandInterest Rate Markets: A Practical Approach to Fixed IncomeÉvaluation : 4 sur 5 étoiles4/5 (2)

- Handbook of Basel III Capital: Enhancing Bank Capital in PracticeD'EverandHandbook of Basel III Capital: Enhancing Bank Capital in PracticePas encore d'évaluation

- Investment Performance Measurement: Evaluating and Presenting ResultsD'EverandInvestment Performance Measurement: Evaluating and Presenting ResultsPhilip Lawton, CIPMÉvaluation : 1 sur 5 étoiles1/5 (1)

- The Econometrics of Individual Risk: Credit, Insurance, and MarketingD'EverandThe Econometrics of Individual Risk: Credit, Insurance, and MarketingPas encore d'évaluation

- Fixed Income Markets: Management, Trading and HedgingD'EverandFixed Income Markets: Management, Trading and HedgingPas encore d'évaluation

- Positive Alpha Generation: Designing Sound Investment ProcessesD'EverandPositive Alpha Generation: Designing Sound Investment ProcessesPas encore d'évaluation

- Derivatives and Risk Management JP Morgan ReportDocument24 pagesDerivatives and Risk Management JP Morgan Reportanirbanccim8493Pas encore d'évaluation

- Evaluating and Hedging Exotic Swap Instruments Via LGMDocument33 pagesEvaluating and Hedging Exotic Swap Instruments Via LGMalexandergirPas encore d'évaluation

- JPMorgan Guide To Credit DerivativesDocument88 pagesJPMorgan Guide To Credit Derivativesl_lidiyaPas encore d'évaluation

- CV DR Rituparna DasDocument8 pagesCV DR Rituparna DasCRMD JodhpurPas encore d'évaluation

- Continuous Test On Project FinanceDocument1 pageContinuous Test On Project FinanceCRMD JodhpurPas encore d'évaluation

- Continuous Test 4: Principles and Practice of BankingDocument5 pagesContinuous Test 4: Principles and Practice of BankingCRMD JodhpurPas encore d'évaluation

- Continuous Test 4: Principles and Practice of BankingDocument5 pagesContinuous Test 4: Principles and Practice of BankingCRMD JodhpurPas encore d'évaluation

- Project List MBA (Ins)Document1 pageProject List MBA (Ins)CRMD JodhpurPas encore d'évaluation

- Instructions: Write Your Roll Number On The Top of The Question Paper Do NotDocument20 pagesInstructions: Write Your Roll Number On The Top of The Question Paper Do NotCRMD JodhpurPas encore d'évaluation

- Instructions: Answer Any Two. Supplement Your Answer With Practical Examples Wherever Possible. All Questions Carry Equal MarksDocument1 pageInstructions: Answer Any Two. Supplement Your Answer With Practical Examples Wherever Possible. All Questions Carry Equal MarksCRMD JodhpurPas encore d'évaluation

- The Financial Markets, MoneyDocument8 pagesThe Financial Markets, MoneyNirmal ShresthaPas encore d'évaluation

- Vi. Manipulation, Fraud, and Insider Trading Manipulation of Security Prices Devices and PracticesDocument9 pagesVi. Manipulation, Fraud, and Insider Trading Manipulation of Security Prices Devices and PracticesJasfher CallejoPas encore d'évaluation

- Model Test Papers For BCSMDocument16 pagesModel Test Papers For BCSMnikhil_kankariaPas encore d'évaluation

- Operational Case Study Prototype Answers Variant 1: Task 1Document8 pagesOperational Case Study Prototype Answers Variant 1: Task 1MyDustbin2010Pas encore d'évaluation

- Financial MarketsDocument32 pagesFinancial MarketsEmil BabiloniaPas encore d'évaluation

- How To Record IFRS 16 LeaseDocument24 pagesHow To Record IFRS 16 Leasehur hussainPas encore d'évaluation

- Coronavirus SME Survey Instrument EnglishDocument6 pagesCoronavirus SME Survey Instrument EnglishnganduPas encore d'évaluation

- Financial DerivativesDocument4 pagesFinancial DerivativesnomanPas encore d'évaluation

- Natura Annual Report 2011Document134 pagesNatura Annual Report 2011Tibério AraújoPas encore d'évaluation

- Fin Mar Ce 910Document29 pagesFin Mar Ce 910moriary artPas encore d'évaluation

- Transmamerica FFIUL Client BrochureDocument24 pagesTransmamerica FFIUL Client BrochuredjdazedPas encore d'évaluation

- Series 7 Suitability Exercise SecuredDocument28 pagesSeries 7 Suitability Exercise SecuredAnthony Mcnichols100% (1)

- Treasury MGTDocument21 pagesTreasury MGTVikram MendaPas encore d'évaluation

- Beaumont vs. Prieto., 41 Phil. 670, No. 8988 March 30, 1916Document42 pagesBeaumont vs. Prieto., 41 Phil. 670, No. 8988 March 30, 1916Elizabeth Jade D. CalaorPas encore d'évaluation

- PruLink Surrender Form PDFDocument4 pagesPruLink Surrender Form PDFHui Jia JunnPas encore d'évaluation

- Share Based Compensation Cheat SheetDocument2 pagesShare Based Compensation Cheat SheetJanePas encore d'évaluation

- Carter J - Using Voodoo Lines-1 PDFDocument34 pagesCarter J - Using Voodoo Lines-1 PDFShabir Rizwan0% (1)

- PGDM II FINANCE ElectivesDocument21 pagesPGDM II FINANCE ElectivesSonia BhagwatPas encore d'évaluation

- Triple Profit Winner Users GuideDocument15 pagesTriple Profit Winner Users GuideNik RazmanPas encore d'évaluation

- Kanpur Confectionries Private Limited (A)Document10 pagesKanpur Confectionries Private Limited (A)GS0402Pas encore d'évaluation

- Practice Questions MDocument18 pagesPractice Questions MYilin YANGPas encore d'évaluation

- Corporate Finance GlossaryDocument10 pagesCorporate Finance Glossaryanmol2590Pas encore d'évaluation

- Equity Variance Swaps With Dividends OpenGammaDocument13 pagesEquity Variance Swaps With Dividends OpenGammamshchetkPas encore d'évaluation

- Australian Interest Rate SwaptionsDocument4 pagesAustralian Interest Rate SwaptionsOMiNYCPas encore d'évaluation

- Late Delivery of Hull From Top CrestDocument3 pagesLate Delivery of Hull From Top Crestsnjanani04Pas encore d'évaluation

- Pathfinders Stock Market Training - Online Course PDFDocument3 pagesPathfinders Stock Market Training - Online Course PDFGarv JainPas encore d'évaluation

- Interesting Thesis Topics FinanceDocument5 pagesInteresting Thesis Topics FinanceTracy Drey100% (2)

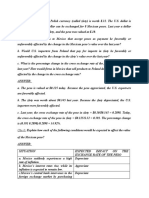

- Câu 5: Assume That The Polish Currency (Called Zloty) Is Worth $.32. The U.S. Dollar IsDocument4 pagesCâu 5: Assume That The Polish Currency (Called Zloty) Is Worth $.32. The U.S. Dollar IsQuốc HuyPas encore d'évaluation

- Derivatives Note SeminarDocument7 pagesDerivatives Note SeminarCA Vikas NevatiaPas encore d'évaluation

- Structured Products SummaryDocument28 pagesStructured Products Summaryfwm949fwxrPas encore d'évaluation