Académique Documents

Professionnel Documents

Culture Documents

Fin543 Fin Anlytics

Transféré par

Rakesh MoparthiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fin543 Fin Anlytics

Transféré par

Rakesh MoparthiDroits d'auteur :

Formats disponibles

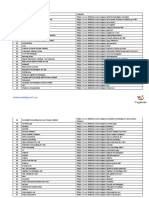

FIN543:WORKSHOP ON FINANCIAL ANALYTICS

Course Outcomes: Through this course students should be able to

CO1 :: analyze financial ratios to assess a firm’s past performance as well as problems and

suggest strategies for dealing with problems

CO2 :: use trend and regression analysis to forecast sales and any other financial variables

CO3 :: calculate the present value and future value of a stream of cash flows

CO4 :: apply several discounted cash flow (DCF) models to value a common stock

CO5 :: employ sensitivity and scenario analysis in capital budgeting decisions

CO6 :: demonstrate various bond valuation techniques to make investment decisions

List of Practicals / Experiments:

Financial statement analysis

• understanding of basic financial statements (balance sheet, income and cash flow)

• financial ratios (liquidity ratios, efficiency ratios, coverage ratios, leverage and profitability ratios)

• z score model for financial distress prediction

Financial forecasting

• forecasting the income statement

• forecasting assets on the balance sheet

• linear trend extrapolation

• regression analysis

Time value of money

• present value (single and multiple cash flows)

• future value (single and multiple cash flows)

• annuity

• perpetuity

• growing annuity

• loan amortization

• compounding interest rates

Business valuation models

• dividend discount models

• return on equity

• cost of equity (gordon growth model)

• analysis of beta

• capital asset pricing model

• weighted average cost of capital

• free cash flow to equity

• free cash flow to firm

• relative valuation approach

Capital budgeting and risk analysis

• net present value

• internal rate of return

• pay back and discounted payback period

• sensitivity analysis

Session 2020-21 Page:1/2

• scenario analysis

Analysis of bonds and long term financing

• valuation of bonds

• current yield

• bond equivalent yield

• macaulay duration

• modified duration

• convexity

Text Books:

1. FINANCIAL ANALYSIS WITH MICROSOFT EXCEL by TIMOTHY R. MAYES AND TODD M.

SHANK, CENGAGE LEARNING

References:

1. MICROSOFT EXCEL 2010 DATA ANALYSIS AND BUSINESS- MODELING by WAYNE L.

WINSTONE, PRENTICE HALL

Session 2020-21 Page:2/2

Vous aimerez peut-être aussi

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskD'EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskÉvaluation : 3.5 sur 5 étoiles3.5/5 (1)

- Financial Management Principles Kingston Course Outline Fall 2023Document24 pagesFinancial Management Principles Kingston Course Outline Fall 2023David ElliottPas encore d'évaluation

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceD'EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellencePas encore d'évaluation

- Study Guide:: Financial Management Semester: Sept - Dec 2010Document9 pagesStudy Guide:: Financial Management Semester: Sept - Dec 2010Muhammad Nurakmal ZainuddinPas encore d'évaluation

- Show Me the Money: How to Determine ROI in People, Projects, and ProgramsD'EverandShow Me the Money: How to Determine ROI in People, Projects, and ProgramsÉvaluation : 4 sur 5 étoiles4/5 (13)

- Ratio Analysis of Bank Al Habib Limited, Habib Metropolitan Bank Limited and J.S Bank Limited For Financial Year 2013, 2014 and 2015Document11 pagesRatio Analysis of Bank Al Habib Limited, Habib Metropolitan Bank Limited and J.S Bank Limited For Financial Year 2013, 2014 and 2015Mubarak HussainPas encore d'évaluation

- Fixed-Income Portfolio Analytics: A Practical Guide to Implementing, Monitoring and Understanding Fixed-Income PortfoliosD'EverandFixed-Income Portfolio Analytics: A Practical Guide to Implementing, Monitoring and Understanding Fixed-Income PortfoliosÉvaluation : 3.5 sur 5 étoiles3.5/5 (1)

- Business & Corporate FinanceDocument5 pagesBusiness & Corporate FinancevivekPas encore d'évaluation

- Private Equity Value Creation Analysis: Volume I: Theory: A Technical Handbook for the Analysis of Private Companies and PortfoliosD'EverandPrivate Equity Value Creation Analysis: Volume I: Theory: A Technical Handbook for the Analysis of Private Companies and PortfoliosPas encore d'évaluation

- Institute of Business Management College of Business Management Department of Accounting and FinanceDocument6 pagesInstitute of Business Management College of Business Management Department of Accounting and Financeace rogerPas encore d'évaluation

- Lecture 10 Life Cycle CostingDocument46 pagesLecture 10 Life Cycle CostingKHAIRIEL IZZAT AZMANPas encore d'évaluation

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajPas encore d'évaluation

- Course Outline UpdatedDocument4 pagesCourse Outline Updatedgeachew mihiretuPas encore d'évaluation

- Acca Afm (P4)Document36 pagesAcca Afm (P4)SamanMurtazaPas encore d'évaluation

- Senior Executive Finance: An EventDocument6 pagesSenior Executive Finance: An EventNoushad N HamsaPas encore d'évaluation

- Ba713 Financial Management Topic 3: Financial Statement AnalysisDocument37 pagesBa713 Financial Management Topic 3: Financial Statement AnalysisTen NinePas encore d'évaluation

- DCF ValuationDocument22 pagesDCF ValuationvnavaridasPas encore d'évaluation

- Analysis of Financial Statements Prof. M .B. ThakoorDocument37 pagesAnalysis of Financial Statements Prof. M .B. Thakoorbnp guptaPas encore d'évaluation

- TOPIC 4 - Financial Statement AnalysisDocument37 pagesTOPIC 4 - Financial Statement AnalysisTom HerreraPas encore d'évaluation

- 1.0 Financial Modeling Intro v2Document28 pages1.0 Financial Modeling Intro v2Arif JamaliPas encore d'évaluation

- Course Outline Financial Management-2018-19Document4 pagesCourse Outline Financial Management-2018-19Jayesh MahajanPas encore d'évaluation

- Security Analysis and Portfolio Management: School of CommerceDocument74 pagesSecurity Analysis and Portfolio Management: School of CommerceashishPas encore d'évaluation

- BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022Document35 pagesBCO126 Mathematics of Finance: 3 Ects Spring Semester 2022summerPas encore d'évaluation

- Project Evaluation-MBADocument5 pagesProject Evaluation-MBASadia FarahPas encore d'évaluation

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocument4 pagesScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiPas encore d'évaluation

- Business Finance II B Lecture 1 March 01, 2021Document16 pagesBusiness Finance II B Lecture 1 March 01, 2021AhsanPas encore d'évaluation

- Project FeasibilityDocument50 pagesProject FeasibilitySudiman SanexPas encore d'évaluation

- DipCF Paper One CFTT Syllabus 2018 FinalDocument8 pagesDipCF Paper One CFTT Syllabus 2018 FinalMutuuPas encore d'évaluation

- B-204: Financial Management: BBA 26 BatchDocument9 pagesB-204: Financial Management: BBA 26 BatchTanvir Hasan SifatPas encore d'évaluation

- 224 23 BS BF 224Document3 pages224 23 BS BF 224D'zite JerePas encore d'évaluation

- UT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)Document6 pagesUT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)UT Dallas Provost's Technology GroupPas encore d'évaluation

- Afs Lect 1 Ver 1Document31 pagesAfs Lect 1 Ver 1rafay khawajaPas encore d'évaluation

- Course Outline Financial Modeling PGDMDocument5 pagesCourse Outline Financial Modeling PGDMDisha DahiyaPas encore d'évaluation

- Project FeasibilityDocument50 pagesProject FeasibilityJaime LawPas encore d'évaluation

- Financial Institutions and Markets: Course Code: Fin 8602 PROGRAM NAME: MBA (Professional)Document12 pagesFinancial Institutions and Markets: Course Code: Fin 8602 PROGRAM NAME: MBA (Professional)sazib kaziPas encore d'évaluation

- Oaf 624 Course OutlineDocument8 pagesOaf 624 Course OutlinecmgimwaPas encore d'évaluation

- Project Feasibility: Does The Input The Output?" or "Can It Work?"Document50 pagesProject Feasibility: Does The Input The Output?" or "Can It Work?"SchizophreniaPas encore d'évaluation

- Project Feasibility: Does The Input The Output?" or "Can It Work?"Document50 pagesProject Feasibility: Does The Input The Output?" or "Can It Work?"Mahek GalaPas encore d'évaluation

- Corporate FinanceDocument6 pagesCorporate FinanceNaveed AhmadPas encore d'évaluation

- Security Analysis and Portfolio Management: School of CommerceDocument74 pagesSecurity Analysis and Portfolio Management: School of CommerceashishPas encore d'évaluation

- Chapter 2: The Conceptual FrameworkDocument36 pagesChapter 2: The Conceptual FrameworkNida Mohammad Khan AchakzaiPas encore d'évaluation

- NYIF CF - VM Day3 10 18Document142 pagesNYIF CF - VM Day3 10 18Ashutosh KumarPas encore d'évaluation

- Business Finance AF-340 Financial Management I FN-400: Program BBADocument5 pagesBusiness Finance AF-340 Financial Management I FN-400: Program BBAHamza BurhanPas encore d'évaluation

- Ingenieria Financiera SyllabusDocument6 pagesIngenieria Financiera SyllabusCarlos Enrique Tapia MechatoPas encore d'évaluation

- Course Outline: Financial Management - I Course Code: Credit:3, Core Course Area: Finance Program: PGDM-B&FS Term: II Academic Year: 2020-22Document6 pagesCourse Outline: Financial Management - I Course Code: Credit:3, Core Course Area: Finance Program: PGDM-B&FS Term: II Academic Year: 2020-22KaranPas encore d'évaluation

- Financial Statement Analysis For Credit DecisionsDocument9 pagesFinancial Statement Analysis For Credit DecisionsSaathwik ChandanPas encore d'évaluation

- 0.1 Course Outline SYBcom CF II 2022Document5 pages0.1 Course Outline SYBcom CF II 2022Harshit ChauhanPas encore d'évaluation

- Subject Outline Financial Risk ManagementDocument6 pagesSubject Outline Financial Risk ManagementDamien KohPas encore d'évaluation

- Scope of Financial ManagementDocument41 pagesScope of Financial ManagementbmsoniPas encore d'évaluation

- Assignment of Tasks To StudentsDocument48 pagesAssignment of Tasks To Studentsmy VinayPas encore d'évaluation

- Financial Modeling CourseDocument20 pagesFinancial Modeling CourseSwati RohtangiPas encore d'évaluation

- FM PDFDocument5 pagesFM PDFShubham SinghPas encore d'évaluation

- 4.31 T.Y.B.Com BM-IV PDFDocument7 pages4.31 T.Y.B.Com BM-IV PDFBhagyalaxmi Raviraj naiduPas encore d'évaluation

- 1.0 Financial Modeling Intro v2Document28 pages1.0 Financial Modeling Intro v2Omer Crestiani100% (1)

- 2021 BUS 823 Master Slide DeckDocument249 pages2021 BUS 823 Master Slide DeckShriya JanjikhelPas encore d'évaluation

- THREE-5540-Investment and Securities ManagementDocument7 pagesTHREE-5540-Investment and Securities ManagementNabeel IftikharPas encore d'évaluation

- The Impact of Credit Risk Management On The Performance of Commercial Banks in CameroonDocument20 pagesThe Impact of Credit Risk Management On The Performance of Commercial Banks in CameroonAmbuj GargPas encore d'évaluation

- 03 Project Valuation and Selection LatestDocument92 pages03 Project Valuation and Selection LatestQamar Hassan IqbalPas encore d'évaluation

- Syllabus EMBA12weeksDocument19 pagesSyllabus EMBA12weeksakcelik04Pas encore d'évaluation

- Lecture 1-Financial AnalysisDocument13 pagesLecture 1-Financial Analysisharsimran KaurPas encore d'évaluation

- SAP CompaniesDocument5 pagesSAP CompaniesRakesh MoparthiPas encore d'évaluation

- Annual Report - Federal Bank 2019-20Document278 pagesAnnual Report - Federal Bank 2019-20Rakesh MoparthiPas encore d'évaluation

- The Paper Industry: Its Present Position and Prospects StatistDocument4 pagesThe Paper Industry: Its Present Position and Prospects StatistRakesh MoparthiPas encore d'évaluation

- OLA - S1 Pro + OLA - S1 PRICE LISTDocument5 pagesOLA - S1 Pro + OLA - S1 PRICE LISTRakesh MoparthiPas encore d'évaluation

- Program Code & Name:P13C::B.Tech. (Chemical Engineering) Year of Admission: 2018 Duration in Years: 4Document10 pagesProgram Code & Name:P13C::B.Tech. (Chemical Engineering) Year of Admission: 2018 Duration in Years: 4Rakesh MoparthiPas encore d'évaluation

- S.No Registration Number Student Name ProgramDocument2 pagesS.No Registration Number Student Name ProgramRakesh MoparthiPas encore d'évaluation

- JD 19501Document5 pagesJD 19501Rakesh MoparthiPas encore d'évaluation

- Public Administration: Historical PerspectivesDocument60 pagesPublic Administration: Historical PerspectivesRakesh MoparthiPas encore d'évaluation

- Shrinkage in Inventories Research PaperDocument13 pagesShrinkage in Inventories Research PaperRakesh Moparthi100% (1)

- Lenskart: A 6/6 Vision For Growth: Rozelle LahaDocument2 pagesLenskart: A 6/6 Vision For Growth: Rozelle LahaRakesh MoparthiPas encore d'évaluation

- Mixture and AlligationDocument26 pagesMixture and AlligationRakesh MoparthiPas encore d'évaluation

- CV 11602966Document2 pagesCV 11602966Rakesh MoparthiPas encore d'évaluation

- MGN 575 Group 2 BIOCHIPPINGDocument7 pagesMGN 575 Group 2 BIOCHIPPINGRakesh MoparthiPas encore d'évaluation

- FIN544-Strategic Approach To Valuationtoday-1Document21 pagesFIN544-Strategic Approach To Valuationtoday-1Rakesh MoparthiPas encore d'évaluation

- HRM FinalDocument10 pagesHRM FinalRakesh MoparthiPas encore d'évaluation

- Fin544-Stock and Debt ApproachDocument21 pagesFin544-Stock and Debt ApproachRakesh MoparthiPas encore d'évaluation

- Capstone Report On Wheel Chair Cum StretcherDocument40 pagesCapstone Report On Wheel Chair Cum StretcherRakesh Moparthi100% (1)

- ClockDocument40 pagesClockRakesh MoparthiPas encore d'évaluation

- Electrical Design and Aspects of Hvac: Unit - 3: Installation of Heating, Cooling, and Refrigeration SystemsDocument41 pagesElectrical Design and Aspects of Hvac: Unit - 3: Installation of Heating, Cooling, and Refrigeration SystemsRakesh MoparthiPas encore d'évaluation

- Electrical Design and Aspects of Hvac: Unit - 3: Installation of Heating, Cooling, and Refrigeration SystemsDocument41 pagesElectrical Design and Aspects of Hvac: Unit - 3: Installation of Heating, Cooling, and Refrigeration SystemsRakesh MoparthiPas encore d'évaluation

- Electrical Design and Aspects of Hvac: Unit - 4: Heating Control DevicesDocument49 pagesElectrical Design and Aspects of Hvac: Unit - 4: Heating Control DevicesRakesh MoparthiPas encore d'évaluation

- MPM2D CPT: Knights of The Night Station: Include All Your Work For Each Part On Their Own .PDF File orDocument5 pagesMPM2D CPT: Knights of The Night Station: Include All Your Work For Each Part On Their Own .PDF File orKavya Pandya100% (2)

- Physics 20 Formula SheetDocument2 pagesPhysics 20 Formula SheetcallalilPas encore d'évaluation

- Danas Si Moja I BozijaDocument1 pageDanas Si Moja I BozijaMoj DikoPas encore d'évaluation

- Geomembrane Liner Installation AtarfilDocument24 pagesGeomembrane Liner Installation Atarfildavid1173Pas encore d'évaluation

- Force Plates: Pressure TransducerDocument9 pagesForce Plates: Pressure Transduceramit_pt021Pas encore d'évaluation

- Gear BoxDocument36 pagesGear BoxNimoPas encore d'évaluation

- 30 MT Tyre Mounted Crane SpecificationsDocument4 pages30 MT Tyre Mounted Crane SpecificationsramyaPas encore d'évaluation

- Building A Flutter Project An Understanding The TermsDocument7 pagesBuilding A Flutter Project An Understanding The TermsSujal ShresthaPas encore d'évaluation

- Manual: Woodward Governor Company Leonhard-Reglerbau GMBHDocument39 pagesManual: Woodward Governor Company Leonhard-Reglerbau GMBHERIQUE SOARES SANTOSPas encore d'évaluation

- Resolución de Problema en FísicaDocument4 pagesResolución de Problema en FísicaCindy ChiribogaPas encore d'évaluation

- Analysis, Design, and Strengthening of Communication TowersDocument253 pagesAnalysis, Design, and Strengthening of Communication TowersLuis Horacio Martínez Martínez100% (4)

- Leaf Spring - Final DocumentationDocument64 pagesLeaf Spring - Final DocumentationSushmitha VadithePas encore d'évaluation

- Ak98 Preset ListDocument21 pagesAk98 Preset ListHichem NaghmouchiPas encore d'évaluation

- 10th Class-Maths Text Book-NewDocument400 pages10th Class-Maths Text Book-NewVishnu Muddasani100% (1)

- Biomedical Short Learning Article CompleteDocument169 pagesBiomedical Short Learning Article Completenebiyu mulugetaPas encore d'évaluation

- Opc Da Client ManualDocument29 pagesOpc Da Client ManualantoPas encore d'évaluation

- Zanussi Zou 342 User ManualDocument12 pagesZanussi Zou 342 User Manualadatok2Pas encore d'évaluation

- Excel VBA To Interact With Other ApplicationsDocument7 pagesExcel VBA To Interact With Other ApplicationsgirirajPas encore d'évaluation

- 2 EesyllDocument77 pages2 EesyllDileepPas encore d'évaluation

- Spiking Into Aqueous Samples: Standard Guide ForDocument6 pagesSpiking Into Aqueous Samples: Standard Guide Formohdhafizmdali100% (1)

- Datasheet ECM 5158 Interface 4pgv1 A80401 PressDocument4 pagesDatasheet ECM 5158 Interface 4pgv1 A80401 Presslgreilly4Pas encore d'évaluation

- Art Appreciation Learning ModulesDocument32 pagesArt Appreciation Learning ModulesJonah ChoiPas encore d'évaluation

- Reviewer MathDocument6 pagesReviewer MathLuna Ronquillo100% (1)

- Open-Air Theatre in The Centre of The City: Acoustic Design and Noise Environment ControlDocument3 pagesOpen-Air Theatre in The Centre of The City: Acoustic Design and Noise Environment ControlArchitectural Visualizations ArchitecturelandsPas encore d'évaluation

- Crop Productivity Aroma Profile and Antioxidant Activity in Pelargonium Graveolens L-H-R Under inDocument7 pagesCrop Productivity Aroma Profile and Antioxidant Activity in Pelargonium Graveolens L-H-R Under inNo VivoPas encore d'évaluation

- PLC Programming With RSLogix 500Document132 pagesPLC Programming With RSLogix 500kemo_750252831Pas encore d'évaluation

- Button - Head - Socket - Screws - Metric - Spec - SheetDocument1 pageButton - Head - Socket - Screws - Metric - Spec - SheetXto PeregrinPas encore d'évaluation

- 01 Process CapabilityDocument33 pages01 Process CapabilitySrinivasagam Venkataramanan100% (1)

- Calflo Heat Transfer Fluids Tech DataDocument4 pagesCalflo Heat Transfer Fluids Tech DataKhaled ElsayedPas encore d'évaluation

- 3D ShapesDocument5 pages3D Shapesdeez000Pas encore d'évaluation

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- The Value of a Whale: On the Illusions of Green CapitalismD'EverandThe Value of a Whale: On the Illusions of Green CapitalismÉvaluation : 5 sur 5 étoiles5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successD'EverandReady, Set, Growth hack:: A beginners guide to growth hacking successÉvaluation : 4.5 sur 5 étoiles4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyD'EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyÉvaluation : 3 sur 5 étoiles3/5 (1)

- Corporate Finance Formulas: A Simple IntroductionD'EverandCorporate Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceD'EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceÉvaluation : 4 sur 5 étoiles4/5 (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsD'EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 5 sur 5 étoiles5/5 (2)

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorD'EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorPas encore d'évaluation

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Financial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessD'EverandFinancial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessÉvaluation : 4 sur 5 étoiles4/5 (2)

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- YouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineD'EverandYouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressD'EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressPas encore d'évaluation