Académique Documents

Professionnel Documents

Culture Documents

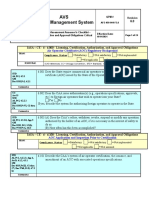

Untitled

Transféré par

sahil_wadhawan89Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Untitled

Transféré par

sahil_wadhawan89Droits d'auteur :

Formats disponibles

International Monetary fund was established in 1944 at the International Monetar

y and Financial Conference, Bretton Woods, New Hampshire, USA. It came into offi

cial existence on December 27, 1945 when 29 countries signed its Articles of Agr

eement hence commenced financial operations on March 1, 1947. There are 182 memb

ers as of September 1, 1998 and approximately 2,700 people are working for IMF f

rom 110 countries. Mr. Camille Gutt, from Belgium was the first Managing Directo

r of IMF and served from 1946 to 1951. France was the first member who availed I

MF resources on May 8, 1947. The currency of IMF is Special Drawing Rights (SDR)

.

Valuation of Special Drawing Rights

SDR is IMF's official currency. It is calculated by selecting basket of currenci

es of top 5 countries for their large exports of goods and services during last

five-year period ending 12 months before the effective date of revision. At pres

ent United States, Germany, Japan, United Kingdom and France are in the basket.

for calculating the value of SDR, the first step is to evaluate the "currency am

ount" that can be computed by multiplying the percentage weights assigned as per

their exports of goods and services with their average exchange rates for last

three months at noon in London, the second step is to

30 Jun 2009 ... Kosovo on Tuesday became the 186th member of the International M

onetary Fund (IMF)

24 Jun 2010 ... Tuvalu became the 187th member of the International Monetary

The International Monetary Fund was conceived in July 1944 originally with 45 me

mbers and came into existence in December 1945 when 29 countries signed the agre

ement

Members' quotas and voting power, and board of governors IMF member country Quo

ta: millions of SDRs Quota: percentage of total Governor Alternate Governor Vote

s: number Votes: percentage of total United States 37,149.3 17.09 Timothy F. G

eithner Ben Bernanke 371,743 16.74 Japan 13,312.8 6.12 Yoshihiko Noda Masaaki

Shirakawa 133,378 6.01 Germany 13,008.2 5.98 Axel A. Weber Wolfgang Schäuble 130

,332 5.87 United Kingdom 10,738.5 4.94 George Osborne Mervyn King 107,635 4.85

France 10,738.5 4.94 Christine Lagarde Christian Noyer 107,635 4.85 China 8

,090.1 3.72 Zhou Xiaochuan Yi Gang 81,151 3.65 Italy 7,055.5 3.24 Giulio Tremo

nti Mario Draghi 70,805 3.19 Saudi Arabia 6,985.5 3.21 Ibrahim A. Al-Assaf Ham

ad Al-Sayari 70,105 3.16 Canada 6,369.2 2.93 Jim Flaherty Mark Carney 63,942 2

.88 Russia 5,945.4 2.73 Aleksei Kudrin Sergey Ignatyev 59,704 2.69 Netherlan

ds 5,162.4 2.37 Nout Wellink L.B.J. van Geest 51,874 2.34 Belgium 4,605.2 2.12

Guy Quaden Jean-Pierre Arnoldi 46,302 2.08 India 4,158.2 1.91 Pranab Mukherje

e Duvvuri Subbarao 41,832 1.88 Switzerland 3,458.5 1.59 Jean-Pierre Roth Hans-

Rudolf Merz 34,835 1.57 Australia 3,236.4 1.49 Wayne Swan Ken Henry 32,614 1.4

7 Mexico 3,152.8 1.45 Agustín Carstens Guillermo Ortiz 31,778 1.43 Spain 3,048

.9 1.40 Elena Salgado Miguel Fernández Ordóñez 30,739 1.38 Brazil 3,036.1 1.40 Guido

Mantega Henrique Meirelles 30,611 1.38 South Korea 2,927.3 1.35 Okyu Kwon Seo

ng Tae Lee 29,523 1.33 Venezuela 2,659.1 1.22 Gastón Parra Luzardo Rodrigo Cabez

a Morales 26,841 1.21 remaining 166 countries 62,593.8 28.79 respective respecti

ve 667,438 30.05

I. Membership Status: Joined: December 27, 1945; Article VIII

I. General Resources Account: SDR Million %Quota

Quota

4,158.20 100.00

Fund holdings of currency

3,270.10 78.64

Reserve Tranche Position

888.35 21.36

Lending to the Fund

Notes Issuance

660.00

Holdings Exchange Rate

II. SDR Department: SDR Million %Allocation

Net cumulative allocation

3,978.26 100.00

Holdings

3,297.07 82.88

I11. Outstanding Purchases and Loans: None

1V. Latest Financial Arrangements:

Date of Expiration Amount Approved Amount Drawn

Type Arrangement Date (SDR Million) (SDR Million)

Stand-By Oct 31, 1991 Jun 30, 1993 1,656.00 1,656.00

Stand-By Jan 18, 1991 Apr 17, 1991 551.93 551.93

EFF Nov 09, 1981 May 01, 1984 5,000.00 3,900.00

V. Projected Payments to Fund 1/

(SDR Million; based on existing use of resources and present holdings of SDRs

):

Forthcoming

2011 2012 2013 2014 2015

Principal

Charges/Interest 2.26 2.21 2.21 2.21 2.21

Total 2.26

2.21

2.21

2.21

2.21

1/ When a member has overdue financial obligations outstanding for more than thr

ee months, the amount of such arrears will be shown in this section.

IMF Executive Board Concludes 2010 Article IV Consultation with India

Public Information Notice (PIN) No. 11/2

January 5, 2011

Public Information Notices (PINs) form part of the IMF's efforts to promote tran

sparency of the IMF's views and analysis of economic developments and policies.

With the consent of the country (or countries) concerned, PINs are issued after

Executive Board discussions of Article IV consultations with member countries, o

f its surveillance of developments at the regional level, of post-program monito

ring, and of ex post assessments of member countries with longer-term program en

gagements. PINs are also issued after Executive Board discussions of general pol

icy matters, unless otherwise decided by the Executive Board in a particular cas

e.

On December 22, 2010, the Executive Board of the International Monetary Fund (IM

F) concluded the Article IV consultation with India.1

Background

India’s growth is among the highest in the world. Since mid-2009 the pace of India’s

recovery—led by domestic demand, especially infrastructure investment—has been stro

ng. Monetary and fiscal policies remain accommodative: real interest rates are l

ow and although there has been some fiscal consolidation, the fiscal deficit rem

ains high. With little slack in the economy, the ongoing exit from the policy st

imulus introduced during the crisis, and structural factors affecting food price

s, inflation measures are in the 8½ to 10½ percent range. Financial conditions are c

omfortable, and capital inflows have been strong.

India’s economy is projected to grow by 8¾ percent in real terms in 2010/11, moderat

ing to about 8 percent the following year. Following last year’s drought, this yea

r’s growth is already benefiting from the rebound in agriculture and the pickup in

private consumption as employment prospects have improved and disposable income

s continue to rise. Infrastructure is expected to remain an important growth dri

ver and corporate investment is likely to accelerate, aided by conducive financi

ng conditions and robust demand growth. India’s medium-term growth prospects remai

n strong. The economy is expected to continue to expand rapidly, supported by hi

gh investment and productivity gains.

Risks to growth are broadly balanced, with downside risks relating mainly to the

global economy. Surging capital inflows could further spur investment, but coul

d complicate macroeconomic management. Sustaining rapid growth over the medium t

erm will depend on sustaining reforms to facilitate infrastructure investment—such

as deepening the corporate bond market and lowering the cost of doing business—an

d improving social indicators while carrying out fiscal consolidation. Improving

social outcomes and infrastructure are two key pillars of the government’s strate

gy to achieve rapid and inclusive growth.

Executive Board Assessment

Executive Directors commended the authorities for their economic stewardship whi

ch has helped India weather the crisis well. Growth is among the fastest growing

in the world, social indicators are improving, and medium-term economic prospec

ts are favorable. Risks stem mainly from weaker global growth. Near-term challen

ges confronting the authorities arise from elevated inflation, fiscal consolidat

ion needs, and buoyant capital inflows, warranting careful calibration of macroe

conomic policies and the diligent pursuit of ongoing reforms.

Directors commended the Reserve Bank of India’s (RBI) efforts to tighten monetary

conditions. Noting that short-term real interest rates remain below historic nor

ms and financing conditions have hardened only marginally, most Directors recomm

ended further steps to bring the real repo rate clearly into positive territory.

They welcomed the RBI’s moves to increase the frequency of policy reviews and pub

lish more guidance on future actions. Most Directors considered that continuing

to improve the CPI, including a new national CPI to be introduced in the future,

and utilizing information from it in policymaking could increase the impact of

monetary policy on inflation expectations. Directors also highlighted the role o

f structural reforms in containing food price inflation.

Directors welcomed the authorities’ commitment to fiscal consolidation, including

their plans to streamline spending. The envisaged Goods and Services Tax and the

new Direct Tax Code should increase tax efficiency. Given buoyant economic grow

th, and since future deficit targets could be more difficult to reach, most Dire

ctors saw merit in a further strengthening of the consolidation effort. Saving t

his year’s over performance in revenue and one-off receipts could help reconstitut

e fiscal space. More substantial current spending adjustment, mainly by further

cutting subsidies and improving the targeting of spending, would help achieve so

cial goals along with medium-term fiscal consolidation. A few Directors favored

an appropriate balance between pacing the consolidation and sustaining growth by

addressing the exigencies of infrastructure investment and social spending.

Directors observed that low yields in advanced economies and India’s favorable gro

wth differentials could raise capital inflows above its absorptive capacity. Whi

le exchange rate flexibility would remain the first line of defense, reserve acc

umulation and macroprudential measures could be employed if strong inflows conti

nue. Absorptive capacity could also be improved by deepening financial markets o

r by liberalizing foreign direct investment (FDI), consistent with India’s gradual

approach to capital account liberalization.

Directors supported the authorities’ focus on strengthening financial stability, i

ncluding efforts to strengthen macroprudential regulations to cool the residenti

al real estate market and to ensure a regulatory level playing field across the

financial industry. While India’s banking system is resilient and well capitalized

, Directors noted that monitoring asset quality will remain important, particula

rly as prudential norms for infrastructure are eased. They commended the introdu

ction of the RBI’s Financial Stability Report, the announced review of financial l

aws, and the creation of the Financial Stability and Development Council, and lo

oked forward to the forthcoming Financial Sector Assessment Program.

Directors welcomed the emphasis on investment in infrastructure and human capita

l.

They supported the measures taken to increase the availability of long-term fina

nce for infrastructure, especially moves to develop the corporate bond market, w

hile noting that in the short run foreign savings also would be needed. Director

s supported the authorities’ reform efforts in areas such as land acquisition and

government clearances, while also stressing the importance of strong accountabil

ity and transparency over large infrastructure projects.

India: Selected Economic Indicators, 2006/07–2010/11 1/

2006/07 2007/08 2008/09 2009/10 2010/11

Prel. Proj.

Growth (y/y percent change)

Real GDP (at factor cost) 9.7 9.2 6.7

7.4 8.8

Industrial production 11.5 8.5 6.7 10.5

...

Prices (y/y percent change, average)

Wholesale prices (2004/05 weights) 5.5 4.6 8.3

3.5 8.5

Wholesale prices (2004/05 weights, end of period) 6.8 7.7

1.5 10.2 6.5

Consumer prices - industrial workers (2001 weights) 6.7 6.2

9.1 12.7 10.8

Saving and investment (percent of GDP)

Gross saving 2/ 34.5 36.4 33.9 32.1 34.4

Gross investment 2/ 35.5 37.7 36.2 35.0

37.7

Fiscal position (percent of GDP) 3/

Central government deficit -4.3 -3.1 -7.5

-6.8 -6.6

General government deficit -6.1 -4.4 -10.8

-10.4 -9.6

General government debt 4/ 77.7 75.0 75.0

76.8 75.0

Money and credit (y/y percent change, end-period) 5/

Broad money 21.3 21.4 19.3 16.8 17.7

Credit to commercial sector 25.7 21.1 16.9

15.9 20.2

Financial indicators (percent, end-period) 6/

91-day treasury bill yield 8.0 7.2 5.0

4.4 6.9

10-year government bond yield 8.0 7.9 7.0

7.8 8.1

Stock market (y/y percent change, end-period) 15.9 19.7

-37.9 80.5 15.3

External trade 7/

Merchandise exports (US$ billions) 128.9 166.2 189.0

182.2 229.4

y/y percent change 22.6 28.9 13.7 -3.6

25.9

Merchandise imports (US$ billions) 190.7 257.6 307.7

299.5 380.6

y/y percent change 21.4 35.1 19.4 -2.7

27.1

Balance of payments (US$ billions)

Current account balance -9.6 -15.7 -28.7 -38.4

-49.9

(in percent of GDP) -1.0 -1.3 -2.4 -2.9

-3.3

Foreign direct investment, net 7.7 15.9 17.5

19.7 23.6

Portfolio investment, net (equity and debt) 7.1 27.4

-14.0 32.4 31.8

Overall balance 36.6 92.2 -20.1 13.4 28.6

External indicators

Gross reserves (in billions of U.S. dollars, end-period) 199.2

309.7 252.0 279.1 307.7

(In months of imports) 8/ 9/ 7.7 10.3 8.4

7.5 7.3

External debt (percent of GDP, end-period) 18.2 18.3

19.1 19.5 19.2

Of which: short-term debt 9/ 3.7 6.8 7.5

8.0 8.2

Ratio of gross reserves to short-term debt (end-period) 9/ 5.7

3.7 2.8 2.7 2.5

Gross reserves to broad money (percent; end-period) 26.2 30.9

26.6 22.4 …

Debt service ratio 10/ 4.9 5.3 5.2 5.0

5.1

Real effective exchange rate

(y/y percent change, period average for annual data) -1.7 7.3

-7.7 -0.5 …

Exchange rate (rupee/US$, end-period) 6/ 43.5 40.1

50.7 45.0 45.9

Sources: Data provided by the Indian authorities; CEIC Data Company Ltd; Bloombe

rg L.P.; World Development Indicators; and IMF staff estimates and projections.

1/ Data are for April-March fiscal years.

2/ Differs from official data, calculated with gross investment and current acco

unt. Gross investment includes errors and omissions.

3/ Divestment and license auction proceeds treated as below-the-line financing.

Subsidy related bond issuance classified as expenditure.

4/ Includes combined domestic liabilities of the center and the states, inclusiv

e of MSS bonds, and external debt at year-end exchange rates.

5/ For 2010/11, as of October 2010.

6/ For 2010/11, as of November 2010.

7/ On balance of payments basis.

8/ Imports of goods and services projected over the following twelve months.

9/ Short-term debt on residual maturity basis, including estimated short-term NR

I deposits on residual maturity basis.

10/ In percent of current account receipts excluding grants.

________________________________________

1 Under Article IV of the IMF s Articles of Agreement, the IMF holds bilateral d

iscussions with members, usually every year. A staff team visits the country, co

llects economic and financial information, and discusses with officials the coun

try s economic developments and policies. On return to headquarters, the staff p

repares a report, which forms the basis for discussion by the Executive Board. A

t the conclusion of the discussion, the Managing Director, as Chairman of the Bo

ard, summarizes the views of Executive Directors, and this summary is transmitte

d to the country s authorities. An explanation of any qualifiers used in summing

s up can be found here: http://www.imf.org/external/np/sec/misc/qualifiers.htm.

Netcharges_SDR February 01, 2011600,378Assessments_SDR April 30, 201132,453Net

charges_SDR May 01, 2011531,515Netcharges_SDR August 01, 2011549,431Netcharges

_SDR November 01, 2011549,431 Total for the year 20112,263,208

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Traffic CitationsDocument1 pageTraffic Citationssavannahnow.comPas encore d'évaluation

- FOI Disclosure Log 374 AnnexDocument1 204 pagesFOI Disclosure Log 374 AnnexSAMEERPas encore d'évaluation

- Phil Hawk Vs Vivian Tan Lee DigestDocument2 pagesPhil Hawk Vs Vivian Tan Lee Digestfina_ong62590% (1)

- VW - tb.26-07-07 Exhaust Heat Shield Replacement GuidelinesDocument2 pagesVW - tb.26-07-07 Exhaust Heat Shield Replacement GuidelinesMister MCPas encore d'évaluation

- City Limits Magazine, January 1991 IssueDocument24 pagesCity Limits Magazine, January 1991 IssueCity Limits (New York)Pas encore d'évaluation

- Bacolod, Lanao Del NorteDocument2 pagesBacolod, Lanao Del NorteSunStar Philippine NewsPas encore d'évaluation

- Form OAF YTTaInternationalDocument5 pagesForm OAF YTTaInternationalmukul1saxena6364Pas encore d'évaluation

- List Atrazine PDFDocument4 pagesList Atrazine PDFGriffin NuzzoPas encore d'évaluation

- International Aviation Safety Assessment Assessor’s ChecklistDocument23 pagesInternational Aviation Safety Assessment Assessor’s ChecklistViktor HuertaPas encore d'évaluation

- The Star News June 18 2015Document36 pagesThe Star News June 18 2015The Star NewsPas encore d'évaluation

- Carbon Monoxide Safety GuideDocument2 pagesCarbon Monoxide Safety Guidewasim akramPas encore d'évaluation

- Mindanao Mission Academy: Business FinanceDocument3 pagesMindanao Mission Academy: Business FinanceHLeigh Nietes-GabutanPas encore d'évaluation

- ИБП ZXDU68 B301 (V5.0R02M12)Document32 pagesИБП ZXDU68 B301 (V5.0R02M12)Инга ТурчановаPas encore d'évaluation

- StarBus - UTC Online 4.0Document1 pageStarBus - UTC Online 4.0Jitendra BhandariPas encore d'évaluation

- DIPLOMA EXAMS MUSIC ENTRYDocument4 pagesDIPLOMA EXAMS MUSIC ENTRYmutiseusPas encore d'évaluation

- 0452 w16 Ms 13Document10 pages0452 w16 Ms 13cheah_chinPas encore d'évaluation

- Florida Bar Complaint Strip Club Owner V Miami Beach CommissionerDocument56 pagesFlorida Bar Complaint Strip Club Owner V Miami Beach CommissionerDavid Arthur WaltersPas encore d'évaluation

- Camper ApplicationDocument4 pagesCamper ApplicationClaire WilkinsPas encore d'évaluation

- Money Mastermind Vol 1 PDFDocument283 pagesMoney Mastermind Vol 1 PDFKatya SivkovaPas encore d'évaluation

- B.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii SemesterDocument1 pageB.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii Semesterabhi bhelPas encore d'évaluation

- ULI110U 18V1S1 8 0 1 SV1 Ebook PDFDocument205 pagesULI110U 18V1S1 8 0 1 SV1 Ebook PDFTunahan KızılkayaPas encore d'évaluation

- Abella Vs Cabañero, 836 SCRA 453. G.R. No. 206647, August 9, 2017Document4 pagesAbella Vs Cabañero, 836 SCRA 453. G.R. No. 206647, August 9, 2017Inday LibertyPas encore d'évaluation

- Manage Your Risk With ThreatModeler OWASPDocument39 pagesManage Your Risk With ThreatModeler OWASPIvan Dario Sanchez Moreno100% (1)

- Commencement of A StatuteDocument110 pagesCommencement of A StatutePrasun Tiwari80% (10)

- LG - Chem - On - User - Guide - EN - Manual For Using The Website - 20211129Document66 pagesLG - Chem - On - User - Guide - EN - Manual For Using The Website - 20211129Our HomePas encore d'évaluation

- Skill Assessment Evidence GuideDocument13 pagesSkill Assessment Evidence Guiderahul.ril1660Pas encore d'évaluation

- USA2Document2 pagesUSA2Helena TrầnPas encore d'évaluation

- Determining The Number of IP NetworksDocument6 pagesDetermining The Number of IP Networksonlycisco.tkPas encore d'évaluation

- Ministry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksDocument4 pagesMinistry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksION NewsPas encore d'évaluation

- Charles Taylor.Document17 pagesCharles Taylor.Will PalmerPas encore d'évaluation