Académique Documents

Professionnel Documents

Culture Documents

Synd Arogya Praposal

Transféré par

Yathish NanjundaswamyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Synd Arogya Praposal

Transféré par

Yathish NanjundaswamyDroits d'auteur :

Formats disponibles

UNITED INDIA INSURANCE CO.

LTD

At United India, It’s always U before

SYNDAROGYA PROPOSAL FORM

Group Mediclaim Insurance Cum Personal Accident

for Syndicate Bank Account Holders

(To be filled by the Bank)

1. NAME & ADDRESS OF THE ACCOUNT HOLDER (in CAPITAL 3 a. Branch Name/City

letters)

b. BIC Code

2. SUM INSURED PER FAMILY (Please tick (√ ) : c. Proposal from (Please tick (√ )

Rs.0.50 lacs Rs.1.00 lac Rs.1.50 lacs Rs.2.00 lacs Rs.2.50 lacs

Rural/Semi Urban/Urban

Rs.3.00 lacs Rs.3.50 lac Rs.4.00 lacs Rs.4.50 lacs Rs.5.00 lacs 4. Account No.

SB/CA/FD/others (Pl. specify)

5. DETAILS OF PERSONS TO BE COVERED - (Please tick (√ ) :Under Plan A ( ) Under Plan B ( )

NAME OF THE RELATIONSHIP EXISTING DISEASE /

SL

INSURED PERSON (in AGE SEX ILLNESS / INJURY

NO

CAPITAL letters)

I

II

III

IV

V

*Additional sheets may be used wherever required.

6. STAMP SIZE PHOTOGRAPH OF THE INSURED PERSONS :

ACCOUNT

SPOUSE CHILD 1 CHILD 2 PARENT 1 PARENT 2

HOLDER

7. NAME OF THE T.P.A : M/S. TTK HEALTH SERVICES PVT. LTD., [ ]

M/S. MEDIASSIST HEALTH SERVICES PVT.LTD. [ ] M/S. E-MEDITEK SOLUTIONS LTD. [ ]

The TPA will be automatically selected by United India Insurance Co.Ltd , and hence need not be ticked

8. I hereby declare and agree that the above statements are true and complete. Myself and my family

members are maintaining good health except the existing diseases/illness/injury as per Serial No. 5 above.

I have read the salient features of the policy and willing to accept the cover subject to the terms, conditions

and exceptions prescribed by the Insurance Company. Enclose copy of existing medical insurance of

account holder or other family members.

I / we agree that Syndicate Bank is no way responsible for claims under SyndArogya and same have to be

pursued with the particular T.P.A. / Insurance Company.

PLACE …………… (X)

DATE …………….. SIGNATURE OF THE PROPOSER

SEAL OF THE BRANCH SIGNATURE OF BRANCH MANAGER

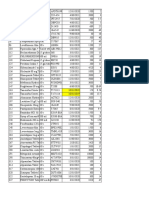

PREMIUM CHART - PLAN A (Family size: 1+3) inclusive of service tax @ 10.3%

PREMIUM CHART - PLAN A (Family size: 1+3) inclusive of service tax @ 10.3%

Sum 0.50 1.00 1.50 2.00 2.5 3.00 3.5 4 4.5 5

insured lacs lacs lacs lacs lacs lacs lacs lacs lacs lacs

Premium 939 1814 2659 3424 4104 4786 5384 5983 6583 7182

PREMIUM CHART - PLAN B (Family size: 1+5) inclusive of service tax @ 10.3%

Sum 0.50 1.00 1.50 2.00 2.5 3.00 3.5 4.00 4.5 5.00

insured lacs lacs lacs lacs lacs lacs lacs lacs 1acs lacs

Premium 1567 3029 4436 5708 6840 7971 8964 9957 10952 11944

EXCLUSIONS:

1. All diseases / injuries which are pre-existing when the cover incepts for the first time. For the purpose

of applying this condition, the date of inception of the initial Medical Policy taken from any Indian

Insurance companies shall be taken provided the renewals have been continuous and without any break.

However, this exclusion will be deleted after three consecutive continuous claims free policy years,

provided, there was no hospitalisation forth pre existing ailment during these years of Insurance.

2. Any disease other than those stated in clause 3 under exclusions, contracted by the insured person

during the first 30 days from the commencement date of the policy. The condition shall not however

apply in case of the insured person having been covered under this scheme or group Insurance Scheme

with any of the Indian Insurance companies for a continuous period of preceding 12 months without

any break.

3. During the first year of the operation of the policy, the expenses on treatment of diseases such as

Cataract, Benign Prostatic Hypertrophy, Hysterectomy for Menorrhagia or Fibromyoma, Hernia,

Hydrocele, Fistula in anus, piles, Sinusitis and related disorders are not payable. if these disease (other

than Congenital Internal Disease) are pre-existing at the time of proposal they will not be covered even

during subsequent period of renewal. If the insured is aware of the existence of congenital internal

disease before inception of the policy, the same will be treated as pre-existing and however subject to

Exclusion No.l.

4. Injury / disease directly or indirectly caused by or arising from or attributable to invasion, Act of

Foreign enemy, war like operations (whether war be declared or not)

5. Circumcision unless necessary for treatment of disease not excluded hereunder or as may be

necessitated due to an accident, vaccination or inoculation or change of life or cosmetic or aesthetic

treatment of any description, plastic surgery other than as may be necessitated due to an accident or as a

part of any illness.

6. Cost of spectacles and contact lenses, hearing aids.

7. Dental treatment or surgery of any kind including hospitalisation either due to Accident / Disease.

8. Convalescence, general debility, rundown condition or rest cure. Congenital external disease or defects

or anomalies, Sterility, Venereal disease, intentional self injury and use of intoxication drugs / alcohol.

9. All expenses arising out of any condition directly or indirectly caused to or associated with Human T-

Cell Lymphotropic Virus Type III (HTLB-III) or Lympadinopathy Associated Virus (LAV) or the

Mutants Derivative or Variation Deficiency Syndrome or any syndrome or condition of a similar kind

commonly referred to as AIDS.

10. Charges incurred at Hospital or Nursing Home primarily for Diagnosis, X-ray or Laboratory

examinations other diagnostic studies not consistent with or incidental to the diagnosis and treatment of

Positive existence of presence of any ailment, sickness or injury, for which confinement is required at a

Hospital/Nursing Home.

11. Expenses on vitamins and tonics unless forming part of treatment for injury / disease as certified by the

attending physician.

12. Injury or Disease directly caused by or contributed to by nuclear weapon / materials.

13. Treatment arising from or traceable to pregnancy (including voluntary termination of pregnancy) and

child birth (including caesarean section).

14. Naturopathy treatment.

Vous aimerez peut-être aussi

- BCONDocument27 pagesBCONYathish NanjundaswamyPas encore d'évaluation

- New Arrived Stock 04-10-2019Document2 pagesNew Arrived Stock 04-10-2019Yathish NanjundaswamyPas encore d'évaluation

- Programming in InfobasicDocument23 pagesProgramming in Infobasicgnana_sam100% (1)

- New Arrived Stock 04-10-2019Document2 pagesNew Arrived Stock 04-10-2019Yathish NanjundaswamyPas encore d'évaluation

- Programming in InfobasicDocument23 pagesProgramming in Infobasicgnana_sam100% (1)

- New Arrived Stock 04-10-2019Document2 pagesNew Arrived Stock 04-10-2019Yathish NanjundaswamyPas encore d'évaluation

- Programming in InfobasicDocument23 pagesProgramming in Infobasicgnana_sam100% (1)

- Us1m PDFDocument467 pagesUs1m PDFYathish NanjundaswamyPas encore d'évaluation

- Us1m PDFDocument467 pagesUs1m PDFYathish NanjundaswamyPas encore d'évaluation

- New Arrived Stock 04-10-2019Document2 pagesNew Arrived Stock 04-10-2019Yathish NanjundaswamyPas encore d'évaluation

- DJRstock 4 10 19Document2 pagesDJRstock 4 10 19Yathish NanjundaswamyPas encore d'évaluation

- New Arrived Stock 04-10-2019Document2 pagesNew Arrived Stock 04-10-2019Yathish NanjundaswamyPas encore d'évaluation

- Repgen R17Document14 pagesRepgen R17Yathish Nanjundaswamy100% (2)

- International Phone Numbers List with Country, Type and NumberDocument1 pageInternational Phone Numbers List with Country, Type and NumberYathish NanjundaswamyPas encore d'évaluation

- Instruction Manual: APN# A99958Document8 pagesInstruction Manual: APN# A99958kmrsg7Pas encore d'évaluation

- Bouquets 03012019Document206 pagesBouquets 03012019Emrald ConsultancyPas encore d'évaluation

- ZP - Brochure - Final 2018 7 31 15 57 13 982Document34 pagesZP - Brochure - Final 2018 7 31 15 57 13 982Yathish NanjundaswamyPas encore d'évaluation

- T24 Application Development - R17Document39 pagesT24 Application Development - R17Yathish Nanjundaswamy100% (1)

- This Statistics Is Calculated by An Android App "EMI Calculator"Document1 pageThis Statistics Is Calculated by An Android App "EMI Calculator"Yathish NanjundaswamyPas encore d'évaluation

- How To Turn Your Windows... A Wireless Access PointDocument3 pagesHow To Turn Your Windows... A Wireless Access PointYathish NanjundaswamyPas encore d'évaluation

- NEFTDocument6 pagesNEFTParoj DuttaPas encore d'évaluation

- Zq¡E//Vġ : Eií (S10) B E LBDocument55 pagesZq¡E//Vġ : Eií (S10) B E LBYathish NanjundaswamyPas encore d'évaluation

- And Rs. 50/-For Others As Postage ChargesDocument26 pagesAnd Rs. 50/-For Others As Postage ChargesFreshers Plane IndiaPas encore d'évaluation

- HRA ReceiptDocument1 pageHRA ReceiptYathish NanjundaswamyPas encore d'évaluation

- NPS Subscriber Registration FormDocument6 pagesNPS Subscriber Registration FormPankaj Batra100% (1)

- Accounting BasicsDocument11 pagesAccounting BasicsYathish NanjundaswamyPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sun Is Not OursDocument125 pagesThe Sun Is Not OursLoraine HamblyPas encore d'évaluation

- Honda Civic Insurance (20-21) PDFDocument10 pagesHonda Civic Insurance (20-21) PDFGuru CharanPas encore d'évaluation

- Hubungan Jumlah Cd4 Dengan Kualitas Hidup Pada Orang Dengan Hiv/Aids (Odha)Document12 pagesHubungan Jumlah Cd4 Dengan Kualitas Hidup Pada Orang Dengan Hiv/Aids (Odha)WihelaPas encore d'évaluation

- CD DRILLS (Communicable DiseasesDocument8 pagesCD DRILLS (Communicable DiseasesJune DumdumayaPas encore d'évaluation

- D.S.S Aiims Prepration Test Series: Com M Un Ic Ab Le An D N On - Co M M Un Ic Ab Le Di Se AsDocument7 pagesD.S.S Aiims Prepration Test Series: Com M Un Ic Ab Le An D N On - Co M M Un Ic Ab Le Di Se AsDr-Sanjay SinghaniaPas encore d'évaluation

- Ebook Development Infancy Through Adolescence 1St Edition Steinberg Test Bank Full Chapter PDFDocument61 pagesEbook Development Infancy Through Adolescence 1St Edition Steinberg Test Bank Full Chapter PDFbastmedalist8t2a100% (9)

- Hiv AidsDocument2 pagesHiv AidsPRINTDESK by DanPas encore d'évaluation

- Mae Tao Clinic 20 Year AnniversaryDocument115 pagesMae Tao Clinic 20 Year AnniversaryMichelle KaticsPas encore d'évaluation

- AbbottDocument53 pagesAbbottsharenPas encore d'évaluation

- ACF-USA 2004 Annual ReportDocument14 pagesACF-USA 2004 Annual ReportAction Against Hunger USAPas encore d'évaluation

- 5 6059713553416323809Document351 pages5 6059713553416323809Dimas RfPas encore d'évaluation

- Mother-To-Child Transmission (MTCT) of Hiv/AidsDocument23 pagesMother-To-Child Transmission (MTCT) of Hiv/AidsParamita ArdiyantiPas encore d'évaluation

- Buunk y Van Vugt (2007) - Applying Social Psychology. From Problem To Solution. Chapter 1Document22 pagesBuunk y Van Vugt (2007) - Applying Social Psychology. From Problem To Solution. Chapter 1yuly anaPas encore d'évaluation

- Unit 4 Human Health and DiseasesDocument12 pagesUnit 4 Human Health and DiseasesDashamiPas encore d'évaluation

- GFBR9Document42 pagesGFBR9emsanchezPas encore d'évaluation

- The Calcium Factor - The Scientific Secret - Barefoot, Robert R Reich, Carl JDocument252 pagesThe Calcium Factor - The Scientific Secret - Barefoot, Robert R Reich, Carl JAnonymous gwFqQcnaX100% (2)

- Amedex Ethics and Professionalism Amc Practice BookDocument147 pagesAmedex Ethics and Professionalism Amc Practice Book0d&H 8100% (1)

- Public Perception On Commercial Sex Working in Kenya RecoveredDocument23 pagesPublic Perception On Commercial Sex Working in Kenya RecoveredFe LixPas encore d'évaluation

- CollinzDocument12 pagesCollinzAMANYIRE COLLENPas encore d'évaluation

- Voorgestelde Lesplan Vir Graad 5Document120 pagesVoorgestelde Lesplan Vir Graad 5Netwerk24Pas encore d'évaluation

- Annual Report 2012 HIV NATDocument89 pagesAnnual Report 2012 HIV NATIs-ma PontiPas encore d'évaluation

- Steps To Use Routine Information To Improve HIV/AIDS ProgramsDocument118 pagesSteps To Use Routine Information To Improve HIV/AIDS ProgramsFuturesGroup1Pas encore d'évaluation

- Oral, Anal, Genital Sex Infections, STDs and PolygynyDocument10 pagesOral, Anal, Genital Sex Infections, STDs and PolygynyLee TylerPas encore d'évaluation

- NCMH - Burden of Disease - (29 Sep 2005)Document388 pagesNCMH - Burden of Disease - (29 Sep 2005)jyoti dua100% (1)

- HQ1 - Gender and Human Sexuality L HIV Aids - SUMMATIVE TESTDocument2 pagesHQ1 - Gender and Human Sexuality L HIV Aids - SUMMATIVE TESTDor Lenn100% (2)

- Global Burden of DiseaseDocument82 pagesGlobal Burden of Diseaseangayarkanni100% (1)

- Star Care Insurance CoverageDocument20 pagesStar Care Insurance CoverageLuna DanielPas encore d'évaluation

- Nwo Plans Exposed 1969 MedicineDocument8 pagesNwo Plans Exposed 1969 MedicineOmara Innocent IvanPas encore d'évaluation

- The Death of Expertise WordDocument12 pagesThe Death of Expertise WordXiuka SafiraPas encore d'évaluation

- The Biology of Sex and Sexual IdentityDocument9 pagesThe Biology of Sex and Sexual Identity란지 리오Pas encore d'évaluation