Académique Documents

Professionnel Documents

Culture Documents

Vijaya Advertisers vs Commissioner Of Central Excise Tribunal Order

Transféré par

DeepamBoraDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Vijaya Advertisers vs Commissioner Of Central Excise Tribunal Order

Transféré par

DeepamBoraDroits d'auteur :

Formats disponibles

Vijaya Advertisers vs Commissioner Of Central Excise on 6 January, 2006

Bench: S Peeran, J T T.K.

Vijaya Advertisers vs Commissioner Of Central Excise on 6/1/2006

ORDER

S.L. Peeran, Member (J)

1. This appeal arises from OIA No. 08/2004-ST dated 20-4-2004 confirming duty demands on larger period

besides confirming penalty. The contention of the appellant is that the demands are barred by time. They were

holders of registration and were paying Service tax on the services rendered by them as Advertising Agency.

They had paid tax upto November, December 1996 and could not pay the amount due to loss incurred by them

from April 1999 onwards. The Department did not initiate any action for recovery of the amount despite being

fully aware that the appellant had stopped paying the Service tax. The statement was recorded from the

Managing Partner, Shri Raju on 13-12-2000 and the Show Cause Notice was issued on 7-12-2001. The only

plea raised by the appellant is that the demands are hit by larger period. It was also contended that during the

relevant period, there was no provision for recovering duty of extended period and it was only during 2004,

the relevant section was amended for recovering the demands for larger period. It is further submitted that this

bench, in the appellant's own case, where he was a partner in Free Look Outdoor Advertising, the Tribunal, on

the same set of facts, set aside demands for larger period by Final Order No. 2249/2005, dated 23-12-2005

2006 (2) S.T.R. 102 (Tribunal) and remanded the case for working out duty for the period within six months.

2. The learned SDR opposes the prayer and contended that larger period was invokable as the appellants had

stopped paying duty and that itself is sufficient to take a view that larger period was invokable.

3. On a careful consideration, we notice that in an identical facts and circumstance, larger period has been set

aside in the case of Free Look Outdoor Advertising by Final Order No. 2249/2005 dated 23-12-2005. The

findings recorded in para 3 of the above Final Order is reproduced herein below:

3. On a careful consideration of the matter, I find that the statements were recorded from the Proprietor on

13-12-2000 and the Show Cause Notice has been issued on 7-12-2001. There is no invocation of larger period

in the Show Cause Notice. Therefore, the Department cannot enforce the demand for the larger period in the

absence of invoking the larger period in the Show Cause Notice and due to inordinate delay in issuing the

Show Cause Notice. Even on going through the Show Cause Notice, it is clear that the assessee had taken

licence and paid Service tax and filed returns for the initial period and thereafter due to loss in the business, he

failed to pay the Service tax. In these circumstances, the Department should have proceeded at the earliest to

recover the dues from him. In view of the plea on the time bar, the demand for the larger period is set aside.

The matter is remanded to the Original Authority to recalculate the demand arising within the time limit and

fix appropriate penalty accordingly. The Original Authority should complete the proceedings within a period

of four months from the date of receipt of this order, after providing an opportunity of hearing to the

appellants.

4. By applying the ratio of the above finding in the present case, we set aside the demand for the larger period

and remand the case to the original authority to re-work out the duty for six months period in terms of the

direction given in the above cited order. The matter shall be disposed of within four months from the receipt

of this order after providing an opportunity of hearing to the appellants.

(Operative portion of this Order was pronounced in open court on conclusion of hearing)

Indian Kanoon - http://indiankanoon.org/doc/402869/ 1

Vous aimerez peut-être aussi

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionD'EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionPas encore d'évaluation

- GR No. 175410 SMI-Ed Philippines Technology, Inc. v. Commissioner of Internal RevenueDocument20 pagesGR No. 175410 SMI-Ed Philippines Technology, Inc. v. Commissioner of Internal RevenueRoxanne Daphne LapaanPas encore d'évaluation

- P&G Asia Pte Ltd v CIR tax refund caseDocument1 pageP&G Asia Pte Ltd v CIR tax refund caseLeogen TomultoPas encore d'évaluation

- Philippine Journalists Inc. v CIR: Waiver of limitations invalid, assessment beyond 3-year periodDocument19 pagesPhilippine Journalists Inc. v CIR: Waiver of limitations invalid, assessment beyond 3-year periodCarolyn Clarin-BaternaPas encore d'évaluation

- TAX REFUND CLAIM DENIED DUE TO PRESCRIPTION AND LACK OF EVIDENCEDocument8 pagesTAX REFUND CLAIM DENIED DUE TO PRESCRIPTION AND LACK OF EVIDENCECollen Anne PagaduanPas encore d'évaluation

- CIR vs. The Stanley Works Sales (Phils.), Inc., G.R. No. 187589. Dec 3, 2014Document10 pagesCIR vs. The Stanley Works Sales (Phils.), Inc., G.R. No. 187589. Dec 3, 2014raph basilioPas encore d'évaluation

- Technopeak vs. CIR CTA Case #7751Document20 pagesTechnopeak vs. CIR CTA Case #7751Geralyn GabrielPas encore d'évaluation

- CIR Vs FBDCDocument2 pagesCIR Vs FBDCCarmz SumilePas encore d'évaluation

- Tax Digest Batch 9 - CTADocument8 pagesTax Digest Batch 9 - CTAVictor SarmientoPas encore d'évaluation

- CIR right to collect 1992 taxes prescribedDocument12 pagesCIR right to collect 1992 taxes prescribedRoma MicuPas encore d'évaluation

- CIR vs. Philippine Global: Request for Reconsideration Does Not Toll PrescriptionDocument3 pagesCIR vs. Philippine Global: Request for Reconsideration Does Not Toll PrescriptionPiaPas encore d'évaluation

- 14 Sunga-Chan v. Court of Appeals, G.R. No. 164401, 25 June 2008Document15 pages14 Sunga-Chan v. Court of Appeals, G.R. No. 164401, 25 June 2008Hanelizan Ert RoadPas encore d'évaluation

- NESTLE v. Uniwide SalesDocument4 pagesNESTLE v. Uniwide SalesRam PagongPas encore d'évaluation

- Httpslearn Nls Ac Inpluginfile php14799coursesection109862820152920820SCC20519 PDFDocument17 pagesHttpslearn Nls Ac Inpluginfile php14799coursesection109862820152920820SCC20519 PDFarunoday RaiPas encore d'évaluation

- A.K.Jayasankaran Nambiar, Syam KumarDocument8 pagesA.K.Jayasankaran Nambiar, Syam KumarArun KeerthiPas encore d'évaluation

- Agra 10Document5 pagesAgra 10Shally Lao-unPas encore d'évaluation

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument15 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon Citylantern san juanPas encore d'évaluation

- Le Jugement Contre Airway CoffeeDocument7 pagesLe Jugement Contre Airway CoffeeL'express MauricePas encore d'évaluation

- Supreme Court: Factual AntecedentsDocument11 pagesSupreme Court: Factual AntecedentsGavin Reyes CustodioPas encore d'évaluation

- Case #7 - Nacar V Gallery Frames Et Al 703 SCRA 439Document6 pagesCase #7 - Nacar V Gallery Frames Et Al 703 SCRA 439Michelle CatadmanPas encore d'évaluation

- Sunga-Chan v. CA, GR 164401Document16 pagesSunga-Chan v. CA, GR 164401Anna NicerioPas encore d'évaluation

- CIR vs. Medical CenterDocument5 pagesCIR vs. Medical CenterJenica Anne DalaodaoPas encore d'évaluation

- 08 CIR Vs Kudos Metal Corp GR No. 178087 May 5, 2010Document7 pages08 CIR Vs Kudos Metal Corp GR No. 178087 May 5, 2010Patrick Dag-um MacalolotPas encore d'évaluation

- Aro Vs NLRCDocument5 pagesAro Vs NLRCJoeyBoyCruzPas encore d'évaluation

- Commissioner of Internal Revenue, Petitioner, vs. Kudos Metal Corporation, RespondentDocument13 pagesCommissioner of Internal Revenue, Petitioner, vs. Kudos Metal Corporation, RespondentWilger UrmazaPas encore d'évaluation

- Anyayahan - Ivan Josef - L (Tax Digest)Document2 pagesAnyayahan - Ivan Josef - L (Tax Digest)Lenette LupacPas encore d'évaluation

- Republic of The PhilippinesDocument8 pagesRepublic of The PhilippinesHashim DimalPas encore d'évaluation

- TAX REMEDIES Page 2Document231 pagesTAX REMEDIES Page 2twenty19 lawPas encore d'évaluation

- City of Parañaque Tax DisputeDocument7 pagesCity of Parañaque Tax DisputeHazel FernandezPas encore d'évaluation

- 9 HERMOSA Case Digest Batch 3.pre TrialDocument2 pages9 HERMOSA Case Digest Batch 3.pre TrialDaryll GenerynPas encore d'évaluation

- Tax Case Digest on VAT Refund RequirementsDocument43 pagesTax Case Digest on VAT Refund RequirementsJasmine TorioPas encore d'évaluation

- EB 1452 LANECO V BIR 20170405 & EB 1246 CIR V South Entertainment Gallery, Inc 20160104 PDFDocument34 pagesEB 1452 LANECO V BIR 20170405 & EB 1246 CIR V South Entertainment Gallery, Inc 20160104 PDFcherryPas encore d'évaluation

- S.64-A JudgementDocument9 pagesS.64-A JudgementHashim TatlahPas encore d'évaluation

- Philippine Jurisprudence Case on Social Security System DisputeDocument6 pagesPhilippine Jurisprudence Case on Social Security System DisputeMIGUEL JOSHUA AGUIRREPas encore d'évaluation

- GROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanDocument4 pagesGROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanJoatham GenovisPas encore d'évaluation

- CIR's bid to collect excise taxes from Shell, Petron deniedDocument4 pagesCIR's bid to collect excise taxes from Shell, Petron deniedGem AusteroPas encore d'évaluation

- Cta 1D CV 09420 M 2021feb03 AssDocument6 pagesCta 1D CV 09420 M 2021feb03 AssFirenze PHPas encore d'évaluation

- 163 Nacar V Gallery Frames (Ipan - Jhon Edgar)Document2 pages163 Nacar V Gallery Frames (Ipan - Jhon Edgar)Jhon Edgar IpanPas encore d'évaluation

- Labor Arbiter Decision on Backwage ComputationDocument9 pagesLabor Arbiter Decision on Backwage ComputationBreth1979Pas encore d'évaluation

- 143.CIR Vs Stanley (Phils.)Document8 pages143.CIR Vs Stanley (Phils.)Clyde KitongPas encore d'évaluation

- Protacio v. Laya MananghayaDocument17 pagesProtacio v. Laya MananghayaEmma Ruby Aguilar-ApradoPas encore d'évaluation

- Swire Realty Development Corporation Petitioner VS Jayne Yu RespondentDocument7 pagesSwire Realty Development Corporation Petitioner VS Jayne Yu Respondentmondaytuesday17Pas encore d'évaluation

- Indian Oil VS FabtechDocument11 pagesIndian Oil VS FabtechJmPas encore d'évaluation

- CIR Vs Phil. Global Communications, GR 167146, Oct. 31, 2006Document4 pagesCIR Vs Phil. Global Communications, GR 167146, Oct. 31, 2006katentom-1Pas encore d'évaluation

- Halite Vs SS VenturesDocument5 pagesHalite Vs SS VenturesHumility Mae FrioPas encore d'évaluation

- CIR vs. Fitness by Design Case DigestDocument1 pageCIR vs. Fitness by Design Case DigestMaestro LazaroPas encore d'évaluation

- SC Judgment 1 PDFDocument14 pagesSC Judgment 1 PDFQazi Ammar AlamPas encore d'évaluation

- Nanox Philippines V CIRDocument4 pagesNanox Philippines V CIRKor CesPas encore d'évaluation

- National Consumer Disputes Redressal Commission New Delhi Revision Petition No. 3369 of 2017Document4 pagesNational Consumer Disputes Redressal Commission New Delhi Revision Petition No. 3369 of 2017Bhan WatiPas encore d'évaluation

- Aaaaaaaaaaaaaaa: D) CIR Vs Standard Chartered Bank G.R. 192173, July 29, 2015Document267 pagesAaaaaaaaaaaaaaa: D) CIR Vs Standard Chartered Bank G.R. 192173, July 29, 2015JouseffLionelColosoMacolPas encore d'évaluation

- 213 Tax - Republic v. Hizon, 320 SCRA 574Document2 pages213 Tax - Republic v. Hizon, 320 SCRA 574Brandon BanasanPas encore d'évaluation

- Case #11Document2 pagesCase #11Edgar Calzita AlotaPas encore d'évaluation

- Kalra PapersDocument7 pagesKalra PapersSiiddharth S DubeyPas encore d'évaluation

- Case 110 - Swire Realty V Jayne YuDocument7 pagesCase 110 - Swire Realty V Jayne YuGlance CruzPas encore d'évaluation

- D) CIR Vs Standard Chartered Bank G.R. 192173, July 29, 2015Document67 pagesD) CIR Vs Standard Chartered Bank G.R. 192173, July 29, 2015JouseffLionelColosoMacolPas encore d'évaluation

- Nacar V Gallery FramesDocument11 pagesNacar V Gallery FramesTiff AtendidoPas encore d'évaluation

- CTA Dismisses Tax Refund PetitionDocument10 pagesCTA Dismisses Tax Refund PetitionRollane ArcePas encore d'évaluation

- Fulltext (Secs 60-75)Document169 pagesFulltext (Secs 60-75)anailabucaPas encore d'évaluation

- Corpo Cases Set 11Document12 pagesCorpo Cases Set 11ninya09Pas encore d'évaluation

- Agreement For SaleDocument24 pagesAgreement For SaleDeepamBoraPas encore d'évaluation

- Association of All AssamDocument1 pageAssociation of All AssamDeepamBoraPas encore d'évaluation

- Similarly in APSRTC v. Abdul Kareem, AIR 2005 SC 3791, The SC Held As FollowsDocument2 pagesSimilarly in APSRTC v. Abdul Kareem, AIR 2005 SC 3791, The SC Held As FollowsDeepamBoraPas encore d'évaluation

- DOPT O.M Dated 27.03.2009Document4 pagesDOPT O.M Dated 27.03.2009DeepamBora100% (1)

- List of Organizations Coming Under CATDocument19 pagesList of Organizations Coming Under CATDeepamBoraPas encore d'évaluation

- MoU for IT Implementation in Agriculture DeptDocument24 pagesMoU for IT Implementation in Agriculture DeptDeepamBoraPas encore d'évaluation

- Feasibility of Tyre PyrolyserDocument14 pagesFeasibility of Tyre PyrolyserDeepamBora100% (1)

- Gujarat RO PlantsDocument26 pagesGujarat RO PlantsShweta Tripathi BanerjeePas encore d'évaluation

- Eguide 1Document4 pagesEguide 1DeepamBoraPas encore d'évaluation

- Dealogic PF Template 2011Document1 pageDealogic PF Template 2011DeepamBoraPas encore d'évaluation

- AdvertisementDocument3 pagesAdvertisementDeepamBoraPas encore d'évaluation

- 7 - Lakhs Bank EstimateDocument8 pages7 - Lakhs Bank Estimatevikram Bargur67% (3)

- Relationship Between Effective Pain Management and Patient RecoveryDocument4 pagesRelationship Between Effective Pain Management and Patient RecoveryAkinyiPas encore d'évaluation

- Expert Java Developer with 10+ years experienceDocument3 pagesExpert Java Developer with 10+ years experienceHaythem MzoughiPas encore d'évaluation

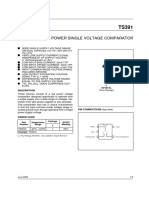

- Ts 391 IltDocument5 pagesTs 391 IltFunnypoumPas encore d'évaluation

- Igbt Irg 4p254sDocument9 pagesIgbt Irg 4p254sMilagros Mendieta VegaPas encore d'évaluation

- Steps To Private Placement Programs (PPP) DeskDocument7 pagesSteps To Private Placement Programs (PPP) DeskPattasan U100% (1)

- Kinds of ObligationDocument50 pagesKinds of ObligationKIM GABRIEL PAMITTANPas encore d'évaluation

- SAPGLDocument130 pagesSAPGL2414566Pas encore d'évaluation

- DMT80600L104 21WTR Datasheet DATASHEETDocument3 pagesDMT80600L104 21WTR Datasheet DATASHEETtnenPas encore d'évaluation

- How To Generate Your First 20,000 Followers On InstagramDocument44 pagesHow To Generate Your First 20,000 Followers On InstagramAdrian Pratama100% (1)

- Fayol's Principles in McDonald's ManagementDocument21 pagesFayol's Principles in McDonald's Managementpoo lolPas encore d'évaluation

- Outdoor Composting Guide 06339 FDocument9 pagesOutdoor Composting Guide 06339 FAdjgnf AAPas encore d'évaluation

- 028 Ptrs Modul Matematik t4 Sel-96-99Document4 pages028 Ptrs Modul Matematik t4 Sel-96-99mardhiah88Pas encore d'évaluation

- Festo Process Control - CatalogDocument3 pagesFesto Process Control - Cataloglue-ookPas encore d'évaluation

- Dues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Document52 pagesDues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Greefield JasonPas encore d'évaluation

- Real Estate Developer Resume SampleDocument1 pageReal Estate Developer Resume Sampleresume7.com100% (2)

- Capital Asset Pricing ModelDocument11 pagesCapital Asset Pricing ModelrichaPas encore d'évaluation

- Loans and AdvanceDocument8 pagesLoans and AdvanceDjay SlyPas encore d'évaluation

- BS 00011-2015Document24 pagesBS 00011-2015fazyroshan100% (1)

- Guideline 3 Building ActivitiesDocument25 pagesGuideline 3 Building ActivitiesCesarMartinezPas encore d'évaluation

- CSCE 3110 Data Structures and Algorithms NotesDocument19 pagesCSCE 3110 Data Structures and Algorithms NotesAbdul SattarPas encore d'évaluation

- Screenshot 2021-10-02 at 12.22.29 PMDocument1 pageScreenshot 2021-10-02 at 12.22.29 PMSimran SainiPas encore d'évaluation

- JuliaPro v0.6.2.1 Package API ManualDocument480 pagesJuliaPro v0.6.2.1 Package API ManualCapitan TorpedoPas encore d'évaluation

- Accor vs Airbnb: Business Models in Digital EconomyDocument4 pagesAccor vs Airbnb: Business Models in Digital EconomyAkash PayunPas encore d'évaluation

- Recent Advances in Mobile Robotics - TopalovDocument464 pagesRecent Advances in Mobile Robotics - TopalovBruno MacedoPas encore d'évaluation

- Steam Turbine and Governor (SimPowerSystems)Document5 pagesSteam Turbine and Governor (SimPowerSystems)hitmancuteadPas encore d'évaluation

- Quiz - DBA and Tcont Bw-TypesDocument4 pagesQuiz - DBA and Tcont Bw-TypesSaifullah Malik100% (1)

- ESA 7.6 Configuration GuideDocument460 pagesESA 7.6 Configuration GuideaitelPas encore d'évaluation

- DPD 2Document1 pageDPD 2api-338470076Pas encore d'évaluation

- FINC 301 MQsDocument40 pagesFINC 301 MQsMichael KutiPas encore d'évaluation