Académique Documents

Professionnel Documents

Culture Documents

Day Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74

Transféré par

Andre_Setiawan_1986Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Day Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74

Transféré par

Andre_Setiawan_1986Droits d'auteur :

Formats disponibles

March 4th 2011

News of Venezuelan President Hugo Chavez’s mediation offer had eased some upward pressure on

oil pressure, leading to a dip in oil prices. This, in turn led to a drop in inflation expectations which

sent the gold prices plunging towards $1,415.20/oz. in the U.S. after previously soaring towards

$1,440/oz. Further positive news came from the jobless claims which saw a drop towards 368K,

below prior week’s claims of 388K and also better than the expected 398K.

The positive indication from the jobless claims number suggested that the nonfam payrolls scheduled

to be released on Friday will be on the strong side. The current consensus lies at 190K after a

puzzling January payrolls of 36K, while the unemployment rate is seen to rise to 9.2% from 9.0%.

Productivity in Q4 was also reported up more than anticipated earlier at 2.6%. Earlier, analysts

expected a rise of 2.2% in productivity, slower than the prior period’s productivity which was also at

2.6%. In the non-manufacturing sector, February saw another uptick in the ISM index. Analysts

previously anticipated a stagnant index at 59.4, but in the end the index hit 59.7 in February.

Elsewhere, in Europe the European Central President Jean-Claude Trichet has surprised the market by

saying that the central bank may rate hike in April. The hike is probably by 25 basis points and the

trigger is most likely the persistently high price of oil.

PC unit for 2011 and 2012 are forecast to be lower. In 2011, global PC shipments are seen to reach

387.8 million units, rising 10.5% from 2010, according to Gartner. Earlier, Gartner expected 15.9%

growth in 2011. In 2012, Gartner sees shipments to be at 440.6 million units, rising 13.6% from 2011

forecast but lower than Gartner’s initial forecast of 14.8% growth.

From the corporate side, nothing much happened on Thursday but WMT has increased its annual

dividend by 21% to $1.46 per share for the current FY11. This annual dividend will be paid each

quarter evenly at $0.365 per share.

CAT became the top performer on Thursday following the stock upgrade from NEUTRAL to

OUTPERFORM by Zacks Investment Research. Currently, Zack’s CAT target lies at $122. CAT led on

Thursday with 3.25% of gains.

Day Ahead

The market will focus on the jobs data on Friday, but it will also keep on monitoring the situations in

Libya. Already the Libyan rebels announced that they rejected Chavez’s mediation offer, hence the

oil prices have returned to the upside around $102.00 per barrel.

1 .DJI 12,258.20 (+1.59%) .SPX 1,330.97 (+1.72%) .IXIC 2,798.74 (+1.84%)

March 4th 2011

Stock Focus: International Business Machines Corporation

IBM

Last Feb 25th Resistances 166.45 174.50 180.75 182.00 184.10

163.48 2.07% Supports 160.35 159.05 156.65 153.70 150.75

WTD MTD Outlook

0.74% 0.99%

POSITIVE

YTD 12-Month

11.39% 27.47% PT $180.75

2 .DJI 12,258.20 (+1.59%) .SPX 1,330.97 (+1.72%) .IXIC 2,798.74 (+1.84%)

March 4th 2011

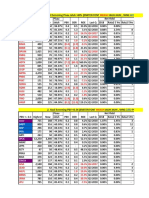

US Economic Calendar

Date Time Report Period Actual Forecast Previous

28-Feb 8:30 AM Personal incomes Jan 1.0% 0.9% 0.4%

28-Feb 8:30 AM Consumer spending Jan 0.2% 0.4% 0.5%

28-Feb 8:30 AM Core PCE price index Jan 0.1% 0.1% 0.0%

28-Feb 10:00 AM Chicago PMI Feb 71.2% 67.7% 68.8%

28-Feb 10:00 AM Pending home sales Jan -2.8% N/A 2.0%

1-Mar 10:00 AM ISM Feb 61.4% 61.0% 60.8%

1-Mar 10:00 AM Construction spending Jan -0.7% -0.1% -1.6%

1-Mar TBA Motor vehicle sales Feb 13.4 mln 12.4 mln 12.6 mln

2-Mar 8:15 AM ADP employment Feb 217K N/A 189K

2-Mar 2:00 PM Beige Book - - - -

3-Mar 8:30 AM Jobless claims 26-Feb 368K 398K 388K

3-Mar 8:30 AM Productivity Q4 2.6% 2.2% 2.6%

3-Mar 8:30 AM ISM nonmanufacturing Feb 59.7% 59.4% 59.4%

4-Mar 8:30 AM Nonfarm payrolls Feb - 190K 36K

4-Mar 8:30 AM Unemployment rates Feb - 9.2% 9.0%

4-Mar 8:30 AM Average hourly earnings Feb - 0.2% 0.4%

4-Mar 10:00 AM Factory orders Jan - 2.2% 0.2%

Price Performance - as of Mar 3rd 2011

Code Last Dy WTD MTD YTD 12-Mos Code Last Dy WTD MTD YTD 12-Mos

AA 16.63 2.78% -0.30% -1.31% 8.06% 16.78% JPM 46.08 1.92% -1.29% -1.31% 8.63% 2.97%

AXP 44.30 2.98% 1.77% 1.68% 3.22% 7.37% KFT 31.81 1.02% 0.32% -0.09% 0.95% 5.19%

BA 71.71 3.08% -0.82% -0.42% 9.88% -1.24% KO 65.57 1.77% 1.96% 2.58% -0.30% 19.22%

BAC 14.27 3.18% 0.49% -0.14% 6.97% -20.06% MCD 76.24 2.08% 2.42% 0.74% -0.68% 14.27%

CAT 104.25 3.25% 2.21% 1.28% 11.31% 65.87% MMM 92.81 1.63% 2.84% 0.63% 7.54% 11.06%

CSCO 18.53 0.16% -0.59% -0.16% -8.40% -28.81% MRK 33.10 1.60% 2.83% 1.63% -8.16% -11.38%

CVX 104.19 0.70% 2.05% 0.42% 14.18% 37.40% MSFT 26.20 0.46% -1.32% -1.43% -6.13% -10.55%

DD 54.55 2.81% 0.89% -0.58% 9.36% 46.48% PFE 19.77 3.02% 4.83% 2.75% 12.91% 15.28%

DIS 44.07 1.80% 2.61% 0.75% 17.49% 26.24% PG 62.55 0.22% -0.46% -0.79% -2.77% -1.14%

GE 20.75 2.12% -0.34% -0.81% 13.45% 14.01% T 28.13 -0.14% 0.00% -0.88% -4.25% 8.86%

HD 37.55 2.43% 1.27% 0.21% 7.10% 16.07% TRV 59.05 0.41% -0.92% -1.47% 6.00% 9.47%

HPQ 43.20 -0.09% 1.22% -0.99% 2.61% -18.72% UTX 83.85 2.19% 0.58% 0.37% 6.52% 13.91%

IBM 163.48 2.07% 0.74% 0.99% 11.39% 27.47% VZ 36.36 0.06% 1.08% -1.52% 1.62% 17.21%

INTC 21.79 1.40% -0.32% 1.49% 3.61% -2.24% WMT 52.01 0.08% 0.50% 0.06% -3.56% -6.46%

JNJ 61.05 0.39% 2.36% -0.63% -1.29% -6.37% XOM 85.82 0.87% 0.56% 0.34% 17.37% 28.13%

Disclaimer: This report is provided for information purposes only. It is not an offer to sell or to buy any securities. This

report has been prepared based on sources believed to be reliable, but there is no assurance or guarantee regarding its

completeness and accuracy. The author accepts no responsibility or liability arising from any use of the report.

3 .DJI 12,258.20 (+1.59%) .SPX 1,330.97 (+1.72%) .IXIC 2,798.74 (+1.84%)

Vous aimerez peut-être aussi

- Inners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Document5 pagesInners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Andre SetiawanPas encore d'évaluation

- Orporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Document4 pagesOrporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Andre SetiawanPas encore d'évaluation

- Lifted The Mood: PayrollsDocument5 pagesLifted The Mood: PayrollsAndre SetiawanPas encore d'évaluation

- Technical Focus: DIS: Dow 12,041.97 +1.81 0.02% S&P 500 1,304.03 - 3.56 - 0.27% Nasdaq 2,749.56 - 1.63 - 0.06%Document3 pagesTechnical Focus: DIS: Dow 12,041.97 +1.81 0.02% S&P 500 1,304.03 - 3.56 - 0.27% Nasdaq 2,749.56 - 1.63 - 0.06%Andre_Setiawan_1986Pas encore d'évaluation

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Document4 pagesSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanPas encore d'évaluation

- Dow 12,062.26 +20.29 0.17% S&P 500 1,307.10 +3.07 0.24% Nasdaq 2,753.88 +4.32 0.16%Document4 pagesDow 12,062.26 +20.29 0.17% S&P 500 1,307.10 +3.07 0.24% Nasdaq 2,753.88 +4.32 0.16%Andre SetiawanPas encore d'évaluation

- Corporate News: .DJI 12,169.88 .SPX 1,321.15 .IXIC 2,784.67Document6 pagesCorporate News: .DJI 12,169.88 .SPX 1,321.15 .IXIC 2,784.67Andre SetiawanPas encore d'évaluation

- Orporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Document4 pagesOrporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Andre SetiawanPas encore d'évaluation

- To Middle East: ReturnDocument5 pagesTo Middle East: ReturnAndre_Setiawan_1986Pas encore d'évaluation

- Of Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Document4 pagesOf Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Andre SetiawanPas encore d'évaluation

- Calling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Document5 pagesCalling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Andre SetiawanPas encore d'évaluation

- Strikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Document4 pagesStrikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Andre SetiawanPas encore d'évaluation

- The Season Ends : EPS Estimates (Left) and Revenues Expectations (Right) On HD, WMT and HPQDocument4 pagesThe Season Ends : EPS Estimates (Left) and Revenues Expectations (Right) On HD, WMT and HPQAndre SetiawanPas encore d'évaluation

- Orporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Document5 pagesOrporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Andre SetiawanPas encore d'évaluation

- Index Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Document4 pagesIndex Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Andre_Setiawan_1986Pas encore d'évaluation

- .Dji 12,044.40 (+59.79) .SPX 1,304.28 (+9.17) .Ixic 2,715.61 (+14.59)Document6 pages.Dji 12,044.40 (+59.79) .SPX 1,304.28 (+9.17) .Ixic 2,715.61 (+14.59)Andre_Setiawan_1986Pas encore d'évaluation

- The Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Document4 pagesThe Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Andre SetiawanPas encore d'évaluation

- The Unthinkable: ThinkDocument5 pagesThe Unthinkable: ThinkAndre SetiawanPas encore d'évaluation

- .Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Document6 pages.Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Andre SetiawanPas encore d'évaluation

- The S&P and On To Earnings Again: .DJI 12,266.75 (+65.16) .SPX 1,312.62 (+7.48) .IXIC 2,744.97 (+9.59)Document4 pagesThe S&P and On To Earnings Again: .DJI 12,266.75 (+65.16) .SPX 1,312.62 (+7.48) .IXIC 2,744.97 (+9.59)Andre_Setiawan_1986Pas encore d'évaluation

- Oints of Nterest: .DJI 11,984.61 (-228.48) .SPX 1,295.11 (-24.91) .IXIC 2,701.02 (-50.70)Document5 pagesOints of Nterest: .DJI 11,984.61 (-228.48) .SPX 1,295.11 (-24.91) .IXIC 2,701.02 (-50.70)Andre SetiawanPas encore d'évaluation

- Uneventful: .DJI 12,197.88 (-22.71) .SPX 1,310.19 (-3.61) .IXIC 2,730.68 (-12.38)Document3 pagesUneventful: .DJI 12,197.88 (-22.71) .SPX 1,310.19 (-3.61) .IXIC 2,730.68 (-12.38)Andre SetiawanPas encore d'évaluation

- Dow 12,318.14 +29.97 +0.24% S&P 500 1,340.43 +4.11 +0.31% Nasdaq 2,831.58 +6.02 +0.21%Document5 pagesDow 12,318.14 +29.97 +0.24% S&P 500 1,340.43 +4.11 +0.31% Nasdaq 2,831.58 +6.02 +0.21%Andre_Setiawan_1986Pas encore d'évaluation

- Deal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Document5 pagesDeal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Andre SetiawanPas encore d'évaluation

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Document5 pagesDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanPas encore d'évaluation

- The Osama Factor: WeighingDocument4 pagesThe Osama Factor: WeighingAndre SetiawanPas encore d'évaluation

- Season Greetings!: (Earnings)Document6 pagesSeason Greetings!: (Earnings)Andre SetiawanPas encore d'évaluation

- Super Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualDocument5 pagesSuper Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualAndre SetiawanPas encore d'évaluation

- Or No Shutdown?Document6 pagesOr No Shutdown?Andre_Setiawan_1986Pas encore d'évaluation

- Industrial News: Dow 12,391.25 +73.11 +0.59% S&P 500 1,343.01 +2.58 +0.19% Nasdaq 2,833.95 +2.37 +0.08%Document6 pagesIndustrial News: Dow 12,391.25 +73.11 +0.59% S&P 500 1,343.01 +2.58 +0.19% Nasdaq 2,833.95 +2.37 +0.08%Andre_Setiawan_1986Pas encore d'évaluation

- Orporate Ews: .DJI 11,855.42 (-137.74) .SPX 1,281.87 (-14.52) .IXIC 2,667.33 (-33.64)Document6 pagesOrporate Ews: .DJI 11,855.42 (-137.74) .SPX 1,281.87 (-14.52) .IXIC 2,667.33 (-33.64)Andre SetiawanPas encore d'évaluation

- To Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Document5 pagesTo Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Andre SetiawanPas encore d'évaluation

- Up On M&A Speculation: Revenues in Billions of Dollars Earnings Per ShareDocument5 pagesUp On M&A Speculation: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanPas encore d'évaluation

- Day Ahead: .DJI 12,090.03 .SPX 1,310.13 .IXIC 2,745.63Document6 pagesDay Ahead: .DJI 12,090.03 .SPX 1,310.13 .IXIC 2,745.63Andre SetiawanPas encore d'évaluation

- Crunch: CommodityDocument5 pagesCrunch: CommodityAndre SetiawanPas encore d'évaluation

- Penalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Document6 pagesPenalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Andre SetiawanPas encore d'évaluation

- Earnings Lifted The Street: UpbeatDocument6 pagesEarnings Lifted The Street: UpbeatAndre SetiawanPas encore d'évaluation

- Ups and DownsDocument14 pagesUps and Downsca.deepaktiwariPas encore d'évaluation

- Shutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Document5 pagesShutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Andre_Setiawan_1986Pas encore d'évaluation

- Equities Update: MorningDocument2 pagesEquities Update: MorningsfarithaPas encore d'évaluation

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghPas encore d'évaluation

- EBLSL Daily Market Update - 22nd July 2020Document1 pageEBLSL Daily Market Update - 22nd July 2020Moheuddin SehabPas encore d'évaluation

- .Dji 12,213.09 .SPX 1,321.82 .Ixic 2,765.77Document5 pages.Dji 12,213.09 .SPX 1,321.82 .Ixic 2,765.77Andre_Setiawan_1986Pas encore d'évaluation

- Strikes Back: .DJI 12,723.58 (-83.93) .SPX 1,347.32 (-9.30) .IXIC 2,828.23 (-13.39)Document6 pagesStrikes Back: .DJI 12,723.58 (-83.93) .SPX 1,347.32 (-9.30) .IXIC 2,828.23 (-13.39)Andre SetiawanPas encore d'évaluation

- Equities Update: MorningDocument2 pagesEquities Update: MorningsfarithaPas encore d'évaluation

- Corporate News: .DJI 12,226.34 .SPX 1,327.22 .IXIC 2,782.27Document2 pagesCorporate News: .DJI 12,226.34 .SPX 1,327.22 .IXIC 2,782.27Andre_Setiawan_1986Pas encore d'évaluation

- Screening Saham 3feb19Document6 pagesScreening Saham 3feb19Muhammad Ramdhan IbadiPas encore d'évaluation

- For Impact: BracingDocument6 pagesFor Impact: BracingAndre_Setiawan_1986Pas encore d'évaluation

- January 29, 2010: Market OverviewDocument9 pagesJanuary 29, 2010: Market OverviewValuEngine.comPas encore d'évaluation

- Dow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Document5 pagesDow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Andre_Setiawan_1986Pas encore d'évaluation

- Under The Microscope: .DJI 12,595.37 (+115.49) .SPX 1,347.24 (+11.99) .IXIC 2,847.54 (+21.66)Document5 pagesUnder The Microscope: .DJI 12,595.37 (+115.49) .SPX 1,347.24 (+11.99) .IXIC 2,847.54 (+21.66)Andre SetiawanPas encore d'évaluation

- MNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFDocument8 pagesMNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFANIL PARIDAPas encore d'évaluation

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comPas encore d'évaluation

- Shigeru V3 Gold EA RecapDocument1 pageShigeru V3 Gold EA RecapRenata Claudia Gwen Marsitta SimanjuntakPas encore d'évaluation

- On Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Document5 pagesOn Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Andre SetiawanPas encore d'évaluation

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaPas encore d'évaluation

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comPas encore d'évaluation

- ValuEngine Weekly Newsletter July 30, 2010Document16 pagesValuEngine Weekly Newsletter July 30, 2010ValuEngine.comPas encore d'évaluation

- Factor Boosted The Dow: .DJI 12,763.31 (+72.35) .SPX 1,360.48 (+4.82) .IXIC 2,872.53 (+2.65)Document6 pagesFactor Boosted The Dow: .DJI 12,763.31 (+72.35) .SPX 1,360.48 (+4.82) .IXIC 2,872.53 (+2.65)Andre SetiawanPas encore d'évaluation

- Governing the Market: Economic Theory and the Role of Government in East Asian IndustrializationD'EverandGoverning the Market: Economic Theory and the Role of Government in East Asian IndustrializationÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Shutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Document5 pagesShutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Andre_Setiawan_1986Pas encore d'évaluation

- For Impact: BracingDocument6 pagesFor Impact: BracingAndre_Setiawan_1986Pas encore d'évaluation

- The S&P and On To Earnings Again: .DJI 12,266.75 (+65.16) .SPX 1,312.62 (+7.48) .IXIC 2,744.97 (+9.59)Document4 pagesThe S&P and On To Earnings Again: .DJI 12,266.75 (+65.16) .SPX 1,312.62 (+7.48) .IXIC 2,744.97 (+9.59)Andre_Setiawan_1986Pas encore d'évaluation

- .Dji 12,044.40 (+59.79) .SPX 1,304.28 (+9.17) .Ixic 2,715.61 (+14.59)Document6 pages.Dji 12,044.40 (+59.79) .SPX 1,304.28 (+9.17) .Ixic 2,715.61 (+14.59)Andre_Setiawan_1986Pas encore d'évaluation

- To Middle East: ReturnDocument5 pagesTo Middle East: ReturnAndre_Setiawan_1986Pas encore d'évaluation

- Or No Shutdown?Document6 pagesOr No Shutdown?Andre_Setiawan_1986Pas encore d'évaluation

- Of QE2?: .DJI 12,220.59 (+50.03) .SPX 1,313.80 (+4.14) .IXIC 2,743.06 (+6.64)Document7 pagesOf QE2?: .DJI 12,220.59 (+50.03) .SPX 1,313.80 (+4.14) .IXIC 2,743.06 (+6.64)Andre_Setiawan_1986Pas encore d'évaluation

- Industrial News: Dow 12,391.25 +73.11 +0.59% S&P 500 1,343.01 +2.58 +0.19% Nasdaq 2,833.95 +2.37 +0.08%Document6 pagesIndustrial News: Dow 12,391.25 +73.11 +0.59% S&P 500 1,343.01 +2.58 +0.19% Nasdaq 2,833.95 +2.37 +0.08%Andre_Setiawan_1986Pas encore d'évaluation

- .Dji 12,213.09 .SPX 1,321.82 .Ixic 2,765.77Document5 pages.Dji 12,213.09 .SPX 1,321.82 .Ixic 2,765.77Andre_Setiawan_1986Pas encore d'évaluation

- Stock Focus: BA: Feb 22nd MTD Resistances 2.89% 2.09% Supports YTD 12-Month Outlook 8.69% 12.30% Strategy BADocument1 pageStock Focus: BA: Feb 22nd MTD Resistances 2.89% 2.09% Supports YTD 12-Month Outlook 8.69% 12.30% Strategy BAAndre_Setiawan_1986Pas encore d'évaluation

- Dow 12,318.14 +29.97 +0.24% S&P 500 1,340.43 +4.11 +0.31% Nasdaq 2,831.58 +6.02 +0.21%Document5 pagesDow 12,318.14 +29.97 +0.24% S&P 500 1,340.43 +4.11 +0.31% Nasdaq 2,831.58 +6.02 +0.21%Andre_Setiawan_1986Pas encore d'évaluation

- Stock Focus: KFT: Feb 23rd MTD Resistances 0.67% 3.63% Supports YTD 12-Month Outlook 0.54% 11.43% Strategy KFTDocument2 pagesStock Focus: KFT: Feb 23rd MTD Resistances 0.67% 3.63% Supports YTD 12-Month Outlook 0.54% 11.43% Strategy KFTAndre_Setiawan_1986Pas encore d'évaluation

- Corporate News: .DJI 12,226.34 .SPX 1,327.22 .IXIC 2,782.27Document2 pagesCorporate News: .DJI 12,226.34 .SPX 1,327.22 .IXIC 2,782.27Andre_Setiawan_1986Pas encore d'évaluation

- Dow 12,288.17 +61.53 +0.50% S&P 500 1,336.32 +8.31 +0.63% Nasdaq 2,825.56 +21.21 +0.76%Document6 pagesDow 12,288.17 +61.53 +0.50% S&P 500 1,336.32 +8.31 +0.63% Nasdaq 2,825.56 +21.21 +0.76%Andre_Setiawan_1986Pas encore d'évaluation

- Dow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Document5 pagesDow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Andre_Setiawan_1986Pas encore d'évaluation

- Dow 12,273.26 +43.97 +0.36% S&P 500 1,329.15 +7.28 +0.55% Nasdaq 2,809.44 +18.99 +0.68%Document6 pagesDow 12,273.26 +43.97 +0.36% S&P 500 1,329.15 +7.28 +0.55% Nasdaq 2,809.44 +18.99 +0.68%Andre_Setiawan_1986Pas encore d'évaluation

- Dow 12,268.19 - 5.07 - 0.04% S&P 500 1,332.32 +3.17 +0.24% Nasdaq 2,817.18 +7.74 +0.28%Document6 pagesDow 12,268.19 - 5.07 - 0.04% S&P 500 1,332.32 +3.17 +0.24% Nasdaq 2,817.18 +7.74 +0.28%Andre_Setiawan_1986Pas encore d'évaluation

- Dow 12,226.64 - 41.55 - 0.34% S&P 500 1,328.01 - 4.31 - 0.32% Nasdaq 2,804.35 - 12.83 - 0.46%Document6 pagesDow 12,226.64 - 41.55 - 0.34% S&P 500 1,328.01 - 4.31 - 0.32% Nasdaq 2,804.35 - 12.83 - 0.46%Andre_Setiawan_1986Pas encore d'évaluation

- Dow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Document5 pagesDow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Andre_Setiawan_1986Pas encore d'évaluation

- MG 201010Document3 pagesMG 201010Andre_Setiawan_1986Pas encore d'évaluation

- Dow 12,161.63 +69.48 0.57% S&P 500 1,319.05 +8.18 0.62% Nasdaq 2,783.99 +14.69 0.53%Document5 pagesDow 12,161.63 +69.48 0.57% S&P 500 1,319.05 +8.18 0.62% Nasdaq 2,783.99 +14.69 0.53%Andre_Setiawan_1986Pas encore d'évaluation

- Index Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Document4 pagesIndex Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Andre_Setiawan_1986Pas encore d'évaluation

- Configuring Master Data Governance For Customer - SAP DocumentationDocument17 pagesConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoPas encore d'évaluation

- Viceversa Tarot PDF 5Document1 pageViceversa Tarot PDF 5Kimberly Hill100% (1)

- Oem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Document43 pagesOem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Farhad FarajyanPas encore d'évaluation

- Dr. Eduardo M. Rivera: This Is A Riveranewsletter Which Is Sent As Part of Your Ongoing Education ServiceDocument31 pagesDr. Eduardo M. Rivera: This Is A Riveranewsletter Which Is Sent As Part of Your Ongoing Education ServiceNick FurlanoPas encore d'évaluation

- Separation PayDocument3 pagesSeparation PayMalen Roque Saludes100% (1)

- Ingles Avanzado 1 Trabajo FinalDocument4 pagesIngles Avanzado 1 Trabajo FinalFrancis GarciaPas encore d'évaluation

- 30 Creative Activities For KidsDocument4 pages30 Creative Activities For KidsLaloGomezPas encore d'évaluation

- General Financial RulesDocument9 pagesGeneral Financial RulesmskPas encore d'évaluation

- What Is Retrofit in Solution Manager 7.2Document17 pagesWhat Is Retrofit in Solution Manager 7.2PILLINAGARAJUPas encore d'évaluation

- Are Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceDocument6 pagesAre Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceNely Noer SofwatiPas encore d'évaluation

- M2 Economic LandscapeDocument18 pagesM2 Economic LandscapePrincess SilencePas encore d'évaluation

- CDKR Web v0.2rcDocument3 pagesCDKR Web v0.2rcAGUSTIN SEVERINOPas encore d'évaluation

- 2.1 Components and General Features of Financial Statements (3114AFE)Document19 pages2.1 Components and General Features of Financial Statements (3114AFE)WilsonPas encore d'évaluation

- Building New Boxes WorkbookDocument8 pagesBuilding New Boxes Workbookakhileshkm786Pas encore d'évaluation

- HRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesDocument6 pagesHRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesAkosi EtutsPas encore d'évaluation

- Deed of Assignment CorporateDocument4 pagesDeed of Assignment CorporateEric JayPas encore d'évaluation

- Capital Expenditure DecisionDocument10 pagesCapital Expenditure DecisionRakesh GuptaPas encore d'évaluation

- Cs8792 Cns Unit 1Document35 pagesCs8792 Cns Unit 1Manikandan JPas encore d'évaluation

- Analysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodDocument5 pagesAnalysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodleksremeshPas encore d'évaluation

- TAS5431-Q1EVM User's GuideDocument23 pagesTAS5431-Q1EVM User's GuideAlissonPas encore d'évaluation

- CS321 Computer ArchitectureDocument160 pagesCS321 Computer ArchitectureAnurag kumarPas encore d'évaluation

- Review of Related LiteratureDocument4 pagesReview of Related LiteratureCarlo Mikhail Santiago25% (4)

- Marine Lifting and Lashing HandbookDocument96 pagesMarine Lifting and Lashing HandbookAmrit Raja100% (1)

- Topic 4: Mental AccountingDocument13 pagesTopic 4: Mental AccountingHimanshi AryaPas encore d'évaluation

- FIRE FIGHTING ROBOT (Mini Project)Document21 pagesFIRE FIGHTING ROBOT (Mini Project)Hisham Kunjumuhammed100% (2)

- Blade Torrent 110 FPV BNF Basic Sales TrainingDocument4 pagesBlade Torrent 110 FPV BNF Basic Sales TrainingMarcio PisiPas encore d'évaluation

- 2016 066 RC - LuelcoDocument11 pages2016 066 RC - LuelcoJoshua GatumbatoPas encore d'évaluation

- 4 Bar LinkDocument4 pages4 Bar LinkConstance Lynn'da GPas encore d'évaluation

- P394 WindActions PDFDocument32 pagesP394 WindActions PDFzhiyiseowPas encore d'évaluation

- Amare Yalew: Work Authorization: Green Card HolderDocument3 pagesAmare Yalew: Work Authorization: Green Card HolderrecruiterkkPas encore d'évaluation