Académique Documents

Professionnel Documents

Culture Documents

2011 Wilshire Report On State Retirement Systems: Funding Levels and Asset Allocation

Transféré par

jon_ortizTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2011 Wilshire Report On State Retirement Systems: Funding Levels and Asset Allocation

Transféré par

jon_ortizDroits d'auteur :

Formats disponibles

2011 Wilshire Report on State Retirement Systems:

Funding Levels and Asset Allocation

Julia K. Bonafede, CFA, President

Steven J. Foresti, Managing Director

Russell J. Walker, Vice President

February 28, 2011

February 28, 2011

Table of Contents

Summary of Findings .......................................................................................................... 1

Financial Overview ............................................................................................................. 2

Asset Allocation .............................................................................................................. 122

Appendix A: State Retirement Systems ............................................................................ 17

Wilshire Associates Incorporated

1299 Ocean Avenue, Suite 700

Santa Monica, CA 90401

Phone: 310.451.3051

Fax: 310.458.6936

Email: contactconsulting@wilshire.com

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Summary of Findings

o The following study includes 126 state retirement systems. Of these 126 retirement

systems, 99 systems reported actuarial values on or after June 30, 2010 and 27 systems last

reported before June 30, 2010. Only one of these 27 late-reporting systems last reported on

or before June 30, 2008.

o Wilshire Consulting estimates that the ratio of pension assets-to-liabilities, or funding ratio,

for all 126 state pension plans was 69% in 2010, up from an estimated 65% in 2009. This

improvement in funding ratio reflects the U.S. economy’s ongoing recovery from the global

market dislocation events of 2007 and 2008, and the resultant recession that economists

declared ended in June 2009. Growth in fund assets managed to outpace growth in plan

liabilities over fiscal 2010. (Exhibit 1)

o For the 99 state retirement systems that reported actuarial data for 2010, pension assets and

liabilities were $1,671.4 billion and $2,538.4 billion, respectively. The funding ratio for

these 99 state pension plans was 66% in 2010, up from 62% for the same plans in 2009.

(Exhibit 2)

o For the 99 state retirement systems that reported actuarial data for 2010, pension assets grew

by 9.3%, or $141.8 billion, from $1,529.6 billion in 2009 to $1,671.4 billion in 2010 while

liabilities grew 2.4%, or $59.6 billion, from $2,478.8 billion in 2009 to $2,538.4 billion in

2010. The increase in asset values offset the continued steady growth in liabilities for the

99 state pension plans and led to a drop in the aggregate shortfall, as the -$949.2 billion

shortfall in 2009 narrowed to a -$867.0 billion shortfall in 2010. (Exhibit 2)

o For the 125 state retirement systems that reported actuarial data for 2009, pension assets and

liabilities were $2,014.4 billion and $3,113.3 billion, respectively. The funding ratio for

these 125 state pension plans was 65% in 2009. (Exhibit 1)

o Of the 99 state retirement systems that reported actuarial data for 2010, 99% have market

value of assets less than pension liabilities, or are underfunded. The average underfunded

plan has a ratio of assets-to-liabilities equal to 65%.

o Of the 125 state retirement systems that reported actuarial data for 2009, 100% were

underfunded. The average plan has a ratio of assets-to-liabilities equal to 66%.

o State pension portfolios have, on average, a 63.6% allocation to equities – including real

estate and private equity – and a 36.4% allocation to fixed income. The 63.6% equity

allocation is lower than the 65.0% equity allocation in 2000 and largely reflects a rotation

out of U.S. public equities. (Exhibit 13)

o Asset allocation varies by retirement system. Nine of 126 retirement systems have

allocations to equity that equal or exceed 75%, and 12 systems have an equity allocation

below 50%. The 25th and 75th percentile range for equity allocation is 57.3% to 70.7%.

o Wilshire forecasts a long-term median plan return equal to 6.5% per annum, which is 1.5

percentage points below the median actuarial interest rate assumption of 8.0%.

Copyright 2011, Wilshire Associates Incorporated Page 1

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Financial Overview

This is Wilshire Consulting’s sixteenth report on the financial condition of state-sponsored

defined benefit retirement systems and is based upon data gathered from the most recent

financial and actuarial reports provided by 126 retirement systems sponsored by the 50 states

and the District of Columbia. Appendix A lists the 126 retirement systems included in this

year’s study.

The Data

Financial data on public retirement systems lack the timeliness and uniform disclosure

governing pension plans sponsored by publicly traded companies, making it difficult to

conclude a study with data that are both current and consistent across systems. For this reason,

our study methodology involves collecting data during the first one and a half months of each

calendar year with the objective of acquiring as many reports as possible with a June 30

valuation date from the previous year. Even for systems with the desire to report in a timely

manner, it often takes six months to a year for actuaries to determine liability values. Ninety-

nine systems reported actuarial values on or after June 30, 2010 and the remaining 27 systems

last reported prior to June 30, 2010. However, only one of these 27 late-reporting systems last

reported on or before June 30, 2008.

Assets versus Liabilities

Exhibit 1 shows the market value of assets, actuarial value of assets, and pension liability values

for all state retirement systems for which Wilshire has data. With the exception of the two rows

identifying Wilshire’s estimated funded ratios, the data presented in each column of Exhibit 1

are limited to only those systems that reported on or after June of that year. For example, all

126 retirement systems reported actuarial values for 2008 while only 99 systems reported

actuarial values for 2010. Note that Exhibit 1 includes both market value and actuarial value of

assets. Unless otherwise noted, “assets” will refer to market value of assets for the remainder of

this report.

Copyright 2011, Wilshire Associates Incorporated Page 2

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 1

Financial Overview of State Retirement Systems1 ($ billions)

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Total Pension Assets:

Market Value $1,863.7 $1,695.9 $1,799.5 $2,017.4 $2,183.5 $2,381.4 $2,703.5 $2,400.0 $2,014.4 $1,671.4

Actuarial Value $1,956.4 $1,943.7 $1,986.8 $2,054.4 $2,143.1 $2,279.8 $2,469.3 $2,519.2 $2,459.4 $1,931.5

Total Pension Liabilities: $1,964.3 $2,084.4 $2,222.2 $2,345.4 $2,489.8 $2,649.2 $2,834.8 $2,976.0 $3,113.3 $2,538.4

Difference:

Market Value -$100.7 -$388.4 -$422.6 -$328.0 -$306.3 -$267.7 -$131.3 -$576.0 -$1,098.9 -$867.0

Actuarial Value -$7.9 -$140.7 -$235.4 -$291.0 -$346.7 -$369.4 -$365.5 -$456.9 -$653.9 -$606.9

Market Value of Assets as a % of Liabilities:

All Plans (estimate)* 95% 81% 81% 86% 88% 90% 95% 81% 65% 69%

Reported Plans (actual) 95% 81% 81% 86% 88% 90% 95% 81% 65% 66%

Actuarial Value of Assets as a % of Liabilities:

All Plans (estimate)* 100% 93% 89% 88% 86% 86% 87% 85% 79% 77%

Reported Plans (actual) 100% 93% 89% 88% 86% 86% 87% 85% 79% 76%

Total No. of Retirement Systems: 126 126 126 126 126 126 126 126 125 99

*The estimation process is explained later in the report (exhibit 3 and its preceding text).

The aggregate pension asset and liability values in Exhibit 1 are not directly comparable across

columns because of the different number of retirement systems included for each year. As

such, in the case of recent years that do not yet include data for the complete set of plans, we

include an estimate of the funding ratios across all 126 plans. By combining these estimates

with the historical funding ratios for the complete set of plans we can better evaluate the

financial health for these 126 retirement systems over the last nine years. Market value funding

ratios fell dramatically between 2001 and 2003, from 95% to 81% but rebounded steadily to

95% by 2007. Fiscal year 2009 extended the reversal in funded ratios that began in 2008, as

market value funding ratios declined 16% to end the 2009 fiscal year at an estimated 65%.

However, recovering capital markets allowed funding ratios to rebound to an estimated 69% at

fiscal year-end 2010. Actuarial value funding ratios declined between the years 2001 and 2005,

falling from 100% to 86% and holding relatively constant until the 2009 fiscal year’s 6%

decrease to an estimated 79%. Given actuaries’ standard practices of smoothing actuarial asset

valuations, it is not surprising that the actuarial value-based funding ratio for fiscal year-end

2010 actually nudged downward to an estimated 77%; smoothing formulas currently in place

will incorporate the sharp market downturns of 2008 as well as the strong capital asset

performance experienced since early 2009 to the present.

Exhibit 2 shows asset and liability values for the 99 retirement systems which reported actuarial

values for 2010 and compares them with the same totals from the previous nine years.

1

As disclosed in annual reports (most annual reports use a June 30 or December 31 fiscal year). Liabilities are the reported

actuarial accrued liabilities and assets are the current market and actuarial values as of the same valuation date as liabilities.

Copyright 2011, Wilshire Associates Incorporated Page 3

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 2

Financial Overview of 99 State Retirement Systems ($ billions)

Annualized Growth %

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2001-2010 2009-2010

Total Pension Assets:

- Market Value $1,455.1 $1,330.4 $1,368.5 $1,545.6 $1,671.1 $1,816.3 $2,097.7 $1,952.2 $1,529.6 $1,671.4 1.6% 9.3%

- Actuarial Value $1,526.4 $1,508.3 $1,538.1 $1,593.3 $1,655.5 $1,755.0 $1,902.5 $1,964.4 $1,914.4 $1,931.5 2.6% 0.9%

Total Pension Liabilities: $1,527.6 $1,620.7 $1,730.2 $1,836.9 $1,954.3 $2,076.3 $2,225.9 $2,346.7 $2,478.8 $2,538.4 5.8% 2.4%

Difference:

- Market Value -$72.5 -$290.4 -$361.7 -$291.3 -$283.1 -$260.0 -$128.2 -$394.6 -$949.2 -$867.0

- Actuarial Value -$1.1 -$112.4 -$192.1 -$243.5 -$298.8 -$321.4 -$323.4 -$382.3 -$564.4 -$606.9

Assets as a % of Liabilities:

- Market Value 95% 82% 79% 84% 86% 87% 94% 83% 62% 66%

- Actuarial Value 100% 93% 89% 87% 85% 85% 85% 84% 77% 76%

Underfunded Plans as % of All Plans:

- Market Value 69% 93% 95% 89% 88% 83% 69% 87% 100% 99%

- Actuarial Value 56% 68% 78% 81% 85% 86% 84% 87% 95% 96%

Total No. of Systems: 99 99 99 99 99 99 99 99 99 99

In 2009, pension liabilities for these 99 plans exceeded assets by $949.2 billion and the funding

ratio, or ratio of assets-to-liabilities, one measure of pension fund health, stood at 62%. One

year later, assets have risen to $1,671.4 billion, a change of 9.3%, while liabilities have grown

to $2,538.4 billion, a rate of 2.4%. The result has been a decrease in the shortfall between

assets and liabilities from -$949.2 billion to -$867.0 billion, a $82.2 billion decline, and an

increase in the funding ratio for these 99 plans from 62% to 66%.

In 2003, after the equity market declines of 2000 through 2002, pension liabilities for these 99

plans exceeded assets by $361.7 billion and the funding ratio stood at 79%. During the next

four years, assets grew at an average rate of 11.3% while liabilities grew by 6.5%. This

difference in growth rates is reflected in the increasing funding ratio of the market value of

assets to liabilities through the year 2007. In 2008 however, the shortfall between assets and

liabilities widened dramatically from -$128.2 billion to -$394.6 billion, leading to a fall in the

funding ratio for these 99 plans from 94% to 83%. 2009, as mentioned above, extended this

trend as the effects of the global market dislocations of 2007 and 2008 fully impacted fund

performance. Funding ratios have started to recover from their 2009 lows, with asset growth

outpacing the growth in fund liabilities through fiscal year 2010.

It is important to note, as with any sample, there exists some level of statistical error. Although

the 99 funds with 2010 fiscal year data constitute a sizable majority of the state plans in our

survey, one will find some transient variance in sample data from the entire plan cohort.

Exhibit 3 provides a graphical comparison between the historical data of all plans versus the

subset of 99 plans with more recently reported data. The dotted line represents Wilshire’s

estimated funding ratio for the complete set of 126 plans, which is derived from the historical

relationship between the 99-plan sample and the complete set of 126 plans. Using this approach

one can reasonably expect a funding ratio of approximately 69% once all plans have reported

2010 actuarial data. This estimation approach and graphical representation of estimated data

will be used throughout the remainder of this report.

Copyright 2011, Wilshire Associates Incorporated Page 4

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 3

Funding Ratio Comparison of 99 Plan Sample vs. Complete Set of 126 Plans

120% 150

110%

100%

Retirement Systems

100

Funded Ratio

90%

80%

70%

50

60%

50%

126 126 126 126 126 126 126 126 125 99

40% 0

FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

99 Plans Estimate All Plans

Funding Ratios

Expanding on Exhibit 3, Exhibit 4 shows the aggregate, average, median, 25th, and 75th

percentile market value funding ratios for the 126 state pension systems by fiscal year.

Historically, the market value funding ratios for our sample generally fell between 2001 and

2002. After stabilizing in 2003, the funding ratios experienced a fairly steady improvement

through 2007. In 2008 and 2009 however, funding ratios broke trend and rapidly declined.

Fiscal year 2010 saw funding ratios reverse course and stage a moderate recovery.

Copyright 2011, Wilshire Associates Incorporated Page 5

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 4

Market Value Funding Ratios by Fiscal Year for 126 Plans

120% 150

Market Value Funding Ratio 110% 75th Percentile

100%

Retirement Systems

100

90%

80%

70%

50

60%

25th Percentile

50%

126 126 126 126 126 126 126 126 125 99

40% 0

FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

AGGREGATE AVERAGE MEDIAN

Exhibit 5 shows the same information as Exhibit 4, except it uses the actuarial value of assets to

determine funding ratios. Similar to Exhibit 4, though at a slower rate, funding ratios generally

fell between 2001 and 2002. However, unlike Exhibit 4, funding ratios based on actuarial value

of assets continued to fall through 2006, briefly stabilizing in 2007 and then declining slightly

during 2008 and more markedly through 2009, with a further downward drift in 2010. In

contrast to market value funding ratios, actuarial value funding ratios tend to exhibit moderated

patterns of change, as a result of the smoothing of actuarial values.

Exhibit 5

Actuarial Value Funding Ratios by Fiscal Year for 126 Plans

130% 150

Actuarial Value Funding Ratio

120%

Retirement Systems

110% 75th Percentile

100

100%

90%

50

80%

25th Percentile

70%

126 126 126 126 126 126 126 126 125 99

60% 0

FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

AGGREGATE AVERAGE MEDIAN

Copyright 2011, Wilshire Associates Incorporated Page 6

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 6 gives a more detailed picture of the fiscal condition for the 99 state retirement systems

that reported actuarial values for 2010.

Exhibit 6

Distribution of 99 State Pension Systems by FY10 Funding Ratio

35

30 100% Funded

Retirement Systems

25

20

15

10

Market Value Actuarial Value

Bucket Count Cumulative Count

Market Value Actuarial Value Market Value Actuarial Value

Distribution Distribution

Count % of Total Count % of Total Count % of Total Count % of Total

0-50% 13 13% 8 8% 0-50% 13 13% 8 8%

50-60% 26 26% 8 8% 0-60% 39 39% 16 16%

60-70% 31 31% 22 22% 0-70% 70 71% 38 38%

70-80% 11 11% 28 28% 0-80% 81 82% 66 67%

80-90% 13 13% 16 16% 0-90% 94 95% 82 83%

90-100% 4 4% 13 13% 0-100% 98 99% 95 96%

100-110% 1 1% 3 3% 0-110% 99 100% 98 99%

110-120% 0 0% 0 0% 0-120% 99 100% 98 99%

120-130% 0 0% 1 1% 0-130% 99 100% 99 100%

130-140% 0 0% 0 0% 0-140% 99 100% 99 100%

140-150% 0 0% 0 0% 0-150% 99 100% 99 100%

Total 99 100% 99 100% Total 99 100% 99 100%

We have noted above that 99% of these 99 plans with 2010 actuarial data, or 98 plans, are

underfunded; Exhibit 6 demonstrates the extent of the shortfall. Thirty-nine plans have assets

less than 60% of liabilities; 70 plans have assets less than 70% of liabilities; and 81 plans have

assets less than 80% of liabilities. Using the actuarial value of assets to determine funding

ratios, 95 plans have assets below liabilities. Sixteen plans have assets less than 60% of

liabilities; 38 plans have assets less than 70% of liabilities; and 66 plans have assets less than

80% of liabilities.

Similarly to Exhibit 6, Exhibit 7 examines the fiscal condition of the 125 state retirement

systems that reported actuarial values for 2009.

Copyright 2011, Wilshire Associates Incorporated Page 7

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 7

Distribution of 125 State Pension Systems by FY09 Funding Ratio

40

100% Funded

Retirement Systems

30

20

10

Market Value Actuarial Value

Bucket Count Cumulative Count

Market Value Actuarial Value Market Value Actuarial Value

Distribution Distribution

Count % of Total Count % of Total Count % of Total Count % of Total

0-50% 20 16% 6 5% 0-50% 20 16% 6 5%

50-60% 36 29% 14 11% 0-60% 56 45% 20 16%

60-70% 33 26% 18 14% 0-70% 89 71% 38 30%

70-80% 19 15% 32 26% 0-80% 108 86% 70 56%

80-90% 13 10% 30 24% 0-90% 121 97% 100 80%

90-100% 4 3% 17 14% 0-100% 125 100% 117 94%

100-110% 0 0% 7 6% 0-110% 125 100% 124 99%

110-120% 0 0% 0 0% 0-120% 125 100% 124 99%

120-130% 0 0% 1 1% 0-130% 125 100% 125 100%

130-140% 0 0% 0 0% 0-140% 125 100% 125 100%

140-150% 0 0% 0 0% 0-150% 125 100% 125 100%

Total 125 100% 125 100% Total 125 100% 125 100%

Using the market value of assets to determine funding ratios, all of the 125 plans had assets less

than liabilities. Twenty plans had assets less than 50% of liabilities; 56 plans had assets less

than 70% of liabilities; and 108 plans had assets less than 80% of liabilities. Using the actuarial

value of assets to determine funding ratios, 117 of the 125 plans, or 94%, had assets less than

liabilities. Six plans had assets less than 50% of liabilities; 38 plans had assets less than 70% of

liabilities; and 70 plans had assets less than 80% of liabilities.

Unfunded Actuarial Accrued Liability

The financial health of retirement systems can also be measured by comparing the size of the

unfunded actuarial accrued liability (UAAL) to relevant metrics. Since assets under

Governmental Accounting Standards Board (GASB) Statement No. 252 are based on actuarial

values, this section calculates the UAAL using actuarial value of assets.

2

GASB No. 25, Financial Reporting for Defined Benefit Pension Plans and Note Disclosures for Defined Contribution Plans.

Copyright 2011, Wilshire Associates Incorporated Page 8

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 8 shows the median size of the UAAL relative to the covered payroll during the last ten

fiscal years for the 126 retirement systems. Exhibit 8 also shows the 25th and 75th percentile for

each year. UAAL has increased over the past decade, with an especially steep climb during the

most recent recession:

Exhibit 8

UAAL as a % of Covered Payroll by Fiscal Year for 126 Plans

250% 150

75th Percentile

200%

UAAL as a % of Payroll

Retirement Systems

100

150%

100%

50

25th Percentile

50%

126 126 126 126 126 126 126 126 125 99

0% 0

FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

MEDIAN

Exhibit 9 shows the median size of the UAAL relative to the actuarial value of assets during the

last ten fiscal years for the 126 plans. Exhibit 9 also shows the 25th and 75th percentile for each

year.

Copyright 2011, Wilshire Associates Incorporated Page 9

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 9

UAAL as a % of Actuarial Value of Assets by Fiscal Year for 126 Plans

100% 150

75th Percentile

UAAL as a % of AVA

75%

Retirement Systems

100

50%

50

25th Percentile

25%

126 126 126 126 126 126 126 126 125 99

0% 0

FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

MEDIAN

Exhibit 10 shows the median size of the UAAL relative to the actuarial accrued liability during

the last ten years for all 126 retirement systems. Exhibit 10 also shows the 25th and 75th

percentile for each year.

Exhibit 10

UAAL as a % of Accrued Liabilities by Fiscal Year for 126 Plans

50% 150

75th Percentile

UAAL as a % of Liabilities

40%

Retirement Systems

100

30%

20%

50

25th Percentile

10%

126 126 126 126 126 126 126 126 125 99

0% 0

FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

MEDIAN

From 2005 to 2008, the UAAL had generally stabilized relative to all metrics. Over 2008 and

2009, however, poor market performance pushed the covered payroll ratio and the 25th and 75th

percentiles of the actuarial value of assets and accrued liability higher. We must also bear in

mind that actuarial valuation typically employs smoothing formulae in order to reduce the

impact of market fluctuations when determining pension fund contributions. If the UAAL were

Copyright 2011, Wilshire Associates Incorporated Page 10

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

calculated using the market value of assets, the negative market returns experienced during

fiscal 2008 and 2009 would have led to a much larger increase in the UAAL relative to these

metrics, indicating a more substantial deterioration in the financial health of most state

retirement systems. However, thanks to the strong markets experienced during fiscal 2010,

UAAL as a percent of asset market value has decreased somewhat over the past fiscal year.

Market Value of Assets versus Actuarial Value of Assets

As mentioned above, the actuarial value of assets is often calculated using a smoothing method

in order to reduce the effects of market volatility when determining contribution rates. For

example, a five-year smooth market value method would recognize 20% of the gain or loss3 in

the market value of assets over five years. Therefore, the dramatic market losses of 2007 and

2008 and the current recovery that started in early 2009 are all being incorporated into

smoothing formulae when calculating the actuarial value of assets.

Exhibit 11 displays the aggregate, average, and median ratio of the market value of assets

(MVA) as a percentage of the actuarial value of assets (AVA) during the last ten years for the

99 state plans that reported actuarial values for 2010. Exhibit 11 also shows the 25th and 75th

percentiles for each year. From FY03 to FY07, actuarial values declined relative to market

values since they were still reflecting the poor market returns experienced during the bust of the

internet stock bubble. In FY08, the actuarial value of assets now recognizes mostly positive

market returns experienced between 2003 and 2007. Driving the overall ratio lower for FY08

and FY09 is the severe market sell-off in late 2007 through early 2009, which is fully reflected

in plan assets at market value but only partially recognized in today’s actuarial values. The

notable rally in global capital markets over fiscal 2010 resulted in a fairly sharp increase in the

MVA/AVA ratio over fiscal 2009.

3

A gain (loss) occurs when the actual rate of return is greater than (less than) the assumed rate of return.

Copyright 2011, Wilshire Associates Incorporated Page 11

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 11

MVA as a Percentage of AVA by Fiscal Year for 99 Plans

115%

75th Percentile

Market Value / Actuarial Value 110%

105%

100%

95%

90%

85% 25th Percentile

80%

75%

70%

FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10

AGGREGATE AVERAGE MEDIAN

Asset Allocation

In this section we examine the investment strategies employed by the state retirement systems.

Exhibit 12 provides a snapshot of the average asset allocation as of the latest fiscal year-end

across all 126 state retirement systems.

Exhibit 12

Average Asset Allocation for State Pension Plans

Private Equity

8.8%

Real Estate

6.2% U.S. Equity

Other 31.1%

7.9%

Non-U.S. Fixed

1.5%

U.S. Fixed

Non-U.S.

27.0%

Equity

17.5%

Copyright 2011, Wilshire Associates Incorporated Page 12

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 13 examines the change in average asset allocation during the last ten years. During

this period, the average allocations to Non-U.S. equities increased from 13.0% to 17.5% while

allocations to U.S. Bonds decreased from 31.0% to 27.0%.

Exhibit 13

Change in Average Asset Allocation for State Pension Plans

Change in Exposure

Equity 2000 2005 2010 00-10 05-10

U.S. Equity 45.0 % 44.0 % 31.1 % -13.9 % -12.9 %

Non-U.S. Equity 13.0 15.0 17.5 4.5 2.5

Real Estate 4.0 4.2 6.2 2.2 2.0

Private Equity 3.0 4.4 8.8 5.8 4.4

Equity Subtotal 65.0 67.6 63.6 -1.4 -4.0

Debt

U.S. Fixed 31.0 28.6 27.0 -4.0 -1.6

Non-U.S. Fixed 2.0 1.2 1.5 -0.5 0.3

Other 2.0 2.6 7.9 5.9 5.3

Debt Subtotal 35.0 32.4 36.4 1.4 4.0

Return * 6.3 6.5 6.5 0.1 0.0

Risk * 10.4 10.8 10.3 -0.1 -0.5

* Return and Risk are based on Wilshire Consulting’s current asset class assumptions (exhibit 14).

Overall equity exposure, comprised of U.S. and non-U.S. public market equities along with real

estate and private equity, decreased 1.4% over the past decade, while overall debt exposure,

comprised of U.S. and non-U.S. fixed income and other non-equity assets (itself consisting of

cash and cash equivalents as well as hedge funds and other absolute return/zero net-beta

strategies), increased. However, it must be noted that plans’ exposures to U.S. public market

equity and U.S. fixed income over this period fell while allocations to non-U.S. assets, real

estate, private market equity and other risk assets increased. One can propose several possible

explanations, alone or in combination:

Depressed U.S. equity holdings still recovering from the recent market plunge;

Rotation out of the relatively efficient U.S. stock and bond markets into less-efficient

asset spaces;

Plan sponsors reducing the home-market bias in their fund holdings;

Plan sponsors increasing asset diversification in an attempt to de-risk the Total Fund.

Portfolio expected return and risk are calculated by combining Wilshire’s assumptions for the

major asset classes and each retirement system’s actual asset allocation. Exhibit 13 calculates

the expected return and risk based on the average asset allocations from 2000, 2005 and 2010

using Wilshire’s current long-term return and risk assumptions illustrated in Exhibit 14. The

redeployment of assets over the past decade out of U.S. public markets and into offshore and

alternative assets has caused the average state pension plan to move towards a slightly higher

Copyright 2011, Wilshire Associates Incorporated Page 13

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

expected return and slightly lower risk profile along the efficient frontier. Increased allocations

to real estate and private equity from 2005 to 2010 provided notably lower risk expectations for

the average state plan.

Exhibit 14

Wilshire’s 2011 Capital Market Assumptions

Expected

Return Risk

U.S. Equity 7.25 % 16.0 %

Non-U.S. Equity 7.25 17.0

Private Equity 9.70 26.0

Real Estate 5.50 15.0

U.S. Bonds 3.75 5.0

Non-U.S Bonds 3.40 4.0

Exhibit 15 contains summary statistics on asset allocation for all state retirement systems. The

median allocation4 is 31.6% to U.S. equities and 17.4% to Non-U.S. equities. However, as the

lowest and highest columns suggest, there is considerable variability in allocations among

individual systems. Wilshire estimates that the median state pension fund has an expected

return of 6.5%. This result is 1.5% less than the current median actuarial interest rate of 8.0%.

Exhibit 15

Summary Asset Allocation Statistics for State Pension Plans

Lowest (%) Median (%) Highest (%)

U.S. Equity 0.0 % 31.6 % 65.0 %

Non-U.S. Equity 0.0 17.4 52.2

Private Equity 0.0 7.8 46.1

Real Estate 0.0 5.2 18.7

U.S. Bonds 11.2 25.0 65.4

Non-U.S Bonds 0.0 0.0 12.5

Hedge Funds 0.0 0.0 15.0

Other 0.0 4.6 29.9

Expected Returns 0.0 % 6.5 % 7.5 %

Exhibit 16 plots the expected return and risk for each of the 126 state retirement systems based

upon their actual asset allocation. Systems that plot in the upper right employ more aggressive

asset mixes while systems that plot in the lower left represent those with more conservative

mixes. The dashed horizontal line, equal to 8.0%, represents the current median actuarial

interest rate assumption employed by state pension plans.

Using Wilshire’s return forecasts, none of the 126 state retirement systems are expected to earn

long-term asset returns that equal or exceed their actuarial interest rate assumption. It is

4

The “Median” column in Exhibit 15 represents the median for each asset class and therefore does not sum to 100%. The

median expected return is based on the median fund return, not on the median asset mix.

Copyright 2011, Wilshire Associates Incorporated Page 14

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

important to note that Wilshire return assumptions represent beta only, with no projection of

alpha from active management.

Exhibit 16

Projected Return & Risk Forecasts for State Pension Plans

9.0

Long-Term Projected Return (%)

Median Actuarial Rate: 8.0%

8.0

7.0 Median Expected Return:

6.5%

6.0

5.0

4.0

4 6 8 10 12 14 16

Annual Risk (%)

Exhibit 17 addresses the relationship between asset allocation and funding for all state systems.

The allocation to equity asset classes, a proxy for investment aggressiveness, is plotted on the

vertical scale. The market value funding ratio is on the horizontal scale.

Copyright 2011, Wilshire Associates Incorporated Page 15

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Exhibit 17

Asset Allocation & Actuarial Funding Ratios for State Pension Plans

100

under-funded over-funded

% in all Equity Categories

75

50

25

R2 = 0.08

0

0% 25% 50% 75% 100% 125%

Market Value Funding Ratio

The vertical line in Exhibit 17 separates overfunded plans (or, in the current case, the single

plan in funding surplus) from underfunded plans. Casual observation uncovers no pattern

connecting funded ratio to equity exposure. There is almost no correlation between the equity

allocation and a plan’s funding ratio when taking into account the effect of outliers. In

summary, there is no discernable relationship between asset allocation and funding. State

retirement systems show a broad spectrum of asset allocations that appear to be unrelated to the

size of their unfunded liabilities.5

5

We would like to thank Amy Hemphill, Jason Samansky, Peter Bragança, Monica Chum, Nicholas Douty, Thomas Dunlap,

Alex Ford, Jeremy Henningsen, Kaleena Iszkula, David Johnson, Swetha Ketty, Razmik Kirakosyan, Juan Lozano, Taveen

Miloyan, Mangala Murthy, Mayank Prasad, Shahnawaz Sani, Andrew Schroeck, Liana Shir, Brian White and Megan Young for

their diligence in the data collection for this report.

Copyright 2011, Wilshire Associates Incorporated Page 16

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

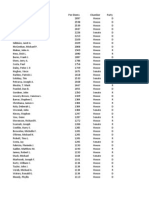

Appendix A: State Retirement Systems6

Retirement System Retirement System Report Date

Alabama ERS Alabama Employees' Retirement System 9/30/2010

Alabama TRS Alabama Teachers' Retirement System 9/30/2010

Alaska PERS Alaska Public Employees' Retirement System 6/30/2010

Alaska TRS Alaska Teachers' Retirement System 6/30/2010

Arizona PSPRS Arizona Public Safety Personnel Retirement System 6/30/2010

Arizona SRS Arizona State Retirement System 6/30/2010

Arkansas Highway ERS Arkansas Highway Employees Retirement System 6/30/2010

Arkansas PERS Arkansas Public Employees Retirement System 6/30/2010

Arkansas TRS Arkansas Teachers Retirement System 6/30/2010

California PERS California Public Employees' Retirement System 6/30/2010

California Regents The Regents of the University of California 6/30/2010

California STRS California State Teachers' Retirement System 6/30/2010

Colorado Fire & Police Colorado Fire & Police Pension Association 12/31/2009

Colorado PERA: Municipal Colorado PERA: Municipal Division Trust Fund 12/31/2009

Colorado PERA: State & School Colorado PERA: State & School Division Trust Fund 12/31/2009

Connecticut SERS Connecticut State Employees' Retirement System 6/30/2010

Connecticut TRS Connecticut State Teacher's Retirement System 6/30/2010

DC Police & Fire District of Columbia Police Officers & Fire Fighters' Retirement System 9/30/2009

DC TRS District of Columbia Teachers Retirement System 9/30/2009

Delaware PERS Delaware Public Employees' Retirement System 6/30/2010

Florida RS Florida Retirement Systems 6/30/2010

Georgia ERS Georgia Employees Retirement System 6/30/2009

Georgia TRS Georgia Teachers Retirement System 6/30/2009

Hawaii ERS Hawaii Employees' Retirement System 6/30/2008

Idaho PERS Idaho Public Employee Retirement System 6/30/2010

Illinois Muni Ret Fund Illinois Municipal Retirement Fund 12/31/2009

Illinois SERS Illinois State Employees' Retirement System 6/30/2009

Illinois SURS Illinois State Universities Retirement System 6/30/2010

Illinois TRS Illinois State Teachers' Retirement System 6/30/2010

Indiana PERF: Employees Indiana Public Employees' Retirement Fund: Employees 6/30/2010

Indiana PERF: Police & Fire Indiana PERF: Police Officers' & Firefighters' Pension & Disability Fund 6/30/2010

Indiana TRF Indiana State Teachers Retirement Fund 6/30/2010

Iowa Fire & Police Iowa Municipal Fire & Police Retirement System 6/30/2010

Iowa PERS Iowa Public Employees Retirement System 6/30/2010

Kansas PERS Kansas Public Employees Retirement System 6/30/2010

Kentucky RS: County Employees Kentucky Employees Retirement System: County Employees 6/30/2010

Kentucky RS: Employees Kentucky Employees Retirement System: Employees 6/30/2010

Kentucky TRS Kentucky Teachers' Retirement System 6/30/2010

Louisiana School ERS Louisiana School Employees' Retirement System 6/30/2010

Louisiana SERS Louisiana State Employees' Retirement Systems 6/30/2010

Louisiana State Police Louisiana State Police Pension & Retirement System 6/30/2010

Louisiana TRS Louisiana Teachers Retirement System 6/30/2010

Maine SRS Maine State Retirement System 6/30/2010

6

All state plan information is obtained from public information sources.

Copyright 2011, Wilshire Associates Incorporated Page 17

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Appendix A: (cont.)

Retirement System Retirement System Report Date

Maryland SRPS: Employees Maryland State Retirement & Pension System: Employees 6/30/2010

Maryland SRPS: State Police Maryland State Retirement & Pension System: State Police 6/30/2010

Maryland SRPS: Teachers Maryland State Retirement & Pension System: Teachers 6/30/2010

Massachusetts SRB Massachusetts Public Employee Retirement Administration Commission: SRB 6/30/2010

Massachusetts Teachers Massachusetts Public Employee Retirement Administration Commission: Teachers 6/30/2010

Michigan Municipal Michigan Municipal Employees Retirement System 12/31/2009

Michigan Public School ERS Michigan Public School Employees Retirement System 9/30/2010

Michigan SERS Michigan State Employees Retirement System 9/30/2010

Michigan State Police Michigan State Police Retirement System 9/30/2010

Minnesota PERA: Employees Minnesota Public Employees Retirement Association: Employees 6/30/2010

Minnesota PERA: Police & Fire Minnesota Public Employees Retirement Association: Police & Fire 6/30/2010

Minnesota SRS: Employees Minnesota State Retirement System: Employees 6/30/2010

Minnesota SRS: State Patrol Minnesota State Retirement System: State Patrol 6/30/2010

Minnesota TRA Minnesota Teachers Retirement Association 6/30/2010

Mississippi PERS Mississippi Public Employees' Retirement System 6/30/2010

Missouri ERS Missouri State Employee Retirement System 6/30/2010

Missouri Highway ERS Missouri Highway & Transportation Employees and Highway Patrol Retirement System 6/30/2010

Missouri PEERS Missouri Public Education Employee Retirement System 6/30/2010

Missouri PSRS Missouri Public School Retirement System 6/30/2010

Montana PERB Montana Public Employees Retirement Board 6/30/2010

Montana TRS Montana Teachers' Retirement System 6/30/2010

Nebraska RS Nebraska Retirement System 6/30/2010

Nevada PERS Nevada Public Employees' Retirement System 6/30/2010

New Hampshire RS: Employees New Hampshire Employees Retirement System 6/30/2010

New Hampshire RS: Police & Fire New Hampshire Firefighters & Police Officers Retirement System 6/30/2010

New Hampshire RS: Teachers New Hampshire Teachers Retirement System 6/30/2010

New Jersey PERS New Jersey Public Employees Retirement System 6/30/2010

New Jersey Police & Fire New Jersey Police & Firemen's Retirement System 6/30/2010

New Jersey State Police New Jersey State Police Retirement System 6/30/2010

New Jersey TPAF New Jersey Teachers' Pension & Annuity Fund 6/30/2010

New Mexico ERB New Mexico Educational Retirement System 6/30/2010

New Mexico PERA New Mexico Public Employees Retirement Association 6/30/2010

New York STRS New York State Teachers Retirement System 6/30/2010

New York: ERS New York State & Local Employees' Retirement System 3/31/2010

New York: Police & Fire New York Police & Fire Retirement System 3/31/2010

North Carolina Local ERS North Carolina Local Governmental Employees' Retirement System 6/30/2010

North Carolina TSERS North Carolina Teachers' & State Employees' Retirement System 6/30/2010

North Dakota PERS North Dakota Public Employees Retirement System 6/30/2010

North Dakota TFFR North Dakota Teachers' Fund for Retirement 6/30/2010

Ohio PERS Ohio Public Employees Retirement System 12/31/2009

Ohio Police & Fire Ohio Police & Fire Pension Fund 12/31/2009

Ohio School Employees RS Ohio School Employees Retirement System 6/30/2010

Copyright 2011, Wilshire Associates Incorporated Page 18

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Appendix A: (cont.)

Retirement System Retirement System Report Date

Ohio STRS Ohio State Teachers Retirement System 6/30/2010

Oklahoma Firefighters Oklahoma Firefighters Pension & Retirement System 6/30/2010

Oklahoma PERS Oklahoma Public Employees Retirement System 6/30/2010

Oklahoma Police Oklahoma Police Pension & Retirement System 6/30/2010

Oklahoma TRS Oklahoma Teachers Retirement System 6/30/2010

Oregon PERS Oregon Public Employees Retirement System 6/30/2010

Pennsylvania PSERS Pennsylvania Public School Employees' Retirement System 6/30/2010

Pennsylvania SERS Pennsylvania State Employees' Retirement System 12/31/2009

Rhode Island ERS: Employees Rhode Island Employees Retirement System: Employees 6/30/2009

Rhode Island ERS: Teachers Rhode Island Employees Retirement System: Teachers 6/30/2009

Rhode Island MERS Rhode Island Municipal Employees Retirement System 6/30/2009

South Carolina Police South Carolina Police Officers Retirement System 6/30/2010

South Carolina RS South Carolina Retirement System 6/30/2010

South Dakota RS South Dakota Retirement System 6/30/2010

Tennessee PSPP Tennessee Consolidated Retirement System Political Subdivision Pension Plan 6/30/2010

Tennessee SETHEEPP Tennessee Consolidated Retirement System State Employees, Teachers, Higher Education 6/30/2010

Employees Pension Plan

Texas CDRS Texas County & District Retirement System 12/31/2009

Texas ERS Texas Employees Retirement System 8/31/2010

Texas LECOSRF Texas Law Enforcement & Custodial Officers Supplemental Retirement Fund 8/31/2010

Texas Municipal Texas Municipal Retirement System 12/31/2009

Texas TRS Texas Teachers Retirement System 8/31/2010

Utah Contributory RS Utah Contributory Retirement System 12/31/2009

Utah Firefighters RS Utah Firefighters Retirement System 12/31/2009

Utah Noncontributory RS Utah Noncontributory Retirement System 12/31/2009

Utah Public Safety RS Utah Public Safety Retirement System 12/31/2009

Vermont MERS Vermont Municipal Employees' Retirement System 6/30/2010

Vermont SERS Vermont State Employees' Retirement System 6/30/2010

Vermont TRS Vermont State Teacher's Retirement System 6/30/2010

Virginia RS Virginia Retirement System 6/30/2010

Washington LEOFF 1 Washington Law Enforcement Officers & Fire Fighters' Retirement System 1 6/30/2010

Washington LEOFF 2 Washington Law Enforcement Officers & Fire Fighters' Retirement System 2 6/30/2010

Washington PERS 1 Washington Public Employees' Retirement System Plan 1 6/30/2010

Washington PERS 2/3 Washington Public Employees' Retirement System Plan 2 6/30/2010

Washington SERS 2 & 3 Washington School Employees' Retirement System Plan 2 & 3 6/30/2010

Washington TRS 1 Washington Teachers' Retirement System Plan 1 6/30/2010

Washington TRS 2 & 3 Washington Teachers' Retirement System Plan 2 & 3 6/30/2010

Washington WSPRS 1 & 2 Washington State Patrol Retirement System 6/30/2010

West Virginia PERS West Virginia Public Employees Retirement System 6/30/2010

West Virginia TRS West Virginia Teachers Retirement System 6/30/2010

Wisconsin RS Wisconsin Retirement System 12/31/2009

Wyoming RS Wyoming Retirement System 12/31/2009

Copyright 2011, Wilshire Associates Incorporated Page 19

Wilshire Consulting

2011 Wilshire Report on State Retirement Systems: Funding Levels and Asset Allocation

February 28, 2011

Important Information

This material contains confidential and proprietary information of Wilshire Consulting, and is

intended for the exclusive use of the person to whom it is provided. It may not be modified, sold

or otherwise provided, in whole or in part, to any other person or entity without prior written

permission from Wilshire Consulting.

The information contained herein has been obtained from sources believed to be reliable.

Wilshire Consulting gives no representations or warranties as to the accuracy of such

information, and accepts no responsibility or liability (including for indirect, consequential or

incidental damages) for any error, omission or inaccuracy in such information and for results

obtained from its use. Information and opinions are as of the date indicated, and are subject to

change without notice.

This material is intended for informational purposes only and should not be construed as legal,

accounting, tax, investment, or other professional advice. Past performance does not guarantee

future returns.

Wilshire® is a registered service mark of Wilshire Associates Incorporated, Santa Monica,

California. All other trade names, trademarks, and/or service marks are the property of their

respective holders.

Copyright © 2011 Wilshire Associates Incorporated. All rights reserved.

Copyright 2011, Wilshire Associates Incorporated Page 20

Vous aimerez peut-être aussi

- 1123 Special Pension BriefingDocument17 pages1123 Special Pension BriefingAnn DwyerPas encore d'évaluation

- GAO Report on US Government FinancesDocument24 pagesGAO Report on US Government FinanceskaligelisPas encore d'évaluation

- Federal Deficits and DebtDocument10 pagesFederal Deficits and DebtSiddhantPas encore d'évaluation

- St. and Local PensionsDocument14 pagesSt. and Local PensionsJbrownie HeimesPas encore d'évaluation

- 2023 Riverside County Pension Advisory Review Committee ReportDocument24 pages2023 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comPas encore d'évaluation

- The Truth About The Pennsylvania State Employees' Retirement SystemDocument6 pagesThe Truth About The Pennsylvania State Employees' Retirement SystemJeremyPas encore d'évaluation

- Week 5 Special Revenue and Measurement Focus and Basis of Accounting - ACTG343Document10 pagesWeek 5 Special Revenue and Measurement Focus and Basis of Accounting - ACTG343Marilou Arcillas PanisalesPas encore d'évaluation

- Macroeconomics: Theory and Applications: SpringDocument15 pagesMacroeconomics: Theory and Applications: Springmed2011GPas encore d'évaluation

- Franchis Chou SeAR 09Document64 pagesFranchis Chou SeAR 09Sww WisdomPas encore d'évaluation

- Twin Def PaperDocument33 pagesTwin Def PaperGeorsh Maicol Paulino VictorianoPas encore d'évaluation

- PM - Slash Seize and SellDocument11 pagesPM - Slash Seize and SellAjah HalesPas encore d'évaluation

- CBO2 Feb 2008Document4 pagesCBO2 Feb 2008Committee For a Responsible Federal BudgetPas encore d'évaluation

- Municipal Bond Market CommentaryDocument8 pagesMunicipal Bond Market CommentaryAnonymous Ht0MIJPas encore d'évaluation

- Nurturing Credibility While Managing Risks To GrowthDocument9 pagesNurturing Credibility While Managing Risks To GrowthcsarpmPas encore d'évaluation

- Measuring The Revenue Shortfall 04-19-10Document4 pagesMeasuring The Revenue Shortfall 04-19-10Grant BossePas encore d'évaluation

- Resident Stipend SurveyDocument18 pagesResident Stipend SurveyNathan LaiPas encore d'évaluation

- 2011 Quick StartDocument24 pages2011 Quick StartNick ReismanPas encore d'évaluation

- MSF 506-Final DocumentDocument22 pagesMSF 506-Final Documentrdixit2Pas encore d'évaluation

- 2010 GAO Audit ReportDocument30 pages2010 GAO Audit ReportkaligelisPas encore d'évaluation

- 2009 GAO Audit ReportaDocument26 pages2009 GAO Audit ReportakaligelisPas encore d'évaluation

- Quick Start Report - 2011-12 - Final 11.5.10Document50 pagesQuick Start Report - 2011-12 - Final 11.5.10New York SenatePas encore d'évaluation

- Bombardier Q2-C2011 Presentation 20110831Document9 pagesBombardier Q2-C2011 Presentation 20110831lgadfPas encore d'évaluation

- OECD Cyclical Indicators: The Performance of The OECD's Composite Leading Indicator During The 2007 Financial CrisisDocument20 pagesOECD Cyclical Indicators: The Performance of The OECD's Composite Leading Indicator During The 2007 Financial Crisiselsarmento8329Pas encore d'évaluation

- NIC Annual Statistics Review 2010-2011Document14 pagesNIC Annual Statistics Review 2010-2011ddh21Pas encore d'évaluation

- G S e (Epge) G V F (FGV)Document19 pagesG S e (Epge) G V F (FGV)Sarowar ZahanPas encore d'évaluation

- Quantifying The Effects of Financial Conditions On US Activity OECDDocument20 pagesQuantifying The Effects of Financial Conditions On US Activity OECDjibay206Pas encore d'évaluation

- ITAC Annual Summary of DWV Budget 2005-2010Document6 pagesITAC Annual Summary of DWV Budget 2005-2010Carolanne ReynoldsPas encore d'évaluation

- Federal Housing Finance AgencyDocument30 pagesFederal Housing Finance AgencyRenée HendrixPas encore d'évaluation

- Accounting For Wealth in The Measurement of Household IncomeDocument24 pagesAccounting For Wealth in The Measurement of Household IncomeYaronBabaPas encore d'évaluation

- Working Paper 7 ADocument144 pagesWorking Paper 7 Aziyad786123Pas encore d'évaluation

- Pimco Corp. Opp Fund (Pty)Document46 pagesPimco Corp. Opp Fund (Pty)ArvinLedesmaChiongPas encore d'évaluation

- Macroeconomics Case Study: Chinese Macroeconomic Policy Position PaperDocument29 pagesMacroeconomics Case Study: Chinese Macroeconomic Policy Position PaperSani SalisuPas encore d'évaluation

- Mpsers 2009 Audit Page 34Document1 pageMpsers 2009 Audit Page 34Rob LawrencePas encore d'évaluation

- DA Aff Spending 15Document15 pagesDA Aff Spending 15AffNeg.ComPas encore d'évaluation

- The $21 Billion State Budget: South Carolina's Three Spending CategoriesDocument25 pagesThe $21 Billion State Budget: South Carolina's Three Spending CategoriesSteve CouncilPas encore d'évaluation

- PIMCO TRF PropsectusDocument23 pagesPIMCO TRF PropsectusZerohedgePas encore d'évaluation

- Leader Capital News: The Cost of CapitalDocument7 pagesLeader Capital News: The Cost of CapitalLeaderCapitalPas encore d'évaluation

- Professor Craig S. Maher Clow Faculty 408 Office Ph. 920-424-7304Document62 pagesProfessor Craig S. Maher Clow Faculty 408 Office Ph. 920-424-7304Diana PobladorPas encore d'évaluation

- ECON6000 Macroeconomic Performance and Implications of ZIRPDocument13 pagesECON6000 Macroeconomic Performance and Implications of ZIRPShubham AgarwalPas encore d'évaluation

- Pension Funds and Emerging Markets: J A. C - LDocument28 pagesPension Funds and Emerging Markets: J A. C - LDasulea V.Pas encore d'évaluation

- Dynamic of Fiscal Finance in USA LeeperDocument47 pagesDynamic of Fiscal Finance in USA LeeperAdnan AhmadPas encore d'évaluation

- A Bumpy Road Lies Ahead For U.S. Public Pension Funded LevelsDocument22 pagesA Bumpy Road Lies Ahead For U.S. Public Pension Funded Levelsapi-227433089Pas encore d'évaluation

- Effects of Global Crisis On Structural Policies and Financial Regulations: The Comparison of OECD EconomiesDocument4 pagesEffects of Global Crisis On Structural Policies and Financial Regulations: The Comparison of OECD EconomiesabdullahburhanbahcePas encore d'évaluation

- State Budget SummaryDocument6 pagesState Budget SummarymelissacorkerPas encore d'évaluation

- Economic Outlook - Q3 2021Document12 pagesEconomic Outlook - Q3 2021Jeremy TurleyPas encore d'évaluation

- Description: Tags: Semi35Document24 pagesDescription: Tags: Semi35anon-318308Pas encore d'évaluation

- 14-NURFC MemoDocument2 pages14-NURFC MemoCOASTPas encore d'évaluation

- Fiscal Policy Report Card On America' S Governors: 2008, Cato Policy AnalysisDocument28 pagesFiscal Policy Report Card On America' S Governors: 2008, Cato Policy AnalysisCato InstitutePas encore d'évaluation

- Economic Stimulus: Issues and Policies: Jane G. GravelleDocument25 pagesEconomic Stimulus: Issues and Policies: Jane G. Gravelleapi-25916560Pas encore d'évaluation

- Analysis of CBO's August 2011 Baseline and Update of CRFB Realistic Baseline August 24, 2011Document6 pagesAnalysis of CBO's August 2011 Baseline and Update of CRFB Realistic Baseline August 24, 2011Committee For a Responsible Federal BudgetPas encore d'évaluation

- OTC Derivatives Market Analysis Year-End 2011: June 2012Document12 pagesOTC Derivatives Market Analysis Year-End 2011: June 2012Srijan KatarukaPas encore d'évaluation

- USA QE Effects On EMDocument22 pagesUSA QE Effects On EMMbongeni ShongwePas encore d'évaluation

- Commsec Economic Statement July 2010Document1 pageCommsec Economic Statement July 2010peter_martin9335Pas encore d'évaluation

- Cyclically Adjusted Local Government Balances in Italy (2002-2007Document46 pagesCyclically Adjusted Local Government Balances in Italy (2002-2007werner71Pas encore d'évaluation

- Comptroller General of The United States: Government Accountability Office Statement 27Document4 pagesComptroller General of The United States: Government Accountability Office Statement 27losangelesPas encore d'évaluation

- Economics Group: Weekly Economic & Financial CommentaryDocument9 pagesEconomics Group: Weekly Economic & Financial Commentaryamberyin92Pas encore d'évaluation

- Preventing Fraud and Mismanagement in Government: Systems and StructuresD'EverandPreventing Fraud and Mismanagement in Government: Systems and StructuresÉvaluation : 4 sur 5 étoiles4/5 (1)

- The Economists' Voice 2.0: The Financial Crisis, Health Care Reform, and MoreD'EverandThe Economists' Voice 2.0: The Financial Crisis, Health Care Reform, and MorePas encore d'évaluation

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsD'EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsPas encore d'évaluation

- Weekly Credit Outlook For Public Finance - November 8, 2013 PDFDocument18 pagesWeekly Credit Outlook For Public Finance - November 8, 2013 PDFPAindyPas encore d'évaluation

- PEL Letter To Scranton 9-30-13 PDFDocument4 pagesPEL Letter To Scranton 9-30-13 PDFPAindyPas encore d'évaluation

- Co Sponsor Vote Count On Property Tax Elimination AmendmentDocument2 pagesCo Sponsor Vote Count On Property Tax Elimination AmendmentPAindyPas encore d'évaluation

- Restaurant Opportunity Center - 2011Document26 pagesRestaurant Opportunity Center - 2011PAindyPas encore d'évaluation

- Kennedy-Shaffer Approval LetterDocument4 pagesKennedy-Shaffer Approval LetterPAindyPas encore d'évaluation

- Property Tax Coalition LetterDocument2 pagesProperty Tax Coalition LetterPAindyPas encore d'évaluation

- Pew Pension Data - StatesDocument2 pagesPew Pension Data - StatesPAindyPas encore d'évaluation

- June Per DiemsDocument4 pagesJune Per DiemsPAindyPas encore d'évaluation

- PSBA - Legal Opinion 2005Document9 pagesPSBA - Legal Opinion 2005PAindyPas encore d'évaluation

- Bridges by CountyDocument2 pagesBridges by CountyPAindyPas encore d'évaluation

- Per Diem Totals - Jan-June 2013Document8 pagesPer Diem Totals - Jan-June 2013PAindyPas encore d'évaluation

- Restaurant Opportunity Center - 2010Document23 pagesRestaurant Opportunity Center - 2010PAindyPas encore d'évaluation

- Delaware DOS Documents 2Document1 pageDelaware DOS Documents 2PAindyPas encore d'évaluation

- PA Sunda Hunting Lawsuit DocumentDocument26 pagesPA Sunda Hunting Lawsuit DocumentPAindyPas encore d'évaluation

- PA Lawsuit Against Montgomery County OfficialDocument23 pagesPA Lawsuit Against Montgomery County OfficialPAindyPas encore d'évaluation

- PA Supreme Court - Eakin Concurring Opinion On Judicial RetirementDocument29 pagesPA Supreme Court - Eakin Concurring Opinion On Judicial RetirementPAindyPas encore d'évaluation

- May Per DiemsDocument4 pagesMay Per DiemsPAindyPas encore d'évaluation

- Whitewood v. Corbett, 2013Document53 pagesWhitewood v. Corbett, 2013PennLivePas encore d'évaluation

- Kennedy-Shaffer Appeal LetterDocument2 pagesKennedy-Shaffer Appeal LetterPAindyPas encore d'évaluation

- Pennsylvania DOS Documents 2Document1 pagePennsylvania DOS Documents 2PAindyPas encore d'évaluation

- Delaware DOS DocumentsDocument1 pageDelaware DOS DocumentsPAindyPas encore d'évaluation

- House GOP Will Bock Budget Over MedicaidDocument3 pagesHouse GOP Will Bock Budget Over MedicaidPAindyPas encore d'évaluation

- Pennsylvania DOS DocumentsDocument1 pagePennsylvania DOS DocumentsPAindyPas encore d'évaluation

- PA Supreme Court - Judicial Retirement RulingDocument3 pagesPA Supreme Court - Judicial Retirement RulingPAindyPas encore d'évaluation

- PLCB Denial LetterDocument2 pagesPLCB Denial LetterPAindyPas encore d'évaluation

- April Per DiemsDocument8 pagesApril Per DiemsPAindyPas encore d'évaluation

- Management DirectiveDocument5 pagesManagement DirectivePAindyPas encore d'évaluation

- Pennsylvania Treasury Memo On NIC PaymentsDocument9 pagesPennsylvania Treasury Memo On NIC PaymentsPAindyPas encore d'évaluation

- PA Property Tax Collection 1981-1982 Through 2011-2012Document1 pagePA Property Tax Collection 1981-1982 Through 2011-2012PAindyPas encore d'évaluation

- Liquor Real Estate Owners AssociationDocument1 pageLiquor Real Estate Owners AssociationPAindyPas encore d'évaluation