Académique Documents

Professionnel Documents

Culture Documents

Health Reform TimeLine Update March2011

Transféré par

Kim HedumDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Health Reform TimeLine Update March2011

Transféré par

Kim HedumDroits d'auteur :

Formats disponibles

Health Reform Timeline

Effective Dates and Implementation Deadlines. Federal and State

Kandis Driscoll, Christina Vane, and Adam Dougherty

Update March 1, 2011

2010

March 23, 2010

Medicare Rebate. Provides a $250 rebate for individuals in Medicare that have reached

the Part D coverage gap.

Medicare Extension for Health Hazards. Expands Medicare to individuals exposed to

environmental health hazards in an area subject to an emergency declaration and have

developed chronic health conditions as of June 17, 2009.

Premium Increase Justification. Requires health plans to justify premium increases

when subject to established review process. States must then report trends in premium

increase and recommend if health plans should be excluded from the Exchange due to

unjustified increases.

Tax Credit. Gives a tax credit of up to 35% of premiums to small employers (those with

no more than 25 employees and less than $50,000 average annual wages) providing health

insurance to employees.

Expanding the Healthcare Workforce. Improves low-interest student loan programs,

scholarships, and loan repayment programs for health students and professionals in hopes

to bolster the healthcare workforce capacity and meet patient needs.

Public Health Professionals. Appropriates $60 million in fiscal year 2010 for

scholarships to mid-career public health professionals, with annual appropriations through

2015.

Disadvantaged Health Professionals. Appropriates $60 million annually for fiscal year

2010 through 2014 for educational assistance in health professions to individuals from

disadvantaged backgrounds.

National Health Care Workforce Commission. Establishes a national Commission to

better align federal resources with health care needs.

Nurse Managed-Health Clinics. Initiates annual grants for nurse-managed health clinics,

appropriating $50 million for fiscal year 2010 and increasing thereafter.

National Health Service Corps. Increases annual funding for the National Health Service

Corps, appropriating $320 million for fiscal year 2010 and up to $1.1 billion in 2015 and

increasing 1% annually thereafter.

Ready Reserve Corps. Appropriates $17.5 million annually for fiscal years 2010-2014 for

a Ready Reserve Corps to address national emergencies and public health disasters.

Provider Screenings. Enhances health care provider screenings procedures to address

waste and fraud in healthcare system.

Generic Versions of Biologics. Authorizes the FDA to approve generic versions of

biologics after 12 years of exclusivity.

New Therapy Investment. Creates a $1 billion credit to encourage investments in new

therapies to prevent, diagnose, and treat acute and chronic disease.

Insure the Uninsured Project

1

Mental and Behavioral Health Education and Training Grants. Appropriates $35

million annually for fiscal year 2010 through 2013 for mental and behavioral health

education and training grants.

Fellowship Training Grants. Appropriates $39.5 million annually for fiscal year 2010

through 2013 towards fellowship training grants in public health.

Early Detection Grants. Appropriates $23 million for the fiscal year 2010 through 2014,

and $20 million for each five-year period thereafter for grants toward early detection of

medical conditions related to environmental hazards.

Patient-Centered Outcomes Research Institute. Terminates the Federal Coordinating

Council for Comparative Effectiveness Research and establishes the independent non-profit

Patient-Centered Outcomes Research Institute to identify national priorities in comparing

the effectiveness of treatments and strategies.

Teaching Health Centers. Appropriates $25 million in fiscal year 2010 and $50 million

annually for two years towards Teaching Health Centers to operate primary care residency

programs.

Centers of Excellence. Appropriates $50 million annually for fiscal year 2010 through

2015 to expand Centers of Excellence with a particular focus towards expanding regional

locations, helping to promote specialized treatment.

Medical Homes. Requires the Department of Health and Human Services (HHS) to create

programs to facilitate development of medical homes and other collaborative management.

Cure Acceleration Network. Appropriates $500 million in fiscal year 2010 towards Cure

Acceleration Networks (CAN), which are to promote technologies that support the

development of high need cures, helping move new medical cures through the development

pipeline faster.

Prevention Efforts. Establishes a $15 billion Prevention and Public Health Fund to

provide to sustain the national investment in public health and prevention programs.

Preventive Improvements. Creates a Preventive Services Task Force and Community

Preventive Services Task Force to develop, update, and disseminate evidence-based

recommendations.

Wellness Services. Establishes a five-year grant program to support delivery of evidence-

based and community-based prevention and wellness services.

California Exchange. Receive federal support for an existing, or newly established,

consumer assistance office to operate the insurance Exchange, pending federal guidance.

Insurance Premiums. California will review health plan premium rates according to

federal guidance.

April 1, 2010

Medicaid Expansion. Provides a state option that covers childless adults through a

Medicaid state plan amendment (SPA).

FMAP. Extends Medicaid federal match (FMAP) to cover MIAs up to 133% FPL.

Insure the Uninsured Project

2

Medi-Cal Expansion. Makes necessary changes to state law for expanding coverage to

newly eligibles, amending the Medi-Cal State Plan, and modifying the application and

enrollment systems. The state is also required to define “benchmark benefits,” including

“wraparound” benefits for children.

Federal Medical Assistance Percentage. FMAP available to states for all individuals

below 133% FPL ($14,404 for an individual).

Dual-Eligibles. California may pursue Home and Community-Based Service option for

those eligible for both Medicare and Medi-Cal (aka Dual-Eligibles or Medi-Medis).

April 30, 2010

Federal Medical Assistance Percentages (FMAP). FMAP available to states for all

individuals below 133% FPL ($14, 404 for an individual).

High-Risk Pool. Deadline for the state to inform HHS of its intention to apply for a

contract to operate California’s high-risk pool.

May 2010

Extending Dependent Coverage. Selected health plans in California extend dependent

coverage early to graduating college students.

June 1, 2010

Retiree Insurance. Establishes a temporary reinsurance program for employers providing

health insurance coverage to retirees over age 55 who are not eligible for Medicare

(applications available June 1, 2010).

June 23, 2010

Funding for Pre-Existing Conditions. $5 billion is available for uninsured individuals

with pre-existing conditions to obtain insurance coverage in high-risk pools through 2014.

Temporary Re-insurance Program. Creates a temporary re-insurance program for

employers that provide benefits to retirees age 55 to 64 to help offset the costs of expensive

health claims.

California Exchange. Comptroller General must appoint CO-OP Advisory Board for

insurance Exchange.

Insure the Uninsured Project

3

June 30, 2010

California’s Pre-Existing Condition Insurance Plan (PCIP). Governor Schwarzenegger

signs high-risk pool legislation into law (effective through January 1, 2014).

Internet Portal. HHS Internet portal for consumers to access information on coverage

options goes live.

July 1, 2010

Web Improvement. The Secretary of HHS must create an Internet website where

individuals can identify affordable health insurance options offered in their state

Payment Protection for Rural Providers. Extends Medicare payment protection to small

rural hospitals with outpatient services, lab services, and those facilities playing a critical

role in their communities.

Tanning Service Tax. Applies a 10% tax on the amount of indoor tanning services

(effective for services on or after July 1, 2010).

August 31, 2010

High-Risk Pool Applications. MRMIB begins accepting names and information for

those who think they might apply for PCIP.

§1115 Waiver. California’s current §1115 waiver expires.

September 1, 2010

Waiver Proposal. Final date for California to submit final waiver proposal to the Centers

for Medicare and Medicaid Services (CMS) for approval.

MIA Matching Funds. All California counties express their intentions with respect to

receipt of federal matching funds to cover MIAs up to 200% under a renewed §1115

waiver (September 2010).

September 23, 2010

Dependent Coverage Insurance Reform. Extends dependent coverage up until age 26

for all individual and group polices.

Insurance Limitations. Prohibits individual and group health plans from rescinding

coverage and from imposing a lifetime limit on the dollar value of coverage. This excludes

cases of fraud and certain annual limits as determined by the Secretary.

Appeals Process. Requires new group and individual health plans to develop and

implement an internal and external appeals process for coverage determination and claims.

Preventive Care. Provides preventive care services, as rated by the U.S. Preventive

Services Task Force, at no cost sharing for infants, children, adolescents, and women.

Insure the Uninsured Project

4

Pre-existing Conditions. Bars employer and new individual health plans from imposing

pre-existing condition exclusion on children’s coverage (applies to adults as of January 1,

2014).

Medical Loss Ratio Reporting. Requires health plans to report medical loss ratios

(MLRs) in individual and small group markets.

Exchange Legislation in California. SB 900 (Alquist & Steinberg) and AB 1602 (Perez)

were signed by Governor Schwarzenegger.

Enrollment Standards. HHS Secretary to develop secure standards and protocols for

enrollment in federal and state health and human services programs.

November 2010

§1115 Waiver Renewal. California was approved for a 5-year renewal which will provide

unlimited federal match for 58 counties coverage of MIAs up to 133% FPL (effective

through October 31, 2015).

Matched Funds for Counties. Counties receive capped federal matching funds to cover

MIAs 133%- 200% under a renewed §1115 waiver (effective through December 31, 2013).

**Adoption Credit.

**Adoption Credit. Allows

Allows adopting

adoptingfamilies

families to

toreceive

receive an

an extra

extra $1,000

$1,000 credit,

credit, which

which will

be tax

will be deductible (effective

tax deductible untiluntil

(effective December 2011).

December 2011).

**New Therapy Investment. Creates a $1 billion capped investment to encourage new

therapies that prevent, diagnose, and treat acute and chronic disease (Available for

qualifying investments made in 2009 and 2010).

**Blue Cross Blue Shield. Requires that the non-profit organizations of Blue Cross Blue

Shield keep their medical loss ratio at 85% to be eligible for tax credits.

2011

January 1, 2011

CLASS Program. Creates a national insurance program to purchase community living

assistance services and supports.

Medicare Prevention. Eliminates all cost sharing for preventive services, as

recommended by the U.S. Preventive Task Force, covered by Medicare and waives the

deductible for colorectal cancer screening test.

Wellness for Medicare. Provides personalized prevention plans and access to

comprehensive health risk assessments to Medicare patients while also providing

incentives for Medicare and Medicaid patients to complete behavior modification

programs.

Medicare Bonus. Provides a 10% Medicare bonus for health professionals, specifically

primary care physicians and general surgeons, practicing in shortage areas (effective

through 2015).

Insure the Uninsured Project

5

Medicare Payments. Sets Medicare Advantage Plan payments to different percentages

of Medicare fee-for-service rates.

Innovation in Medicare. Establishes an Innovation Center within the Centers for

Medicare and Medicaid Services.

Medical Home for Chronic Conditions. Establish a new Medicaid state plan option to

allow enrollees, with at least two chronic conditions to specify a provider as a health

home, providing a 90% FMAP for two years for related services.

Wellness Programs. Provide $200 million in grants for up to five years to small

employers to create wellness programs.

National Health. Develops a National Prevention, Health Promotions and Public Health

Council who will be required to develop a national strategy to improve the nation’s health.

Workforce. Addresses health care workforce shortage through a variety of loans, grants,

and scholarships towards training programs.

Care Coordination. Creates the Community-based Collaborative Care Network Program

to support coordination and integration of health care services for low-income uninsured

and underinsured populations.

Improving Access. Provides $1 billion funding for community health centers and $1.5

billion for the National Health Services Corps over five year, creating new programs to

support school-based health centers and nursed-managed health clinics.

Plans Report Amount Spent on Care. Health Insurance and grandfather plans must

report annual share of premiums dollars spent on medical care, and those totaling less than

80-85% of benefits must provide consumer rebate.

Pharmaceutical Fee. Imposes an annual fee on the pharmaceutical manufacturer

industry, excluding companies with sales of brand drugs totaling $5 million or less.

Pharmaceutical Discount. Pharmaceutical manufacturers must provide a 50% discount

on brand name drugs filled in the Medicare part D coverage gap while phasing in federal

subsidies for generic filled prescriptions.

Tax on Pharmaceutical Manufacturers. Imposes $2.5 billion fee on pharmaceutical

manufacturers according to market share.

Health Savings Account. Increases the tax on health savings account (HSA) withdrawals

for non-qualified health expenditures from 10% to 20%.

Caloric Reporting for Restaurants and Vending Machines. Requires chain restaurants

and vending machines to display calorie information for each menu item.

Tobacco Programs. Requires health plans to cover tobacco cessation programs for

pregnant women.

Community Health Centers. Increases funding for community health centers, $1 billion

in 2011 increasing to $3.6 billion in 2015, with additional $1.5 billion annually for

infrastructure renovation.

Primary Care Training. Allows unused residency training slots to be redistributed to

increase primary care training in underserved areas.

State Tort Projects. Appropriates $50 million for state tort reform demonstration

projects.

Reporting Value of Health Benefits on Tax Forms. Requires employers to report the

value of health benefits on each employee’s FY 2011 W-2 tax form.

Simple Cafeteria Plan. Establishes a Simple Cafeteria Plan to provide small business

with a tax-free mechanism to provide benefits to their employees.

Insure the Uninsured Project

6

Geriatric Career Incentives. Initiates $10 million in annual funding towards geriatric

career incentive rewards (extends through 2013).

NQIS Due. Due date for an HHS National Quality Improvement Strategy.

Medical Home for Chronically Ill Medi-Medis. California may pursue health homes for

chronically ill dual-eligibles.

February 2011

IT Grants. The Obama administration awarded $241 million in grants to seven states to

develop exchanges. The states are Kansas ($31.5 million), Maryland ($6.2 million),

Massachusetts ($35.6 million), New York ($26.4 million), Oklahoma ($54.6 million),

Oregon ($48.1 million), and Wisconsin ($37.8 million).

March 21, 2011

Exchange Planning Grants. HHS must make available Exchange planning grants for

states.

March 23, 2011

Private Health Plans. HHS must develop a standardized format for benefits summary

and coverage information for private health plans.

July 1, 2011

No Payment for Hospital Acquired Conditions. Prohibits federal Medicaid payments

for services related to hospital-acquired conditions.

**Medicare Cost-Sharing. Prohibit higher cost sharing of Medicare Advantage Plans for

some of the Medicare covered benefits than traditionally required in the fee-for-service

program.

**Medicare Income Freeze. Freeze threshold for income-related Medicare part B

premiums at 2010 levels through 2019, and reduce subsidy for specified individuals (those

with incomes above $85,000/individual and $170,000/couple).

October 1, 2011

Extending Medicaid Option. State may pursue Medicaid Community First Choice

Option.

2012

January 1, 2012

Safety Net Hospitals. Provides pilot authority for an all-encompassing flat rate (or global

capitated rate) payment to safety net hospitals (effective fiscal years 2010-2012).

Insure the Uninsured Project

7

At-Home Medicare. Establishes the Medicare Independence at Home demonstration

program for chronically ill Medicare patients. Programs are aimed towards improving

health outcomes while reducing expenditures by creating payment incentives and new

delivery systems composed of primary care teams, directed by physicians and nurse

practitioners.

Integrated Care. Enhanced payment for primary care services to act as an incentive to

form Accountable Care Organizations (ACOs) that will assist in improving efficiencies

and quality.

Hospitalization Bundle Payments. Establishes demonstration projects that use bundle

payments for care involving hospitalizations (effective through December 31, 2016).

March 23, 2012

Quality Reporting. Requires HHS to set regulations on the requirements for health-plan

quality reporting.

Standardized Benefit Summaries. Requires health plans to provide standardized benefit

summaries and coverage information for consumers.

Data Collection. Requires improved data collection and reporting on race, ethnicity, sex,

primary language, and disability status for underserved, rural, and frontier populations

(March 2012).

October 1, 2012

Quality Improvement. Create a hospital value-based purchasing program to help

improve quality outcomes in acute care hospitals. The Secretary must submit a plan to

Congress outlining how to transition home health and nursing home providers into a

value-based purchasing payment system.

**Mental Health Hospitals. Provide Medicaid payments to mental health hospitals for

the adult patients that require emergency stabilization of a condition (effective through

December 31, 2015).

December 31, 2012

Elimination of Part D Subsidy. Eliminates deduction for the subsidy for employers who

have maintained prescription drug plans for eligible Medicare Part D retirees.

**Hospital Readmissions. Requires CMS to track hospital readmission rates for high-

volume and high-cost conditions while providing a new financial incentive for hospitals to

make necessary changes to avoid preventable readmissions.

**Medicare Cost-Sharing. Makes Part D cost-sharing for full-benefit dual eligible

individuals, specifically those receiving home and community based care services, equal

to that of individuals receiving institutional care.

2013

January 1, 2013

Medicaid Primary Care Payment Increase. Requires that Medicaid payment rates to

primary care physicians be no less than 100% of Medicare payment rates in 2013 and

2014. There is 100% federal funding to states for the incremental cost.

Insure the Uninsured Project

8

Care Collaboration. Creates a national pilot program for payment bundling to encourage

increased collaboration and care coordination between doctors, hospitals, and post-acute

care providers to enhance Medicare savings.

Medical Device Tax. Creates a 2.3% excise tax on the sale of medical devices by

manufacturers or importers, excluding devices purchased by the public at retail price for

individual use, such as with eye glasses, contact lenses, hearing aids, etc (on sales made

on or after January 1, 2013).

Tax for Higher Paid Workers. Imposes an increased hospital insurance tax rate by 0.9%

on individuals earning over $200,000 and $250,000 for married individuals filing together.

This also extends the taxable base to include net investment income for individuals

earning over $200,000 and $250,000 for joint returns (tax years beginning 2013 or later).

Federal Subsidies for Prescriptions in Part D Donut Hole. Requires the phasing-in of

federal subsidies for brand-name prescription drugs within the Medicare Part D coverage

gap (Tax years beginning 2013 or later).

Limitation on Executive Compensation Deduction. Limits the deduction of executive

compensation to $500,000 per taxable year if at least 25% of the provider’s premium

income is from health plans meeting the minimum coverage requirements (effective 2013

but applies to services performed after 2009).

Special Needs. Dual-eligible Special Needs Plans must contract with the state.

July 1, 2013

Insurance Exchange. Requires HHS to begin awarding loans and grants for health

insurance co-operatives. Co-Ops are non-profit, non-government, consumer-driven health

plans that are owned and controlled by individuals and small businesses (who purchase the

insurance), serving as an alternative to private insurance.

December 31, 2013

Temporary High-Risk Pool. The temporary high-risk pool ends.

**Administration Standards. Requires health plans to establish uniform standards and

business rules as it relates to electronically exchanging health information.

**Health Flexible Savings Account. Limits contributions to health FSAs to $2,500 per

year (indexed by CPI for subsequent years).

2014

Insure the Uninsured Project

9

January 1, 2014

Health Insurance Regulation. Prohibits the discriminatory practices of insurance

companies involving the sale and renewal of health plans based on health status, the

exclusion of coverage for treatments based on pre-existing conditions, and increased rates

due to health status, gender, etc. Premiums will only vary based on age (at no more than a

3.1 ratio), geography, family size, and tobacco use.

Medicaid Expansion. Increases the eligibility for Medicaid to 133% the FPL for non-

elderly individuals while also providing full federal funding to states to cover the

expanded population.

Health Insurance Exchanges Launch. Health Insurance Exchanges in every State to be

opened to individuals and small businesses, allowing individuals to comparison shop

when seeking affordable health coverage. Subsidies available in the form of refundable

tax credits only through the Exchange.

Individual Mandate. Requires an individual to have health insurance coverage or pay a

set penalty of $95 in 2014, $325 in 2015, $695 or 2.5% of income in 2016. The family

penalty will be capped at $2,250 and will pay half the amount for children. Individuals

will not be penalized if affordable coverage is not available.

Employer Play-or-Pay. Employers that have at least one employee purchasing insurance

through the exchange and receiving a premium tax credit will be subject to a penalty. For

employers not offering coverage, there will be a $2,000 annual penalty for each full-time

employee, receiving a premium credit, over the first 30 employees. For employers

offering insufficient coverage, (defined as that which exceeds 9.5% of an employees

income or coverage that pays for less than 60% of expenses) there will be a $3000 annual

penalty for each full-time employee, receiving a premium credit, over the first 30

employees.

Annual Limits. Eliminates annual limits on the amount of coverage an individual can

receive through employer and new individual health plans.

Clinical Trials. Prevents health plans from dropping or denying routine care coverage if

an individual decides to participate in a clinical trial that treat cancer or other life-

threatening diseases.

Health Care Tax Credits. Provides premium tax credits through the Exchange to

individuals with incomes between 133-400% FPL who are not eligible for (or offered)

acceptable coverage.

Small-Employer Tax Credit. Continues the second phase of the tax credit for small

employers who qualify.

Free-Choice Vouchers. Provides free-choice vouchers for workers who do not qualify

for tax credits but are contributing a high portion of their individual income to employer

health plans. These vouchers allow an individual to utilize an Exchange health plan with

their employer contribution.

Insure the Uninsured Project

10

Transition into Medi-Cal. State is responsible for transitioning children ages 6-18 with

family incomes between 100-133% FPL from the Healthy Families Program to Medi-Cal

coverage.

Medically Indigent Adults. Federal government will pay 100% of the cost of covering

Medically Indigent Adults (MIAs) for three years; phase down starts with 95% in 2017,

94% in 2018, 93% in 2019, and 90% thereafter (effective through 2016).

Modifications to Eligibility and Enrollment. Changes in eligibility and enrollment

rules must be applied, modifying adjusted gross income (AGI) formula for Medi-Cal and

Health Families.

Simplification of Programs. State must implement procedures to simplify the

enrollment process of Medi-Cal and Healthy Families with one electronic application

form .

End of MOEs for Adults. Maintenance of Effort (MOE) requirements for adults

covered by Medi-Cal expires. States may begin modifying Medi-Cal eligibility levels,

standards, and income requirements.

Federal Risk Corridors. Payment adjustments begin for health plans in Federal Risk

Corridor.

Permanent Risk Adjustment Program. State must establish a permanent risk

adjustment program.

Transitional Temporary Reinsurance Program. State must adopt model regulations

and establish transitional temporary reinsurance program.

**Plan Fee. Imposes an annual, non-deductible fee on health insurance plans whose net

premiums written are more than $25 million.

**Multi-State Option. Creates a multi-state option that will be available through

nationwide health plans supervised by the Office of Personal Management, giving

individuals more choice of coverage.

2015

January 1, 2015

Quality-Over-Quantity Payment for Physicians. Creates a physician value-based

payment program to promote increased quality of care for Medicare recipients.

• Continuing Innovation and Lower Health Costs. Establishes an Independent

Payment Advisory Board to develop and submit proposals to Congress and the private

sector. Proposals are focused towards extending the solvency of Medicare, lowering

health care costs, improving health outcomes for patients, promoting quality and

efficiency, and expanding access to evidence-based care.

Insure the Uninsured Project

11

Reducing Medicare Reimbursement Rates for Conditions Acquired in Hospitals.

Reduce Medicare payments to certain hospitals for hospital-acquired conditions by 1%

(effective fiscal year 2015).

April 1, 2015

Transitioning Children. Permits States to transition children who are eligible for

Healthy Families to Medi-Cal or other coverage comparable to Medi-Cal in the

Exchange. However, HHS must first certify that Exchange coverage is adequate.

September 30, 2015

CHIP Funding Ends. The block grant that funds the Children’s Health Insurance

Program (CHIP) expires.

October 1, 2015

Children in the Exchange. Permits States to start enrolling children who are eligible for

Healthy Families into the Exchange.

Federal Matching for Healthy Families. Allows the state to receive 88% matching rate

for the Healthy Families Program.

2016

January 1, 2016

Option to Create Care Choice Compacts. Permits states to form health care choice

compacts and allow insurers to sell policies in any state participating in the compact (may

not take effect before January 1, 2016).

2017

January 1, 2017

Risk Corridor Payments Expire. Ends the Federal risk corridor payments.

2018

January 1, 2018

“Cadillac Tax” Begins. Imposes tax on the cost of coverage in excess of $27,500

(family coverage) and $10,200 (single coverage). It will be increased to $30,950 (family)

and $11,850 (single) for retirees and employees in high-risk professions. Inflation is

taken into account and employers with higher costs on account of the age or fender

Insure the Uninsured Project

12

demographics of their employees may value their coverage using the age and gender

demographics of a national risk pool.

2019

January 2019

Maintenance of Effort. MOE requirements for children in Medicaid end. State may

begin modifying Medi-Cal eligibility levels, standards, and income levels for children.

Note: ** indicates non-specified date for implementation, but is effective within listed year.

References

California HealthCare Foundation. (2010, May). Insurance provisions of the affordable care act:

an implementation timeline for California. Retrieved from

http.//www.chcf.org/~/media/Files/PDF/A/AffordableCareActTimelineForCA8x11.pdf

California Medical Association. (2010, May 13). Federal health reform: medi-cal and healthy

families. Retrieved from

http://www.cmanet.org/healthreform/applets/fhrs_medicaid_chip.pdf

Committees on Ways & Means, Energy and Commerce, and Education and Labor. (2010, April

2). health insurance reform at a glance: implementation timeline. Retrieved from

http.//docs.house.gov/energycommerce/TIMELINE.pdf

The Commonwealth Fund. (2010, April 1). Timeline for health care reform implementation:

system and delivery reform provisions. Retrieved from

http://www.commonwealthfund.org/Content/Publications/Other/2010/Timeline-for-

Health-Care-Reform-Implementation-System.aspx

Coughlin, M.B., & Chelllgren, B.W. (2010, May). The Cures acceleration network: a hidden

gem within the patient protection and affordable care act. ABA Health eSource, 6(9), Retrieved

from http://www.abanet.org/health/esource/Volume6/09/Chellgren.html

Creating a Family. (2010, March 25). Adoption tax credit extended and improved. Retrieved

from http.//www.creatingafamily.org/blog/adoption-domestic-adoption-international-adoption-

embryo-adoption-foster-care-adoption/adoption-tax-credit-extended-improved/

Health Assistance Partnership. (2010, April ).Health reform: key medicare changes effective in

2012 and beyond. Retrieved from http://www.hapnetwork.org/assets/pdfs/2012-fact-

sheet.pdf

Kaiser Family Foundation. (2010, June 15). Health reform implementation timeline. Retrieved

from http.//www.kff.org/healthreform/upload/8060.pdf

Insure the Uninsured Project

13

National Association of Realtors. (2010). Health insurance reform: frequently asked questions

(faqs). Retrieved from

http://www.realtor.org/small_business_health_coverage.nsf/Pages/health_ref_faq_e

xchange?OpenDocument

National Governors Association. (2010, April 13). Implementation timeline for health reform

legislation. Retrieved from

http://www.nga.org/Files/pdf/1003HEALTHSUMMITIMPLEMENTATIONTIMELI

NE.PDF

Trustmark Companies. (2010, May 14). Healthcare reform timeline. Retrieved from

http://www.trustmarkinsurance.com/internet/corporate/files/Healthcare_ReformTim

eline.pdf

The White House. (2010, March). The affordable care act: implementation timeline. Retrieved

from http.//www.whitehouse.gov/healthreform/timeline

Insure the Uninsured Project

14

Vous aimerez peut-être aussi

- Justice For Sale LELDF ReportDocument17 pagesJustice For Sale LELDF ReportPaul Bedard92% (12)

- StabilityDocument3 pagesStabilitykinsonprabuPas encore d'évaluation

- Arabella Big Money in Dark ShadowsDocument36 pagesArabella Big Money in Dark ShadowsKim Hedum100% (1)

- Preventing A Disrupted Presidential Election and Transition: Executive SummaryDocument22 pagesPreventing A Disrupted Presidential Election and Transition: Executive SummaryRadu Zugravu100% (2)

- Restoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostD'EverandRestoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostPas encore d'évaluation

- Hospital OrientationDocument2 pagesHospital OrientationNisarg SutharPas encore d'évaluation

- Health 1Document527 pagesHealth 1venika SharmaPas encore d'évaluation

- Obg Course PlanDocument4 pagesObg Course PlanDelphy VarghesePas encore d'évaluation

- Implementation Timeline: P C W & M, E & C, E & L, A 2, 2010Document7 pagesImplementation Timeline: P C W & M, E & C, E & L, A 2, 2010Lydia GaltonPas encore d'évaluation

- Key Features of The Affordable Care Act by YearDocument8 pagesKey Features of The Affordable Care Act by YearGabriel NguyenPas encore d'évaluation

- 2018-19 SFY Health and Mental Hygiene Budget HighlightsDocument7 pages2018-19 SFY Health and Mental Hygiene Budget HighlightsNew York SenatePas encore d'évaluation

- HCRprovisions - Older Adults 3-30-10Document6 pagesHCRprovisions - Older Adults 3-30-10hcreformPas encore d'évaluation

- NYS DOB - Health Dept Budget 2018 HightlightsDocument13 pagesNYS DOB - Health Dept Budget 2018 Hightlightssrikrishna natesanPas encore d'évaluation

- CHIP Annual Report 2011Document16 pagesCHIP Annual Report 2011State of UtahPas encore d'évaluation

- Department of Health and Human Services: Since 2001, The AdministrationDocument11 pagesDepartment of Health and Human Services: Since 2001, The AdministrationlosangelesPas encore d'évaluation

- HHS Provides Billions For Home VisitsDocument18 pagesHHS Provides Billions For Home VisitsKim HedumPas encore d'évaluation

- 201720180SB562 - Senate HealthDocument20 pages201720180SB562 - Senate HealthMaggie DeSistoPas encore d'évaluation

- (MOHW) The Eighth Public Engagement RoundtableDocument4 pages(MOHW) The Eighth Public Engagement Roundtableinkorea202425Pas encore d'évaluation

- (Public Laws 111-148,: Summary of Behavioral Health Provisions in The Patient Protection and Affordable Care Act (Ppaca)Document4 pages(Public Laws 111-148,: Summary of Behavioral Health Provisions in The Patient Protection and Affordable Care Act (Ppaca)daniellestfuPas encore d'évaluation

- Summary of The Medicare and Medicaid Extenders Act of 2010Document3 pagesSummary of The Medicare and Medicaid Extenders Act of 2010api-25909546Pas encore d'évaluation

- Medicore PrimerDocument32 pagesMedicore PrimeryeshpalsinghthakurPas encore d'évaluation

- CA Fact Sheet 062510Document3 pagesCA Fact Sheet 062510nchc-scribdPas encore d'évaluation

- Department of Health and Human Services: The President's 2009 Budget WillDocument6 pagesDepartment of Health and Human Services: The President's 2009 Budget Willapi-19777944Pas encore d'évaluation

- Fact Sheet - California - 0Document3 pagesFact Sheet - California - 0nchc-scribdPas encore d'évaluation

- Letter To GovernorsDocument4 pagesLetter To GovernorsSarah KliffPas encore d'évaluation

- Patient Protection and Affordable Care ActDocument22 pagesPatient Protection and Affordable Care Actnie621Pas encore d'évaluation

- Healthcare Reform: Enhancing Services On A Sustainable BasisDocument18 pagesHealthcare Reform: Enhancing Services On A Sustainable BasisextravaganzarPas encore d'évaluation

- Focus: Health ReformDocument4 pagesFocus: Health ReformHenry Jacob Baker JrPas encore d'évaluation

- Focus: Health ReformDocument7 pagesFocus: Health ReformBrian ShawPas encore d'évaluation

- CaidActuarial Report 2011Document59 pagesCaidActuarial Report 2011QMx2014Pas encore d'évaluation

- SHARE Grantee Newsletter October 2009Document4 pagesSHARE Grantee Newsletter October 2009butle180Pas encore d'évaluation

- Task 3 Comparison of Health CareDocument4 pagesTask 3 Comparison of Health CareHogan ObiPas encore d'évaluation

- The Patient Protection and Affordable Care ActDocument5 pagesThe Patient Protection and Affordable Care ActMichael MaddalenaPas encore d'évaluation

- Payers & Providers Midwest Edition - Issue of June 5, 2012Document6 pagesPayers & Providers Midwest Edition - Issue of June 5, 2012PayersandProvidersPas encore d'évaluation

- Executive Summary - Medicaid Expansion White PaperDocument29 pagesExecutive Summary - Medicaid Expansion White PaperCourier JournalPas encore d'évaluation

- Massachusetts' Plan: A Failed Model For Health Care Reform: February 18, 2009Document19 pagesMassachusetts' Plan: A Failed Model For Health Care Reform: February 18, 2009raj2closePas encore d'évaluation

- HHS Budget-Justification-Fy2019 PDFDocument364 pagesHHS Budget-Justification-Fy2019 PDFOliverPas encore d'évaluation

- CO Health Reform Fact Sheet 071510 RRDocument4 pagesCO Health Reform Fact Sheet 071510 RRnchc-scribdPas encore d'évaluation

- #6 The Democratic Voter, February 1, 2012 #6 Small SizeDocument8 pages#6 The Democratic Voter, February 1, 2012 #6 Small Sizedisaacson1Pas encore d'évaluation

- Averting The Medicare Crisis: Health IRAs, Cato Policy AnalysisDocument8 pagesAverting The Medicare Crisis: Health IRAs, Cato Policy AnalysisCato InstitutePas encore d'évaluation

- Ealth Nsurance IN Ndia: R M - 05PH2010Document6 pagesEalth Nsurance IN Ndia: R M - 05PH2010api-26832469Pas encore d'évaluation

- Detailed First 5 Ca Improper Gives To The State - Copy 2Document50 pagesDetailed First 5 Ca Improper Gives To The State - Copy 2api-126378091Pas encore d'évaluation

- AHASpecialBulletin House3Trillion FinalDocument5 pagesAHASpecialBulletin House3Trillion FinalJohnPas encore d'évaluation

- IRG Health Care ReportDocument57 pagesIRG Health Care ReportAnthony DaBruzziPas encore d'évaluation

- EHRIP Eligible Professionals Tip Sheet PDFDocument4 pagesEHRIP Eligible Professionals Tip Sheet PDFdnice408Pas encore d'évaluation

- California AB 1810 (2018)Document66 pagesCalifornia AB 1810 (2018)ThePoliticalHatPas encore d'évaluation

- Understanding The ACA's Health Care ExchangesDocument10 pagesUnderstanding The ACA's Health Care ExchangesMarketingRCAPas encore d'évaluation

- The Future Role of Community Health Centers in ADocument15 pagesThe Future Role of Community Health Centers in Aintan juitaPas encore d'évaluation

- 05 - Main Report HIB FinalDocument39 pages05 - Main Report HIB FinalShurendra GhimirePas encore d'évaluation

- International Social Welfare ProgramsDocument10 pagesInternational Social Welfare ProgramsZaira Edna JosePas encore d'évaluation

- The Affordable Care Act: Universal and Continuous CoverageDocument16 pagesThe Affordable Care Act: Universal and Continuous CoverageIndiana Family to FamilyPas encore d'évaluation

- Health System Reform Short SummaryDocument11 pagesHealth System Reform Short SummarySteve LevinePas encore d'évaluation

- Financing HealthcareDocument21 pagesFinancing HealthcareEnrique Guillen InfantePas encore d'évaluation

- The Pluralistic Reform Model: The Patient Protection and Affordable Care Act of 2010Document4 pagesThe Pluralistic Reform Model: The Patient Protection and Affordable Care Act of 2010Ben HsuPas encore d'évaluation

- Stimulas Department of Health and Human Services1Document4 pagesStimulas Department of Health and Human Services1Kathleen DearingerPas encore d'évaluation

- Actu CanadaDocument8 pagesActu CanadaJuasadf IesafPas encore d'évaluation

- Comprehensive Proposal of AmendmentsDocument22 pagesComprehensive Proposal of AmendmentsMaricel Pereña Diesta PajanustanPas encore d'évaluation

- Health Sector Reform Agenda - CHNDocument3 pagesHealth Sector Reform Agenda - CHNMadsPas encore d'évaluation

- Health Reform in 2013Document3 pagesHealth Reform in 2013alessandrabrooks646Pas encore d'évaluation

- Hcentive Health Insurance Exchange PlatformDocument16 pagesHcentive Health Insurance Exchange PlatformalishanorthPas encore d'évaluation

- Share Grantee Newsletter Mar 2010Document5 pagesShare Grantee Newsletter Mar 2010butle180Pas encore d'évaluation

- Impact of ACA On The Safety NetDocument6 pagesImpact of ACA On The Safety NetiggybauPas encore d'évaluation

- HHS Letter To State Medicaid Directors On Hospice Care For Children in Medicaid and CHIPDocument3 pagesHHS Letter To State Medicaid Directors On Hospice Care For Children in Medicaid and CHIPBeverly TranPas encore d'évaluation

- 2022 End of Session Report January 1 Effective DateDocument6 pages2022 End of Session Report January 1 Effective DateAbby KousourisPas encore d'évaluation

- PHC ManualDocument92 pagesPHC ManualRory Rose PereaPas encore d'évaluation

- Centers For Disease Control and Prevention: Lobbying Policies and Monitoring For Program To Reduce Obesity and Tobacco Use GAO-13-477R, Apr 30, 2013Document11 pagesCenters For Disease Control and Prevention: Lobbying Policies and Monitoring For Program To Reduce Obesity and Tobacco Use GAO-13-477R, Apr 30, 2013Patricia DillonPas encore d'évaluation

- NC Health Refom Fact Sheet 073010 RRDocument3 pagesNC Health Refom Fact Sheet 073010 RRnchc-scribdPas encore d'évaluation

- The Power of Ice Cream: Number 45 California Central Coast ChapterDocument2 pagesThe Power of Ice Cream: Number 45 California Central Coast ChapterMarcusPas encore d'évaluation

- Operational Law Handbook 2012Document576 pagesOperational Law Handbook 2012mary engPas encore d'évaluation

- Join Us For A Forum On Racial Profiling, Federal Hate Crimes Enforcement and "Stand Your Ground" Laws: Protecting A "Suspect" CommunityDocument2 pagesJoin Us For A Forum On Racial Profiling, Federal Hate Crimes Enforcement and "Stand Your Ground" Laws: Protecting A "Suspect" CommunityBeverly TranPas encore d'évaluation

- Affidavit of Probable Cause To Charge George Zimmerman With Second Degree MurderDocument4 pagesAffidavit of Probable Cause To Charge George Zimmerman With Second Degree MurderMatthew KeysPas encore d'évaluation

- Grand Juries Indict 34 in Arms Trafficking Arizona Jamuary 2011Document3 pagesGrand Juries Indict 34 in Arms Trafficking Arizona Jamuary 2011Kim HedumPas encore d'évaluation

- Twin Lakes Shooting Initial ReportDocument4 pagesTwin Lakes Shooting Initial ReportGeneParkPas encore d'évaluation

- CAIR Files Complaint Against Schools in MinnesotaDocument4 pagesCAIR Files Complaint Against Schools in MinnesotaKim HedumPas encore d'évaluation

- Iraq Construction January - 2012Document7 pagesIraq Construction January - 2012Kim HedumPas encore d'évaluation

- Housing White Paper 20120104Document28 pagesHousing White Paper 20120104Foreclosure FraudPas encore d'évaluation

- Environmental Justice 5 Year Implementation PlanDocument16 pagesEnvironmental Justice 5 Year Implementation PlanKim HedumPas encore d'évaluation

- Mexico US Relations September 2 2010Document42 pagesMexico US Relations September 2 2010Kim HedumPas encore d'évaluation

- More Facts On Holder RE Fast and Furious by IssaGrassleyDocument26 pagesMore Facts On Holder RE Fast and Furious by IssaGrassleyKim Hedum100% (1)

- U.S. Political & Social Issues: November 2011 Congress Campaign Guide For Congressional Candidates and CommitteesDocument8 pagesU.S. Political & Social Issues: November 2011 Congress Campaign Guide For Congressional Candidates and CommitteesKim HedumPas encore d'évaluation

- BASIC EPIDEMIOLOGY NotesDocument16 pagesBASIC EPIDEMIOLOGY NotesJanPaolo TorresPas encore d'évaluation

- Patient Mobility Assessment:: Assistance Level Mobility Level Based On The Bmat Recommended Equipment Caregiver(s)Document2 pagesPatient Mobility Assessment:: Assistance Level Mobility Level Based On The Bmat Recommended Equipment Caregiver(s)Nandhini NandhiniPas encore d'évaluation

- E-Health in The PhilippinesDocument4 pagesE-Health in The PhilippinesviktoriaaguilaPas encore d'évaluation

- ID Peran Kader Kesehatan Dalam Program Perencanaan Persalinan Dan Pencegahan Kompli PDFDocument9 pagesID Peran Kader Kesehatan Dalam Program Perencanaan Persalinan Dan Pencegahan Kompli PDFSukma Nisa CaemPas encore d'évaluation

- NURS FPX 6612 Assessment 1 Triple Aim Outcome MeasuresDocument6 pagesNURS FPX 6612 Assessment 1 Triple Aim Outcome Measuresfarwaamjad771Pas encore d'évaluation

- Robert Half BenefitsDocument30 pagesRobert Half BenefitsGiorgos MeleasPas encore d'évaluation

- CM Problems 1Document18 pagesCM Problems 1amcharren0911Pas encore d'évaluation

- CV Ade Adrain Sitompul (Update 24 April 2018) PDFDocument12 pagesCV Ade Adrain Sitompul (Update 24 April 2018) PDFAdra AdePas encore d'évaluation

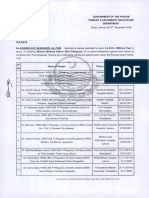

- Government of The Punjab Primary & Secondary Healthcare DepartmentDocument2 pagesGovernment of The Punjab Primary & Secondary Healthcare DepartmentMasroor HassanPas encore d'évaluation

- Preparing For The Next Version of HIPAA Standards: January 1, 2012 Compliance DateDocument4 pagesPreparing For The Next Version of HIPAA Standards: January 1, 2012 Compliance DateNikhil SatavPas encore d'évaluation

- ICH E2E GuidelineDocument20 pagesICH E2E Guidelinetito1628Pas encore d'évaluation

- Course Schedule 2019 PDFDocument30 pagesCourse Schedule 2019 PDFcassindromePas encore d'évaluation

- Patient Satisfaction Survey SampleDocument4 pagesPatient Satisfaction Survey SampleAnjana VenugopalanPas encore d'évaluation

- Health Statistics Report 2019Document147 pagesHealth Statistics Report 20197063673nasPas encore d'évaluation

- The Philippine Health Situation May 2017Document22 pagesThe Philippine Health Situation May 2017Amil P. Tan IIPas encore d'évaluation

- SIP Poster - Alison WEB PDFDocument1 pageSIP Poster - Alison WEB PDFNCPQSWPas encore d'évaluation

- Member Data Record: Philippine Health Insurance CorporationDocument1 pageMember Data Record: Philippine Health Insurance CorporationJoseph EsperidaPas encore d'évaluation

- NHA-Uganda 2016-2019 Report FinalDocument43 pagesNHA-Uganda 2016-2019 Report FinalGodwinPas encore d'évaluation

- Pharmacy Law - Terminology & PrinciplesDocument18 pagesPharmacy Law - Terminology & PrinciplesHIND MOHAMEDPas encore d'évaluation

- United States: Health System ReviewDocument479 pagesUnited States: Health System ReviewRiccardo CarraroPas encore d'évaluation

- Tribal Population in India: A Public Health Challenge and Road To FutureDocument2 pagesTribal Population in India: A Public Health Challenge and Road To FutureMlbb GameplaysPas encore d'évaluation

- Facts and Figures: Geographical and Demographic ProfileDocument4 pagesFacts and Figures: Geographical and Demographic ProfileJulius MarcelinoPas encore d'évaluation

- File 3Document2 pagesFile 3Ashish BhattPas encore d'évaluation

- National Service Training Program Civic Welfare Training ServiceDocument2 pagesNational Service Training Program Civic Welfare Training ServiceRichard BorjaPas encore d'évaluation

- Evidence Based Practice and Clinical Decision-MakingDocument3 pagesEvidence Based Practice and Clinical Decision-MakingSamwel KangyPas encore d'évaluation

- 2 CLINICAL PHARMACOLOGY - Prescription - WritingDocument52 pages2 CLINICAL PHARMACOLOGY - Prescription - Writingtf.almutairi88Pas encore d'évaluation