Académique Documents

Professionnel Documents

Culture Documents

Notes On Segment Information Principal Segments

Transféré par

nerishakhandelwal0 évaluation0% ont trouvé ce document utile (0 vote)

17 vues1 page1. Infosys Technologies Limited reported unaudited consolidated financial results for the quarter and nine months ended December 31, 2009.

2. Revenues for the quarter were Rs. 5,741 crore with net profit of Rs. 1,559 crore.

3. Infosys BPO acquired McCamish Systems LLC, a US-based business process solutions provider, for a total consideration of Rs. 238 crore.

Description originale:

Titre original

Q3-2010-AD

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document1. Infosys Technologies Limited reported unaudited consolidated financial results for the quarter and nine months ended December 31, 2009.

2. Revenues for the quarter were Rs. 5,741 crore with net profit of Rs. 1,559 crore.

3. Infosys BPO acquired McCamish Systems LLC, a US-based business process solutions provider, for a total consideration of Rs. 238 crore.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

17 vues1 pageNotes On Segment Information Principal Segments

Transféré par

nerishakhandelwal1. Infosys Technologies Limited reported unaudited consolidated financial results for the quarter and nine months ended December 31, 2009.

2. Revenues for the quarter were Rs. 5,741 crore with net profit of Rs. 1,559 crore.

3. Infosys BPO acquired McCamish Systems LLC, a US-based business process solutions provider, for a total consideration of Rs. 238 crore.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

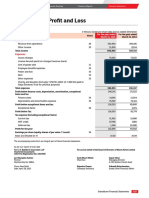

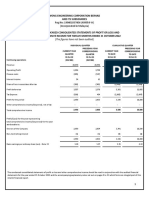

Infosys Technologies Limited Other information:

(in Rs. crore)

Regd. office: Electronics City, Hosur Road, Bangalore – 560 100, India. Particulars Quarter ended Nine months ended Year ended

December 31, December 31, March 31,

Unaudited consolidated financial results of Infosys Technologies Limited and its subsidiaries 2009 2008 2009 2008 2009

for the quarter and nine months ended December 31, 2009 prepared in compliance with Staff costs 3,029 3,004 8,885 8,406 11,405

International Financial Reporting Standards (IFRS) Items exceeding 10% of aggregate expenditure – – – – –

(in Rs. crore, except per share data) Details of other income:

Particulars Quarter ended Nine months ended Year ended Interest on deposits with banks and others 159 229 580 612 871

December 31, December 31, March 31, Dividend on investments in liquid mutual funds 41 – 74 3 5

2009 2008 2009 2008 2009 Miscellaneous income, net 11 29 17 32 36

Revenues 5,741 5,786 16,798 16,058 21,693

Gains/(losses) on foreign currency 20 (218) 65 (424) (439)

Cost of sales 3,263 3,267 9,605 9,266 12,535

Gross profit 2,478 2,519 7,193 6,792 9,158 Total 231 40 736 223 473

Selling and marketing expenses 314 274 851 835 1,106 Notes:

Administrative expenses 380 407 1,221 1,201 1,631

1. The audited financial statements have been taken on record by the Board of Directors at its meeting held at Mysore on January 12, 2010.

Operating profit 1,784 1,838 5,121 4,756 6,421 The statutory auditors have expressed an unqualified audit opinion. The information presented above is extracted from the audited financial

Other income 230 38 738 221 473 statements as stated. The financial statements are prepared in accordance with the principles and procedures for the preparation and

Profit before income taxes 2,014 1,876 5,859 4,977 6,894 presentation of consolidated financial statements as set out in the Accounting Standard on Consolidated Financial Statements prescribed

Income tax expense 455 241 1,240 617 919 by Rule 3 of the Companies (Accounting Standards) Rules, 2006, the provisions of the Companies Act, 1956 and guidelines issued by the

Net profit 1,559 1,635 4,619 4,360 5,975 Securities and Exchange Board of India.

Other comprehensive income

2. An interim dividend of Rs. 10.00 per share was declared at the Board meeting held on October 9, 2009 and was paid on October 20, 2009. The

Exchange differences on translating foreign operations (7) (53) 66 (32) (32) interim dividend declared in the previous year was Rs. 10.00 per share.

Total other comprehensive income (7) (53) 66 (32) (32)

Total comprehensive income 1,552 1,582 4,685 4,328 5,943 3. Information on investor complaints pursuant to Clause 41 of the Listing Agreement for the quarter ended December 31, 2009.

Profit attributable to: Nature of complaints received Opening balance Additions Disposal Closing balance

Owners of the company 1,559 1,635 4,619 4,360 5,975

Dividend/Bonus/Annual report related – 188 188 –

Non-controlling interest – – – – –

1,559 1,635 4,619 4,360 5,975

4. On December 4, 2009, Infosys BPO acquired 100% of the voting interests in McCamish Systems LLC (McCamish), a business process

Total comprehensive income attributable to: solutions provider based in Atlanta, Georgia, in the United States. The business acquisition was conducted by entering into Membership Interest

Owners of the company 1,552 1,582 4,685 4,328 5,943 Purchase Agreement for a cash consideration of Rs. 171 crore and a contingent consideration of Rs. 67 crore. The acquisition was completed

Non-controlling interest – – – – – during the quarter and accounted as a business combination which resulted in goodwill of Rs. 225 crore.

1,552 1,582 4,685 4,328 5,943

5. On October 9, 2009 the Company incorporated wholly-owned subsidiary, Infosys Public Services, Inc. Additionally during the quarter ended

Paid-up equity share capital (par value Rs. 5/- each,

December 31, 2009 the Company invested Rs. 24 crore (USD 5 million) in the subsidiary.

fully paid) 286 286 286 286 286

Share premium, Retained earnings and other components

of equity 22,134 17,265 22,134 17,265 18,908 Segment reporting (Consolidated – Audited)

(in Rs. crore)

Earnings per share (par value Rs. 5/- each)

Basic 27.33 28.72 81.00 76.56 104.89 Particulars Quarter ended Nine months ended Year ended

Diluted 27.30 28.69 80.90 76.42 104.71 December 31, December 31, March 31,

2009 2008 2009 2008 2009

Notes:

Revenue by industry segment

1. The reconciliation of net profit as per Indian GAAP and IFRS is as follows:

(in Rs. crore) Financial services 1,985 2,022 5,663 5,500 7,358

Particulars Three months ended Nine months ended Year ended Manufacturing 1,106 1,134 3,307 3,118 4,289

December 31, December 31, March 31, Telecom 928 969 2,752 2,962 3,906

2009 2008 2009 2008 2009 Retail 754 727 2,264 1,969 2,728

Consolidated net profit as per Indian GAAP 1,582 1,641 4,649 4,375 5,988 Others 968 934 2,812 2,509 3,412

Amortization of intangible assets and others (23) (4) (29) (10) (6) Total 5,741 5,786 16,798 16,058 21,693

Share-based compensation (IFRS 2) – (2) (1) (5) (7)

Less: Inter-segment revenue – – – – –

Consolidated net profit as per IFRS 1,559 1,635 4,619 4,360 5,975

Net revenue from operations 5,741 5,786 16,798 16,058 21,693

2. The Securities and Exchange Board of India (SEBI) had on November 9, 2009 issued a press release permitting listed entities having Segment profit before tax, depreciation and minority

subsidiaries to voluntarily submit the consolidated financial statements as per IFRS. Pending the notification of the circular, for the quarter interest:

ended December 31, 2009, the company has voluntarily prepared and published consolidated IFRS Financial Statements, in addition to

Financial services 727 716 1,977 1,768 2,374

preparing and publishing audited standalone and audited consolidated financial statements in accordance with Indian GAAP. Our statutory

auditors have, additionally, performed a review of the Consolidated IFRS financial statements as at and for the quarter and nine months ended Manufacturing 343 371 993 966 1,326

December 31, 2009 and have issued an unqualified review report. The IFRS numbers presented for fiscal 2009 are unaudited and have not Telecom 386 364 1,105 1,107 1,442

been reviewed. Upon issuance of the notification of the Circular by SEBI and change in Listing Agreement, we will only publish consolidated Retail 246 246 770 624 888

financial statements as per IFRS. Others 336 334 994 839 1,165

Total 2,038 2,031 5,839 5,304 7,195

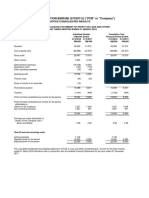

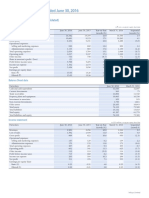

Audited consolidated financial results of Infosys Technologies Limited and its subsidiaries for

Less: Other un-allocable expenditure 231 187 685 533 761

the quarter and nine months ended December 31, 2009 (excluding un-allocable income)

(in Rs. crore, except per share data)

Operating profit before tax and minority interest 1,807 1,844 5,154 4,771 6,434

Particulars Quarter ended Nine months ended Year ended

December 31, December 31, March 31, Notes on segment information

2009 2008 2009 2008 2009

Principal segments

Income from software services, products and business

process management 5,741 5,786 16,798 16,058 21,693 The company’s operations predominantly relate to providing technology services, delivered to clients globally, operating in various industry

Software development and business process management segments. Accordingly, revenues represented along industries served constitute the primary basis of the segmental information set out above.

expenses 3,009 3,075 8,887 8,720 11,765 Segmental capital employed

Gross profit 2,732 2,711 7,911 7,338 9,928

Fixed assets used in the company’s business or liabilities contracted have not been identified to any of the reportable segments, as the fixed assets

Selling and marketing expenses 314 274 851 834 1,104

and support services are used interchangeably between segments. Accordingly, no disclosure relating to total segment assets and liabilities has

General and administration expenses 380 406 1,221 1,200 1,629 been made.

Operating profit before depreciation and minority

interest 2,038 2,031 5,839 5,304 7,195 By order of the Board

for Infosys Technologies Limited

Depreciation 231 187 685 533 761

Operating profit before tax and minority interest 1,807 1,844 5,154 4,771 6,434 Mysore, India S. D. Shibulal S. Gopalakrishnan

Other income, net 231 40 736 223 473 January 12, 2010 Chief Operating Officer Chief Executive Officer

Provision for investments 1 2 1 2 – and Director and Managing Director

Net profit before tax and minority interest 2,037 1,882 5,889 4,992 6,907

Provision for taxation 455 241 1,240 617 919

The Board has also taken on record the unaudited consolidated results of Infosys Technologies Limited and its

Net profit after tax and before minority interest 1,582 1,641 4,649 4,375 5,988

subsidiaries for the three months and nine months ended December 31, 2009, prepared as per International Financial

Minority interest – – – – –

Net profit after tax and minority interest 1,582 1,641 4,649 4,375 5,988

Reporting Standards (IFRS). A summary of the financial statements is as follows:

(in US$ million, except per ADS data)

Paid-up equity share capital (par value Rs. 5/- each,

fully paid) 286 286 286 286 286 Particulars Three months ended Nine months ended Year ended

Reserves and surplus 22,122 17,230 22,122 17,230 17,968 December 31, December 31, March 31,

Earnings per share (par value Rs. 5/- each) 2009 2008 2009 2008 2009

Basic 27.75 28.66 81.53 76.44 104.60 Revenues 1,232 1,171 3,508 3,542 4,663

Diluted 27.72 28.63 81.43 76.30 104.43 Cost of sales 700 661 2,005 2,049 2,699

Dividend per share (par value Rs. 5/- each) Gross profit 532 510 1,503 1,493 1,964

(Refer Note 2)

Net profit 334 332 964 960 1,281

Interim dividend – – 10.00 10.00 10.00

Earnings per American Depositary Share (ADS)

Final dividend – – – – 13.50

Total dividend – – 10.00 10.00 23.50 Basic 0.59 0.58 1.69 1.69 2.25

Total Public Shareholding# Diluted 0.59 0.58 1.69 1.68 2.25

Number of shares 37,39,14,056 36,87,28,400 37,39,14,056 36,87,28,400 36,87,57,435 Total assets 5,578 4,216 5,578 4,216 4,376

Percentage of shareholding 65.19 64.39 65.19 64.39 64.37 Cash and cash equivalents including certificates of deposit 1,972 1,989 1,972 1,989 2,167

Promoters and Promoter Group Shareholding

Pledged / Encumbered The reconciliation of net profit as per Indian GAAP and IFRS is as follows:

Number of shares* – 16,000 – 16,000 16,000 (in US$ million)

Percentage of shares (as a % of the total shareholding of

Particulars Three months ended Nine months ended Year ended

promoter and promoter group) – 0.02 – 0.02 0.02

December 31, December 31, March 31,

Percentage of shares (as a % of the total share capital of

2009 2008 2009 2008 2009

the company) – – – – –

Non-encumbered Consolidated net profit as per Indian GAAP 339 334 970 963 1,284

Number of shares 9,20,84,978 9,44,68,978 9,20,84,978 9,44,68,978 9,44,68,978 Amortization of intangible assets and others (5) (1) (6) (2) (2)

Percentage of shares (as a % of the total shareholding of Share-based compensation (IFRS 2) – (1) – (1) (1)

promoter and promoter group) 100.00 99.98 100.00 99.98 99.98 Consolidated net profit as per IFRS 334 332 964 960 1,281

Percentage of shares (as a % of the total share capital of

the company) 16.06 16.49 16.06 16.49 16.49 Statements in connection with this release may include forward-looking statements within the meaning of U.S. Securities laws intended to qualify for the “safe

harbor” under the Private Securities Litigation Reform Act. These forward-looking statements are subject to risks and uncertainties including those described

#

Total public shareholding as defined under Clause 40A of the Listing Agreement (excludes shares held by founders and American Depositary Receipt holders). in our SEC filings available at www.sec.gov including our Annual Report on Form 20-F for the year ended March 31, 2009, and our other recent filings, and

* Pledge released on April 13, 2009 actual results may differ materially from those projected by forward-looking statements. We may make additional written and oral forward-looking statements

Note: The audited results of Infosys Technologies Limited for the quarter and nine months ended December 31, 2009 is available on our website www.infosys.com but do not undertake, and disclaim any obligation, to update them.

Vous aimerez peut-être aussi

- Statement of Profit and LossDocument1 pageStatement of Profit and LossAbhilash JackPas encore d'évaluation

- Copy Treasury StocksDocument213 pagesCopy Treasury StocksJuren Demotor Dublin100% (2)

- CFA 1 Financial Reporting & AccountingDocument92 pagesCFA 1 Financial Reporting & AccountingAspanwz Spanwz100% (1)

- Kasha ToDocument26 pagesKasha ToAldrian Ala100% (1)

- Cash FlowsDocument26 pagesCash Flowsvickyprimus100% (1)

- Jawaban Quiz 2Document2 pagesJawaban Quiz 2Muhammad IrvanPas encore d'évaluation

- Business PlanDocument36 pagesBusiness PlanPopol Benavidez60% (10)

- Fap Chapter 3 Solution ManualDocument66 pagesFap Chapter 3 Solution Manualummara_javed69% (16)

- Computation of Gross ProfitDocument21 pagesComputation of Gross ProfitMariaAngelaAdanEvangelista100% (1)

- q3 and 9m Fy24 Financial Results AuditorsreportsDocument19 pagesq3 and 9m Fy24 Financial Results AuditorsreportsSadanand MahatoPas encore d'évaluation

- q4 and 12m Fy24 Financial Results AuditorsreportsDocument26 pagesq4 and 12m Fy24 Financial Results Auditorsreportsmehtaharshit0709Pas encore d'évaluation

- PETROBRASDocument5 pagesPETROBRASNacho DiazPas encore d'évaluation

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathorePas encore d'évaluation

- DangoteCement FY2018 AccountsDocument79 pagesDangoteCement FY2018 AccountsReuben GrahamPas encore d'évaluation

- Annexure 7 - Audited Financial Results For The Year Ended March 31 2011Document3 pagesAnnexure 7 - Audited Financial Results For The Year Ended March 31 2011PGurusPas encore d'évaluation

- Consolidated Fi Nancial Statements and Notes To The Consolidated Fi Nancial StatementsDocument5 pagesConsolidated Fi Nancial Statements and Notes To The Consolidated Fi Nancial Statementsria septiani putriPas encore d'évaluation

- Quarterly Report 20160331Document17 pagesQuarterly Report 20160331Ang SHPas encore d'évaluation

- Vitrox q42021Document17 pagesVitrox q42021Dennis AngPas encore d'évaluation

- Orascom - Interim Financial Report Q1 2020 FinalDocument28 pagesOrascom - Interim Financial Report Q1 2020 FinalTawfeeg AwadPas encore d'évaluation

- DRB HICOM Berhad Interim Report 31 December 2020 1Document30 pagesDRB HICOM Berhad Interim Report 31 December 2020 1hayatiammadPas encore d'évaluation

- BEIS Annual Report and Accounts 2020-21 Financial Statements and Trust Statement 25112021Document112 pagesBEIS Annual Report and Accounts 2020-21 Financial Statements and Trust Statement 25112021LukaPas encore d'évaluation

- Quarterly Report 20180331Document15 pagesQuarterly Report 20180331Ang SHPas encore d'évaluation

- Financial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Document10 pagesFinancial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderPas encore d'évaluation

- Eng Interim Report q4 2011 TablesDocument1 pageEng Interim Report q4 2011 TablessamPas encore d'évaluation

- 中期报告2011614Document54 pages中期报告2011614yf zPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Vitrox q42019Document17 pagesVitrox q42019Dennis AngPas encore d'évaluation

- Financial ResultsDocument44 pagesFinancial ResultshousePas encore d'évaluation

- Ar - 2018 - Ferrari - NV - Web - 0 (Dragged)Document1 pageAr - 2018 - Ferrari - NV - Web - 0 (Dragged)Sterling ArcherPas encore d'évaluation

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Document11 pagesRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaPas encore d'évaluation

- Unaudited Condensed Consolidated Income Statement: Misc BerhadDocument20 pagesUnaudited Condensed Consolidated Income Statement: Misc BerhadAzizi JaisPas encore d'évaluation

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanPas encore d'évaluation

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaPas encore d'évaluation

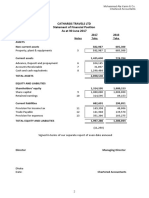

- Catersis Traves Ltd-2017 1Document16 pagesCatersis Traves Ltd-2017 1YenPas encore d'évaluation

- PARTEX Financial Statements 2010Document44 pagesPARTEX Financial Statements 2010Made2Web DeveloperPas encore d'évaluation

- Financial - Result - For The Financial Year Ended 31st March 2021Document20 pagesFinancial - Result - For The Financial Year Ended 31st March 2021Priyanshu PalPas encore d'évaluation

- Audited Consolidated-Statements - PAL 2022Document10 pagesAudited Consolidated-Statements - PAL 2022P patelPas encore d'évaluation

- 7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Document13 pages7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Quint WongPas encore d'évaluation

- Extract of Balance SheetDocument2 pagesExtract of Balance SheetBIPIN KUMAR SAHOOPas encore d'évaluation

- en PDFDocument49 pagesen PDFJ. BangjakPas encore d'évaluation

- Institute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesDocument11 pagesInstitute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesColleen BosmanPas encore d'évaluation

- Estado de Resultados Integrales Consolidado: Correspondiente Al Año Finalizado Al 31 de Diciembre de 2020 y 2019Document2 pagesEstado de Resultados Integrales Consolidado: Correspondiente Al Año Finalizado Al 31 de Diciembre de 2020 y 2019frmartinezPas encore d'évaluation

- Livestock Improvement Corporation Annual Report: For The Year Ended 31 May 2018Document28 pagesLivestock Improvement Corporation Annual Report: For The Year Ended 31 May 2018Rhytham KothariPas encore d'évaluation

- Vitrox q22020Document16 pagesVitrox q22020Dennis AngPas encore d'évaluation

- Vitrox q12008Document11 pagesVitrox q12008Dennis AngPas encore d'évaluation

- Ratio - Tesco AssignmentDocument11 pagesRatio - Tesco AssignmentaXnIkaran100% (1)

- Consolidated Income Statement For The Year Ended December 31, 2018Document1 pageConsolidated Income Statement For The Year Ended December 31, 2018Cresilda DelgadoPas encore d'évaluation

- Selecta Group - Q1 2023 Financial StatementsDocument22 pagesSelecta Group - Q1 2023 Financial StatementsJean Claude HechtPas encore d'évaluation

- ANNEXURE 4 - Q4 FY08-09 Consolidated ResultsDocument1 pageANNEXURE 4 - Q4 FY08-09 Consolidated ResultsPGurusPas encore d'évaluation

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanPas encore d'évaluation

- AR Ali 103Document1 pageAR Ali 103Lieder CLPas encore d'évaluation

- Vitrox q12015Document12 pagesVitrox q12015Dennis AngPas encore d'évaluation

- United Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Document40 pagesUnited Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Евно АзефPas encore d'évaluation

- Oppstar - Prospectus (Part 2)Document204 pagesOppstar - Prospectus (Part 2)kokueiPas encore d'évaluation

- Report For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)Document7 pagesReport For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)ashokdb2kPas encore d'évaluation

- 500 1000 Imo Result 20230215Document12 pages500 1000 Imo Result 20230215Contra Value BetsPas encore d'évaluation

- Fs Credo Ye 2017Document38 pagesFs Credo Ye 2017AzerPas encore d'évaluation

- Antler Fabric Printers (PVT) LTD 2016Document37 pagesAntler Fabric Printers (PVT) LTD 2016IsuruPas encore d'évaluation

- JIL Results 31122022Document12 pagesJIL Results 31122022shalini15_85Pas encore d'évaluation

- Mq-18-Results-In-Excel - tcm1255-522302 - enDocument5 pagesMq-18-Results-In-Excel - tcm1255-522302 - enbhavanaPas encore d'évaluation

- KPIs Bharti Airtel 04022020Document13 pagesKPIs Bharti Airtel 04022020laksikaPas encore d'évaluation

- Q2 2023 Financial SchedulesDocument30 pagesQ2 2023 Financial SchedulesVinieboy De mepperPas encore d'évaluation

- Vitrox q22018Document14 pagesVitrox q22018Dennis AngPas encore d'évaluation

- TXP MDA December 31 2019 FINALDocument47 pagesTXP MDA December 31 2019 FINALasraghuPas encore d'évaluation

- Assignment Briefs (Module 4)Document8 pagesAssignment Briefs (Module 4)aung sanPas encore d'évaluation

- TZero 2018 10-KDocument20 pagesTZero 2018 10-KgaryrweissPas encore d'évaluation

- Microsoft Corporation Financial Statements and Supplementary DataDocument43 pagesMicrosoft Corporation Financial Statements and Supplementary DataDylan MakroPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- LAS 4 Types of Major AccountDocument7 pagesLAS 4 Types of Major AccountFelicity BondocPas encore d'évaluation

- Budget and Budgetary Control Literature ReviewDocument7 pagesBudget and Budgetary Control Literature Reviewafmzsprjlerxio100% (1)

- Marasigan (Ledger & PCTB)Document17 pagesMarasigan (Ledger & PCTB)Mika CunananPas encore d'évaluation

- Full Test Bank For Financial Statement Analysis and Valuation 5Th Edition by Easton Mcanally Sommers Zhang PDF Docx Full Chapter ChapterDocument36 pagesFull Test Bank For Financial Statement Analysis and Valuation 5Th Edition by Easton Mcanally Sommers Zhang PDF Docx Full Chapter Chapterficodogdraw.gcim100% (9)

- MAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer PricingDocument4 pagesMAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer PricingAlliahData100% (1)

- Bonus ch15 PDFDocument45 pagesBonus ch15 PDFFlorence Louise DollenoPas encore d'évaluation

- Chapter 3Document60 pagesChapter 3Girma NegashPas encore d'évaluation

- GDA Final Report V2Document34 pagesGDA Final Report V2Shaheer EtimadPas encore d'évaluation

- Cambridge IGCSE™: Accounting 0452/23 October/November 2020Document14 pagesCambridge IGCSE™: Accounting 0452/23 October/November 2020ATTIQ UR REHMANPas encore d'évaluation

- Android App Development For Dummies 3rd EditionDocument377 pagesAndroid App Development For Dummies 3rd EditionSiva KarthikPas encore d'évaluation

- Istilah AkuntansiDocument6 pagesIstilah AkuntansiRio Fafan YoshinagaPas encore d'évaluation

- Liabilities and EquityDocument23 pagesLiabilities and Equityadmiral spongebobPas encore d'évaluation

- Seat Work 02 - DingcongDocument3 pagesSeat Work 02 - DingcongJheilson S. DingcongPas encore d'évaluation

- Also Distinction Between Capital and Revenue ReceiptsDocument15 pagesAlso Distinction Between Capital and Revenue ReceiptsSun MoonPas encore d'évaluation

- HE1-Allocation of Family Income and BudgetDocument4 pagesHE1-Allocation of Family Income and BudgetJellian LibresPas encore d'évaluation

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JPas encore d'évaluation

- p3 Acc 110 ReviewerDocument12 pagesp3 Acc 110 ReviewerRona Amor MundaPas encore d'évaluation

- Concept of Financial Statement and Financial RatiosDocument28 pagesConcept of Financial Statement and Financial RatiosPalash DongrePas encore d'évaluation

- Solution To Exercise Set Chapter 3-4Document22 pagesSolution To Exercise Set Chapter 3-4Pham Le Tram Anh (K16HCM)Pas encore d'évaluation

- Kennel Business PlanDocument15 pagesKennel Business PlanAndresVargasPas encore d'évaluation

- Accounting 1A Exam 1 - Spring 2014 - Section 1 - SolutionsDocument9 pagesAccounting 1A Exam 1 - Spring 2014 - Section 1 - SolutionsRishab KhandelwalPas encore d'évaluation

- Assigment 3Document1 pageAssigment 3Syakil AhmedPas encore d'évaluation