Académique Documents

Professionnel Documents

Culture Documents

Loan Sanction - Documents

Transféré par

Chini ChandrashekarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Loan Sanction - Documents

Transféré par

Chini ChandrashekarDroits d'auteur :

Formats disponibles

DOCUMENTS REQUIRED FROM NRI APPLICANT’s FOR HOME

LOAN SANCTION

1. One photograph of applicant (& co applicant, if any)-For Home loan application form

2. Latest Salary Certificate from the Employer on letterhead with seal mentioning

Name as in passport, Date of joining, Passport no., Designation , Latest salary and

perquisites

3. Copies of Salary slips of last 3 months

4. Copy of Employment Contract. (or Appointment letter)

5. Passport copies with valid Residence visa page

6. Copy of Work Permit/ Labour card / Photocopy of Identity card or any other proof of

work/employment issued by proper Govt. authorities

7. Copies of Local Bank Statements of latest 6 months (Salary Credit A/c)

8. Copies of 6 months NRE/NRO account statement (Installments are to be paid by way of

Post Dated Cheques from such a/c’s as per RBI guidelines) – In your case copies of the

savings bank a/c in Axis bank

Additional Documents

1. Copy of Loan details of Existing Loans ,if any and Any proof of Residence

2. Copy of the latest statement of Credit card/s.

3. Copy of Educational Qualification Certificates

4. Power of Attorney in DHFL Format. To be Attested by the officials of the Indian

Consulate/Embassy

Processing Fee

Processing fee cheque drawn on applicant’s NRI a/c or Re. draft payable at the place where the

application will be processed along with Application form

Property documents

Copies can be submitted in nearest branch where property located. This is required for Legal &

Technical checking by our staff before disbursement of sanctioned amount is made. Loan

Disbursement is subject to L & T Verification.

* Sanction validity:

• The validity of sanction shall be for a period of 3 months from the date of letter of

offer. Revalidation possible on individual merit. In case of lapse of sanction

period, the processing charges levied cannot be refunded.

* Repayment:

• The repayment shall commence in EMI’s from the next month after full

disbursement is made. EMI comprises of Principal and Interest

• PEMI (i.e. interest) is levied on the disbursed amount till full disbursement is

made.

* INTEREST RATES: ***

*** Variable Rate /Floating Rate - (Applicable as at time of Disbursement)

* Certain Originals may be needed for verification

Dewan Housing Finance Corporation ltd.-

Dubai - P.O. Box 48991, Office 211, Atrium Centre, Khalid Bin AL Walid Road (Bank Street), Bur

Dubai, UAE. Tel: 971 - 4-3524905 Fax 971 - 4-3524906, email: dubai@dhfl.com

Abu Dhabi - UAE sponsorship centre, Omier Bin Yousuf building /02 level, Landmark: next to

delma centre, Hamdan Street/Abu Dhabi, Tel: 971 – 2 -4945507

*** Fixed Rate- (Applicable as at time of Disbursement)

* Certain Originals may be needed for verification

Dewan Housing Finance Corporation ltd.-

Dubai - P.O. Box 48991, Office 211, Atrium Centre, Khalid Bin AL Walid Road (Bank Street), Bur

Dubai, UAE. Tel: 971 - 4-3524905 Fax 971 - 4-3524906, email: dubai@dhfl.com

Abu Dhabi - UAE sponsorship centre, Omier Bin Yousuf building /02 level, Landmark: next to

delma centre, Hamdan Street/Abu Dhabi, Tel: 971 – 2 -4945507

Vous aimerez peut-être aussi

- NRI Home ChecklistDocument3 pagesNRI Home ChecklistReema ChowdhuryPas encore d'évaluation

- BPI Family Housing Loans Requirements & ProcessDocument2 pagesBPI Family Housing Loans Requirements & ProcessAdrian FranciscoPas encore d'évaluation

- Home ChecklistDocument3 pagesHome ChecklisthomeloansPas encore d'évaluation

- Direct Housing Finance Scheme: BranchesDocument5 pagesDirect Housing Finance Scheme: BranchesGunjan Kumar BantiPas encore d'évaluation

- Document ChecklistDocument2 pagesDocument ChecklistSuresh IndhumathiPas encore d'évaluation

- Term Sheet-DD Work (Booking Charges) - 240329 - 133514Document4 pagesTerm Sheet-DD Work (Booking Charges) - 240329 - 133514Shailesh MeshramPas encore d'évaluation

- Checklist - Purchase of Flat or ConstructionDocument4 pagesChecklist - Purchase of Flat or ConstructionUdhasu PatkarPas encore d'évaluation

- Meaning of The LoanDocument26 pagesMeaning of The LoanHarmanjot Singh RiarPas encore d'évaluation

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativedesignmukeshPas encore d'évaluation

- Loan Application Form WebDocument10 pagesLoan Application Form WebSabuj SarkarPas encore d'évaluation

- Loan Application Form: CIN: L65922DL1988PLC033856Document10 pagesLoan Application Form: CIN: L65922DL1988PLC033856Lucky SinghPas encore d'évaluation

- DineshDocument10 pagesDineshShubham TripathiPas encore d'évaluation

- Internship ReportDocument9 pagesInternship ReportchanakyaPas encore d'évaluation

- Sop For Client Purchase of PropertyDocument3 pagesSop For Client Purchase of PropertyMary FuntoPas encore d'évaluation

- NRI Document Checklist - Merchant NavyDocument2 pagesNRI Document Checklist - Merchant NavyAvinash ChaurasiaPas encore d'évaluation

- Salary Dost Credit Policy: Loan Limit and TenureDocument11 pagesSalary Dost Credit Policy: Loan Limit and TenureAlpesh KulePas encore d'évaluation

- Finance Process & Terms & ConditionsDocument3 pagesFinance Process & Terms & ConditionsPalash PatankarPas encore d'évaluation

- Cash Credit: OverviewsDocument1 pageCash Credit: OverviewsViswa KeerthiPas encore d'évaluation

- Underwriter NotesDocument6 pagesUnderwriter Notessambamurthy sunkaraPas encore d'évaluation

- Registration Steps ProcessDocument2 pagesRegistration Steps ProcessngmihahPas encore d'évaluation

- Apr.12 - 871 App Nri FormDocument10 pagesApr.12 - 871 App Nri FormsnkrmPas encore d'évaluation

- BDO Biñan BranchDocument4 pagesBDO Biñan BranchRosel Aubrey RemigioPas encore d'évaluation

- Mitc PDFDocument3 pagesMitc PDFShreePas encore d'évaluation

- Credila Conversion of Accounts - Resident To Non ResidentDocument3 pagesCredila Conversion of Accounts - Resident To Non Residents8500537237Pas encore d'évaluation

- Loan SBPPDocument46 pagesLoan SBPPDrasti DesaiPas encore d'évaluation

- Isr Guidance and Forms TPLDocument11 pagesIsr Guidance and Forms TPLParag SaxenaPas encore d'évaluation

- Sbi Guidelines Checkoff ListDocument5 pagesSbi Guidelines Checkoff ListSubhashis ChatterjeePas encore d'évaluation

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- MCUS B0034 Full Doc Processing Checklist NRDocument3 pagesMCUS B0034 Full Doc Processing Checklist NRScott RoyvalPas encore d'évaluation

- Home Loan ProcessDocument1 pageHome Loan ProcessVinit JetwaniPas encore d'évaluation

- Application Transaction ProcedureDocument3 pagesApplication Transaction ProcedurefaridatunPas encore d'évaluation

- AnswerDocument8 pagesAnswerRohan ShresthaPas encore d'évaluation

- Welcome To Prosperous Living: Application FormDocument6 pagesWelcome To Prosperous Living: Application FormHeeresh Kumar AryaPas encore d'évaluation

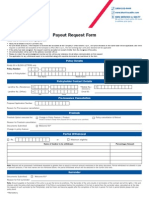

- Payout Request FormDocument2 pagesPayout Request FormSATHISHLATEST2005100% (11)

- Some of The Common Reasons For Delay in Sanction or Rejection of Loan ApplicationDocument2 pagesSome of The Common Reasons For Delay in Sanction or Rejection of Loan ApplicationpankajnsitPas encore d'évaluation

- Bye Laws of Various Authorities in Delhi NCR and Document To Be Taken To Mortgage in IciciDocument3 pagesBye Laws of Various Authorities in Delhi NCR and Document To Be Taken To Mortgage in IciciBiswajit DashPas encore d'évaluation

- Non Face To Face Account Opening FormDocument10 pagesNon Face To Face Account Opening FormAlvin Samuel PandianPas encore d'évaluation

- Bank Audit Check List & Procedure (Concurrent Audit) : IndexDocument12 pagesBank Audit Check List & Procedure (Concurrent Audit) : IndexCA Jay ThakurPas encore d'évaluation

- Pay-Out Request Form Ver1.1Document2 pagesPay-Out Request Form Ver1.1Mahendra AsawalePas encore d'évaluation

- List of Requirements Prior Turn inDocument1 pageList of Requirements Prior Turn indavid durianPas encore d'évaluation

- NOC Application 2022 1220 PDFDocument2 pagesNOC Application 2022 1220 PDFAshish ShankarPas encore d'évaluation

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaPas encore d'évaluation

- Small Biz LoanDocument4 pagesSmall Biz LoanJulian AlbaPas encore d'évaluation

- Change Bank Details FormDocument2 pagesChange Bank Details FormMustafa Bapai100% (1)

- Concurrent Audit Check ListDocument14 pagesConcurrent Audit Check Listrjamal566Pas encore d'évaluation

- Non Face To Face Form With AMB Declaration PDFDocument10 pagesNon Face To Face Form With AMB Declaration PDFrohit.godhani9724Pas encore d'évaluation

- 4 PDFDocument4 pages4 PDFsatish sharmaPas encore d'évaluation

- An Assignment of Project Appraisal ON Home LoanDocument16 pagesAn Assignment of Project Appraisal ON Home LoanSouvik BarmanPas encore d'évaluation

- Arvind BankDocument24 pagesArvind BankDarshan GedamPas encore d'évaluation

- Withdrawal Policy: Sl. No. Situation RefundDocument4 pagesWithdrawal Policy: Sl. No. Situation RefundSaiyed IqbalPas encore d'évaluation

- Risalah Ansuran Bulanan Rumah Ogos 2012 EngDocument4 pagesRisalah Ansuran Bulanan Rumah Ogos 2012 EngcheqmatePas encore d'évaluation

- Welcome Letter PDFDocument4 pagesWelcome Letter PDFVinay KumarPas encore d'évaluation

- RMT-1C 3Document3 pagesRMT-1C 3AkashPas encore d'évaluation

- Loan Process & ProcedureDocument4 pagesLoan Process & ProcedureAscent CorporationPas encore d'évaluation

- Irr 942 PDFDocument33 pagesIrr 942 PDFjc cayananPas encore d'évaluation

- 25 S49Loans, GoldLoans, UBLN, SuretyLoanDocument13 pages25 S49Loans, GoldLoans, UBLN, SuretyLoanSyed FaisalPas encore d'évaluation

- Check List For Loan - Housing - MortgageDocument1 pageCheck List For Loan - Housing - Mortgagecrmc999Pas encore d'évaluation

- New Era University: Etbanan@neu - Edu.phDocument9 pagesNew Era University: Etbanan@neu - Edu.phRed YuPas encore d'évaluation

- HL Product 8may2012Document11 pagesHL Product 8may2012kumargaurav786Pas encore d'évaluation

- Show Catalogue: India's Leading Trade Fair For Organic ProductsDocument58 pagesShow Catalogue: India's Leading Trade Fair For Organic Productsudiptya_papai2007Pas encore d'évaluation

- Ost BSMDocument15 pagesOst BSMTata Putri CandraPas encore d'évaluation

- Engineering Management Past, Present, and FutureDocument4 pagesEngineering Management Past, Present, and Futuremonty4president100% (1)

- Solution and AnswerDocument4 pagesSolution and AnswerMicaela EncinasPas encore d'évaluation

- Assignment F225summer 20-21Document6 pagesAssignment F225summer 20-21Ali BasheerPas encore d'évaluation

- AGM Minutes 2009Document3 pagesAGM Minutes 2009Prateek ChawlaPas encore d'évaluation

- Jordan Leavy Carter Criminal ComplaintDocument10 pagesJordan Leavy Carter Criminal ComplaintFOX 11 NewsPas encore d'évaluation

- Upsc 1 Year Study Plan 12Document3 pagesUpsc 1 Year Study Plan 12siboPas encore d'évaluation

- Eliza Valdez Bernudez Bautista, A035 383 901 (BIA May 22, 2013)Document13 pagesEliza Valdez Bernudez Bautista, A035 383 901 (BIA May 22, 2013)Immigrant & Refugee Appellate Center, LLCPas encore d'évaluation

- Christmas Pop-Up Card PDFDocument6 pagesChristmas Pop-Up Card PDFcarlosvazPas encore d'évaluation

- A2 UNIT 2 Extra Grammar Practice RevisionDocument1 pageA2 UNIT 2 Extra Grammar Practice RevisionCarolinaPas encore d'évaluation

- Airport Planning and Engineering PDFDocument3 pagesAirport Planning and Engineering PDFAnil MarsaniPas encore d'évaluation

- Lesson 9 Government Programs and Suggestions in Addressing Social InequalitiesDocument25 pagesLesson 9 Government Programs and Suggestions in Addressing Social InequalitiesLeah Joy Valeriano-QuiñosPas encore d'évaluation

- QBE 2022 Sustainability ReportDocument44 pagesQBE 2022 Sustainability ReportVertika ChaudharyPas encore d'évaluation

- Metaphysics Aristotle Comm Aquinas PDFDocument778 pagesMetaphysics Aristotle Comm Aquinas PDFhsynmnt100% (1)

- Warnord 041600zmar19Document4 pagesWarnord 041600zmar19rjaranilloPas encore d'évaluation

- Top 10 Division Interview Questions and AnswersDocument16 pagesTop 10 Division Interview Questions and AnswersyawjonhsPas encore d'évaluation

- S No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCADocument10 pagesS No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCAarorathevipulPas encore d'évaluation

- Donralph Media Concept LimitedDocument1 pageDonralph Media Concept LimitedDonRalph DMGPas encore d'évaluation

- Security Incidents and Event Management With Qradar (Foundation)Document4 pagesSecurity Incidents and Event Management With Qradar (Foundation)igrowrajeshPas encore d'évaluation

- Gillette vs. EnergizerDocument5 pagesGillette vs. EnergizerAshish Singh RainuPas encore d'évaluation

- Bsee25 Lesson 1Document25 pagesBsee25 Lesson 1Renier ArceNoPas encore d'évaluation

- RamadanDocument12 pagesRamadanMishkat MohsinPas encore d'évaluation

- Music of The Medieval PeriodDocument33 pagesMusic of The Medieval PeriodEric Jordan ManuevoPas encore d'évaluation

- Session - 30 Sept Choosing Brand Elements To Build Brand EquityDocument12 pagesSession - 30 Sept Choosing Brand Elements To Build Brand EquityUmang ShahPas encore d'évaluation

- ARTA Art of Emerging Europe2Document2 pagesARTA Art of Emerging Europe2DanSanity TVPas encore d'évaluation

- Chinese and Korean Art Before 1279 CeDocument67 pagesChinese and Korean Art Before 1279 Ceragunath palaniswamyPas encore d'évaluation

- Noah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFDocument358 pagesNoah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFGabriel Reis100% (1)

- Leander Geisinger DissertationDocument7 pagesLeander Geisinger DissertationOrderPapersOnlineUK100% (1)

- Lease FinancingDocument17 pagesLease FinancingPoonam Sharma100% (2)