Académique Documents

Professionnel Documents

Culture Documents

Summary - Investment Analysis

Transféré par

thetubby1Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Summary - Investment Analysis

Transféré par

thetubby1Droits d'auteur :

Formats disponibles

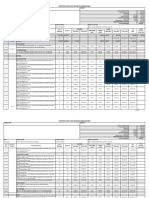

Sample Property Apartments 28.

Units Your Your Name

1234 Elm Street, Dallas, Texas 75225 Corporate Your Company

Year 1 - Starting Point Second Year - Stabilized Logo 123 Maple Avenue, Suite 5600

Apart Average Unit Dallas, Texas 75225

Unit S.F. Quant Size current rents Rent Rent Rent 214-555-1212

660 1 1/1 $600 $600 $618 $618 Investment Analysis Summary

800 27 2/1 $725 $19,575 $747 $20,162 ASKING PRICE: $ 1,070,000

Purchase (Offer) Price $ 900,000 CAP Rate

Price per Unit: $ 32,143

Number of Units: 28. Units

Down Payment $180,000 9.37%

Closing/Rehab Costs $10,800 Property Grade

Total Cash Needed $190,800

1st Year ROI

Stablized ROI

15.56%

15.95% C

Monthly Rental Income $20,175 3.00% $20,780 Does This Property Pass the Minimum Criteria?

Total Rentable Square Feet: 23,661 Rent Escalation 2nd Year Performance Ratio Investor Minimums This Property

Average Unit SF: 845 CAP RATE 7.00% 9.37%

Income Year 1 Stabilized GRM 5.00 3.72

Rent (Potential Rental Income) $242,100 $249,363 Net Income ROI -1.00% 2.79%

Utility Reimbursement Cash on Cash ROI 12.00% 15.56%

Miscellaneous $2,201 Total Return on Investment 16.00% 19.78%

Laundry $924 IRR - After Tax - 8 CAP 20.00% 43.35%

minus: Collections, Loss to Lease, Etc. 2% ($4,842) DSCR 1.20 1.54

minus: Vacancy Factor 5% ($12,105) 7% ($17,455) Break-Even Ratio 89.0% 87.0%

Total Effective Gross Income (EGI): $228,278 $231,908 Does This Property Pass the Minimum Criteria? YES

Re-Sale CAP Rate 8.00% Hold in # of Years

Increase /

Expenses % of EGI $/Unit Year 1 Decrease Stabilized Estimated Sale Price $ 1,331,651 5 Years

Property Taxes 10.05% $ 820 $22,950 2.00% $23,409 Loan Information

Franchise Tax 0.71% $ 58 $1,622 $1,654 Down Payment: 20% $180,000

Utilities 26.28% $ 2,143 $60,000 $61,200 Loan Amount: 80% $720,000

Insurance 2.33% $ 190 $5,320 $5,426 Loan Interest Rate: 6.50%

New Loan

On-site Payroll 9.77% $ 797 $22,308 $22,754 Amortization Period 30

Maint./MR Supplies 4.36% $ 355 $9,946 $10,145 Property Information

Admin. / Misc. 2.54% $ 207 $5,796 $5,912 Land Size in Acres: 0.98 Acres

Contract Services 1.95% $ 159 $4,452 $4,541 Land Size in SF: 42,623 SF

Management Fee 5.07% $ 414 $11,584 $11,816 Units/Acre: 28.62 Units per Acre

63.07% Total Expenses: $143,978 IREM $146,857 Leasable Area: 23,661 Square Feet

Expenses per Unit $5,142 $4,228 $5,245 Roofs: Pitched

Expenses per Square Foot $6.09 $5.18 $6.21 Type HVAC: 2-pipe Chiller

Net Operating Income $84,300 $85,050 Metering: Electric: Master

Cap Rate @ $ 900,000 9.37% Gas: Master

Re-sale Value if sold at this CAP Rate & this NOI 7.00% $1,215,002 Water: Master

Misc. Notes about Property

EGI Effective Gross Income $228,278 $231,908 Property Grade C

Expenses Operating Expenses $143,978 $146,857 Area Grade C

NOI Net Operating Income $84,300 $85,050 Actual Current Occupancy 95%

Debt Service Proposed $54,611 $54,611 Neighborhood direction Stable

Cash Flow Net Income $29,689 $30,439 Age of Property 1968

Return on Investment 15.56% 15.95%

See attachments for Budget, Cash Flows, Resale and IRR calculations Buyer's Offer Analysis

Sale Price $ 900,000 Price CAP RATE Note

Down Payment at 20% % down $180,000 $ 1,070,000 7.88% Asking Price

Financing at 6.50% % interest rate - 1st Note $720,000 $ 900,000 9.37% Suggested MAX

Subtotal $900,000 $ 867,900 9.71%

Renovation + Closing Costs $10,800 $ 835,800 10.09%

Total Cost $910,800 $ 803,700 10.49%

$ 771,600 10.93% Suggested Start

Cash Requirement

Offer Price Analysis

Down Payment $180,000

$1,500,000

Est. Closing Costs $10,800 O P Asking Price

Renovation f r

$1,000,000

Total Cash $190,800 Insert Picture(s) Here

f i $500,000

e c

Please see attached Budget, Actual Rent Roll and Financials (if available), Rent Comparables, and Sales Comparables. The above and $-

attached Budget numbers were derived from property actuals, industry and sub-market norms, and over 20 years of multi-family

r e

7.88% 9.37% 9.71% 10.09% 10.49% 10.93%

property management experience. Please read the below Disclaimer.

MAX Offer Price CAP Rates at Different Offer Prices

DISCLAIMER: This analysis is not all inclusive nor do we guarantee any portion. It is to be used as a projection analysis only and is not to be considered fact. A thorough investigation is recommended during the inspection and feasability period. This package has been

prepared for informational purposes only to assist a potential purchaser in determining whether it wishes to proceed with an in depth investigation of the property. The information contained within this investment analysis has been derived from information deemed reliable or

may even be estimated information. However, it is subject to errors, omissions, price change, and/or withdrawal, and no warranty is made as to the accuracy. Further, no warranties or representations shall be made by MBP Capital, Inc. and/or its agents, representatives, or

affiliates regarding oral statements which have been made in the discussion of the above property. This presentation was sent to the recipient under the assumption that he is a buying principal unless otherwise agreed to in writing. Any potential purchaser of this subject

© Intellectual Property of MBP Capital, Inc.

Vous aimerez peut-être aussi

- Davenport, FL 33897: 15% Down With Mi Financed ProformaDocument3 pagesDavenport, FL 33897: 15% Down With Mi Financed ProformaManuel CamachoPas encore d'évaluation

- American Valley MHPDocument21 pagesAmerican Valley MHPDenise MathrePas encore d'évaluation

- APOD - A Sample of The ReportDocument1 pageAPOD - A Sample of The ReportJames R Kobzeff100% (1)

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoPas encore d'évaluation

- Week4 ROIC Tree Group ExerciseDocument1 pageWeek4 ROIC Tree Group Exercise刘春晓Pas encore d'évaluation

- Nyse Aan 2007Document52 pagesNyse Aan 2007gaja babaPas encore d'évaluation

- Iqor Call Center: 6000 New Way, Klamath Falls, or 97601Document9 pagesIqor Call Center: 6000 New Way, Klamath Falls, or 97601DANICA QUIOMPas encore d'évaluation

- IA 3 Chapter 20 River CoDocument1 pageIA 3 Chapter 20 River CoPrytj Elmo QuimboPas encore d'évaluation

- AltitudeWestside FLYERDocument2 pagesAltitudeWestside FLYERchargers2010Pas encore d'évaluation

- DVT Dashboard-1Document1 pageDVT Dashboard-1Aadesh SrivastavPas encore d'évaluation

- Feasobility SpeadsheetDocument4 pagesFeasobility Speadsheetramadhan lazrdPas encore d'évaluation

- Busines Summary - Sjms Coal: Un. Variable & Data ValueDocument1 pageBusines Summary - Sjms Coal: Un. Variable & Data ValueRino ErmawanPas encore d'évaluation

- Apartment Analyse FormDocument5 pagesApartment Analyse FormWillie Adams III100% (1)

- MT2 Ch13Document7 pagesMT2 Ch13api-3725162100% (1)

- Analyze Real Estate InvestmentDocument1 pageAnalyze Real Estate InvestmentHisExcellencyPas encore d'évaluation

- Property Name: Important CalculationsDocument2 pagesProperty Name: Important Calculationsapi-28625429Pas encore d'évaluation

- Real Estate Development 101Document19 pagesReal Estate Development 101Ramani K100% (2)

- Construction Cost Estimate BreakdownDocument5 pagesConstruction Cost Estimate BreakdownSignificant AntPas encore d'évaluation

- Burger King - Aiken, SC OM PDFDocument19 pagesBurger King - Aiken, SC OM PDFAnonymous vIdlWledPas encore d'évaluation

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaPas encore d'évaluation

- You Exec - KPI Dashboards Pt1 FreeDocument11 pagesYou Exec - KPI Dashboards Pt1 FreeManishPas encore d'évaluation

- Extra Payment CalculatorDocument12 pagesExtra Payment CalculatorZafar AhmedPas encore d'évaluation

- LECTURE NOTES-Translation of Foreign FSDocument4 pagesLECTURE NOTES-Translation of Foreign FSGenesis CervantesPas encore d'évaluation

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaPas encore d'évaluation

- Correct Unit Mix ApodDocument2 pagesCorrect Unit Mix Apodassistant_sccPas encore d'évaluation

- Earnings Statement: Pay SummaryDocument3 pagesEarnings Statement: Pay Summary9qrt6c7w5bPas encore d'évaluation

- CH 12 - SolutionDocument50 pagesCH 12 - SolutionMuhammad RehmanPas encore d'évaluation

- Financial Profit & Loss KPI Dashboard: Open Index 80 % Income StatementDocument11 pagesFinancial Profit & Loss KPI Dashboard: Open Index 80 % Income StatementArturo MunozPas encore d'évaluation

- Re I Property AnalyzerDocument1 pageRe I Property AnalyzerUcok DedyPas encore d'évaluation

- Khairun Nadia Binti Mohamad Zuber NO 36 Jalan Bintang 7 Desa Rening Jaya 44200 RASADocument6 pagesKhairun Nadia Binti Mohamad Zuber NO 36 Jalan Bintang 7 Desa Rening Jaya 44200 RASAMohdMuazPas encore d'évaluation

- Project Red: Problem 9-3: Daisy CompanyDocument2 pagesProject Red: Problem 9-3: Daisy CompanyJPPas encore d'évaluation

- ACCT 423 Cheat Sheet 1.0Document2 pagesACCT 423 Cheat Sheet 1.0HelloWorldNowPas encore d'évaluation

- 1Q MA Emerging Market Financial Advisory ReviewDocument16 pages1Q MA Emerging Market Financial Advisory ReviewRahul MahajanPas encore d'évaluation

- Financial Feasibility SampleDocument66 pagesFinancial Feasibility SampleKimmyPas encore d'évaluation

- 120 Sherman Ave. S.Document1 page120 Sherman Ave. S.TonyGintPas encore d'évaluation

- Whiteboard Feb 01, 2021Document11 pagesWhiteboard Feb 01, 2021arun maheshwariPas encore d'évaluation

- L2WGDG08386796 SoastatementnewDocument4 pagesL2WGDG08386796 SoastatementnewAkash MulagundmathPas encore d'évaluation

- Material - Gestión Financiera - Excel Master Class Investment Decision MakingDocument8 pagesMaterial - Gestión Financiera - Excel Master Class Investment Decision MakingjessicaPas encore d'évaluation

- West City Medical Response - Provider SummaryDocument1 pageWest City Medical Response - Provider SummaryTomal HalderPas encore d'évaluation

- Entrep 07 Activity 1Document2 pagesEntrep 07 Activity 1Ronald varrie BautistaPas encore d'évaluation

- P.T. Valbury Asia Futures Sigit Pamungkas: HoldingsDocument4 pagesP.T. Valbury Asia Futures Sigit Pamungkas: HoldingsSigit PamungkasPas encore d'évaluation

- Catalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023Document4 pagesCatalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023catalbasPas encore d'évaluation

- Vehicle Renting Business Financials 20.27.05Document5 pagesVehicle Renting Business Financials 20.27.05Faizal NugrohoPas encore d'évaluation

- Updated Concorde Amber Price Sheet 2016Document1 pageUpdated Concorde Amber Price Sheet 2016Mudit SrivastavaPas encore d'évaluation

- Rate Buydown FlyerDocument1 pageRate Buydown FlyerKen CaianiPas encore d'évaluation

- Form47 1Document2 pagesForm47 1Myreddy VijayaPas encore d'évaluation

- IAS 23 Borrowing CostsDocument6 pagesIAS 23 Borrowing CostsfungilismPas encore d'évaluation

- Budget Murujuy ApartmentsDocument15 pagesBudget Murujuy ApartmentsJaime CuelloPas encore d'évaluation

- Bedford-Union Armory Financial DocumentDocument1 pageBedford-Union Armory Financial DocumentThe Brooklyn PaperPas encore d'évaluation

- ROI Analyzer Boot Camp Version - 20200319Document65 pagesROI Analyzer Boot Camp Version - 20200319Kateryna BondarenkoPas encore d'évaluation

- Iesha Indi July Statement 2021Document1 pageIesha Indi July Statement 2021Sharon JonesPas encore d'évaluation

- Income Property Cash Flow3Document1 pageIncome Property Cash Flow3CraigFrazerPas encore d'évaluation

- Mixed Bank F3-2020 - AnswerDocument13 pagesMixed Bank F3-2020 - AnswerPhuong ThuyPas encore d'évaluation

- Get DocumentDocument2 pagesGet DocumentsadasdsaPas encore d'évaluation

- Nipro PharmaDocument1 pageNipro PharmaMAHMUDUL HASANPas encore d'évaluation

- Nicholas Indi July Statement 2021Document1 pageNicholas Indi July Statement 2021Sharon JonesPas encore d'évaluation

- 10 YrDocument1 page10 Yrapi-25887578Pas encore d'évaluation

- Sweet Beginning Co-PrintDocument2 pagesSweet Beginning Co-PrintPrince Mico SarcinoPas encore d'évaluation

- 2B Balance SheetDocument4 pages2B Balance SheetChristian LeejohnPas encore d'évaluation

- 1 Rural Indebtedness, Assets and Credit: Inter-State Variations in IndiaDocument4 pages1 Rural Indebtedness, Assets and Credit: Inter-State Variations in IndiaashwatinairPas encore d'évaluation

- Marathon Sponser ProposalDocument9 pagesMarathon Sponser ProposalPrabahar RajaPas encore d'évaluation

- CA PracticeDocument2 pagesCA PracticeNatalia CalaPas encore d'évaluation

- 5Document15 pages5balwantPas encore d'évaluation

- General Financial Accounting TestDocument9 pagesGeneral Financial Accounting TestDuas and Urdu Dramas/Movies100% (1)

- L Oréal Travel Retail Presentation SpeechDocument6 pagesL Oréal Travel Retail Presentation Speechsaketh6790Pas encore d'évaluation

- Our Friends at The Bank PDFDocument1 pageOur Friends at The Bank PDFAnnelise HermanPas encore d'évaluation

- For: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXDocument2 pagesFor: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXLiza L. PadriquezPas encore d'évaluation

- 1 .Operating Ratio: Year HUL Nestle Britannia MaricoDocument17 pages1 .Operating Ratio: Year HUL Nestle Britannia MaricoSumith ThomasPas encore d'évaluation

- Interweave Knits Sum13Document124 pagesInterweave Knits Sum13Michelle Arroyave-Mizzi100% (25)

- Answer KeysDocument6 pagesAnswer Keyspolina2707562% (13)

- Bien Cuit ProposedGrandCentalMenuDocument3 pagesBien Cuit ProposedGrandCentalMenuDaniela GalarzaPas encore d'évaluation

- Bar GraphDocument16 pagesBar Graph8wtwm72tnfPas encore d'évaluation

- Income Statement PDFDocument4 pagesIncome Statement PDFMargarete DelvallePas encore d'évaluation

- Accrual Process For Perpetual Accruals - PoDocument8 pagesAccrual Process For Perpetual Accruals - PokolleruPas encore d'évaluation

- Wells Fargo Preferred CheckingDocument3 pagesWells Fargo Preferred CheckingAarón CantúPas encore d'évaluation

- Hul Marketing Starategies Over The YearsDocument11 pagesHul Marketing Starategies Over The YearsJay Karan Singh ChadhaPas encore d'évaluation

- CHAPTER 1 For Cebu Port RedevelopmentDocument7 pagesCHAPTER 1 For Cebu Port RedevelopmentHonie CastanedaPas encore d'évaluation

- Tugas Bahasa Inggris Semester 1Document1 pageTugas Bahasa Inggris Semester 1Dody LastarunaPas encore d'évaluation

- Excerpt PDFDocument10 pagesExcerpt PDFAvish GreedharryPas encore d'évaluation

- SR05 - Amruth Pavan Davuluri - How Competitive Forces Shape StrategyDocument14 pagesSR05 - Amruth Pavan Davuluri - How Competitive Forces Shape Strategyamruthpavan09Pas encore d'évaluation

- Tata-Corus Acquisition: Group2Document25 pagesTata-Corus Acquisition: Group2Bharti GuptaPas encore d'évaluation

- James Montier WhatGoesUpDocument8 pagesJames Montier WhatGoesUpdtpalfiniPas encore d'évaluation

- Data StructureDocument6 pagesData Structuremohit1485Pas encore d'évaluation

- Atlantic Computer: A Bundle of Pricing Options Group 4Document16 pagesAtlantic Computer: A Bundle of Pricing Options Group 4Rohan Aggarwal100% (1)

- Money Growth and InflationDocument52 pagesMoney Growth and InflationMica Ella GutierrezPas encore d'évaluation

- Charlotte Addendum 1Document6 pagesCharlotte Addendum 1Danny InkleyPas encore d'évaluation

- Fairtrade Quiz For Children 2012Document3 pagesFairtrade Quiz For Children 2012pauricbanPas encore d'évaluation

- Accounting Changes and Error AnalysisDocument39 pagesAccounting Changes and Error AnalysisIrwan Januar100% (1)

- MyDocument33 pagesMyAnubhav GuptaPas encore d'évaluation