Académique Documents

Professionnel Documents

Culture Documents

Budget 1 2011 3 2 21

Transféré par

Kumar Makarand BhaskerDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Budget 1 2011 3 2 21

Transféré par

Kumar Makarand BhaskerDroits d'auteur :

Formats disponibles

THE TIMES OF INDIA, MUMBAI

WEDNESDAY, MARCH 2, 2011 BUDGET: THE DAY AFTER 19

Healthcare service levy On social sector allocation,

FM doesn’t walk the talk

may be rolled back

TIMES NEWS NETWORK

Sidhartha & Surojit Gupta | TNN

New Delhi: Pranab

Mukherjee might have spent

Little To

Cheer

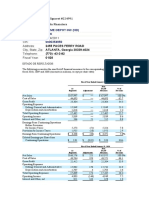

Social sector

Agriculture

2010-11

1,86,927

17,695

2011-12 % change

1,99,187

17,523

6.6

-1.0

As for the subsidy themselves,

in case of fertiliser, Mukher-

jee has budgeted for decrease

of 9% (nearly Rs 5,000 crore)

an hour trying to emphasize About, Health 25,055 30,456 21.6 while accounting for a burden

New Delhi: Caught between

public outcry and Congress

reservations, the government

on Tuesday indicated that it

INDIA his government’s inclusive

agenda and focus on infra-

structure but it does not seem

to have translated into actu-

Mr FM Education

Rural devpt

Subsidies

54,548

89,629

1,61,795

63,363

87,845

1,35,567

16.2

-2.0

-16.2

of Rs 50,000 crore.

The finance minister told

industry captains on Tues-

day that he has actually pro-

was willing to review the Bud- ON THE SICK BED al allocation. Fertilizer 55,215 50,245 -9.0 vided more than what has

get proposal to levy a service His social sector spending, Food 68,021 61,606 -9.4 been done in the past few

charge on healthcare costs of based on a comparison be- Oil 38,559 23,716 -38.5 years. In any case, he said,

individuals. But those opting Public spending on health | tween the Budget estimates the government has made the

for medical insurance might 0.94% of GDP among lowest for the next financial year and Infrastructure 56,509.25 60,145.00 6.4 process more transparent by

have to remain under the am- in the world revised estimates for this year, Civil aviation 2,656 2,394 -9.9 providing cash subsidy in-

bit of the levy. Drugs accounted translate into a 6.56% increase Power 8,552 9,507 11.2 stead of resorting to issuing

In comparison, the figure for 72% of the

‘‘Whether the service tax in allocation for four min- Roads 25,563 26,438 3.4 bonds, which were not ac-

will be on 25-bed hospitals or

stands at 14% in the total private out-of- istries — health, education, counted for in the Budget.

whether it will be on all tests Maldives, 29% in Bhutan, pocket expenditure Source: Lancet rural development and agri- Shipping 1,605 1,806 12.5 Though the expectation is

is something that can be dis- 53% in Sri Lanka, 31% in culture (see table). Within this, Railways 18,133.25 20,000 10.3 that the government will have

cussed,’’ revenue secretary Thailand and 61% in China 39 mn Indians pushed into 47% of hospital admissions the allocation for ministries Amounts in crore to allocate more money for

Sunil Mitra said. Indians have to pay 80% poverty from ill health every yr in rural India and 31% of agriculture and rural de- subsidies, Mukherjee said he

Finance minister Pranab of their medical expenses in urban India financed by velopment, which is respon- the actual increase in alloca- if the assistance given to rail- could not take a call now as

Mukherjee in his Budget pro-

30% of rural Indians didn’t loans and the sale of assets sible for the NREGA, have de- tion works out to around 12%. ways and India Infrastructure oil prices were highly volatile.

from their pocket go for treatment for financial

posed to levy 5% service tax creased marginally. The story is similar in five Finance Company Ltd from The government’s calcu-

on all services provided by 74% of this expenditure reasons in 2004, up from 15% Between 1986 and 2004, avg There is a significant in- infrastructure ministries — the department of economic lations have come under crit-

centrally air-conditioned clin- incurred for outpatient in 1995. In cities, the figure was real expenditure per hospital crease in the allocation for ed- power, roads, shipping, rail- affairs have been included. In icism from economists who

ical establishments with 25 treatment, not hospital care 20%, up from 10% in 1995 admission increased 3 times ucation (16%) and health ways, communications & IT addition, the department expect that the projection of

beds. In addition, tests at di- (21.5%). In value terms, this and civil aviation — with the housed in the finance min- 4.6% of GDP for 2011-12 will

agnostic clinics are proposed care service providers and ing on healthcare was low, holders. ‘‘If the view is that it translates into Rs 8,815 crore last two seeing a decrease in istry is providing funds for be overshot.

to be brought under the levy. those going to private hospi- something that Pranab should not be taxed, we will for the two departments of the allocation for 2011-12. Cumu- strengthening the PPP and vi- “We believe the current

Consultant doctors would be tals and diagnostic centres, Mukherjee acknowledged. look at it,’’ he said, adding that HRD ministry and Rs 5,401 latively, they have seen their ability gap funding. government expenditure pro-

part of the levy too. Against government officials sug- P N Arora, MD of Yasho- a negative list of services, crore for health ministry. allocation increase by around In case of the ministries jections can eventually throw

the 10% service tax levy, gested that the levy would im- da Hospital, argued that gov- which will not be subjected to Of the Rs 8,815 crore that 3.5% to around Rs 77,000 crore. that administer the three large upside surprise and put

Mukherjee had proposed 50% pact only a handful of people ernment should not make a levy under the Goods & Ser- Mukherjee has earmarked for In his Budget speech, main subsidies — oil, food and upward pressure on the

abatement, resulting in a to- who use high-end medical healthcare costlier. vices Tax regime would be school and secondary educa- Mukherjee had said that he fertilizer — it is not about an deficit numbers,” Barclays

tal levy of 5%. care facilities. Later, Mitra told TOI that prepared. tion, Rs 1,900 crore is the ad- has raised the allocation for increase in the allocation. It’s Capital economists Sid-

Congress sources indicat- ‘‘It is inhuman to put fur- the big impact of the propos- Congress is concerned ditional mop up from the edu- infrastructure by 23.3% to Rs a story of lower availability dhartha Sanyal and Kumar

ed the party would urge ther burden. It is the aam al was in case of individuals that service tax on diagnos- cation cess. Counting that out, 2.14 lakh crore. It is not clear of funds, at least to begin with. Rachapudi said in a note.

Mukherjee to withdraw the admi who will have to bear the and hinted that the tax would tics and healthcare may sour

unpopular proposal that can burden. It’s cruelty,’’ Naresh apply for those using a med- the otherwise pleasant post-

make the ruling party vul-

nerable to the opposition’s

charge of being anti-poor.

Party leaders are sure 25-

Trehan, cardiac surgeon and

chairman & managing direc-

tor of Medanta, said during a

post-Budget interaction with

ical cover whether purchased

in their individual capacity

or through a corporate tie-up.

Asked if healthcare should

budget mood. Party leaders

feel the provision would di-

rectly hit the poor consumers

seeking healthcare and ar-

GDP gallops but spending on

bed hospitals would pass on the

additional burden to patients,

thus annoying voters when

Congress cannot afford to.

Amid protests from health-

the finance minister.

Apollo Hospital’s Shobana

Kamineni too sought a roll-

back of the ‘‘retrograde step’’

given that government spend-

be taxed given that several do

not have access to medical fa-

cilities, Mitra said the gov-

ernment was willing to dis-

cuss the issue with the stake-

gued it would have been bet-

ter if the tax was levied on

super-speciality hospitals

which were owned by and

cater to the rich.

public health schemes shrinks

Rema Nagarajan has gone down.

TIMES INSIGHT GROUP Recipe for disaster? Quite inexplicably, despite

the increase in the incidence

‘Misery tax prescription Most drug

prices likely

B

elying the celebration

in the Budget of a “re-

markable fiscal year”

and the return of the econo-

National health programmes

National Programme for Prevention

2009-10

(Actual)

in Cr

2011-12 Difference in

(Budget)

in Cr

allocation

2009-11 (%)

and the geographical spread

of vector borne diseases such

as malaria, dengue, chikun-

gunya and Japanese en-

will have domino effect’ to go up

my to “its pre-crisis growth

trajectory”, some of the most

crucial public health pro-

grammes have suffered

& Control of Diabetes,

Cardiovascular Disease and Stroke

National Vector Borne Disease

Control Programme

7.36

568.08 437.28

20 172

-23

cephalitis, the budget of the

National Vector Borne Dis-

ease Control Programme has

been reduced from Rs 568

Malathy Iyer & Rupali Mukherjee | TNN slashed budgets. In a few cas- crore to Rs 437 crore. Even the

Kounteya Sinha | TNN The patient will have to es, the allocation has been in- National TB Control Programme 426.72 380 -11 TB control programme’s

pay 5% extra at every Mumbai: You will have to pay creased but by a laughably funds have been cut down,

National Trachoma & Blindness

New Delhi/ Mumbai: Car- more for that flu shot, or to ease small amount compared to 272.21 261 -4 even as a large number of pa-

diac surgeon Dr Devi Shetty

level — to the private pain during surgery. Prices of the much-lauded increase in

Control Programme

tients are struggling to get ex-

calls it the “misery tax” and hospital consultant, to vaccines, anaesthetics and in- GDP and in the enhanced al- National Integrated Disease pensive second line treatment

40.01 55 37

pathologist Dr Navin Dang the laboratory travenous fluids (IV fluids) are location to the health min- Surveillance Programme for drug resistant TB.

says it is completely “unac- conducting his tests expected to rise with the im- istry. The aam admi seems to The only public health

ceptable.” position of an excise levy. have been shortchanged in

Routine Immunization 618.91 511 -17 programme that has been en-

Pranab Mukherjee’s pro- and to the hospital, Not just that. Ayurvedic, healthcare. Total Allocation 1933.29 1664.28 -14 hanced significantly is the

posal to impose a service tax even if he needs to unani, siddha and homeo- The country’s GDP is National Programme for Pre-

on health checkups and treat- pathic drugs will also cost estimated to increase by The actual expenditure is available for 2009-10 and not for vention and Control of Dia-

stay overnight 2010-11. Hence the comparison is being made between the

ment in all hospitals with more with them being brought 37% from 2009-10 to 2011-12 betes, Cardiovascular Disease

more than 25 beds and diag- under the excise net for the and the allocation for the 2009-10 and 2011-12 data and Stroke. The funding for

nostic tests in AC diagnostic ran Africa that spends around a patient’s fundamental right. first time, with a 1% levy. health ministry has in- this programme has been

centres has the healthcare sec- 2.5% of its GDP. Over 80% of The government has decided The Budget has hiked the creased by 33% in the same get population, even the budg- deaths in the world. more than doubled. But con-

tor up in arms. A close look at Indians foot their health bills to tax this very right.’’ Con- excise levy on medicines by period. Yet, the allocation et for routine immunization Paradoxically, the Na- sidering the amount involved

the finance minister’s pre- from their pocket. sidering that a checkup could 1% from the existing 4%, mak- for the various national dis- has gone down from Rs 618 tional Integrated Disease Sur- is just Rs 20 crore, that’s not

scription for the healthcare “The government spends cost between Rs 3,000 and Rs ing all medicines (allopathic) ease control programmes has crore in 2009-10 to Rs 511 crore veillance Programme, which saying much.

sector shows patients may end nothing on healthcare and will 10,000 depending on the tests, dearer. On vaccines, a 5% ex- gone down by 14% over these in the current Budget. is meant to track incidence With such poor alloca-

up paying more than just 5% now tax patients who already patients will have to shell out cise duty is being levied, with two years from Rs 1,933 crore This is when over 26 mil- of diseases, detect disease tions, there is great concern

extra to healthcare providers. pay from their pocket. This is Rs 150 to Rs 500 extra. They a concessional duty of 1% to Rs 1,664 crore. lion children are born in the trends and risk factors and among public health experts

In fact, the patient will have a misery tax,” Shetty told TOI. will also have to pay extra for without Cenvat credit facility. Despite the latest Nation- country every year who need also help to devise public about the ability of these al-

to pay 5% extra at every level In a letter, he is sending the fi- the doctor overseeing the A top official of major vaccine al Family Health Survey re- to be covered by the routine health strategies to tackle ready underfunded public

— to the private hospital con- nance minister, the surgeon checkup. manufacturer Serum India vealing that the coverage of immunization programme them, has seen an increase in health programmes to effec-

sultant, to the laboratory con- writes: “India needs at least 25 Shetty added that the idea told TOI: “We will pass on the the universal immunization which protects them against its allocation. But the money tively address the needs of

ducting his tests and to the lakh heart surgeries annual- of service tax on AC hospitals excise burden to consumers, programme is a mere 43.5%, six diseases. India accounts to tackle the diseases being the poorest who are the most

hospital, even if he needs to ly. Unfortunately, less than was based on wrong assump- and accordingly, there will be way below even half the tar- for over 21% of under-five tracked by this programme susceptible to ill health.

stay overnight. “This is going 90,000 people undergo heart tions. “You cannot legally per- around 1% increase in prices

to have a domino effect on the surgery, most of them using form any major surgeries in of vaccines.”

patient’s purse,’’ doctor-ad-

ministrator of a Mumbai hos-

their lives’ savings. Today, less

than 5% of our population can

an operation theatre without

AC. You cannot have an ICU

Others like Sanofi and

Panacea Biotech are also plan-

LIKE THAT ONLY JUG SURAIYA & AJIT NINAN

Budget session

pital said. afford to undergo treatment without an AC, CT scans MRIs ning to increase prices. Prices

Then, there is the sales tax for heart, brain and kidney ail- and cathlabs do not work with- may go up in the range of 1-1.5% may end early

that individual doctors will ments and cancer. Unless the out AC. Blood banks don’t get for most vaccines, excluding

have to pay. “It can snowball

into a big problem for the pa-

government supports the

health sector by offering tax

licences unless they are air

conditioned. Only the general

those under the National Im-

munization Programme.

in view of polls

tient. It is said that if lawyers benefits, more than 90% of our wards and the toilets are not Also, prices of most home- New Delhi: There is a move to

are brought under the purview population cannot afford it. Is air conditioned in most hospi- opathic, unani, siddha and curtail the three-week recess

of sales tax why not doctors? the 5% service tax fair?” tals. In short you cannot have ayurvedic concoctions and and end the Budget session of

But doctors perform an emer- Dang said patients with tertiary hospital without AC.” pills are expected to go up with Parliament early next month

gency and life-saving job,’’ Dr chronic illnesses like cancer The cardiac surgeon writes the 1% excise levy. So, compa- to enable MPs to campaign in

Arun Bal of Acash (Associa- and diabetes need constant in his letter to Mukherjee: nies like Dabur, Baidyanath, five states for assembly elec-

tion for Consumers’ Action on blood tests. They will be bur- “…Poor people on the whole Himalaya Drug Company, Dr tions starting on April 4. The

Safety & Health) said. dened with extra costs every fall sick more often than the Batra’s and Baksons Home- move to reschedule the Budget

There is another hidden time they get a test done, some- rich, they need major inter- opathy will be impacted. session gained momentum af-

cost. “If hospitals, labs and times thrice a day. vention most of the time be- The domestic pharma ter some MPs from these states

doctors have to pay sales tax, “The worst affected will be cause they come late nearly at industry will be adversely petitioned the parliamentary

they will have to hire people preventive health check ups. the end stage for treatment. impacted because of the im- affairs ministry for an early

who can do it for them. More At present, the numbers are Any extra cost is only going to position of minimum alter- end to the session in view of

hiring means more salary. The low because people think get- hurt them more.” nate tax of 18.5% on special elections. West Bengal, Assam,

only way of recovering it is by ting a preventive check up is Pervez Ahmed, CEO Max economic zones. Cipla direc- Tamil Nadu, Pondicherry and

asking patients to pay more,’’ futile. Now, they won’t come Healthcare said the decision tor S Radhakrishnan said: Kerala are going to elections.

a private hospital adminis- forward even more because of was unfortunate. “We will pass “The removal of tax benefit Government managers

trator said. the additional service tax,” this tax on to the patients. The on SEZs is not good news. think that by shortening the

The government spends Dang said. government needs to re-ex- We have made a huge invest- mid-session recess by a few

roughly 1% of the GDP on Bal of Acash added: “A pre- amine the notion of a service,” ment of over Rs 700 crore days, Parliament can be ad-

health, lower than sub-Saha- ventive health checkup is like he said. at Indore SEZ”. journed sine die around the date

for the first phase of polling.

Parliamentary affairs minister

NAC slams ‘unimaginative’ Budget Vayalar to take travel tax woes to Pranab P K Bansal will consult leaders

of different political parties on

Thursday to rework the sched-

ule for the session.

Subodh Ghildiyal & Nitin Sethi | TNN sidised fertilizer and kerosene Saurabh Sinha | TNN stance, a Delhi-Mumbai business The first phase of polling in

with cash transfers. “They are liv- class ticket on an average Assam takes place on April 4.

New Delhi: Key members of the ing in a fool’s paradise, if cash New Delhi: Upcoming assembly costs about Rs 20,000, of which According to a tentative

Sonia Gandhi-led National Advi- transfer is a way to eradicate cor- elections in Kerala may be a the basic fare and fuel surcharge schedule, Parliament will go

sory Council (NAC) criticized the ruption or leakage,” Roy said. ray of hope for budget interna- component is Rs 19,000. So into recess on March 16 to re-

UPA budget for doing little on the She explained, “giving a per- tional travellers resenting the the service tax could rise from Rs assemble on March 28. TNN

social sector front and ‘lacking son money to buy kerosene from steep hike in service tax that has 100 from at present to Rs 1,900 un-

imagination’. “It is more a state- open market at whatever prices is been raised in Monday’s budget der the new provision.

ment of intent and not resources,”

said Harsh Mander, member of the Aruna Roy was critical of the low

not good. Supporting him through

public distribution system is much

from Rs 500 to Rs 750. Since Ker-

ala sees huge travel between the

While the service tax shocker

will kick in next fiscal, aviation

Times Now most

NAC and Supreme Court commis-

sioner on food and poverty case.

allocation for MNREGA more straight forward.”

Mandar echoed Roy. “It is wor-

state and Gulf, this hike may not

go down well with people.

turbine fuel (ATF) has already

started taking its toll. Oil market-

watched on B-Day

While welcoming the addi-

tional allocations for health and

education, he said, “social inclu-

REGA wages had just been hiked

after being linked to the consumer

price index and shouldn’t have

rying. Especially in the case of fer-

tilizers, there are large number of

sharecroppers and tenants and for-

According to highly placed

sources, aviation minister Vayalar

Ravi is likely to raise the issue

ing companies on Tuesday hiked

ATF price by about Rs 2,000 per

kilolitre (KL), raising the price in

T imes Now on Monday issued

a statement saying that for

the third year in a row, it was the

sion and equity remained small been frozen at Rs 40,000 crore — est-dwellers who will not be able of hiked tax with finance minis- Delhi from Rs 53,000 per KL to al- most watched channel on Budget

ticket add-ons in the budget where around last year’s outgo on the mas- to present their land papers to ter Pranab Mukherjee and point POLL COMPULSIONS: Vayalar Ravi most Rs 55,000 per KL. day, ahead of CNBC TV18, NDTV

the poor are left out.” sive social scheme. “Though one claim the cash. This will turn into out that even the tax of Rs 500 Airlines have started passing 24x7 and CNN IBN. While Times

Another member Aruna Roy, can argue that it is a demand driv- cash transfers to absentee land- is steep enough and should not be fare component — basic fare on the increased cost to passen- Now’s viewership was 3.5 times

too, criticized the budget for low en programme and borne by the lords instead,” he said. further hiked. and fuel surcharge. The same is gers. Kingfisher hiked fuel sur- of NDTV 24x7 and nearly eight

allocations to MNREGA. “The ref- Centre, the fact of matter is that The duo pointed out that there The travel industry is worried likely to be adopted for domestic charge from Rs 100 to Rs 200 from times that of CNN IBN, it was

erence point for allocations should budgetary allocation does show an was no proof that cash transfers about the service tax hike for do- business class, although final Tuesday, while Jet had already 64% ahead of CNBC TV18,

be revised estimates. Why should estimation on that programme’s eradicated corruption. Mander cit- mestic travellers in business class, clarity will come later,” said done so some days back. Some in- according to data released by

it be the budgetary allocations of expenditure,” she told TOI. ed the case of old age pension which is proposed to be raised Travel Agents Federation of India ternational airlines like Cathay AMAP for February 28. Times

last year?” she asked. Both the members were harsh- schemes, claiming evidence sug- from Rs 100 to 10% of fare. chief Anil Kalsi. Pacific also hiked this cess from Now is 8.37 GRPs; CNBC TV18 -

Indicating that the allocations er in their criticism of the deci- gested a higher level of corruption “The 10% service tax being levied This would mean a huge Tuesday and others also recently 5.1; NDTV 24X7 -2.27; and, CNN

were low, she pointed out that MN- sion to replace supply of sub- prevailed there than in PDS. on international travel is on the service tax component. For in- upwardly hiked their surcharge. IBN - 1.06. TNN

Vous aimerez peut-être aussi

- India Solar Rooftop Map DecDocument2 pagesIndia Solar Rooftop Map DecPrateek HarbolaPas encore d'évaluation

- India Solar Rooftop Map December 2017Document2 pagesIndia Solar Rooftop Map December 2017Himanshu1712Pas encore d'évaluation

- Country Profile: BahrainDocument10 pagesCountry Profile: BahrainOMERPas encore d'évaluation

- Southeast Texas January Unemployment ReportDocument1 pageSoutheast Texas January Unemployment ReportCharlie FoxworthPas encore d'évaluation

- 1713 Beaumontmsa PDFDocument1 page1713 Beaumontmsa PDFBrandon ScottPas encore d'évaluation

- Mkts Dip 2% As Omicron Variant Spooks Investors: BusinessDocument1 pageMkts Dip 2% As Omicron Variant Spooks Investors: BusinessAvi SaiPas encore d'évaluation

- Xing 1Document45 pagesXing 1tempguy7369Pas encore d'évaluation

- Thesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidDocument1 pageThesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidImpulsive collectorPas encore d'évaluation

- India Solar Rooftop Map 2017 1Document2 pagesIndia Solar Rooftop Map 2017 1niranjandalviPas encore d'évaluation

- World Competitieveness CenterDocument10 pagesWorld Competitieveness CenterYusuf OppoF7Pas encore d'évaluation

- Blok G30xDocument1 pageBlok G30xCRYSMEL SIMANJUNTAKPas encore d'évaluation

- Materi BisnisDocument28 pagesMateri BisnissofyanPas encore d'évaluation

- Blossom City BrochureDocument5 pagesBlossom City BrochureParbancha AmitPas encore d'évaluation

- Nazara Technologies: A Perspective Unlisted FinancialsDocument4 pagesNazara Technologies: A Perspective Unlisted FinancialsTushar GargPas encore d'évaluation

- Global Peace Index 2019Document1 pageGlobal Peace Index 2019Julián CastilloPas encore d'évaluation

- Key Performance Indicators: Building CommunitiesDocument2 pagesKey Performance Indicators: Building CommunitiesMohammed AbdoPas encore d'évaluation

- Lifetime FitnessDocument1 pageLifetime FitnessBryan CambroneroPas encore d'évaluation

- Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichDocument1 pageThesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichImpulsive collectorPas encore d'évaluation

- WOPS Digital Strategic Plan UPDATED 2Document1 pageWOPS Digital Strategic Plan UPDATED 2Fay Dianna CruzPas encore d'évaluation

- Legend:: Exhaust FanDocument1 pageLegend:: Exhaust FanGrazel MDPas encore d'évaluation

- Business Notes 2Document6 pagesBusiness Notes 2alfaazmcsPas encore d'évaluation

- 1 Icu Arch Combined RevisedDocument5 pages1 Icu Arch Combined RevisedAlvin LaurencePas encore d'évaluation

- Exe Summary TX-05Document1 pageExe Summary TX-05SundeepPas encore d'évaluation

- Voltages / Loading: Inactive Out of Calculation De-EnergizedDocument1 pageVoltages / Loading: Inactive Out of Calculation De-EnergizedAnish PoudelPas encore d'évaluation

- Country Profile PE - IMD Business School 2021Document10 pagesCountry Profile PE - IMD Business School 2021Lucero RuizPas encore d'évaluation

- Real Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsDocument4 pagesReal Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsAshwet JadhavPas encore d'évaluation

- Home DepotDocument4 pagesHome Depotaleonor90Pas encore d'évaluation

- INFINITIDocument11 pagesINFINITIapi-3757629100% (1)

- TOYOTA Report: FY2017 SummaryDocument5 pagesTOYOTA Report: FY2017 SummaryPanos PanosPas encore d'évaluation

- C Persperctive Proposed Modern ResortDocument9 pagesC Persperctive Proposed Modern Resortgawgaming11Pas encore d'évaluation

- Sector5 BalkumDocument1 pageSector5 BalkumAksh RdPas encore d'évaluation

- Dimensions: (MM) Recommended Land Pattern: (MM) : Scale - 1.5:1Document7 pagesDimensions: (MM) Recommended Land Pattern: (MM) : Scale - 1.5:1Geneva Joyce TorresPas encore d'évaluation

- BracDocument1 pageBracer. kapilePas encore d'évaluation

- Hot Spot:: Changes in Land Use - NOIDADocument1 pageHot Spot:: Changes in Land Use - NOIDASHUBHAM ARORAPas encore d'évaluation

- 1 NPWC Education Trends PDFDocument2 pages1 NPWC Education Trends PDFAnna Beatrix SantosPas encore d'évaluation

- PlayDefense FI UITsDocument2 pagesPlayDefense FI UITsag rPas encore d'évaluation

- Environmental Scanning The Basic Model: - 30/11/2011 - Prepared by Carl Olav Staff / Rune Fjellvang Page 1 of 1Document1 pageEnvironmental Scanning The Basic Model: - 30/11/2011 - Prepared by Carl Olav Staff / Rune Fjellvang Page 1 of 1Baher WilliamPas encore d'évaluation

- MAHINDRA AND MAHINDRA FINANCIAL SERVICES LTD. Investor PresentationDocument36 pagesMAHINDRA AND MAHINDRA FINANCIAL SERVICES LTD. Investor Presentationmukesh bhattPas encore d'évaluation

- 24.5m Argao Drainage FinalDocument33 pages24.5m Argao Drainage FinalChristian Jahweh Sarvida SabadoPas encore d'évaluation

- Presentation To PetromindoDocument10 pagesPresentation To PetromindoBuls projectPas encore d'évaluation

- CBDRP Reporting Form 1Document1 pageCBDRP Reporting Form 1Edward Aguirre PingoyPas encore d'évaluation

- Plan Road Widening N. Bacalso Ave. k0084125 k0085500 CheckedDocument55 pagesPlan Road Widening N. Bacalso Ave. k0084125 k0085500 CheckedTeddie B. YapPas encore d'évaluation

- Country Profile: ColombiaDocument10 pagesCountry Profile: ColombiaPaula Andrea RodríguezPas encore d'évaluation

- TopGlove - Integrated - Annual - Report - 2022 - Part 1Document25 pagesTopGlove - Integrated - Annual - Report - 2022 - Part 1Dharesini ChandranPas encore d'évaluation

- Village Map: Taluka: Bhor District: PuneDocument1 pageVillage Map: Taluka: Bhor District: PunesmartwaiPas encore d'évaluation

- Hal 1 LayoutDocument1 pageHal 1 LayoutRicky AriyantoPas encore d'évaluation

- ETFS Investment Insights April 2017 - Broad Commodities A Key Alternative InvestmentDocument3 pagesETFS Investment Insights April 2017 - Broad Commodities A Key Alternative InvestmentAnonymous Ht0MIJPas encore d'évaluation

- 201807071412199687644-TEJASNET ReIterating Apr18Document18 pages201807071412199687644-TEJASNET ReIterating Apr18naveenPas encore d'évaluation

- ÉVÉ) BÉEÉÒ °ô (É®äJÉÉ: Budget ProfileDocument1 pageÉVÉ) BÉEÉÒ °ô (É®äJÉÉ: Budget ProfileShreyans JainPas encore d'évaluation

- Dubai BIM RoadmapDocument1 pageDubai BIM RoadmapZÄkãrîãêÊlJêmLîPas encore d'évaluation

- Ohio Rest Areas To Be Renovated by 2026Document1 pageOhio Rest Areas To Be Renovated by 2026The Columbus DispatchPas encore d'évaluation

- Daily Newspaper - 2015 - 10 - 03 - 000000Document44 pagesDaily Newspaper - 2015 - 10 - 03 - 000000Rachid MeftahPas encore d'évaluation

- CSE Equity Market Performance - One Year Equity Market PerformanceDocument2 pagesCSE Equity Market Performance - One Year Equity Market PerformanceMudassir IjazPas encore d'évaluation

- Production/ Producer's & Construction Sector's Index: Base Year: 2017/18 100Document2 pagesProduction/ Producer's & Construction Sector's Index: Base Year: 2017/18 100Akash AjayPas encore d'évaluation

- LabelDocument1 pageLabelThisila ColombagePas encore d'évaluation

- Pos Malaysia Berhad Annual Report 2009Document102 pagesPos Malaysia Berhad Annual Report 2009azoama100% (1)

- The Heart of Civil Society: The Uk Voluntary SectorDocument1 pageThe Heart of Civil Society: The Uk Voluntary Sectorapi-26695331Pas encore d'évaluation

- 100 Best ChatGPT Prompts To Unleash AI's Potential - Metaverse PostDocument3 pages100 Best ChatGPT Prompts To Unleash AI's Potential - Metaverse PostShea17% (6)

- Ahmar Sharmin Khalil, Zaman, Nabeel: Prepared ByDocument15 pagesAhmar Sharmin Khalil, Zaman, Nabeel: Prepared ByNabil RanaPas encore d'évaluation

- Disvoucher Tev Ro Seminar Adaiv CruzDocument8 pagesDisvoucher Tev Ro Seminar Adaiv CruzMhelody Gutierrez BelmontePas encore d'évaluation

- Online MPIC FAQ S PDFDocument3 pagesOnline MPIC FAQ S PDFakkisantosh7444Pas encore d'évaluation

- Mpa 16 PDFDocument12 pagesMpa 16 PDFFirdosh Khan100% (1)

- Lesson Plan - ME 3193 - Industrial - ManagementDocument4 pagesLesson Plan - ME 3193 - Industrial - ManagementxoxoPas encore d'évaluation

- Budget Message 2023Document1 pageBudget Message 2023elainePas encore d'évaluation

- 6 Budget in Brief English 2021 22Document55 pages6 Budget in Brief English 2021 22Dawndotcom100% (2)

- SF-181 Ethnicity and Race Identification Standard Form 181Document26 pagesSF-181 Ethnicity and Race Identification Standard Form 181Sistar Makkah94% (16)

- OPEX Budget Guidelines.2017Document13 pagesOPEX Budget Guidelines.2017Mark BuendiaPas encore d'évaluation

- Acct 2020 Excel Master BudgetDocument6 pagesAcct 2020 Excel Master Budgetapi-302665852Pas encore d'évaluation

- Balance of PaymentDocument35 pagesBalance of PaymentRupesh MorePas encore d'évaluation

- Forbes 2015 05 04Document124 pagesForbes 2015 05 04Jame ThanhPas encore d'évaluation

- Module 7: Financials: ENTPLA1 - Thalia AtendidoDocument17 pagesModule 7: Financials: ENTPLA1 - Thalia AtendidoNevan NovaPas encore d'évaluation

- Risk Register 7D6129 - Risk Log Template2Document4 pagesRisk Register 7D6129 - Risk Log Template2prabha_501131890Pas encore d'évaluation

- Oracle Cloud Budgetary ControlDocument30 pagesOracle Cloud Budgetary ControljrparidaPas encore d'évaluation

- Budget Preparation-SKDocument28 pagesBudget Preparation-SKJeffrey Manalastas100% (6)

- Unit 10 Approaches To Budgeting: StructureDocument17 pagesUnit 10 Approaches To Budgeting: StructurerehanPas encore d'évaluation

- CBSE Class 12 Economics Sample Paper (For 2014)Document19 pagesCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperPas encore d'évaluation

- 1.0 Accountant Job DescriptionDocument2 pages1.0 Accountant Job Descriptionvishal9patel-63Pas encore d'évaluation

- 634574722696418750Document11 pages634574722696418750Anamika SonawanePas encore d'évaluation

- Adaptive Insights Cfo Let It Roll Rolling Forecasts White PaperDocument4 pagesAdaptive Insights Cfo Let It Roll Rolling Forecasts White PaperGilang W IndrastaPas encore d'évaluation

- Case of Study The Investment DetectiveDocument2 pagesCase of Study The Investment DetectiveMaylaniPas encore d'évaluation

- OECD Review of The Corporate Governance of State Owned Enterprises CroatiaDocument180 pagesOECD Review of The Corporate Governance of State Owned Enterprises CroatiagianniM0Pas encore d'évaluation

- Macro AssignmentDocument4 pagesMacro AssignmentAbdul Nasir NichariPas encore d'évaluation

- Accounting ExamDocument13 pagesAccounting ExamLowry GuettaPas encore d'évaluation

- Study Note 3, Page 148-196Document49 pagesStudy Note 3, Page 148-196samstarmoonPas encore d'évaluation

- Par - Merger and AcquisitionDocument14 pagesPar - Merger and AcquisitionRoma Bhatia0% (1)

- 12th CBSE Money Banking, Budget, Indian Economy ch.1-3 MCQDocument7 pages12th CBSE Money Banking, Budget, Indian Economy ch.1-3 MCQPriyanshu GehlotPas encore d'évaluation

- Makati Development Corporation: Special Budget Appropriation RequestDocument1 pageMakati Development Corporation: Special Budget Appropriation RequestRRPas encore d'évaluation

- Responsibility Accounting and Transfer PricingDocument14 pagesResponsibility Accounting and Transfer PricingTsundere DoradoPas encore d'évaluation

- Summary: The Myth of Normal: Trauma, Illness, and Healing in a Toxic Culture By Gabor Maté MD & Daniel Maté: Key Takeaways, Summary & AnalysisD'EverandSummary: The Myth of Normal: Trauma, Illness, and Healing in a Toxic Culture By Gabor Maté MD & Daniel Maté: Key Takeaways, Summary & AnalysisÉvaluation : 4 sur 5 étoiles4/5 (9)

- Do You Believe in Magic?: The Sense and Nonsense of Alternative MedicineD'EverandDo You Believe in Magic?: The Sense and Nonsense of Alternative MedicinePas encore d'évaluation

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassD'EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassPas encore d'évaluation

- Uncontrolled Spread: Why COVID-19 Crushed Us and How We Can Defeat the Next PandemicD'EverandUncontrolled Spread: Why COVID-19 Crushed Us and How We Can Defeat the Next PandemicPas encore d'évaluation

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsD'EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsPas encore d'évaluation

- The Best Team Wins: The New Science of High PerformanceD'EverandThe Best Team Wins: The New Science of High PerformanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (31)

- CAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitD'EverandCAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitÉvaluation : 4 sur 5 étoiles4/5 (6)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsD'EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsÉvaluation : 4 sur 5 étoiles4/5 (4)

- Deaths of Despair and the Future of CapitalismD'EverandDeaths of Despair and the Future of CapitalismÉvaluation : 4.5 sur 5 étoiles4.5/5 (30)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessD'EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- The Wisdom of Plagues: Lessons from 25 Years of Covering PandemicsD'EverandThe Wisdom of Plagues: Lessons from 25 Years of Covering PandemicsÉvaluation : 4.5 sur 5 étoiles4.5/5 (6)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.D'EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Évaluation : 5 sur 5 étoiles5/5 (91)

- How To Budget And Manage Your Money In 7 Simple StepsD'EverandHow To Budget And Manage Your Money In 7 Simple StepsÉvaluation : 5 sur 5 étoiles5/5 (4)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantD'EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantÉvaluation : 4 sur 5 étoiles4/5 (104)

- The Inescapable Immune Escape PandemicD'EverandThe Inescapable Immune Escape PandemicÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Gut-Immune Connection: How Understanding the Connection Between Food and Immunity Can Help Us Regain Our HealthD'EverandThe Gut-Immune Connection: How Understanding the Connection Between Food and Immunity Can Help Us Regain Our HealthPas encore d'évaluation

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonD'EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonÉvaluation : 5 sur 5 étoiles5/5 (9)

- War on Ivermectin: The Medicine that Saved Millions and Could Have Ended the PandemicD'EverandWar on Ivermectin: The Medicine that Saved Millions and Could Have Ended the PandemicÉvaluation : 4 sur 5 étoiles4/5 (7)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyD'EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Truth about Wuhan: How I Uncovered the Biggest Lie in HistoryD'EverandThe Truth about Wuhan: How I Uncovered the Biggest Lie in HistoryÉvaluation : 4 sur 5 étoiles4/5 (6)

- Fatal Conveniences: The Toxic Products and Harmful Habits That Are Making You Sick—and the Simple Changes That Will Save Your HealthD'EverandFatal Conveniences: The Toxic Products and Harmful Habits That Are Making You Sick—and the Simple Changes That Will Save Your HealthÉvaluation : 4 sur 5 étoiles4/5 (7)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)D'EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Évaluation : 3.5 sur 5 étoiles3.5/5 (9)

- Epidemics and Society: From the Black Death to the PresentD'EverandEpidemics and Society: From the Black Death to the PresentÉvaluation : 4.5 sur 5 étoiles4.5/5 (9)