Académique Documents

Professionnel Documents

Culture Documents

Accounting Assignment Document Final Draft

Transféré par

Sarang BatraDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting Assignment Document Final Draft

Transféré par

Sarang BatraDroits d'auteur :

Formats disponibles

Introduction

Whitehaven and Macarthur both are public companies in the coal mining industry. The

purpose of this report is to evaluate the annual reports for the periods 2008 to 2010 from the

perspective of investors by assessing the liquidity, profitability gearing and efficiency levels.

Trend Analysis and Financial Ratios

Ratios are calculated and analysed to examine a company’s performance and efficiency

PROFITABILITY RATIOS

Return on Investment

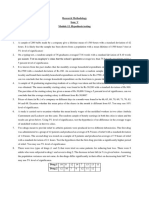

Profitability ratios assist in assessing the operating performance of the business. The figures

and diagrams show that ROI for Whitehaven and Macarthur rose in 2009 as follows; 24.25%

and 11.80% respectively. In 2010 Whitehaven’s ROI fell by 15.75%, while Macarthur’s had

a steady fall of 3.82%.

Whitehaven Macarthur

Return on Investment 2008 8.32% 7.01%

2009 24.25% 11.80%

2010 8.50% 7.98%

[Placidia , Wael and Kateb] Page 1

Net Profit Margin

Both companies’ profits increased in year 2009. Whitehaven coal sales grew by 40%

thereby increasing the net profit margin by 29.32%. Whitehaven increased underwriting

capacity by 15 tons in sales. The company also used US forward exchange contracts for

accounts receivables. Macarthur’s sales grew by 42% and increased the net profit margin by

6.08%. In 2010 sales for both companies fell.

In 2010 Whitehaven’s sales fell by 16.87% and Net Profit Margin also declined by 21.66%.

Macarthur’s sales fell by 3.58% and a Net profit margin declined by 5.58% .Reason being

large closing inventories for both companies and increase in expenses. The ratios show that

Whitehaven is comparatively better than Macarthur.

Whitehaven Macarthur

Net Profit margin 2008 20.58% 18.16%

2009 49.90% 24.24%

2010 28.24% 18.66%

[Placidia , Wael and Kateb] Page 2

LIQUIDITY RATIOS

Whitehaven Macarthur

Working

Capital/Current ratio 2008 289.81% 242.30%

2009 166.01% 374.88%

2010 223.01% 368.20%

Whitehaven Macarthur

2008 277.14% 224.27%

Acid Test (quick ratio) 2009 159.54% 350.72%

[Placidia , Wael and Kateb] Page 3

2010 213.72% 344.70%

The liquidity ratios show financial condition and how well a company manages its working

capital including payment of short term loans. Both companies have been able to cover their

current liabilities in the short term.

The current ratios for Macarthur are all above 200% with the highest working capital at

374.88% in 2009, which reasonably declined in 2010. Whitehaven’s working capital

decreased from 289.80% to 166.01% in 2009 and it increased by 57% in 2010 due to use of

forward exchange contracts. Macarthur’s working capital increased in 2009 and fell by small

margin in 2010. The quick asset ratio in Macarthur shows a huge growth of 126.45% in 2009.

This is also attributable to increase in the accounts receivable, and cash and equivalents.

Whitehaven’s working capital fell by 117.60%. This was due to increase in huge current

liabilities. The total debt liability increased by 112.33%. In 2010 the company regained 54.18

% in working capital due to reduction in liabilities. Comparing both the companies

Whitehaven seemed to highly liquid and for Macarthur it seems are not utilising their assets

well.

[Placidia , Wael and Kateb] Page 4

Gearing (Leverage) ratios

Macarthur Whitehaven

Debt to equity 2008 0.50 0.27

2009 0.42 0.39

2010 0.39 0.32

Macarthur Whitehaven

Debt to total Assets 2008 33.43% 21.47%

2009 29.34% 28.22%

2010 27.98% 24.28%

[Placidia , Wael and Kateb] Page 5

These ratios show balance between borrowed funds and shareholders equity.

Whitehaven’s ratio went up in 2009 and then went down in 2010. Based on debit to equity

ratios the lenders and creditors contributed $0.32 (30%) for $1 contributed by equity

shareholders while Macarthurs lenders and creditors contributed to $0.39 (30%) in 2010.

The debt to total assets ratios indicates that the lenders and creditors in Macarthur provided

33.43%, 29.34% and 27.98% while Whitehaven 21.47%, 28.22% and 24.28% in 2008 to

2010 , to the total funds required to finance the total assets of the business.

The trend shows Macarthur’s gearing ratios are good and the declining which shows

improvement in gearing.

EFFECIENCY RATIOS

Whitehaven Macarthur

Inventory Turnover 2008 3.41 times 8.71times

[Placidia , Wael and Kateb] Page 6

2009 25.51 times 11.59times

2010 13.83 times 8.52 times

Whitehaven Macarthur

Total Asset turnover ratio 2008 0.40 times 0.39 times

2009 0.49 times 0.49 times

2010 0.30 times 0.43 times

To check the best efficient use of assets to generate sales, we use the activity/efficiency

ratios. In 2009 both companies had a turn around of .49 times followed by a decline to .30

times and .43 times in 2010 for Whitewhaven and Macarthur respectively . This suggests

[Placidia , Wael and Kateb] Page 7

that every dollar invested in assets of the business generated 0.30 times and 43 times in sales

per year. This suggest that the assets are not efficiently used for returns in both companies.

Inventory turn over indicate the same result as total asset turn over ratio. A decline in ratios

suggests that they are maintaining higher levels of inventory and resulting in higher current

assets as shown by the acid test ratio. Closing inventories for both companies have continued

to increase in 2010, Whitehaven 12% and Marcarthur 34%.

Shareholders Returns

Dividends per share

Whitehaven Macarthur

Dividends per share 2008 1.7 17

2009 6 13

2010 2.8 25

Looking at the dividends per share for both the companies the dividend per share of both the

companies has fluctuated in the three years but for Macarthur coal it has gone up in 2010

where as it has gone down for Whitehaven so Macarthur coal looks in better possition.

[Placidia , Wael and Kateb] Page 8

Earnings Per Share

Whitehaven Macarthur

Earnings per share 2008 14.5 36.6

2009 60.5 79.3

2010 24.2 49.3

Earning per share for both the companies risen in 2009 from 2008 figures and then gone

down again in 2010. The earning per share for both the companies has gone down because of

theprices going high and lower profits.

Red Flags

Whitehaven:

[Placidia , Wael and Kateb] Page 9

• Werris Creek Pty Ltd which is a 100% owned by Whitehaven was accused by EPA

for a breach of an environmental license in 2008. Werris Creek Pvt Ltd admitted to

liability offence and was fined $49000 in 2009. Werris Creek Pty Ltd was also asked

payment of $34700 to the prosecutors. All this was published in Sydney Morning

Herald and Australian Financial Review to warn other companies.

• At the end of June 2007 Whitehaven invest in foreign currency through AMCI (this

company is ruled by Hans Mende one of the director of Whitehaven) and at the end of

June 2008, the company acquired a loss $1,867,000.

• Because of the floods Whitehaven lost about 650000 tons of production in the second

half of 2010 which is a significant quantity when three of the mines produce 1.9

million tons for the period.

• Whitehaven Coal in the second half of 2010 acquired an overall net loss of $35

million.

Macarthur:

• The profit for Macarthur has been reduced down by 22 percent in four weeks because

of the floods that hit Queensland. As anticipated by theaustralian.com.au first half net

profit after tax would be in lower end of the guidance range of $97 million to $102

[Placidia , Wael and Kateb] Page 10

million provided to the market on December 16 following the first flooding in the

state.

• According to The Australian of 5th January 2011 lower coal volumes will be produced

in 2011 as a result of bad weather in Queensland.

Assessment of Qualitative and non-financial information:

Annual reports of Whitehaven contained information about mines owned, sales, revenue

forecasts, corporate governance, director’s reports, principle activities during the year,

independent auditor’s reports, shareholder information and any likely developments in future.

One important event took place in 2008 when Mr. Keith Ross restired as Managing director.

Mr. Ross was integral in the development of Whitehaven. This might have been an anxious

moment for some investors who do not feel comfortable when changes take place at the top

management level.

In 2010 it was decided to sell Whitehaven and it was estimated of the value of $3.5 billion.

The Annual reports of Macarthur contains information about chairman’s report, Risk

management and environmental issue management, regulatory developments and climate

change, directors report, financial reports, auditors reports, shareholder information. Which is

useful information.

$250000 was donated by Macarthur Coal to Premier’s Flood Relief Appeal to help the

affected.

The report mentions Macarthur coal’s target was to avoid any environmental issues in 2010

but the business incurred two penalty infringement notices due to the new water management

[Placidia , Wael and Kateb] Page 11

regulations introduced by the Queensland department of Environment and Resource

Management.

The information qualitative and non-financial information contained in the annual reports of

both the companies help to gain a better understanding of both the company’s financial

operation.

Evaluation of notes to the Account

Annual report and financial statements give basic understanding to the investors about

accounting policy, standards and practices to allow accurate interpretation and analyses of the

information. The notes to the financial statements provide essential information which must

be read in conjunction with the figures provided in the balance sheet, income statement and

cash flow statement.

Whitehaven mentions in the notes to the accounts that the Group initially recognises loans

and receivables and deposits on the date that they are originated. All other financial assets

(including assets designated at fair value through profit or loss) are recognised initially on the

trade date at which the Group becomes a party to the contractual provisions of the instrument.

The investors might be interested to know that in April 2010, 2.18% of shares in

Middlemount were transferred by Macarthur Coal under the terms of the share sale

agreement. The remaining derivative liabilities relate to the obligation for the final sell trigger

under the share sale agreement and the obligation under the call option agreement.

The notes to the accounts help to provide the financial clarifications but sometimes the

information maybe hidden or indirectly mentioned.

Utility of Annual Reports and Financial statement analysis

[Placidia , Wael and Kateb] Page 12

The annual reports of both the companies contain the necessary information that is needed to

help the investors make informed decisions. However, in order to substantiate the direct

information provided in the annual reports, carrying out the financial statement analysis is

essential. The financial statement and trend analysis for both the companies have resulted in

realizing a clearer picture of the two companies, as explained.

Conclusion

Looking at the ratios, trends and other information provided for both the companies

Macarthur Coal looks a better choice from the investors’ point of view.

References

• Atrll P, Harvey D, Mclaney E Accounting for Business 2 Ed 1994

• Bazley M and Hancock P Contemporary Accounting 6 Ed 2004

[Placidia , Wael and Kateb] Page 13

• Bazley M and Hancock P Contemporary Accounting 7 Ed 2006

• Macarthur Coal(2008,2009,2010) Macarthur Coal limited Annual report:

Strenghtening production: Securing Growth, Accessed on March 27,2011

www.macarthurcoal.com.au/Potals/0/2008%20 Annual%Report.pdf

• Whitehaven(2008,2009,2010) Whitehaven Coal Annual Report> Assessed, March

27,2011 www.whitehaven.net.au/investors/documents/26092008WHCAnnual

ReporttoShareholders

• Business with the Wallstree Journal 2011, Floods sweep Macarthur Coal

profits lower. Viewed on 02 April 2011.

http://www.theaustralian.com.au/business/mining-energy/macarthur-coal-

trims-profit-guidance-due-to-queensland-floods/story-e6frg9e6-

1225982331278

• Financial Review 2010, MACARTHUR COAL LIMITED. Viewed on 03 April

2011.

http://afr.com/tags;jsessionid=2CC23F9EEB4AFD2B1C168F95B6B01642?

tag=C_MACARTHUR%20COAL%20LIMITED-MCC

[Placidia , Wael and Kateb] Page 14

Vous aimerez peut-être aussi

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationD'EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationPas encore d'évaluation

- Ratio Analysis Liquidity Ratios 200 2 200 3 200 4 200 5 200 6 20 07 20 08 20 09 2010Document5 pagesRatio Analysis Liquidity Ratios 200 2 200 3 200 4 200 5 200 6 20 07 20 08 20 09 2010Ahmer KhanPas encore d'évaluation

- Supply Chain Management and Business Performance: The VASC ModelD'EverandSupply Chain Management and Business Performance: The VASC ModelPas encore d'évaluation

- Al NoorDocument12 pagesAl NoorRehmatullah Abdul AzizPas encore d'évaluation

- The Signs Were There: The clues for investors that a company is heading for a fallD'EverandThe Signs Were There: The clues for investors that a company is heading for a fallÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Individual Course Work - Finance - SVKDocument13 pagesIndividual Course Work - Finance - SVKVenkatesh Kumar SubburajPas encore d'évaluation

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesD'EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesPas encore d'évaluation

- Bellway INFULLREPORTDocument13 pagesBellway INFULLREPORTAnup BajajPas encore d'évaluation

- Hiscox Interim Statement 2005Document12 pagesHiscox Interim Statement 2005saxobobPas encore d'évaluation

- YTL Power IC - 20070912 - Global Utility PlayDocument18 pagesYTL Power IC - 20070912 - Global Utility PlayMuhamad Firdaus MinhadPas encore d'évaluation

- Sohail AssignDocument3 pagesSohail AssignAkash SirohiPas encore d'évaluation

- Maple Leaf Cement Factory LimitedDocument70 pagesMaple Leaf Cement Factory LimitedMubasharPas encore d'évaluation

- Ellcot Spinning Mills PresentationDocument22 pagesEllcot Spinning Mills PresentationAhsan ShahidPas encore d'évaluation

- Revision: Richard HillDocument36 pagesRevision: Richard Hill393852019Pas encore d'évaluation

- FM Presentation On Capital Structure Analysis of FirmsDocument22 pagesFM Presentation On Capital Structure Analysis of FirmsRaiza SideequePas encore d'évaluation

- ChevronDocument29 pagesChevronKhawaja UsmanPas encore d'évaluation

- Boom Logistics Limited: Annual Report 2006Document80 pagesBoom Logistics Limited: Annual Report 2006Jorge GarzaPas encore d'évaluation

- Welcorp q2 Business UpdatesDocument8 pagesWelcorp q2 Business UpdatesVivek AnandPas encore d'évaluation

- Victoria ChemicalsDocument3 pagesVictoria ChemicalsJia You100% (2)

- FMA AssignmentDocument17 pagesFMA AssignmentnoorPas encore d'évaluation

- Unconsolidated Condensed Interim Financial Statements of Allied Bank LimitedDocument44 pagesUnconsolidated Condensed Interim Financial Statements of Allied Bank LimitedenkashmiriPas encore d'évaluation

- Boa FinalDocument21 pagesBoa Finalabhishek4sonuPas encore d'évaluation

- DH-09-0469 Mine - Year-End Review FINALDocument52 pagesDH-09-0469 Mine - Year-End Review FINALOwm Close CorporationPas encore d'évaluation

- Aqua Bounty CaseDocument9 pagesAqua Bounty CaseValentin MardonPas encore d'évaluation

- BEL Annual Report 2010Document44 pagesBEL Annual Report 2010Lisa ShomanPas encore d'évaluation

- Abl Half Yearly 2009Document44 pagesAbl Half Yearly 2009ibrahim978Pas encore d'évaluation

- At The End of 2008 Lucretia Mcevil Company Has 180 000Document1 pageAt The End of 2008 Lucretia Mcevil Company Has 180 000M Bilal SaleemPas encore d'évaluation

- 2008 Bos RaDocument114 pages2008 Bos RasaxobobPas encore d'évaluation

- Financial Analysis of Oil & Natural Gas Corporation LTDDocument52 pagesFinancial Analysis of Oil & Natural Gas Corporation LTDRejaul KarimPas encore d'évaluation

- Barttlet SolutionDocument3 pagesBarttlet SolutionKiri chrisPas encore d'évaluation

- Singapore's Balance Sheet 2008Document7 pagesSingapore's Balance Sheet 2008Alwin TanPas encore d'évaluation

- Ratio Analysis FINALDocument10 pagesRatio Analysis FINALPuja SharmaPas encore d'évaluation

- SAR-MAR-210422-1227PM - RR - 034-COPY 1.editedDocument12 pagesSAR-MAR-210422-1227PM - RR - 034-COPY 1.editedJishnu ChaudhuriPas encore d'évaluation

- Bhel Financial AnalysisDocument10 pagesBhel Financial Analysisashish_verma_22Pas encore d'évaluation

- Unconsolidated Condensed Interim Financial Statements of Allied Bank LimitedDocument40 pagesUnconsolidated Condensed Interim Financial Statements of Allied Bank Limitedcooldudes007Pas encore d'évaluation

- Taqa Co 100305Document3 pagesTaqa Co 100305Yue XiangPas encore d'évaluation

- Sainsbury Financial AnalysisDocument21 pagesSainsbury Financial AnalysisReena mOhammedPas encore d'évaluation

- Analysis of Financial Stetement PSODocument14 pagesAnalysis of Financial Stetement PSODanish KhalidPas encore d'évaluation

- Annual 03Document80 pagesAnnual 03LightninWolf32Pas encore d'évaluation

- Xstrata Half Yr Report 2010Document85 pagesXstrata Half Yr Report 2010mckenzie0415Pas encore d'évaluation

- 2008 ResultsDocument24 pages2008 Resultstipu001Pas encore d'évaluation

- Profitablity RatiosDocument5 pagesProfitablity RatiosNithin KuniyilPas encore d'évaluation

- RIL 2Q FY21 Analyst Presentation 30oct20Document60 pagesRIL 2Q FY21 Analyst Presentation 30oct20ABHISHEK GUPTAPas encore d'évaluation

- Project Report of AnkushDocument21 pagesProject Report of AnkushdinnubhattPas encore d'évaluation

- Buy Tata ChemicalsDocument9 pagesBuy Tata ChemicalsSovid GuptaPas encore d'évaluation

- Nse Bse LetterDocument29 pagesNse Bse Lettergmatmat200Pas encore d'évaluation

- Book-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Document12 pagesBook-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Hein Linn KyawPas encore d'évaluation

- Abm Presentai0nDocument9 pagesAbm Presentai0nadnan_708nPas encore d'évaluation

- Automotive Review Sample July 10Document9 pagesAutomotive Review Sample July 10Taiyeb BanswarawalaPas encore d'évaluation

- GCC Telecom Sector Results FY2009Document4 pagesGCC Telecom Sector Results FY2009Omar RanaPas encore d'évaluation

- Mock BPP P2 (3 8)Document32 pagesMock BPP P2 (3 8)naveedawan3210% (1)

- Marketing Report On Fruit Juices - Murree BreweryDocument17 pagesMarketing Report On Fruit Juices - Murree BreweryHumayun100% (9)

- Financial Analysis Retail Industry UK - Case Study PrimarkDocument21 pagesFinancial Analysis Retail Industry UK - Case Study PrimarkOre.APas encore d'évaluation

- Mining Data SetsDocument3 pagesMining Data SetsPedro HernandezPas encore d'évaluation

- Aviva UK Analyst Day: Delivering Value in The New Business Environment November 2010Document36 pagesAviva UK Analyst Day: Delivering Value in The New Business Environment November 2010Aviva GroupPas encore d'évaluation

- Caterpillar Inc.: 3Q 2009 Earnings ReleaseDocument34 pagesCaterpillar Inc.: 3Q 2009 Earnings ReleaseqtipxPas encore d'évaluation

- CanaraDocument38 pagesCanaraShiv ShantPas encore d'évaluation

- Tata Motors Group Q2 FY24 Financial Results Press ReleaseDocument5 pagesTata Motors Group Q2 FY24 Financial Results Press ReleaseSaadPas encore d'évaluation

- Steel Industry: A Project ReportDocument13 pagesSteel Industry: A Project ReportVijendra SinghPas encore d'évaluation

- Ar Engro2009Document554 pagesAr Engro2009Faryal ArifPas encore d'évaluation

- Od226085445032329000 2Document1 pageOd226085445032329000 2Rohan UndePas encore d'évaluation

- Haryana MGMTDocument28 pagesHaryana MGMTVinay KumarPas encore d'évaluation

- Business Development Sales Manager in Colorado Springs CO Resume Rick KlopenstineDocument2 pagesBusiness Development Sales Manager in Colorado Springs CO Resume Rick KlopenstineRick KlopenstinePas encore d'évaluation

- Supply Chain Supply Chain: Hype RealityDocument8 pagesSupply Chain Supply Chain: Hype Realitycons thePas encore d'évaluation

- Oil and Gas Industry Overview SsDocument2 pagesOil and Gas Industry Overview SsVidhu PrabhakarPas encore d'évaluation

- Part & Process Audit: Summary: General Supplier InformationDocument20 pagesPart & Process Audit: Summary: General Supplier InformationNeumar Neumann100% (1)

- Overview of Stock Transfer Process in SAP WMDocument11 pagesOverview of Stock Transfer Process in SAP WMMiguel TalaricoPas encore d'évaluation

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmalePas encore d'évaluation

- GL 003 14 Code of Good Practice For Life InsuranceDocument19 pagesGL 003 14 Code of Good Practice For Life InsuranceAdrian BehPas encore d'évaluation

- Xxxxacca Kısa ÖzzetttDocument193 pagesXxxxacca Kısa ÖzzetttkazimkorogluPas encore d'évaluation

- Virata V Wee To DigestDocument29 pagesVirata V Wee To Digestanime lovePas encore d'évaluation

- Importance of Human Resource ManagementDocument9 pagesImportance of Human Resource Managementt9inaPas encore d'évaluation

- BSBMGT517 Manage Operational Plan Template V1.0619Document14 pagesBSBMGT517 Manage Operational Plan Template V1.0619Edward AndreyPas encore d'évaluation

- 1-Minute Vine Robot Parts List: Intro Version 6.4.18Document2 pages1-Minute Vine Robot Parts List: Intro Version 6.4.18Pratyush PalPas encore d'évaluation

- Bcom Final Year ProjectDocument65 pagesBcom Final Year ProjectSHIBIN KURIAKOSE87% (69)

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost RatioRhonita Dea AndariniPas encore d'évaluation

- SHS Business Finance Chapter 2Document24 pagesSHS Business Finance Chapter 2Ji BaltazarPas encore d'évaluation

- USP Cat Jan-FEB 2013 SandipDocument294 pagesUSP Cat Jan-FEB 2013 SandipNarendra SaiPas encore d'évaluation

- MKT 566 Quiz 2Document16 pagesMKT 566 Quiz 2kaz92Pas encore d'évaluation

- Slides CBDocument30 pagesSlides CBhasan_usman1234Pas encore d'évaluation

- Kuis PDFDocument4 pagesKuis PDFZhay Anty0% (1)

- Module 12. Worksheet - Hypothesis TestingDocument3 pagesModule 12. Worksheet - Hypothesis TestingShauryaPas encore d'évaluation

- Design Failure Mode and Effects Analysis: Design Information DFMEA InformationDocument11 pagesDesign Failure Mode and Effects Analysis: Design Information DFMEA InformationMani Rathinam Rajamani0% (1)

- Tomas Claudio CollegesDocument16 pagesTomas Claudio CollegesGemmillyn DigmaPas encore d'évaluation

- SAP ResumeDocument4 pagesSAP ResumesriabcPas encore d'évaluation

- 1LPS 3 BoQ TemplateDocument369 pages1LPS 3 BoQ TemplateAbdulrahman AlkilaniPas encore d'évaluation

- Chapter 15 PartnershipDocument56 pagesChapter 15 PartnershipNurullita KartikaPas encore d'évaluation

- Save Capitalism From CapitalistsDocument20 pagesSave Capitalism From CapitalistsLill GalilPas encore d'évaluation

- Intermediate Accounting 14th Edition Kieso Test BankDocument25 pagesIntermediate Accounting 14th Edition Kieso Test BankReginaGallagherjkrb100% (58)

- Assignment 1.3Document3 pagesAssignment 1.3ZeusPas encore d'évaluation