Académique Documents

Professionnel Documents

Culture Documents

US Internal Revenue Service: Irb05-45

Transféré par

IRSDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

US Internal Revenue Service: Irb05-45

Transféré par

IRSDroits d'auteur :

Formats disponibles

Bulletin No.

2005-45

November 7, 2005

HIGHLIGHTS

OF THIS ISSUE

These synopses are intended only as aids to the reader in

identifying the subject matter covered. They may not be

relied upon as authoritative interpretations.

SPECIAL ANNOUNCEMENT EMPLOYEE PLANS

Announcement 2005–81, page 941. Notice 2005–75, page 929.

The Eighteenth Annual Institute on Current Issues in Interna- 2006 cost-of-living adjustments; retirement plans, etc.

tional Taxation, jointly sponsored by the Internal Revenue Ser- This notice sets forth certain cost-of-living adjustments effec-

vice and The George Washington University Law School, will be tive January 1, 2006, applicable to the dollar limits on benefits

held on December 8 and 9, 2005, at the J.W. Marriott Hotel in under qualified defined benefit pension plans and to other provi-

Washington, DC. sions affecting (1) certain plans of deferred compensation and

(2) “control employees.” This notice restates the data in News

Release IR-2005-120 issued October 14, 2005.

INCOME TAX

EXEMPT ORGANIZATIONS

Rev. Rul. 2005–70, page 919.

2005 base period T-bill rate. The “base period T-bill rate”

for the period ending September 30, 2005, is published as Announcement 2005–82, page 941.

required by section 995(f) of the Code. Delta Regional Transit System, Inc., of Greenville, MS; Gibson

Trust, Inc., of Hollywood, FL; Housing Development Group, Inc.,

Rev. Rul. 2005–71, page 923. of Providence, RI; and National Credit Education and Review, of

Federal rates; adjusted federal rates; adjusted federal Canton, MI, no longer qualify as organizations to which contri-

long-term rate and the long-term exempt rate. For pur- butions are deductible under section 170 of the Code.

poses of sections 382, 642, 1274, 1288, and other sections

of the Code, tables set forth the rates for November 2005. Announcement 2005–83, page 941.

A list is provided of organizations now classified as private foun-

Announcement 2005–79, page 941. dations.

Form 8884, New York Liberty Zone Business Employee Credit,

is obsolete as of December 31, 2004. As a result, any carry-

forward credit from Form 8884 is now reported in Section B

of Form 8835, Renewable Electricity, Refined Coal, and Indian

Coal Production Credit.

(Continued on the next page)

Announcements of Disbarments and Suspensions begin on page 935.

Finding Lists begin on page ii.

EMPLOYMENT TAX

REG–114371–05, page 930.

Proposed regulations under section 7701 of the Code explain

that certain disregarded entities (qualified subchapter S sub-

sidiaries and single owner eligible entities) are to be treated as

entities separate from their owners for purposes of paying and

reporting federal employment and certain excise taxes.

EXCISE TAX

REG–114371–05, page 930.

Proposed regulations under section 7701 of the Code explain

that certain disregarded entities (qualified subchapter S sub-

sidiaries and single owner eligible entities) are to be treated as

entities separate from their owners for purposes of paying and

reporting federal employment and certain excise taxes.

ADMINISTRATIVE

T.D. 9227, page 924.

REG–114444–05, page 934.

Final, temporary, and proposed regulations under section 7804

of the Code amend 26 CFR Part 801 to clarify when quantity

measures, which are not tax enforcement results, may be used

in measuring organizational and employee performance.

November 7, 2005 2005–45 I.R.B.

The IRS Mission

Provide America’s taxpayers top quality service by helping applying the tax law with integrity and fairness to all.

them understand and meet their tax responsibilities and by

Introduction

The Internal Revenue Bulletin is the authoritative instrument of court decisions, rulings, and procedures must be considered,

the Commissioner of Internal Revenue for announcing official and Service personnel and others concerned are cautioned

rulings and procedures of the Internal Revenue Service and for against reaching the same conclusions in other cases unless

publishing Treasury Decisions, Executive Orders, Tax Conven- the facts and circumstances are substantially the same.

tions, legislation, court decisions, and other items of general

interest. It is published weekly and may be obtained from the

The Bulletin is divided into four parts as follows:

Superintendent of Documents on a subscription basis. Bulletin

contents are compiled semiannually into Cumulative Bulletins,

which are sold on a single-copy basis. Part I.—1986 Code.

This part includes rulings and decisions based on provisions of

It is the policy of the Service to publish in the Bulletin all sub- the Internal Revenue Code of 1986.

stantive rulings necessary to promote a uniform application of

the tax laws, including all rulings that supersede, revoke, mod- Part II.—Treaties and Tax Legislation.

ify, or amend any of those previously published in the Bulletin. This part is divided into two subparts as follows: Subpart A,

All published rulings apply retroactively unless otherwise indi- Tax Conventions and Other Related Items, and Subpart B, Leg-

cated. Procedures relating solely to matters of internal man- islation and Related Committee Reports.

agement are not published; however, statements of internal

practices and procedures that affect the rights and duties of

taxpayers are published. Part III.—Administrative, Procedural, and Miscellaneous.

To the extent practicable, pertinent cross references to these

subjects are contained in the other Parts and Subparts. Also

Revenue rulings represent the conclusions of the Service on the included in this part are Bank Secrecy Act Administrative Rul-

application of the law to the pivotal facts stated in the revenue ings. Bank Secrecy Act Administrative Rulings are issued by

ruling. In those based on positions taken in rulings to taxpayers the Department of the Treasury’s Office of the Assistant Sec-

or technical advice to Service field offices, identifying details retary (Enforcement).

and information of a confidential nature are deleted to prevent

unwarranted invasions of privacy and to comply with statutory

requirements. Part IV.—Items of General Interest.

This part includes notices of proposed rulemakings, disbar-

ment and suspension lists, and announcements.

Rulings and procedures reported in the Bulletin do not have the

force and effect of Treasury Department Regulations, but they

may be used as precedents. Unpublished rulings will not be The last Bulletin for each month includes a cumulative index

relied on, used, or cited as precedents by Service personnel in for the matters published during the preceding months. These

the disposition of other cases. In applying published rulings and monthly indexes are cumulated on a semiannual basis, and are

procedures, the effect of subsequent legislation, regulations, published in the last Bulletin of each semiannual period.

The contents of this publication are not copyrighted and may be reprinted freely. A citation of the Internal Revenue Bulletin as the source would be appropriate.

For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC 20402.

2005–45 I.R.B. November 7, 2005

Part I. Rulings and Decisions Under the Internal Revenue Code

of 1986

Section 42.—Low-Income Section 482.—Allocation in an amount equal to the product of the

Housing Credit of Income and Deductions shareholder’s DISC-related deferred tax li-

Among Taxpayers ability for the year and the “base period

The adjusted applicable federal short-term, mid-

T-bill rate.” Under section 995(f)(4), the

term, and long-term rates are set forth for the month Federal short-term, mid-term, and long-term rates

of November 2005. See Rev. Rul. 2005-71, page

base period T-bill rate is the annual rate

are set forth for the month of November 2005. See

923. Rev. Rul. 2005-71, page 923.

of interest determined by the Secretary to

be equivalent to the average of the 1-year

constant maturity Treasury yields, as pub-

Section 280G.—Golden Section 483.—Interest on lished by the Board of Governors of the

Parachute Payments Certain Deferred Payments Federal Reserve System, for the 1-year pe-

riod ending on September 30 of the calen-

Federal short-term, mid-term, and long-term rates The adjusted applicable federal short-term, mid-

term, and long-term rates are set forth for the month

dar year ending with (or of the most recent

are set forth for the month of November 2005. See

of November 2005. See Rev. Rul. 2005-71, page calendar year ending before) the close of

Rev. Rul. 2005-71, page 923.

923. the taxable year of the shareholder. The

base period T-bill rate for the period end-

Section 382.—Limitation ing September 30, 2005 is 3.18 percent.

Section 642.—Special Pursuant to section 6222 of the Code,

on Net Operating Loss Rules for Credits and

Carryforwards and Certain interest must be compounded daily. The

Deductions table below provides factors for com-

Built-In Losses Following

pounding the base period T-bill rate daily

Ownership Change Federal short-term, mid-term, and long-term rates

for any number of days in the share-

are set forth for the month of November 2005. See

The adjusted applicable federal long-term rate is Rev. Rul. 2005-71, page 923. holder’s taxable year (including a 52–53

set forth for the month of November 2005. See Rev. week accounting period) for the 2005 base

Rul. 2005-71, page 923. period T-bill rate. To compute the amount

Section 807.—Rules for of the interest charge for the shareholder’s

Certain Reserves taxable year, multiply the amount of the

Section 412.—Minimum The adjusted applicable federal short-term, mid- shareholder’s DISC-related deferred tax

Funding Standards term, and long-term rates are set forth for the month liability (as defined in section 995(f)(2))

of November 2005. See Rev. Rul. 2005-71, page for that year by the base period T-bill rate

The adjusted applicable federal short-term, mid-

923. factor corresponding to the number of

term, and long-term rates are set forth for the month

of November 2005. See Rev. Rul. 2005-71, page days in the shareholder’s taxable year for

923. Section 846.—Discounted which the interest charge is being com-

Unpaid Losses Defined puted. Generally, one would use the factor

for 365 days. One would use a different

Section 467.—Certain The adjusted applicable federal short-term, mid- factor only if the shareholder’s taxable

Payments for the Use of term, and long-term rates are set forth for the month year for which the interest charge being

Property or Services of November 2005. See Rev. Rul. 2005-71, page

determined is a short taxable year, if the

923.

shareholder uses the 52–53 week taxable

The adjusted applicable federal short-term, mid-

term, and long-term rates are set forth for the month

year, or if the shareholder’s taxable year

of November 2005. See Rev. Rul. 2005-71, page

Section 995.—Taxation is a leap year.

923. of DISC Income to For the base period T-bill rates for the

Shareholders periods ending in prior years, see Rev. Rul.

2004–99, 2004–2 C.B. 720, Rev. Rul.

Section 468.—Special 2005 base period T-bill rate. The 2003–111, 2003–2 C.B. 1009, Rev. Rul.

Rules for Mining and Solid “base period T-bill rate” for the period 2002–68, 2002–2 C.B. 808, Rev. Rul.

Waste Reclamation and ending September 30, 2005, is published 2001–56, 2001–2 C.B. 500, and Rev. Rul.

Closing Costs as required by section 995(f) of the Code. 2000–52, 2000–2 C.B. 516.

The adjusted applicable federal short-term, mid- Rev. Rul. 2005–70 DRAFTING INFORMATION

term, and long-term rates are set forth for the month

of November 2005. See Rev. Rul. 2005-71, page Section 995(f)(1) of the Internal Rev- The principal author of this revenue rul-

923. enue Code provides that a shareholder of a ing is David Bergkuist of the Office of the

DISC shall pay interest each taxable year Associate Chief Counsel (International).

2005–45 I.R.B. 919 November 7, 2005

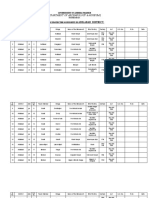

For further information about this revenue 2005 ANNUAL RATE, 2005 ANNUAL RATE,

ruling, contact Mr. Bergkuist at (202) COMPOUNDED DAILY COMPOUNDED DAILY

622–3850 (not a toll-free call).

3.180 PERCENT 3.180 PERCENT

DAYS FACTOR DAYS FACTOR

2005 ANNUAL RATE,

COMPOUNDED DAILY 36 .003141225 76 .006643049

37 .003228622 77 .006730751

3.180 PERCENT 38 .003316027 78 .006818461

DAYS FACTOR 39 .003403439 79 .006906178

40 .003490859 80 .006993903

1 .000087123

2 .000174254

41 .003578286 81 .007081636

3 .000261393

42 .003665721 82 .007169376

4 .000348539

43 .003753164 83 .007257124

5 .000435692

44 .003840614 84 .007344880

45 .003928072 85 .007432643

6 .000522854

7 .000610022

46 .004015537 86 .007520414

8 .000697199

47 .004103011 87 .007608192

9 .000784383

48 .004190491 88 .007695978

10 .000871575

49 .004277980 89 .007783772

50 .004365476 90 .007871574

11 .000958774

12 .001045981

51 .004452979 91 .007959383

13 .001133195

52 .004540491 92 .008047199

14 .001220417

53 .004628009 93 .008135024

15 .001307647

54 .004715536 94 .008222856

55 .004803070 95 .008310695

16 .001394884

17 .001482129

56 .004890612 96 .008398543

18 .001569381

57 .004978161 97 .008486398

19 .001656641

58 .005065718 98 .008574260

20 .001743909

59 .005153283 99 .008662131

60 .005240855 100 .008750009

21 .001831184

22 .001918467

61 .005328435 101 .008837894

23 .002005757

62 .005416022 102 .008925788

24 .002093055

63 .005503618 103 .009013689

25 .002180361

64 .005591220 104 .009101597

65 .005678831 105 .009189513

26 .002267674

27 .002354995

66 .005766449 106 .009277437

28 .002442323

67 .005854075 107 .009365369

29 .002529659

68 .005941708 108 .009453308

30 .002617003

69 .006029349 109 .009541255

70 .006116997 110 .009629210

31 .002704354

32 .002791713

71 .006204654 111 .009717172

33 .002879080

72 .006292317 112 .009805142

34 .002966454

73 .006379989 113 .009893119

35 .003053836

74 .006467668 114 .009981104

75 .006555355 115 .010069097

November 7, 2005 920 2005–45 I.R.B.

2005 ANNUAL RATE, 2005 ANNUAL RATE, 2005 ANNUAL RATE,

COMPOUNDED DAILY COMPOUNDED DAILY COMPOUNDED DAILY

3.180 PERCENT 3.180 PERCENT 3.180 PERCENT

DAYS FACTOR DAYS FACTOR DAYS FACTOR

116 .010157098 156 .013683413 196 .017222039

117 .010245106 157 .013771729 197 .017310663

118 .010333122 158 .013860052 198 .017399294

119 .010421145 159 .013948383 199 .017487933

120 .010509177 160 .014036721 200 .017576580

121 .010597216 161 .014125068 201 .017665235

122 .010685262 162 .014213421 202 .017753897

123 .010773316 163 .014301783 203 .017842567

124 .010861378 164 .014390152 204 .017931245

125 .010949448 165 .014478529 205 .018019930

126 .011037525 166 .014566914 206 .018108624

127 .011125610 167 .014655306 207 .018197325

128 .011213703 168 .014743707 208 .018286033

129 .011301803 169 .014832114 209 .018374750

130 .011389911 170 .014920530 210 .018463474

131 .011478026 171 .015008953 211 .018552206

132 .011566150 172 .015097384 212 .018640945

133 .011654281 173 .015185823 213 .018729693

134 .011742419 174 .015274269 214 .018818448

135 .011830566 175 .015362723 215 .018907211

136 .011918720 176 .015451185 216 .018995981

137 .012006881 177 .015539654 217 .019084760

138 .012095051 178 .015628131 218 .019173546

139 .012183228 179 .015716616 219 .019262339

140 .012271412 180 .015805109 220 .019351141

141 .012359605 181 .015893609 221 .019439950

142 .012447805 182 .015982117 222 .019528767

143 .012536013 183 .016070633 223 .019617592

144 .012624228 184 .016159156 224 .019706424

145 .012712451 185 .016247687 225 .019795264

146 .012800682 186 .016336226 226 .019884112

147 .012888921 187 .016424773 227 .019972968

148 .012977167 188 .016513327 228 .020061831

149 .013065421 189 .016601889 229 .020150702

150 .013153682 190 .016690459 230 .020239581

151 .013241952 191 .016779036 231 .020328468

152 .013330229 192 .016867621 232 .020417362

153 .013418513 193 .016956214 233 .020506264

154 .013506806 194 .017044815 234 .020595174

155 .013595106 195 .017133423 235 .020684092

2005–45 I.R.B. 921 November 7, 2005

2005 ANNUAL RATE, 2005 ANNUAL RATE, 2005 ANNUAL RATE,

COMPOUNDED DAILY COMPOUNDED DAILY COMPOUNDED DAILY

3.180 PERCENT 3.180 PERCENT 3.180 PERCENT

DAYS FACTOR DAYS FACTOR DAYS FACTOR

236 .020773017 276 .024336391 316 .027912205

237 .020861950 277 .024425635 317 .028001760

238 .020950891 278 .024514886 318 .028091323

239 .021039840 279 .024604145 319 .028180894

240 .021128796 280 .024693412 320 .028270472

241 .021217760 281 .024782687 321 .028360058

242 .021306732 282 .024871969 322 .028449653

243 .021395712 283 .024961260 323 .028539254

244 .021484699 284 .025050558 324 .028628864

245 .021573694 285 .025139863 325 .028718482

246 .021662697 286 .025229177 326 .028808107

247 .021751708 287 .025318498 327 .028897740

248 .021840726 288 .025407827 328 .028987381

249 .021929752 289 .025497164 329 .029077030

250 .022018786 290 .025586509 330 .029166687

251 .022107828 291 .025675861 331 .029256351

252 .022196877 292 .025765222 332 .029346023

253 .022285934 293 .025854590 333 .029435703

254 .022374999 294 .025943966 334 .029525391

255 .022464072 295 .026033349 335 .029615087

256 .022553152 296 .026122741 336 .029704790

257 .022642240 297 .026212140 337 .029794501

258 .022731336 298 .026301547 338 .029884220

259 .022820440 299 .026390962 339 .029973947

260 .022909551 300 .026480384 340 .030063682

261 .022998671 301 .026569814 341 .030153425

262 .023087798 302 .026659253 342 .030243175

263 .023176933 303 .026748699 343 .030332933

264 .023266075 304 .026838152 344 .030422699

265 .023355225 305 .026927614 345 .030512473

266 .023444383 306 .027017083 346 .030602254

267 .023533549 307 .027106560 347 .030692044

268 .023622723 308 .027196045 348 .030781841

269 .023711904 309 .027285538 349 .030871646

270 .023801093 310 .027375038 350 .030961459

271 .023890290 311 .027464547 351 .031051280

272 .023979495 312 .027554063 352 .031141109

273 .024068707 313 .027643587 353 .031230945

274 .024157928 314 .027733118 354 .031320789

275 .024247156 315 .027822658 355 .031410641

November 7, 2005 922 2005–45 I.R.B.

2005 ANNUAL RATE, Section 1274.—Determi- AFR) for the current month for purposes

COMPOUNDED DAILY nation of Issue Price in the of section 1288(b). Table 3 sets forth the

Case of Certain Debt Instru- adjusted federal long-term rate and the

3.180 PERCENT

ments Issued for Property long-term tax-exempt rate described in

DAYS FACTOR section 382(f). Table 4 contains the ap-

(Also Sections 42, 280G, 382, 412, 467, 468, 482,

propriate percentages for determining the

356 .031500501 483, 642, 807, 846, 1288, 7520, 7872.)

low-income housing credit described in

357 .031590369

Federal rates; adjusted federal rates; section 42(b)(2) for buildings placed in

358 .031680244

adjusted federal long-term rate and the service during the current month. Finally,

359 .031770128

long-term exempt rate. For purposes of Table 5 contains the federal rate for deter-

360 .031860019

sections 382, 642, 1274, 1288, and other mining the present value of an annuity, an

sections of the Code, tables set forth the interest for life or for a term of years, or

361 .031949918

rates for November 2005. a remainder or a reversionary interest for

362 .032039825 purposes of section 7520.

363 .032129740

364 .032219662 Rev. Rul. 2005–71

365 .032309593

This revenue ruling provides various

prescribed rates for federal income tax

366 .032399531

purposes for November 2005 (the current

367 .032489477

month). Table 1 contains the short-term,

368 .032579431

mid-term, and long-term applicable fed-

369 .032669392 eral rates (AFR) for the current month

370 .032759362 for purposes of section 1274(d) of the

Internal Revenue Code. Table 2 contains

371 .032849339 the short-term, mid-term, and long-term

adjusted applicable federal rates (adjusted

REV. RUL. 2005–71 TABLE 1

Applicable Federal Rates (AFR) for November 2005

Period for Compounding

Annual Semiannual Quarterly Monthly

Short-term

AFR 4.04% 4.00% 3.98% 3.97%

110% AFR 4.45% 4.40% 4.38% 4.36%

120% AFR 4.86% 4.80% 4.77% 4.75%

130% AFR 5.27% 5.20% 5.17% 5.14%

Mid-term

AFR 4.23% 4.19% 4.17% 4.15%

110% AFR 4.66% 4.61% 4.58% 4.57%

120% AFR 5.09% 5.03% 5.00% 4.98%

130% AFR 5.52% 5.45% 5.41% 5.39%

150% AFR 6.39% 6.29% 6.24% 6.21%

175% AFR 7.46% 7.33% 7.26% 7.22%

Long-term

AFR 4.57% 4.52% 4.49% 4.48%

110% AFR 5.03% 4.97% 4.94% 4.92%

120% AFR 5.49% 5.42% 5.38% 5.36%

130% AFR 5.97% 5.88% 5.84% 5.81%

2005–45 I.R.B. 923 November 7, 2005

REV. RUL. 2005–71 TABLE 2

Adjusted AFR for November 2005

Period for Compounding

Annual Semiannual Quarterly Monthly

Short-term adjusted 2.87% 2.85% 2.84% 2.83%

AFR

Mid-term adjusted AFR 3.32% 3.29% 3.28% 3.27%

Long-term adjusted 4.22% 4.18% 4.16% 4.14%

AFR

REV. RUL. 2005–71 TABLE 3

Rates Under Section 382 for November 2005

Adjusted federal long-term rate for the current month 4.22%

Long-term tax-exempt rate for ownership changes during the current month (the highest of the adjusted

federal long-term rates for the current month and the prior two months.) 4.24%

REV. RUL. 2005–71 TABLE 4

Appropriate Percentages Under Section 42(b)(2) for November 2005

Appropriate percentage for the 70% present value low-income housing credit 8.02%

Appropriate percentage for the 30% present value low-income housing credit 3.44%

REV. RUL. 2005–71 TABLE 5

Rate Under Section 7520 for November 2005

Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years,

or a remainder or reversionary interest 5.0%

Section 7804.—Other ACTION: Final and temporary regula-

Personnel tions.

Section 1288.—Treatment

of Original Issue Discount 26 CFR 801.1: Balanced performance measurement

system; in general.

SUMMARY: This document contains fi-

on Tax-Exempt Obligations nal and temporary regulations relating to

the balanced system for measuring or-

The adjusted applicable federal short-term, mid- T.D. 9227 ganizational and employee performance

term, and long-term rates are set forth for the month within the IRS. The temporary regulations

of November 2005. See Rev. Rul. 2005-71, page DEPARTMENT OF prospectively amend the existing final

923.

THE TREASURY regulations in 26 CFR Part 801 to clarify

Internal Revenue Service when quantity measures, which are not

Section 7520.—Valuation 26 CFR Part 801 tax enforcement results, may be used in

Tables measuring organizational and employee

Balanced System for performance. The portions of this doc-

The adjusted applicable federal short-term, mid-

ument that are final regulations provide

term, and long-term rates are set forth for the month Measuring Organizational necessary cross-references to the tempo-

of November 2005. See Rev. Rul. 2005-71, page

923.

and Employee Performance rary regulations. These regulations affect

Within the Internal Revenue internal operations of the IRS and the

Service systems it employs to evaluate the perfor-

mance of organizations within the IRS.

AGENCY: Internal Revenue Service The text of the temporary regulations also

(IRS), Treasury. serves as the text of proposed regulations

November 7, 2005 924 2005–45 I.R.B.

(REG–114444–05) set forth in this issue employees. Section 1204, however, does be used to evaluate the performance of

of the Bulletin. not prohibit the use of quantity measures such employees. The temporary regula-

in evaluating organizational and employee tions do not affect the continuing prohibi-

DATES: Effective Date: These regulations performance. The temporary regulations tion on the use of ROTERS to evaluate em-

are effective on October 17, 2005. in this document amend the existing regu- ployee performance or to impose or sug-

Applicability Date: For dates of appli- lations in part 801 to clarify when quantity gest production quotas or goals for any em-

cability, see §§801.7 and 801.8T. measures may be used in measuring orga- ployee.

nizational and employee performance.

FOR FURTHER INFORMATION Special Analyses

CONTACT: Neil Worden, (202) 283–7900 Explanation of Provisions

(not a toll-free number). It has been determined that this is not

The final regulations provide guidance a significant regulatory action as defined

SUPPLEMENTARY INFORMATION: and direction for the establishment of a in Executive Order 12866. Therefore,

balanced performance measurement sys- a regulatory assessment is not required.

Background tem for the IRS. The three elements of this It also has been determined that section

balanced measurement system are (1) cus- 553(b) of the Administrative Procedure

This document amends final regu- tomer satisfaction measures, (2) employee Act (5 U.S.C. chapter 5) does not apply to

lations in 26 CFR Part 801 (the Final satisfaction measures and (3) business re- these regulations. For applicability of the

Regulations) that implement the Balanced sults measures. These organizational mea- Regulatory Flexibility Act, please refer

System for Measuring Organizational and sures may be used to evaluate the perfor- to the cross-reference notice of proposed

Employee Performance within the IRS. mance of, or to impose or suggest produc- rulemaking published elsewhere in this

The Final Regulations were published tion goals for, any organizational unit. Bulletin. Pursuant to section 7805(f) of

in the Federal Register on August 6, The temporary regulations contained in the Internal Revenue Code, these tempo-

1999 (T.D. 8830, 1999–2 C.B. 430 [64 this document relate primarily to the busi- rary regulations will be submitted to the

FR 42834–42837]). The Final Regula- ness results measures. Business results are Chief Counsel for Advocacy of the Small

tions emanated from section 1201 of the measured through quality measures and Business Administration for comment on

Internal Revenue Service Restructuring quantity measures. Quality measures are its impact on small business.

and Reform Act of 1998, Public Law based on reviews of a statistically valid

105–206, 112 Stat. 685, 713 (1998) (the sample of cases handled by certain orga- Drafting Information

Act), which required the IRS to estab- nizational units such as examination, col-

lish a performance management system lection and Automated Collection System The principal author of these regula-

for those employees covered by 5 U.S.C. units. The quality review of other work tions is Karen F. Keller, Office of Asso-

4302 that, among other things, establishes units is determined according to criteria es- ciate Chief Counsel (General Legal Ser-

“goals or objectives for individual, group, tablished by the Commissioner or his del- vices). However, other personnel from the

or organizational performance (or any egate. IRS participated in their development.

combination thereof), consistent with the The IRS and Treasury Department have

*****

IRS’ performance planning procedures, determined that the provisions of the exist-

including those established under the ing Part 801 regulations that limit the use Amendments to the Regulations

Government Performance and Results Act of quantity measures in evaluating orga-

of 1993, division E of the Clinger-Cohen nizational units and imposing or suggest- Accordingly, 26 CFR Part 801 is

Act of 1966 . . ., Revenue Procedure ing production goals for employees restrict amended as follows:

64–22 . . ., and taxpayer service surveys.” the IRS’ ability to monitor program per-

Section 1201 further required the IRS to formance and track effectiveness of oper- PART 801—BALANCED SYSTEM FOR

use “such goals and objectives to make ations, and have caused confusion as to MEASURING ORGANIZATIONAL

performance distinctions among employ- what types of data or measures may be AND INDIVIDUAL PERFORMANCE

ees or groups of employees,” and to use discussed between managers and employ- WITHIN THE INTERNAL REVENUE

“performance assessments as a basis for ees and reflected in manager and employee SERVICE

granting employee awards, adjusting an goals. These temporary regulations re-

employee’s rate of basic pay, and other move the limitations on the use of quantity Paragraph 1. The authority citation for

appropriate personnel actions . . . .” measures in evaluating the performance of, Part 801 continues to read in part as fol-

In addition, section 1201 of the Act or imposing or suggesting goals for orga- lows:

required that the IRS performance man- nizational units. These temporary regu- Authority: 5 U.S.C. 9501 * * *

agement system comply with section lations also remove the limitations on the Par. 2. Section 801.1 is amended by:

1204, which prohibits the use of “records use of quantity measures to impose or sug- 1. Adding the new center heading.

of tax enforcement results” (ROTERs) in gest goals for employees. The regulations 2. Removing and reserving paragraph

the evaluation of IRS employees or to sug- continue to provide that performance mea- (b).

gest or impose production goals for such sures based on quantity measures will not The addition reads as follows:

2005–45 I.R.B. 925 November 7, 2005

REGULATIONS APPLICABLE will, to the maximum extent possible, be evaluated pursuant to workplans, em-

BEFORE OCTOBER 17, 2005 be stated in objective, quantifiable, and ployment agreements, performance agree-

measurable terms and will be used to mea- ments, or similar documents entered into

§801.1 Balanced performance sure the overall performance of various between the IRS and the employee.

measurement system; in general. operational units within the IRS. In ad- (d) General workforce. The perfor-

dition to implementing the requirements mance evaluation system for all other

***** of the Act, the measures described here employees will—

Par. 3. Section 801.7 is added to read will, where appropriate, be used in es- (1) Establish one or more retention

as follows: tablishing performance goals and making standards for each employee related to the

performance evaluations established, inter work of the employee and expressed in

§801.7 Effective dates.

alia, under Division E, National Defense terms of individual performance;

The provisions of §§801.1 through Authorization Act for Fiscal Year 1996 (2) Require periodic determinations of

801.6 apply before October 17, 2005. (the Clinger-Cohen Act of 1996) (Public whether each employee meets or does not

For the applicable provisions on or after Law 104–106, 110 Stat. 186, 679); the meet the employee’s established retention

October 17, 2005, see §§801.1T through Government Performance and Results Act standards;

801.7T. of 1993 (Public Law 103–62, 107 Stat. (3) Require that action be taken in ac-

Par. 4. Sections 801.1T through 801.8T 285); and the Chief Financial Officers Act cordance with applicable laws and regu-

and a new center heading are added to read of 1990 (Public Law 101–576, 108 Stat. lations, with respect to employees whose

as follows: 2838). Thus, organizational measures performance does not meet the established

of customer satisfaction, employee sat- retention standards;

REGULATIONS APPLICABLE ON OR isfaction, and business results (including (4) Establish goals or objectives for in-

AFTER OCTOBER 17, 2005 quality and quantity measures as described dividual performance consistent with the

in §801.6T) may be used to evaluate the IRS’s performance planning procedures;

§801.1T Balanced performance performance of or to impose or suggest (5) Use such goals and objectives to

measurement system; in general production goals for, any organizational make performance distinctions among em-

(temporary). unit. ployees or groups of employees; and

(6) Use performance assessments as a

(a) In general. (1) The regulations in §801.3T Measuring employee basis for granting employee awards, ad-

this part 801 implement the provisions of performance (temporary). justing an employee’s rate of basic pay,

sections 1201 and 1204 of the Internal and other appropriate personnel actions, in

Revenue Service Restructuring and Re- (a) In general. All employees of the

accordance with applicable laws and regu-

form Act of 1998 (Public Law 105–106, IRS will be evaluated according to the crit-

lations.

112 Stat. 685, 715–716, 722) (the Act) and ical elements and standards or such other

(e) Limitations. (1) No employee of the

provide rules relating to the establishment performance criteria as may be established

IRS may use records of tax enforcement

by the Internal Revenue Service (IRS) for their positions. In accordance with

results (as described in §801.6T) to eval-

of a balanced performance measurement the requirements of 5 U.S.C. 4312, 4313,

uate any other employee or to impose or

system. and 9508 and section 1201 of the Act, the

suggest production quotas or goals for any

(2) Modern management practice and performance criteria for each position as

employee.

various statutory and regulatory provisions are appropriate to that position, will be

(i) For purposes of the limitation con-

require the IRS to set performance goals composed of elements that support the or-

tained in this paragraph (e), employee

for organizational units and to measure the ganizational measures of Customer Satis-

has the meaning as defined in 5 U.S.C.

results achieved by those units with respect faction, Employee Satisfaction, and Busi-

2105(a).

to those goals. To fulfill these require- ness Results; however, such organizational

(ii) For purposes of the limitation con-

ments, the IRS has established a balanced measures will not directly determine the

tained in this paragraph (e), evaluate

performance measurement system, com- evaluation of individual employees.

includes any process used to appraise or

posed of three elements: Customer Satis- (b) Fair and equitable treatment of tax-

measure an employee’s performance for

faction Measures; Employee Satisfaction payers. In addition to all other criteria re-

purposes of providing the following:

Measures; and Business Results Measures. quired to be used in the evaluation of em-

(A) Any required or requested perfor-

The IRS is likewise required to establish ployee performance, all employees of the

mance rating.

a performance evaluation system for indi- IRS will be evaluated on whether they pro-

(B) A recommendation for an award

vidual employees. vided fair and equitable treatment to tax-

covered by Chapter 45 of Title 5; 5 U.S.C.

(b) [Reserved]. payers.

5384; or section 1201(a) of the Act.

(c) Senior Executive Service and spe-

(C) An assessment of an employee’s

§801.2T Measuring organizational cial positions. Employees in the Senior

qualifications for promotion, reassign-

performance (temporary). Executive Service will be rated in accor-

ment, or other change in duties.

dance with the requirements of 5 U.S.C.

The performance measures that com- 4312 and 4313 and employees selected

prise the balanced measurement system to fill positions under 5 U.S.C. 9503 will

November 7, 2005 926 2005–45 I.R.B.

(D) An assessment of an employee’s methods. For example, questionnaires, (1) Cases started;

eligibility for incentives, allowances, or surveys, and other information gather- (2) Cases closed;

bonuses. ing mechanisms may be employed to (3) Work items completed;

(E) Ranking of employees for re- gather data regarding satisfaction. The (4) Customer education, assistance, and

lease/recall and reductions in force. information gathered will be used to mea- outreach efforts completed;

(2) Employees who are responsible for sure, among other factors bearing upon (5) Time per case;

exercising judgment with respect to tax en- employee satisfaction, the quality of su- (6) Direct examination time/out of of-

forcement results in cases concerning one pervision and the adequacy of training fice time;

or more taxpayers may be evaluated on and support services. All employees of an (7) Cycle time;

work done on such cases only in the con- operating unit will have an opportunity to (8) Number or percentage of overage

text of their critical elements and stan- provide information regarding employee cases;

dards. satisfaction within the operating unit under (9) Inventory information;

(3) Performance measures based in conditions that guarantee them anonymity. (10) Toll-free level of access; and

whole or in part on quantity measures (as (11) Talk time.

described in §801.6T) will not be used to §801.6T Business results measures (d) Definitions—(1) Tax enforcement

evaluate the performance of any non-su- (temporary). results. A tax enforcement result is the

pervisory employee who is responsible outcome produced by an IRS employee’s

(a) In general. The business results

for exercising judgment with respect to exercise of judgment in recommending

measures will consist of numerical scores

tax enforcement results (as described in or determining whether or how the IRS

determined under the quality measures and

§801.6T). should pursue enforcement of the tax

the quantity measures described elsewhere

laws. Examples of tax enforcement re-

§801.4T Customer satisfaction measures in this section.

sults include a lien filed, a levy served,

(temporary). (b) Quality measures. Quality mea-

a seizure executed, the amount assessed,

sures will be determined on the basis of a

the amount collected, and a fraud referral.

The customer satisfaction goals and ac- review by a specially dedicated staff within

Examples of data that are not tax enforce-

complishments of operating units within the IRS of a statistically valid sample of

ment results include a quantity measure

the IRS will be determined on the basis work items handled by certain functions

and data derived from a quality review or

of information gathered through various or organizational units determined by the

from a review of an employee’s or a work

methods. For example, questionnaires, Commissioner or his delegate such as the

unit’s work on a case, such as the number

surveys and other types of information following:

or percentage of cases in which correct

gathering mechanisms may be employed (1) Examination and collection units

examination adjustments were proposed

to gather data regarding customer satisfac- and Automated Collection System Units

or appropriate lien determinations were

tion. Information to measure customer sat- (ACS). The quality review of the handling

made.

isfaction for a particular work unit will be of cases involving particular taxpayers will

(2) Records of tax enforcement results.

gathered from a statistically valid sample focus on such factors as whether IRS per-

Records of tax enforcement results are

of the customers served by that operating sonnel devoted an appropriate amount of

data, statistics, compilations of informa-

unit and will be used to measure, among time to a matter, properly analyzed the

tion or other numerical or quantitative

other things, whether those customers be- facts, and complied with statutory, regula-

recordations of the tax enforcement re-

lieve that they received courteous, timely, tory, and IRS procedures, including time-

sults reached in one or more cases. Such

and professional treatment by the IRS per- liness, adequacy of notifications, and re-

records may be used for purposes such as

sonnel with whom they dealt. Customers quired contacts with taxpayers.

forecasting, financial planning, resource

will be permitted to provide information (2) Toll-free telephone sites. The qual-

management, and the formulation of case

requested for these purposes under con- ity review of telephone services will focus

selection criteria. Records of tax en-

ditions that guarantee them anonymity. on such factors as whether IRS personnel

forcement results may be used to develop

For purposes of this section, customers provided accurate tax law and account in-

methodologies and algorithms for use in

may include individual taxpayers, orga- formation.

selecting tax returns to audit. Records of

nizational units, or employees within the (3) Other work units. The quality re-

tax enforcement results do not include tax

IRS and external groups affected by the view of other work units will be deter-

enforcement results of individual cases

services performed by the IRS operating mined according to criteria prescribed by

when used to determine whether an em-

unit. the Commissioner or his delegate.

ployee exercised appropriate judgment

(c) Quantity measures. Quantity mea-

in pursuing enforcement of the tax laws

§801.5T Employee satisfaction measures sures will consist of outcome-neutral pro-

based upon a review of the employee’s

(temporary). duction and resource data that does not

work on that individual case.

contain information regarding the tax en-

The employee satisfaction numerical forcement result reached in any case that §801.7T Examples (temporary).

ratings to be given operating units within involves particular taxpayers. Examples

the IRS will be determined on the basis of quantity measures include, but are not (a) The rules of §801.3T are illustrated

of information gathered through various limited to— by the following examples:

2005–45 I.R.B. 927 November 7, 2005

Example 1. (i) Each year Division A’s Examina- ization and each employee’s role in meeting those §801.8T Effective dates (temporary).

tion and Collection functions develop detailed work- goals. The communications will include expectations

plans that set goals for specific activities (e.g., num- regarding the average number of case closures that (a) The provisions of §§801.1T through

ber of audits or accounts closed) and for other quan- would have to occur to reach those goals, taking into 801.7T apply on or after October 17, 2005.

tity measures such as cases started, cycle time, over- account the fact that each employee’s actual closures

(b) The applicability of §§801.1T

age cases, and direct examination time. These quan- will vary based upon the facts and circumstances of

tity measure goals are developed nationally and by specific cases. through 801.7T expires on or before Oc-

Area Office based on budget allocations, available re- (iv) Setting these quantity measure goals, and the tober 14, 2008.

sources, historical experience, and planned improve- communication of those goals, is permissible because

ments. These plans also include information on mea- case closures are a quantity measure. Case closures Mark E. Matthews,

sures of quality, customer satisfaction, and employee are an example of outcome-neutral production data Deputy Commissioner for

satisfaction. Results are updated monthly to reflect that does not specify the outcome of any specific case Services and Enforcement.

how each organizational unit is progressing against such as the amount assessed or collected.

its workplan, and this information is shared with all Example 2. In conducting a performance evalua-

Approved October 3, 2005.

levels of management. tion, a supervisor is permitted to take into considera-

(ii) Although specific workplans are not devel- tion information the supervisor has developed show-

oped at the Territory level, Headquarters management ing that the employee failed to propose an appropri-

Eric Solomon,

expects the Area Directors to use the information in ate adjustment to tax liability in one of the cases the Acting Deputy Assistant Secretary

the Area plans to guide the activity in their Territo- employee examined, provided that information is de- (Tax Policy).

ries. For 2005, Area Office 1’s workplan has a goal rived from a review of the work done on the case. All

to close 1,000 examinations of small business cor- information derived from such a review of individ- (Filed by the Office of the Federal Register on October 14,

2005, 8:45 a.m., and published in the issue of the Federal

porations and 120,000 taxpayer delinquent accounts ual cases handled by the employee, including time Register for October 17, 2005, 70 F.R. 60214)

(TDAs), and there are 10 Exam Territories and 12 expended, issues raised, and enforcement outcomes

Collection Territories in Area Office 1. While tak- reached should be considered and discussed with the

ing into account the mix and priority of workload, employee and used in evaluating the employee.

and available staffing and grade levels, the Exami- Example 3. When assigning a case, a supervisor Section 7872.—Treatment

nation Area Director communicates to the Territory is permitted to discuss with the employee the mer- of Loans With Below-Market

Managers the expectation that, on average, each Ter- its, issues, and development of techniques of the case Interest Rates

ritory should plan to close about 100 cases. The Col- based upon a review of the case file.

lection Area Director similarly communicates to each Example 4. A supervisor is not permitted to estab- The adjusted applicable federal short-term, mid-

Territory the expectation that, on average, they will lish a goal for proposed adjustments in a future exam- term, and long-term rates are set forth for the month

close about 10,000 TDAs, subject to similar factors ination. of November 2005. See Rev. Rul. 2005-71, page

of workload mix and staffing. (b) [Reserved]. 923.

(iii) Similar communications then occur at the

next level of management between Territory Man-

agers and their Group Managers, and between Group

Managers and their employees. These communica-

tions will emphasize the overall goals of the organ-

November 7, 2005 928 2005–45 I.R.B.

Part III. Administrative, Procedural, and Miscellaneous

2006 Limitations Adjusted As The annual compensation limit under Limitations specified by statute

Provided in Section 415(d), §§ 401(a)(17), 404(l), 408(k)(3)(C),

etc.1 and 408(k)(6)(D)(ii) is increased from The Code, as amended by EGTRRA,

$210,000 to $220,000. specifies the applicable dollar amount for

Notice 2005–75 a particular year for certain limitations.

The dollar limitation under These applicable dollar amounts are as fol-

Section 415 of the Internal Revenue § 416(i)(1)(A)(i) concerning the lows:

Code (the Code) provides for dollar lim- definition of key employee in a The limitation under § 402(g)(1) on

itations on benefits and contributions un- top-heavy plan is increased from the exclusion for elective deferrals de-

der qualified retirement plans. Section 415 $135,000 to $140,000. scribed in § 402(g)(3) is increased from

also requires that the Commissioner annu- $14,000 to $15,000.

ally adjust these limits for cost-of-living The dollar amount under

increases. Other limitations applicable to § 409(o)(1)(C)(ii) for determining The limitation on deferrals under

deferred compensation plans are also af- the maximum account balance in an § 457(e)(15) concerning deferred com-

fected by these adjustments. Many of the employee stock ownership plan sub- pensation plans of state and local gov-

limitations will change for 2006. For most ject to a 5-year distribution period is ernments and tax-exempt organizations

of the limitations, the increase in the cost- increased from $850,000 to $885,000, is increased from $14,000 to $15,000.

of-living index met the statutory thresh- while the dollar amount used to de-

olds that trigger their adjustment. Further- termine the lengthening of the 5-year The dollar limitation under

more, several of these limitations, set by distribution period is increased from § 414(v)(2)(B)(i) for catch-up con-

the Economic Growth and Tax Relief Rec- $170,000 to $175,000. tributions to an applicable employer

onciliation Act of 2001 (EGTRRA), are plan other than a plan described in

scheduled to increase at the beginning of The limitation used in the definition § 401(k)(11) or 408(p) for individuals

2006. For example, under EGTRRA, the of highly compensated employee un- aged 50 or over is increased from

limitation under § 402(g)(1) of the Code der § 414(q)(1)(B) is increased from $4,000 to $5,000. The dollar limitation

on the exclusion for elective deferrals de- $95,000 to $100,000. under § 414(v)(2)(B)(ii) for catch-up

scribed in § 402(g)(3) is increased from contributions to an applicable em-

$14,000 to $15,000. This limitation affects The annual compensation limitation ployer plan described in § 401(k)(11)

elective deferrals to section 401(k) plans under § 401(a)(17) for eligible partic- or 408(p) for individuals aged 50

and to the Federal Government’s Thrift ipants in certain governmental plans or over is increased from $2,000 to

Savings Plan, among other plans. that, under the plan as in effect on July $2,500.

1, 1993, allowed cost-of-living adjust-

Cost-of-Living limits for 2006 ments to the compensation limitation Administrators of defined benefit or de-

under the plan under § 401(a)(17) to be fined contribution plans that have received

Effective January 1, 2006, the limita- taken into account, is increased from favorable determination letters should not

tion on the annual benefit under a defined $315,000 to $325,000. request new determination letters solely

benefit plan under § 415(b)(1)(A) is in- because of yearly amendments to adjust

creased from $170,000 to $175,000. For The compensation amount under maximum limitations in the plans.

participants who separated from service § 408(k)(2)(C) regarding simplified

before January 1, 2006, the limitation for employee pensions (SEPs) remains un- Drafting Information

defined benefit plans under § 415(b)(1)(B) changed at $450.

is computed by multiplying the partic- The principal author of this notice is

ipant’s compensation limitation, as ad- The compensation amounts under John Heil of the Employee Plans, Tax

justed through 2005, by 1.0383. § 1.61–21(f)(5)(i) of the Income Tax Exempt and Government Entities Divi-

The limitation for defined contribution Regulations concerning the definition sion. For further information regarding

plans under § 415(c)(1)(A) is increased of “control employee” for fringe benefit the data in this notice, please contact

from $42,000 to $44,000. valuation purposes remains unchanged the Employee Plans’ taxpayer assistance

The Code provides that various other at $85,000. The compensation amount telephone service at 1–877–829–5500 (a

dollar amounts are to be adjusted at the under § 1.61–21(f)(5)(iii) is increased toll-free call) between the hours of 8 a.m.

same time and in the same manner as the from $170,000 to $175,000. and 6:30 p.m. Eastern time Monday

dollar limitation of § 415(b)(1)(A). These through Friday. For information regarding

dollar amounts and the adjusted amounts The limitation under § 408(p)(2)(E) re- the methodology used in arriving at the

are as follows: garding SIMPLE retirement accounts data in this notice, please contact Mr. Heil

remains unchanged at $10,000. at 1–202–283–9888 (not a toll-free call).

1 Based on News Release IR–2005–120 dated October 14, 2005.

2005–45 I.R.B. 929 November 7, 2005

Part IV. Items of General Interest

Notice of Proposed the IRS Internet site at www.irs.gov/regs ployer is generally defined as the person

Rulemaking or via the Federal eRulemaking Por- for whom an individual performs ser-

tal at www.regulations.gov (IRS and vices as an employee. Sections 3401(d),

Disregarded Entities; REG–114371–05). 3121(d), and 3306(a). Because a disre-

garded entity is not recognized for Federal

Employment and Excise FOR FURTHER INFORMATION tax purposes, the owner of the disregarded

Taxes CONTACT: Concerning the proposed reg- entity is treated as the employer for pur-

ulations, John Richards at (202) 622–6040 poses of employment tax liabilities and all

REG–114371–05 (on the employment tax provisions) or other employment tax obligations related

Susan Athy at (202) 622–3130 (on the to wages paid to employees performing

AGENCY: Internal Revenue Service excise tax provisions); concerning the services for the disregarded entity.

(IRS), Treasury. submission of comments or requests for a If an entity is disregarded for Federal

hearing, Robin Jones at (202) 622–7180 tax purposes under section 1361(b)(3)(A)

ACTION: Notice of proposed rulemaking.

(not toll-free numbers). or §§301.7701–1 through 301.7701–3,

SUMMARY: This document contains Notice 99–6, 1999–1 C.B. 321, provides

SUPPLEMENTARY INFORMATION:

proposed regulations under which qual- that employment taxes and other em-

ified subchapter S subsidiaries and sin- Background ployment tax obligations with respect to

gle-owner eligible entities that currently employees performing services for the

are disregarded as entities separate from 1. Disregarded Entities disregarded entity may be satisfied in one

their owners for federal tax purposes of two ways: (1) calculation and payment

would be treated as separate entities for Under the Internal Revenue Code of all employment taxes and satisfaction

employment tax and related reporting re- (Code) and its regulations, qualified of all other employment tax obligations

quirement purposes. These regulations subchapter S subsidiaries (QSubs) (un- with respect to employees performing

also propose to treat such disregarded der section 1361(b)(3)(B)) and certain services for the disregarded entity by its

entities as separate entities for purposes single-owner eligible entities (under owner under the owner’s name and em-

of certain excise taxes reported on Forms §§301.7701–1 through 301.7701–3 of ployer identification number (EIN); or

720, 730, 2290, and 11-C; excise tax re- the Procedure and Administration Regula- (2) separate calculation and payment of

funds or payments claimed on Form 8849; tions) are disregarded as entities separate all employment taxes and satisfaction

and excise tax registrations on Form 637. from their owners (“disregarded entities”). of all other employment tax obligations

These proposed regulations would affect The disregarded entity rules of section by the disregarded entity with respect to

disregarded entities and the owners and 1361(b)(3)(A) and §§301.7701–1 through employees performing services for the

employees of disregarded entities in the 301.7701–3 apply for all purposes of the disregarded entity by the disregarded en-

payment and reporting of federal employ- Code, including employment and excise tity under its own name and EIN. The

ment taxes. These regulations also would taxes. notice states that ultimate liability for em-

affect disregarded entities and their own- ployment taxes remains with the owner of

ers in the payment and reporting of certain 2. Employment Taxes the disregarded entity regardless of which

Federal excise taxes and in registration alternative is chosen.

Employers are required to deduct and

and claims related to certain Federal ex-

withhold income and Federal Insurance 3. Excise Taxes

cise taxes.

Contributions Act (FICA) taxes from their

DATES: Written or electronic comments employees’ wages under sections 3402(a) A. Liability for excise taxes

and requests for a public hearing must be and 3102(a), and are separately liable for

received by January 17, 2006. their share of FICA taxes as well as for Liability for federal excise taxes is im-

Federal Unemployment Tax Act (FUTA) posed on certain transactions and activities

ADDRESSES: Send submissions to: taxes under sections 3111 and 3301 (the under the following chapters of the Inter-

CC:PA:LPD:PR (REG–114371–05), room withholding, FICA and FUTA taxes are nal Revenue Code (Code).

5203, Internal Revenue Service, P.O. Box collectively referred to herein as employ- Chapter 31 imposes retail excise taxes

7604, Ben Franklin Station, Washing- ment taxes). Sections 3403, 3102(b), on the sale or use of special fuels (sec-

ton, DC 20044. Submissions may be 3111, and 3301 provide that the employer tion 4041); the use of fuel in commercial

hand delivered Monday through Friday is the person liable for the withholding transportation on inland waterways (sec-

between the hours of 8 a.m. and 4 p.m. and payment of employment taxes. In tion 4042); and the sale of heavy trucks and

to: CC:PA:LPD:PR (REG–114371–05), addition, the employer is required to make trailers (section 4051).

Courier’s Desk, Internal Revenue Service, timely tax deposits, file employment tax Chapter 32 imposes manufacturers ex-

1111 Constitution Avenue, NW, Wash- returns, and issue wage statements (Forms cise taxes on the sale of gas guzzler auto-

ington, DC. Alternatively, taxpayers may W–2) to employees (collectively, other mobiles (section 4064); the sale of high-

submit electronic comments directly to employment tax obligations). An em- way-type tires (section 4071); the removal,

November 7, 2005 930 2005–45 I.R.B.

entry, or sale of taxable fuel (section 4081); not been previously claimed, and section excise taxes. Under the proposed regula-

the sale of coal (section 4121); the sale of 38 provides an income tax credit (general tions, these entities generally would con-

vaccines (section 4131); and the sale of business credit) for alcohol or biodiesel tinue to be treated as disregarded entities

sporting goods (section 4161). used as a fuel (under sections 40 and 40A). for other federal tax purposes.

Chapter 33 imposes excise taxes on

payments for communications facilities 4. Reason for Change 1. Employment Taxes

and services (section 4251); payments for

transportation of persons by air (section Administrative difficulties have arisen The proposed regulations would elimi-

4261); and payments for transportation of from the interaction of the disregarded en- nate disregarded entity status for purposes

property by air (section 4271). tity rules and the federal employment tax of federal employment taxes. A dis-

Chapter 34 imposes excise taxes on provisions. Problems have arisen for both regarded entity would be regarded for

policies issued by foreign insurers (section taxpayers and the IRS with respect to re- employment tax purposes, and, accord-

4371). porting, payment and collection of em- ingly, become liable for employment taxes

Chapter 35 imposes excise taxes on wa- ployment taxes, particularly where state on wages paid to employees of the dis-

gers (sections 4401 and 4411). employment tax law also sets requirements regarded entity, and be responsible for

Chapter 36 imposes excise taxes on for reporting, payment and collection that satisfying other employment tax obli-

transportation by water (section 4471) and may be in conflict with the federal disre- gations (e.g., backup withholding under

the use of heavy highway vehicles (section garded entity rules. The Treasury Depart- section 3406, making timely deposits of

4481). ment and the IRS believe that treating the employment taxes, filing returns, and pro-

Chapter 38 imposes excise taxes on the disregarded entity as the employer for pur- viding wage statements to employees on

sale of ozone-depleting chemicals and im- poses of federal employment taxes will im- Forms W–2). The owner of the disre-

ported taxable products (section 4681). prove the administration of the tax laws garded entity would no longer be liable

The IRS does not administer, and these and simplify compliance. for employment taxes or satisfying other

regulations have no effect on the chapter Difficulties also have arisen from the employment tax obligations with respect

32 tax on firearms (section 4181) or the interaction of the disregarded entity rules to the employees of the disregarded entity.

chapter 36 tax on port use (section 4461). and certain federal excise tax provisions. The disregarded entity would continue to

Many of these provisions rely on state be disregarded for other Federal tax pur-

B. Excise tax registration law, rather than federal law, to determine poses. The proposed regulations contain

liability for an excise tax, attachment of an example illustrating the interaction of

A person may be required to register

a tax, and allowance of a credit, refund, the income tax provisions and employ-

with the IRS for certain excise tax pur-

or payment. For example, §48.0–2(b) of ment tax provisions. For example, the

poses. Registration may be required un-

the Manufacturers and Retailers Excise proposed regulations illustrate that an in-

der section 4101 with respect to the taxes

Tax Regulations provides that such excise dividual owner of a disregarded entity

imposed on motor fuels or under section

taxes attach when title to an article passes would continue to be treated as self-em-

4412 in the case of persons subject to the

to the purchaser. In general, determining ployed for purposes of Self Employment

occupational tax on wagering. In addition,

when title passes depends on the intention Contributions Act (SECA) taxes (section

section 4222 generally permits sales for

of the parties. Absent express intention, 1401 et sequitur), and not as an employee

certain exempt purposes to be made on a

however, the laws of the jurisdiction where of the disregarded entity for employment

tax-free basis only if the sellers and pur-

the sale is made govern this determination. tax purposes.

chasers are registered.

Such a determination is required also in The employment tax provisions of

C. Excise tax credits, refunds, and applying certain excise tax credit, refund, these regulations are proposed to apply to

payments and payment provisions that allow claims wages paid on or after January 1 following

by ultimate purchasers, ultimate vendors, the date these regulations are published

The Code allows excise taxpayers to and producers. as final regulations in the Federal Regis-

claim credits or refunds for overpayments, ter. QSubs, single-owner eligible entities

including overpayments determined under Explanation of Provisions disregarded under §§301.7701–1 through

sections 4081(e), 6415, 6416, and 6419 301.7701–3, and the owners of such en-

(section 6402). The Code generally al- These proposed regulations would treat tities may continue to use the procedures

lows non-excise taxpayers to claim cred- QSubs and single-owner eligible entities permitted by Notice 99–6 to satisfy the

its or payments for fuels used for nontax- that are disregarded entities for Federal owners’ employment tax liabilities and

able purposes (sections 6420, 6421, and tax purposes as separate entities for pur- other employment tax obligations for pe-

6427) and allows blenders to claim credits poses of employment taxes and other re- riods before the effective date of these

or payments for the production of alcohol quirements of law arising under subtitle regulations. As required by Notice 99–6,

and biodiesel mixtures (sections 6426 and C of the Code, certain excise taxes, and if the owner currently satisfies the employ-

6427(e)). Section 34 provides an income the application of the rules under subtitle ment tax liabilities and other employment

tax credit for amounts payable for the non- F of the Code relating to matters such as tax obligations with respect to wages paid

taxable use of fuels under sections 6420, reporting, assessment, collection, and re- to employees performing services for the

6421, and 6427, if these amounts have funds regarding employment and certain disregarded entity, then the owner must

2005–45 I.R.B. 931 November 7, 2005

continue to satisfy such liabilities and ministrative Procedure Act (5 U.S.C. chap- PART 1—INCOME TAX

obligations until these regulations become ter 5) does not apply to these proposed reg-

final and effective, at which time Notice ulations, and because these proposed reg- Paragraph 1. The authority citation for

99–6 will be obsoleted. ulations do not impose a collection of in- part 1 continues to read, in part, as follows:

formation on small entities, the Regulatory Authority: 26 U.S.C. 7805 * * *

2. Excise Taxes Flexibility Act (5 U.S.C. chapter 6) does Par. 2. Section 1.34–1 is revised to read

not apply. Pursuant to section 7805(f) of as follows:

The proposed regulations would elimi- the Code, this notice of proposed rulemak-

nate disregarded entity status for purposes §1.34–1 Special rule for owners of certain

ing will be submitted to the Chief Counsel

of certain excise taxes. An entity that is business entities.

for Advocacy of the Small Business Ad-

disregarded for other federal tax purposes ministration for comment on their impact

would be required to pay and report ex- Amounts payable under sections 6420,

on small business. 6421, and 6427 to a business entity that

cise taxes, required and allowed to regis-

ter, and allowed to claim any credits (other is treated as separate from its owner un-

Comments and Requests for a Public

than income tax credits), refunds, and pay- der §1.1361–4(a)(8) (relating to certain

Hearing

ments. The excise tax provisions that are qualified subchapter S subsidiaries) or

excluded from the proposed regulations Before these proposed regulations are §301.7701–2(c)(2)(v) of this chapter (re-

are specified. Because a disregarded en- adopted as final regulations, consideration lating to certain wholly-owned entities)

tity does not file an income tax return, the will be given to any written (a signed origi- are, for purposes of section 34, treated as

credit on Form 4136 under section 34 is nal and (8) copies) or electronic comments payable to the owner of that entity.

claimed on the owner’s income tax return that are submitted timely to the IRS. The §§1.34–2 through 1.34–6 [Removed]

and appropriate identification of the sin- IRS and the Treasury Department request

gle-owner entity and its taxpayer identi- comments on the clarity of the proposed Par. 3. Sections 1.34–2 through 1.34–6

fication number is required. The income regulations and how they may be made are removed.

tax credit under section 38 (including any easier to understand. In addition, com- Par. 4. Section 1.1361–4 is amended as

credit under sections 40 and 40A) is not af- ments are requested specifically on any follows:

fected by these proposed regulations. transition issues that might arise with re- 1. In paragraph (a)(1), the language

The excise tax provisions in these reg- spect to employment taxes, and any transi- "Except as otherwise provided in para-

ulations are proposed to apply to liabilities tion relief that should be provided with re- graphs (a)(3) and (a)(6)" is removed, and

imposed and actions first required or per- spect to employment tax obligations. All "Except as otherwise provided in para-

mitted in periods beginning on or after Jan- comments will be available for public in- graphs (a)(3), (a)(6), (a)(7), and (a)(8)" is

uary 1 following the date these regulations spection and copying. A public hearing added in its place.

are published as final regulations in the will be scheduled if requested in writing 2. Paragraphs (a)(7) and (a)(8) are

Federal Register. For periods beginning by any person that timely submits written added.

before the effective date of these regula- comments. If a public hearing is sched- The additions read as follows:

tions, the IRS will treat payments made by uled, notice of the date, time, and place for

a disregarded entity, or other actions taken the hearing will be published in the Fed- §1.1361–4 Effect of QSub election.

by a disregarded entity, with respect to the eral Register.

excise taxes affected by these regulations (a) * * *

as having been made or taken by the sole Drafting Information (7) Treatment of QSubs for purposes

owner of that entity. Thus, for such peri- of employment taxes—(i) In general. A

The principal authors of these regula- QSub is treated as a separate corporation

ods, the owner of a disregarded entity will

tions are Susan Athy, Office of Associate for purposes of Subtitle C — Employ-

be treated as satisfying the owner’s obli-

Chief Counsel (Passthroughs and Special ment Taxes and Collection of Income Tax

gations with respect to the excise taxes af-

Industries), and John Richards, Office of (Chapters 21, 22, 23, 23A, 24, and 25 of

fected by these regulations, provided that

Associate Chief Counsel (Tax Exempt and the Internal Revenue Code).

those obligations are satisfied either (i) by

Government Entities). However, other (ii) Effective date. This paragraph

the owner itself or (ii) by the disregarded

personnel from the IRS and the Treasury (a)(7) applies with respect to wages paid

entity on behalf of the owner.

Department participated in their develop- on or after January 1 following the date

Special Analyses ment. these regulations are published as final

***** regulations in the Federal Register.

It has been determined that this notice (8) Treatment of QSubs for purposes of

of proposed rulemaking is not a significant Proposed Amendments to the certain excise taxes—(i) In general. A

regulatory action as defined in Executive Regulations QSub is treated as a separate corporation

Order 12866. Therefore, a regulatory as- for purposes of—

sessment is not required. It also has been Accordingly, 26 CFR parts 1 and 301 (A) Federal tax liabilities imposed by

determined that section 553(b) of the Ad- are proposed to be amended as follows: Chapters 31, 32 (other than section 4181),

November 7, 2005 932 2005–45 I.R.B.

33, 34, 35, 36 (other than section 4461), (iv) Special rule for employment tax (1) Federal tax liabilities imposed by

and 38 of the Internal Revenue Code, or purposes—(A) In general. Paragraph Chapters 31, 32 (other than section 4181),

any floor stocks tax imposed on articles (c)(2)(i) of this section (relating to certain 33, 34, 35, 36 (other than section 4461),

subject to any of these taxes; wholly owned entities) does not apply to and 38 of the Internal Revenue Code, or

(B) Collection of tax imposed by Chap- taxes imposed under Subtitle C — Em- any floor stocks tax imposed on articles

ter 33 of the Internal Revenue Code; ployment Taxes and Collection of Income subject to any of these taxes;

(C) Registration under sections 4101, Tax (Chapters 21, 22, 23, 23A, 24, and 25 (2) Collection of tax imposed by Chap-

4222, and 4412; and of the Internal Revenue Code). ter 33 of the Internal Revenue Code;

(D) Claims of a credit (other than a (B) Example. The following example (3) Registration under sections 4101,

credit under section 34), refund, or pay- illustrates the application of paragraph 4222, and 4412; and

ment related to a tax described in para- (c)(2)(iv) of this section: (4) Claims of a credit (other than a

graph (a)(8)(A) of this section. Example. (i) LLCA is an eligible entity owned credit under section 34), refund, or pay-

(ii) Effective date. This paragraph by individual A and is generally disregarded as an ment related to a tax described in para-

entity separate from its owner for federal tax pur-

(a)(8) applies to liabilities imposed and ac- poses. However, LLCA is treated as an entity sep-

graph (c)(2)(v)(A)(1) of this section.

tions first required or permitted in periods arate from its owner for purposes of subtitle C of the (B) Example. The following example

beginning on or after January 1 following Internal Revenue Code. LLCA has employees and illustrates the provisions of this paragraph

the date these regulations are published as pays wages as defined in sections 3121(a), 3306(b), (c)(2)(v).

final regulations in the Federal Register. and 3401(a). Example. (i) LLCB is an eligible entity that has

(ii) LLCA is subject to the provisions of subtitle C a single owner, B. LLCB is generally disregarded as

Par. 5. Section 1.1361–6 is amended as of the Internal Revenue Code and related provisions an entity separate from its owner. However, under

follows: under 26 CFR subchapter C, Employment Taxes and paragraph (c)(2)(v) of this section, LLCB is treated as

The language “Except as other- Collection of Income Tax at Source, parts 31 through an entity separate from its owner for certain purposes

wise provided in §§1.1361–4(a)(3)(iii), 39. Accordingly, LLCA is required to perform such relating to excise taxes.

1.1361–4(a)(5)(i), and 1.1361–5(c)(2)" acts as are required of an employer under those pro- (ii) LLCB mines coal from a coal mine

visions of the Code and regulations thereunder that

is removed, and "Except as provided in apply. All provisions of law (including penalties)

located in the United States. Section 4121

§§1.1361–4(a)(3)(iii), 1.1361–4(a)(5)(i), and the regulations prescribed in pursuance of law of chapter 32 of the Internal Revenue Code

1.1361–4(a)(6)(iii), 1.1361–4(a)(7)(ii), applicable to employers in respect of such acts are imposes a tax on the producer’s sale of

1.1361–4(a)(8)(ii), and 1.1361–5(c)(2)" is applicable to LLCA. Thus, for example, LLCA is such coal. Section 48.4121–1(a) of this

added in its place. liable for income tax withholding, Federal Insurance chapter defines a "producer" generally as

Contributions Act (FICA) taxes, and Federal Un-

employment Tax Act (FUTA) taxes. See sections

the person in whom is vested ownership of

PART 301—PROCEDURE AND 3402 and 3403 (relating to income tax withhold- the coal under state law immediately af-

ADMINISTRATION ing); 3102(b) and 3111 (relating to FICA taxes), and ter the coal is severed from the ground.

3301 (relating to FUTA taxes). In addition, LLCA LLCB is the person that owns the coal un-

Par. 6. The authority citation for part must file under its name and EIN the applicable der state law immediately after it is sev-

301 continues to read in part as follows: Forms in the 94X series, for example, Form 941,

“Employer’s Quarterly Federal Tax Return,” Form

ered from the ground. Under paragraph

Authority: 26 U.S.C. 7805 * * * (c)(2)(v)(A)(1) of this section, LLCB is the

940, “Employer’s Annual Federal Unemployment

Par. 7. Section 301.7701–2 is amended (FUTA) Tax Return;” file with the Social Security producer of the coal and is liable for tax on

as follows: Administration and furnish to LLCA’s employees its sale of such coal under chapter 32 of the

1. In paragraph (a), a sentence is added statements on Forms W–2, “Wage and Tax State- Internal Revenue Code. LLCB must re-